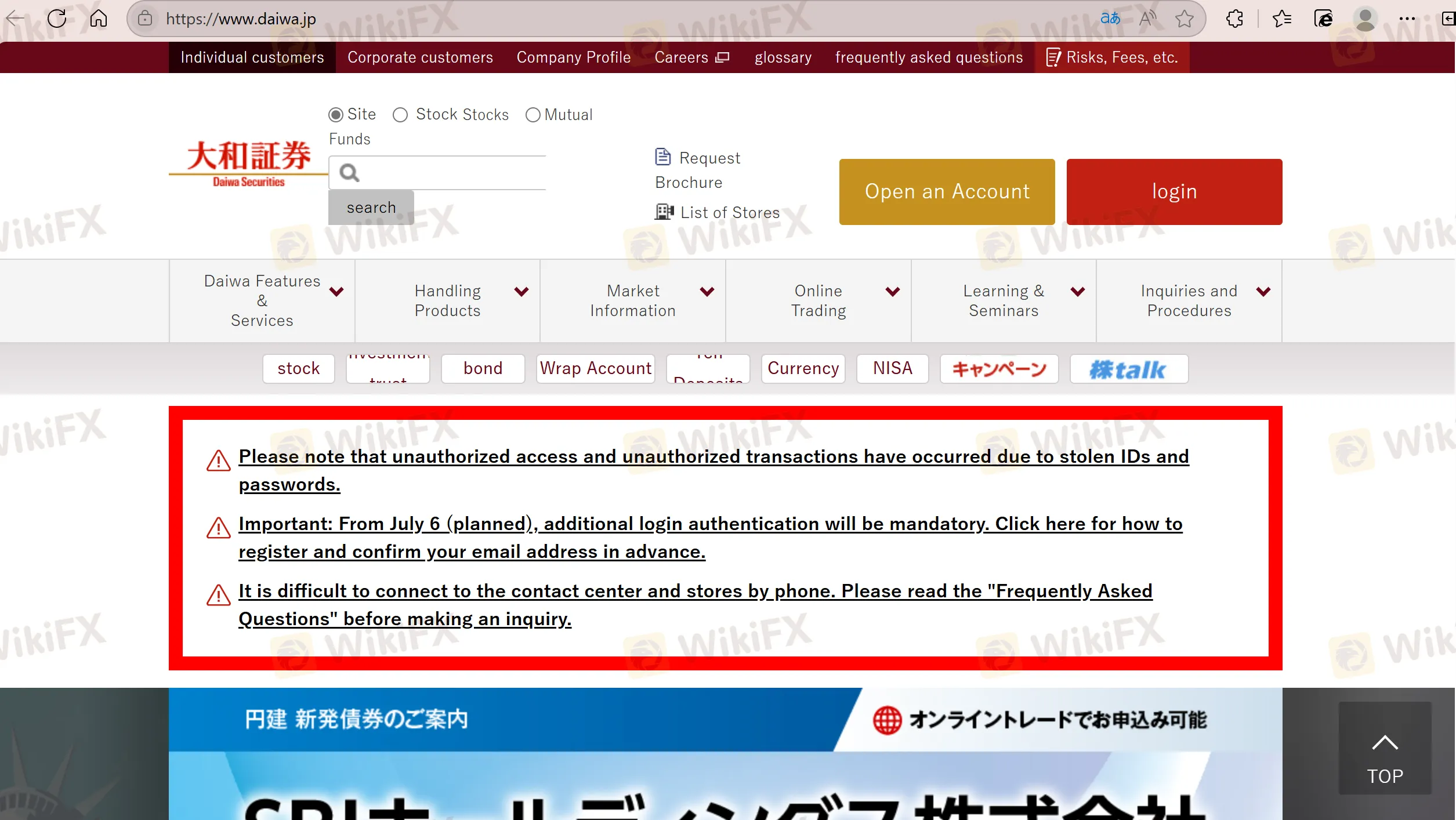

公司简介

| 大和证券 评论摘要 | |

| 成立时间 | 2007 |

| 注册国家/地区 | 日本 |

| 监管 | FSA |

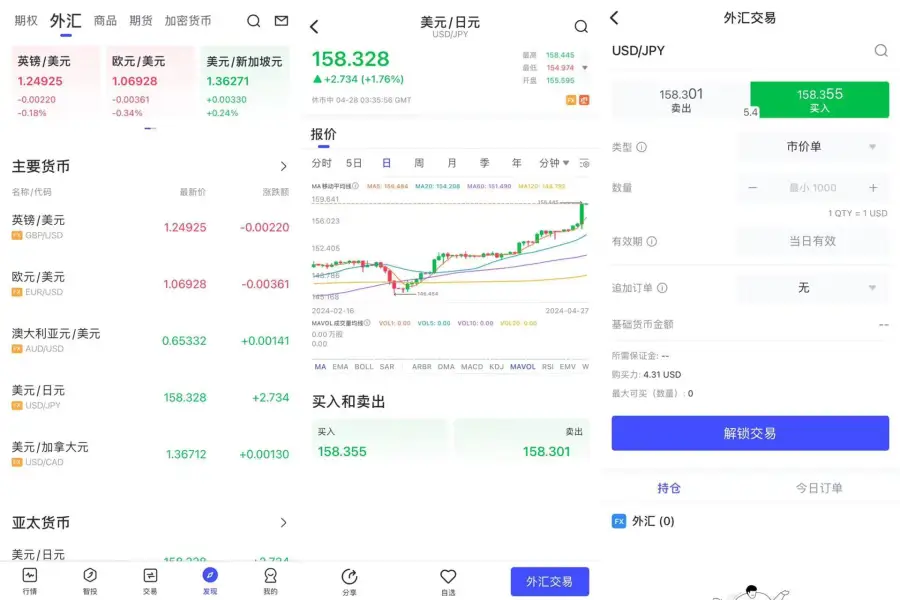

| 产品 | 股票、养老金与保险、证券质押贷款、首次公开募股、投资信托、证券、PO、债券、外汇 |

| 交易平台 | D-Port、Stock Walk |

| 最低存款 | / |

| 客服支持 | 电话:0120 - 010101 |

大和证券 信息

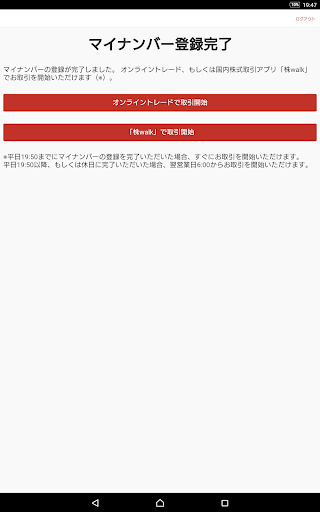

