公司簡介

| 三豐證券 檢討摘要 | |

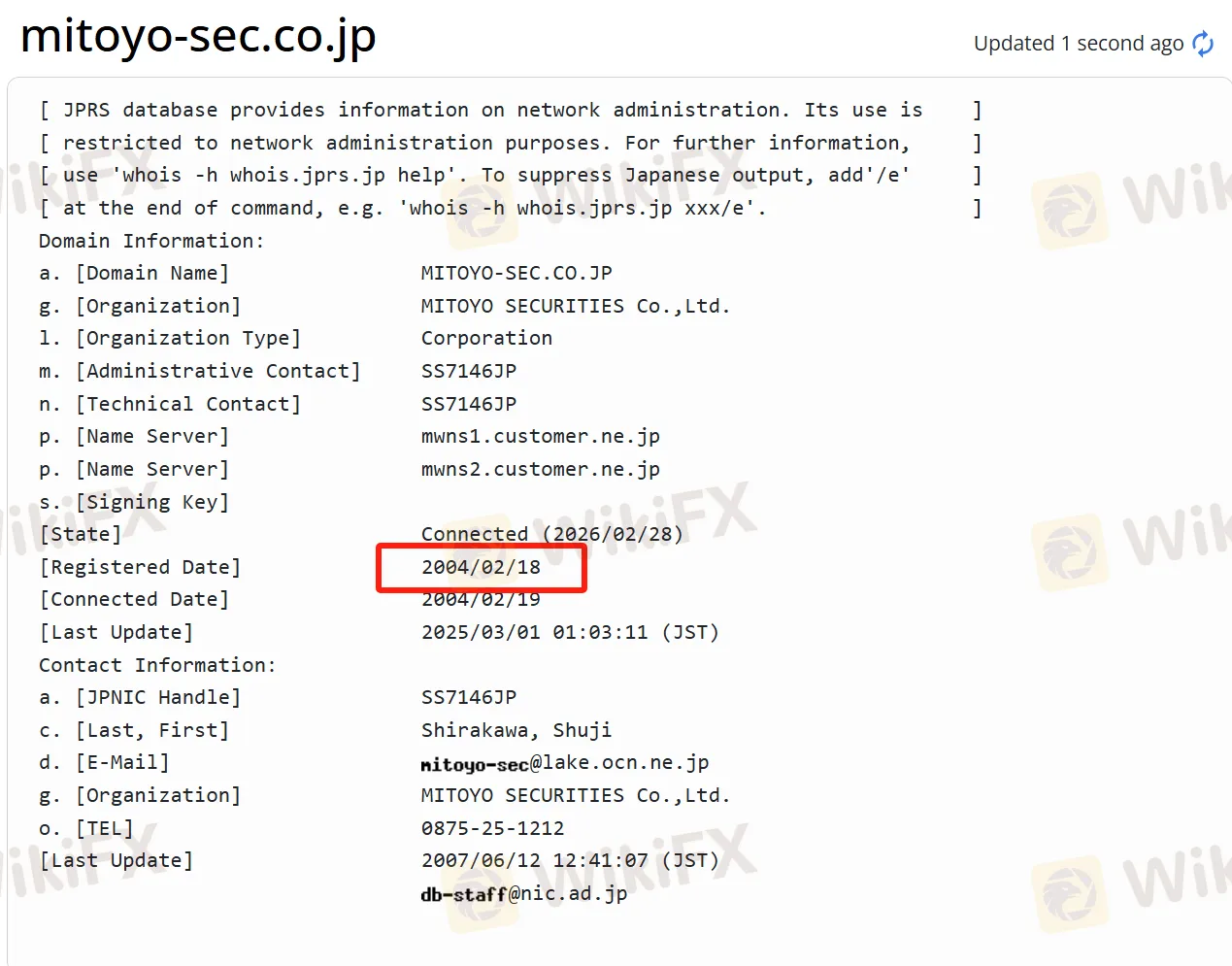

| 成立年份 | 2004 |

| 註冊國家/地區 | 日本 |

| 監管 | FSA(受監管) |

| 市場工具 | 投資信託、債券和股票 |

| 交易平台 | / |

| 客戶支援 | 電話:0875-25-1212 |

| 傳真:0875-25-1221 | |

三豐證券 資訊

三豐證券 證券是一家歷史悠久的日本證券公司。自成立以來,公司深耕當地並以三豐證券地區為據點進行業務。公司提供多樣化的金融產品,包括多個國內交易所上市的股票、各種投資信託和不同類型的債券。同時,它提供個性化的金融解決方案和多種交易工具,滿足不同投資者的需求。公司擁有良好的福利和福利制度,重視當地發展,積極參與當地振興。

優點與缺點

| 優點 | 缺點 |

| 受監管 | 國際業務有限 |

| 多種交易工具 | |

| 良好的福利和福利制度 | |

| 重視當地發展 | |

| 長時間運作 |

三豐證券 是否合法?

三豐證券 是一家合法且合規的證券公司。《金融廳(FSA)》監管三豐證券 證券,其許可證號碼為四國首席財務官(金融商人)第7號。

WikiFX 實地調查

WikiFX 實地調查團隊訪問了三豐證券 在日本的地址,我們確認了其在現場設有實體辦公室。

我可以在三豐證券 交易什麼?

三豐證券 提供國內多個交易所上市的股票,包括東京證券交易所、名古屋證券交易所、札幌證券交易所和福岡證券交易所。

各種投資信託包括股權投資信託、公共債券型投資信託(MRF、公共債券投資信託)、ETF、J-REITs 等。投資者可以通過投資信託實現多元化投資。

投資者還可以選擇各種債券產品,例如面向個人的政府債券(包括三種類型:10年變動、5年固定和3年固定),新窗口銷售政府債券,CB(具有新股認購權的國內可轉換債券型企業債券),以及外幣計價債券等。

| 可交易工具 | 支援 |

| 投資信託 | ✔ |

| 債券 | ✔ |

| 股票 | ✔ |

| 外匯 | ❌ |

| 大宗商品 | ❌ |

| 指數 | ❌ |

| 加密貨幣 | ❌ |

| 期權 | ❌ |

| ETFs | ❌ |