Resumo da empresa

| Shin Resumo da Revisão | |

| Registrado em | 15-20 anos |

| País/Região Registrada | Japão |

| Regulação | FSA |

| Instrumentos de Mercado | Ações, Fundos de Investimento, Obrigações |

| Conta Demonstrativa | / |

| Suporte ao Cliente | 076-222-8088 |

| 0120-739-679 | |

| 0120-660-544 | |

Informações sobre Shin

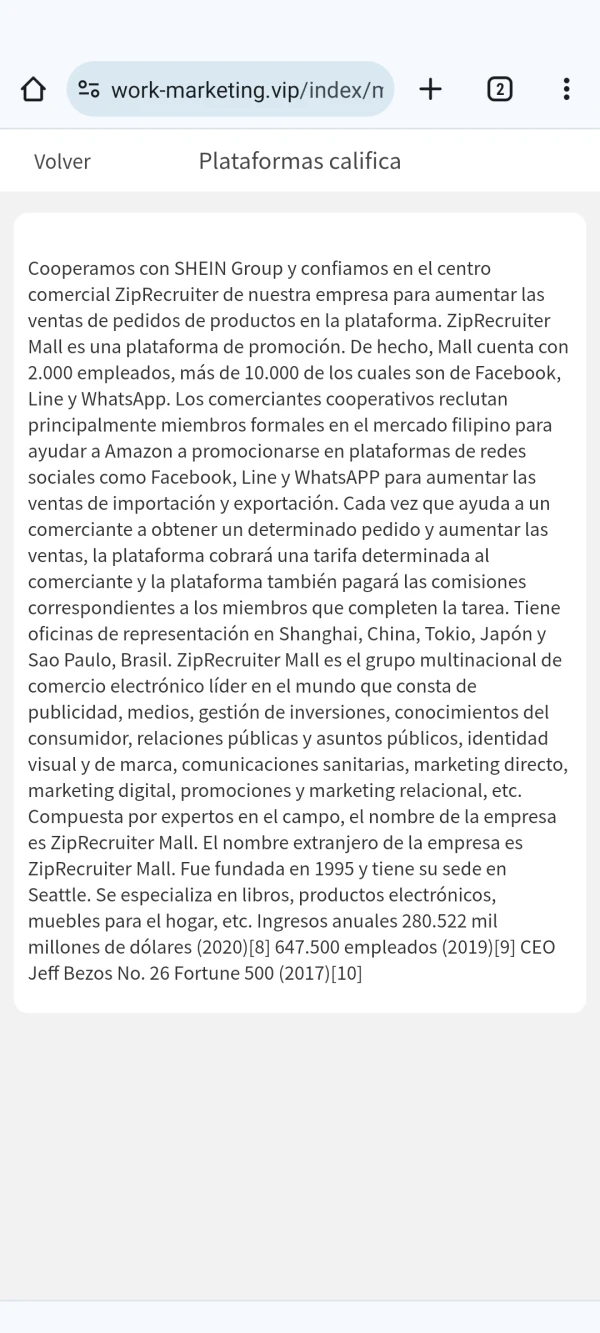

Shin Securities Sakamoto é uma empresa de valores mobiliários japonesa especializada em investidores iniciantes. Com sede em Kanazawa, a empresa oferece baixas taxas (por exemplo, compras de ações domésticas gratuitas para menores de 50 anos), contas NISA isentas de impostos e produtos diversos como ações e obrigações. É regulamentada pela Agência de Serviços Financeiros do Japão (FSA), embora não tenha uma plataforma online e cobertura no exterior.

Prós e Contras

| Prós | Contras |

| Regulamentada | Sem plataforma de negociação online |

| Taxas de comissão baixas | Informações de taxas pouco claras |

| Consulta de investimento gratuita | Baixa cobertura de mercado internacional |

| Conta NISA isenta de impostos disponível | |

| Serviços de produtos diversos |

É Shin Legítimo?

