Basic Information

India

India

Score

India

|

5-10 years

|

India

|

5-10 years

| http://www.ansplshares.com

Website

Rating Index

Influence

D

Influence index NO.1

India 2.60

India 2.60 Licenses

LicensesNo valid regulatory information, please be aware of the risk!

India

India ansplshares.com

ansplshares.com India

India

| ANS Review Summary | |

| Founded | 2005 |

| Registered Country/Region | India |

| Regulation | No regulation |

| Trading Products | Equities, futures, options, commodities, ETFs, currencies, mutual funds, bonds, IPOs |

| Demo Account | ❌ |

| Leverage | / |

| Spread | / |

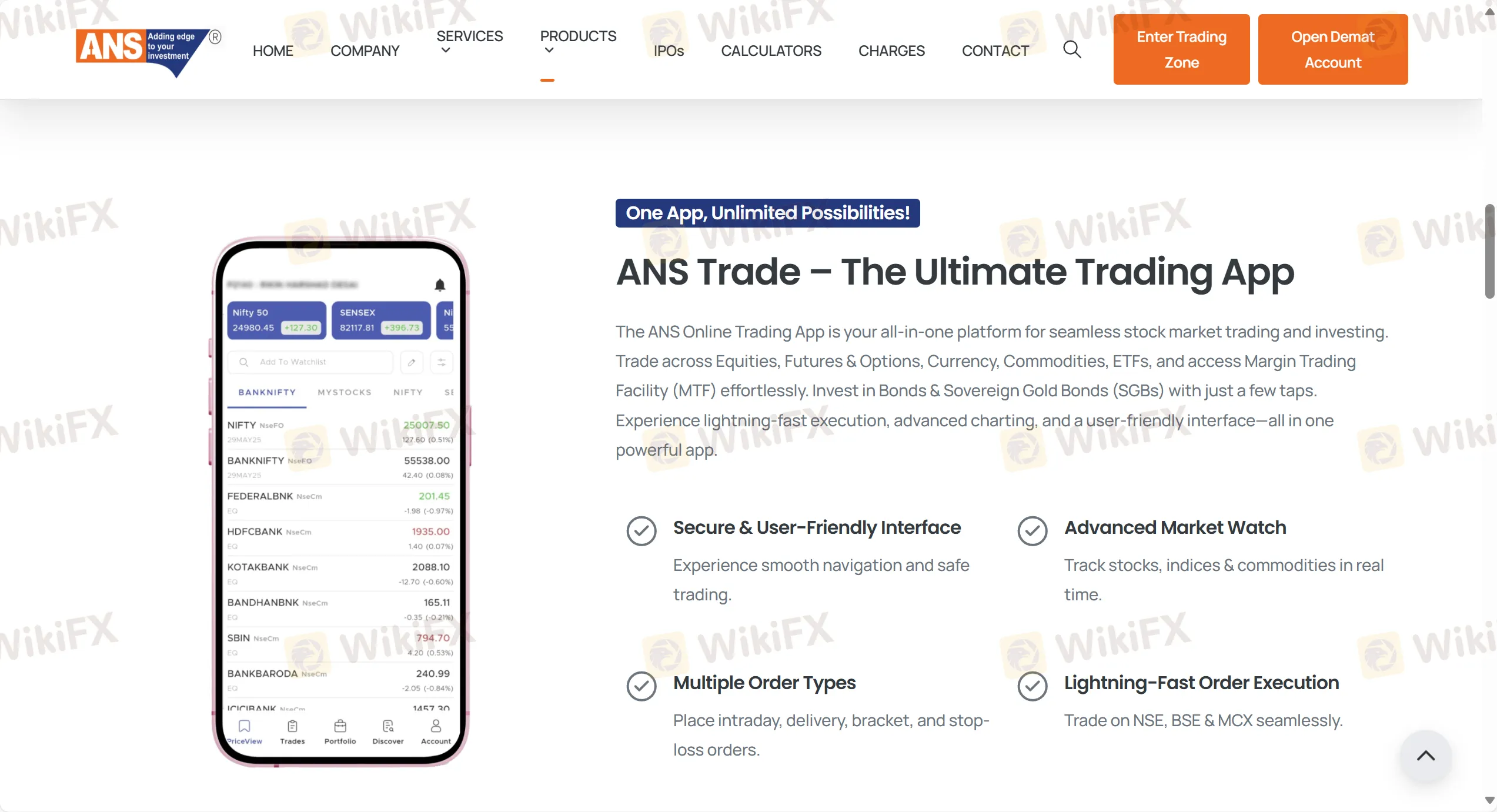

| Trading Platform | ANS Trade, ANS Money, ANSPL BO, ANS Connect, MoneyMaker Solo, MoneyMaker Dealer, Greeksoft's GREEK |

| Minimum Deposit | / |

| Customer Support | Contact form |

| Tel: +91 97265 44944 | |

| Email: info@anspl.net | |

| WhatsApp, Facebook, Instagram, Linkedin, Youtube | |

| Address: “ARHAM” FinancialCenter, PanchnathTemple Road, HariharChowk, Rajkot - 360 001 | |

