基礎資訊

日本

日本天眼評分

日本

|

15-20年

|

日本

|

15-20年

| http://www.maruchika-shoken.co.jp

官方網址

評分指數

影響力

C

影響力指數 NO.1

日本 2.59

日本 2.59 監管資訊

監管資訊持牌機構:丸近證券株式会社

監管證號:近畿財務局長(金商)第35号

單核

1G

40G

1M*ADSL

日本

日本

| 丸近證券 評論摘要 | |

| 成立年份 | 1918 |

| 註冊國家 | 日本 |

| 監管 | FSA |

| 交易產品 | 證券、投資信託 |

| 模擬帳戶 | ❌ |

| 交易平台 | / |

| 最低存款 | / |

| 客戶支援 | 電話:075-341-5110 |

成立於1918年,Maruchika Securities是日本最古老的經紀商之一。專門從事股票和投資信託。日本FSA對其進行監管,並且具有良好服務歷史。然而,與全球大型經紀商相比,它似乎沒有那麼多現代化的網絡平台。

| 優點 | 缺點 |

| 悠久歷史,聲譽卓著 | 網上交易平台資訊有限 |

| 受FSA監管 | 無模擬帳戶 |

| 專注於日本特色服務 |

是的,丸近證券(丸近證券株式会社)是一家受日本金融廳(FSA)監管的金融機構,獲得了零售外匯牌照,編號近畿財務局長(金商)第35號。

Maruchika Securities提供有限的金融服務,主要集中在證券和投資信託,面向個人和機構客戶。

| 交易產品 | 支援 |

| 證券 | ✔ |

| 投資信託 | ✔ |

| 外匯 | × |

| 大宗商品 | × |

| 指數 | × |

| 股票 | × |

| 加密貨幣 | × |

| 債券 | × |

| 期權 | × |

| ETFs | × |

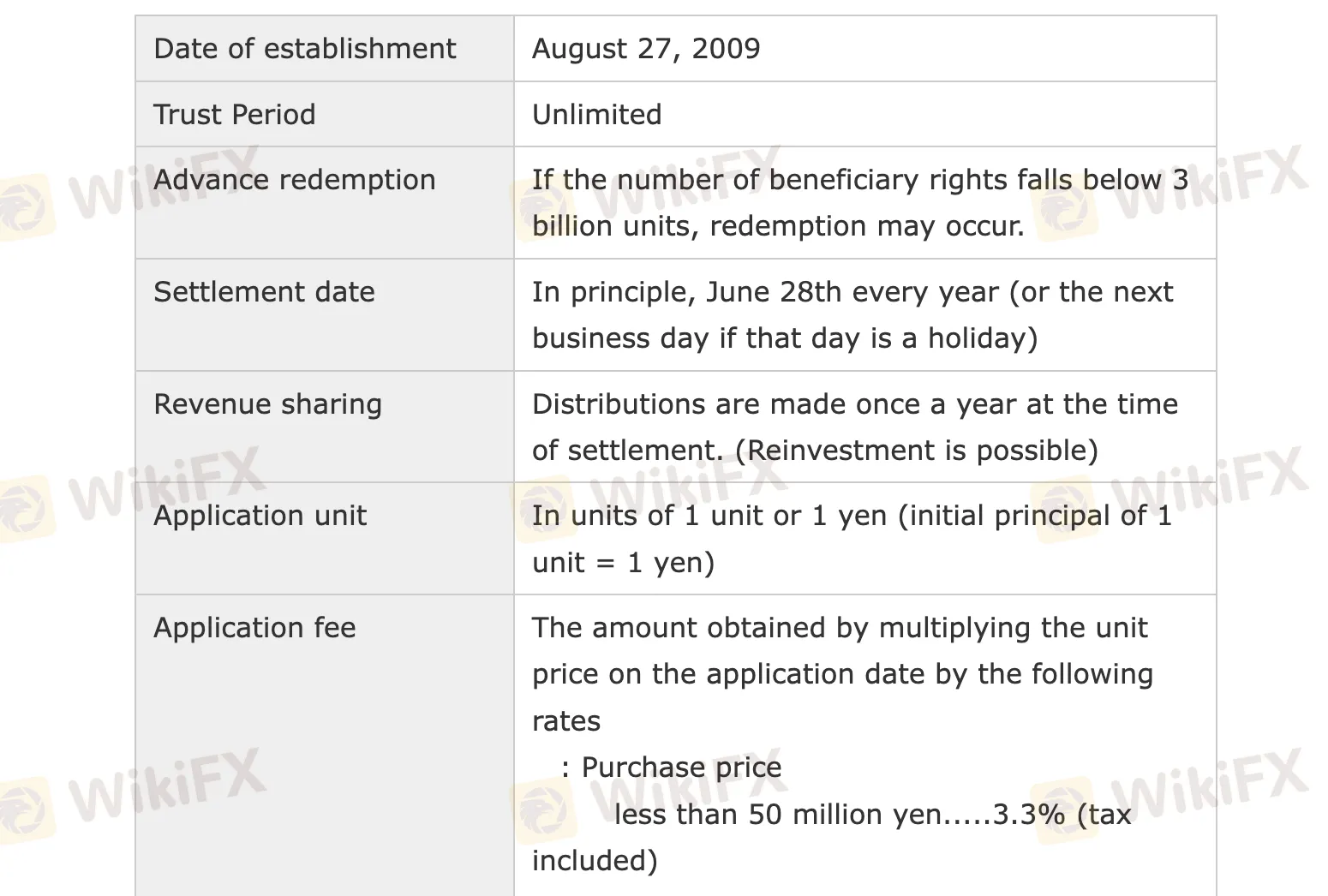

Maruchika Securities的投資信託產品費用大多符合日本的標準。他們對於購買、管理和贖回資產收取普通費用,但對於大額投資則提供折扣。

| 費用類型 | 詳情 |

| 申請(購買)費 | < ¥50M:3.3%;¥50M–200M:2.2%;¥200M–500M:1.65%;> ¥500M:1.1%(所有費用包括稅款) |

| 信託管理費 | 年度總淨資產的1.65%(包括稅款) |

| 贖回費(信託儲備) | 每單位贖回的單位價格的0.3% |

| 其他費用 | 經紀費、保管費、審計費、基金稅 — 各種費用,並非固定或預先設定上限 |

| 股息支付頻率 | 每年一次,結算日期(6月28日或下一個工作日) |

While Maruchika has a solid reputation and is regulated by the FSA, its platform options are more limited compared to larger global brokers. Unlike brokers that offer popular trading platforms like MT4 or MT5, Maruchika’s online platform options are restricted, which may deter traders seeking modern, advanced tools. Additionally, the absence of demo accounts makes it challenging for potential clients to test the platform or practice strategies before investing real funds. Maruchika’s focus on Japanese services also means that international investors may not find the wide range of products they desire.

Yes, as a regulated broker under Japan’s FSA, Maruchika Securities is required to adhere to strict standards designed to protect investors' funds. This includes measures such as segregating client funds from company funds, which adds an additional layer of security. However, as with any investment, there are risks involved, and it's always important to fully understand the products you are investing in. Maruchika's limited product range and lack of advanced platform offerings may be a concern for some investors seeking a more diverse and robust trading environment.

Founded in 1918, Maruchika has built a strong reputation, making it one of Japan’s oldest brokers. This extensive experience in the financial sector offers clients stability and trust. Maruchika is regulated by the Financial Services Agency (FSA), which ensures compliance with local financial regulations and offers protection for investors. The company focuses on specialized services within Japan, especially in securities and investment trusts, which could be an attractive option for clients seeking localized investment solutions.

Yes, Maruchika Securities is a legitimate broker regulated by Japan’s Financial Services Agency (FSA), holding a Retail Forex License. With over a century of operation, the company has built a trusted reputation in Japan’s financial market. Although it primarily offers securities and investment trust products, its FSA regulation ensures that Maruchika complies with local laws and offers a secure environment for its clients within Japan.

請輸入...