Resumo da empresa

| Nomura Asset ManagementResumo da Revisão | |

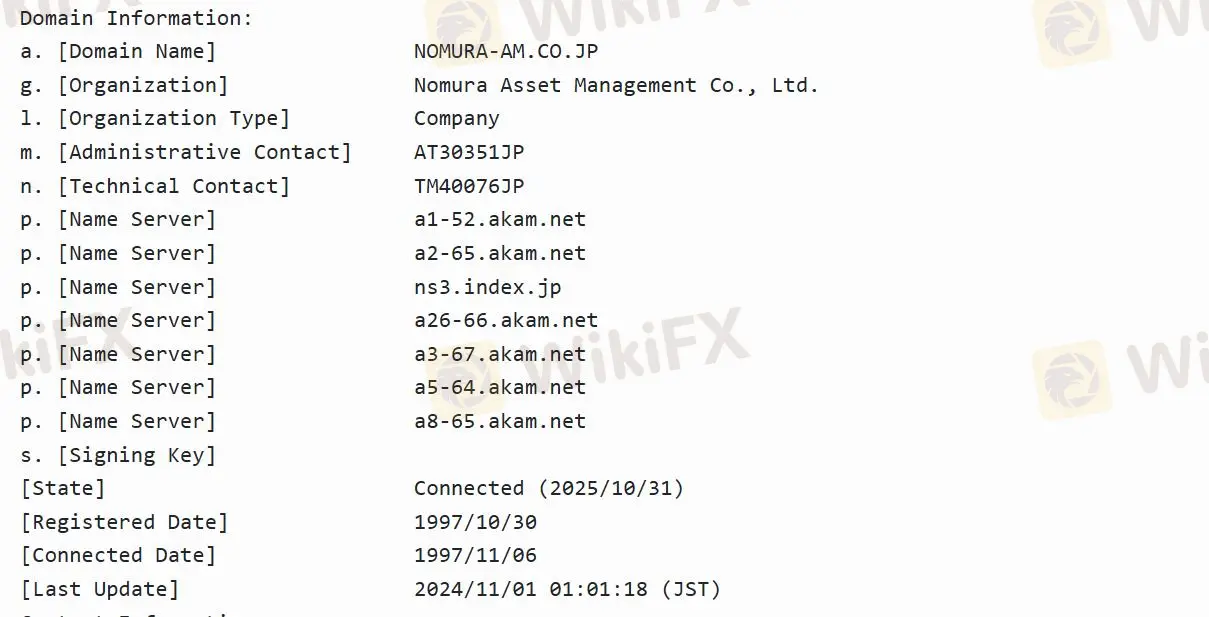

| Fundado | 1997-10-30 |

| País/Região Registrado | Japão |

| Regulação | Regulado |

| Setores de Negócios | Negócio de Gestão de Fundos de Investimento/Negócio de Gestão de Investimentos Institucionais |

