Company Summary

| au Kabucom SecuritiesReview Summary | |

| Founded | 1997 |

| Registered Country/Region | Japan |

| Regulation | FSA |

| Products & Services | Stocks, Margin, Transaction (System/General), Initial Public Offering (IPO)/Public offering sale (PO), ETF/ETN/REIT, Free ETF (Commission-Free Exchange Traded Fund), Petit Shares (Shares LessThan One Unit), Tender Offer (TOB), Investment Trust, FX (Forex Margin Trading), Futures/Options Trading, Bonds (Foreign Bonds), Foreign Currency Denominated MMF, CFD (share 365) |

| Demo Account | / |

| Leverage | / |

| Spread | / |

| Trading Platform | Au Kabucom FX app |

| Min Deposit | / |

| Customer Support | Live chat |

| Tel: 0120 390 390, 05003-6688-8888 | |

| Email: cs@kabu.com | |

| Social Media: Twitter, Facebook. Instagram, Line, YouTube | |

au Kabucom Securities is an online brokerage company and is the core company of Mitsubishi UFJ Financial Group (MUFG Group) 's online financial services. The business is involved in securities trading, brokerage, offering, and selling. Along with other financial services, it offers bank agency and foreign exchange margin trading.

Pros and Cons

| Pros | Cons |

| Regulated by FSA | Limited info on trading conditions |

| Established company with a reputable parent company | |

| Various trading products and services | |

| Live chat support |

Is au Kabucom Securities Legit?

Yes, Au Kabucom is currently regulated by the Financial Services Agency (FSA), holding a retail forex license (No.61).

| Regulated Country | Regulated Authority | Current Status | Regulated Entity | License Type | License Number |

| Financial Services Agency (FSA) | Regulated | auカブコム証券株式会社 | Retail Forex License | 関東財務局長(金商)第61号 |

Products and Services

| Products & Services | Available |

| Stocks | ✔ |

| Margin Transaction (System/General) | ✔ |

| Initial Public Offering (IPO)/Public Offering Sale (PO) | ✔ |

| ETF/ETN/REIT | ✔ |

| Free ETF (Commission-Free Exchange Traded Fund) | ✔ |

| Petit Shares (Shares Less Than One Unit) | ✔ |

| Tender Offer (TOB) | ✔ |

| Investment Trust | ✔ |

| FX (Forex Margin Trading) | ✔ |

| Futures/Options Trading | ✔ |

| Bonds (Foreign Bonds) | ✔ |

| Foreign Currency Denominated MMF | ✔ |

| CFD (Share 365) | ✔ |

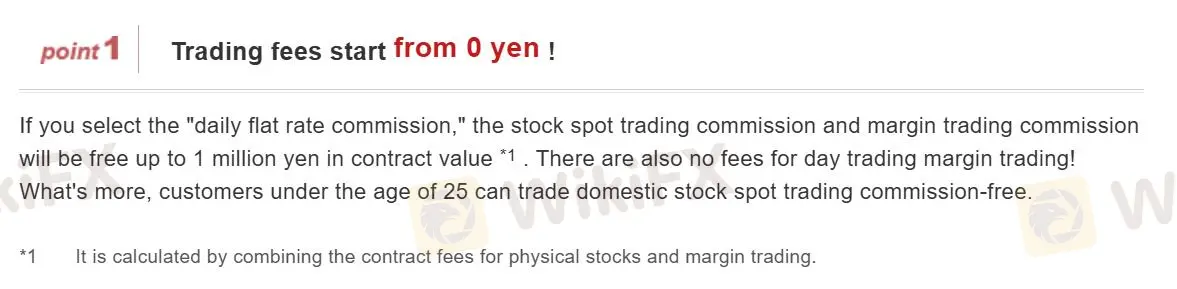

Fees

au Kabucom Securities offers commission-free forex trading, where the trading cost is incorporated into the spreads.

Au Kabucom charges for transactions involving other products, nevertheless. Here is the stock trading commission, for instance.

Stock trading commission (excluding Petit (Kabu®) and Premium Accumulation (Petit (Kabu® )))

| Contract Price (JPY) | Physical Fee (tax included) | Large-Volume Preferential Plan |

| 0 yen to 50,000 yen or less | 55 yen | ❌ |

| Over 50,000 yen to under 100,000 yen | 99 yen | |

| Over 100,000 yen to under 200,000 yen | 115 yen | |

| Over 200,000 yen to under 500,000 yen | 275 yen | |

| Over 500,000 yen to under 1,000,000 yen | 535 yen | |

| Over 1 million yen | Contract amount × 0.099% (tax included) + 99 yen [Maximum: 4,059 yen] |

Note:

- The above fees will be applied regardless of the execution conditions (market order, limit order, automated trading, etc.).

- If a calculation (fee calculation or consumption tax calculation) results in a fractional part, it will be rounded down.

