Buod ng kumpanya

| Daiwa Buod ng Pagsusuri | |

| Itinatag | 2007 |

| Nakarehistrong Bansa/Rehiyon | Hapon |

| Regulasyon | FSA |

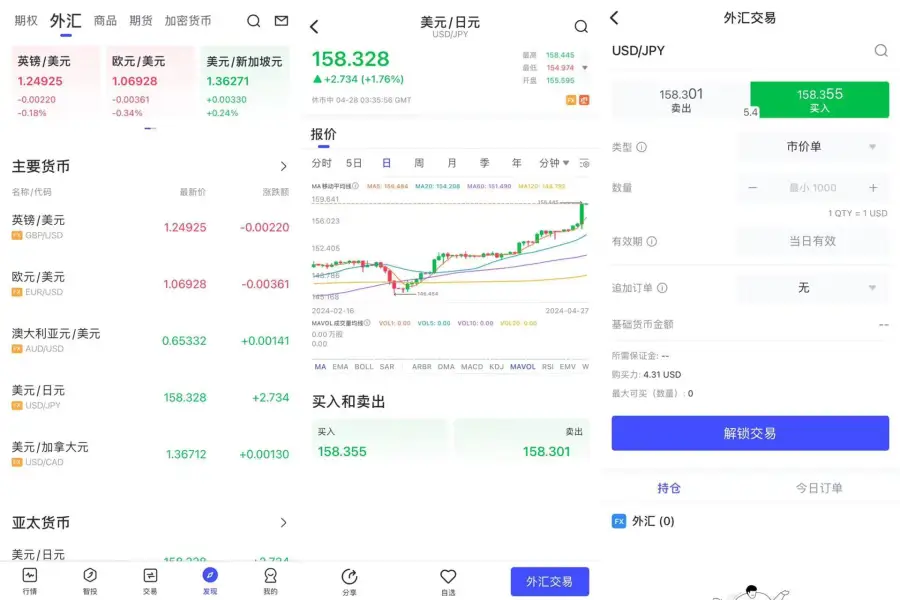

| Mga Produkto | Stocks, Pension & Insurance, Securities-backed loans, IPO, Investment Trust, Securities, PO, Bonds, FX |

