Company Summary

Company Summary

Company Profile

| ZFX | Basic Information |

| Registered Country/Region | London, UK |

| Founded in | 2010 |

| Regulations | FCA, FSA |

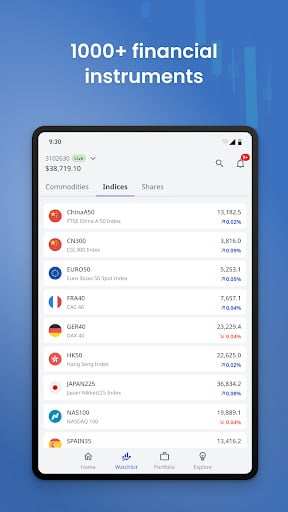

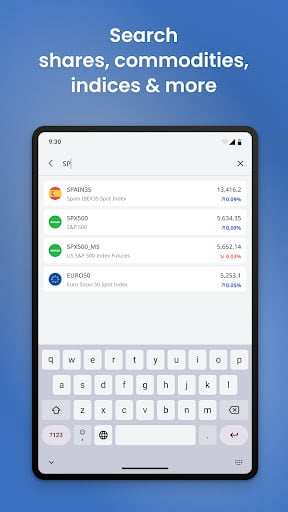

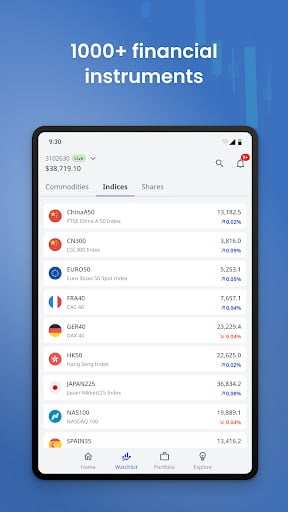

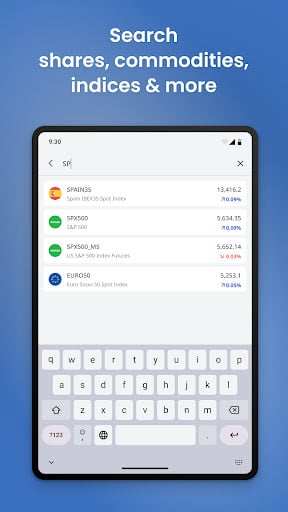

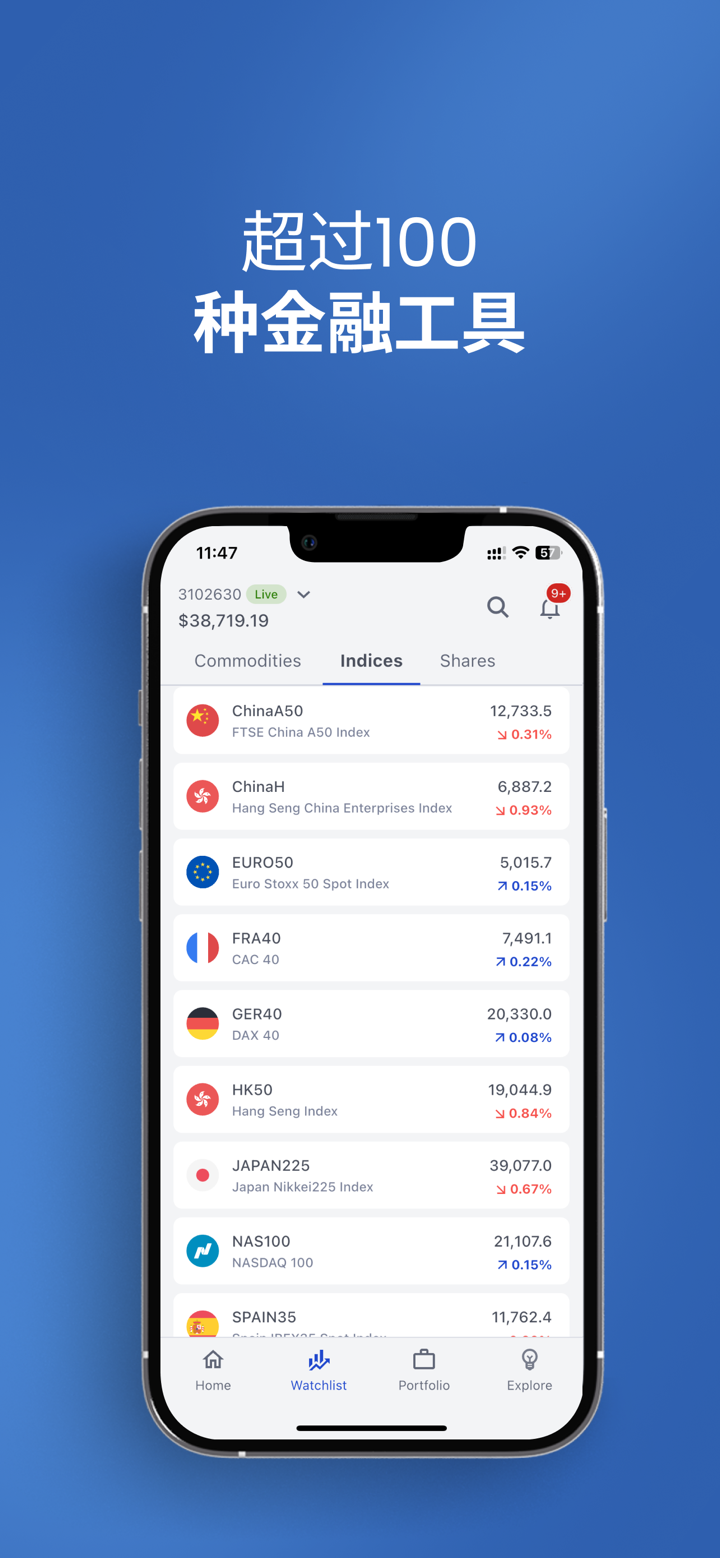

| Tradable Assets | Forex, commodities, indices, stocks |

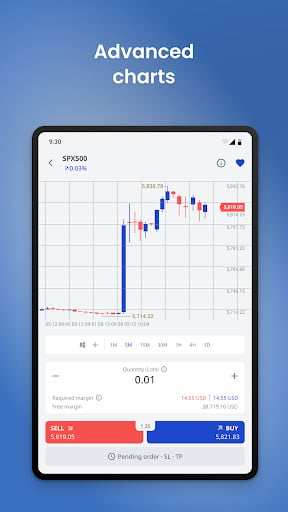

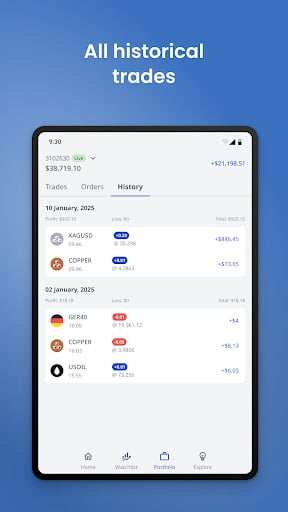

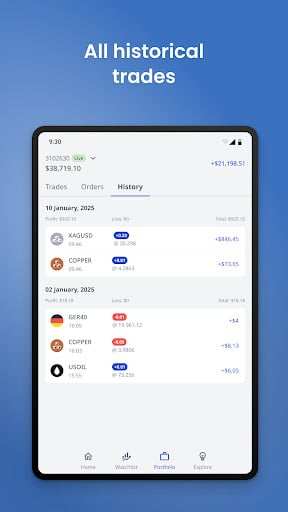

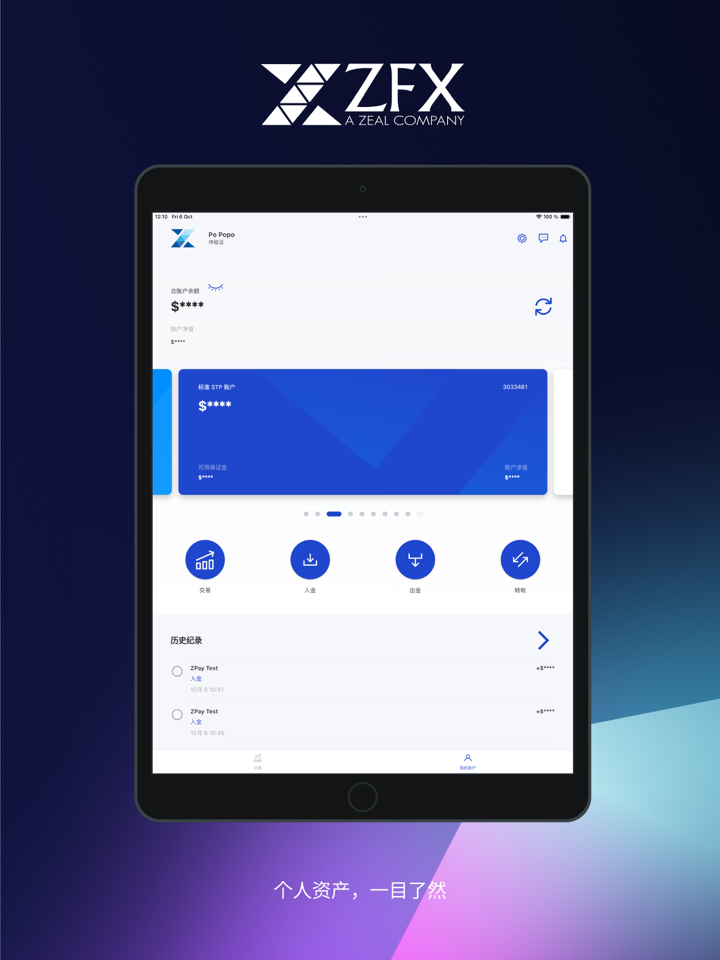

| Platforms | MetaTrader 4, mobile trading app |

| Minimum Deposit | $50 |

| Demo Account | Available |

| Islamic Account | Available |

| Leverage | Up to 1:2000 |

| Spreads | From 0.0 pips |

| Commission | No commission on most accounts |

| Platforms | MetaTrader 4, ZFX Trader, mobile trading app |

| Payment Methods | Credit/debit cards, bank transfer, e-wallets |

| Customer Support | 24/5 live chat, email support, phone support, social media support |

| Education | Video tutorials, eBooks, webinars, market analysis |

Overview of ZFX

ZFX is a forex and CFD broker founded in 2010 and headquartered in the United Kingdom. ZFX offers variety of trading instruments, including Forex currency pairs, commodities, indices, and cryptocurrencies, on the popular trading platforms, MetaTrader 4 and MetaTrader 5.

ZFX offers three types of accounts, including Mini, Standard, and ECN accounts. The minimum deposit required to open a Mini account is $50, standard accouunt at $200, while the minimum deposit required for an ECN account is $2000. All account types offer variable spreads and leverage varying from 1:500 to 1:2000.

ZFX provides a variety of deposit and withdrawal options, including bank wire transfers, credit/debit cards, and e-wallets such as Skrill, Neteller, and WebMoney. The broker does not charge any fees for deposits or withdrawals, although traders may need to pay transaction fees charged by their payment provider.

Is ZFX legit or a scam?

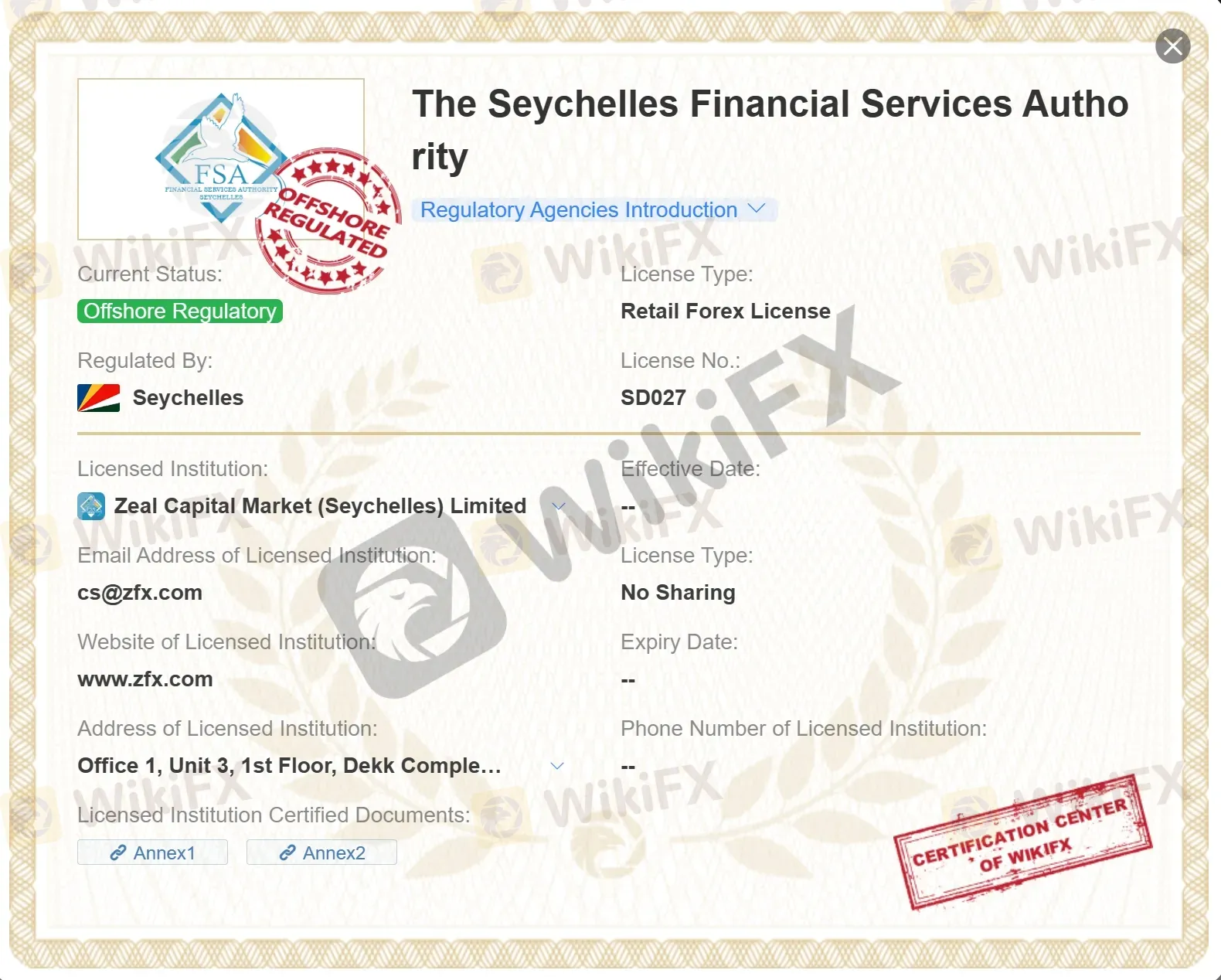

ZFX is a regulated broker. Its company name is Zeal Capital Market (UK) Limited, and it is authorized and regulated by the Financial Conduct Authority (FCA) in the United Kingdom under the registration number 758318. The FCA is one of the most reputable regulatory bodies in the world, and its strict regulations ensure that ZFX adheres to high standards of transparency and fairness.

Additionally, ZFX is also registered with the Financial Services Compensation Scheme (FSCS), which protects client funds up to £85,000 in case of the company's insolvency. This means that traders can have peace of mind knowing that their funds are safe with ZFX.

ZFX's other entity, Zeal Capital Market (Seychelles) Limited, is authorized and regulated by the Seychelles Financial Services Authority (FSA) under regulatory license number: SD027.

Pros and Cons of ZFX

ZFX is a broker that offers several advantages and disadvantages to traders. On the positive side, ZFX is a regulated broker, offering a variety of trading instruments, including Forex, commodities, and indices, and provides traders with access to the popular MetaTrader 4 trading platform. In addition, ZFX offers competitive spreads and commissions, with no hidden fees or charges.