- For transactions over the phone, an operator fee of 2,200 yen (tax included) will be added separately.

- The fees for buying and selling stock acquisition rights are the same as the fees for buying and selling physical shares mentioned above.

- There are no fees for transactions within a NISA (tax-free small-scale investment) account.

- If the upper limit of the price range (stop high) changes due to a period-specified order and the available amount falls short, the order will be forcibly canceled.

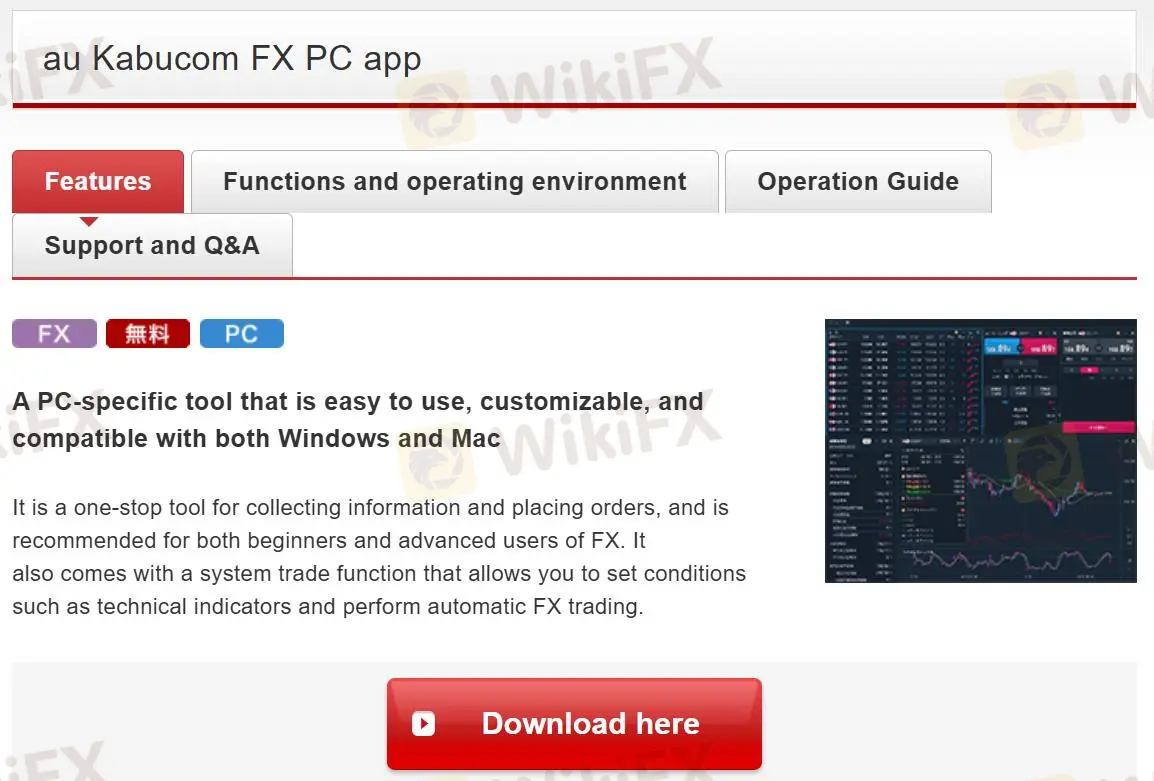

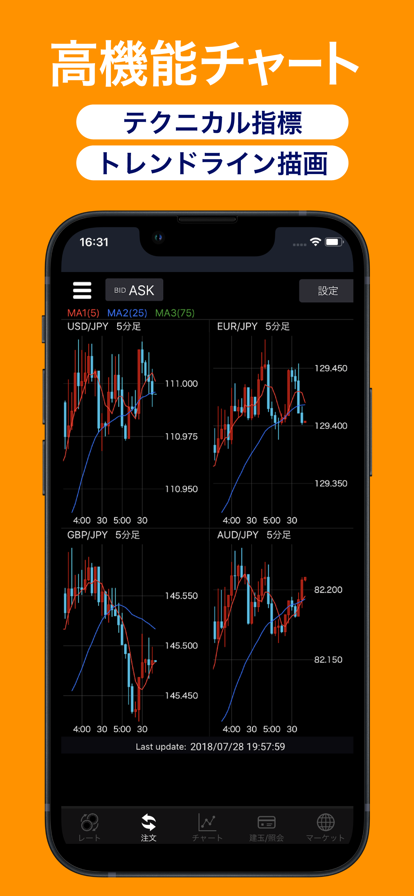

Trading Platform

Au Kabucom Securities offers an au Kabucom app which is available both on the PC and mobile platform.

| Trading Platform | Supported | Available Devices | Suitable for |

| Au Kabucom FX app | ✔ | Desktop, Mobile | / |

| MT5 | ❌ | / | Experienced traders |

| MT4 | ❌ | / | Beginners |