| Platform ng Paggagalaw | D-Port, Stock walk |

| Minimum na Deposito | / |

| Suporta sa Customer | Tel: 0120 - 010101 |

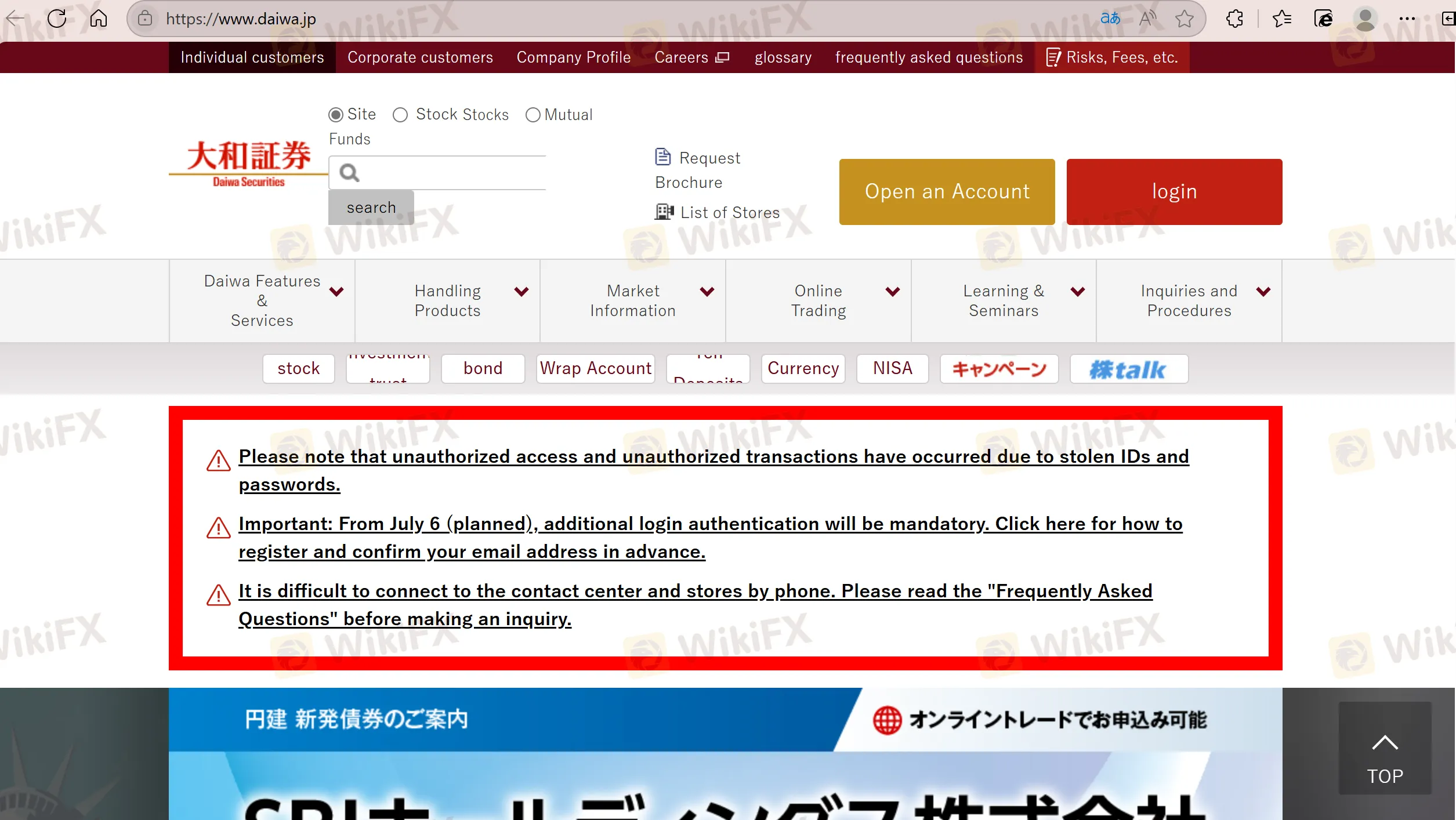

Impormasyon Tungkol sa Daiwa

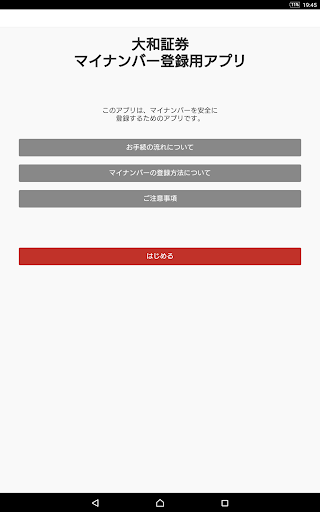

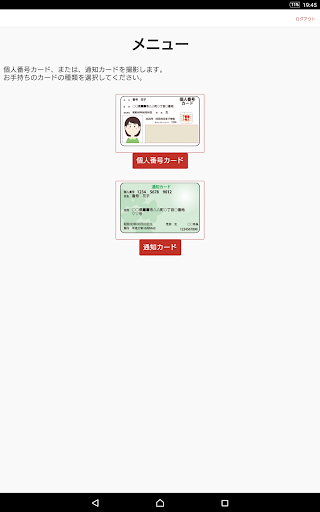

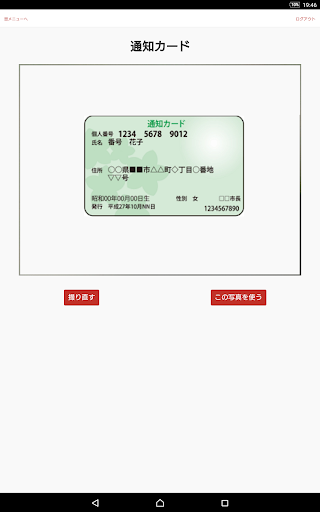

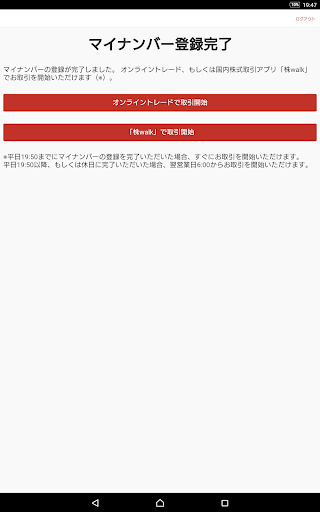

Daiwa, itinatag noong 2007 at nireregula ng Financial Services Agency (FSA) ng Hapon, ay isang online na plataporma ng kalakalan na nag-aalok ng maraming produkto at serbisyo sa pinansyal, kabilang ang lokal at U.S. stocks, mga stock sa Tsina, IPOs, investment trusts, bonds, foreign currency, yen deposits, robo-advisors, at iba pa. Nagbibigay sila ng mga madaling gamiting plataporma tulad ng D-Port at Stock Walk.

Mga Kalamangan at Disadvantages

| Mga Kalamangan | Mga Disadvantages |

|

|

|

|

|

Tunay ba ang Daiwa?

Ang Daiwa ay may Retail Forex License na nireregula ng Financial Services Agency (FSA) sa Hapon.

| Otoridad na Nireregula | Kasalukuyang Kalagayan | Nireregulang Bansa | Lisensiyadong Entidad | Uri ng Lisensya | Numero ng Lisensya |

| Financial Services Agency (FSA) | Nireregula | Hapon | Daiwa株式会社 | Retail Forex License | 関東財務局長(金商)第108号 |

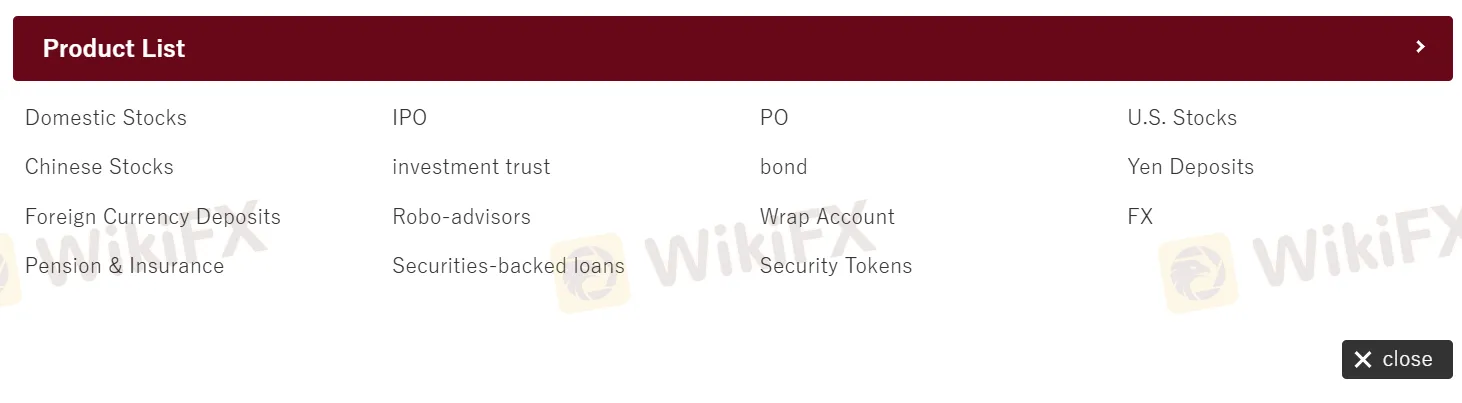

Mga Produkto

Daiwa nag-aalok ng iba't ibang produkto sa pinansyal, kabilang ang lokal at Tsino mga stock, IPOs, investment trusts, bonds, dayuhang deposito sa pera, robo-advisors, wrap accounts, pensyon at mga serbisyo sa seguro, securities-backed loans, U.S. stocks, yen deposits, at security tokens.

