Company Summary

| Nomura Asset ManagementReview Summary | |

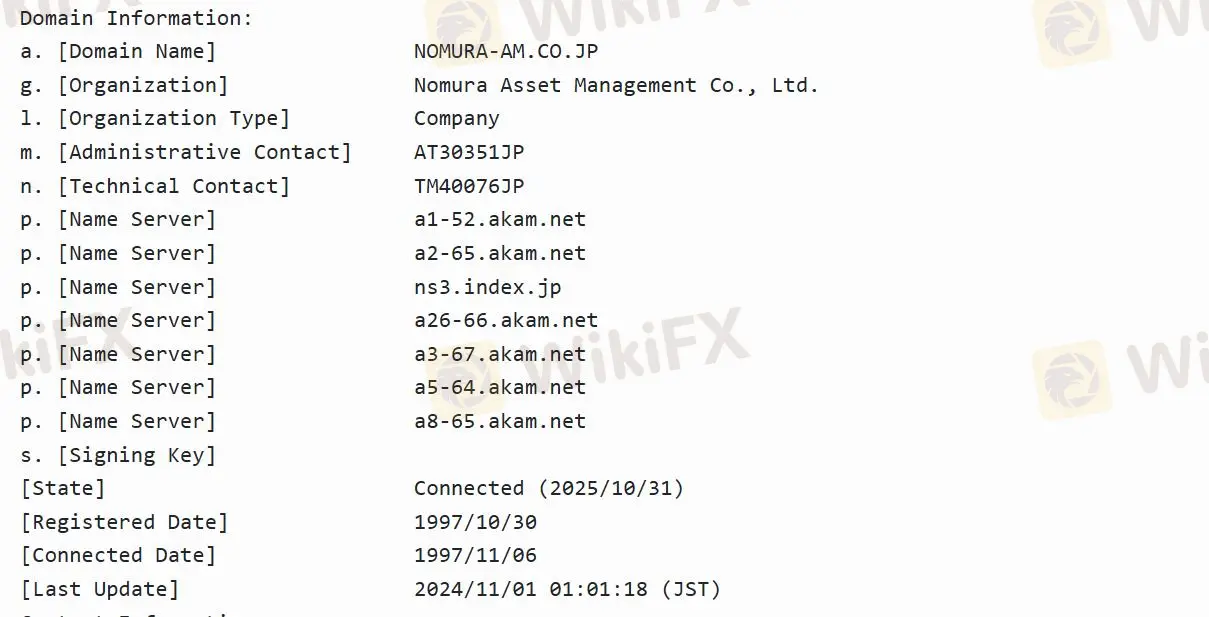

| Founded | 1997-10-30 |

| Registered Country/Region | Japan |

| Regulation | Regulated |

| Business Sectors | Investment Trust Management Business/Institutional Investment Management Business |

| Customer Support | / |

Nomura Asset Management Information

Nomura Asset Management is a wholly owned subsidiary of Nomura Holdings, lnc. and is the core brand within the group's investment management division specializing in investment trust management business and institutional investment management business. As of December 31, 2023, it is the largest investment trust manager in Japan.

Is Nomura Asset Management Legit?

Nomura Asset Management is regulated by the Financial Services Agency(FSA) under license No.関東財務局長(金商)第373号 and License Type Retail Forex License, making it safer than unregulated.

What investment strategies does Nomura Asset Management offer?

Fixed Income: covers a broad range of fixed income-related investment strategies including sovereign bonds, high-yield corporate bonds, emerging market bonds, inflation-linked bonds, and unconstrained fixed income strategies.

Alternatives: manages a range of alternative absolute return investments including a long/short market neutral strategy and a short extended 130/30 strategy targeting Japanese equities.

Multi-Asset: Long multi-asset strategies use active judgment to measure market beta and include assets such as fixed income, equities, REITs, commodities, gold, and high-yield bonds.

Smart Beta: includes RAFI® Fundamental Index, Minimum Volatility, and our proprietary Investment and Profitability (Quality Focus) strategy.