Company Summary

| MARUCHIKA Review Summary | |

| Founded | 1918 |

| Registered Country | Japan |

| Regulation | FSA |

| Trading Products | Securities, investment trusts |

| Demo Account | ❌ |

| Trading Platform | / |

| Minimum Deposit | / |

| Customer Support | Phone: 075-341-5110 |

MARUCHIKA Information

Founded in 1918, Maruchika Securities is one of Japan's oldest brokers. It specializes in stocks and investment trusts. The Japan FSA keeps an eye on it, and it has a long history of good service. However, it doesn't seem to have as many modern web platforms as bigger global brokers.

Pros and Cons

| Pros | Cons |

| Long history, established reputation | Limited online trading platform information |

| Regulated by FSA | No demo accounts |

| Focus on specialized Japanese services |

Is MARUCHIKA Legit?

Yes, MARUCHIKA (丸近證券株式会社) is a regulated financial institution that Japan's Financial Services Agency (FSA) has given a Retail Forex License, number 近畿財務局長(金商)第35号.

What Can I Trade on Maruchika Securities?

Maruchika Securities provides a limited set of financial services, mostly focused on securities and investment trusts, to both individual and institutional clients.

| Trading Products | Supported |

| Securities | ✔ |

| Investment Trusts | ✔ |

| Forex | × |

| Commodities | × |

| Indices | × |

| Stocks | × |

| Cryptocurrencies | × |

| Bonds | × |

| Options | × |

| ETFs | × |

MARUCHIKA Fees

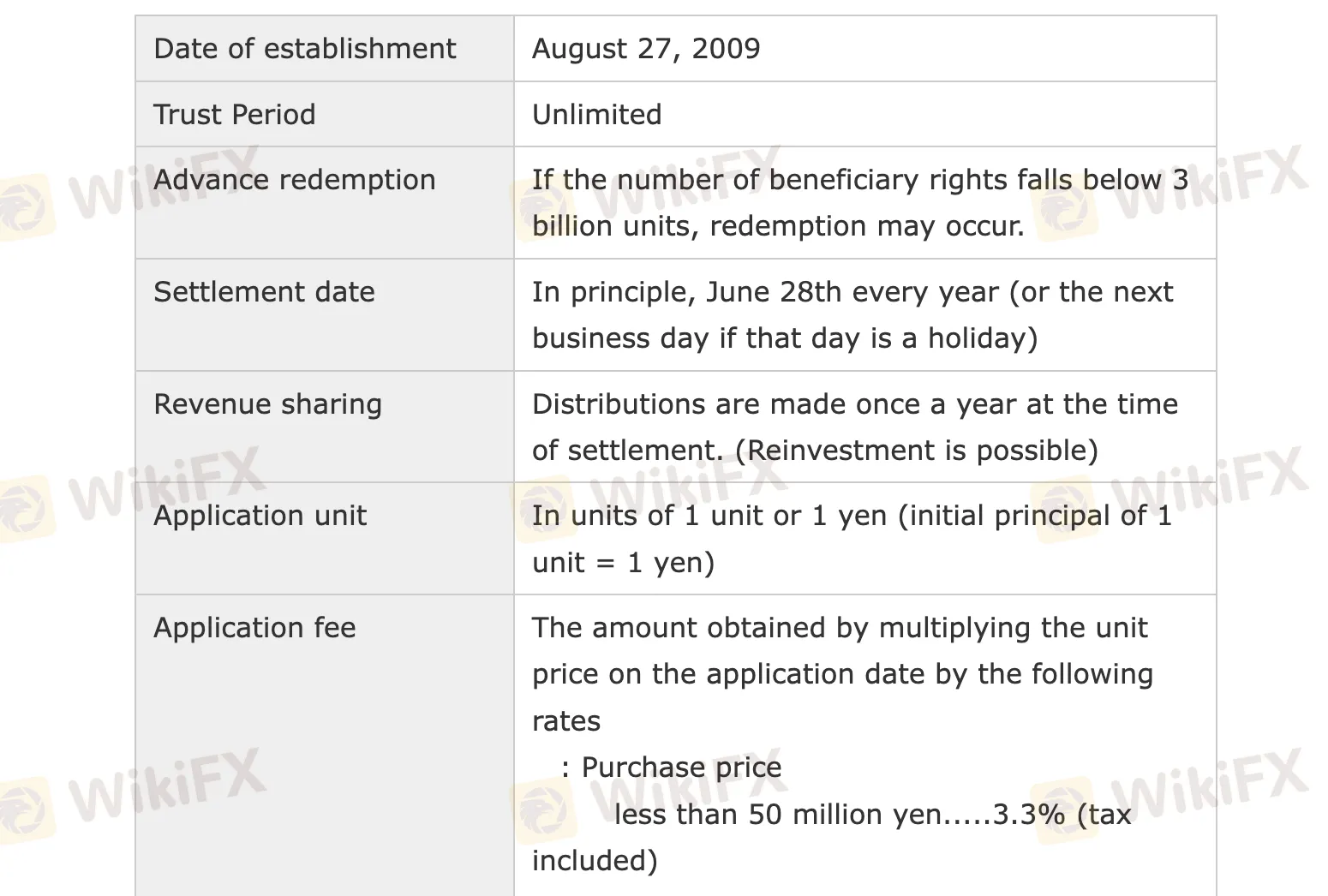

The fees for Maruchika Securities' investment trust products are mostly in accordance with what is normal in Japan. They charge ordinary fees for buying, managing, and redeeming assets, although they give discounts for large investments.

| Fee Type | Details |

| Application (Purchase) Fee | < ¥50M: 3.3%; ¥50M–200M: 2.2%; ¥200M–500M: 1.65%; > ¥500M: 1.1% (all incl. tax) |

| Trust Management Fee | Annual 1.65% (incl. tax) of total net assets |

| Redemption Fee (Trust Reserve) | 0.3% of unit price per unit redeemed |

| Other Expenses | Brokerage fees, custody fees, audit fees, fund taxes — varies, not fixed or capped upfront |

| Dividend Frequency | Once per year at settlement date (June 28 or next business day) |