Company Summary

| CHIEFReview Summary | |

| Founded | 1979 |

| Registered Country/Region | Hong Kong |

| Regulation | Regulated |

| Market Instruments | SecuritiesFutures |

| Demo Account | ❌ |

| Leverage | / |

| Spread | / |

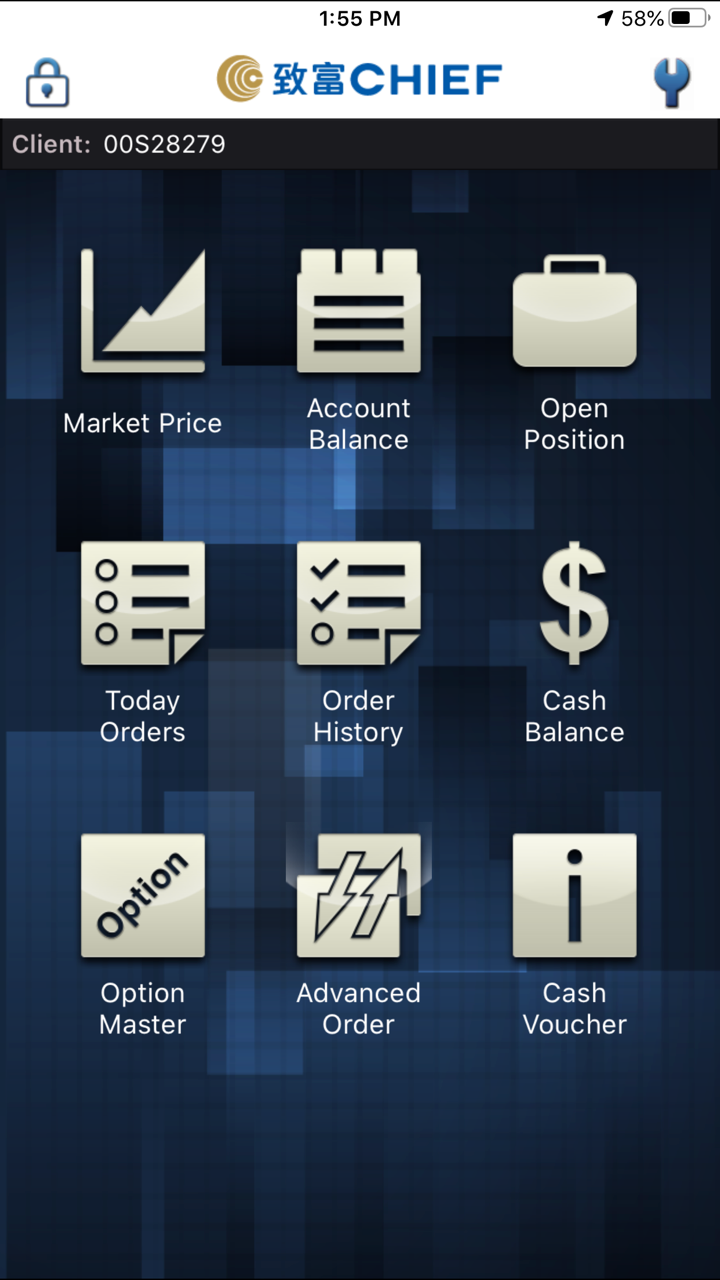

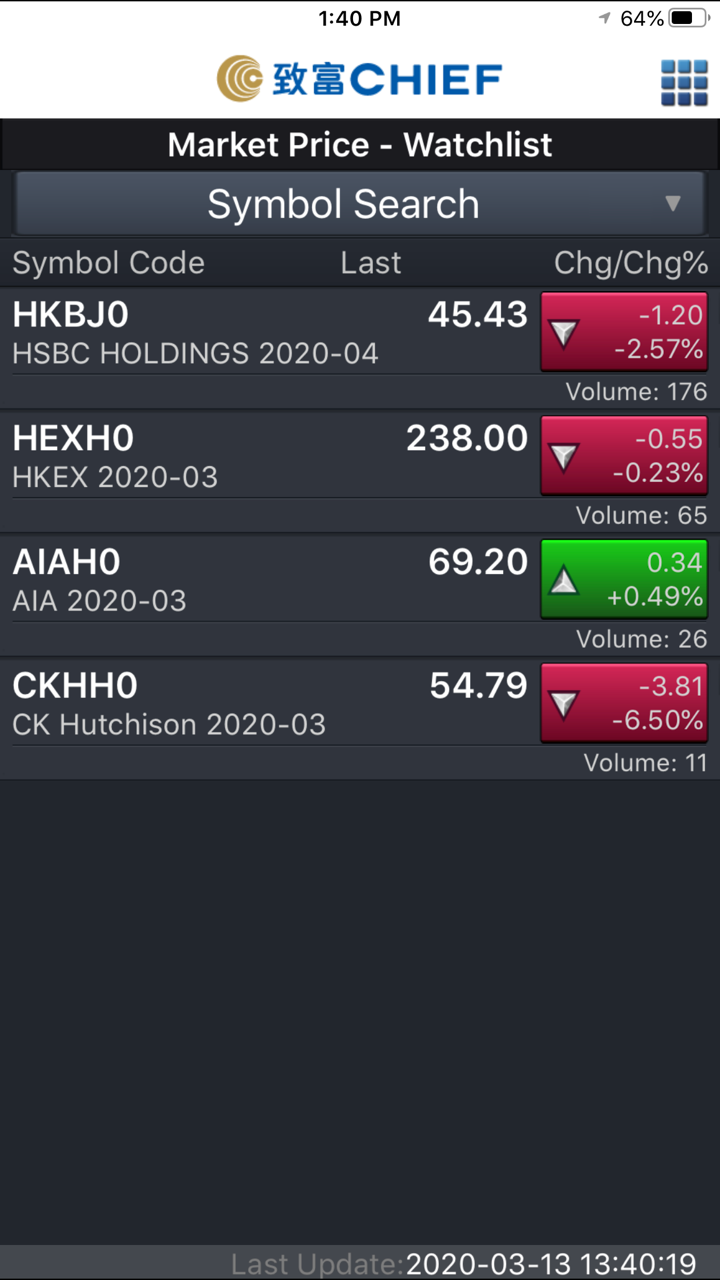

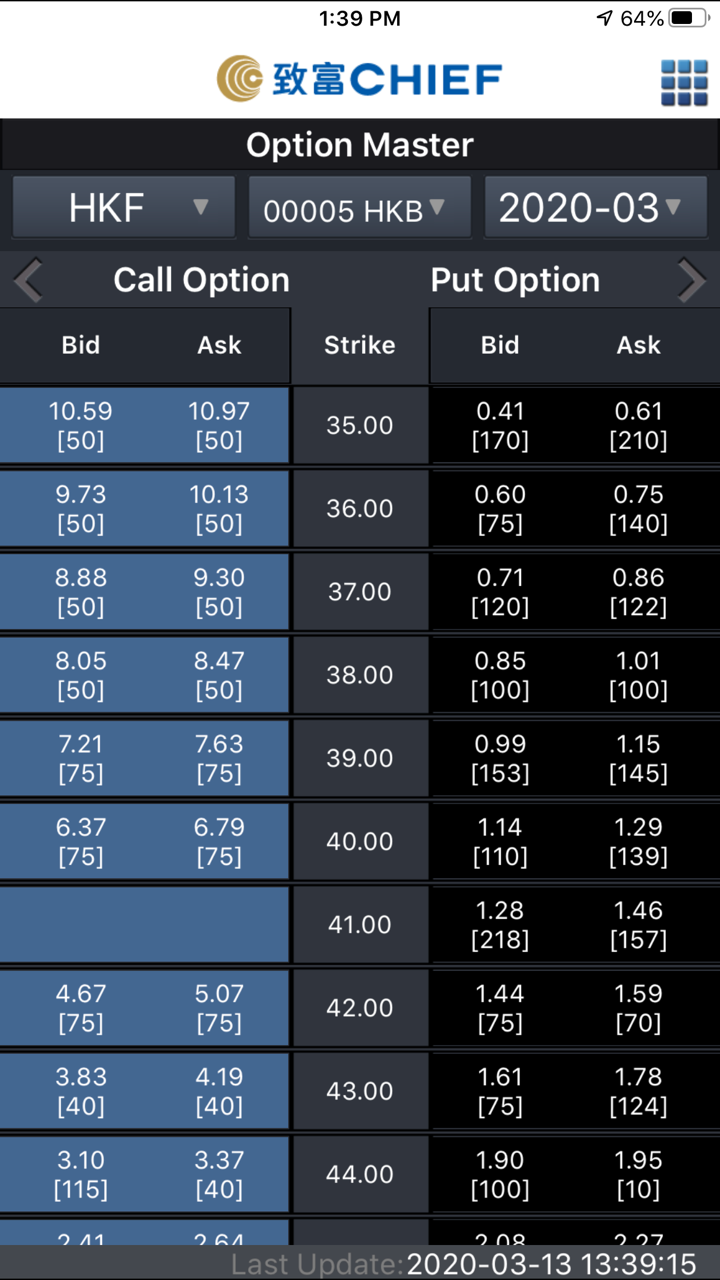

