公司简介

| Nomura Asset Management评论摘要 | |

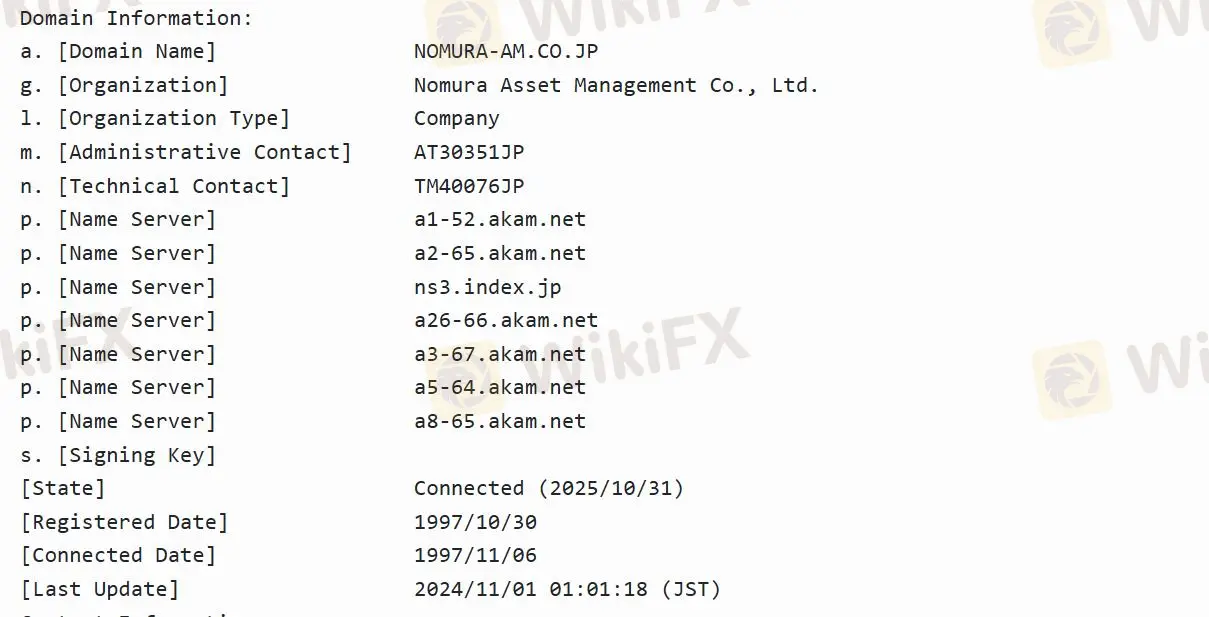

| 成立日期 | 1997-10-30 |

| 注册国家/地区 | 日本 |

| 监管 | 受监管 |

| 业务领域 | 投资信托管理业务/机构投资管理业务 |

| 客户支持 | / |

Nomura Asset Management 信息

Nomura Asset Management 是野村控股有限公司的全资子公司,是集团投资管理部门的核心品牌,专注于投资信托管理业务和机构投资管理业务。截至2023年12月31日,它是日本最大的投资信托管理公司。

Nomura Asset Management 是否合法?

Nomura Asset Management 受金融厅(FSA)监管,许可证号为関東財務局長(金商)第373号,许可证类型为零售外汇许可证,比未受监管更安全。

Nomura Asset Management 提供哪些投资策略?

固定收益:涵盖广泛的固定收益相关投资策略,包括主权债券、高收益公司债券、新兴市场债券、通胀联动债券和无限制的固定收益策略。

替代投资:管理一系列替代绝对回报投资,包括多头/空头市场中性策略和短期扩展130/30策略,目标是日本股票。

多资产:长期多资产策略使用积极判断来衡量市场基准,包括固定收益、股票、房地产投资信托(REITs)、大宗商品、黄金和高收益债券等资产。

智能贝塔:包括RAFI®基本指数、最小波动性和我们自有的投资和盈利能力(质量关注)策略。