Resumo da empresa

| Mitoyo Resumo da Revisão | |

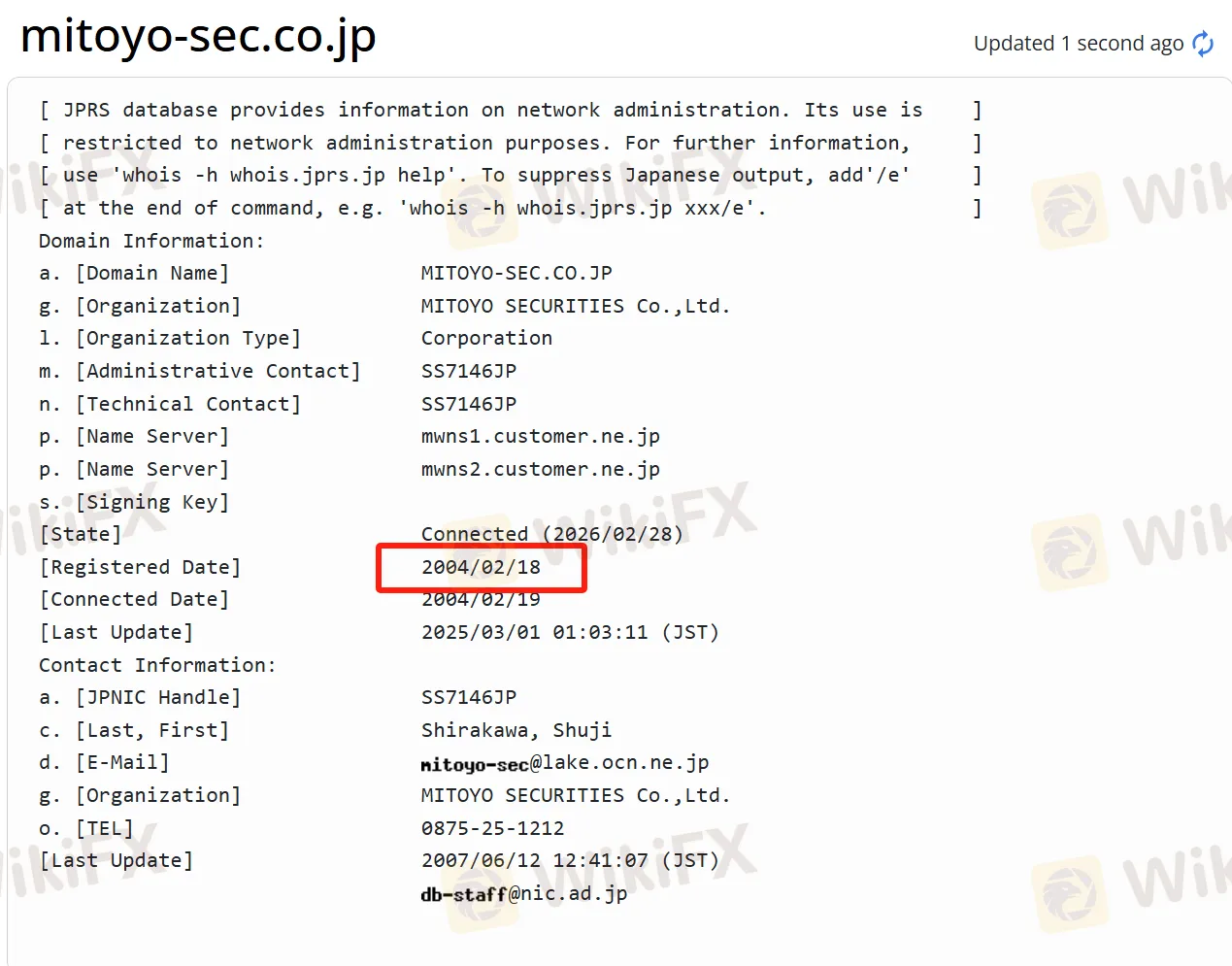

| Fundação | 2004 |

| País/Região Registrada | Japão |

| Regulação | FSA (Regulado) |

| Instrumentos de Mercado | Fundos de investimento, Títulos e Ações |

| Plataforma de Negociação | / |

| Suporte ao Cliente | Tel: 0875-25-1212 |

| Fax: 0875-25-1221 | |

Informações sobre Mitoyo

Mitoyo Securities é uma empresa de valores mobiliários japonesa com uma longa história. Desde a sua fundação, está profundamente enraizada na área local e conduz seus negócios com a região de Mitoyo como sua base. Oferece uma ampla variedade de produtos financeiros, cobrindo ações listadas em várias bolsas domésticas, vários fundos de investimento e diferentes tipos de títulos. Ao mesmo tempo, fornece soluções financeiras personalizadas e várias ferramentas de negociação, que podem atender às necessidades de diferentes investidores. A empresa possui um bom sistema de bem-estar e benefícios, dá grande importância ao desenvolvimento local e participa ativamente na revitalização local.

Prós e Contras

| Prós | Contras |

| Regulado | Negócios internacionais limitados |

| Múltiplos instrumentos de negociação | |

| Bom sistema de bem-estar e benefícios | |

| Ênfase no desenvolvimento local | |

| Longo tempo de operação |

Mitoyo é Legítimo?

Mitoyo é uma empresa de valores mobiliários legítima e em conformidade. A Agência de Serviços Financeiros (FSA) regulamenta a Mitoyo Securities, e seu número de licença é Shikoku Chief Financial Officer (Financial Merchant) No. 7.

Pesquisa de Campo WikiFX

A equipe de pesquisa de campo da WikiFX visitou o endereço da Mitoyo no Japão e confirmamos que possui um escritório físico no local.

O Que Posso Negociar na Mitoyo?

Mitoyo oferece ações domésticas listadas em várias bolsas, incluindo a Bolsa de Valores de Tóquio, Bolsa de Valores de Nagoia, Bolsa de Valores de Sapporo e Bolsa de Valores de Fukuoka.

Os fundos de investimento são de diversos tipos, incluindo fundos de investimento em ações, fundos de investimento em títulos públicos (MRF, fundos de investimento em títulos públicos), ETFs, J-REITs, etc. Os investidores podem obter investimentos diversificados por meio de fundos de investimento.

Os investidores também podem escolher entre vários produtos de obrigações, como obrigações governamentais orientadas para indivíduos (incluindo três tipos: variável por 10 anos, fixa por 5 anos e fixa por 3 anos), obrigações governamentais de nova janela de venda, CB (obrigações corporativas do tipo conversível domésticas com novos direitos de subscrição de ações), obrigações denominadas em moeda estrangeira, etc.

| Instrumentos Negociáveis | Suportado |

| Trusts de Investimento | ✔ |

| Obrigações | ✔ |

| Ações | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Índices | ❌ |

| Criptomoedas | ❌ |

| Opções | ❌ |

| ETFs | ❌ |