公司簡介

| 大和證券 檢討摘要 | |

| 成立年份 | 2007 |

| 註冊國家/地區 | 日本 |

| 監管 | FSA |

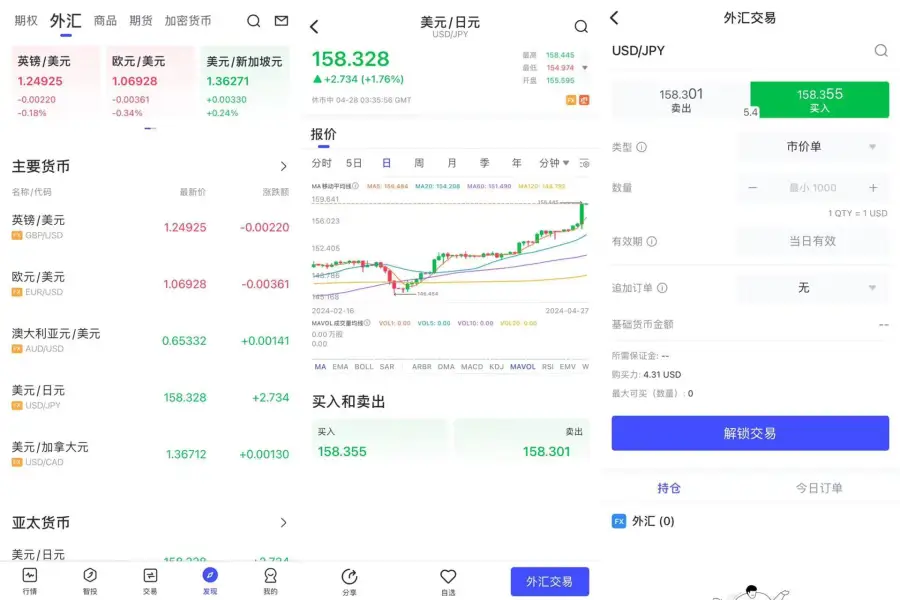

| 產品 | 股票、養老金和保險、證券擔保貸款、首次公開募股、投資信託、證券、PO、債券、外匯 |

| 交易平台 | D-Port、Stock walk |

| 最低存款 | / |

| 客戶支援 | 電話:0120 - 010101 |

大和證券 資訊

大和證券,成立於2007年,受日本金融廳(FSA)監管,是一個在線交易平台,主要提供國內和美國股票、中國股票、首次公開募股、投資信託、債券、外幣、日元存款、智能投顧等多種金融產品和服務。他們提供易於使用的平台,如D-Port和Stock Walk。

優點和缺點

| 優點 | 缺點 |

|

|

|

|

|

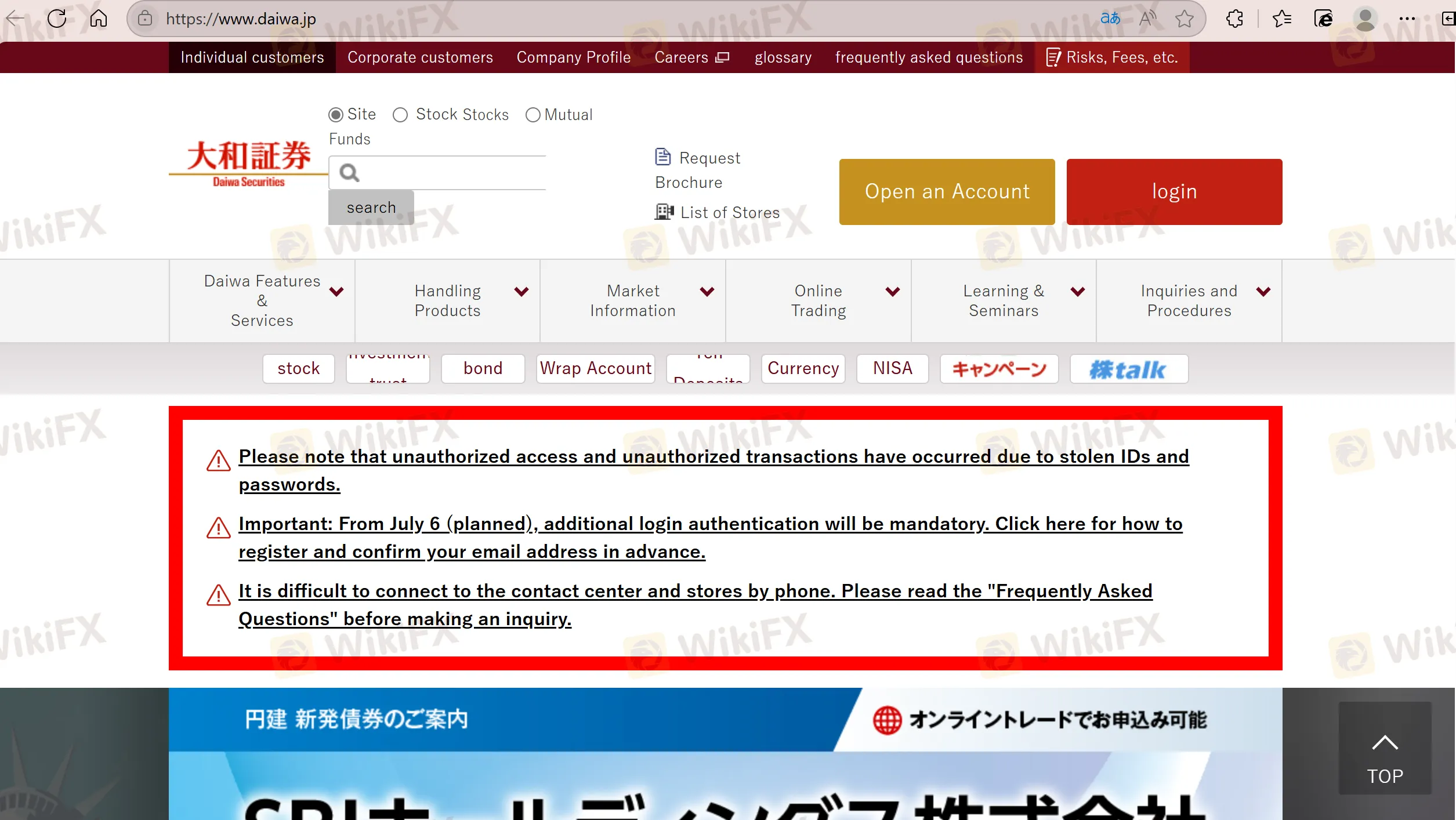

大和證券 是否合法?