ANS is an unregulated service provider of premier brokerage and financial services, which was founded in India in 2005. It offers trading in equities, futures, options, commodities, ETFs, currencies, mutual funds, bonds, and IPOs via multiple proprietary mobile apps.

| Pros | Cons |

| Long operation time | Lack of regulation |

| Various trading products | No demo accounts |

| Various contact channels | Complex fee structure |

| No MT4/MT5 platform | |

| No info on deposit and withdrawal |

No. ANS currently has no valid regulations. Please be aware of the risk!

| Trading Products | Supported |

| Equities | ✔ |

| Futures | ✔ |

| Options | ✔ |

| Commodities | ✔ |

| ETFs | ✔ |

| Currencies | ✔ |

| Mutual Funds | ✔ |

| Bonds | ✔ |

| IPOs | ✔ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

Futures

| Equity Intraday | Equity Delivery | |

| STT/CTT | 0.02% on the sell side | 0.125% on intrinsic value |

| 0.1% on option sell (premium) | ||

| Transactional Charges | NSE: 0.00173% | NSE: 0.03503% (on premium) |

| BSE: 0 | BSE: 0.0325% (on premium) | |

| GST | 18% on (brokerage + SEBI charges + transaction charges) | |

| SEBI Charges | ₹10/crore | |

| Stamp Duty | 0.002% or ₹200/ crore on buy side | 0.003% or ₹300/ crore on buy side |

Equity

| Equity Intraday | Equity Delivery | |

| STT/CTT | 0.025% on the sell side | 0.1% on buy & sell |

| Transactional Charges | NSE: 0.00297% | NSE: 0.00297% |

| BSE: 0.00375% | BSE: 0.00375% | |

| GST | 18% on (brokerage + SEBI charges + transaction charges) | |

| SEBI Charges | ₹10/crore | |

| Stamp Duty | 0.003% or ₹300 / crore on buy side | 0.015% or ₹1500 / crore on buy side |

Commodity & Currency

| Equity Intraday | Equity Delivery | |

| STT/CTT | 0.01% on the sell side | 0.05% on buy & sell |

| Transactional Charges | MCX: 0.0021% | MCX: 0.0418% |

| NSE: 0.0001% | NSE: 0.001% | |

| GST | 18% on (brokerage + SEBI charges + transaction charges) | |

| SEBI Charges | Agri: ₹1/ crore | ₹10/ crore |

| Non-agri: ₹10 / crore | ||

| Stamp Duty | 0.002% or ₹200/ crore on buy side | 0.003% or ₹300/ crore on buy side |

Depository& Account-Related Charges

| Rate | |

| DP Charges (Debit-side) | ₹17.70 per scrip (₹4 CDSL + ₹11 ANS + ₹2.5 GST) |

| Pledging Charges | ₹20 + GST per pledge request per ISIN |

| MTF Pledge Charges | ₹50 or 0.03% of the total value per ISIN (Whichever is higher) |

| MTF Pledge Charges | Holdings up to ₹4,00,000 - Rs. 0 AMC |

| Rs. 4 lakhs to Rs. 10lakhs - Rs.100 AMC | |

| Above Rs.10 lakhs - Regular AMC may be levied | |

| AMC – Non-BSDA Demat Account | ₹300/year + 18% GST (charged quarterly) |

Transactional & Platform Charges

| Charge Type | Rate |

| Buyback Applications | No charge on application; Brokerage applied on allotted shares as per your slab |

| OFS (Offer for Sale) | Charged as per your regular brokerage slab |

| Off-Market Transfer (> ₹1.3 lakh) | 0.03% of total transaction value |

| Off-Market Transfer (< ₹1.3 lakh) | ₹40 per transaction |

| Account with Debit Balance | 0.049% interest per day |

| Payment Gateway Charges | 0 |

| Delayed Payment Charges | 18% annually or 0.05% per day on debit balances |

| Trading Platform | Supported | Available Devices | Suitable for |

| ANS Trade | ✔ | Mobile | / |

| ANS Money | ✔ | Mobile | / |

| ANSPL BO | ✔ | Mobile | / |

| ANS Connect | ✔ | Mobile | / |

| MoneyMaker Solo | ✔ | PC, web, mobile | / |

| MoneyMaker Dealer | ✔ | PC, web, mobile | / |

| Greeksoft's GREEK | ✔ | PC, web, mobile | / |

| MT4 | ❌ | / | Beginners |

| MT5 | ❌ | / | Experienced traders |

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now