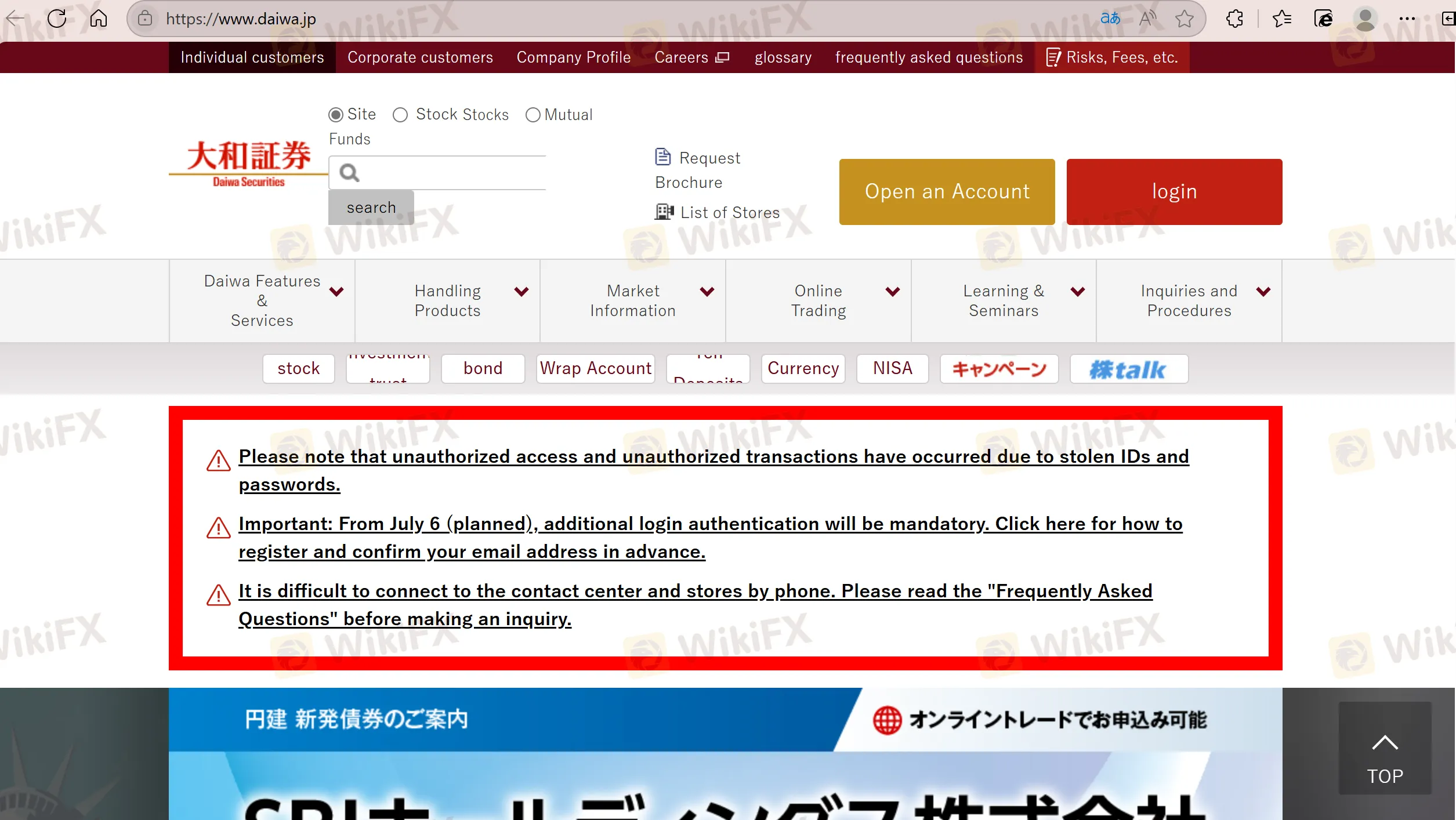

Company Summary

| Daiwa Review Summary | |

| Founded | 2007 |

| Registered Country/Region | Japan |

| Regulation | FSA |

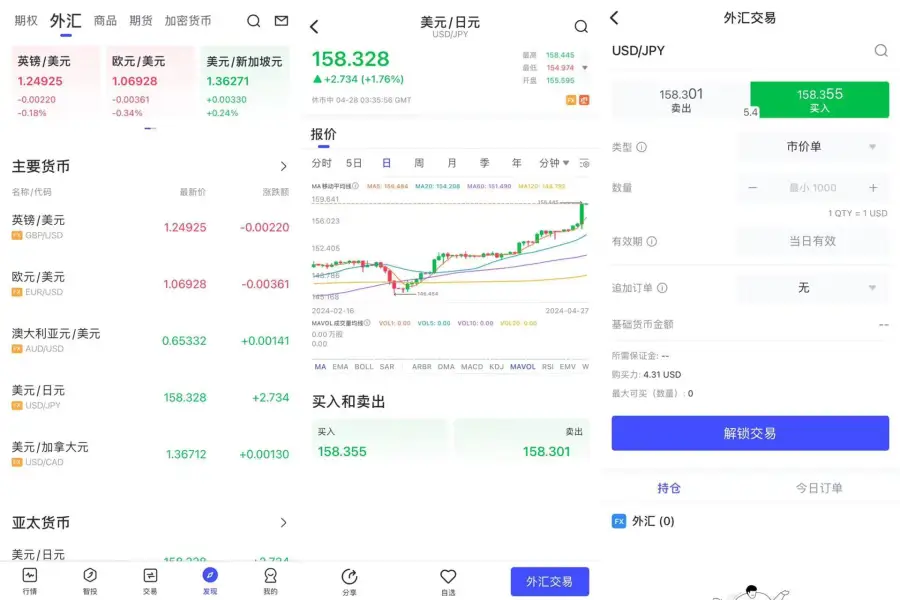

| Products | Stocks, Pension & Insurance, Securities-backed loans, IPO, Investment Trust, Securities, PO, Bonds, FX |

