Resumo da empresa

| YM Securities Resumo da Revisão | |

| Fundação | 2007 |

| País/Região Registrada | Japão |

| Regulação | FSA |

| Produtos de Negociação | Ações, Obrigações e Fundos de Investimento |

| Plataforma de Negociação | / |

| Depósito Mínimo | / |

| Suporte ao Cliente | / |

Informações sobre YM Securities

YM Securities é uma empresa de valores mobiliários do Grupo Financeiro Yamaguchi do Japão (YMFG), com sede no Japão. Ele oferece principalmente negociação de ações, obrigações e fundos de investimento.

Prós e Contras

| Prós | Contras |

| Regulado pela FSA | Estrutura de taxas complexa |

| Histórico operacional longo | Alto limite de adesão |

| Sistema de benefícios para membros (desconto de 80% para ativos pré-depositados acima de 10.000.000 JPY) | Principalmente conteúdo japonês |

| Tipos limitados de produtos de negociação | |

| Canais de suporte ao cliente pouco claros |

YM Securities é Legítimo?

YM Securities é uma corretora de valores mobiliários legalmente registrada no Japão, reguladapela Agência de Serviços Financeiros (FSA). Seu número de registro é 中国財務局長(金商)第8号.

O Que Posso Negociar na YM Securities?

YM Securities oferece ações domésticas e estrangeiras, obrigações e fundos de investimento que investem em temas como ações domésticas e estrangeiras, obrigações e imóveis, e suporta planos de poupança regulares (acumulação de fundos de investimento).

| Produtos de Negociação | Suportado |

| Ações | ✔ |

| Obrigações | ✔ |

| Fundos de Investimento | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Índices | ❌ |

| Criptomoedas | ❌ |

| Opções | ❌ |

| ETFs | ❌ |

| Fundos Mútuos | ❌ |

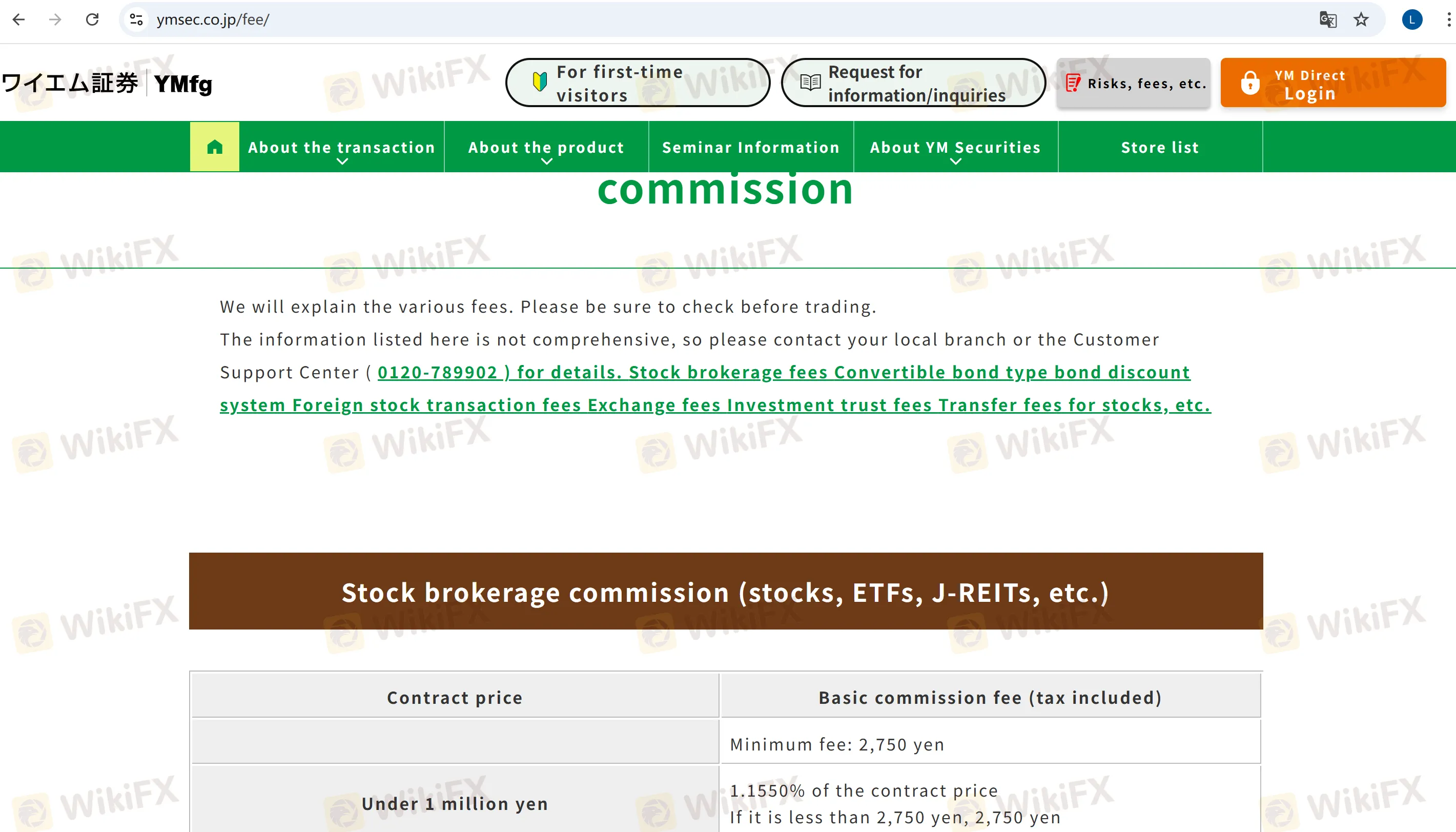

Taxas da YM Securities

As principais taxas da YM Securities são as seguintes:

Taxas de Negociação de Ações (Ações Domésticas, ETFs, etc.): Mínimo de 2.750 JPY (impostos incluídos), cobrados em camadas com base no valor da transação (por exemplo, 1,155% para valores abaixo de 1.000.000 JPY; 0,88% + 2.750 JPY para 1.000.000–5.000.000 JPY). Um desconto de 20% está disponível para membros.