On the negative side, ZFX does not provide traders with a demo account option, which may be a disadvantage for beginner traders who want to practice their trading strategies before trading with real money. Another disadvantage is that ZFX charges a high minimum deposit requirement, which may not be affordable for some traders. Additionally, ZFX does not offer any educational resources or tools to help traders improve their skills and knowledge.

| Pros | Cons |

| Regulated by the FCA | Limited range of trading instruments |

| Multiple account types available | No social trading or copy trading features |

| Commission-free trading on most account types | Limited educational resources and research tools |

| Low minimum deposit requirement for the Mini Account | Limited customer support options |

| Wide range of funding options | No cryptocurrency trading |

| Negative balance protection | No MT5 platform available |

| MT4 and proprietary trading platform supported | Limited market analysis and insights |

| Access to advanced trading tools and features | No Islamic account option for Muslim traders |

Market Intruments

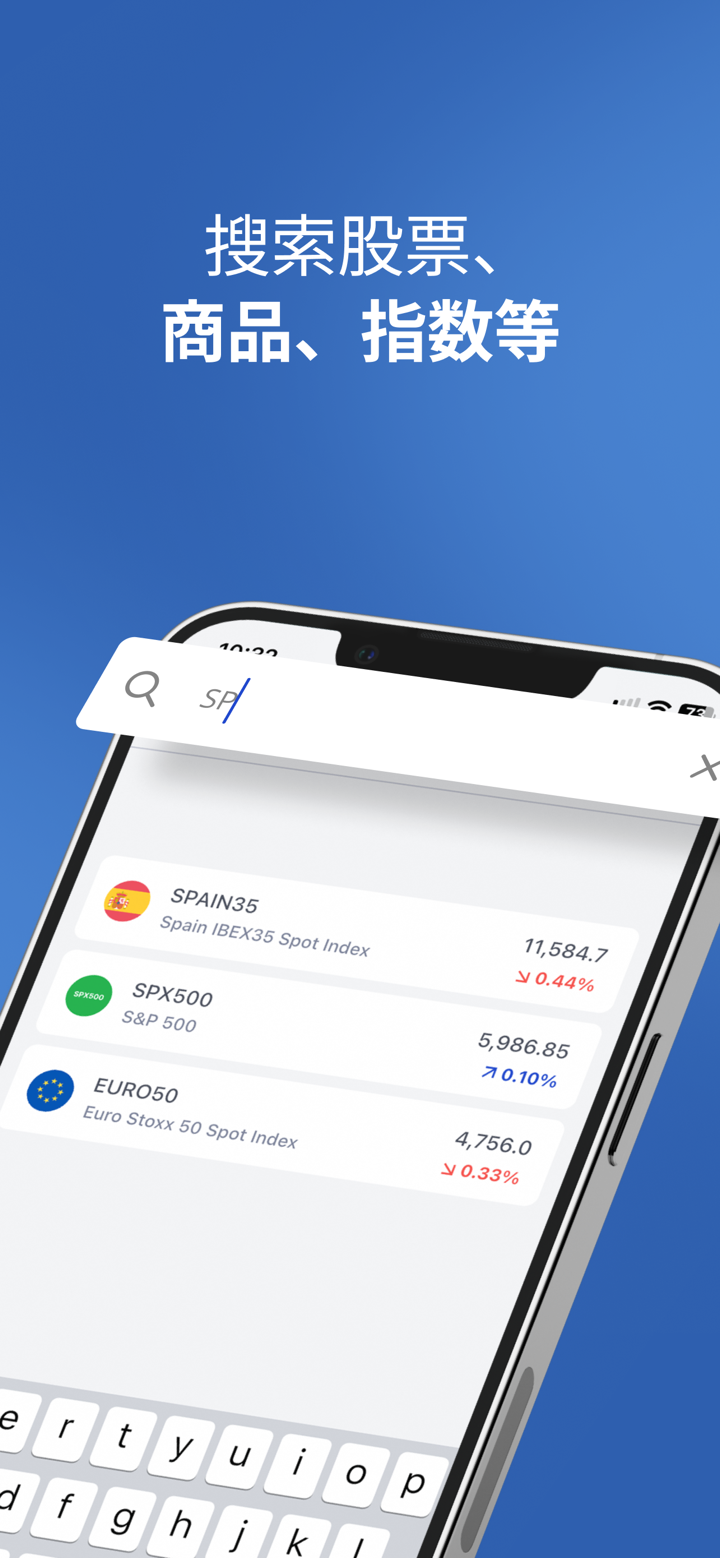

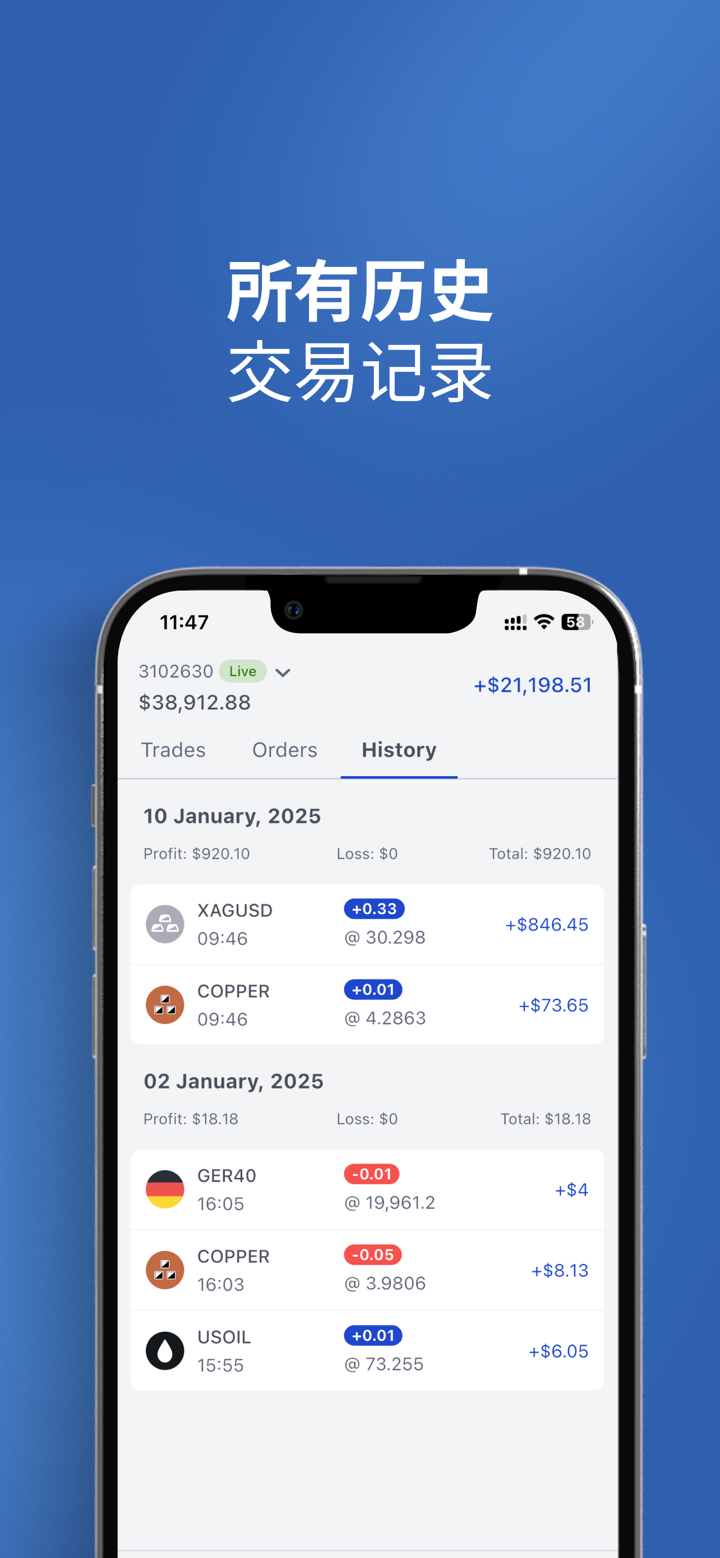

ZFX is a forex and CFD broker that offers a wide range of trading instruments to its clients. The broker offers a diverse range of tradable assets, including major, minor and exotic currency pairs, precious metals, indices, and commodities, index and stocks. While the broker does not offer cryptocurrencies, it does provide a substantial number of instruments in other categories, which traders can take advantage of.

ZFX's platform allows traders to trade the most popular and liquid assets in the market, including popular forex pairs like EUR/USD and USD/JPY, as well as commodities such as gold and oil. This allows traders to take advantage of different market conditions and adjust their trading strategies to suit the market environment.

| Pros | Cons |

| Wide range of trading instruments including forex, metals, indices, and commodities | No cryptocurrency trading options |

| Availability of MT4 trading platform | Limited number of trading instruments compared to some other brokers |

| Access to multiple liquidity providers | |

| Commission-free trading on most instruments |

Account Types

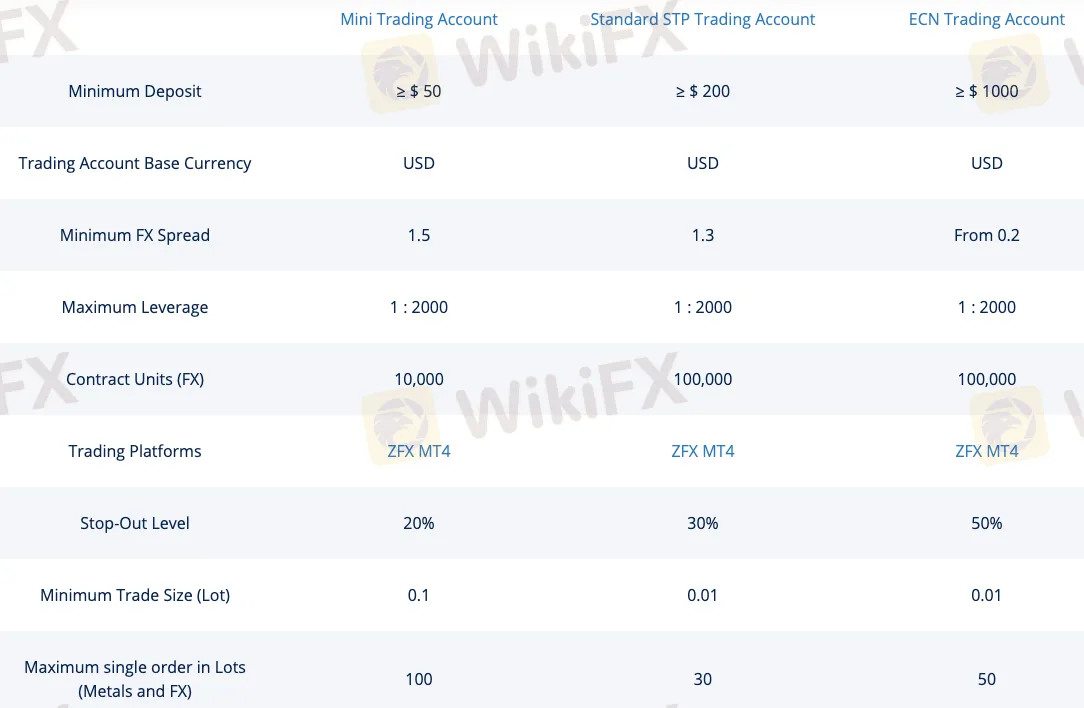

ZFX offers three types of trading accounts, namely Mini, Standard, and ECN accounts. Each account has its own unique features and advantages, catering to different levels of traders with varying trading styles and preferences.

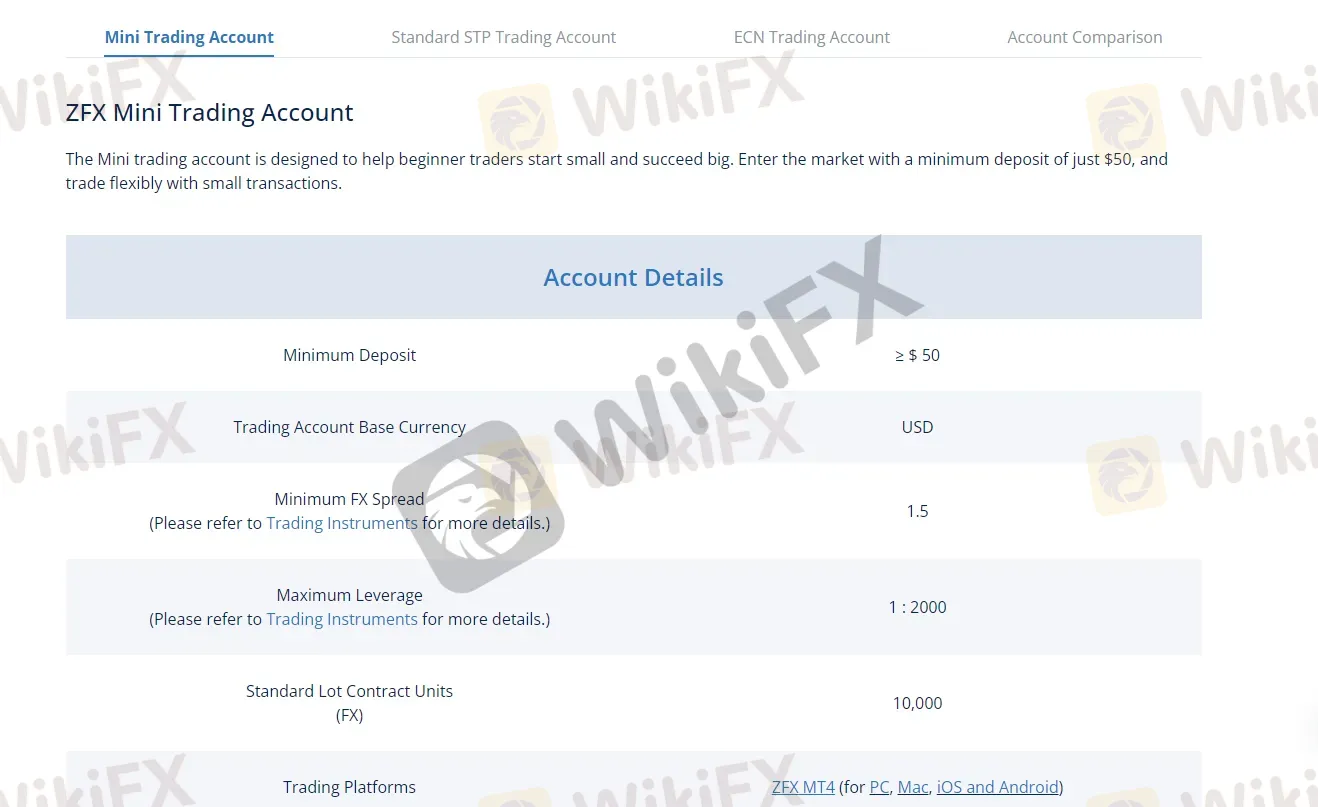

Mini Account:The Mini account is designed for beginner traders who are new to the forex market. It requires a minimum deposit of $50 and offers the minimum FX spreads starting from 1.5 pips. The leverage is up to 1:2000, and the minimum trading size is 0.01 lots. The Mini account allows traders to trade in 32 currency pairs, gold, and silver.

Standard Account:The Standard account is designed for experienced traders who require a more comprehensive trading environment. It requires a minimum deposit of $200 and offers floating spreads starting from 1.3 pips. The leverage is up to 1:500, and the minimum trading size is 0.1 lots. The Standard account allows traders to trade in 49 currency pairs, gold, silver, and crude oil.