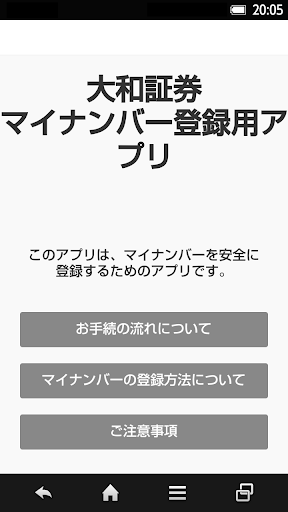

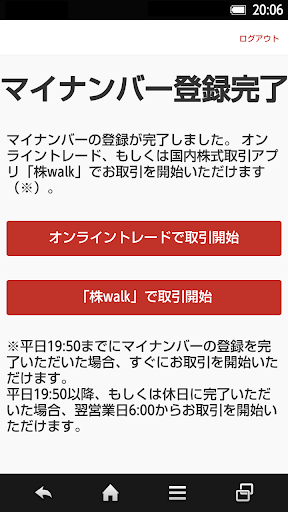

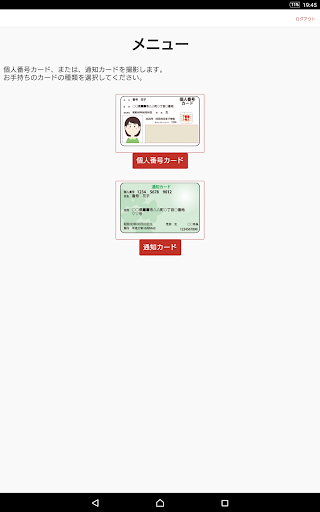

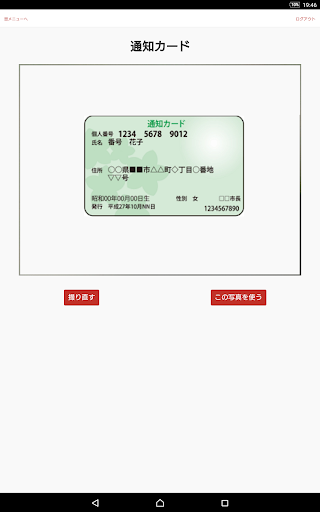

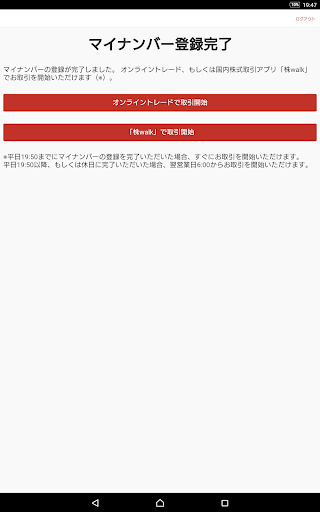

| Trading Platform | D-Port, Stock walk |

| Minimum Deposit | / |

| Customer Support | Tel: 0120 - 010101 |

Daiwa Information

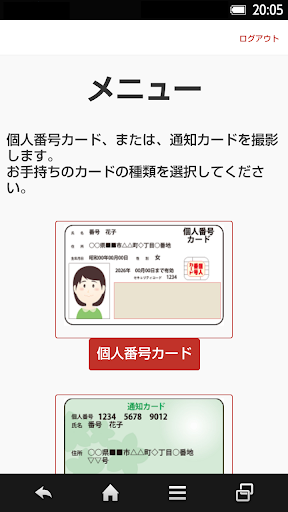

Daiwa, founded in 2007 and regulated by Japan's Financial Services Agency (FSA), is an online trading platform that offers many financial products and services, mainly including domestic and U.S. stocks, Chinese stocks, IPOs, investment trusts, bonds, foreign currency, yen deposits, robo-advisors, and more. They provide easy-to-use platforms like D-Port and Stock Walk.

Pros and Cons

| Pros | Cons |

|

|

|

|

|

Is Daiwa Legit?

Daiwa has a Retail Forex License regulated by the Financial Services Agency (FSA) in Japan.

| Regulated Authority | Current Status | Regulated Country | Licensed Entity | License Type | License No. |

| Financial Services Agency (FSA) | Regulated | Japan | 大和証券株式会社 | Retail Forex License | 関東財務局長(金商)第108号 |