大和证券成立于2007年,受日本金融厅(FSA)监管,是一家在线交易平台,主要提供国内和美国股票、中国股票、首次公开募股、投资信托、债券、外币、日元存款、智能投顾等多种金融产品和服务。他们提供易于使用的平台,如D-Port和Stock Walk。

优缺点

| 优点 | 缺点 |

|

|

|

|

|

大和证券 是否合法?

大和证券持有由日本金融厅(FSA)颁发的零售外汇牌照。

| 监管机构 | 当前状态 | 监管国家 | 持牌实体 | 牌照类型 | 牌照号码 |

| 日本金融厅(FSA) | 受监管 | 日本 | 大和证券株式会社 | 零售外汇牌照 | 関東財務局長(金商)第108号 |

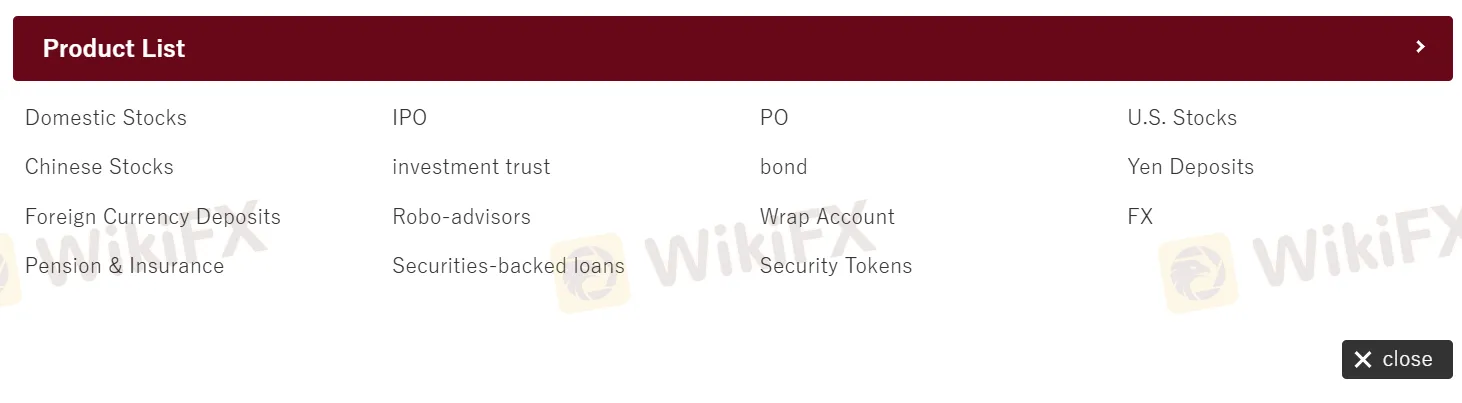

产品

大和证券提供不同的金融产品,主要包括国内和中国股票、IPO、投资信托、债券、外币存款、智能投顾、包装账户、养老金和保险服务、证券抵押贷款、美国股票、日元存款和安全通证。