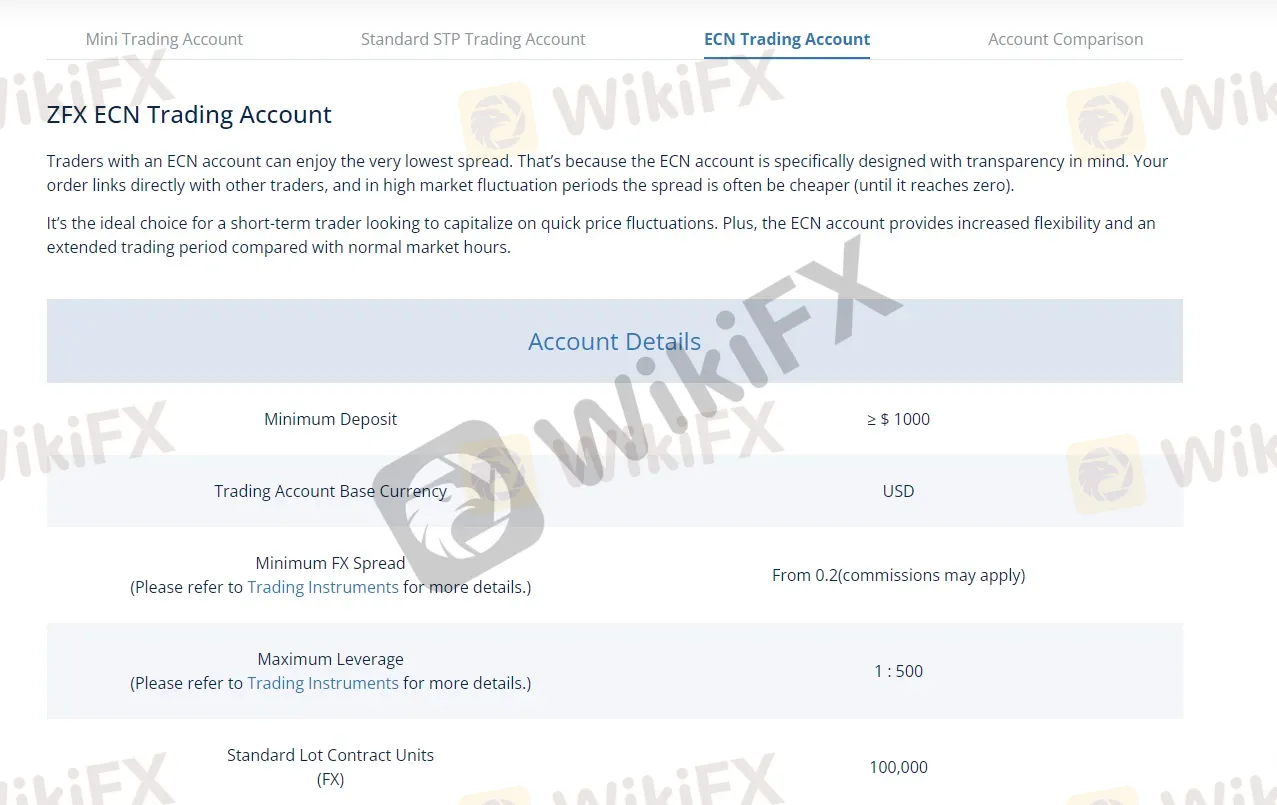

ECN Account:The ECN account is designed for professional traders who require direct access to liquidity providers. It requires a minimum deposit of $2000 and offers spreads starting from 0.2 pips (commission may apply). The leverage is up to 1:500, and the minimum trading size is 0.1 lots. The ECN account allows traders to trade in 49 currency pairs, gold, silver, and crude oil.

| Pros | Cons |

| Variety of account types to choose from | Limited features in the Mini account |

| Low minimum deposit requirement for the Mini account | High minimum deposit requirement for the ECN account |

| Commission-free trading in the Standard and Mini accounts | Commission charges in the ECN account |

| Access to high leverage for all account types | Limited trading instruments in the Mini account |

| No Islamic account option available |

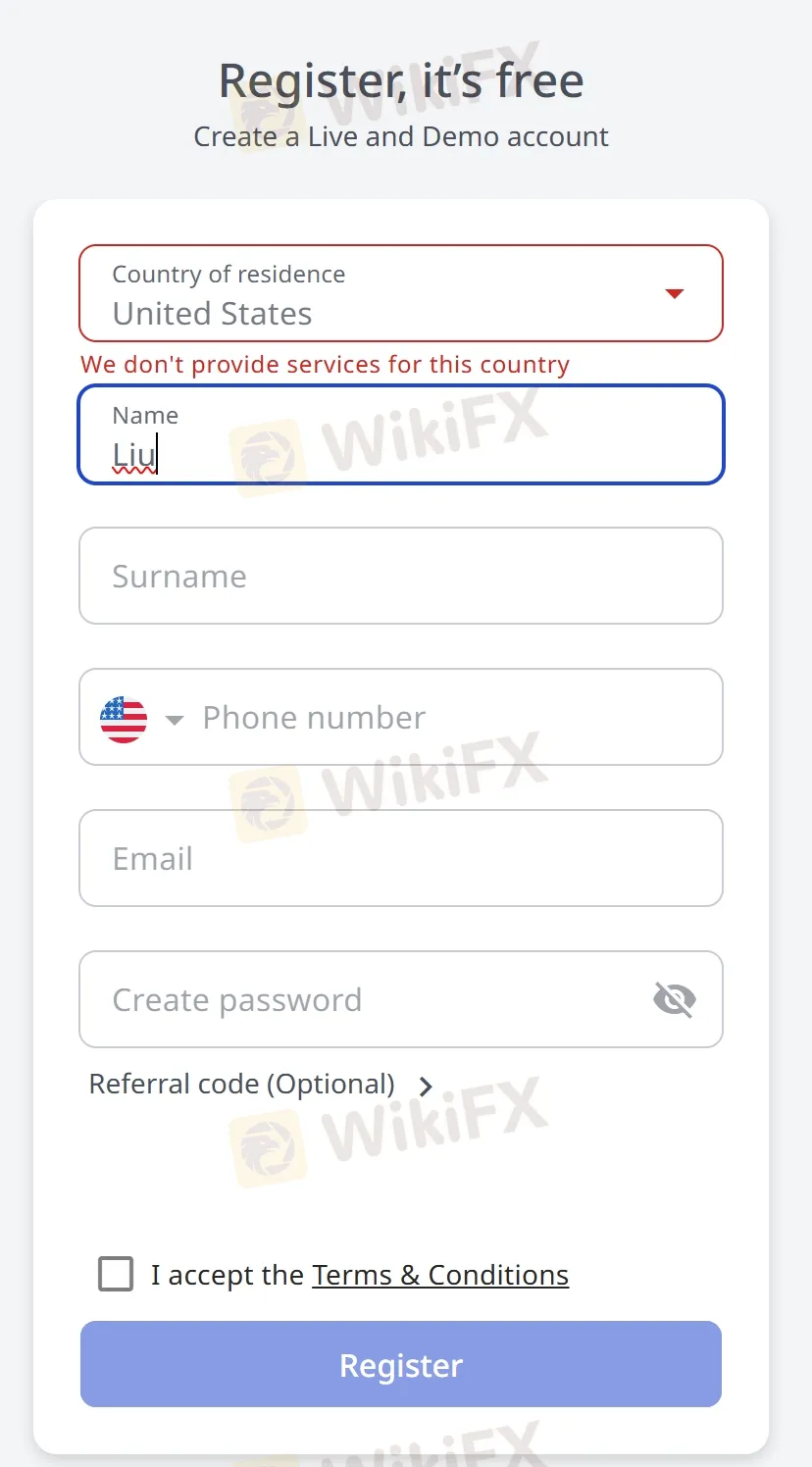

How to open an account?

Opening an account with ZFX is a simple and straightforward process that can be completed in just a few steps.

First, navigate to the ZFX website and click on the “Open Account” button.

You will then be prompted to fill out a registration form with your personal information, including your name, email address, phone number, and country of residence.

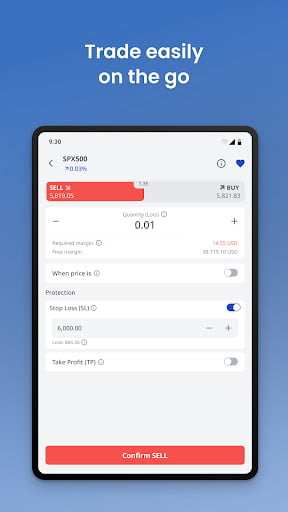

Next, you will need to choose the account type that best suits your needs, whether it be a Mini, Standard, or ECN account. Each account type has its own minimum deposit requirement, so be sure to check the details carefully before making your selection.

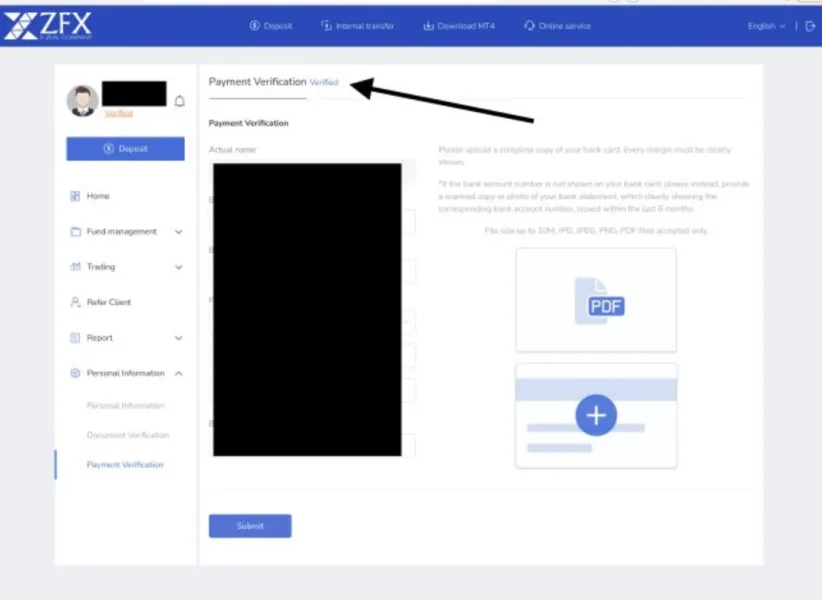

Once you have completed the registration form and selected your account type, you will need to provide some additional documentation to verify your identity and address.This typically includes a copy of your passport or national ID card, as well as a recent utility bill or bank statement. Once your account has been approved, you will be able to fund it and start trading in the financial markets.

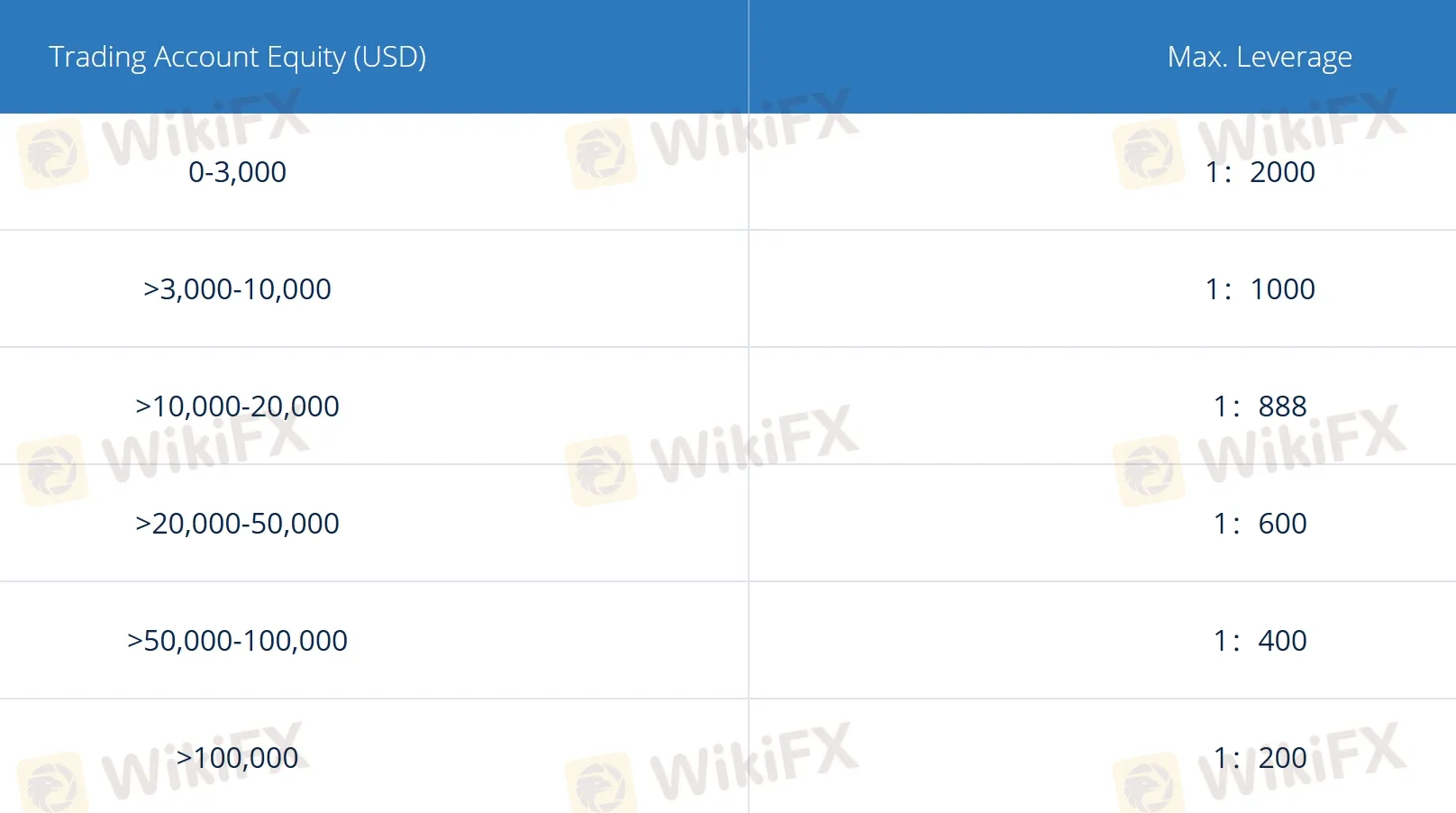

Leverage

The maximum leverage offered by ZFX is up to 1:2000 and the leverage amount may vary depending on the account type and trading instrument. Additionally, ZFX operates on a tiered margin system, where the leverage is determined based on account equity. For accounts with equity between $0 and $3,000, the maximum leverage is 1:200.For equity between $3,001 and $10,000, the maximum leverage is 1:1000.

Please note that high leverage carries a high level of risk, as it amplifies both potential profits and losses. Traders should carefully consider their risk tolerance and financial situation before utilizing high leverage ratios. ZFX also provides negative balance protection to help mitigate the risk of account balances falling below zero.

Spreads & Commissions (Trading Fees)

ZFX says it offers competitive spreads and commissions on its trading instruments, which vary depending on the account type and market conditions. The broker operates on a variable spread model, meaning that the spread can widen or narrow based on the volatility of the markets.

For the MINI account, the minimum spread for forex pairs is 1.5 pips, with no commission charged per lot. The STANDARD account has a minimum spread of 1.3 pips for forex pairs, with no commission charged per lot. The ECN account has a minimum spread of 0.0 pips for forex pairs, but a commission of $7 per lot is charged.

Non-Trading Fees

ZFX does not charge any fees for deposits and withdrawals, but third-party fees such as bank wire transfer fees may apply. There are no account inactivity fees or fees for using the trading platform. However, ZFX does charge a swap fee for positions held overnight, which is a common practice in the forex industry.

ZFX also offers a VPS (Virtual Private Server) hosting service for traders who wish to use algorithmic trading strategies. The VPS service is free for traders who maintain a minimum balance of $2,000 in their trading account or have traded at least 20 standard lots in the previous month. Otherwise, a monthly fee is charged for the VPS service.

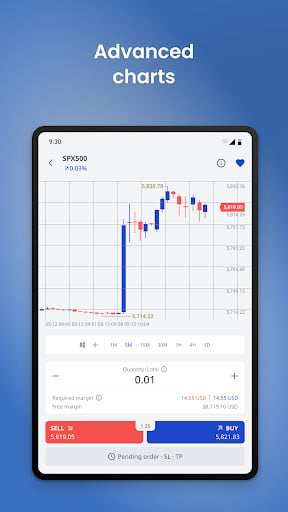

Trading Platform

ZFX offers the popular trading platform MetaTrader 4 (MT4), which is widely recognized in the forex industry for its user-friendly interface and advanced trading tools. MT4 provides access to various order types, technical analysis tools, and customization options, making it suitable for both novice and experienced traders. In addition, ZFX offers mobile versions of the MT4 platform for both iOS and Android devices, enabling traders to access the markets from anywhere, at any time.