大和證券 持有由日本金融廳(FSA)頒發的零售外匯牌照。

| 監管機構 | 當前狀態 | 監管國家 | 許可實體 | 牌照類型 | 牌照號碼 |

| 日本金融廳(FSA) | 受監管 | 日本 | 大和證券株式会社 | 零售外匯牌照 | 関東財務局長(金商)第108号 |

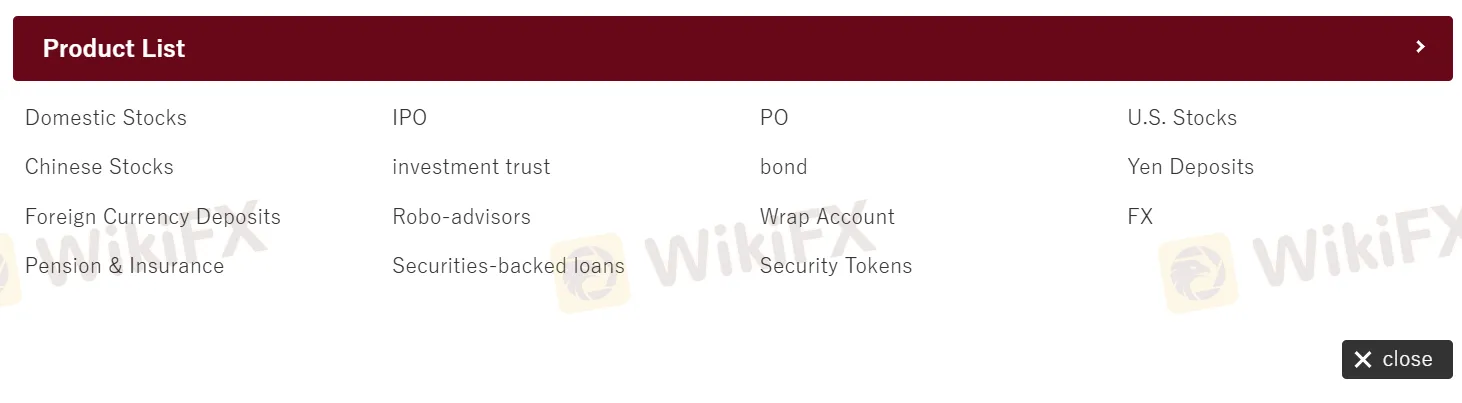

產品

大和證券 提供不同的金融產品,主要包括國內和中國的股票、IPO、投資信託、債券、外幣存款、智能投顧、包裝帳戶、養老金和保險服務、證券擔保貸款、美國股票、日圓存款和證券代幣。

