Company Summary

| Mitoyo Review Summary | |

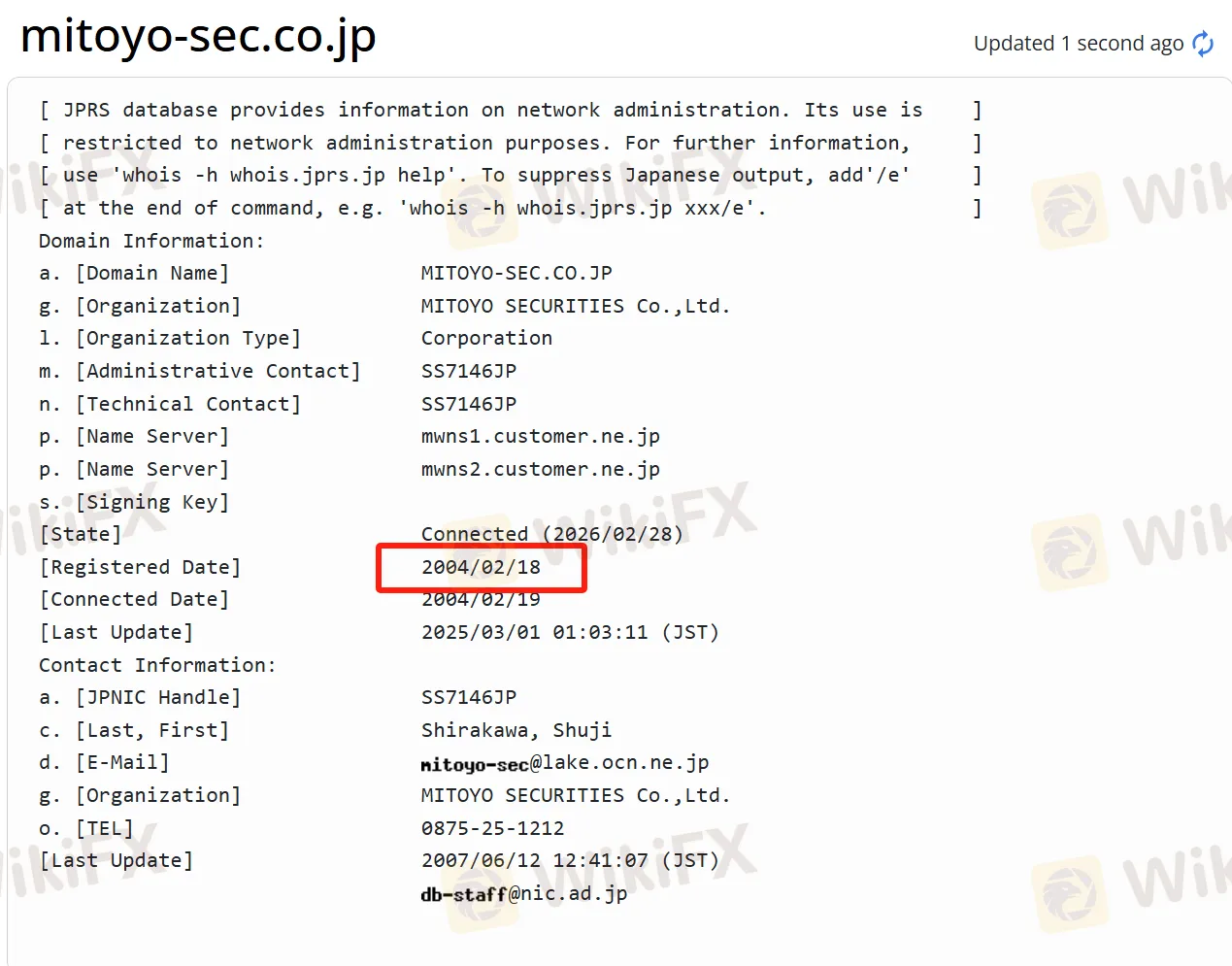

| Founded | 2004 |

| Registered Country/Region | Japan |

| Regulation | FSA (Regulated) |

| Market Instruments | Investment trusts, Bonds, and Stocks |

| Trading Platform | / |

| Customer Support | Tel: 0875-25-1212 |

| Fax: 0875-25-1221 | |

Mitoyo Information

Mitoyo Securities is a Japanese securities company with a long history. Since its establishment, it has been deeply rooted in the local area and conducted its business with the Mitoyo region as its stronghold. It offers a wide variety of financial products, covering stocks listed on multiple domestic exchanges, various investment trusts, and different types of bonds. At the same time, it provides personalized financial solutions and multiple trading tools, which can meet the needs of different investors. The company has a good welfare and benefits system, attaches great importance to local development, and actively participates in local revitalization.

Pros and Cons

| Pros | Cons |

| Regulated | Limited international business |

| Multiple trading instruments | |

| Good welfare and benefit system | |

| Emphasis on local development | |

| Long operation time |

Is Mitoyo Legit?

Mitoyo is a legitimate and compliant securities company. The Financial Services Agency (FSA)regulated Mitoyo Securities, and its license number is Shikoku Chief Financial Officer (Financial Merchant) No. 7.

WikiFX Field Survey

WikiFX field survey team visited Mitoyo's address in Japan, and we confirmed that it has a physical office on site.

What Can I Trade on Mitoyo?

Mitoyo provides domestic stocks listed on multiple exchanges, including the Tokyo Stock Exchange, Nagoya Stock Exchange, Sapporo Stock Exchange, and Fukuoka Stock Exchange.

The investment trusts are of diverse types, including equity investment trusts, public bond-type investment trusts (MRF, public bond investment trusts), ETFs, J-REITs, etc. Investors can achieve diversified investment through investment trusts.

Investors can also choose from various bond products, such as individual-oriented government bonds (including three types: variable for 10 years, fixed for 5 years, and fixed for 3 years), new window-selling government bonds, CB (domestic convertible bond-type corporate bonds with new share subscription rights), foreign currency-denominated bonds, etc.

| Tradable Instruments | Supported |

| Investment trusts | ✔ |

| Bonds | ✔ |

| Stocks | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| Options | ❌ |

| ETFs | ❌ |