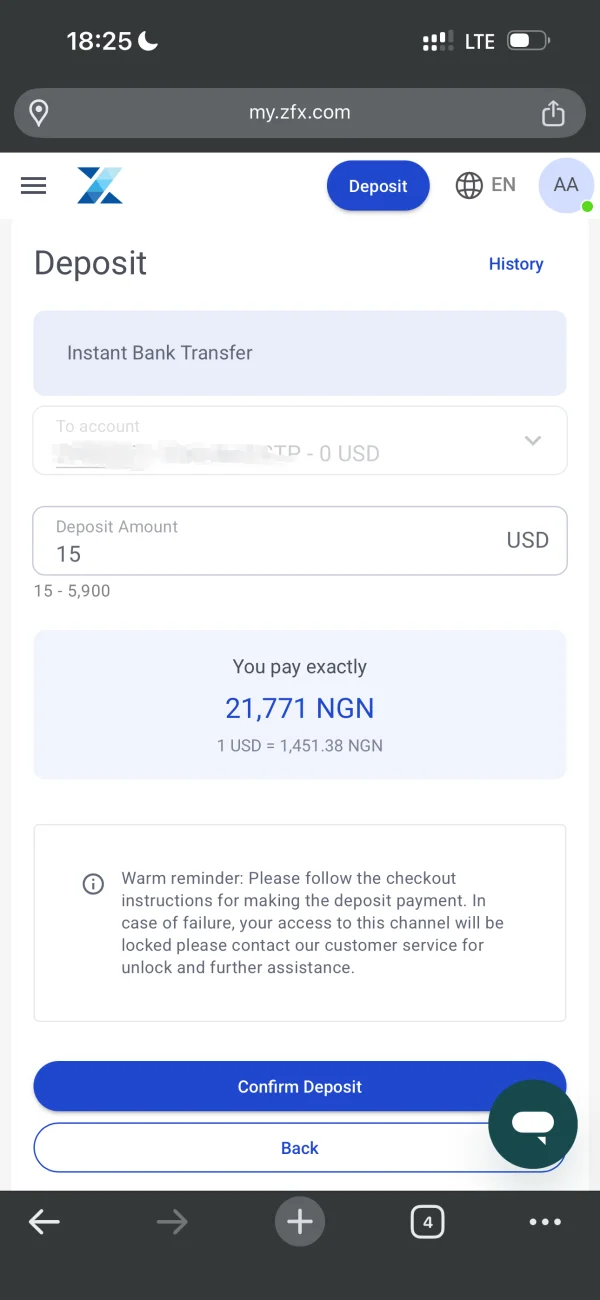

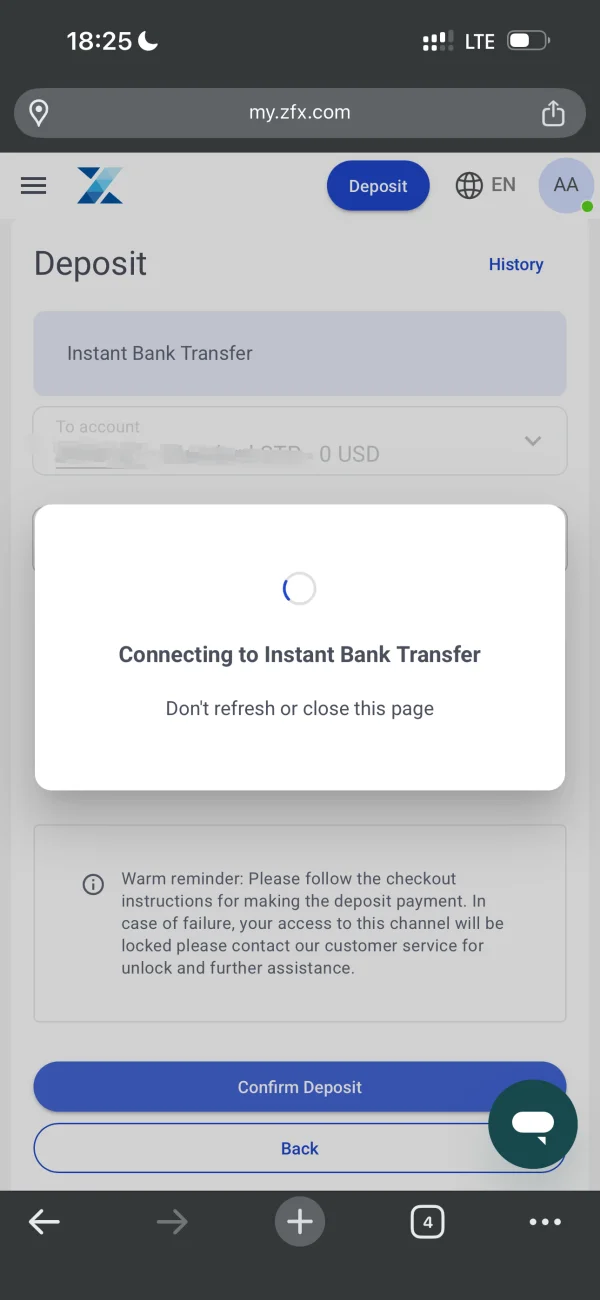

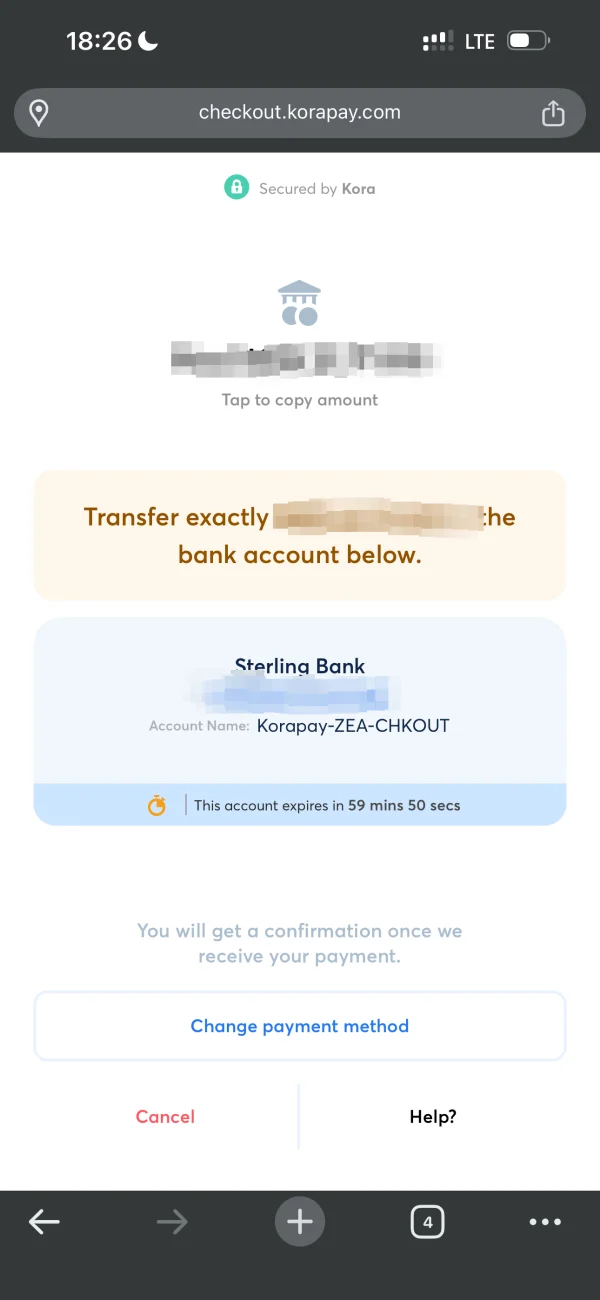

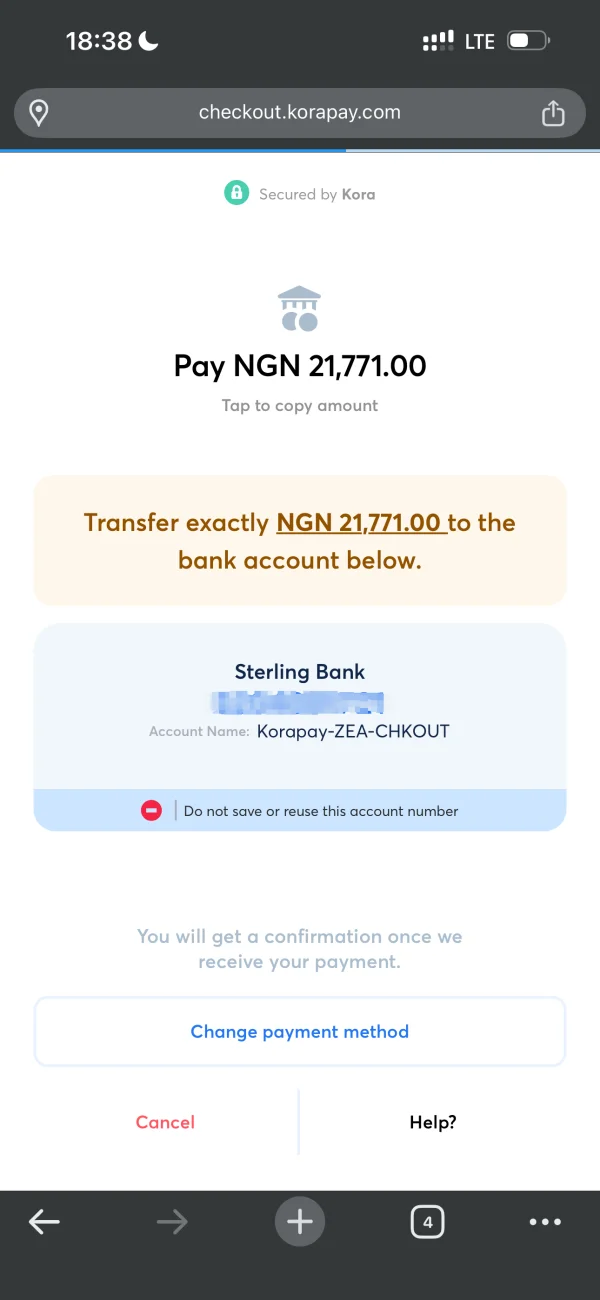

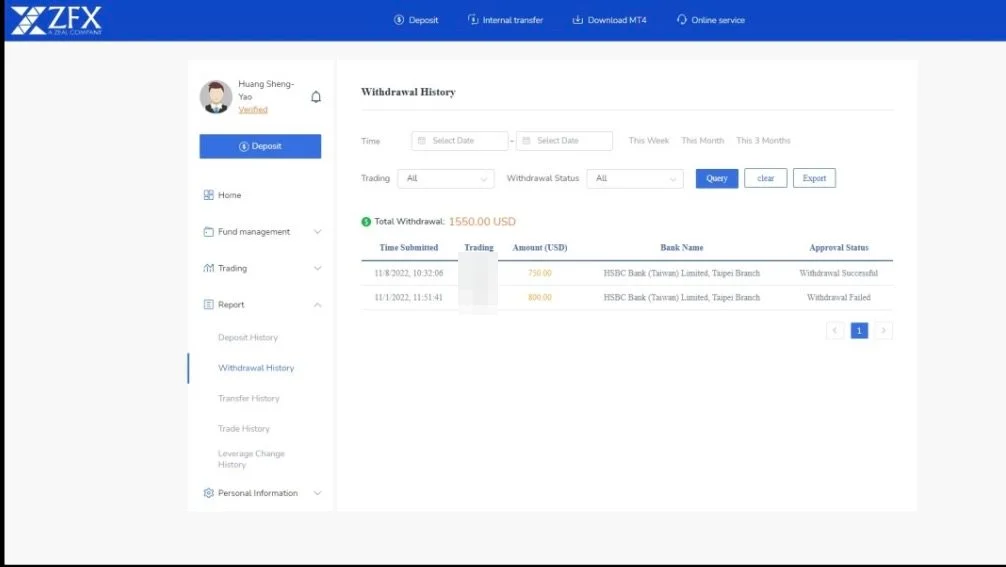

Deposit & Withdrawal

ZFX offers a variety of deposit and withdrawal options to their clients. Deposits can be made using bank transfers, credit/debit cards, and e-wallets such as Skrill, Neteller, and Perfect Money. The minimum deposit amount is $50 for Mini and Standard accounts, and $500 for ECN accounts.

Withdrawals can be made using the same methods used for deposits, with the exception of credit cards. ZFX does not allow withdrawals to credit cards due to the limitations imposed by card issuers. The minimum withdrawal amount is $10 for e-wallets and $100 for bank transfers. Withdrawals are typically processed within 24 hours, but the time it takes for the funds to reach the client's account may vary depending on the withdrawal method and the client's bank.

| Pros | Cons |

| Supports multiple deposit and withdrawal methods, including bank transfer, credit/debit cards, and e-wallets such as Skrill and Neteller | Limited number of supported currencies for deposits and withdrawals |

| Fast and efficient withdrawal processing times, with most requests processed within 24 hours | Withdrawal fees may be charged depending on the chosen method |

| No deposit fees charged by the broker | Minimum deposit and withdrawal amounts may be relatively high for some traders |

| User-friendly deposit and withdrawal interface through the ZFX client portal | Deposit and withdrawal processing times may vary depending on the chosen method and location of the trader |