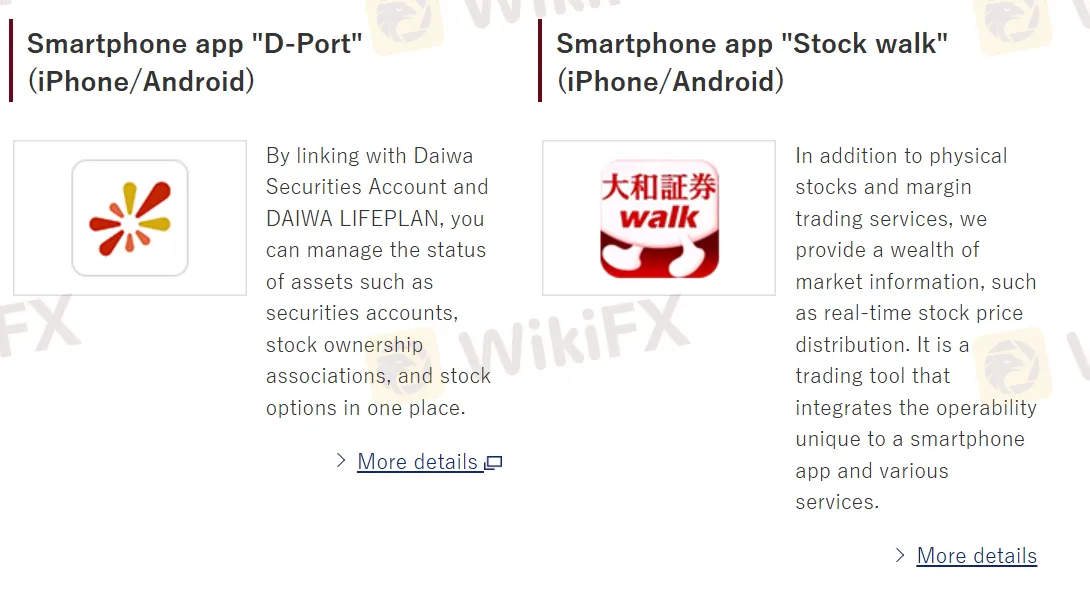

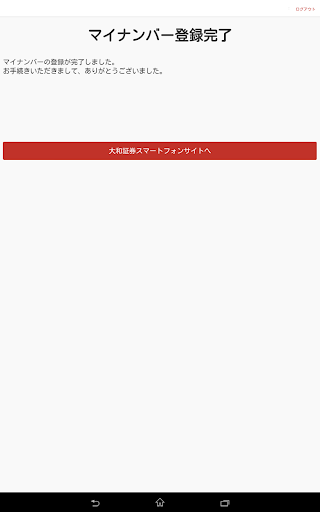

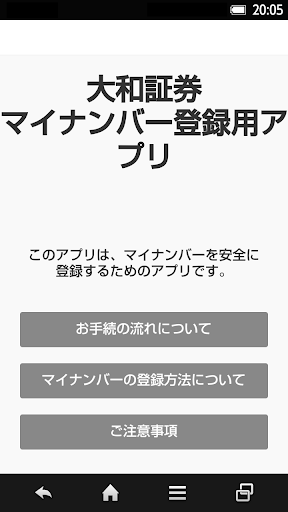

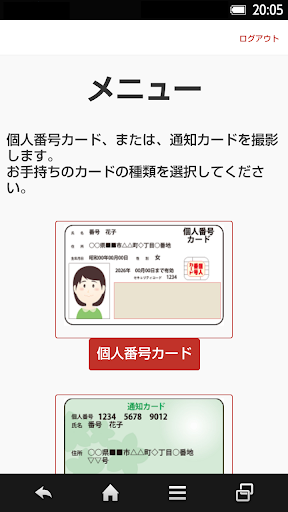

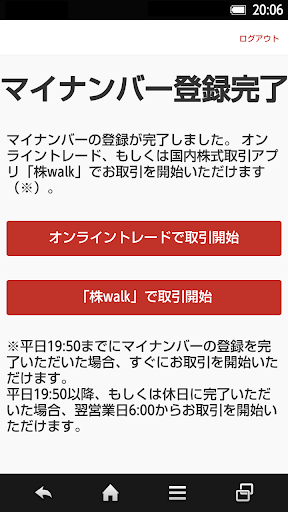

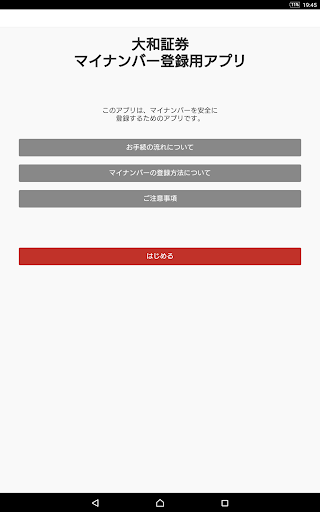

