Unternehmensprofil

| Mitoyo Überprüfungszusammenfassung | |

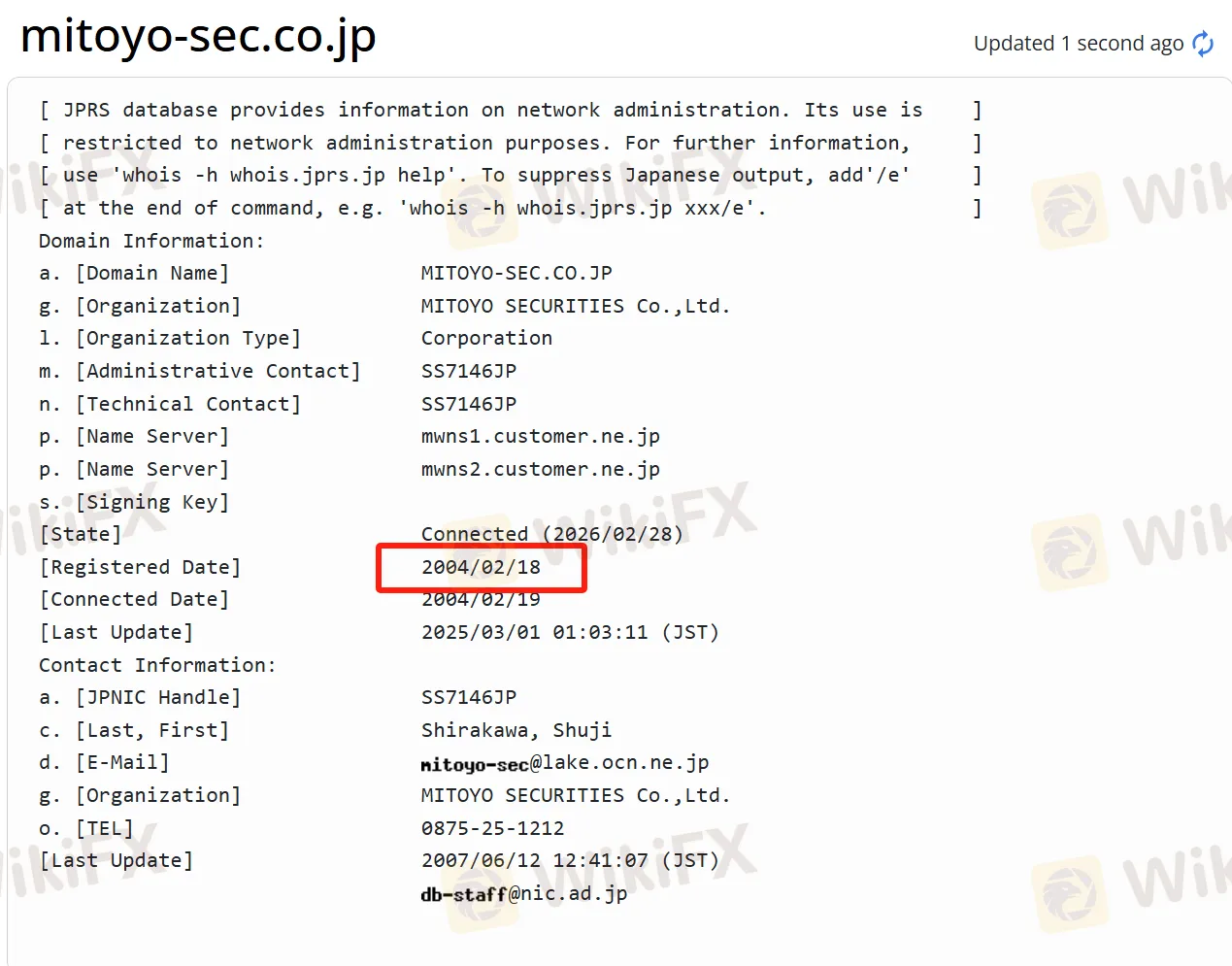

| Gegründet | 2004 |

| Registriertes Land/Region | Japan |

| Regulierung | FSA (Reguliert) |

| Marktinstrumente | Investmentfonds, Anleihen und Aktien |

| Handelsplattform | / |

| Kundenbetreuung | Tel: 0875-25-1212 |

| Fax: 0875-25-1221 | |

Mitoyo Informationen

Mitoyo Securities ist ein japanisches Wertpapierunternehmen mit einer langen Geschichte. Seit seiner Gründung ist es tief in der lokalen Gegend verwurzelt und führt sein Geschäft mit der Mitoyo-Region als Schwerpunkt durch. Es bietet eine Vielzahl von Finanzprodukten, darunter Aktien, die an mehreren inländischen Börsen notiert sind, verschiedene Investmentfonds und verschiedene Arten von Anleihen. Gleichzeitig bietet es personalisierte Finanzlösungen und mehrere Handelstools, die den Bedürfnissen verschiedener Anleger gerecht werden können. Das Unternehmen verfügt über ein gutes Sozialleistungs- und Vergütungssystem, legt großen Wert auf die lokale Entwicklung und beteiligt sich aktiv an der lokalen Revitalisierung.

Vor- und Nachteile

| Vorteile | Nachteile |

| Reguliert | Begrenztes internationales Geschäft |

| Mehrere Handelsinstrumente | |

| Gutes Sozialleistungs- und Vergütungssystem | |

| Betonung der lokalen Entwicklung | |

| Lange Betriebszeit |

Ist Mitoyo legitim?

Mitoyo ist ein legitimes und konformes Wertpapierunternehmen. Die Financial Services Agency (FSA) hat Mitoyo Securities reguliert, und die Lizenznummer lautet Shikoku Chief Financial Officer (Financial Merchant) Nr. 7.

WikiFX-Felduntersuchung

Das WikiFX-Felduntersuchungsteam hat die Adresse von Mitoyo in Japan besucht, und wir haben bestätigt, dass es vor Ort ein physisches Büro gibt.

Was kann ich bei Mitoyo handeln?

Mitoyo bietet inländische Aktien an, die an mehreren Börsen notiert sind, darunter die Tokyo Stock Exchange, Nagoya Stock Exchange, Sapporo Stock Exchange und Fukuoka Stock Exchange.

Die Investmentfonds sind verschiedener Art, darunter Aktieninvestmentfonds, öffentliche Anleihe-Investmentfonds (MRF, öffentliche Anleihe-Investmentfonds), ETFs, J-REITs usw. Anleger können durch Investmentfonds eine diversifizierte Anlage erreichen.

Investoren können auch aus verschiedenen Anleihe-Produkten wählen, wie beispielsweise individuell ausgerichteten Staatsanleihen (einschließlich drei Typen: variabel für 10 Jahre, fest für 5 Jahre und fest für 3 Jahre), neuem Fensterverkauf von Staatsanleihen, CB (inländische Wandelanleihe-Unternehmensanleihen mit neuen Aktienzeichnungsrechten), Fremdwährungsanleihen usw.

| Handelbare Instrumente | Unterstützt |

| Investmentfonds | ✔ |

| Anleihen | ✔ |

| Aktien | ✔ |

| Forex | ❌ |

| Waren | ❌ |

| Indizes | ❌ |

| Kryptowährungen | ❌ |

| Optionen | ❌ |

| ETFs | ❌ |