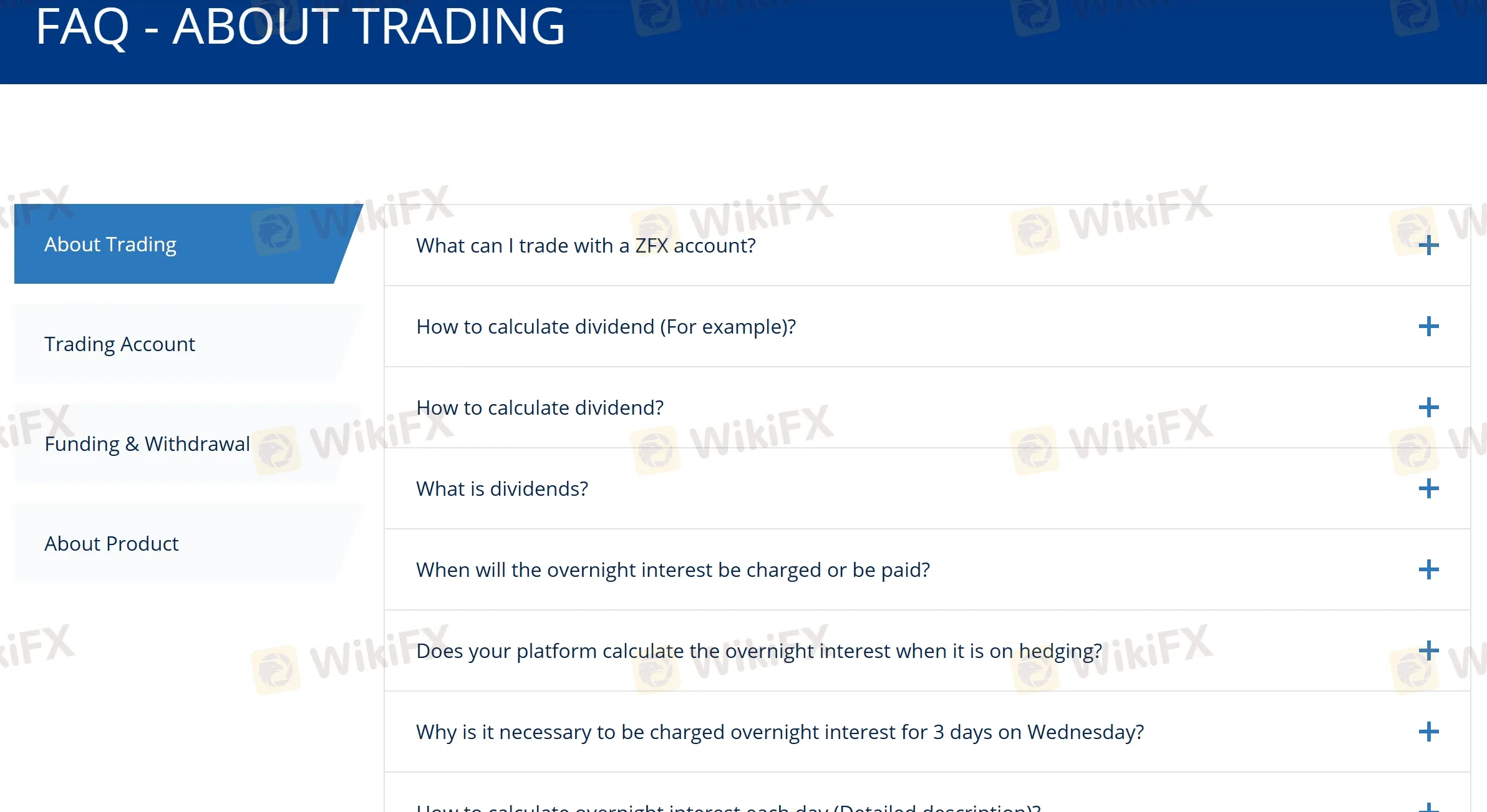

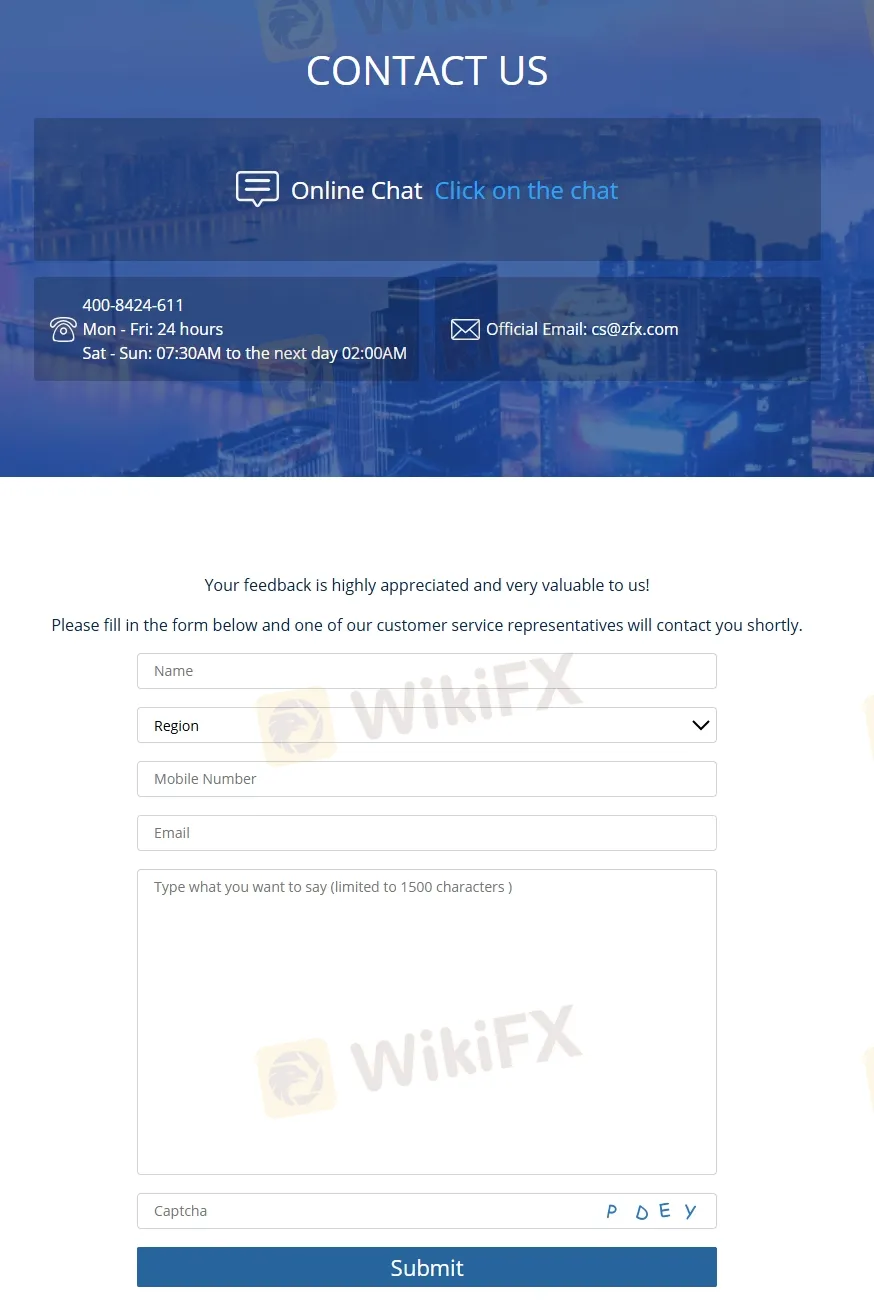

Customer Support

ZFX offers customer support through several channels, including email, phone, live chat, and social media platforms. The support team is available 24/5 to assist traders with any issues they may encounter. In addition, the broker provides an extensive FAQ section on their website, which covers a range of topics, including account opening, funding, and trading.

ZFX 's customer support is available in several languages, including English, Chinese, Thai, Vietnamese, and Indonesian. This is particularly useful for traders who are not fluent in English and prefer to communicate in their native language.

| Pros | Cons |

| Multiple channels for support (live chat, email, phone) | No 24/7 customer support |

| Multilingual support | No physical office in some countries, which may make it difficult for some traders to reach the company |

| An FAQ section on the website |

Educational Resources

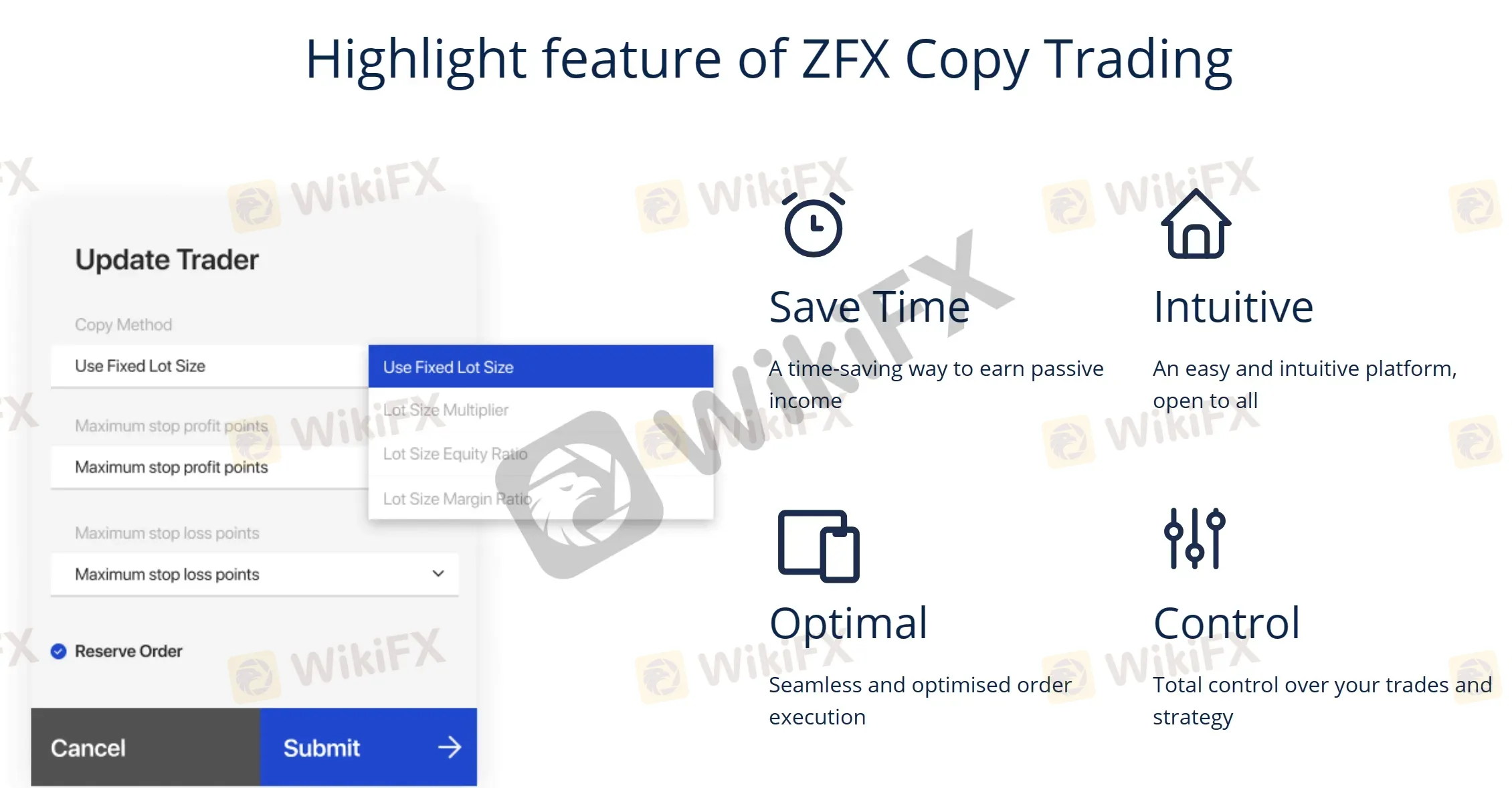

ZFX provides a range of educational resources to help traders improve their knowledge and skills in trading. These resources include articles, tutorials, videos, and webinars. ZFX also provides a demo account for new traders to practice trading without risking real money.

The articles and tutorials cover various topics such as technical analysis, fundamental analysis, trading strategies, risk management, and trading psychology. The videos are mainly tutorials on how to use the trading platform and some trading strategies.

ZFX also conducts webinars regularly with industry experts to provide traders with more in-depth knowledge about trading. The webinars cover a wide range of topics such as market analysis, trading strategies, and risk management.

| Pros | Cons |

| Comprehensive educational resources | No live trading sessions or mentorship |

| Demo account for practice | |

| Regularly conducted webinars | |

| Suitable for traders of different levels |

Conclusion

Overall, ZFX is a reputable option for traders looking to access the financial markets. The broker's maximum trading leverage of 1:2000, based on account equity, is one of the highest in the industry and can provide traders with significant opportunities for profit. Additionally, the absence of non-trading fees, competitive spreads, and commissions, and a choice of two popular trading platforms further strengthen ZFX's position as a reliable broker.

However, ZFX's limited educational resources may be a drawback for traders seeking to improve their knowledge and skills. While the broker offers some market analysis and trading tools, more comprehensive educational resources, such as webinars, courses, or tutorials, are not readily available. Moreover, while the broker's customer support team is responsive and available 24/5, the absence of phone support may be an inconvenience for some traders.

FAQs

Q: Is ZFX a regulated broker?

A: Yes, ZFX is a regulated broker. It is authorized and regulated by the Financial Conduct Authority (FCA) in the UK, and the Seychelles Financial Services Authority (FSA).

Q: What account types does ZFX offer?

A: ZFX offers three types of accounts: Mini, Standard, and ECN. Each account type comes with different features and trading conditions that cater to the needs of different types of traders.

Q: What is the maximum leverage offered by ZFX?

A: The maximum leverage offered by ZFX is up to 1:2000, depending on the equity of the trader's account.

Q: What trading platforms does ZFX offer?

A: ZFX offers two trading platforms: MetaTrader 4 (MT4) and ZFX Trader. Both platforms are widely used in the industry and offer advanced charting tools, technical analysis indicators, and automated trading options.

Q: What are the deposit and withdrawal methods supported by ZFX?

A: ZFX supports various deposit and withdrawal methods, including bank transfer, credit/debit cards, and e-wallets such as Skrill and Neteller.

Q: Does ZFX charge any commissions or fees?

A: ZFX charges low commissions on its ECN account type, while its other account types do not charge any commissions. Additionally, ZFX does not charge any deposit or withdrawal fees, but there may be fees charged by the payment service provider.

Q: Does ZFX offer educational resources?

A: Yes, ZFX offers educational resources such as trading guides, video tutorials, and webinars to help traders improve their skills and knowledge.

Q: What is the customer support offered by ZFX?

A: ZFX offers 24/5 customer support through various channels, including live chat, email, and phone. Additionally, the broker provides multilingual support to cater to traders from different regions.

FX3405973326

Pakistan

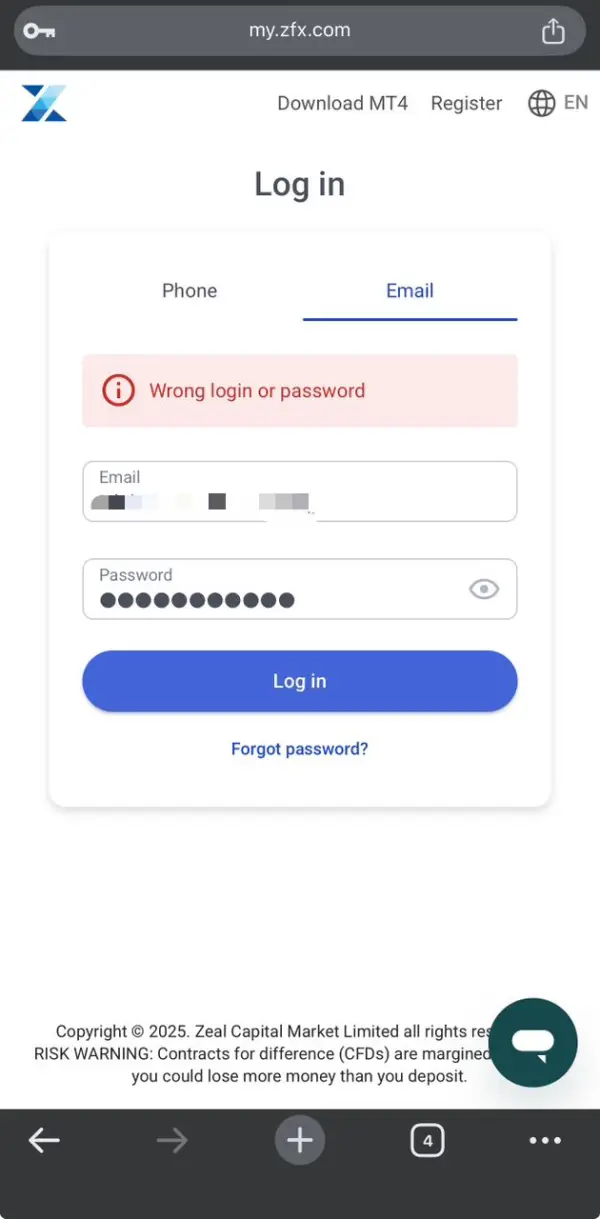

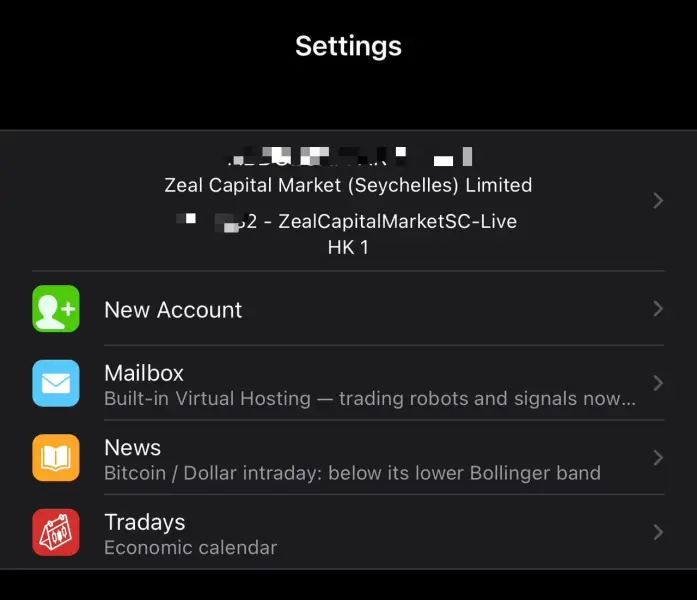

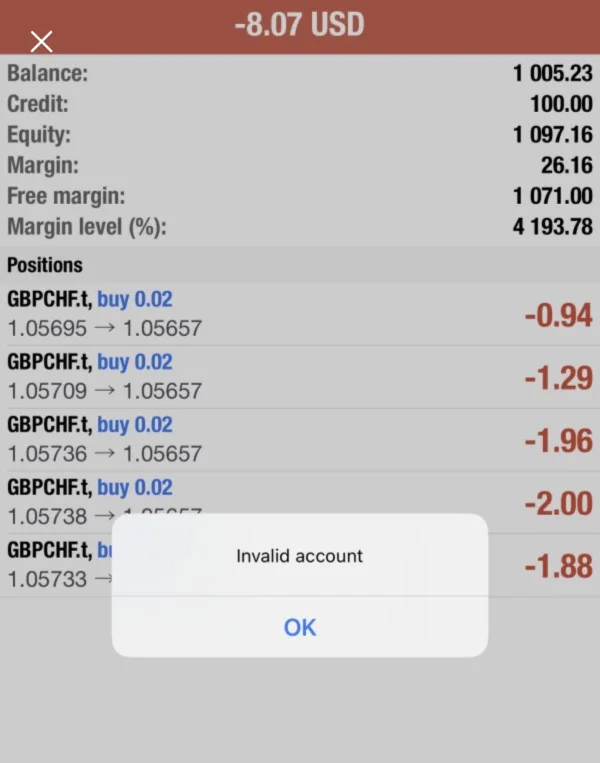

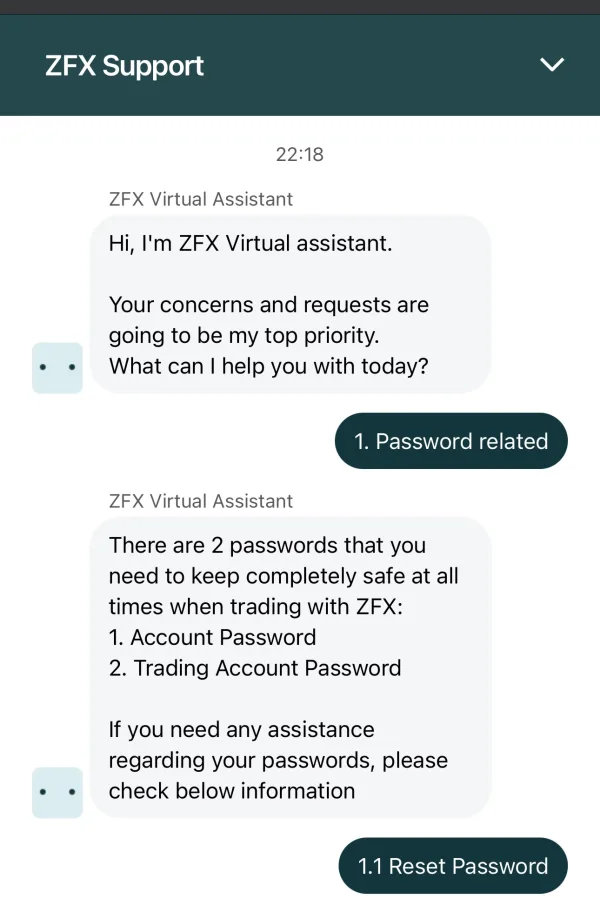

I was Trading and all of a sudden my account stopped working and was showing Disabled it’s confusing even more when I can’t login to my account anymore using both phone number or Email on the broker web page it’s keeps saying invalid password or login this people are scammers