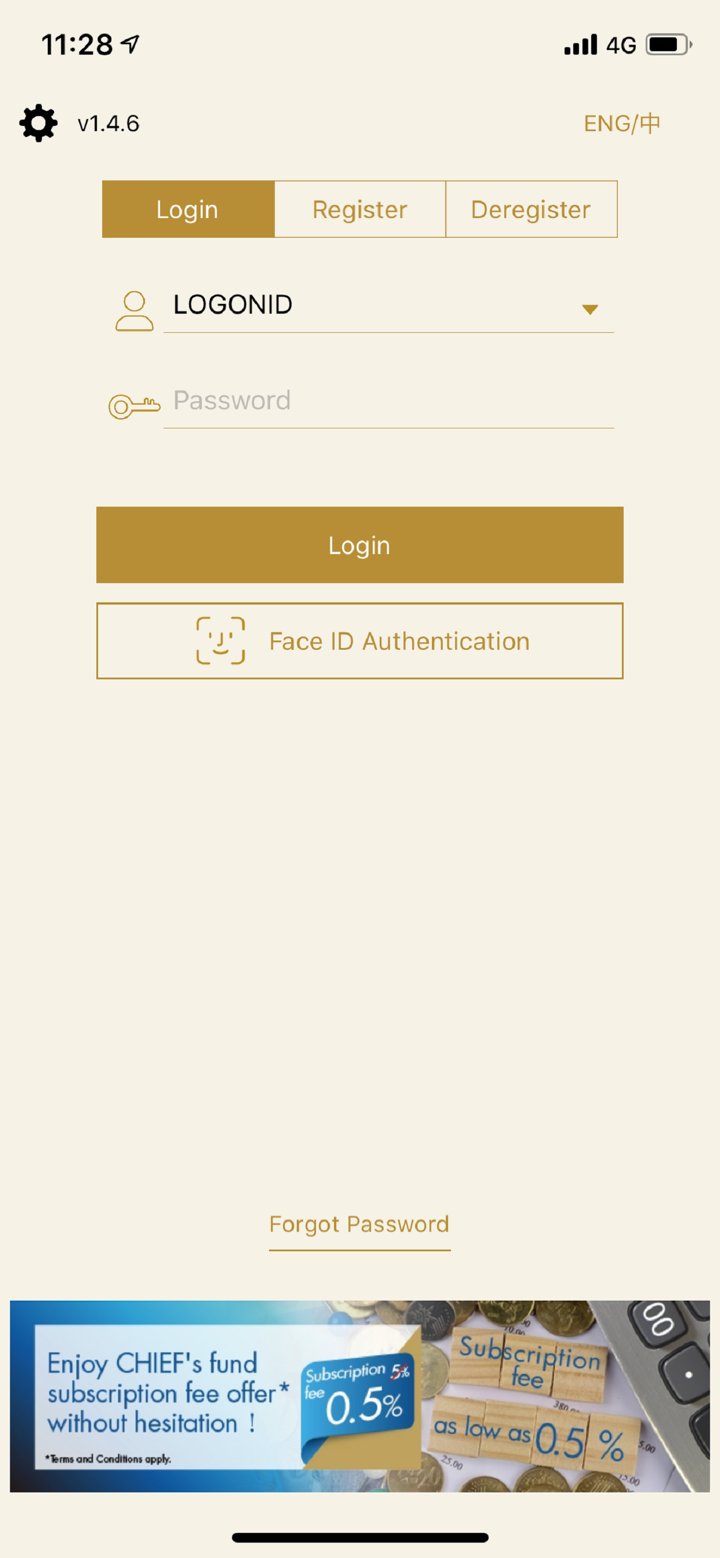

| Trading Platform | Chief Deal |

| Min Deposit | / |

| Customer Support | Email: cs@chiefgroup.com.hk |

| Social Media: Facebook, Linkedin, Youtube, Whatsapp, Wechat | |

CHIEF Information

CHIEF, incorporated in Hong Kong in 1979. It is currently regulated by the SFC, mainly provides securities and futures trading, and has its own trading platform.