Shin é regulamentado pela FSA com um número de licença: Diretor do Escritório Regional de Tributação de Hokuriku (Kinsho) No. 5. Possui um nível relativamente alto de segurança.

O que posso negociar na Shin?

| Instrumentos Negociáveis | Suportado |

| Ações | ✔ |

| Fundos de Investimento | ✔ |

| Obrigações | ✔ |

| Ações | ❌ |

| ETFs | ❌ |

| Obrigações | ❌ |

| Fundos Mútuos | ❌ |

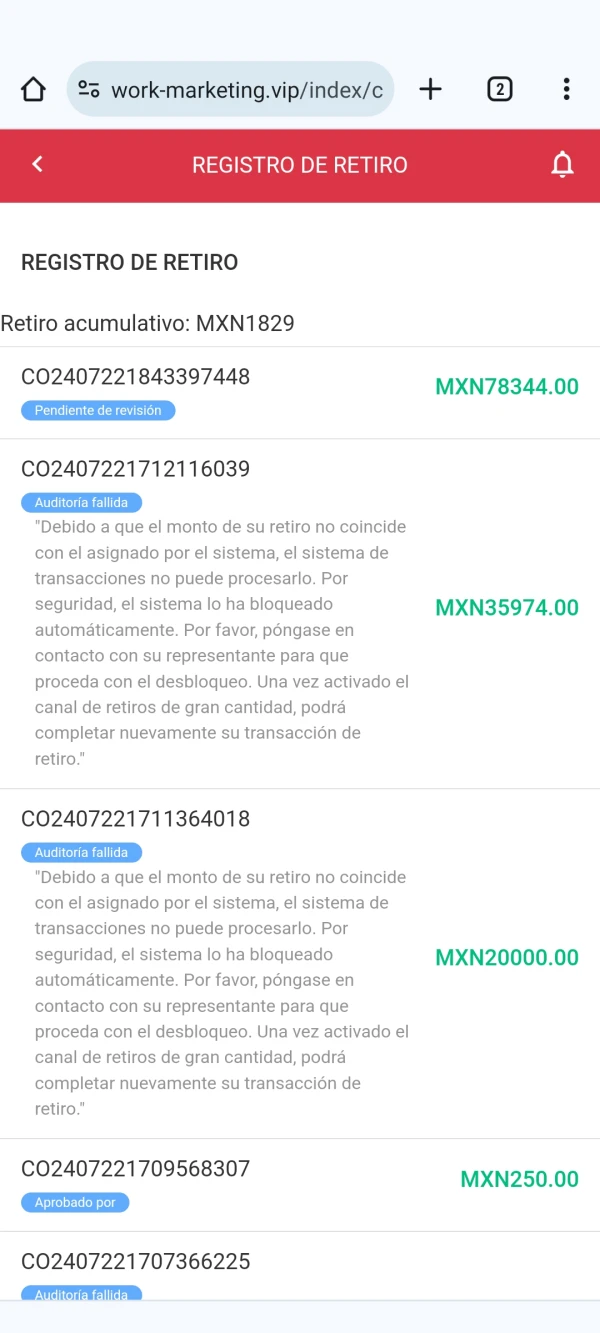

Tipo de Conta

| Tipo de Conta | Principais Funções |

| Conta Abrangente de Valores Mobiliários | Uma conta de negociação básica que suporta a compra e venda de ações, fundos de investimento e obrigações. Os fundos são automaticamente transferidos para o fundo de mercado monetário "Nomura MRF" para ganhar juros. |

| Conta Específica | 1. Com retenção de impostos: A empresa de valores mobiliários retém impostos, eliminando a necessidade de declaração individual.2. Sem retenção de impostos: Requer autodeclaração de impostos. |

| Conta NISA | Uma conta de investimento exclusiva isenta de impostos que requer revisão pelo escritório de impostos (aproximadamente 2 semanas). |