Taxas de Negociação de Ações Estrangeiras: Inclui taxas locais (por exemplo, taxas de câmbio) e taxas de agência doméstica (por exemplo, 1,43% para montantes inferiores a 1.000.000 JPY).

Taxas de Negociação de Obrigações: Produtos do tipo obrigação conversível têm uma taxa mínima de 2.750 JPY, cobrada em camadas com base no montante da transação (por exemplo, 1,1% para montantes inferiores a 1.000.000 JPY).

Outras Taxas: Taxa de transferência de conta: Começa em 1.100 JPY por unidade, com um máximo de 6.600 JPY.

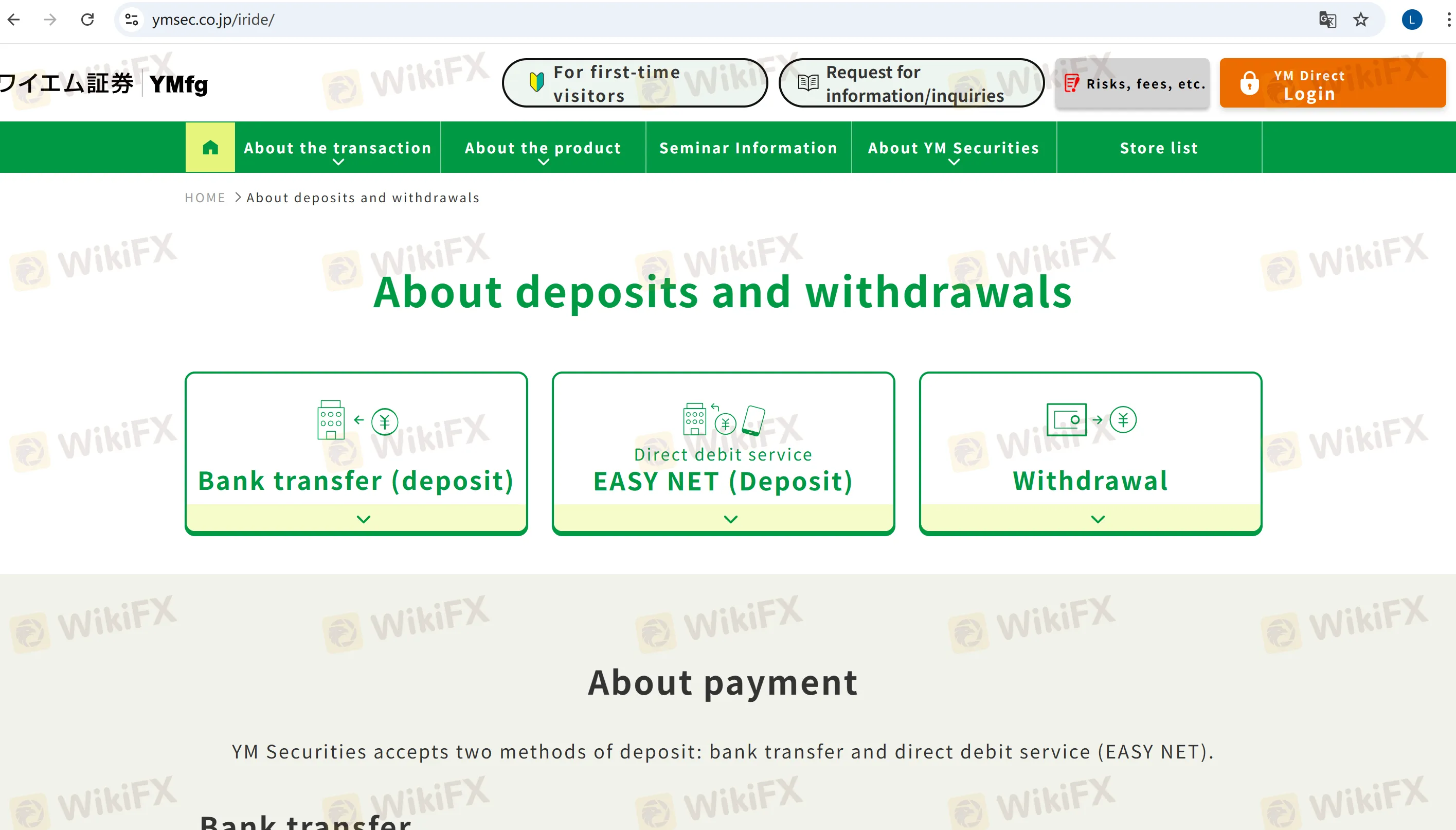

Depósito e Retirada

Depósito

Transferência Bancária: Suporta contas no Banco de Yamaguchi, Banco de Momiji e Banco de Kitakyushu. As taxas de processamento são geralmente cobertas pela corretora.

EASY NET: Um serviço gratuito de transferência instantânea de fundos vinculado a bancos do grupo, operável através da plataforma online ou instruções por telefone.

Retirada

As solicitações podem ser feitas através da plataforma online ou por telefone, e os fundos serão transferidos automaticamente para a conta bancária pré-registrada. Você pode especificar um dia útil a partir do próximo dia para a chegada dos fundos.