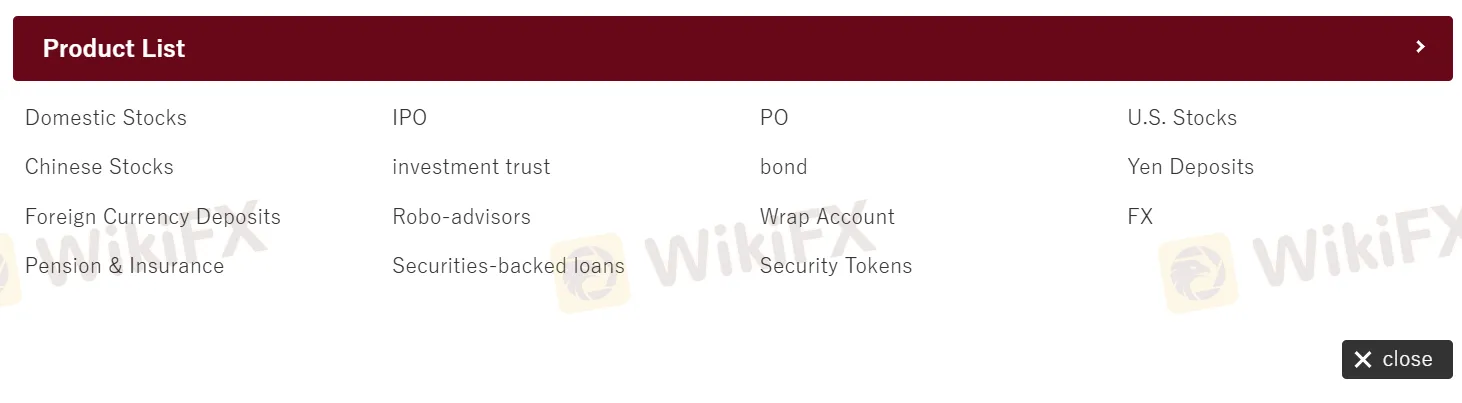

Products

Daiwa offers different financial products, mainly including domestic and Chinese stocks, IPOs, investment trusts, bonds, foreign currency deposits, robo-advisors, wrap accounts, pension and insurance services, securities-backed loans, U.S. stocks, yen deposits, and security tokens.