| Suporte ao Cliente | / |

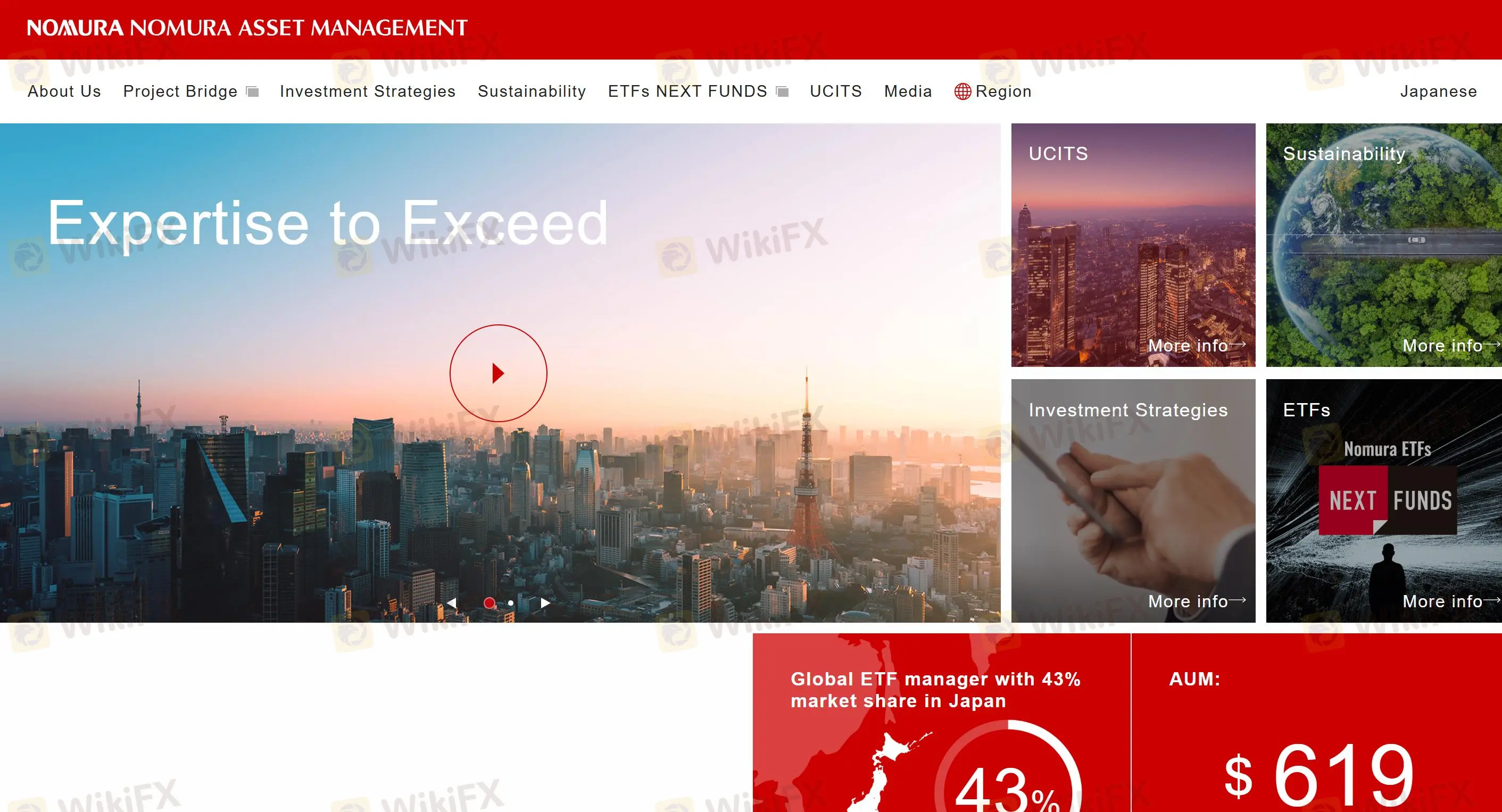

Informações Nomura Asset Management

Nomura Asset Management é uma subsidiária integral da Nomura Holdings, lnc. e é a marca principal dentro da divisão de gestão de investimentos do grupo, especializada em negócios de gestão de fundos de investimento e gestão de investimentos institucionais. Em 31 de dezembro de 2023, é o maior gestor de fundos de investimento do Japão.

Nomura Asset Management é Legítimo?

Nomura Asset Management é regulado pela Agência de Serviços Financeiros (FSA) sob a licença No.関東財務局長(金商)第373号 e Licença de Forex para Varejo, tornando-o mais seguro do que não regulamentado.

Quais estratégias de investimento Nomura Asset Management oferece?

Renda Fixa: abrange uma ampla gama de estratégias de investimento relacionadas a renda fixa, incluindo títulos soberanos, títulos corporativos de alto rendimento, títulos de mercados emergentes, títulos indexados à inflação e estratégias de renda fixa não restritas.

Alternativas: gerencia uma variedade de investimentos alternativos de retorno absoluto, incluindo uma estratégia de mercado neutra longa/curta e uma estratégia estendida curta 130/30 direcionada para ações japonesas.

Multi-Ativos: As estratégias multi-ativos de longo prazo usam julgamento ativo para medir o beta de mercado e incluem ativos como renda fixa, ações, REITs, commodities, ouro e títulos de alto rendimento.

Smart Beta: inclui o Índice Fundamental RAFI®, Volatilidade Mínima e nossa estratégia proprietária de Investimento e Rentabilidade (Foco em Qualidade).