Exposure

FX6648050122

India

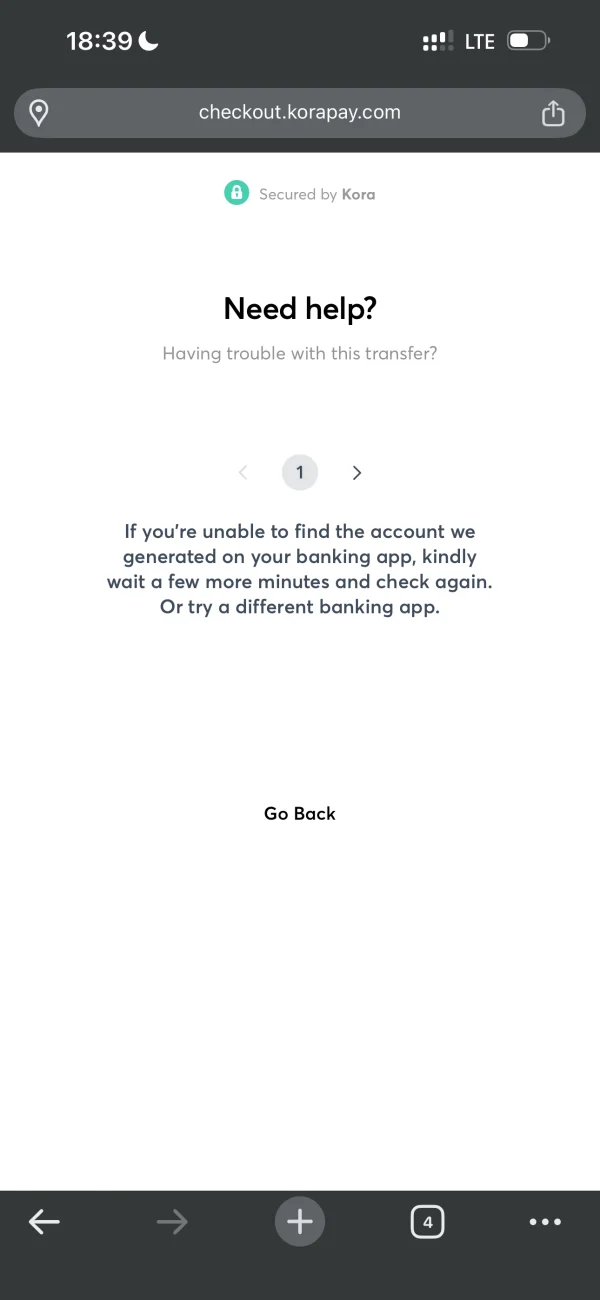

I have been trying to complete a deposit but the account number keep changing almost every minutes it doesn’t even take up 1 hour as the said it just keeps on changing on its on how can I complete a deposit the customer support are not helping matters the haven’t been responding to the issue the keep saying wait for sometime

Exposure

Nasirjee

Pakistan

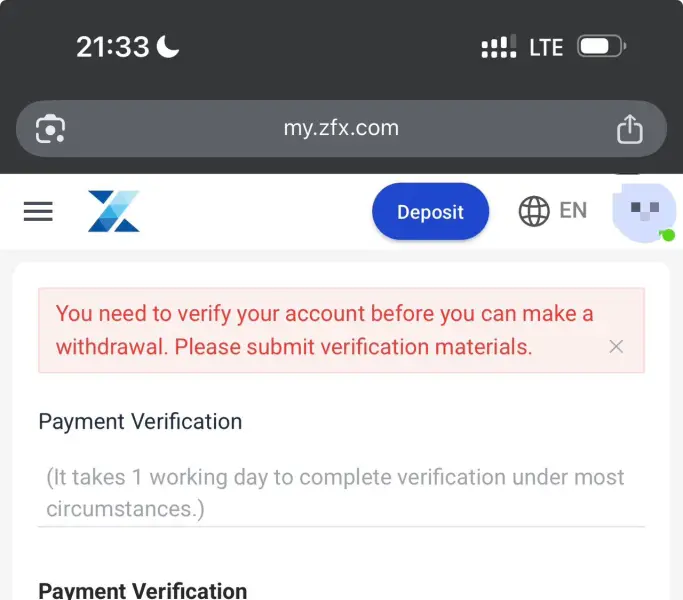

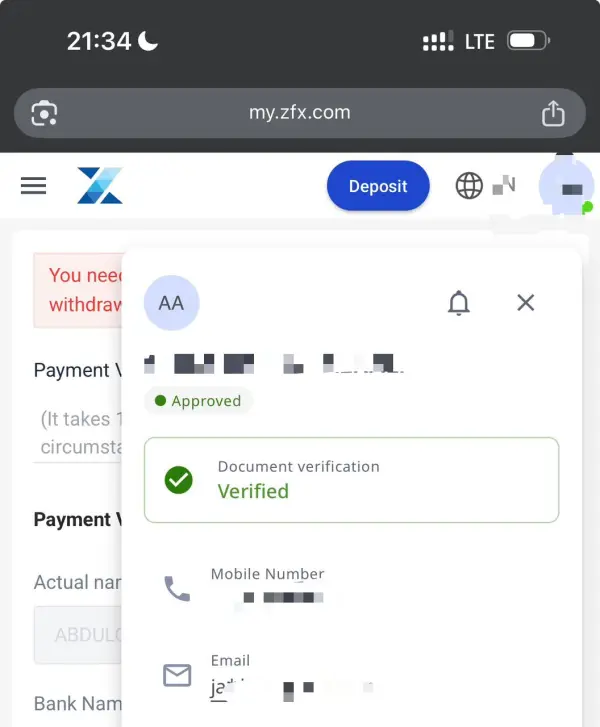

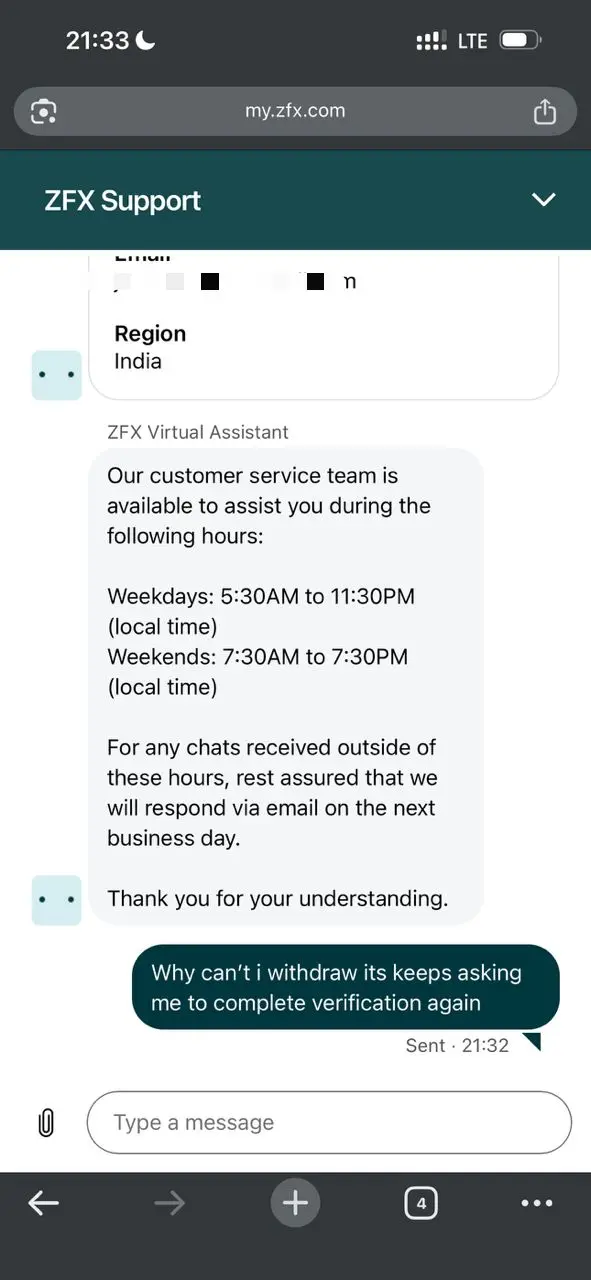

my account is already verified and approved but I don’t know for what reason I can’t seems to withdraw again because the keep asking for another verification but the are not approving it also I have made a lot of profits from my trade already I can’t withdraw

Exposure

FX1789342994

Pakistan

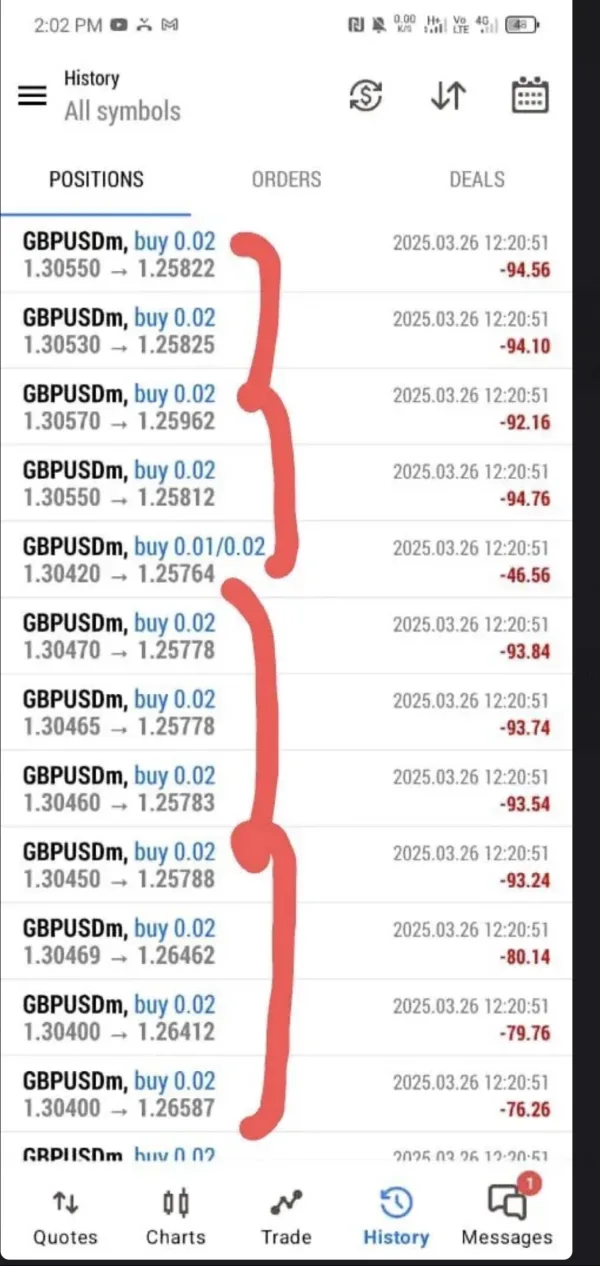

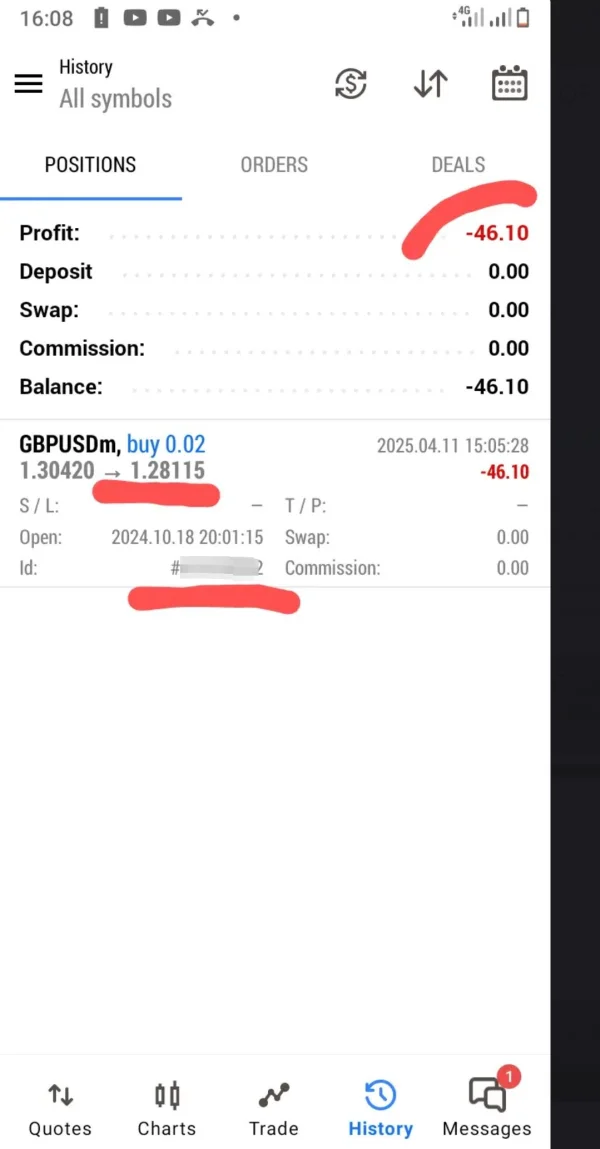

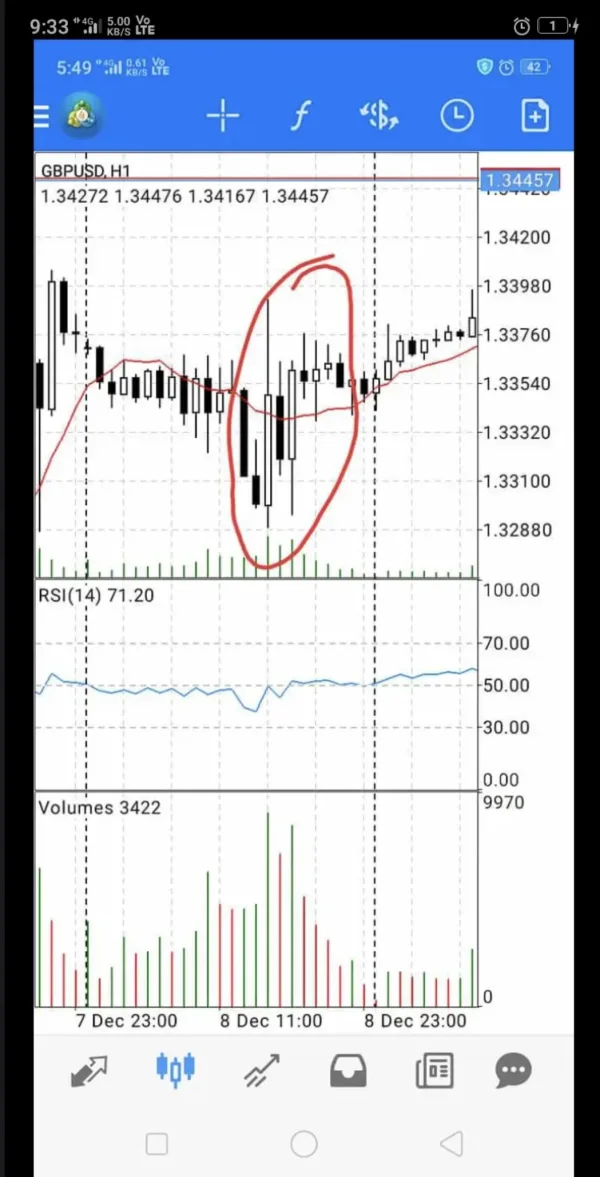

I was holding a volume of 0,6 Lot in Sell and 0,48 Lot in Buy, and at rollover time the chart was showing some movements (10 pips up and down) on GBPUSD, but it was going almost in a straight line, and suddenly in a few seconds I lost aprox. 200€ of free margin forcing the closure of all my positions. On normal situation it shouldn't have mattered much if it went upwards or downwards, but suddenly both sides where going against me!