Pros and Cons

| Pros | Cons |

| Regulated by SFC | MT4/5 is not supported |

| Demo accounts are not available |

Is CHIEF Legit?

| Regulated Country/Region |  |

| Regulated Authority | SFC |

| Regulated Entity | Chief Commodities Limited |

| License Type | Dealing in futures contracts |

| License Number | AAZ607 |

| Current Status | Regulated |

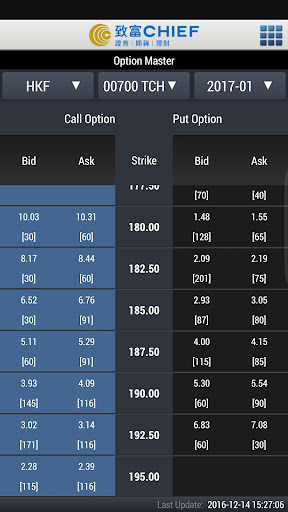

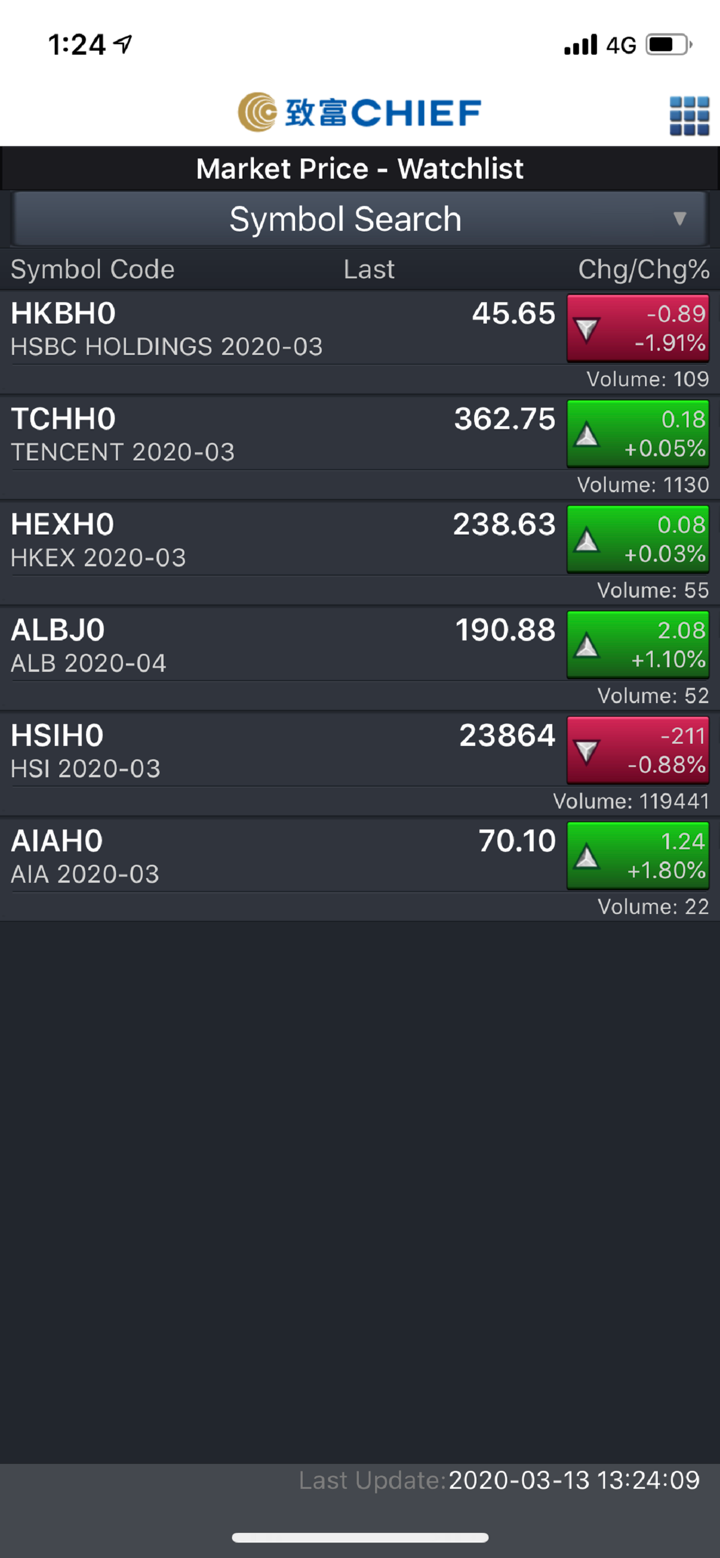

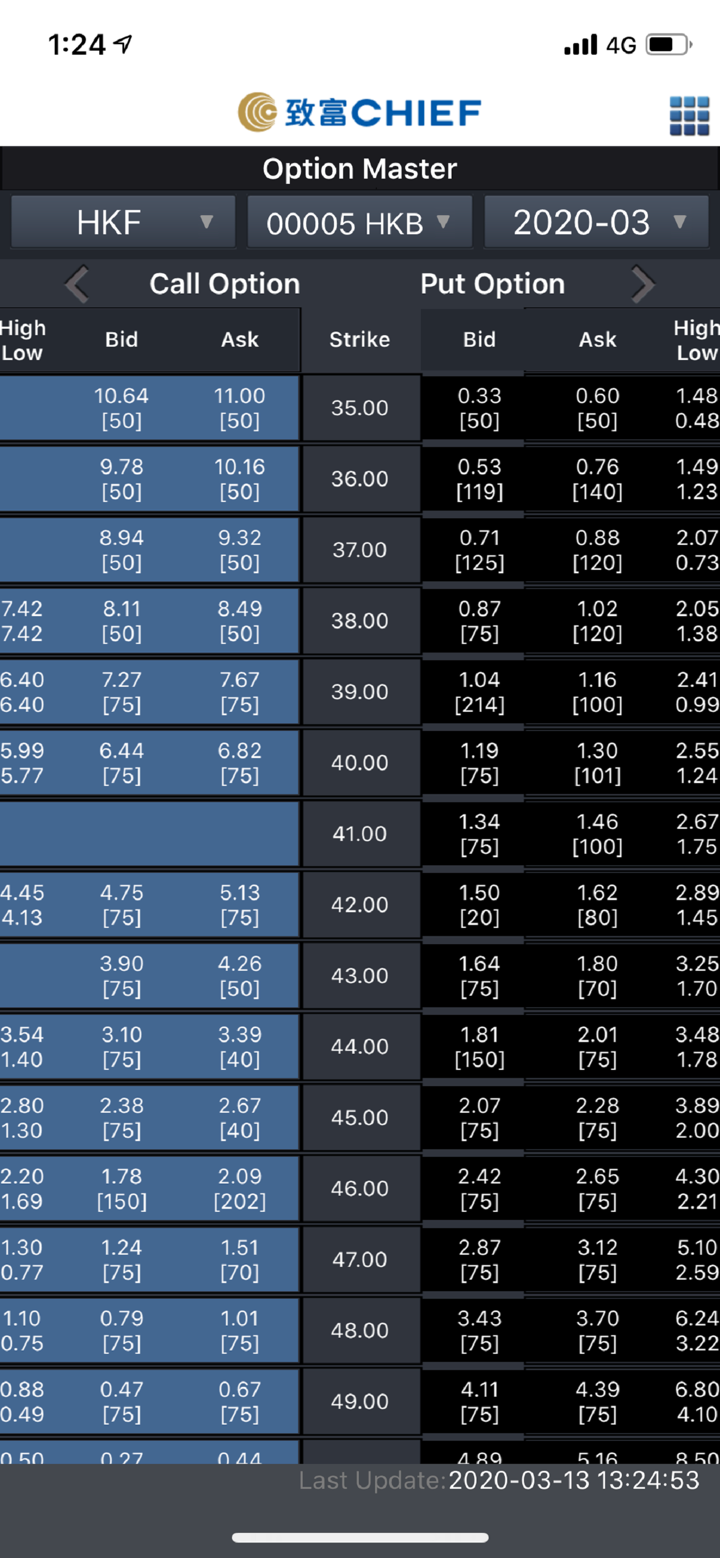

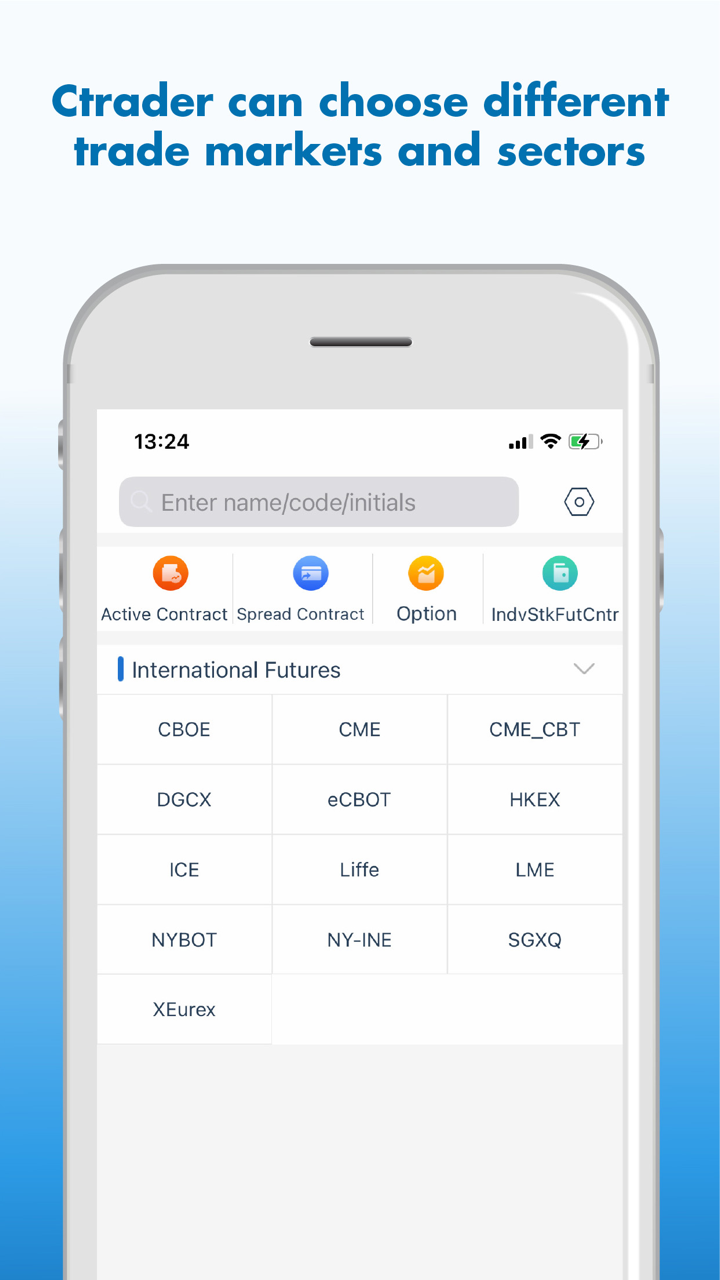

What Can I Trade on CHIEF?

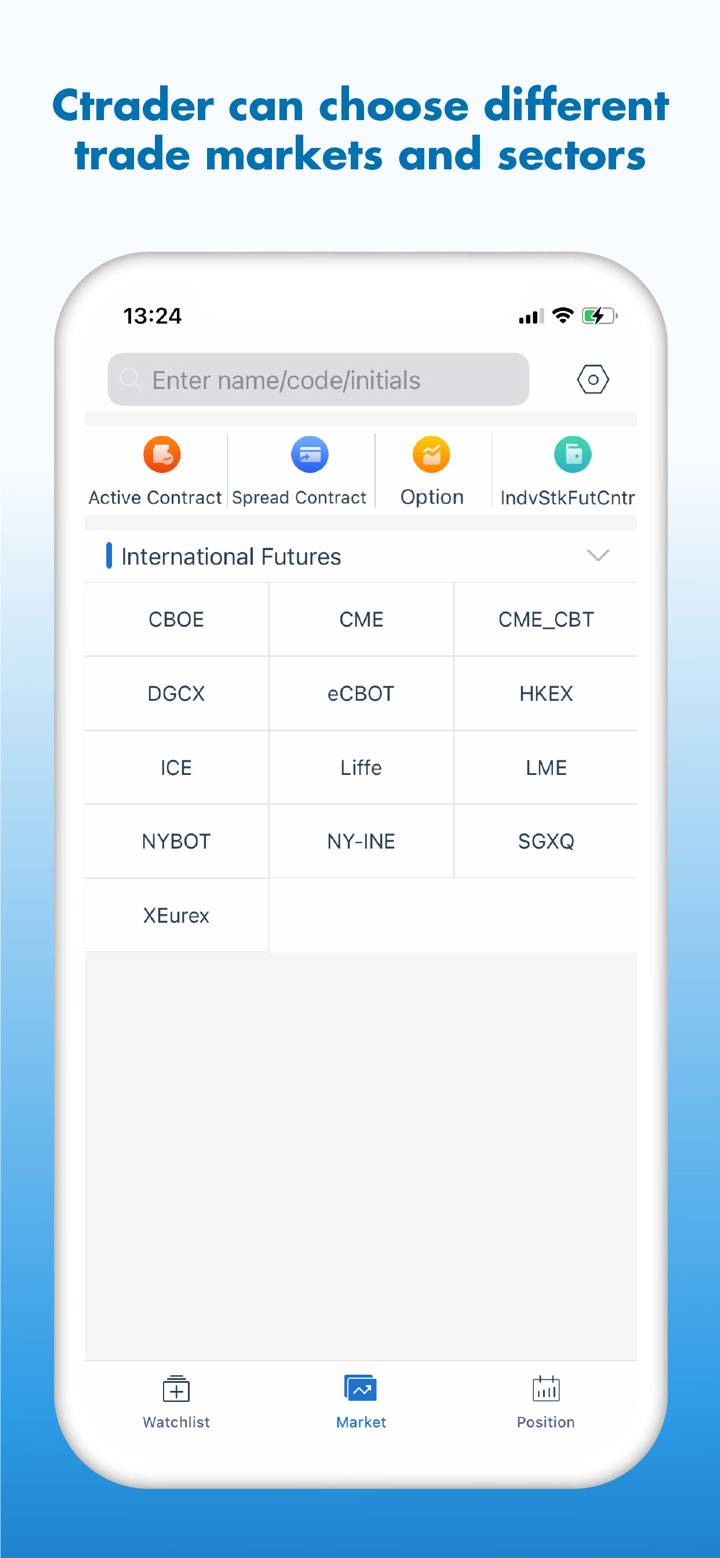

CHIEF supports you in securities and futures trading.

