Unternehmensprofil

| Nomura Asset ManagementÜberprüfungszusammenfassung | |

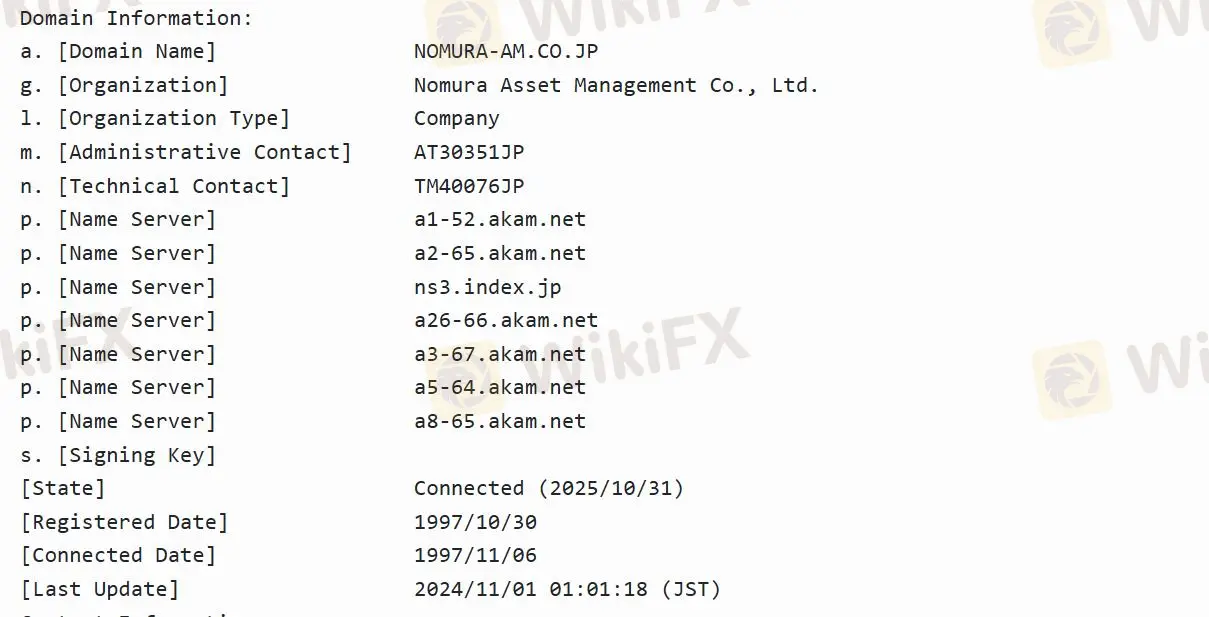

| Gegründet | 1997-10-30 |

| Registriertes Land/Region | Japan |

| Regulierung | Reguliert |

| Geschäftsbereiche | Investment Trust Management Business/Institutional Investment Management Business |

| Kundensupport | / |

Nomura Asset Management Informationen

Nomura Asset Management ist eine hundertprozentige Tochtergesellschaft von Nomura Holdings, lnc. und ist die Kernmarke innerhalb der Investment-Management-Division der Gruppe, die sich auf das Investment-Trust-Managementgeschäft und das institutionelle Investment-Managementgeschäft spezialisiert hat. Zum 31. Dezember 2023 ist es der größte Investment-Trust-Manager in Japan.

Ist Nomura Asset Management legitim?

Nomura Asset Management wird von der Financial Services Agency (FSA) unter der Lizenz Nr.関東財務局長(金商)第373号 und der Lizenzart Retail Forex License reguliert, was es sicherer macht als unregulierte Unternehmen.

Welche Anlagestrategien bietet Nomura Asset Management an?

Festverzinsliche Wertpapiere: umfasst eine breite Palette von festverzinslichen Anlagestrategien, einschließlich Staatsanleihen, Hochzinsunternehmensanleihen, Anleihen aus Schwellenländern, inflationsgebundenen Anleihen und ungebundenen festverzinslichen Strategien.

Alternative Anlagen: verwaltet eine Reihe von alternativen absoluten Renditeinvestitionen, darunter eine Long/Short-Marktneutral-Strategie und eine kurze erweiterte 130/30-Strategie, die auf japanische Aktien abzielt.

Mehr-Asset: Long-Mehr-Asset-Strategien verwenden aktive Urteilsbildung, um den Marktbeta zu messen, und umfassen Vermögenswerte wie festverzinsliche Wertpapiere, Aktien, REITs, Rohstoffe, Gold und Hochzinsanleihen.

Smart Beta: umfasst RAFI® Fundamental Index, Minimum Volatility und unsere proprietäre Investment- und Rentabilitätsstrategie (Qualitätsfokus).