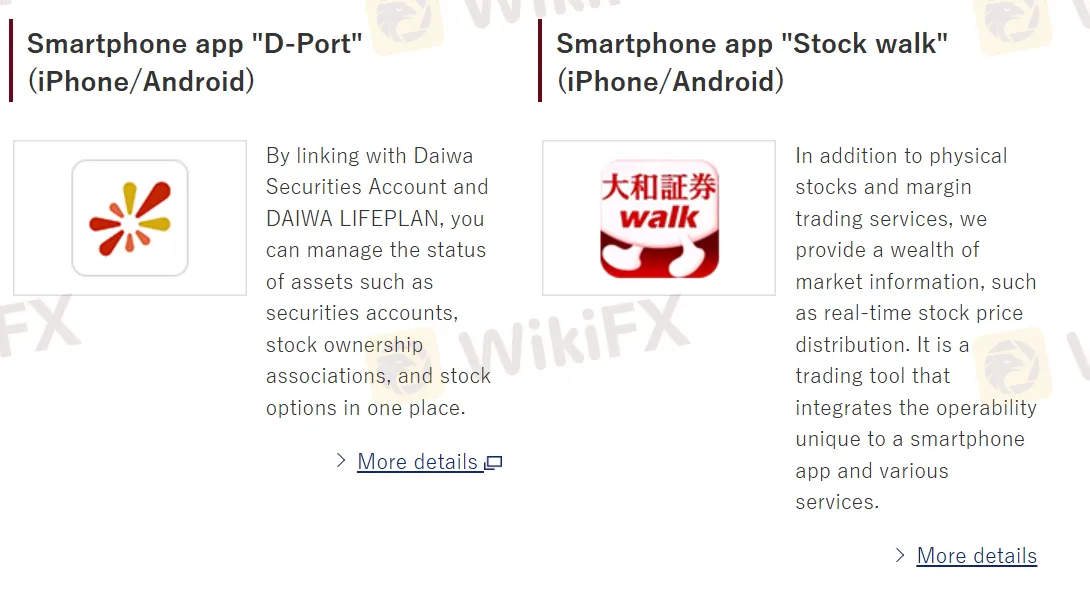

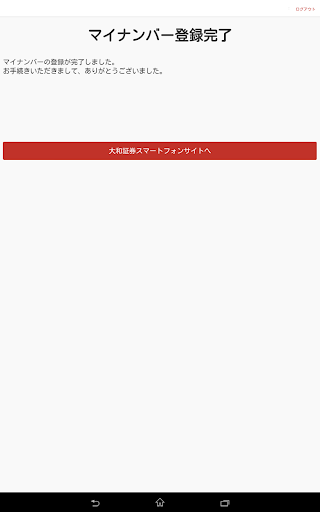

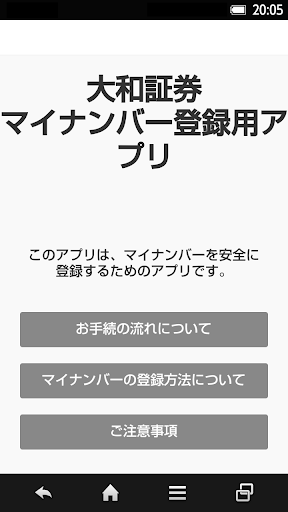

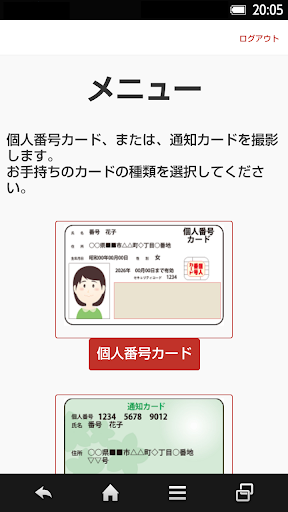

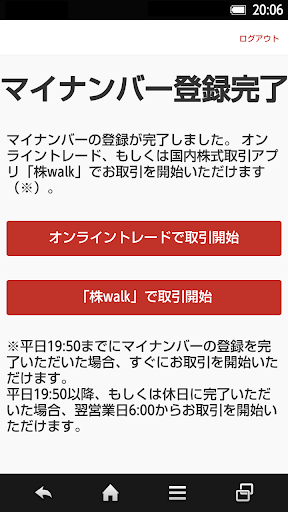

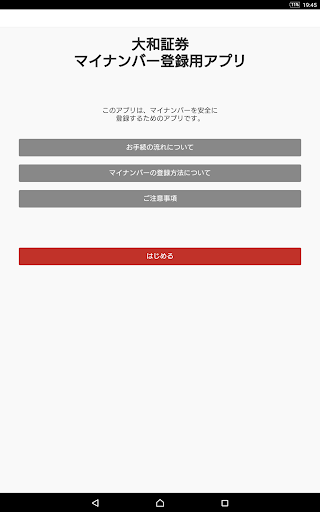

