公司簡介

| Shin 評論摘要 | |

| 註冊時間 | 15-20 年 |

| 註冊國家/地區 | 日本 |

| 監管 | FSA |

| 市場工具 | 股票、投資信託、債券 |

| 模擬帳戶 | / |

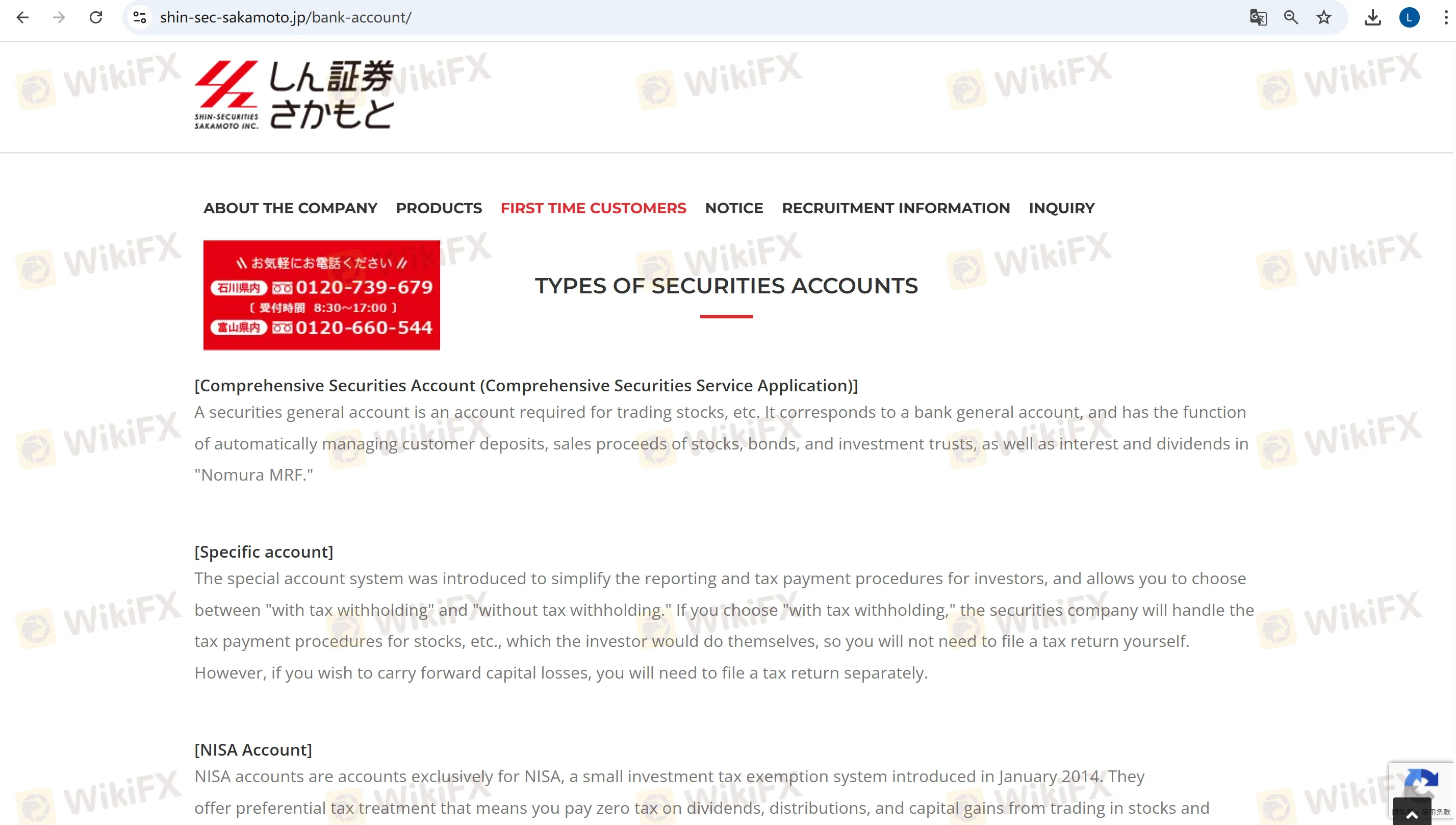

| 客戶支援 | 076-222-8088 |

| 0120-739-679 | |

| 0120-660-544 | |

Shin 資訊

Shin 證券坂本是一家專門為新手投資者提供服務的日本證券公司。總部設在金澤,公司提供低費用(例如,50 歲以下人士可免費購買國內股票)、免稅 NISA 帳戶,以及股票和債券等多樣化產品。雖然受日本金融廳(FSA)監管,但缺乏線上平台和海外覆蓋。

優缺點

| 優點 | 缺點 |

| 受監管 | 沒有線上交易平台 |

| 低佣金費用 | 費用資訊不清晰 |

| 免費投資諮詢 | 海外市場覆蓋較低 |

| 提供 NISA 免稅帳戶 | |

| 多元化產品服務 |

Shin 是否合法?

Shin受FSA監管,許可證號碼為:北陸地區稅務局(金商)第5號。具有相對較高的安全性。

Shin可以交易什麼?

| 可交易工具 | 支援 |

| 股票 | ✔ |

| 投資信託 | ✔ |

| 債券 | ✔ |

| 股份 | ❌ |

| ETF | ❌ |

| 債券 | ❌ |

| 共同基金 | ❌ |

帳戶類型

| 帳戶類型 | 主要功能 |

| 證券綜合帳戶 | 支持股票、投資信託和債券的基本交易帳戶。資金會自動轉入「野村MRF」貨幣市場基金以賺取利息。 |

| 特定帳戶 | 1. 有代扣稅:證券公司會代扣稅款,無需個人申報。2. 無代扣稅:需要自行申報稅款。 |

| NISA帳戶 | 免稅專用投資帳戶,需經稅務局審查(約2週)。 |