| Tradable Instruments | Supported |

| Securities | ✔ |

| Futures | ✔ |

| Forex | ❌ |

| Precious metals & Commodities | ❌ |

| Indices | ❌ |

| Bonds | ❌ |

| ETF | ❌ |

Account Types

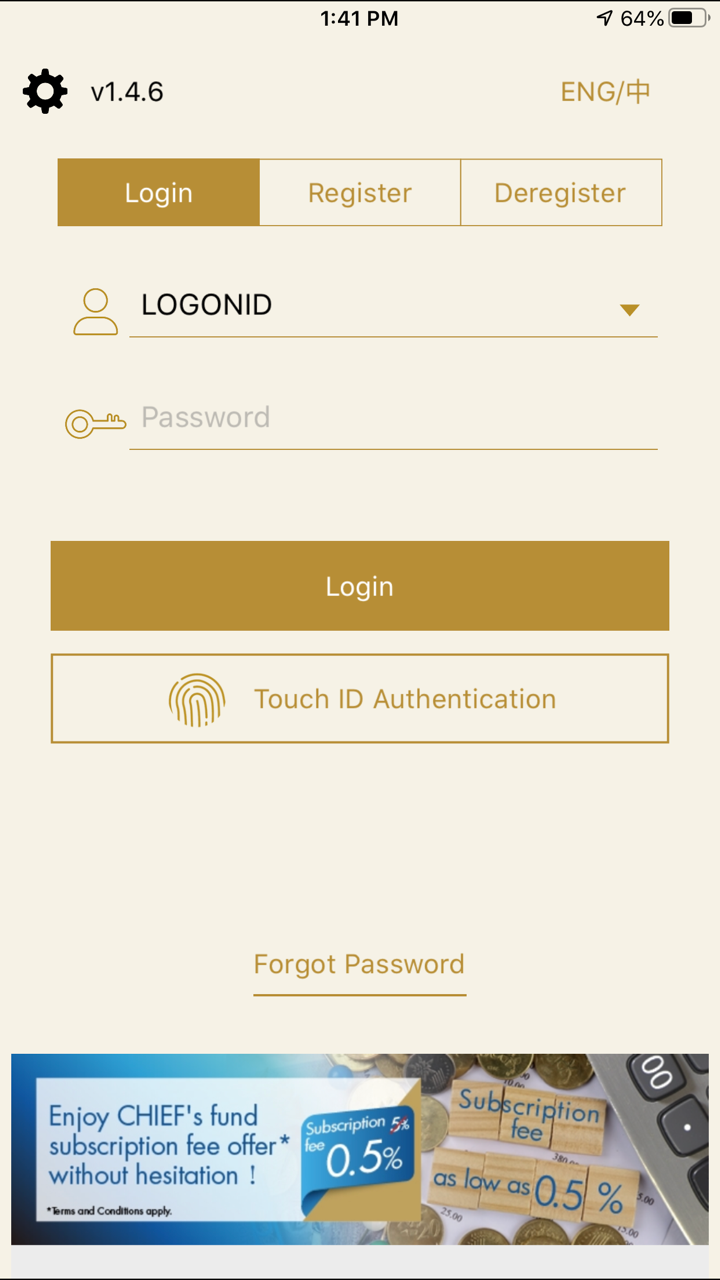

CHIEF did not provide account information. However, the supported account opening methods are “remote account opening pass” appointments, in person and mail account opening. You can refer to: https://www.chiefgroup.com.hk/hk/account?apply=e-account

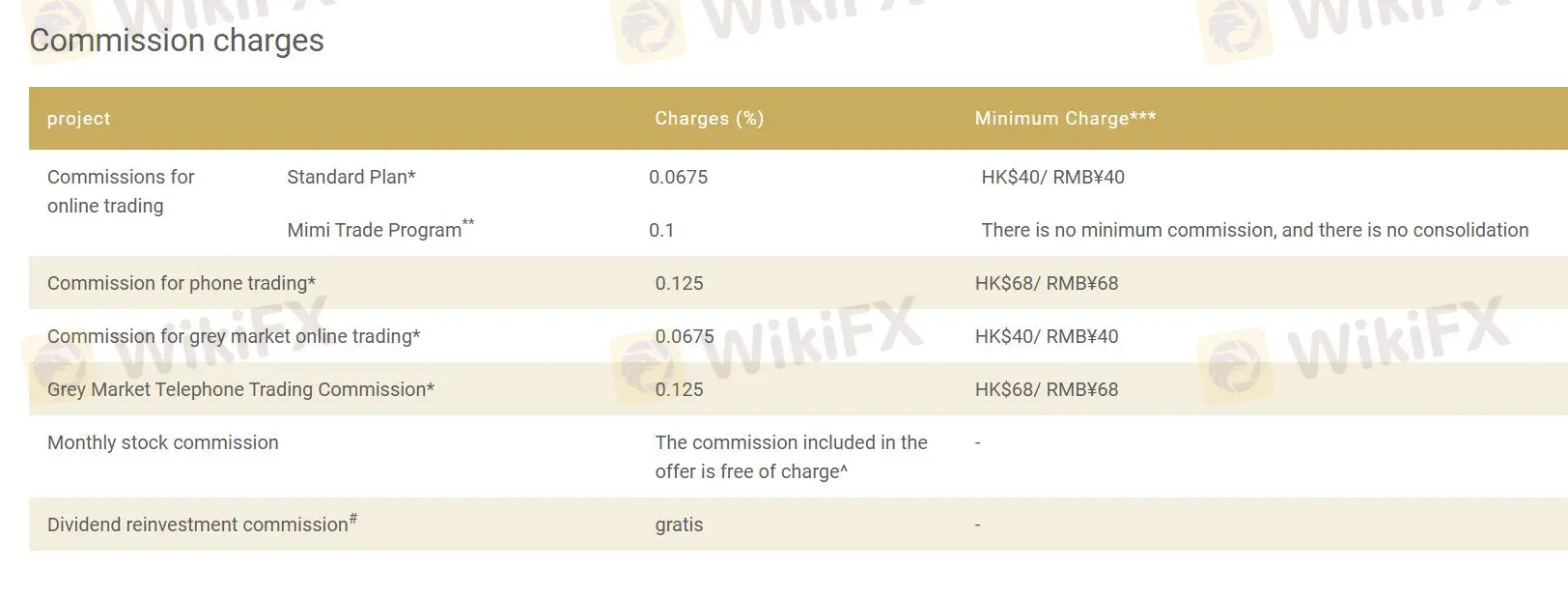

CHIEF Fees

CHIEF supports some projects free of commission, and the commission rate of the project is no more than 0.2%. The minimum fee ranges from HK $40 to HK $68 and RMB ¥40 to RMB ¥68.