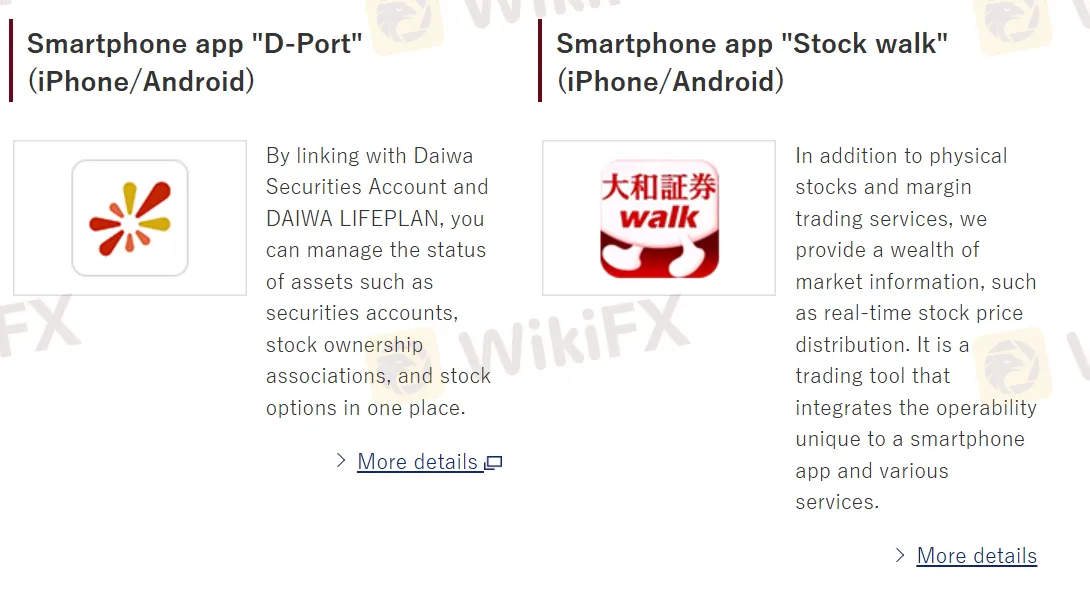

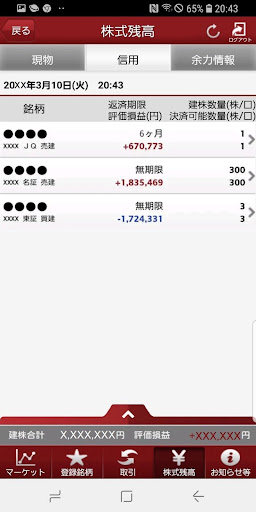

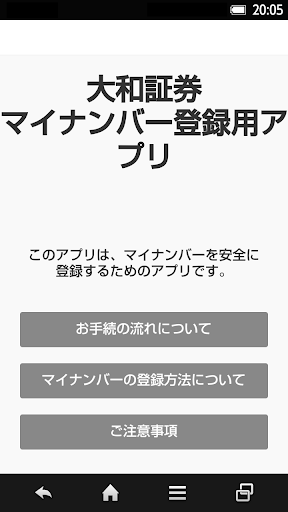

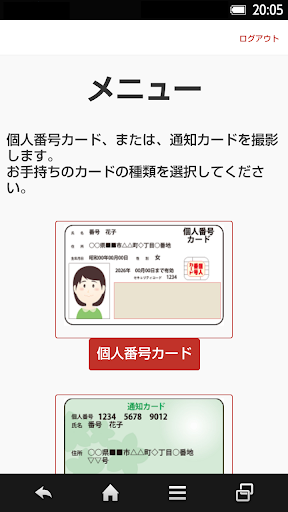

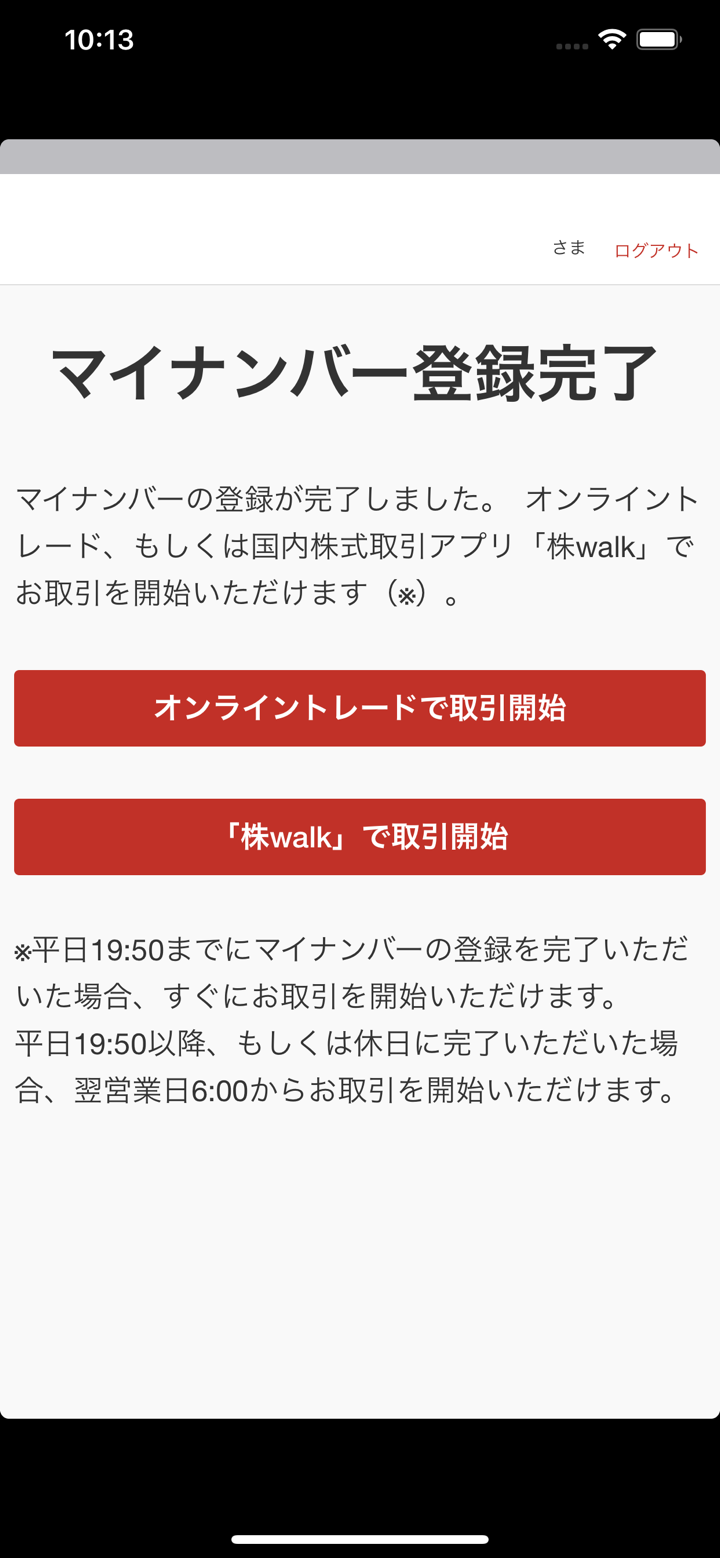

Plataforma ng Kalakalan

| Plataforma ng Kalakalan | Supported | Available Devices |

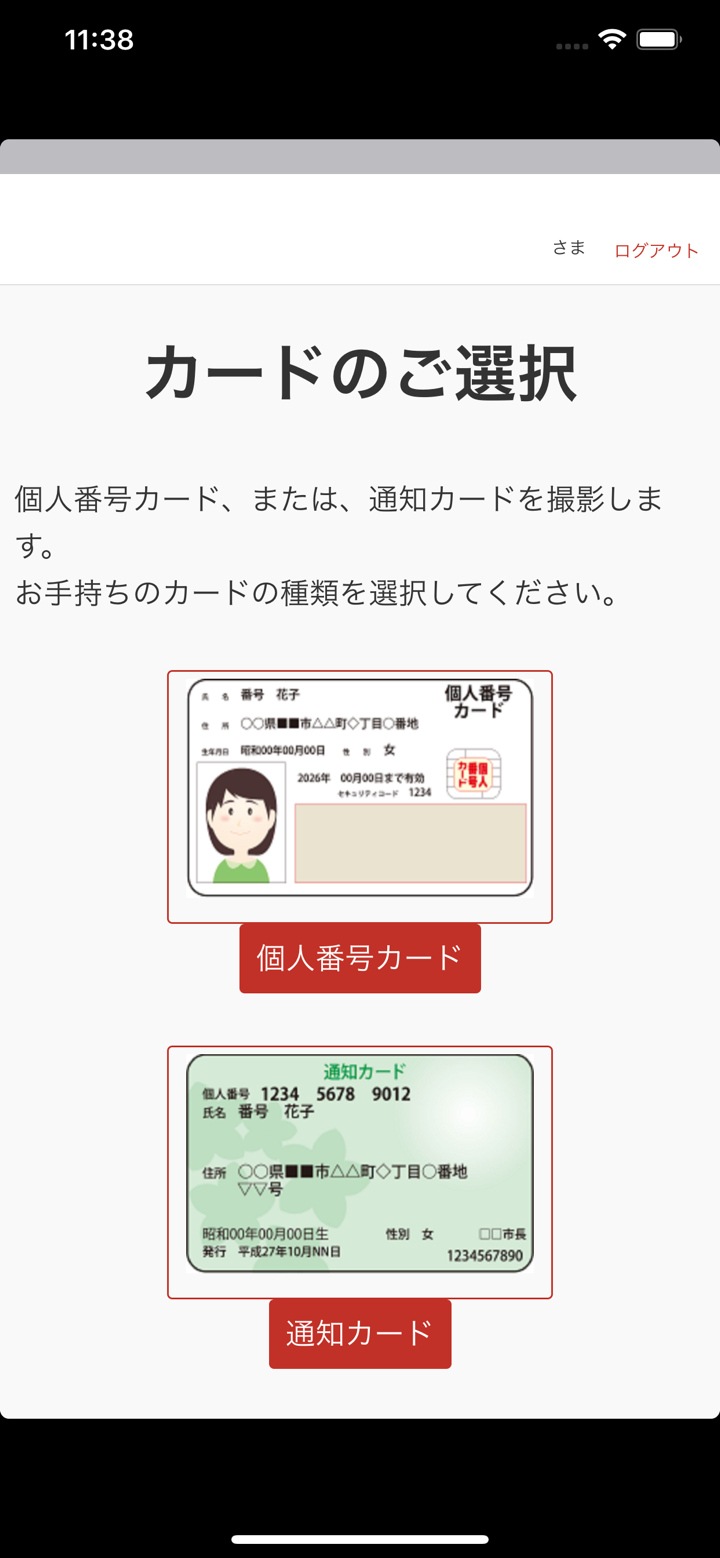

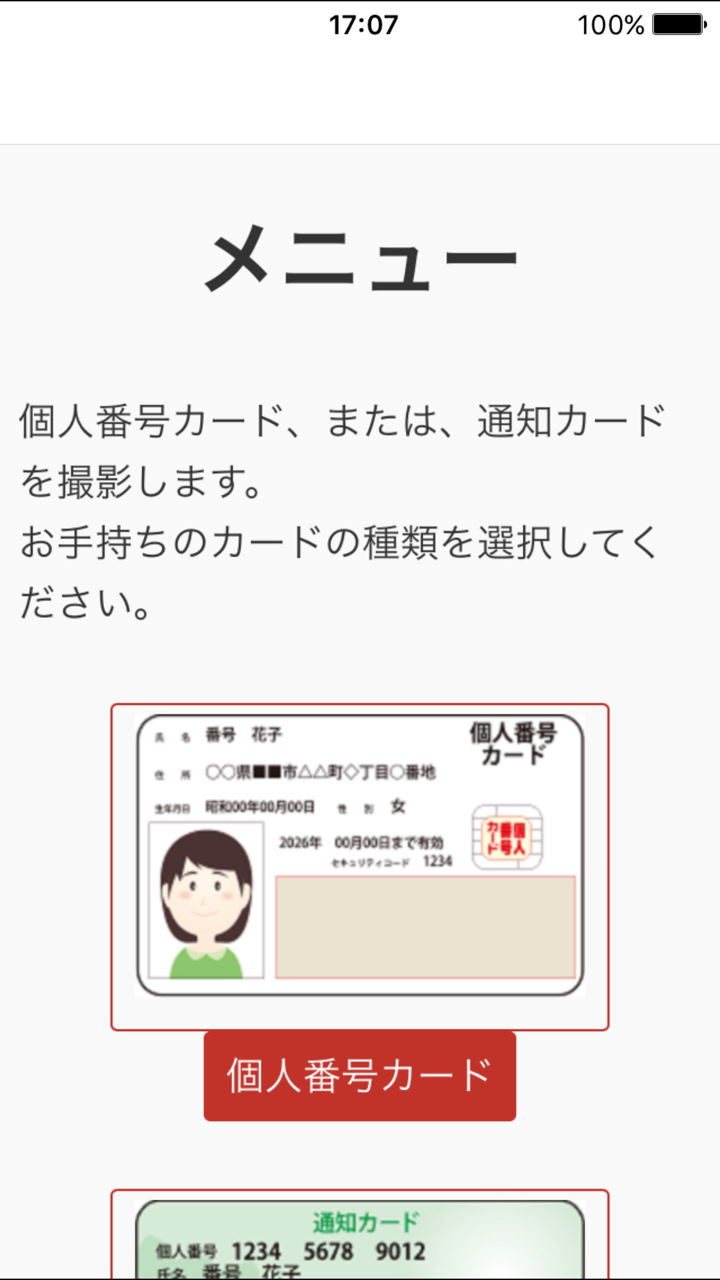

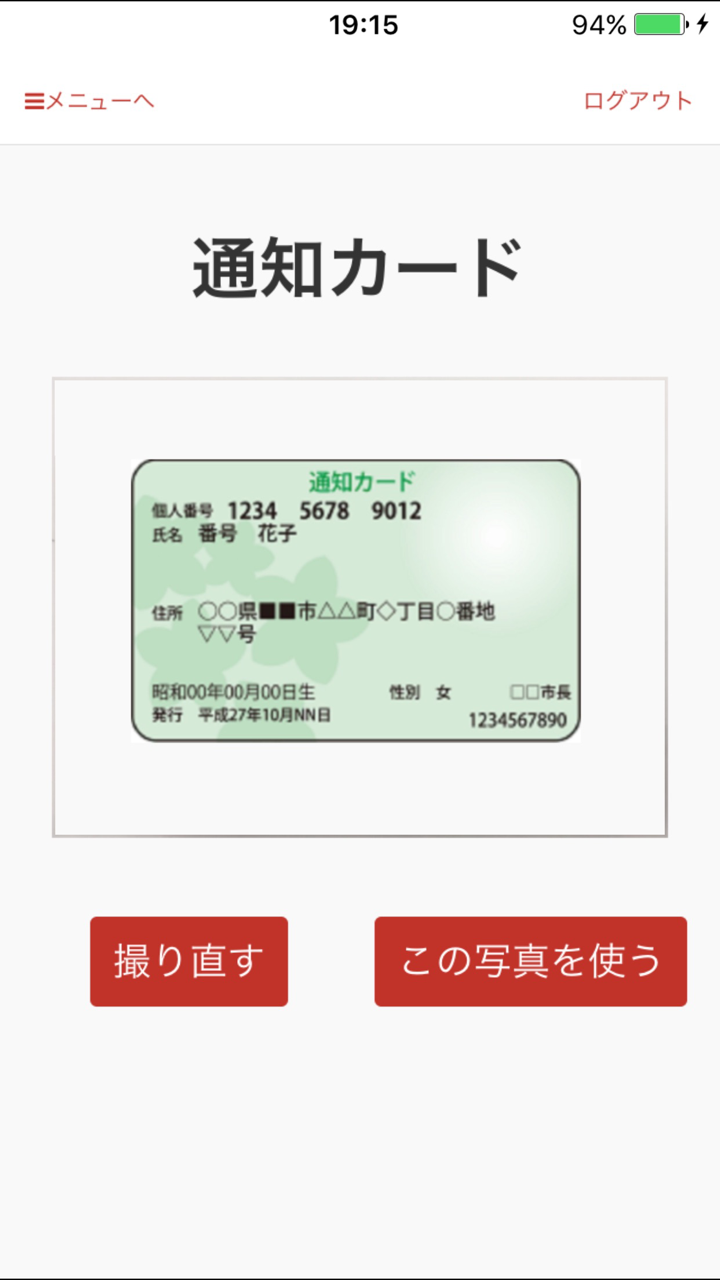

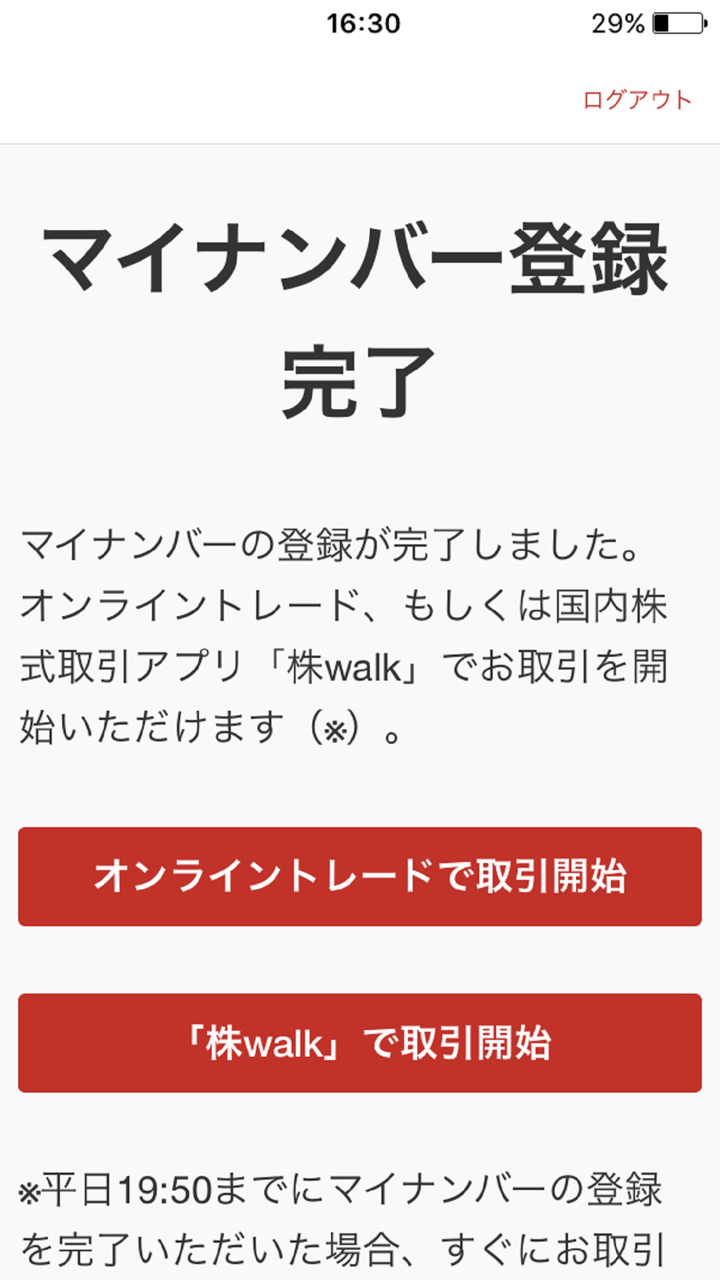

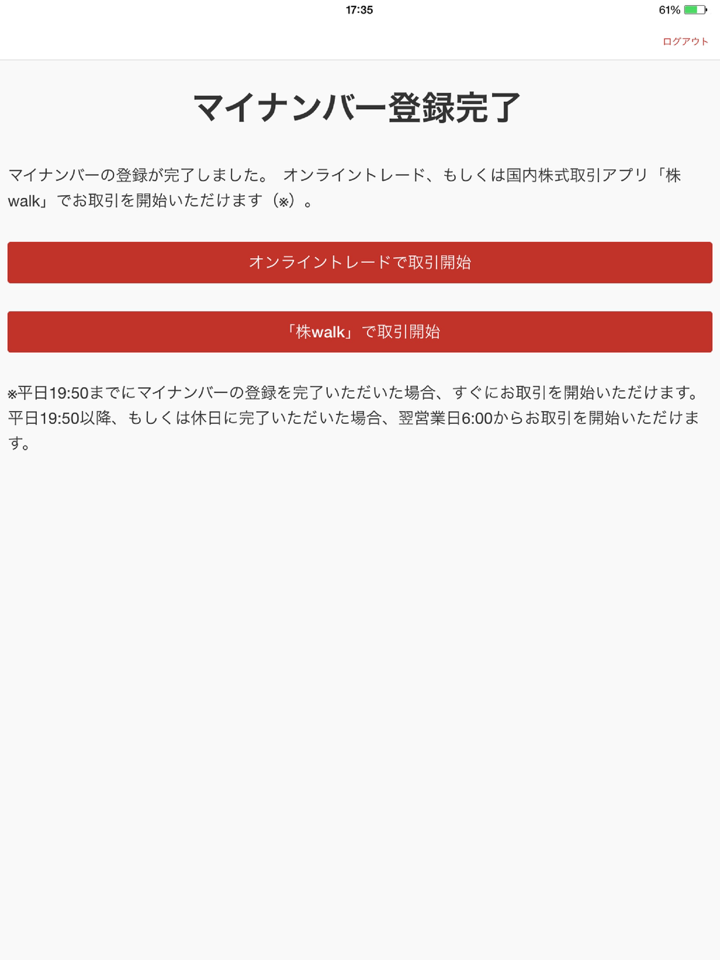