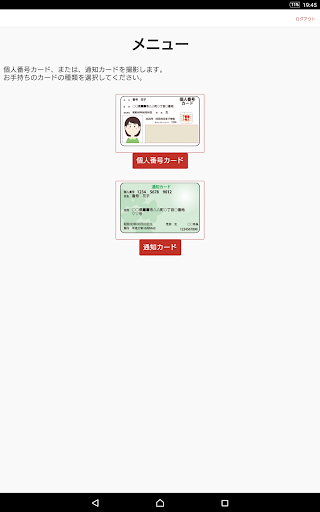

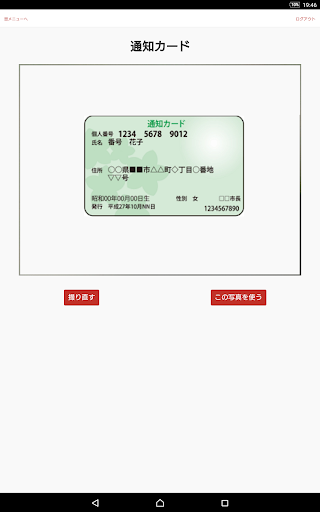

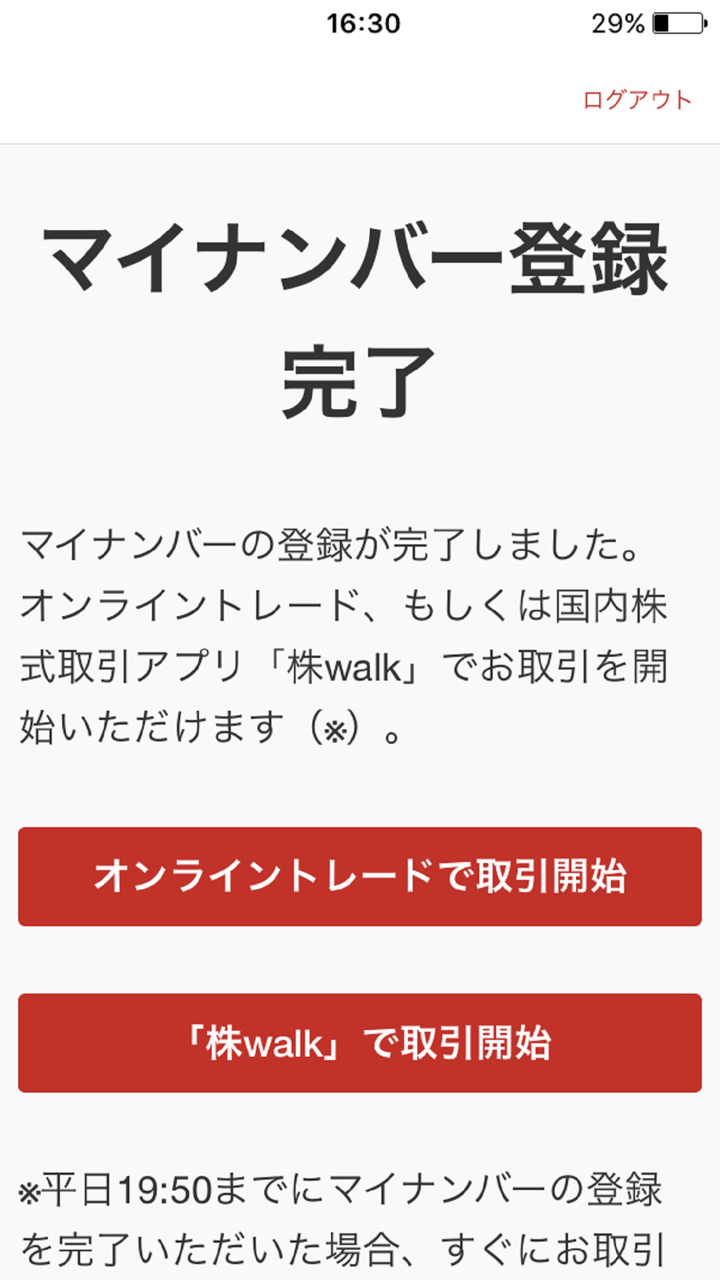

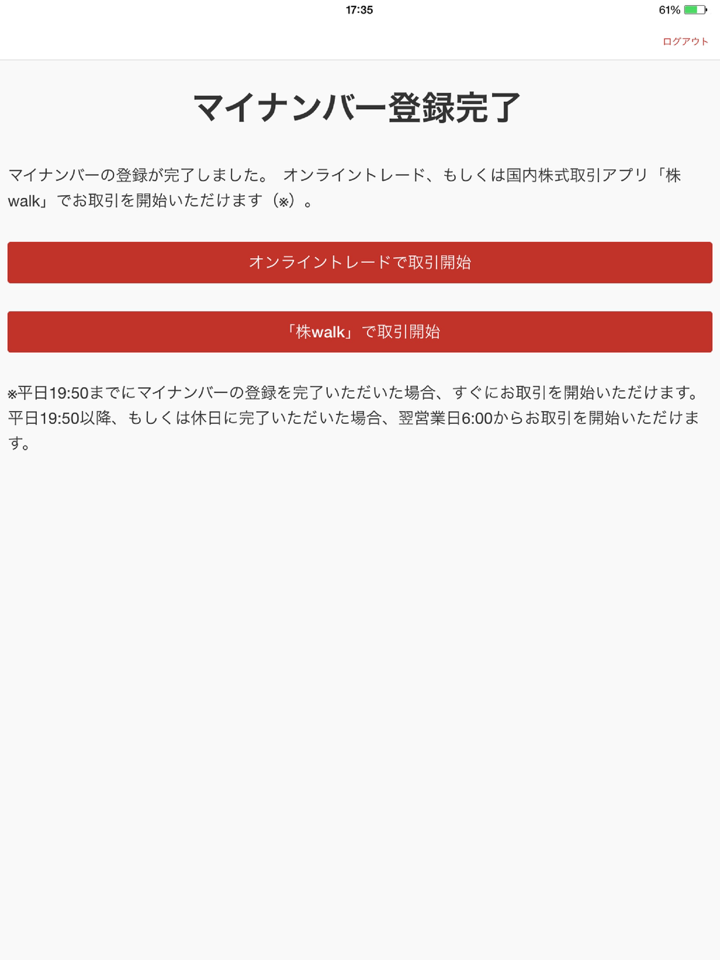

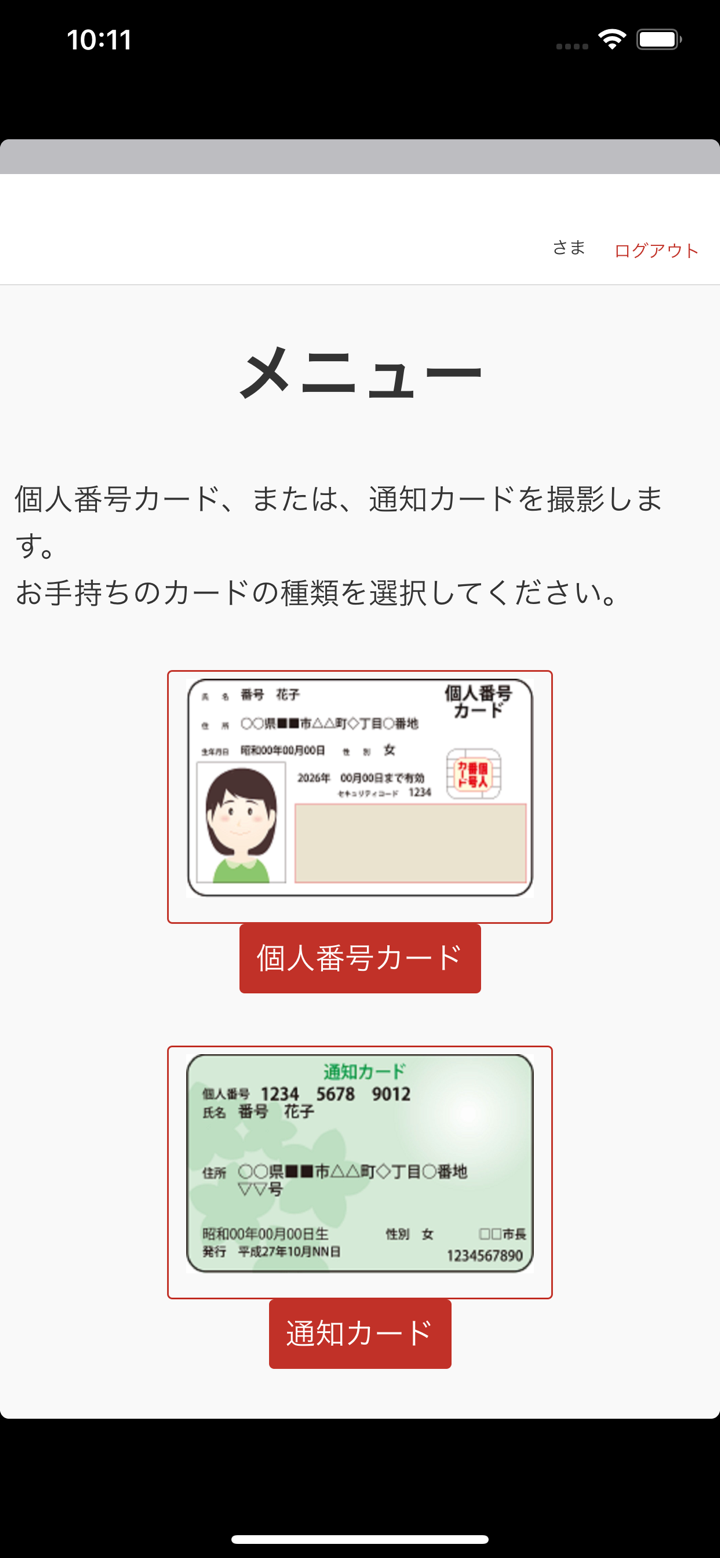

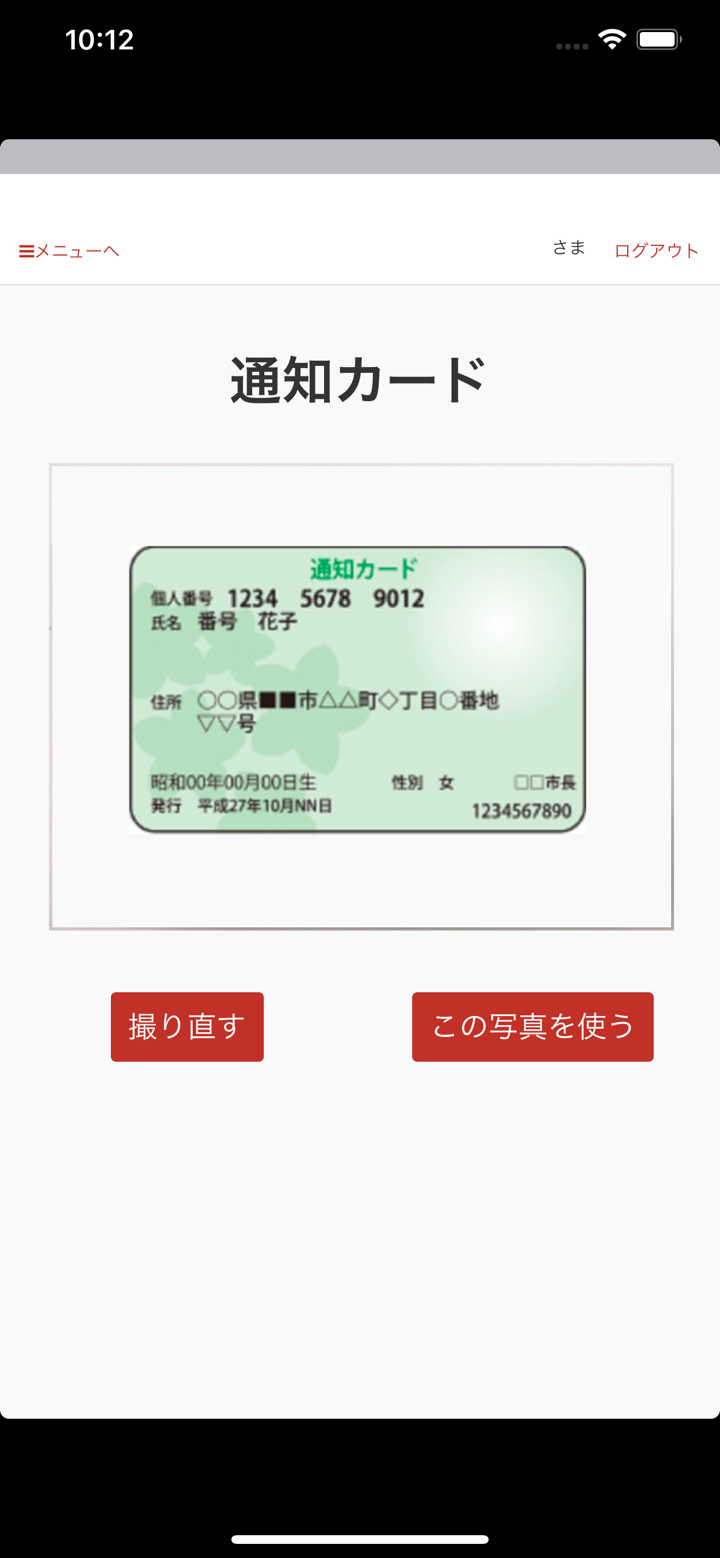