| Project | Charges (%) | Minimum Charge**** |

| Commissions for online trading | ||

| Standard Plan* | 0.0675 | HK$40 / RMB¥40 |

| Mimi Trade Program** | 0.1 | No minimum commission, no consolidation |

| Commission for phone trading* | 0.125 | HK$68 / RMB¥68 |

| Commission for grey market online trading* | 0.0675 | HK$40 / RMB¥40 |

| Grey Market Telephone Trading Commission* | 0.125 | HK$68 / RMB¥68 |

| Monthly stock commission | The commission included in the offer is free of charge* | - |

| Dividend reinvestment commission# | gratis | - |

Trading Platform

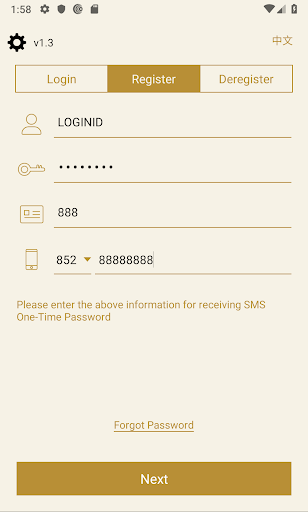

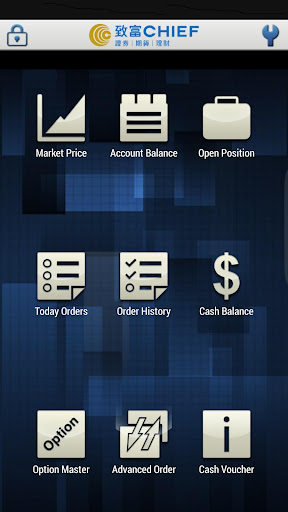

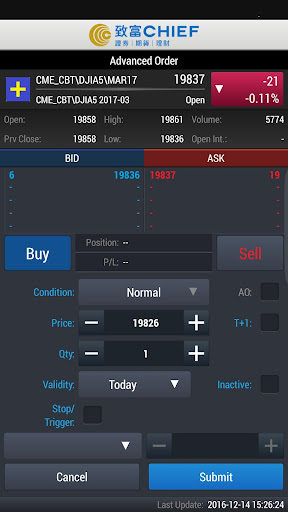

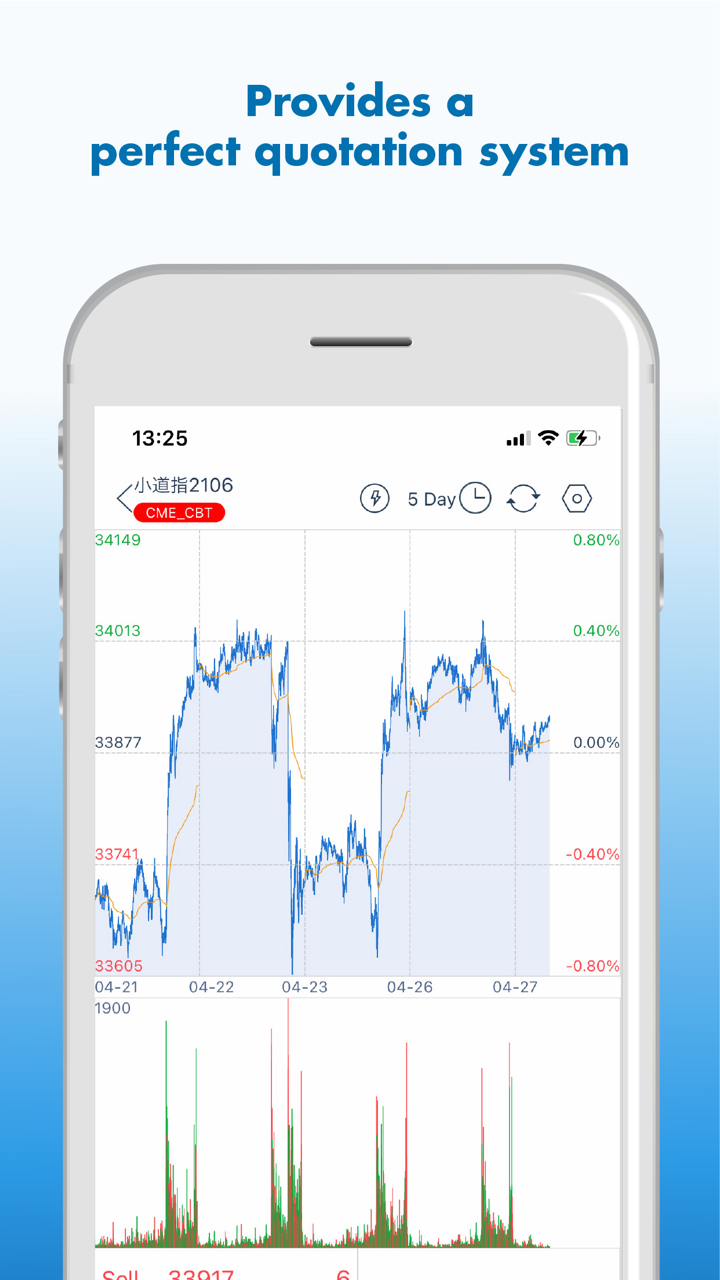

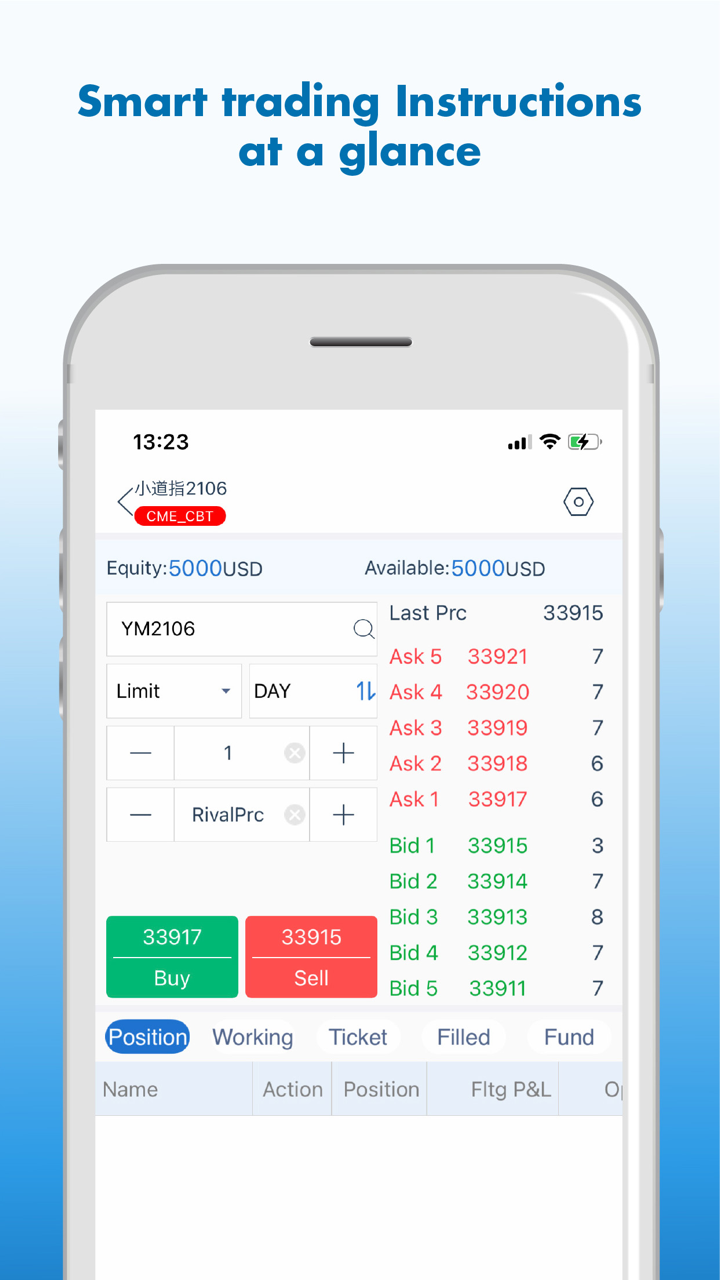

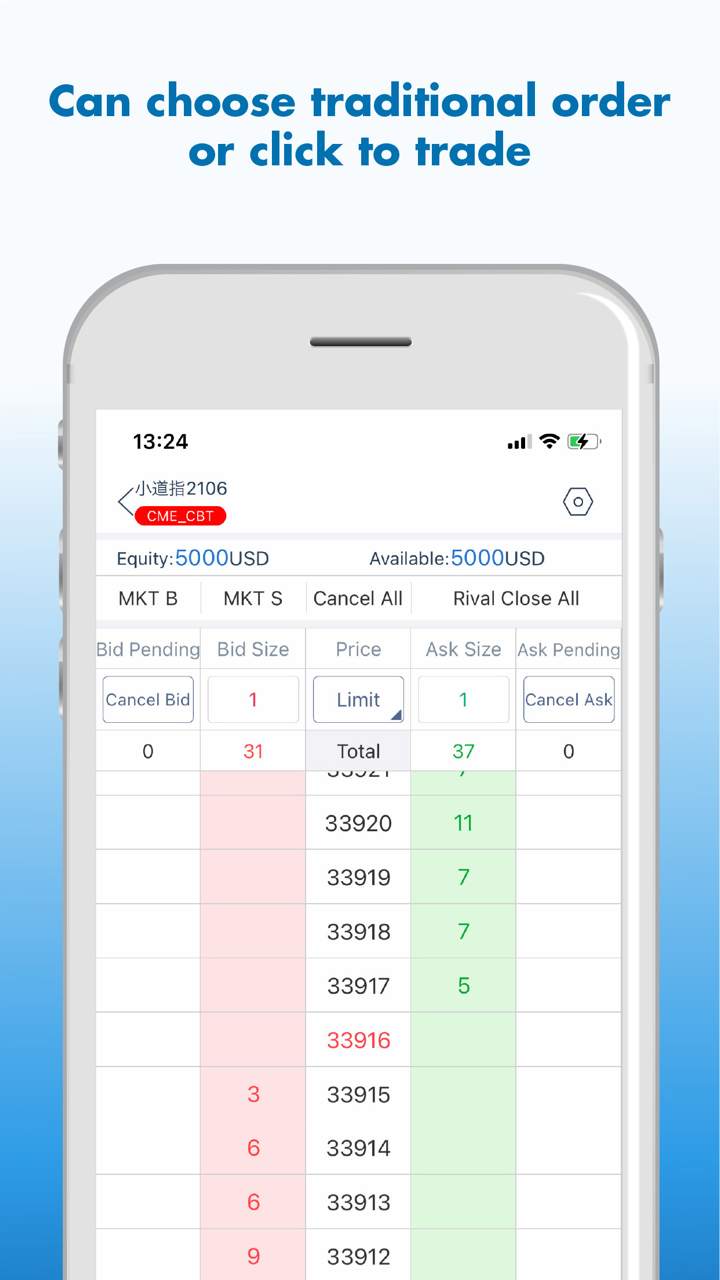

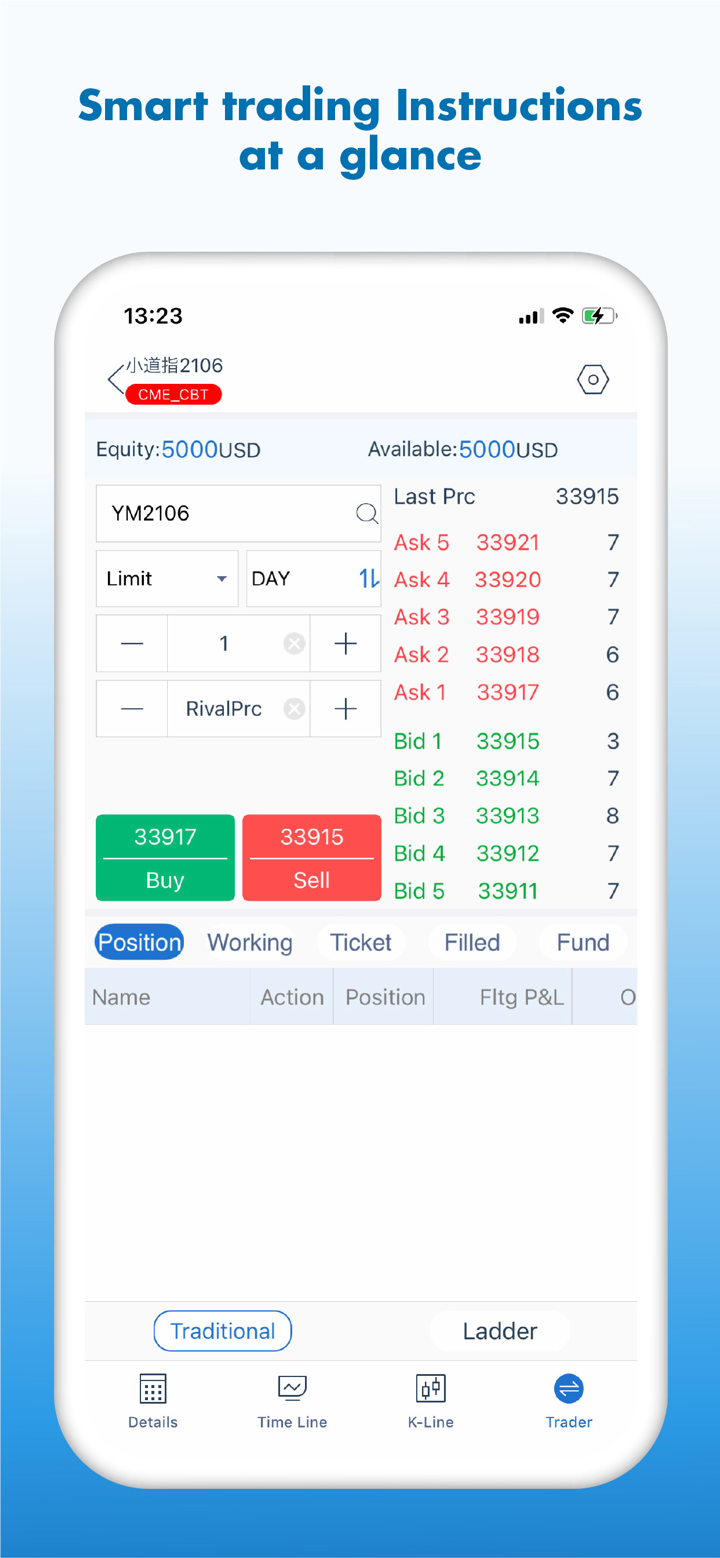

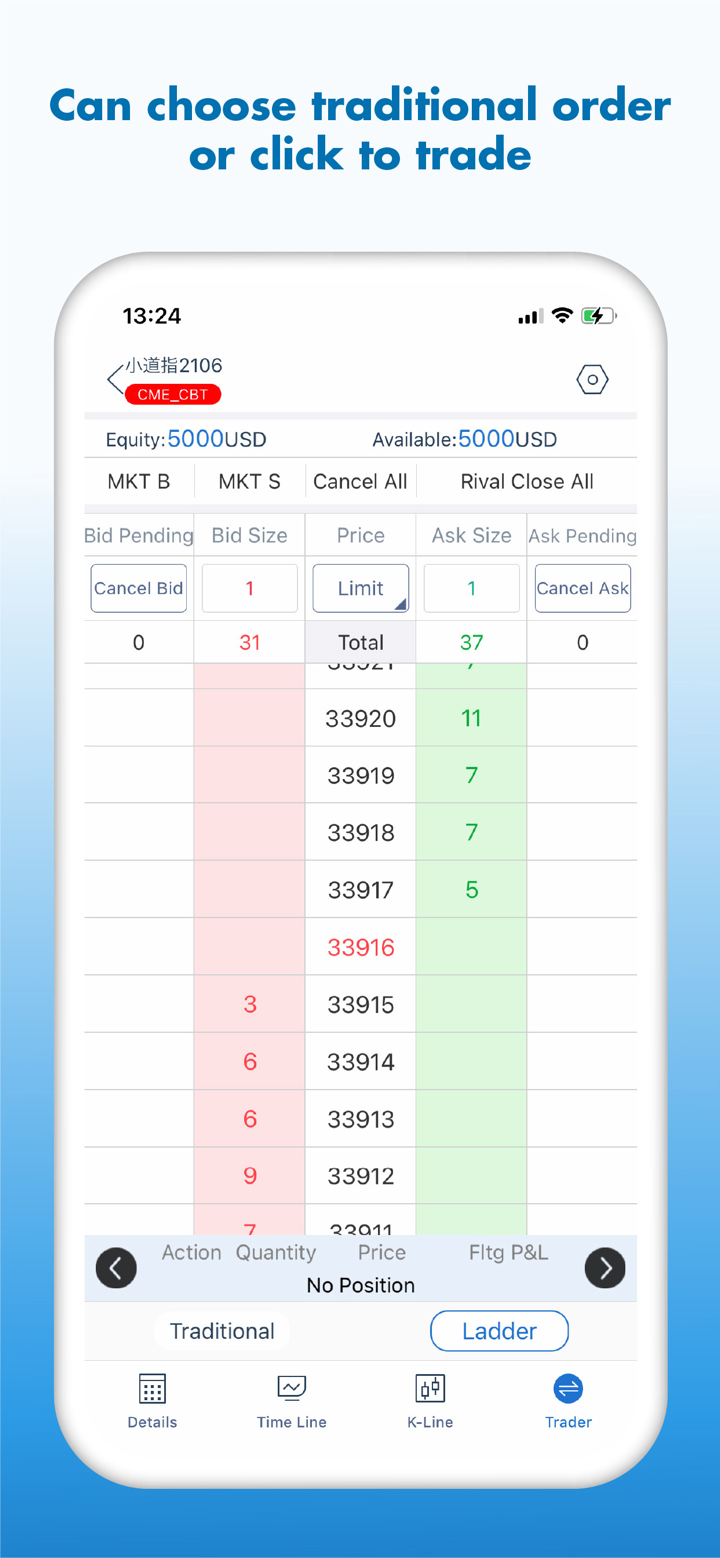

CHIEF offers its own platform Chief Deal, which can be used on mobile.

