회사 소개

| Nomura Asset Management리뷰 요약 | |

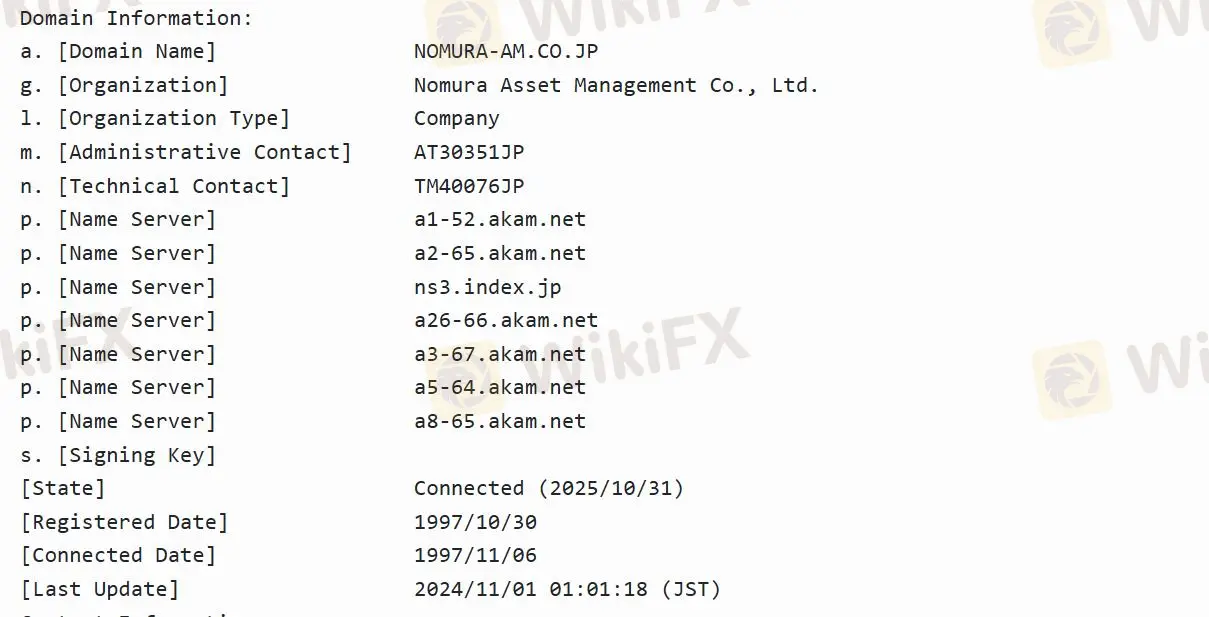

| 설립일 | 1997-10-30 |

| 등록 국가/지역 | 일본 |

| 규제 | 규제됨 |

| 사업 부문 | 투자신탁관리업/기관 투자관리업 |

| 고객 지원 | / |

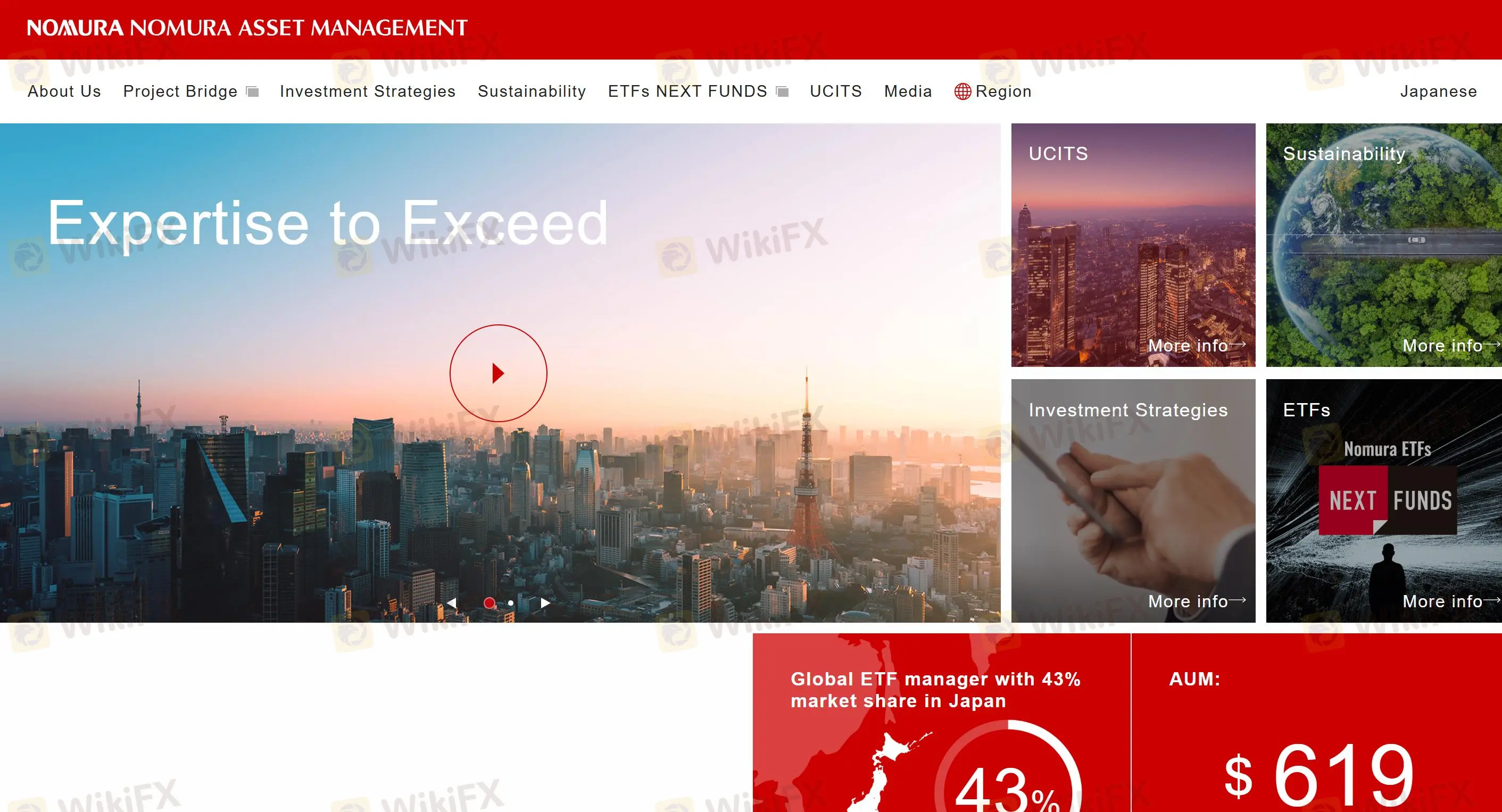

Nomura Asset Management 정보

Nomura Asset Management은 Nomura Holdings, lnc.의 완전 소유 자회사로서, 투자신탁관리업 및 기관 투자관리업에 특화된 그룹의 핵심 브랜드입니다. 2023년 12월 31일 기준으로 일본에서 가장 큰 투자신탁 관리자입니다.

Nomura Asset Management의 신뢰성

Nomura Asset Management은 금융 서비스 기관(FSA)에 의해 관리되며, 라이선스 번호 No.関東財務局長(金商)第373号 및 라이선스 유형 Retail Forex License로 규제되어 있어 규제되지 않은 것보다 안전합니다.

Nomura Asset Management이 제공하는 투자 전략

고정 소득: 주권채권, 고수익 회사채, 신흥 시장 채권, 인플레이션 링크 채권 및 제한 없는 고정 소득 전략을 포함한 다양한 고정 소득 관련 투자 전략을 다룹니다.

대안: 롱/숏 시장 중립 전략 및 일본 주식을 대상으로 한 단기 확장 130/30 전략을 포함한 다양한 대안적 절대 수익 투자를 관리합니다.

멀티 자산: 롱 멀티 자산 전략은 시장 베타를 측정하기 위해 능동적인 판단을 사용하며, 고정 소득, 주식, 부동산 투자 신탁(REITs), 상품, 금 및 고수익 채권과 같은 자산을 포함합니다.

스마트 베타: RAFI® 기본 지수, 최소 변동성 및 자체 개발된 투자 및 수익성(품질 중심) 전략을 포함합니다.