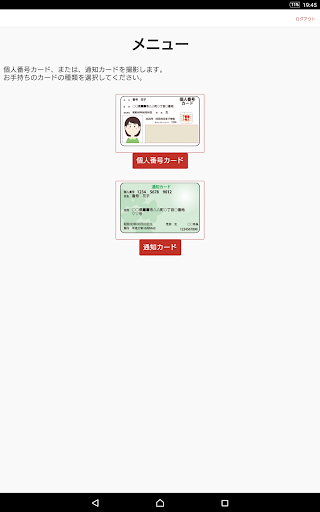

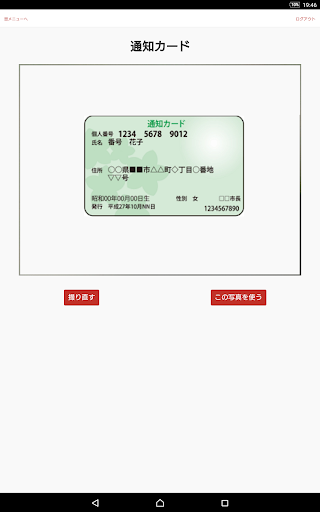

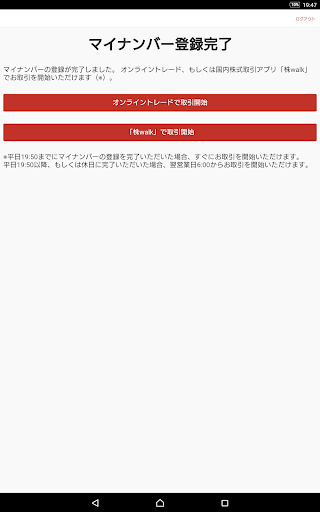

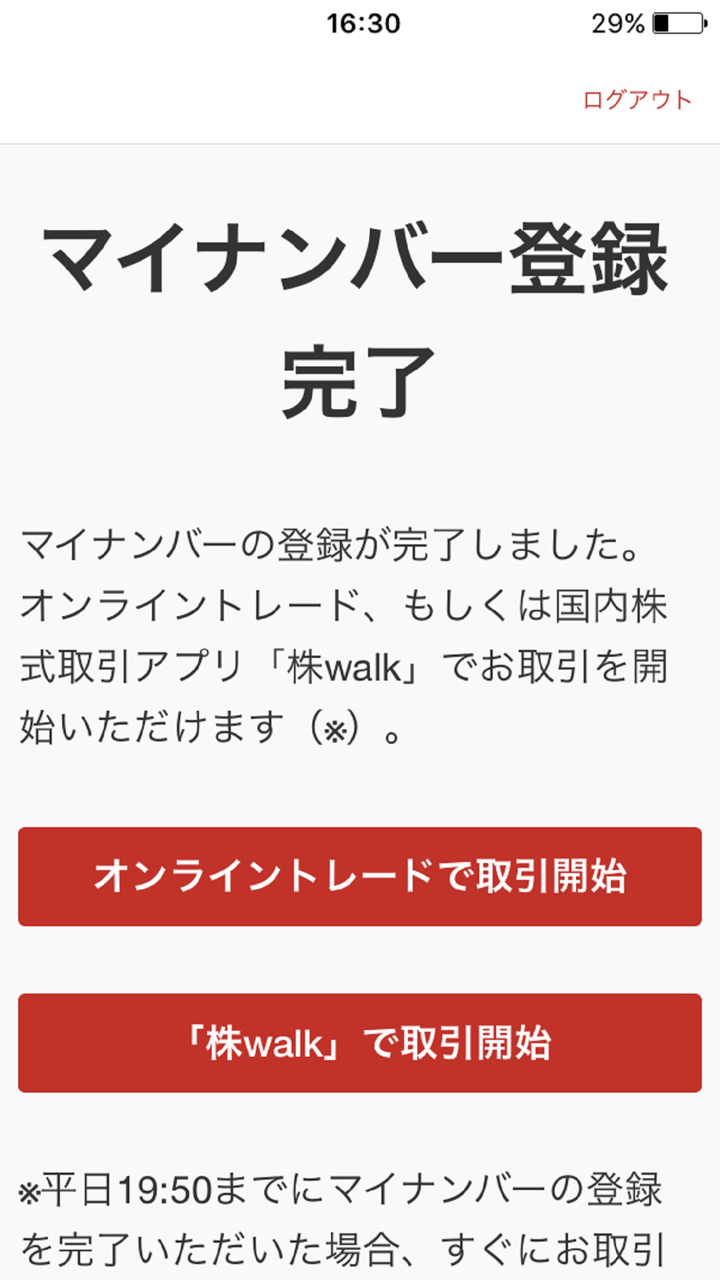

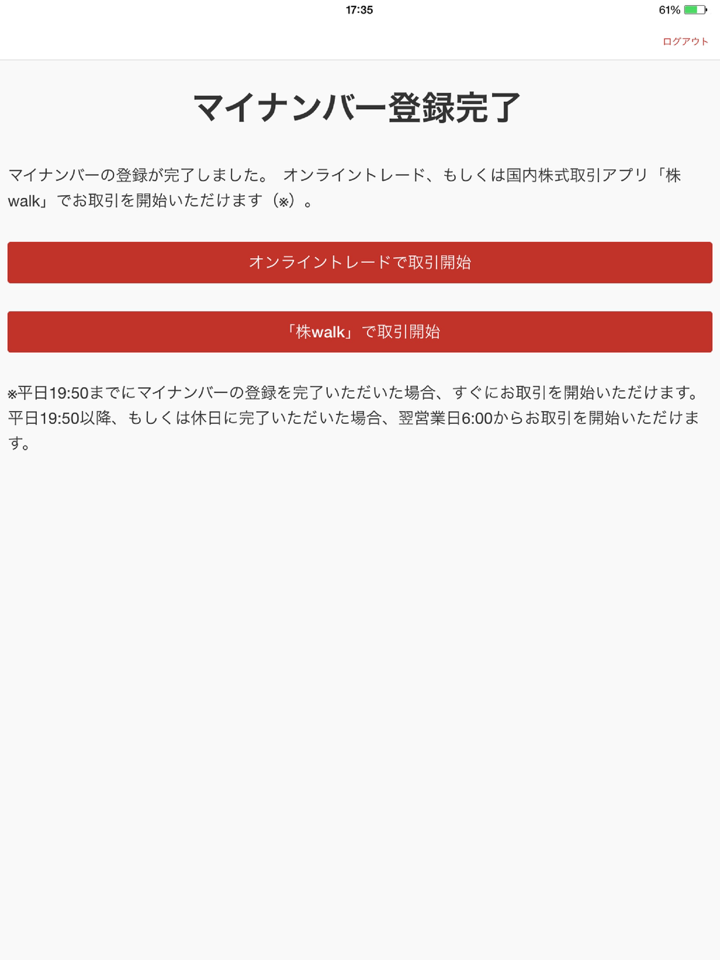

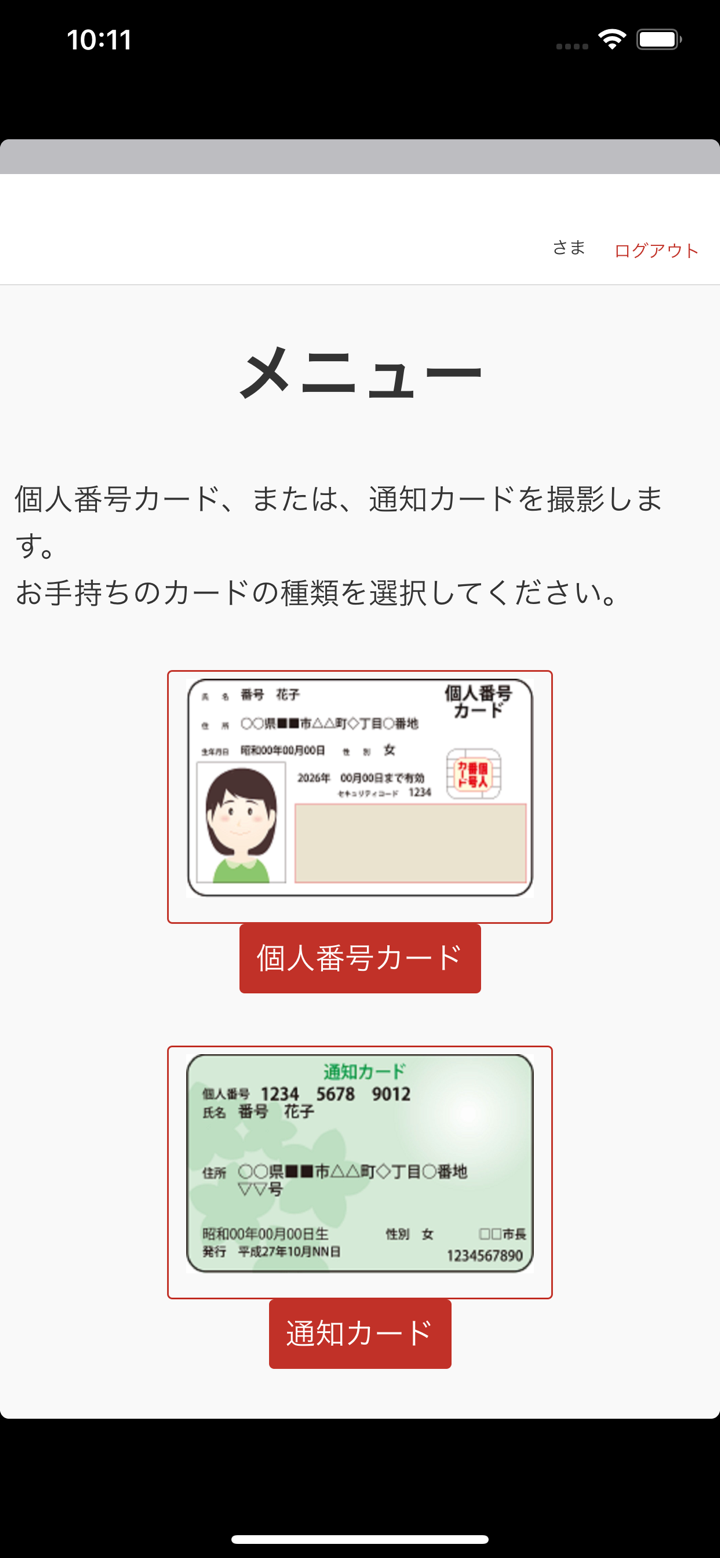