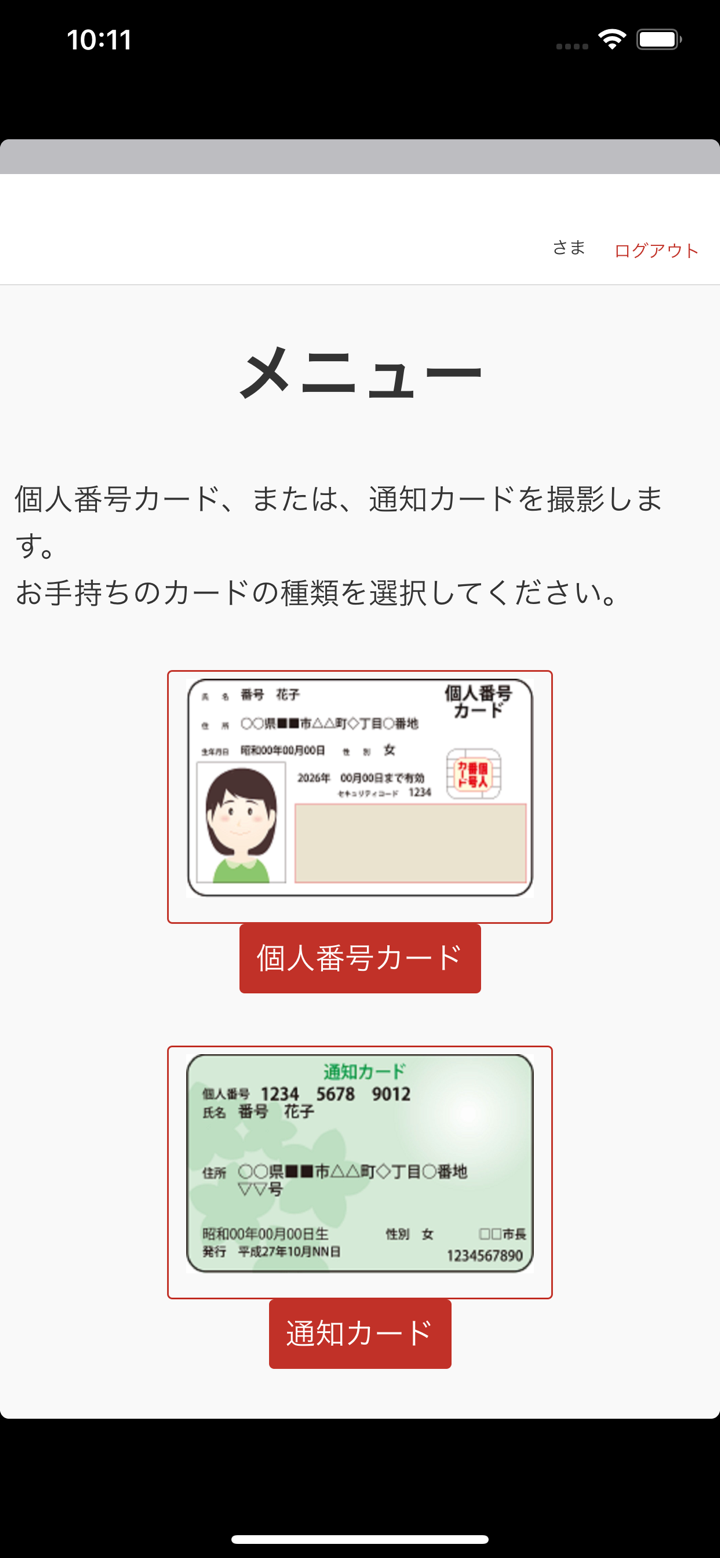

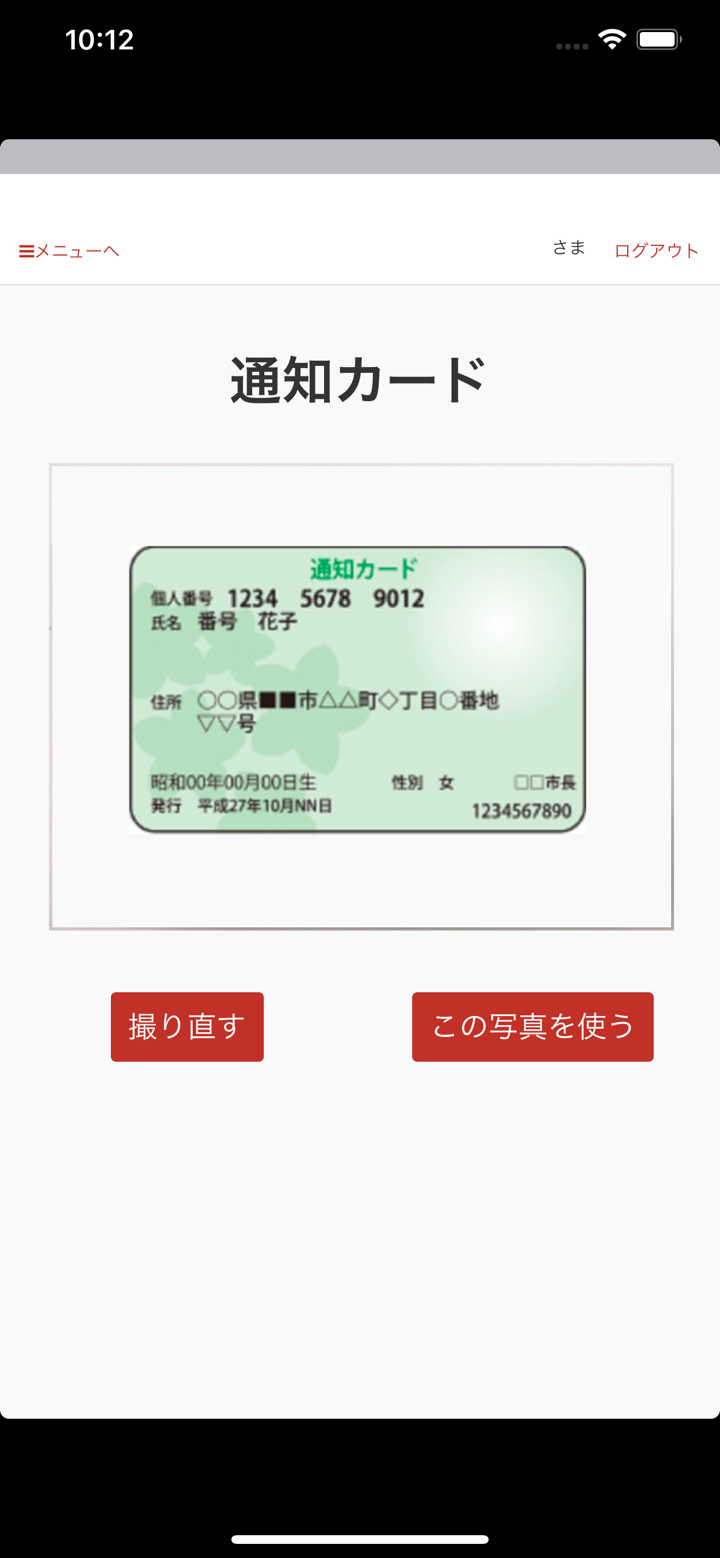

| D-Port | ✔ | iPhone/Android |

| Stock walk | ✔ | iPhone/Android |

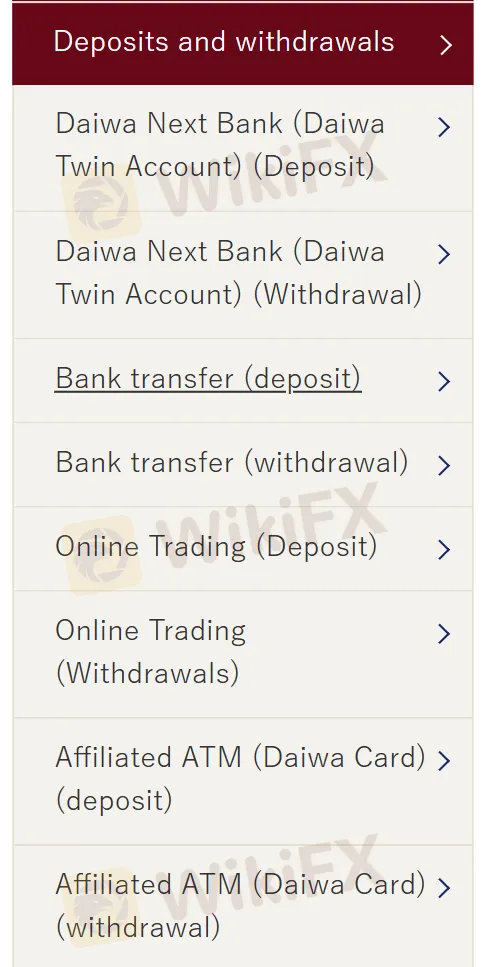

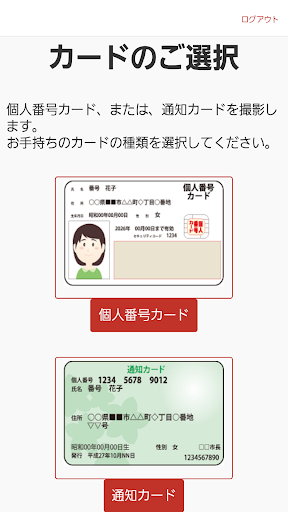

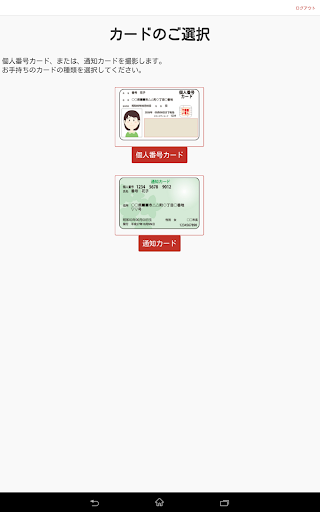

Deposito at Pag-withdraw

Para sa mga paraan ng pagdedeposito at pagwi-withdraw, nag-aalok si Daiwa ng iba't ibang opsyon upang gawing madali para sa mga customer. Kasama sa mga paraan ang pasilidad ng kontrata sa pamamagitan ng Daiwa Next