Tom Nalichowski

1-2年

How much do you need to deposit at a minimum to start a live trading account with Pi Securities?

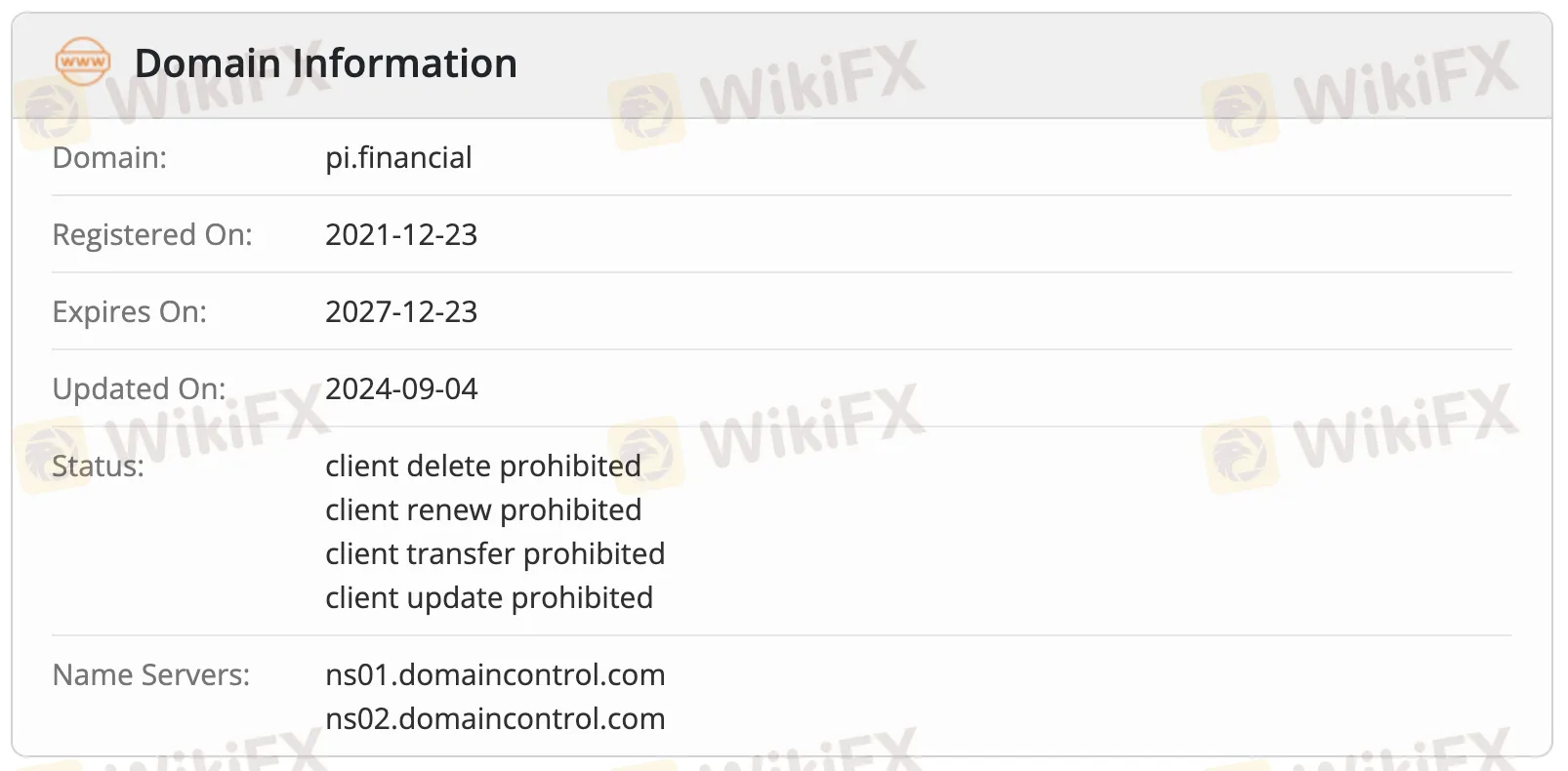

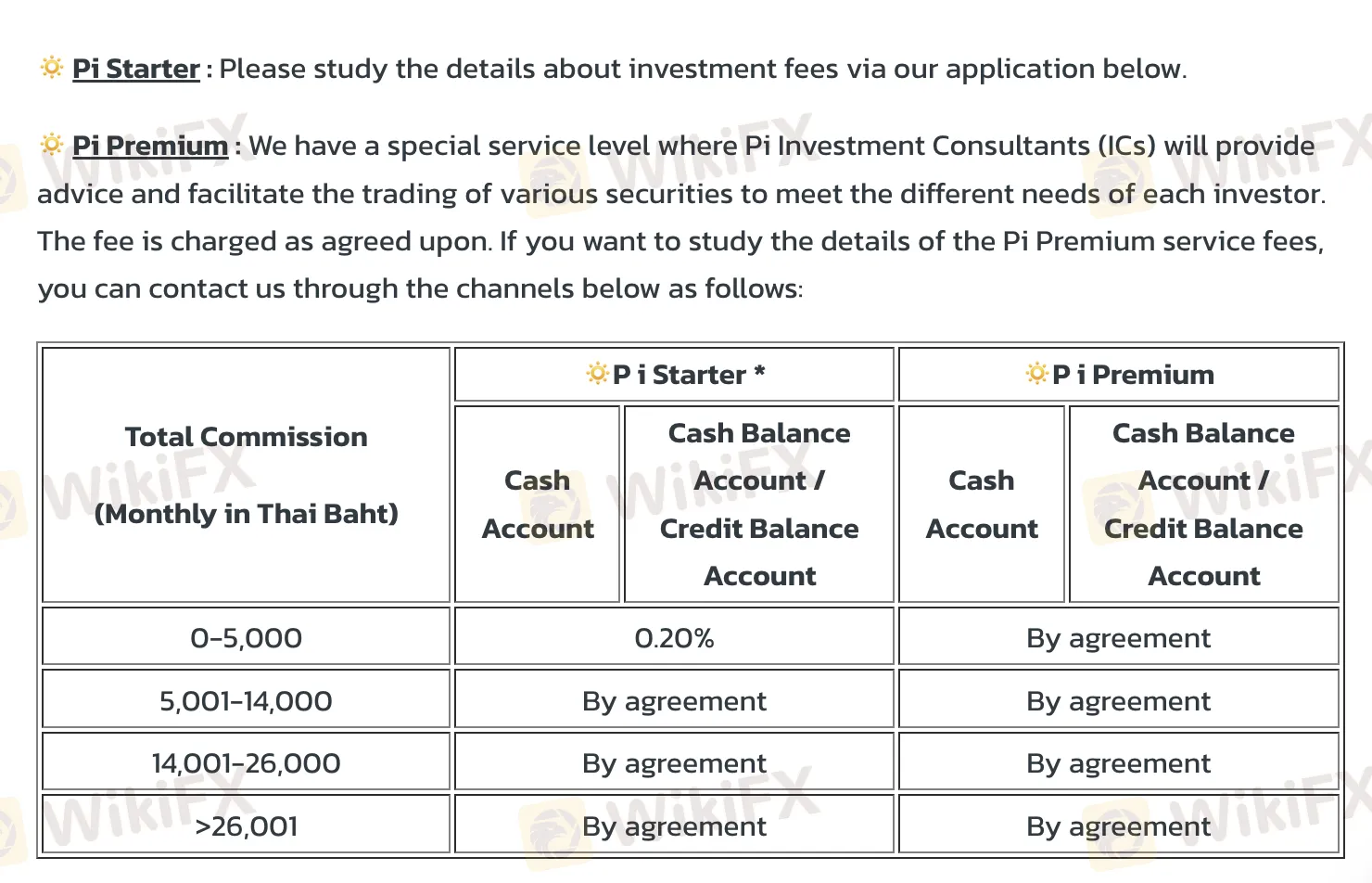

Based on my direct experience researching Pi Securities and considering their available account offerings, I was unable to find a clearly stated minimum deposit amount required to open a live trading account. This lack of transparency immediately stood out for me, especially since, as a trader, understanding upfront financial commitments is essential for risk management and planning. In general, brokers with strong reputations provide this information openly to help prospective clients make informed decisions and gauge their own readiness.