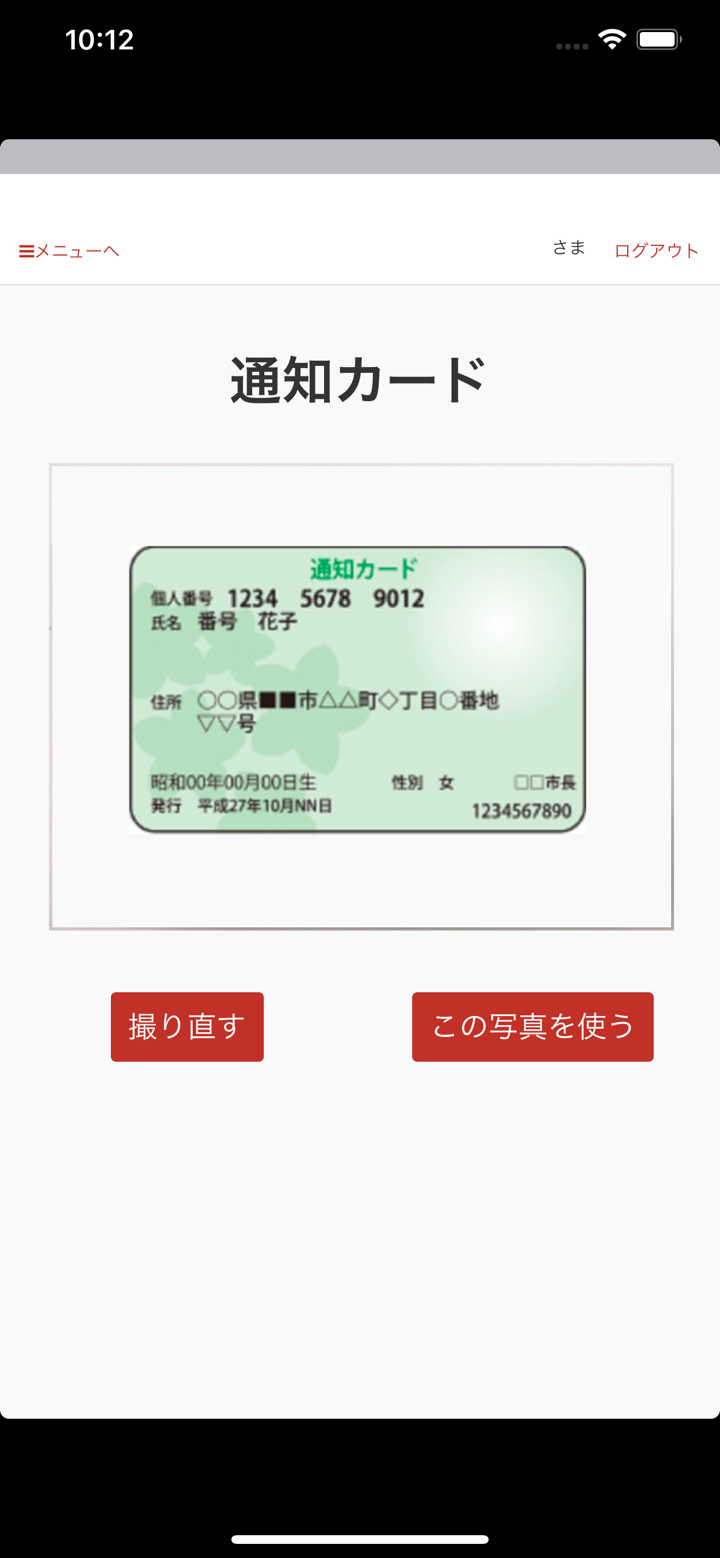

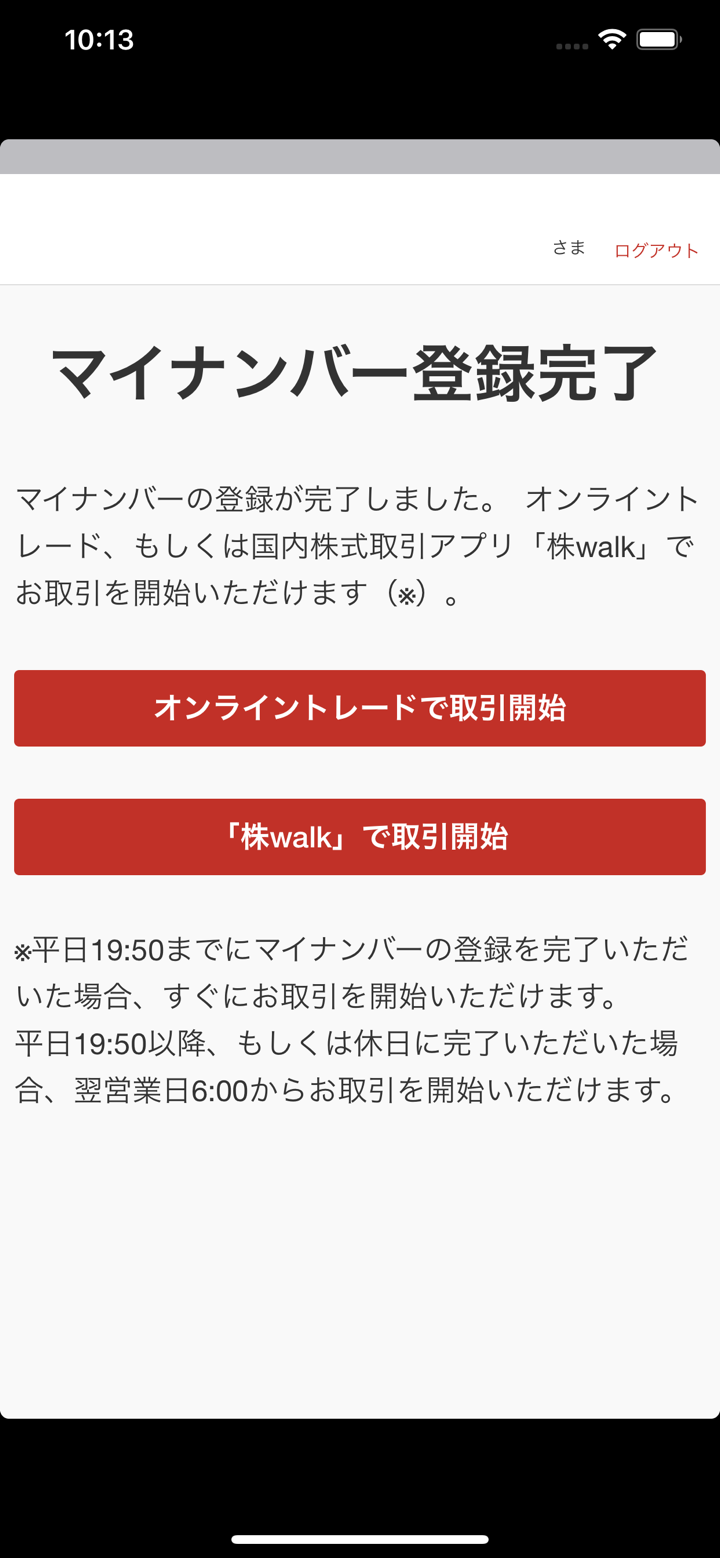

交易平台

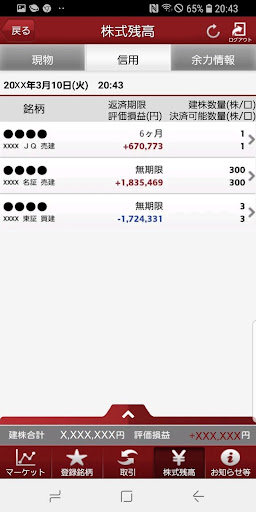

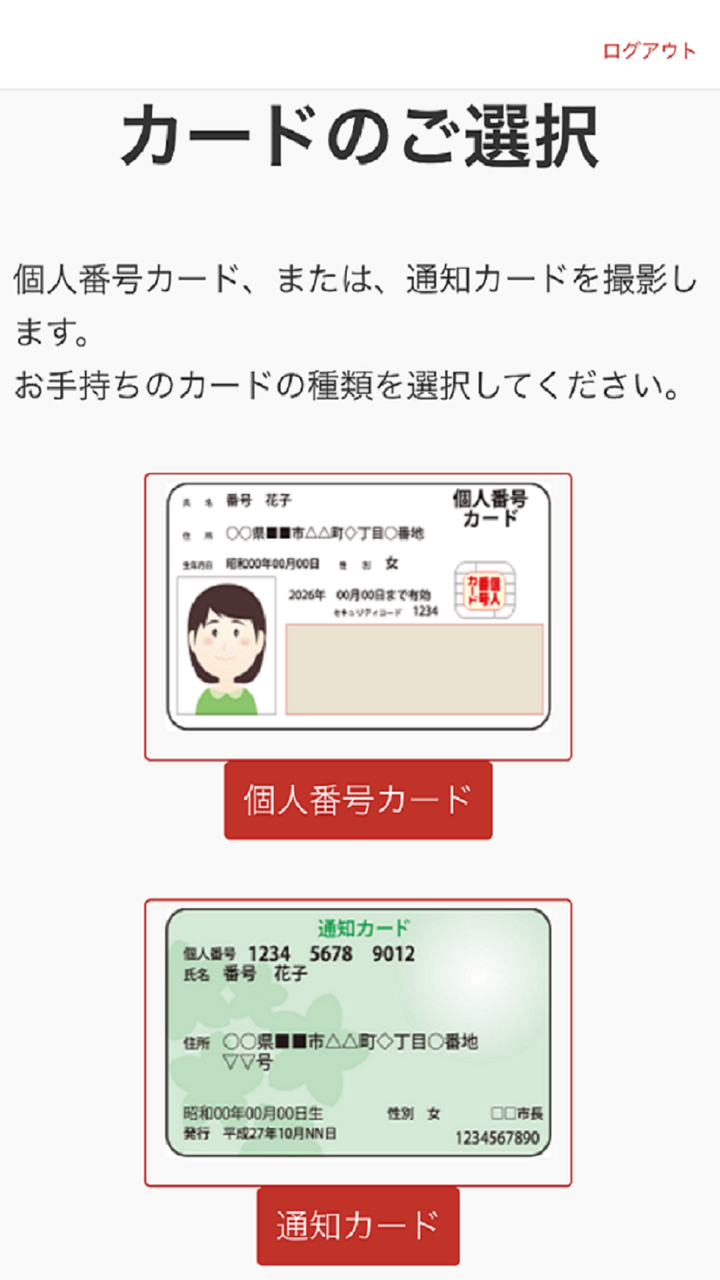

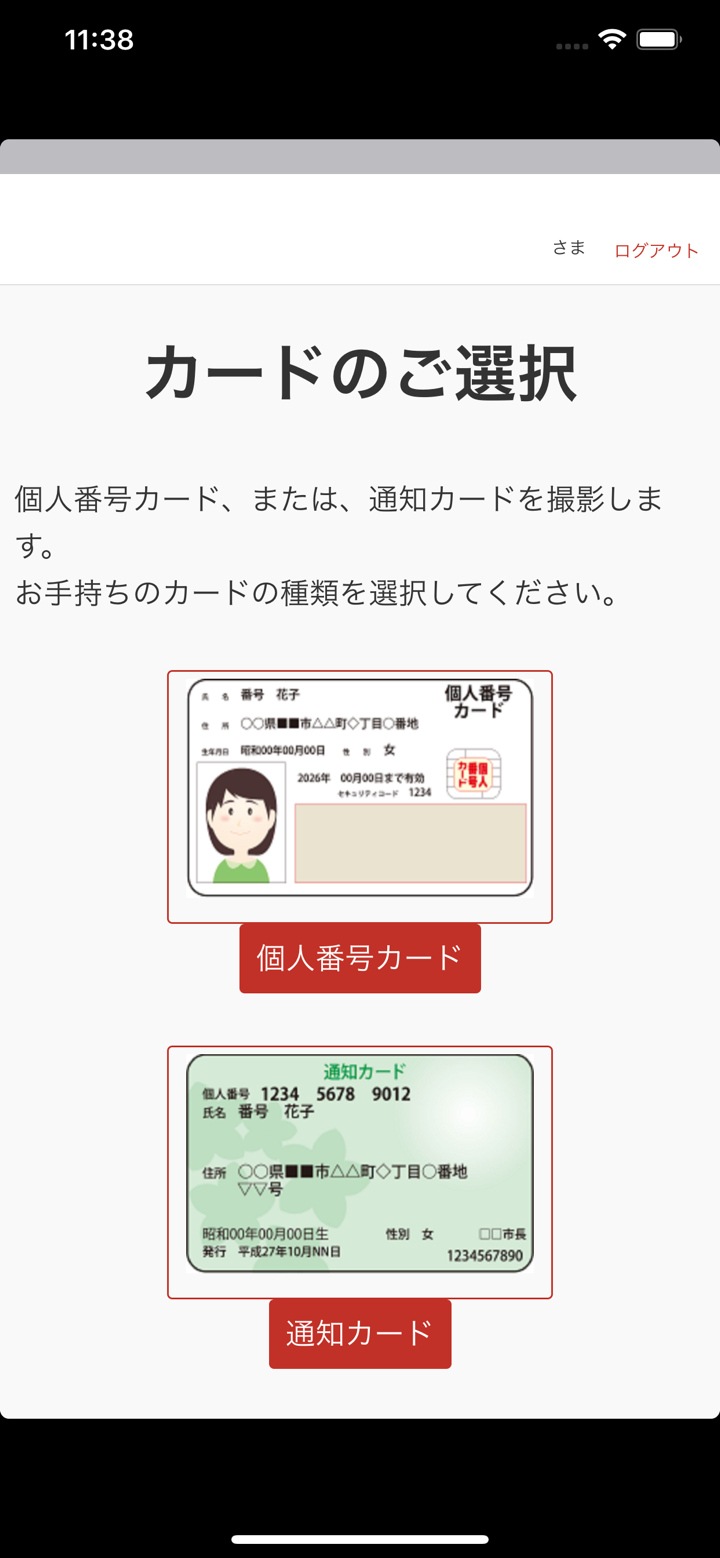

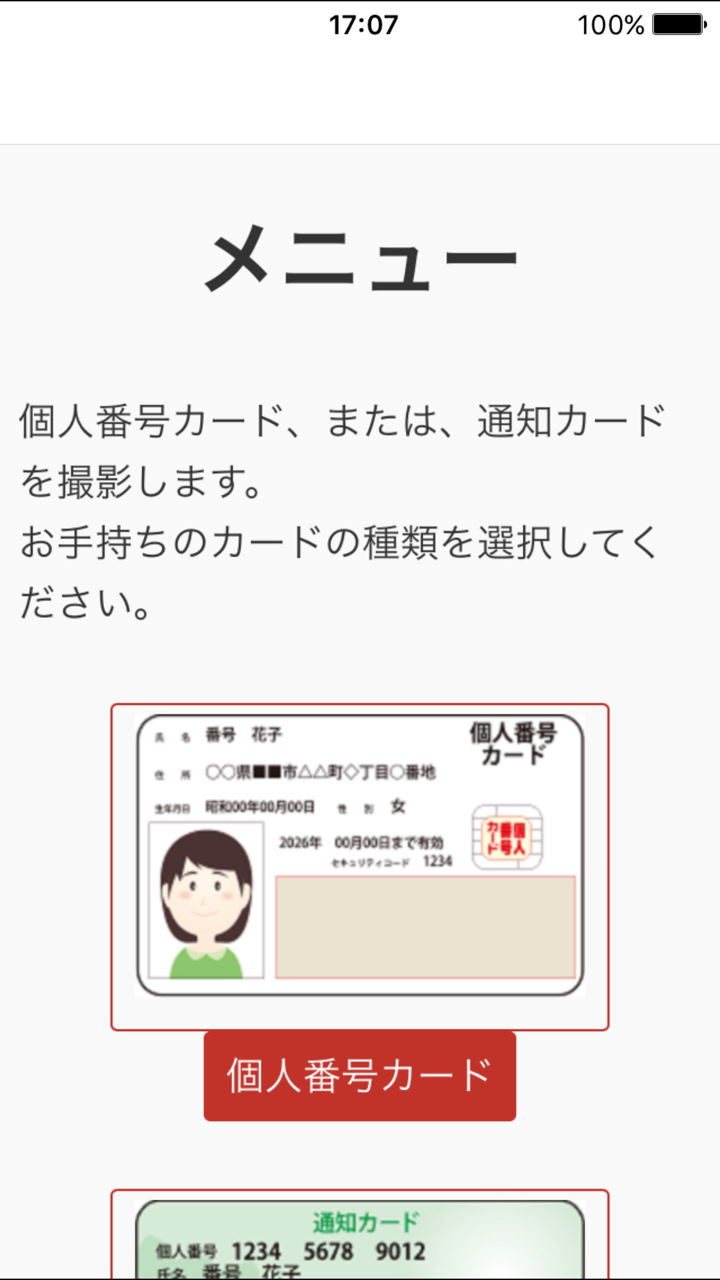