交易平台

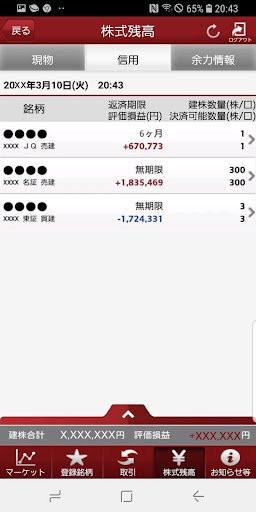

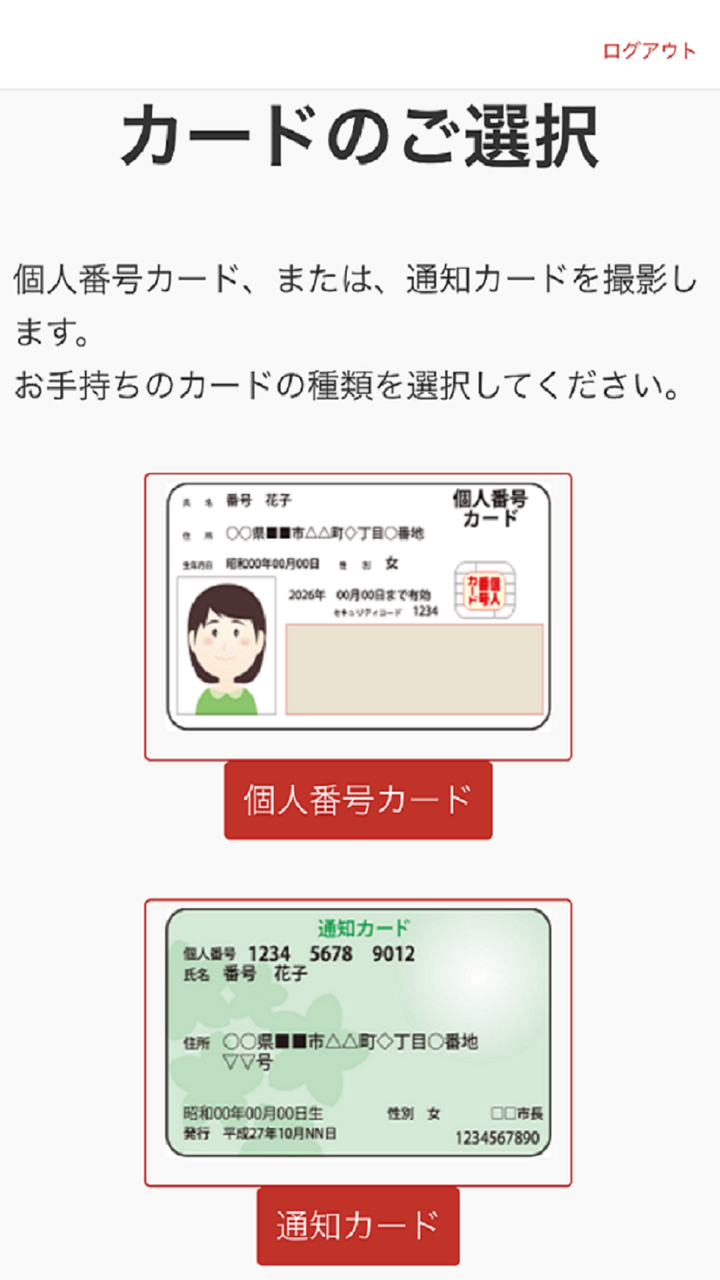

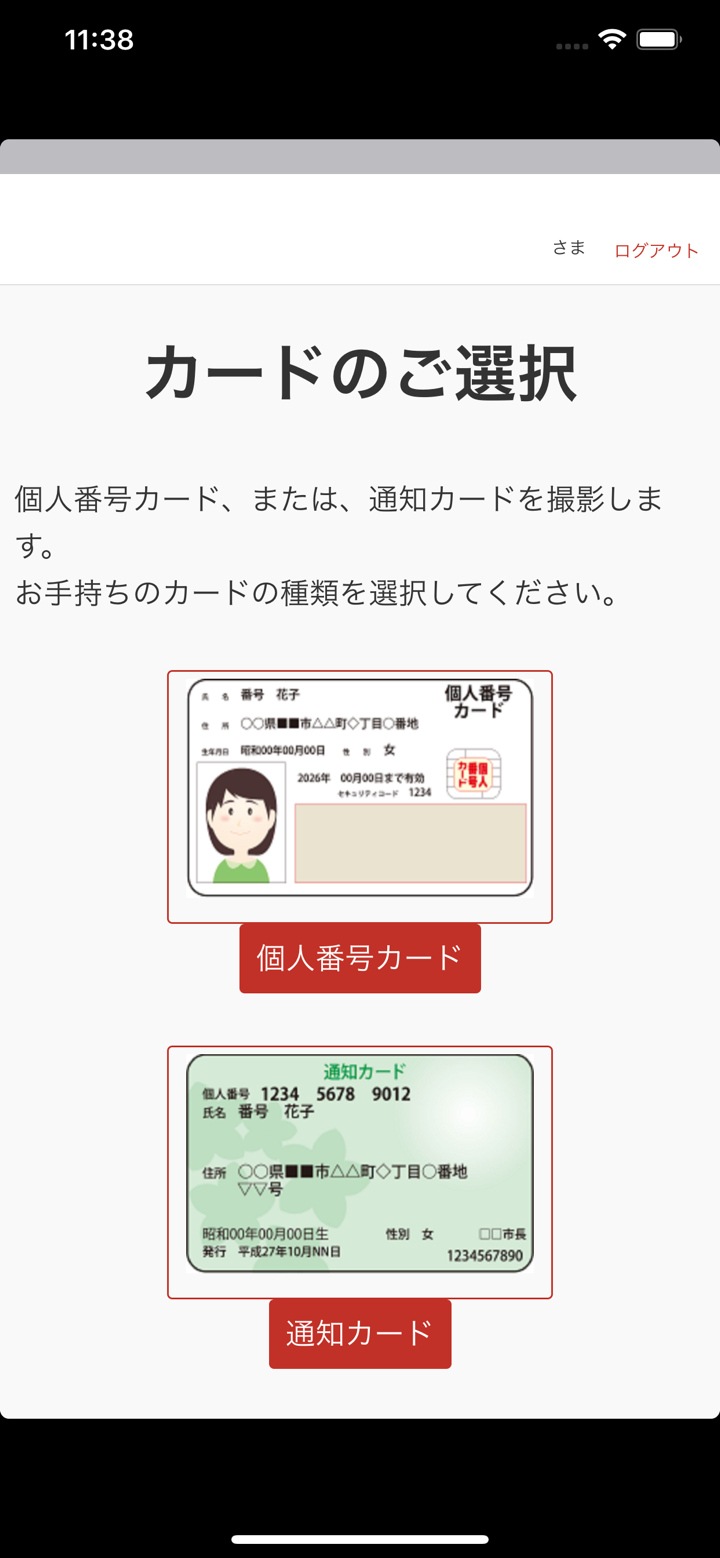

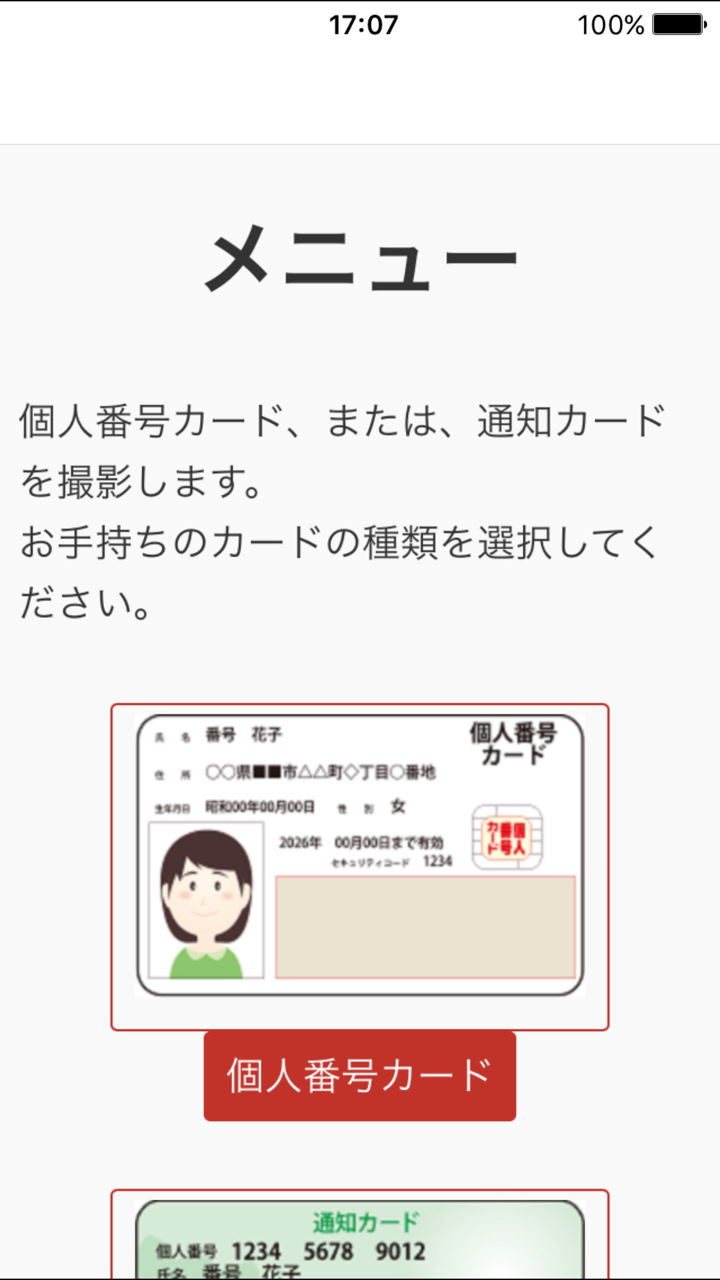

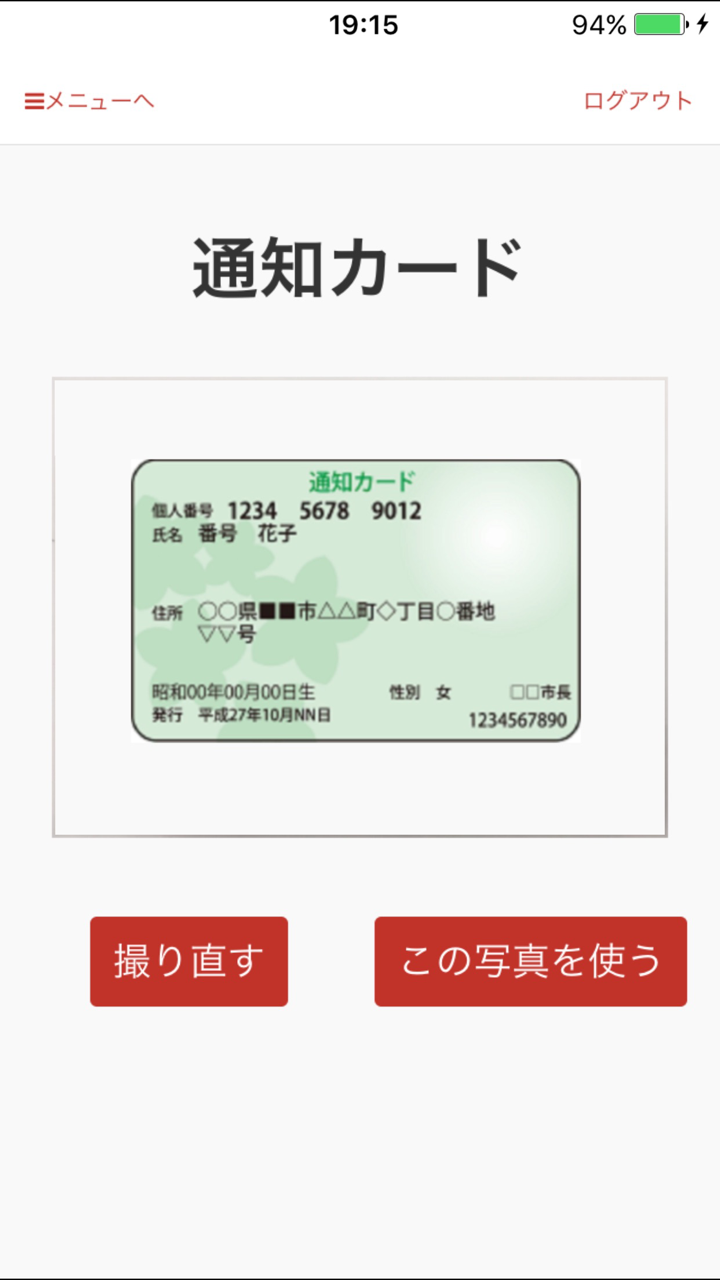