Exposure

money-long

India

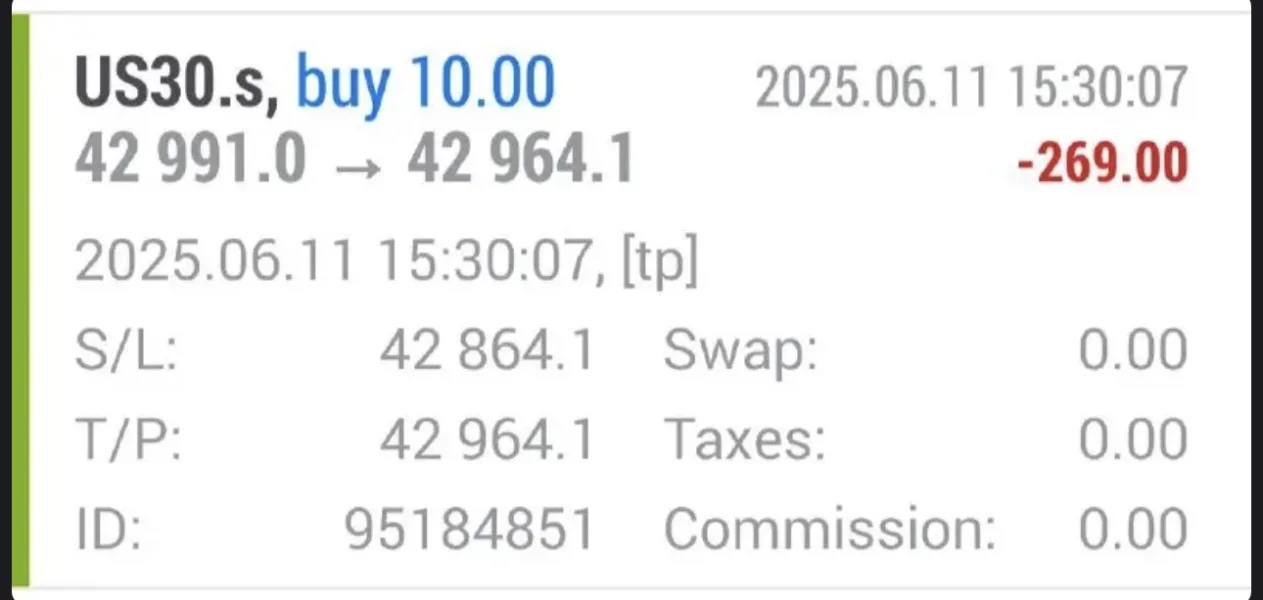

I opened a buy stop order at price 42870 for US30. It was triggered at 42991, a massive 121 points difference! Even more ridiculous is that my order then TP at 42964.1 This is the first time I've seen such a ridiculous trade execution and I've tried numerous brokers. When I bring this up for them to check, their compliance provided the standard reply of slippage due to high market volatility or news release and won't compensate me.

Exposure

FX4064930872

India

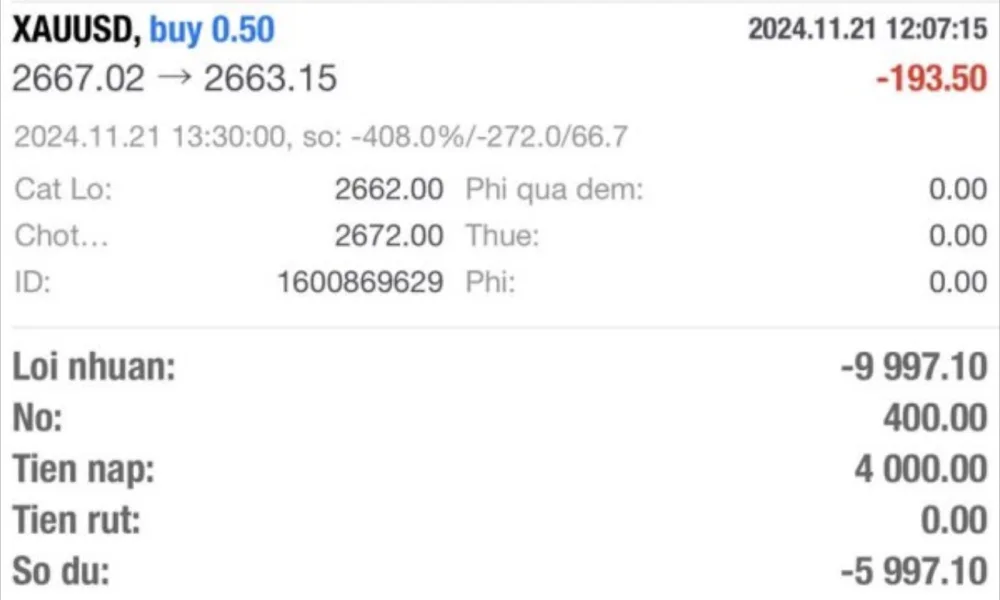

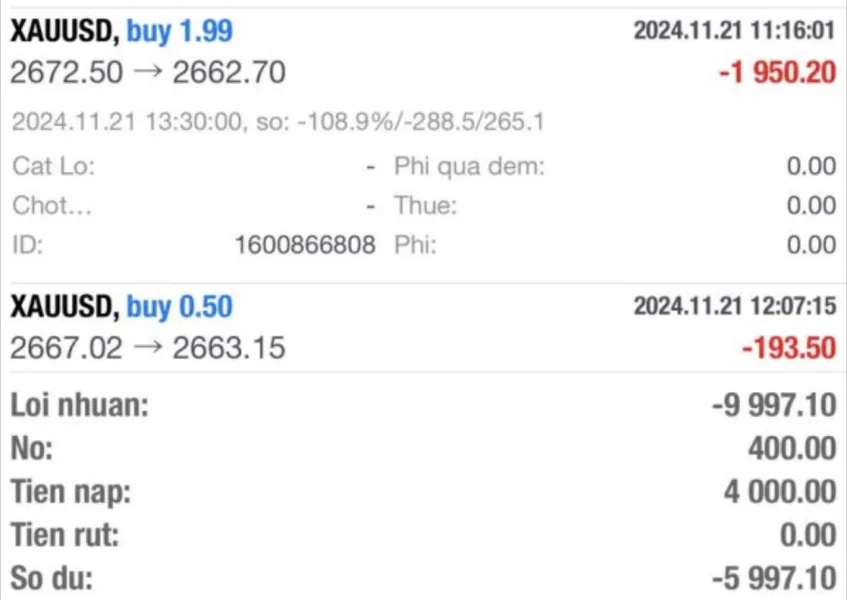

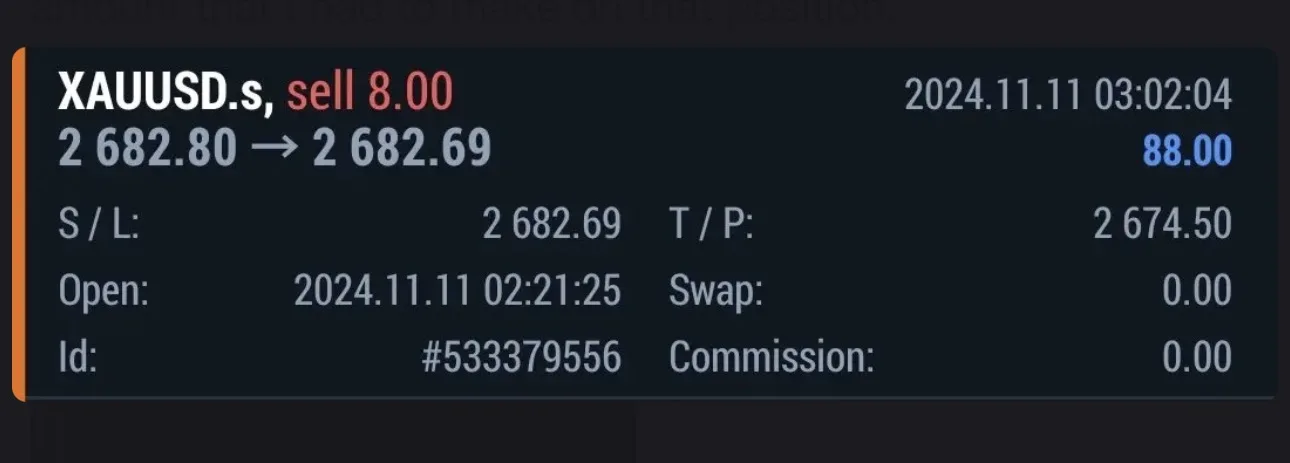

I had a sell position on XAUUSD for 8.00 Lots (11-11-2024) at the price of 2682.80 I have waited for this trade like 40-45 minutes till the Asian markets opened and the price started to drop and as soon as it crossed my entry price I put a SL at 2682.69 to protect my position. Once I have closed the trade modification the position was already closed even when the candle kept dropping and it reached my desired TP at 2674.5. I have contacted their support for almost a month till I got an answer on this matter yet they claim that when the SL was placed the price came back up to 2682.69 then it dropped again, recently I had a free time to check this out on MT5 strategy tester to check specifically how the candles formed, yet the candle never retraced to my SL and the price it stayed at for a few milliseconds was around 2682.61-2682.63 then it continued dropping. I checked this time stamp with multiple brokers that I trade with yet the price never came back to my SL during that duration.

Exposure

FX2918152098

Pakistan

My account can’t withdraw funds again the withdrawal keep failing each time after making enquiries I was told that I will have to complete a payment verification then what was the use of the initial verification I did the don’t want to give me my money and allow me to withdraw these broker are scammers

Exposure

FX2149931286

Pakistan

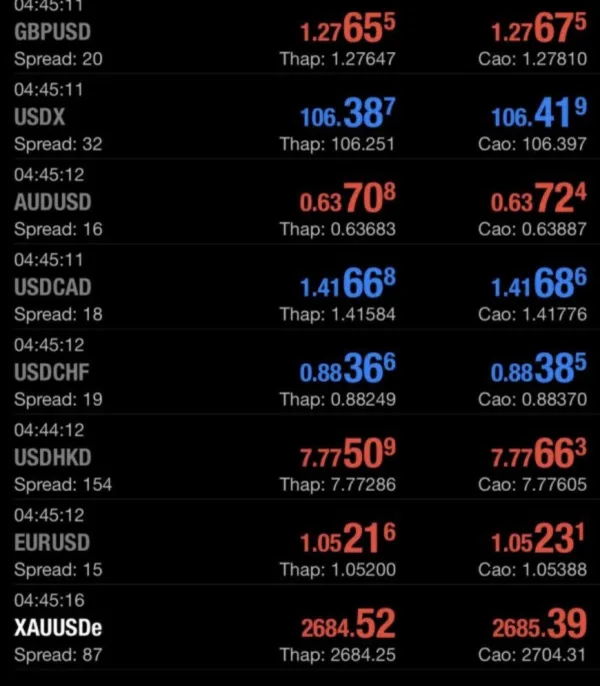

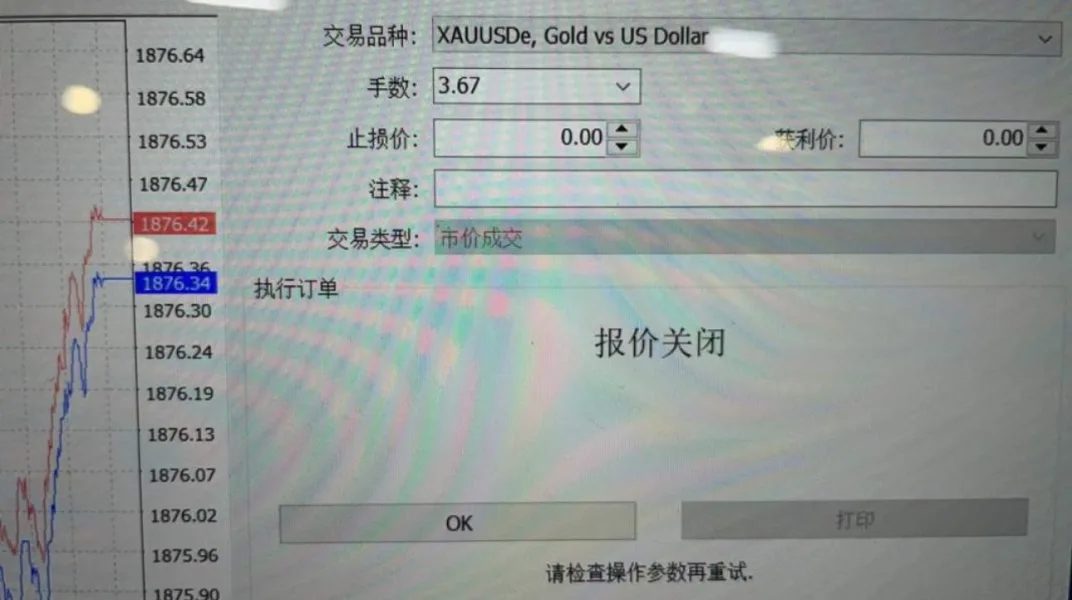

I was trading XAUUSD as usual, and in the middle of the day, ZFX suddenly closed the Gold markets. Now I’m stuck in a trade that I can’t control anymore, and I have no idea how long this will last. My Account is in huge Loss already but the have been no responses from the customer service or any help rendered from the mails