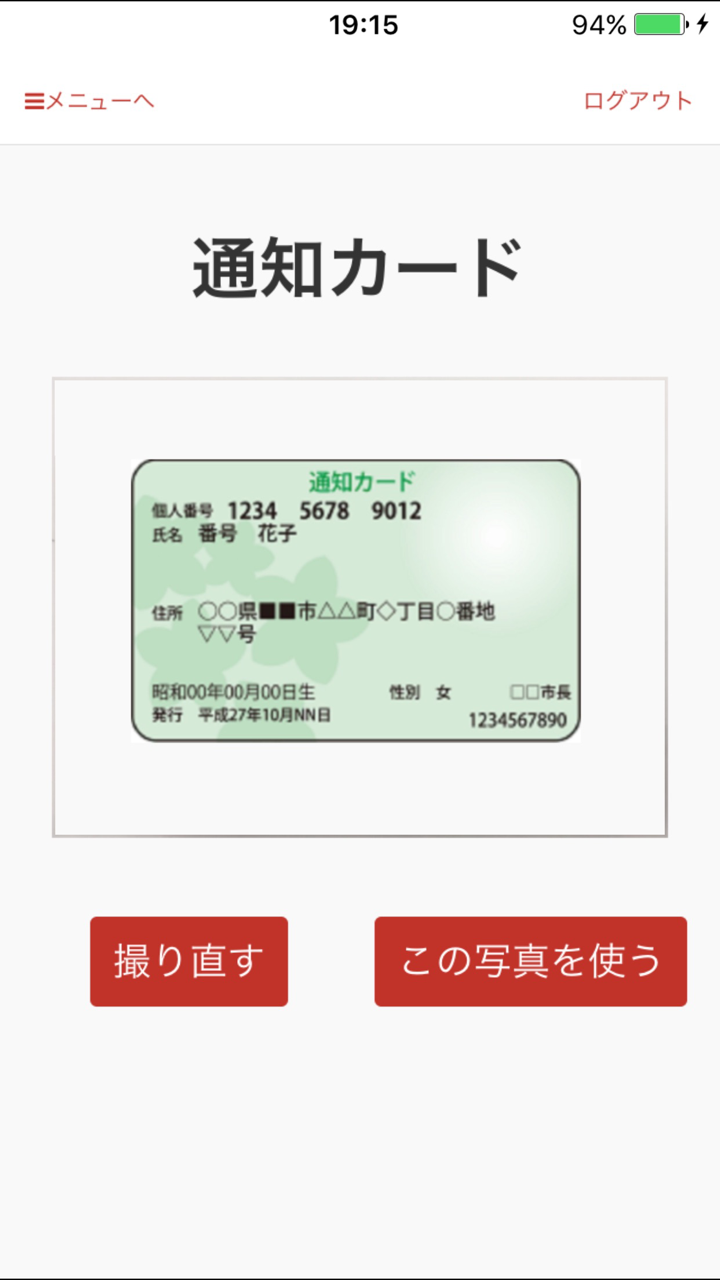

| 交易平台 | 支援 | 可用設備 |

| D-Port | ✔ | iPhone/Android |

| Stock walk | ✔ | iPhone/Android |

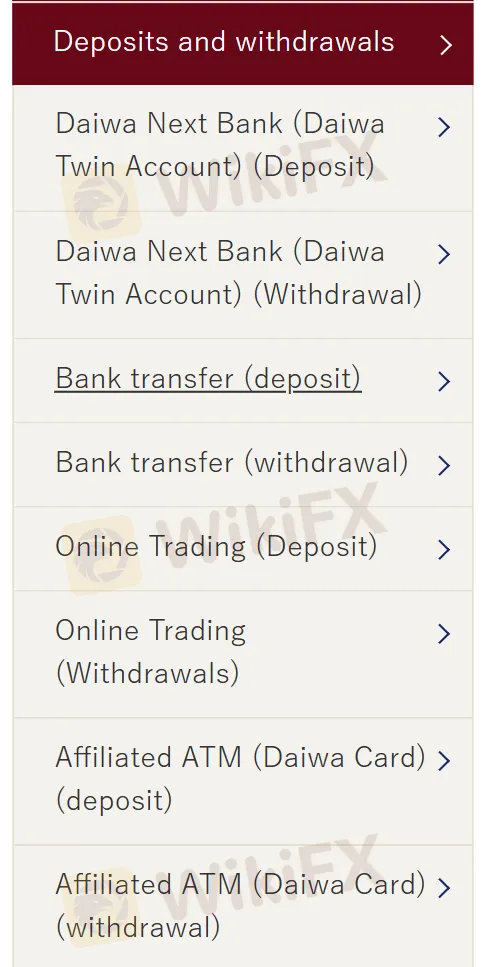

存款和提款

就存款和提款方式而言,大和證券 提供不同選擇,以方便客戶。方法包括通過大和證券 Next Bank、標準銀行轉帳、線上交易平台進行合約操作,以及使用大和證券卡在海外貨幣的附屬ATM進行交易。

我行

香港

大和证券无法打开无法出金,软件进不去,找不到客服

爆料

春日里的阳光

香港

是正规的,手续费默认按万分之2.5收取,相对来说还可以

好評

FX1732221901

阿根廷

自2020年以來,我一直使用大和證券,沒有理由轉換到其他券商。客戶服務一直很出色,存款和提款非常方便 - 從未遇到問題。只要他們繼續為用戶提供優秀的交易條件,我將繼續與他們合作。

好評

AA资治通鉴

摩洛哥

公司比我年長,所以我想能堅持這麼久一定是個好公司。經過2個月的體驗,我覺得他們的總體交易條件非常好,可以免費存取款,沒有最低存款要求,並且可以使用各種工具。

好評

孙东方

香港

提供廣泛的金融產品和服務,沒有任何最低存款額要求,您可以隨心所欲地投資。但他們到此為止......交易條件不夠透明!該經紀商表示,它確實收取一些外匯交易佣金,但沒有具體說明。他們也懶得提及任何關於槓桿的事情。

中評

刘家

香港

一家歷史悠久的經紀人,提供多元化的產品和服務,如果您有任何疑問,一般客戶支持,沒有可用的在線支持團隊......

中評