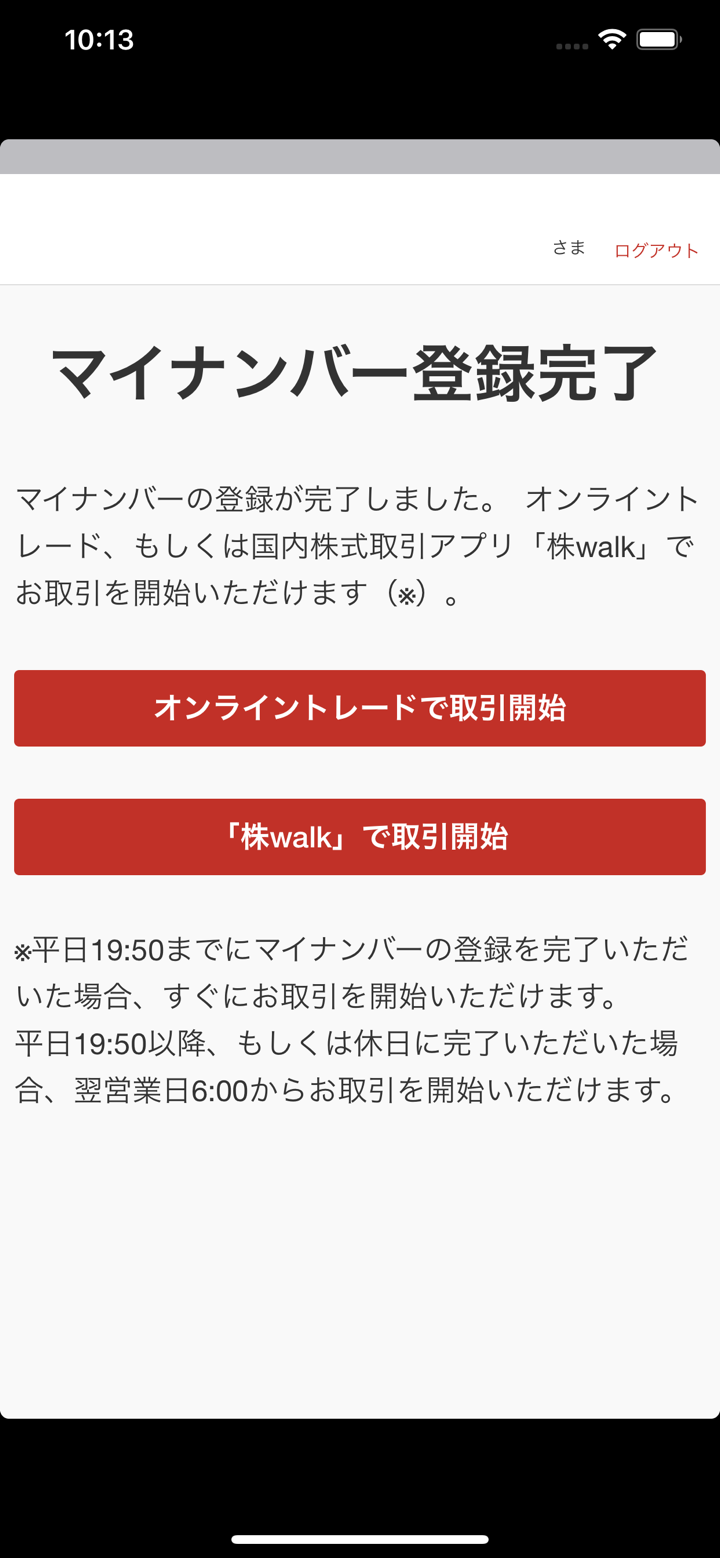

| 交易平台 | 支持 | 可用设备 |

| D-Port | ✔ | iPhone/Android |

| 股票漫步 | ✔ | iPhone/Android |

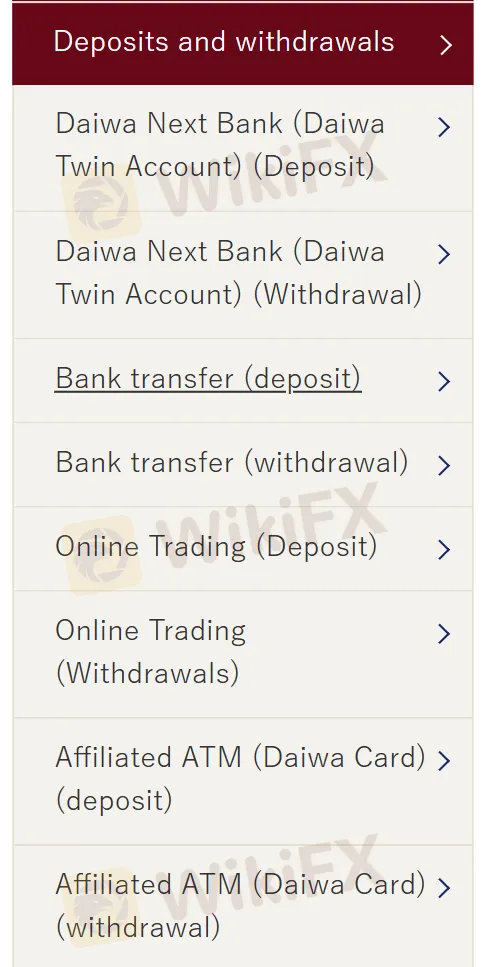

存取款

对于存取款方式,大和证券提供不同选择以方便客户。方法包括通过大和证券 Next Bank、标准银行转账、在线交易平台进行合同操作,以及使用大和证券卡在海外货币的关联ATM机上进行交易。

我行

香港

大和证券无法打开无法出金,软件进不去,找不到客服

曝光

春日里的阳光

香港

是正规的,手续费默认按万分之2.5收取,相对来说还可以

好评

FX1732221901

阿根廷

自2020年以来,我一直在使用大和证券,没有理由换成其他经纪商。客户服务一直很出色,存款和取款非常方便,从未遇到问题。只要他们继续为用户提供优秀的交易条件,我将一直与他们合作。

好评

AA资治通鉴

摩洛哥

公司比我年长,所以我想能坚持这么久一定是个好公司。经过2个月的体验,我觉得他们的总体交易条件非常好,可以免费存取款,没有最低存款要求,并且可以使用各种工具。

好评

孙东方

香港

提供广泛的金融产品和服务,没有任何最低存款额要求,您可以随心所欲地投资。但他们到此为止......交易条件不够透明!该经纪商表示,它确实收取一些外汇交易佣金,但没有具体说明。他们也懒得提及任何关于杠杆的事情。

中评

刘家

香港

一家历史悠久的经纪人,提供多元化的产品和服务,如果您有任何疑问,一般客户支持,没有可用的在线支持团队......

中评