公司简介

| 丸近证券 评论摘要 | |

| 成立时间 | 1918 |

| 注册国家 | 日本 |

| 监管 | FSA |

| 交易产品 | 证券,投资信托 |

| 模拟账户 | ❌ |

| 交易平台 | / |

| 最低存款 | / |

| 客服支持 | 电话:075-341-5110 |

丸近证券 信息

成立于1918年,Maruchika Securities是日本最古老的经纪商之一。专注于股票和投资信托。日本FSA对其进行监管,具有良好的服务历史。然而,与全球较大的经纪商相比,它似乎没有那么多现代化的网络平台。

优缺点

| 优点 | 缺点 |

| 悠久历史,声誉卓著 | 有限的在线交易平台信息 |

| 受FSA监管 | 无演示账户 |

| 专注于日本特色服务 |

丸近证券 是否合法?

是的,丸近证券(丸近证券株式会社)是一家受日本金融厅(FSA)监管的金融机构,获得了零售外汇许可证,编号近畿财务局长(金商)第35号。

在Maruchika Securities上可以交易什么?

Maruchika Securities提供有限的金融服务,主要集中在证券和投资信托,面向个人和机构客户。

| 交易产品 | 支持 |

| 证券 | ✔ |

| 投资信托 | ✔ |

| 外汇 | × |

| 大宗商品 | × |

| 指数 | × |

| 股票 | × |

| 加密货币 | × |

| 债券 | × |

| 期权 | × |

| ETF | × |

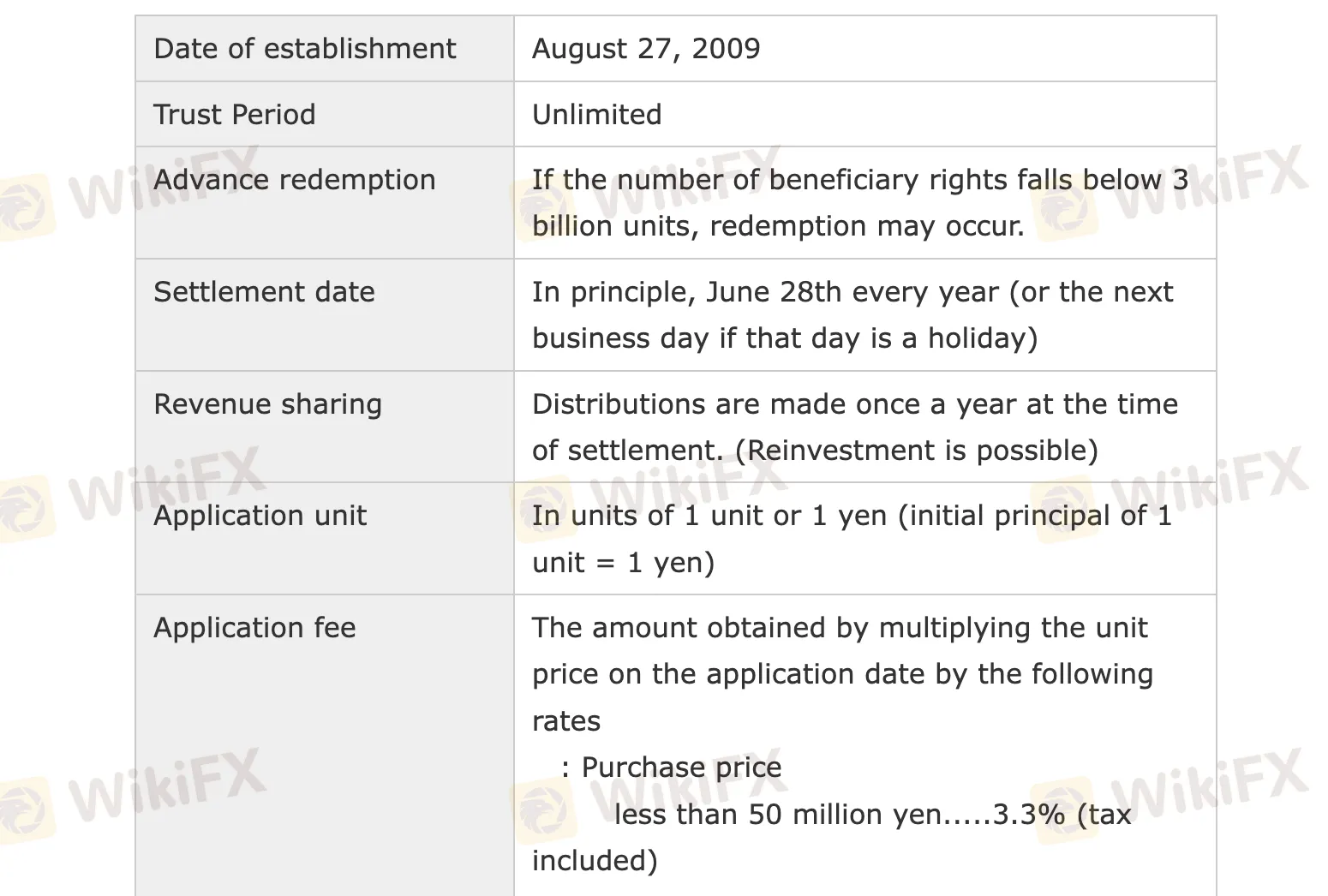

丸近证券 费用

丸近证券的投资信托产品的手续费大多符合日本的正常标准。他们对购买、管理和赎回资产收取普通的手续费,尽管对大额投资给予折扣。

| 费用类型 | 详细信息 |

| 申请(购买)费 | < ¥50M:3.3%; ¥50M–200M:2.2%; ¥200M–500M:1.65%; > ¥500M:1.1%(含税) |

| 信托管理费 | 年度总净资产的1.65%(含税) |

| 赎回费(信托储备) | 每单位赎回的单位价格的0.3% |

| 其他费用 | 经纪手续费、托管手续费、审计手续费、基金税 — 各种费用,没有固定或预先设定的上限 |

| 分红频率 | 每年一次,结算日期(6月28日或下一个工作日) |