In Pi Securities’ case, the absence of a specified minimum deposit—combined with the fact that many of their fees and conditions for premium services are “by agreement” and not listed on their official channels—means there's an added layer of uncertainty for anyone considering opening an account. For me, this raises practical concerns about accountability and basic transparency, which I consider very important when choosing a broker.

Additionally, Pi Securities is currently unregulated, further increasing my need for caution. Without strong regulatory oversight, the onus is on the trader to investigate all conditions thoroughly before proceeding. Before committing any funds, I would strongly advise contacting their support channels directly and requesting detailed information on deposit requirements and all related trading costs. For me, this due diligence is non-negotiable—and I recommend other traders take the same approach to protect their capital and expectations.

Broker Issues

Withdrawal

Deposit

Mansuber007

1-2年

Does Pi Securities provide a demo account at no cost, and if so, are there any restrictions such as a time limit on its use?

In my experience as a trader, being able to test a broker’s platform and services through a demo account is essential, especially when considering a firm I’m not already familiar with. This allows me to evaluate order execution, platform stability, and overall user experience without risking actual funds. When I looked into Pi Securities, I found that they do not offer a demo account. This is significant because it means I couldn’t simulate trading or get hands-on experience with their MT4 or MT5 setups before opening a live account. For me, this absence makes proper due diligence more difficult, and it introduces additional risk, as I would have to fund an account and potentially face live market conditions with unfamiliar systems.

From a risk management standpoint, I prefer brokers that allow thorough testing before any financial commitment. The lack of a demo option at Pi Securities is among the factors I weigh heavily; it’s not something I overlook, particularly given there are no public details about demo access, trial periods, or any alternative for practice trades. This transparency gap underscores the need for extra caution and emphasizes the importance of being fully comfortable with the firm’s trading platforms and processes before depositing funds or beginning live trading.

Broker Issues

Account

Instruments

Platform

Leverage

Solotim

1-2年

Does Pi Securities apply any charges when you deposit or withdraw funds?

After a detailed review of Pi Securities, I found there is no information provided about deposit or withdrawal charges. For me as a trader, this lack of transparency around fund movements is concerning, especially since handling fees can significantly affect the real cost of trading, particularly for active investors or anyone moving larger sums. In my experience, regulated brokers typically disclose all such fees clearly on their platforms or within client documents, allowing traders to factor these costs into their risk and money management strategies. The fact that Pi Securities does not publish details about deposit or withdrawal charges is a notable limitation, as it introduces uncertainty and makes it difficult to effectively plan out trading expenses. This is even more relevant given the broker operates without recognized regulatory oversight. Whenever a broker chooses not to publicly disclose something as fundamental as funding charges, I err on the side of caution. I strongly recommend that anyone considering Pi Securities seek direct and written clarification from their customer support before proceeding with any funding. Not knowing the full picture could expose traders to unexpected costs, which is an unnecessary risk in my view.

Broker Issues

Withdrawal

Deposit

Mohammed Mazhar

1-2年

Is it possible to trade individual assets such as Gold (XAU/USD) and Crude Oil through Pi Securities?

After reviewing all available information, I cannot recommend Pi Securities for trading individual assets like Gold (XAU/USD) or Crude Oil. In my experience, it is essential to confirm not only what products are advertised, but what is actually supported on a broker’s real trading platforms. According to the details I found, Pi Securities focuses on equities, derivatives, mutual funds, and bonds, specifically within the Thai market and some international equities. There is no indication, either in the official materials or their supported product lists, that they offer forex pairs or commodity CFDs such as gold or crude oil.

For me, the absence of forex, commodities, indices, cryptocurrencies, and options suggests that Pi Securities is not equipped for those who want to trade global commodities directly. While they do support MT4 and MT5, which often offer these assets at other brokers, the asset list in this case remains strictly limited. I have also noticed that transparency is lacking—there is no clear public information about available instruments, account conditions, or even deposit and withdrawal processes.

Given the lack of regulation and the significant limitations in tradable products, I would exercise extreme caution. From my perspective, if my goal was exposure to gold or oil via instruments like XAU/USD or oil CFDs, I would search for a well-regulated broker with explicit commodity offerings, and clear, publicly available terms and conditions.

Broker Issues

Account

Instruments

Leverage

Platform