Bank, standard bank transfers, online trading platforms, at transaksyon mula sa kaugnay na mga ATM sa mga dayuhang pera gamit ang isang Daiwa Card.

我行

Hong Kong

Ang serbisyo sa customer ay wala nang contact

Paglalahad

春日里的阳光

Hong Kong

Ang <strong>Yingda Futures</strong> ay nagbibigay ng paraan para sa mga <a href="http://www.baidu.com">trader</a> upang magdeposito at magwithdraw ng pondo sa kanilang mga account sa pamamagitan ng term na kapaligiran ng operasyon.

Positibo

FX1732221901

Argentina

Ako ay gumagamit ng Daiwa mula noong 2020 at wala akong dahilan upang lumipat sa ibang broker. Ang serbisyo sa customer ay napakagaling, at ang pagdedeposito at pagwiwithdraw ng pondo ay napakadali - wala akong naging problema. Mananatili ako sa kanila hangga't patuloy nilang ibinibigay ang mahusay na mga kondisyon sa pagtetrade para sa kanilang mga user.

Positibo

AA资治通鉴

Morocco

Ang kumpanya ay mas matanda kaysa sa akin, kaya naisip ko na ito ay dapat na isang magandang kumpanya upang tumagal ng ganito katagal. Pagkatapos ng 2 buwang karanasan, sa tingin ko ang kanilang pangkalahatang mga kondisyon sa pangangalakal ay napakahusay, tulad ng libreng deposito at pag-withdraw, walang minimum na kinakailangan sa deposito, at iba't ibang instrumento na magagamit.

Positibo

孙东方

Hong Kong

Ang malawak na hanay ng mga produkto at serbisyo sa pananalapi ay inaalok nang walang anumang minimum na halaga ng deposito na kinakailangan, maaari kang mamuhunan ng anumang halaga ayon sa gusto mo. Ngunit nagtatapos sila dito..ang kondisyon ng kalakalan ay hindi sapat na transparent! Sinasabi ng broker na naniningil ito ng ilang komisyon para sa forex trading, ngunit hindi tinukoy. Hindi rin sila nag-abala na mag-refer ng anuman tungkol sa leverage..

Katamtamang mga komento

刘家

Hong Kong

Isang matagal nang itinatag na broker na nagbibigay ng sari-sari na hanay ng mga produkto at serbisyo, karaniwang suporta sa customer para sa kung mayroon kang anumang mga katanungan, walang available na online na team ng suporta......

Katamtamang mga komento