Exposure

FX1889076981

Pakistan

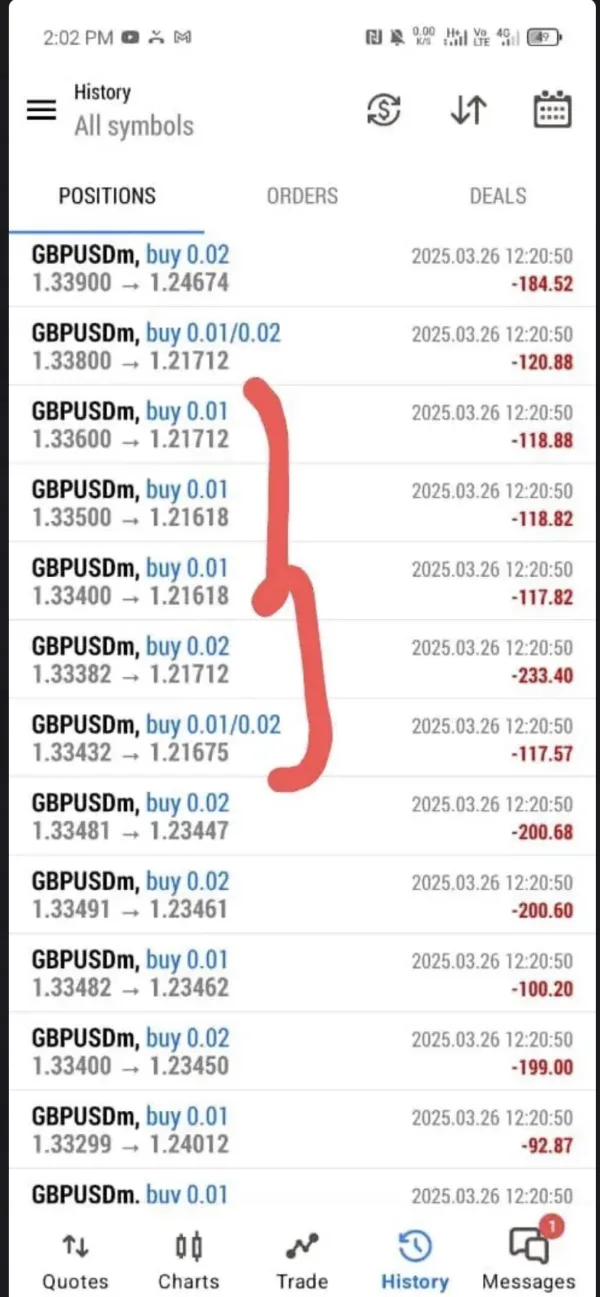

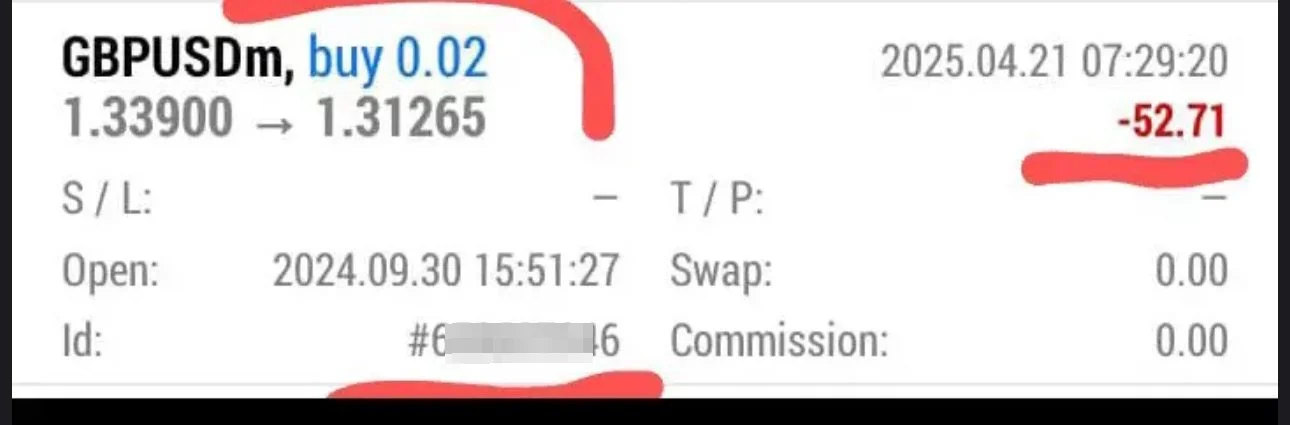

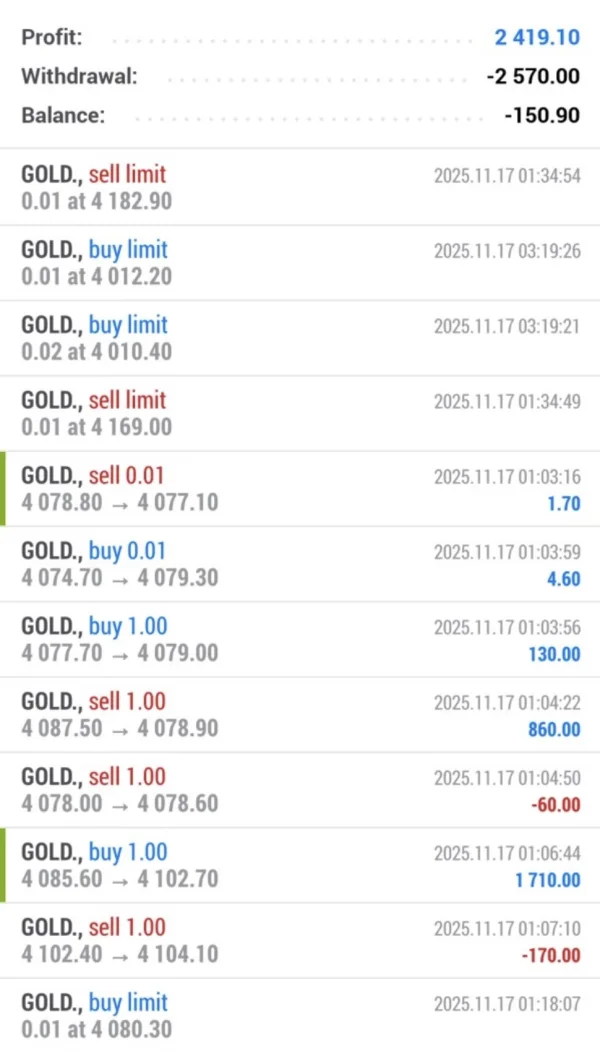

I traded normally with real market strategy and volume. As clearly shown in the attached screenshots of my MT4 terminal All trades were placed manually with realistic volume sizes (0.1 to 0.24). Multiple symbols were traded (e.g., US30, US100, XAUUSD, EURUSD, GBPUSD). Trades include both profits and losses – indicating a real trader, not a bonus exploiter. Over $2,500 was deposited and withdrawn was denied without any valid trading violation cited.

Exposure

FX2918562927

Pakistan

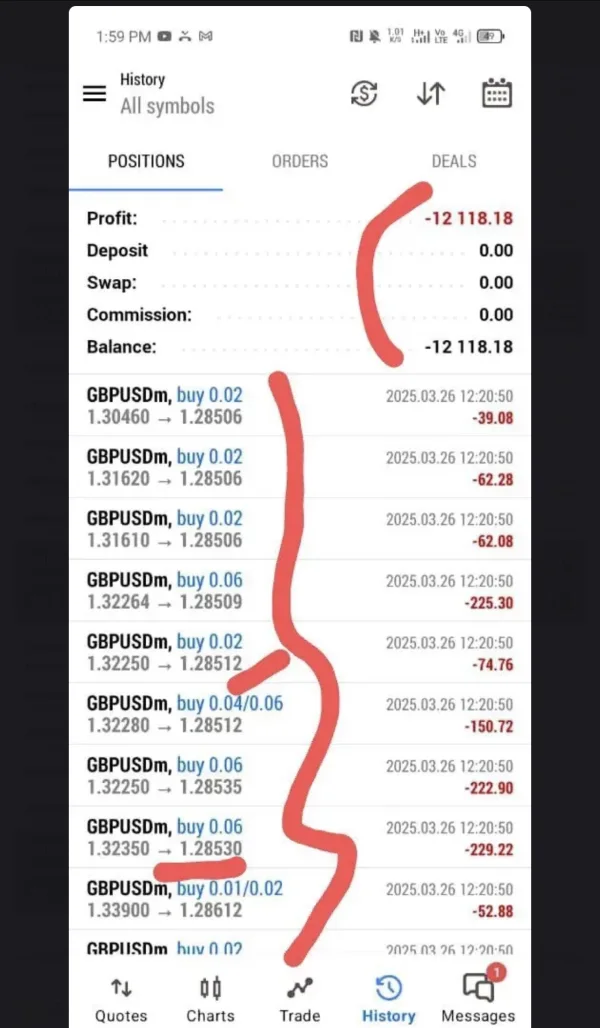

As an ordinary investor, I put a lot of money into forex trading, believing in the supposed “regulated overseas platform.” But up to this day, over three hundred thousand US dollars of mine is still stuck in my ZFX account, entirely unable to be withdrawn. When I tried contacting customer service or lodging complaints with the platform, I received nothing but silence; they even froze my account at will, turning all their previous promises into empty words In the end, over $300,000 of my money was frozen outright, with absolutely no hope of withdrawal. Afterward, I turned to authorities and regulatory bodies, yet the company responded with the attitude of “we’re an offshore company, not subject to domestic oversight—feel free to complain.” There are many other investors like me, whose funds have been trapped inexplicably or who have lost everything to margin calls. I sincerely hope more investors heed this warning

Exposure

Dendi11

Ireland

After using it for several years, it's rare to find a platform with such fast deposits and withdrawals—every withdrawal arrives instantly. Plus, there's never any slippage.

Positive

币安小能手

Thailand

Tried it out, really good. The experience is great.

Positive

FX2052612871

Vietnam

ZFX Vietnam does not send notifications or emails regarding trading hours to customers or IB. Even ZFX Vietnam's own officers are unaware of the trading hours for ZFX's BTC pair therefore unable to assist customers. This resulted in a critical risk to my account due to ZFX's error, leading to a loss of 43815.23USD.

Exposure

FX2052612871

Vietnam

Dear Wiki I created my trading account on 27th April 2025. Total deposite 46.000 US Dollar Withdraw 8.000 US Dollar I opened SELL 3.0 Lot BTCUSD at the price 103310.02 and another position SELL 2.0 Lot BTCUSD at the price 103570.33. All this position was opened at around 2:00PM - 3:00PM Sunday 18th May 2025 Vietnam time. At 3:00AM 19th May 2025 Vietnam time, ZFX didn’t let me close my position, they said that they was updating their system and market close but I didn’t received any notice about this problems. Exness and other platfrom still open by the time. No email from ZFX about changing of trading session. Customer support Phuc Thao Maze try to let my account liquidated. I have more evidence, video and picture to report.

Exposure

FX1775346222

Taiwan

Zeal Capital Market has held up hundreds of thousands of US dollars in my account and refused to let me withdraw the funds. They asked me to submit a large amount of materials involving personal privacy, such as bank statements, proof of employment, proof of address, etc., and even required me to record videos and send them to the platform for review. After I submitted all these materials, Zeal Capital Market still refused to process my withdrawal. Last month, I filed a complaint with Zeal Capital Market's regulatory authority. In response, Zeal Capital Market sent me an email stating that I needed to have a telephone communication with their staff. I made seven or eight phone calls, but my problem was never fully resolved. Finally, Zeal Capital Market informed me that they would only release my principal, while my hundreds of thousands of dollars in profits were completely wiped out and deemed invalid. Unconvinced, I started exposing Zeal Capital Market's actions on various social med

Exposure

FX4140598420

Vietnam

The platform does not take responsibility for compensating customers, deceiving and intervening in customer accounts.

Exposure

FX4140598420

Vietnam

The exchange does not regulate price adjustments, leading to account losses.

Exposure

FX1775346222

United States

After multiple appeals, the platform sent me an email informing me that my account balance needed to be adjusted. The balance currently displayed in my account is not the actual state. The shocking scene before me was that my account balance was deducted from over three hundred thousand US dollars to tens of thousands of US dollars (see backend screenshot). The customer service at ZFX explained this as a "data synchronization anomaly," yet they have been unable to provide any technical logs or compliance explanations. They even refused to acknowledge the profit records I had created. What's more ironic is that my losing orders were recorded in real-time and forcibly closed, but profit records could be "deleted with one click," revealing the manipulative intent behind this "selective malfunction." Privacy extortion-style "compliance": Recording a video of the bank account as a withdrawal threshold In order to recover the principal and profits (totaling over 300,000 US dollars), I was forced to comply with ZFX' "KYC verification" and submitted the following: - Handheld ID card photo - Utility bills and address proof for the past 3 months - Bank card statements for deposits - Trading account real-name authentication materials However, the platform's demands became increasingly unreasonable—they actually required me to record a video logging into my personal bank account, showing the account balance and transactions, and simultaneously provide screenshots of the bank's app. This request has crossed all financial platform compliance boundaries: ✅ Privacy violation: Bank accounts involve core privacy such as deposit amounts, transaction details, security tokens, etc., and video recording could lead to account theft. ✅ Logical breakdown: Verifying the source of funds only requires providing transaction-related deposit and withdrawal statements, so why demand disclosure of other account information? ✅ Double standards: The platform has never set such strict thresholds for deposits, yet they layer obstacles for withdrawals, clearly intending to delay and make it difficult for investors. The platform repeatedly demanded private information, and it was only then that I realized: they simply do not intend to return the money; they only want to use privacy extortion to force investors to compromise! 600 days of fighting for rights: From data tampering to regional threats, the tactics are outrageous From October 2023 to the present, I have experienced three disgusting operations by ZFX: 1. "Pseudo-negotiation" after regulatory complaints On April 11, 2025, after I complained to regulatory bodies such as the Seychelles FSA and the UK FCA, and planned to publicly fight for my rights on social media, the platform finally sent an email "seeking reconciliation," claiming to be "willing to negotiate over the phone." I had 5 phone calls with them (all recorded and can be made public, below are some screenshots of the call records), each time they delayed citing "complex processes" and "need for senior approval." Even in the final call on May 12, they proposed: "You must come to the Hong Kong office for a face-to-face meeting, otherwise, there will be no discussion."

Exposure

FX1775346222

Singapore

After multiple appeals, the platform sent me an email informing me that my account balance needed to be adjusted. The balance currently displayed in my account is not the actual state. However, the scene before me was shocking - my account balance was deducted from over three hundred thousand US dollars to tens of thousands of US dollars (see backend screenshot). The customer service of ZFX explained this as a "data synchronization anomaly," yet they have consistently failed to provide any technical logs or compliance explanations, and even refused to acknowledge the profit records I had created. Ironically, while my loss orders were recorded in real-time and forcibly closed, profit records could be "deleted with one click," revealing the manipulative intent behind this "selective malfunction." Privacy extortion "compliance": Recording a video of the bank account as a withdrawal threshold To reclaim my initial investment and profits (totaling more than $300,000), I was compelled to comply with Shanhai Securities' 'KYC Verification', during which I had to submit the following: - Handheld ID card photos - Utility bills and address proof for the past 3 months - Deposit bank card statements - Trading account real-name authentication materials However, the platform's demands became increasingly unreasonable - They actually required me to record a video logging into my personal bank account, showing the account balance and transactions, and simultaneously provide screenshots of the bank's app. This requirement has crossed all financial platform compliance boundaries: ✅ Privacy violation: Bank accounts involve deposit amounts, transaction details, security tokens, and other core privacy information. Video recording may lead to an account being misused. ✅ Logical breakdown: Verifying the source of funds only requires providing transaction-related deposit and withdrawal records. Why demand disclosure of other account information? ✅ Double standards: The platform has never set such strict thresholds for deposits, but layers of obstacles during withdrawals clearly indicate an intention to delay and make it difficult for investors. It was only at this point, after the platform repeatedly demanded private information, that I realized: they simply do not intend to return the money, but rather want to use privacy extortion to force investors to compromise! 600 days of fighting for rights: From data tampering to regional threats, the tactics are outrageous From October 2023 to the present, I have experienced three disgusting operations by ZFX: 1. "Pseudo-negotiation" after regulatory complaints On April 11, 2025, after I complained to regulatory agencies such as the Seychelles FSA and the UK FCA, and planned to publicly fight for my rights on social media, the platform finally sent an email "seeking reconciliation," claiming to be "willing to negotiate over the phone." I had 5 phone calls with them (all recorded and can be made public, below are some screenshots of the call records), each time they delayed citing "complex processes" and "need for senior approval," even proposing in the final call on May 12: "You must come to the Hong Kong office for a face-to-face meeting, otherwise, there will be no discussion."

Exposure

FX1775346222

Taiwan

On October 13, 2023, I found my MT4 account inexplicably closed, rendering me unable to access it. I have video evidence that my account clearly shows profits exceeding $300,000. After multiple attempts to communicate with the platform, my account finally was restored, but as can be seen from the screenshot, ZFX has cleared all my trade orders and profit and loss records. Despite providing all requested documents, including personal identification and financial records, ZFX also required me to film a video logging into my bank account and displaying my balance. This request, which I find a serious invasion of my privacy, was refused. All other required documents have been provided. My request is the return of my principal and profit, $225,100.45 USD. ZFX requests an array of personal documents from investors, which is a clear disrespect of customer rights and privacy. Furthermore, platform even requested users record video, revealing extensive personal details and account trade information, posing a serious threat to user information security. The handling of my case since 2023 has been extremely slow. A clear willful delay! After filing a regulatory complaint last month, the platform contacted me for phone consultations. After four or five calls, the final result presented on May 12 was they would only return my principal and not a penny of my profit! As a customer, I want to know where the transparency and fairness of platform trading is? If you earn a lot, they directly wipe out your profit. With one and a half year's KYC submissions, if the platform doesn't want to allow you to withdraw, they stick it out, letting you abandon your claim!

Exposure

FX1568699357

Vietnam

I have encountered many cases where you use std std +1, but I still get a 30 spread when I use ecn. This greatly affects me. If I am not handled, I will complain in a higher community.

Exposure

FX1568699357

Vietnam

You can see the Sell order on the platform. I am currently in a position. I am a trader with ID 6816802 and I trade on the zfx platform. The price is 2698.90 and I set the Stop Loss at 2698.50. I set the Stop Loss at 3:48. At that time, the price of Gold was only at 2698.1 and the spread of the ECN account was $11. So why did the Stop Loss trigger and the price drop by 100 pips? Because I had another order of 0.05 lots, which was larger, and it was also stopped out unreasonably. The platform only refunded 50% of the loss from my Buy order on Monday, which had a spread of 0.34 and $11. When I entered the order, it was negative $44, which made me lose money. With two consecutive orders like this, I suspect that the platform is cheating not only me but also many other accounts. I hope Wiki FX can support me.

Exposure

dala3421

Taiwan

I am writing to file a formal and urgent complaint against ZFX for their unethical and fraudulent actions concerning my MT4 account. As a client registered under MT4 account number 2856855, I am deeply alarmed by their handling of my account, including the unjust clearing of my trading history and their unreasonable demands for invasive documentation. Here are my details: Registered Email: woow889988@163.com MT4 Account Number: 2856855 Initial Balance: $311,291.64 USD Current Balance: $86,191.19 USD Deposit: $41,000 USD On October 13, 2023, I discovered that my MT4 account had been inexplicably closed, leaving me unable to access it. I have attached a video recording from the same day, clearly showing that my account had accumulated profits exceeding $300,000 USD. After multiple attempts to communicate with ZFX, my account was eventually reinstated. However, upon regaining access, I found that all my trading orders and profit/loss history had been completely cleared, as evidenced b

Exposure