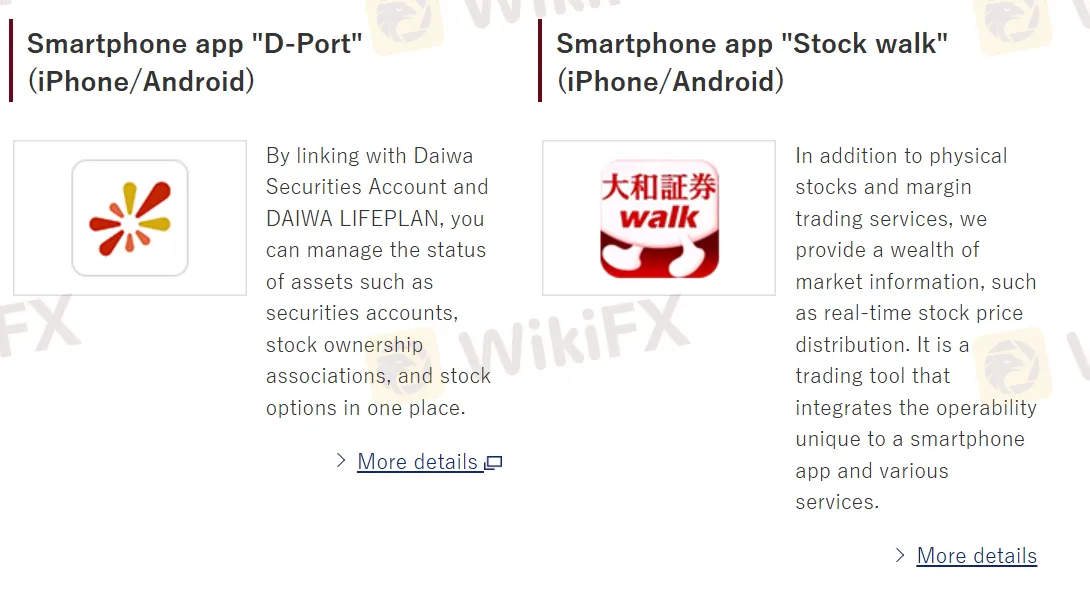

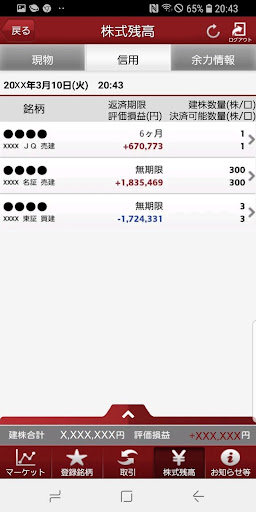

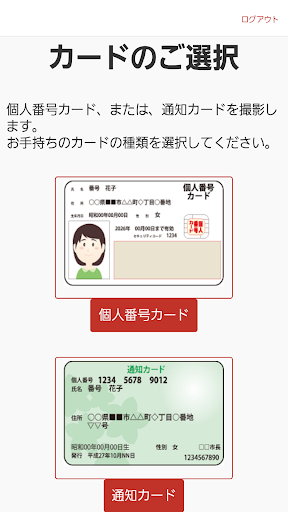

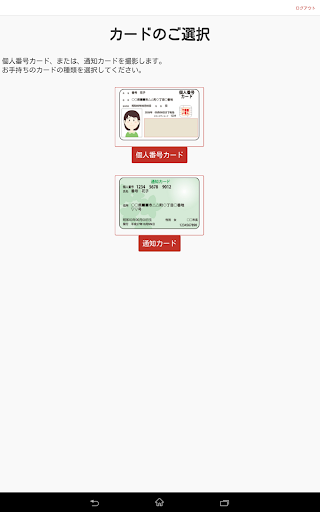

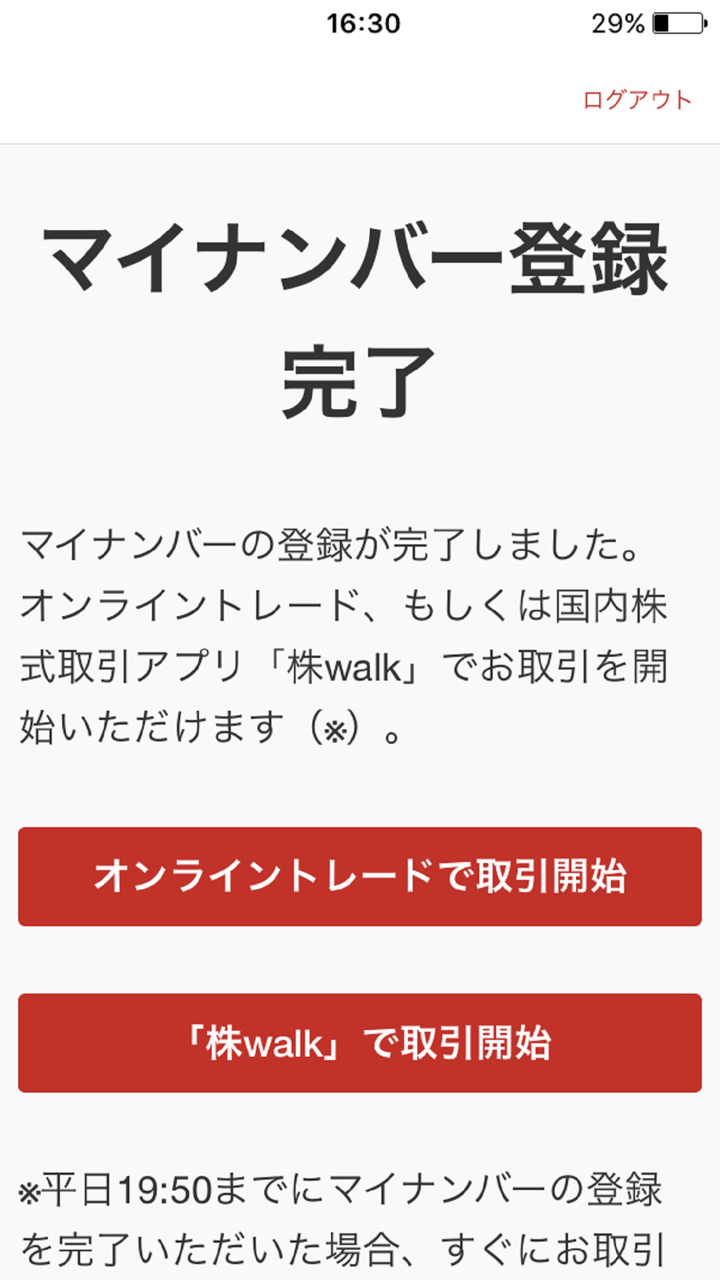

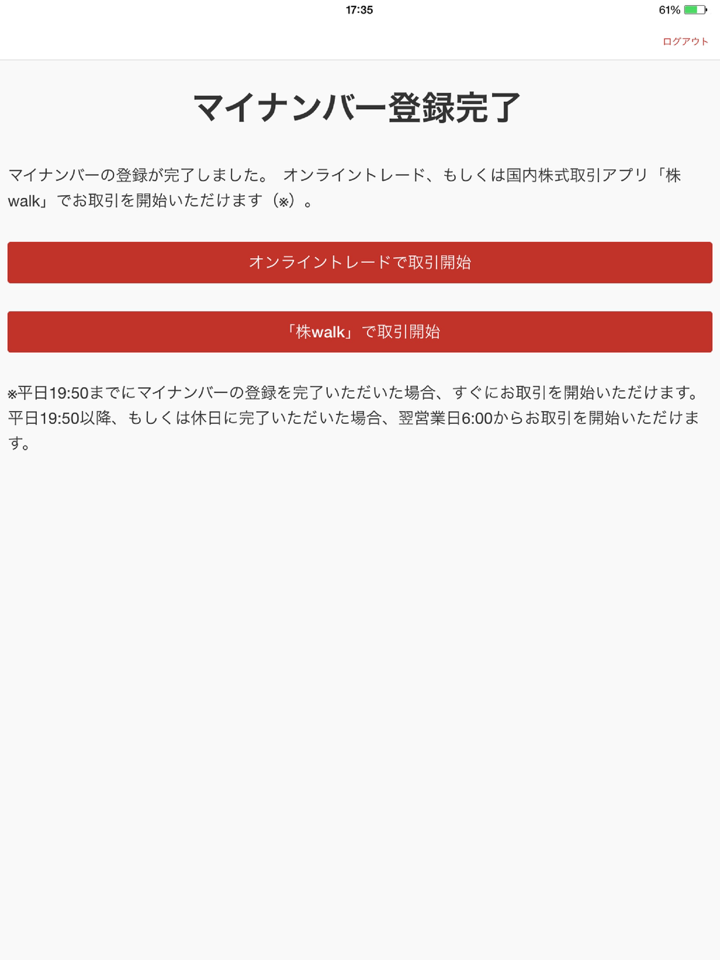

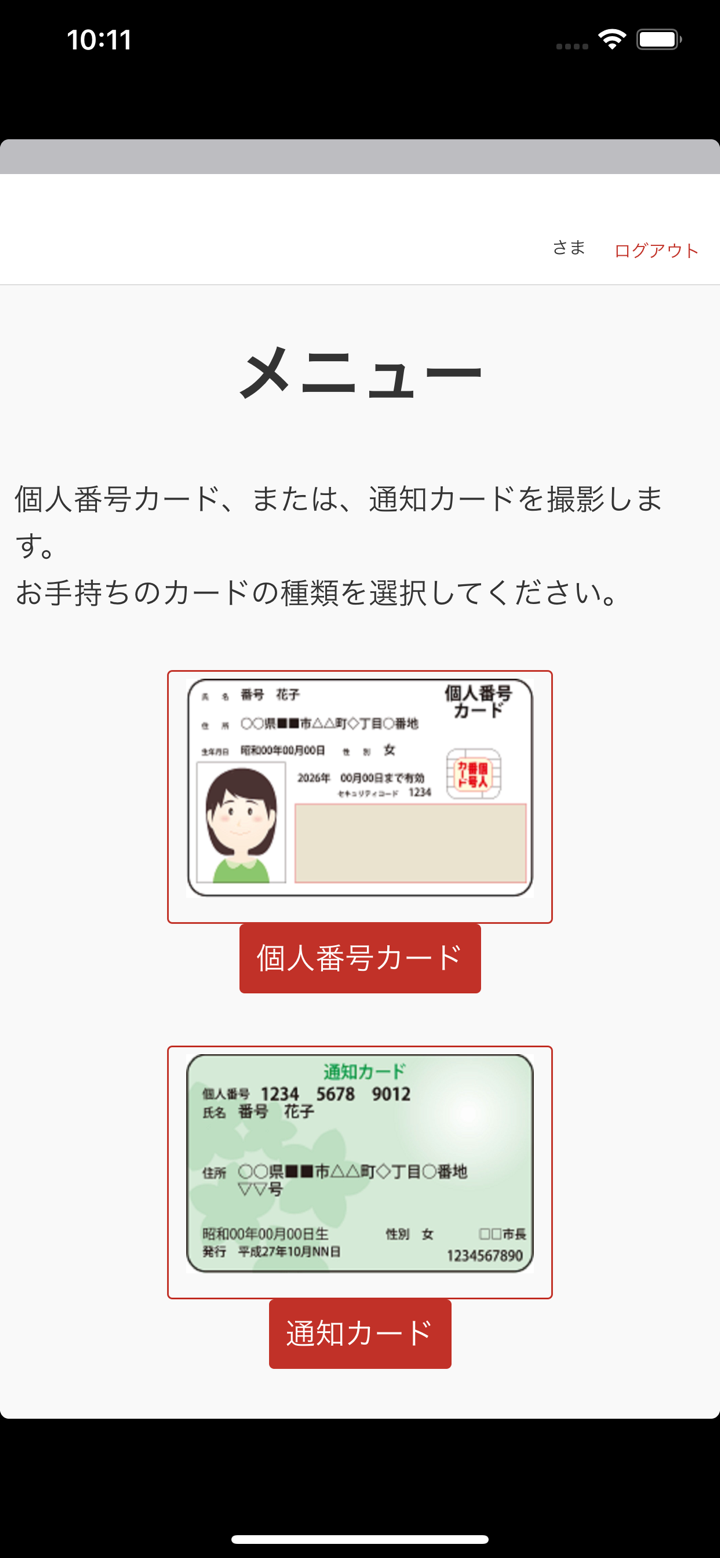

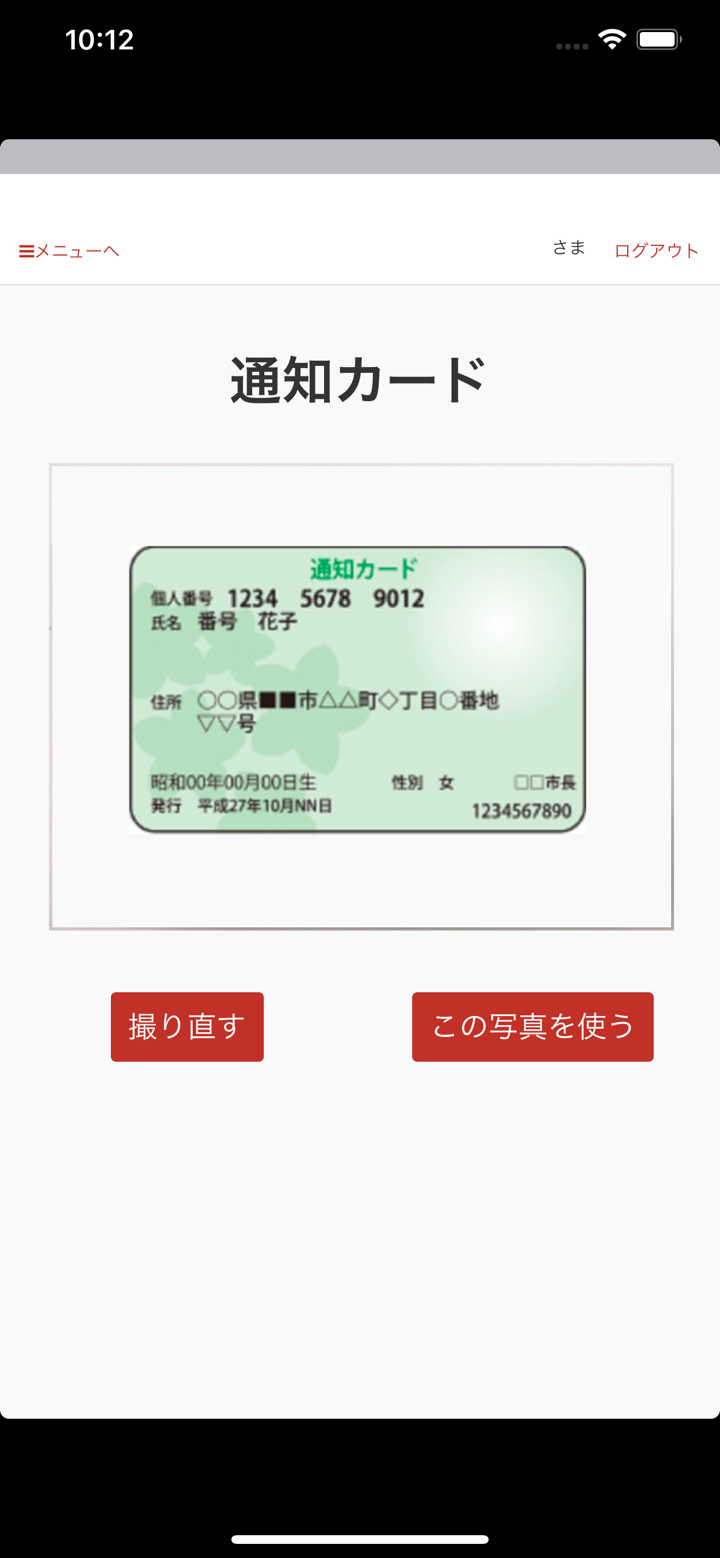

Trading Platform

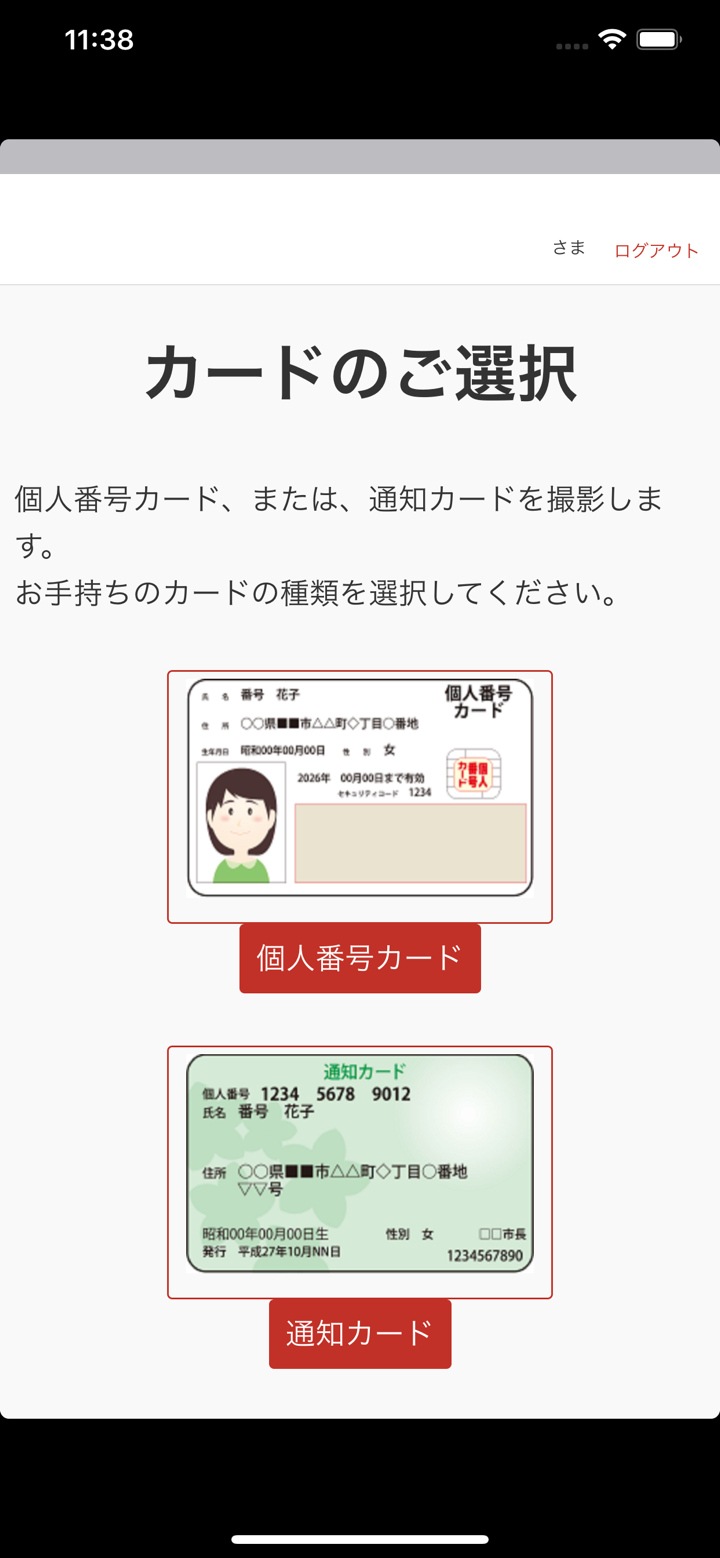

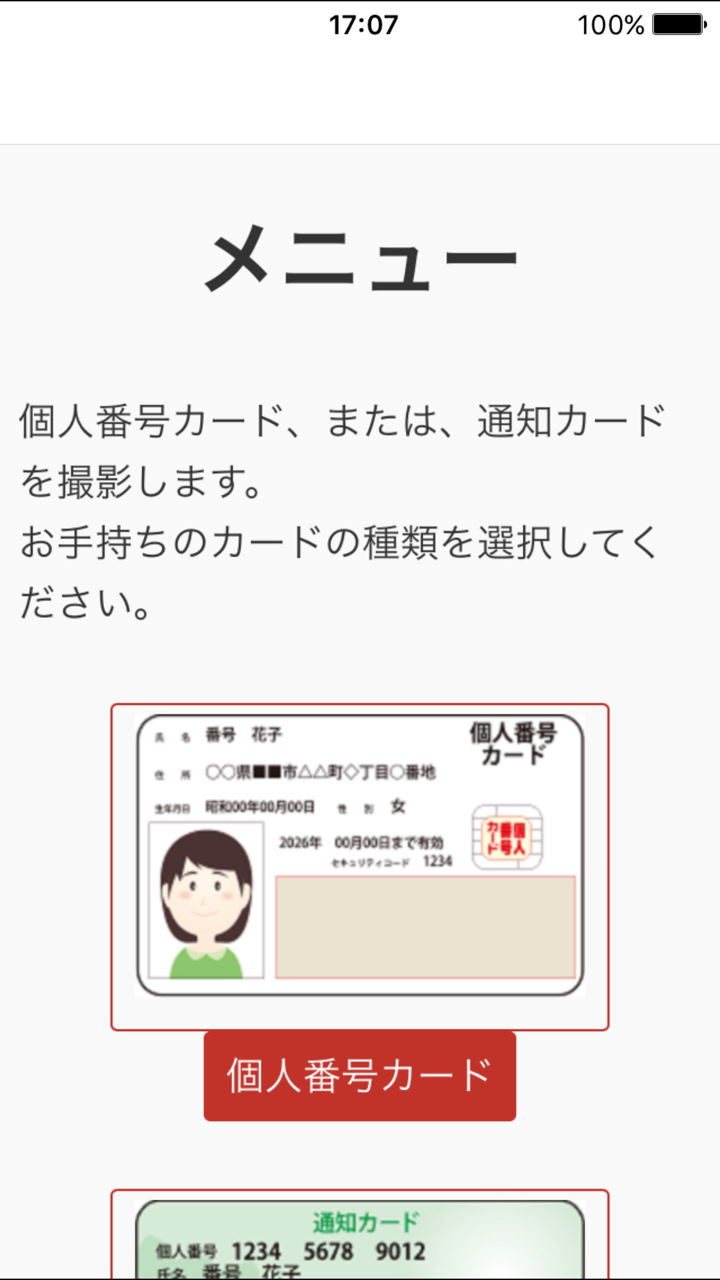

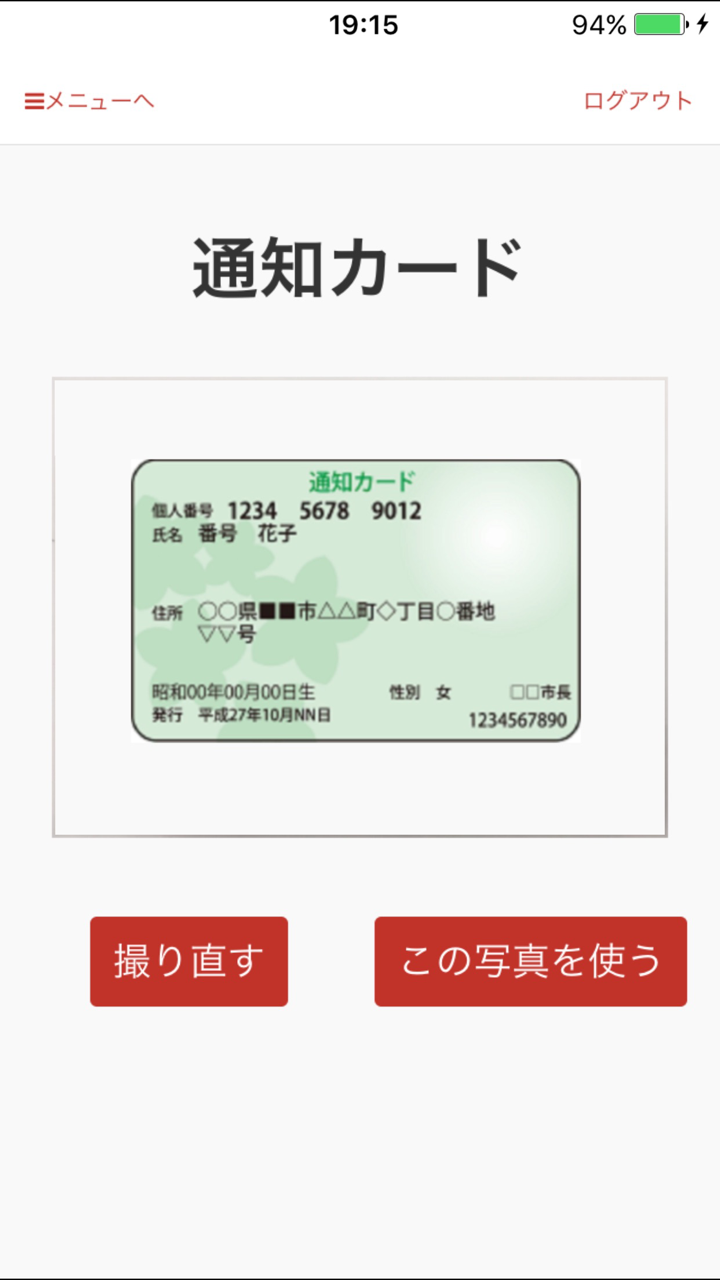