| Trading Platform | Supported | Available Devices | Suitable for |

| Chief Deal | ✔ | Mobile | All traders |

| MT4 | ❌ | ||

| MT5 | ❌ |

Deposit and Withdrawal

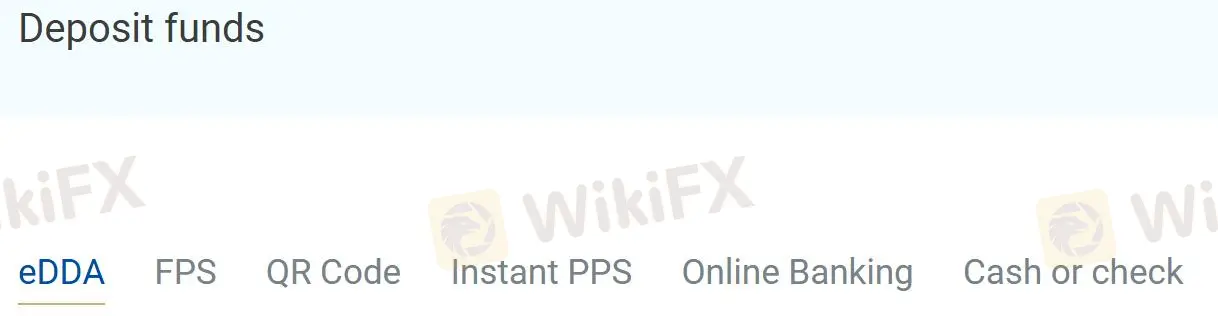

CHIEF offers 6 deposit methods: eDDA, FPS, QR Code, Instant PPS, Online Banking, Cash or check.

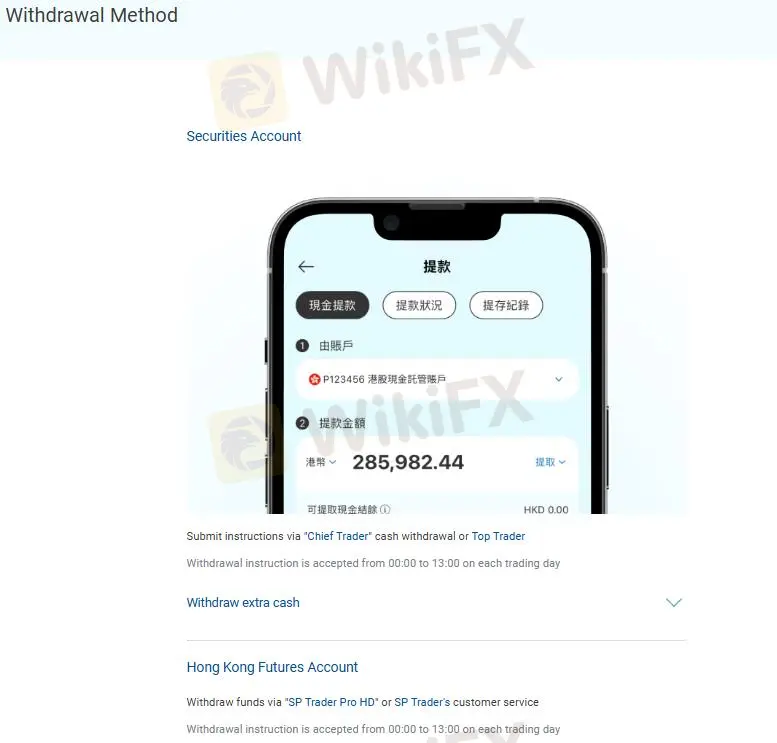

Withdrawals need to submit instructions via “Chief Trader” cash withdrawal or Top Trader, or withdraw funds via “SP Trader Pro HD” or SP Trader's customer service.