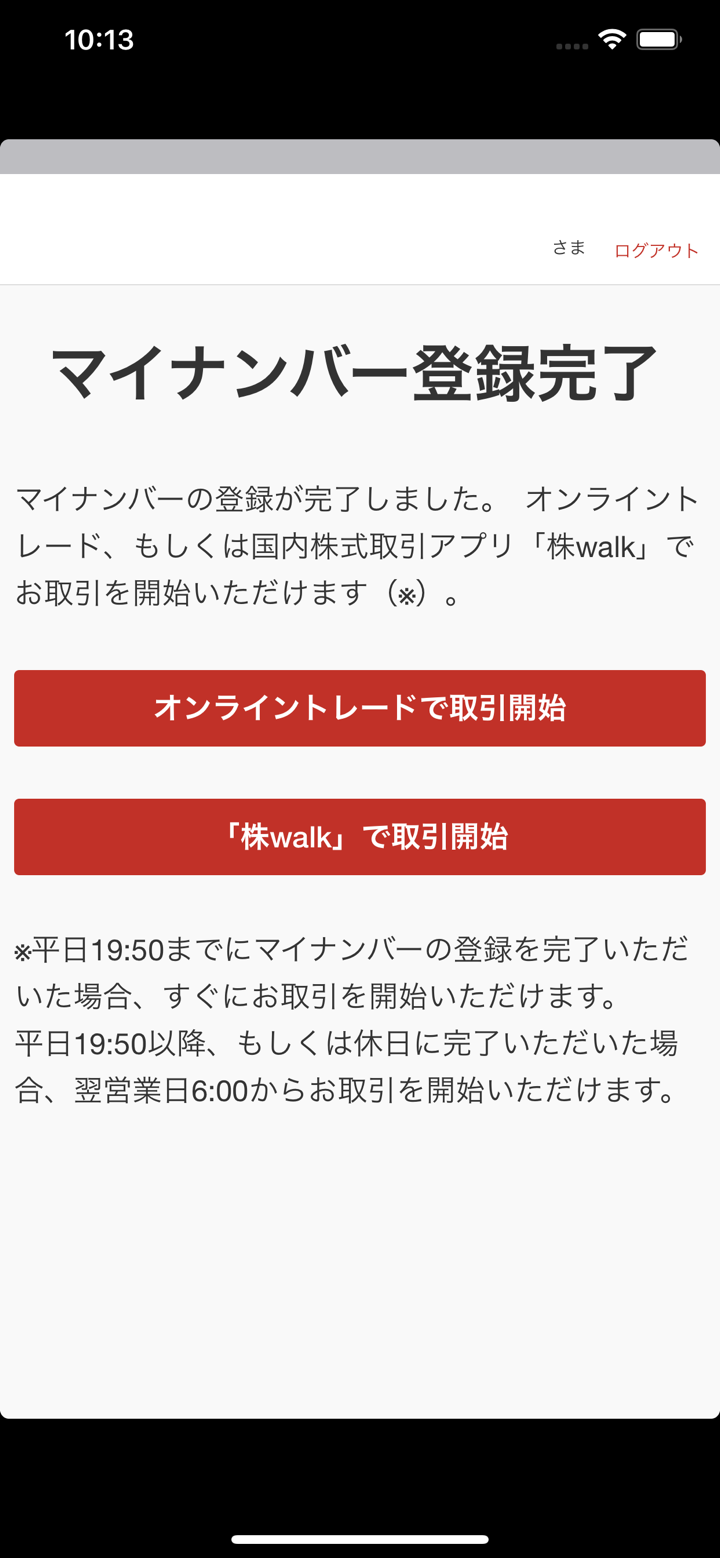

| Trading Platform | Supported | Available Devices |

| D-Port | ✔ | iPhone/Android |

| Stock walk | ✔ | iPhone/Android |

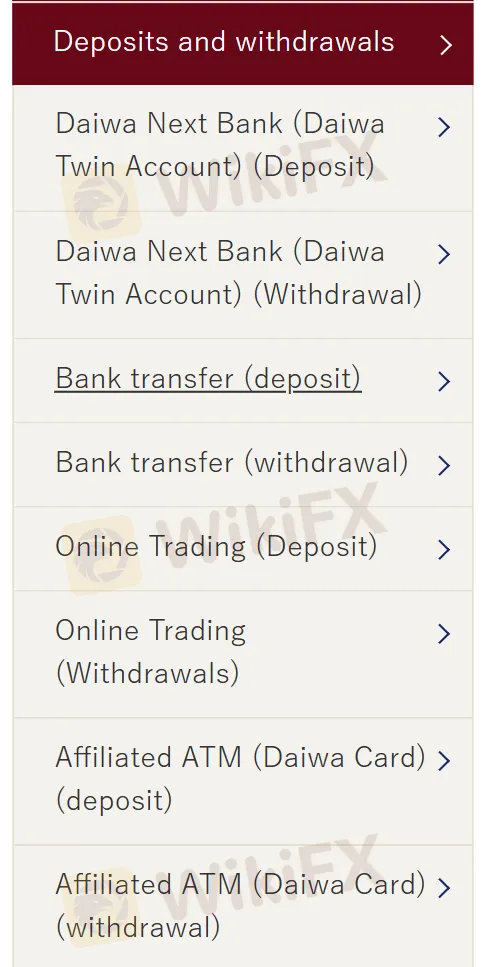

Deposit and Withdrawal

For deposit and withdrawal methods, Daiwa offers different options to make it convenient for customers. Methods include contract facility via Daiwa Next Bank, standard bank transfers, online trading platforms, and transactions from affiliated ATMs in overseas currencies with the use of a Daiwa Card.

我行

Hong Kong

The customer service is out of contact

Exposure

春日里的阳光

Hong Kong

It is legitimate, and the commission fee is charged at a default rate of 0.025%, which is relatively acceptable.

Positive

FX1732221901

Argentina

I have been using Daiwa since 2020 and have no reason to change to another broker. Customer service has been excellent, and depositing and withdrawing funds is a breeze - never had issues. I will remain with them as long as they continue to provide excellent trading conditions for their users.

Positive

AA资治通鉴

Morocco

The company is older than me, so I thought it must be a good company to last this long. After 2 months of experience, I think their general trading conditions are very good, like free deposit and withdrawal, no minimum deposit requirement, and various instruments available.

Positive

孙东方

Hong Kong

Wide range of financial products and services are offered without any minimum deposit amount requirement, you can invest any amount as you want. But they end here..the trading condition is not transparent enough! The broker says that it does charge some commissions for forex trading, but not specified. They also don’t bother to refer anything about the leverage..

Neutral

刘家

Hong Kong

A long-established broker providing diversified range of prodcuts and servcies, average customer support for if you have any inquiries, no online support team available......

Neutral