신고

ZipRecruiter Mall 회사에 의한 사기

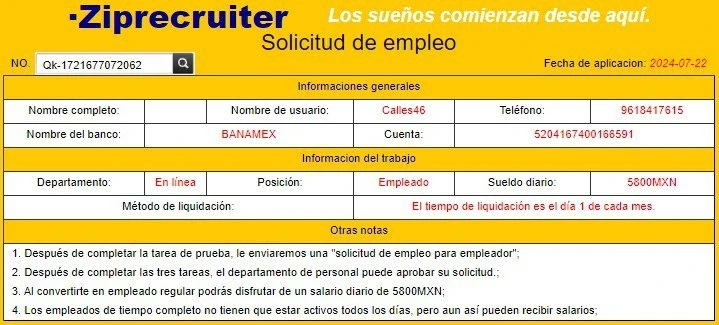

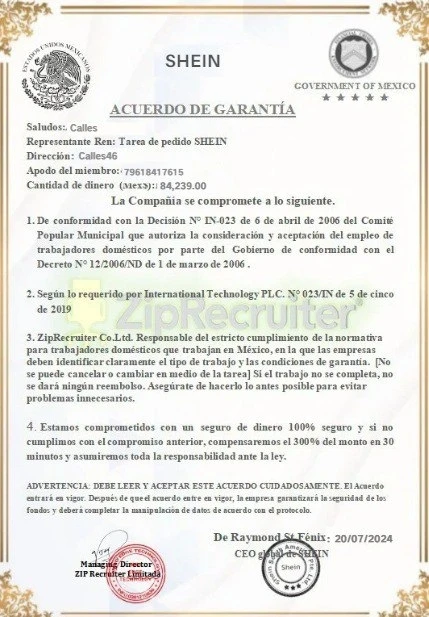

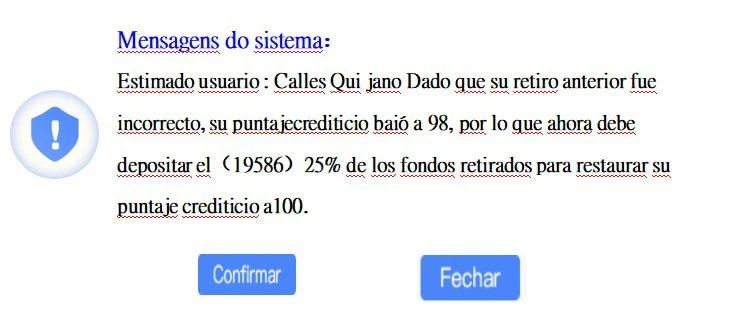

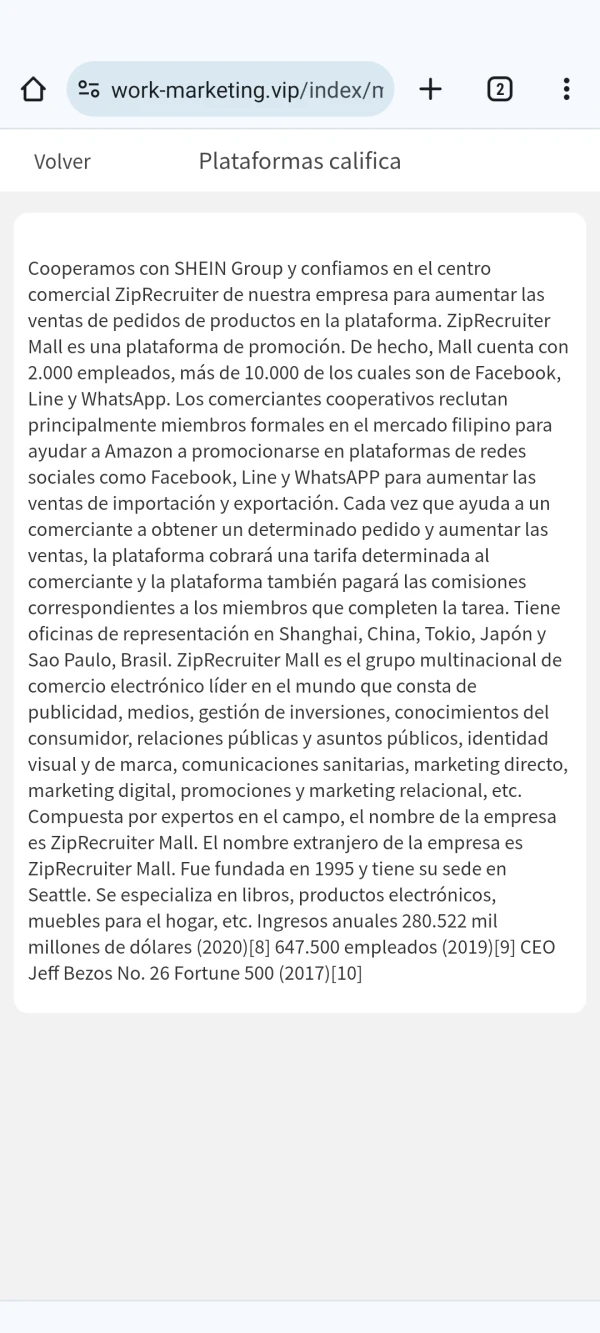

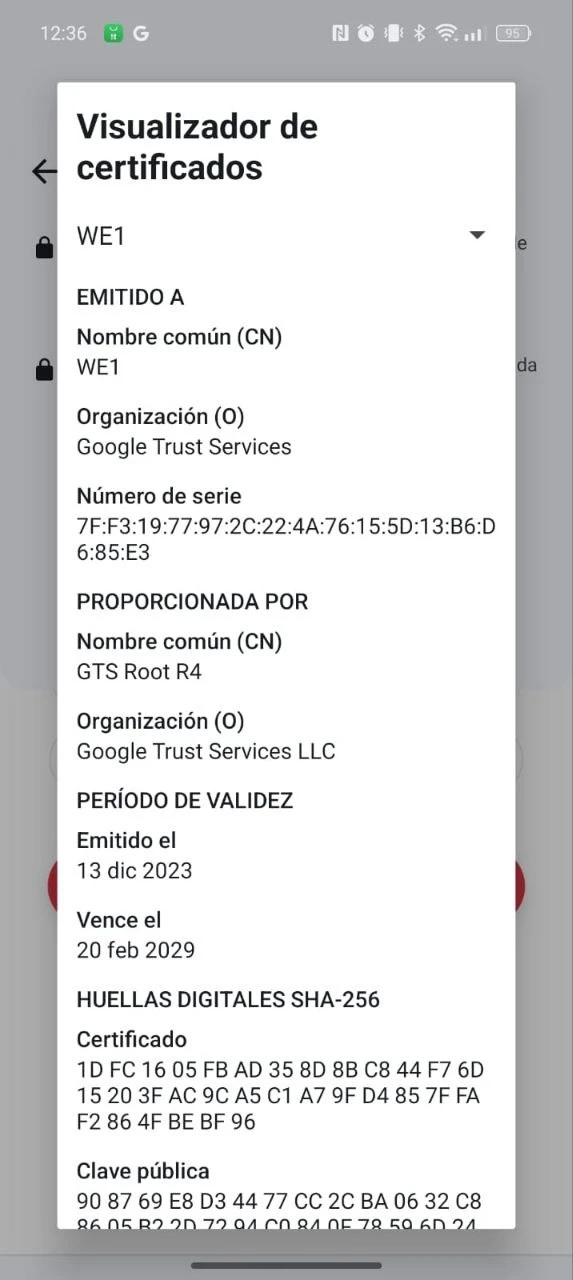

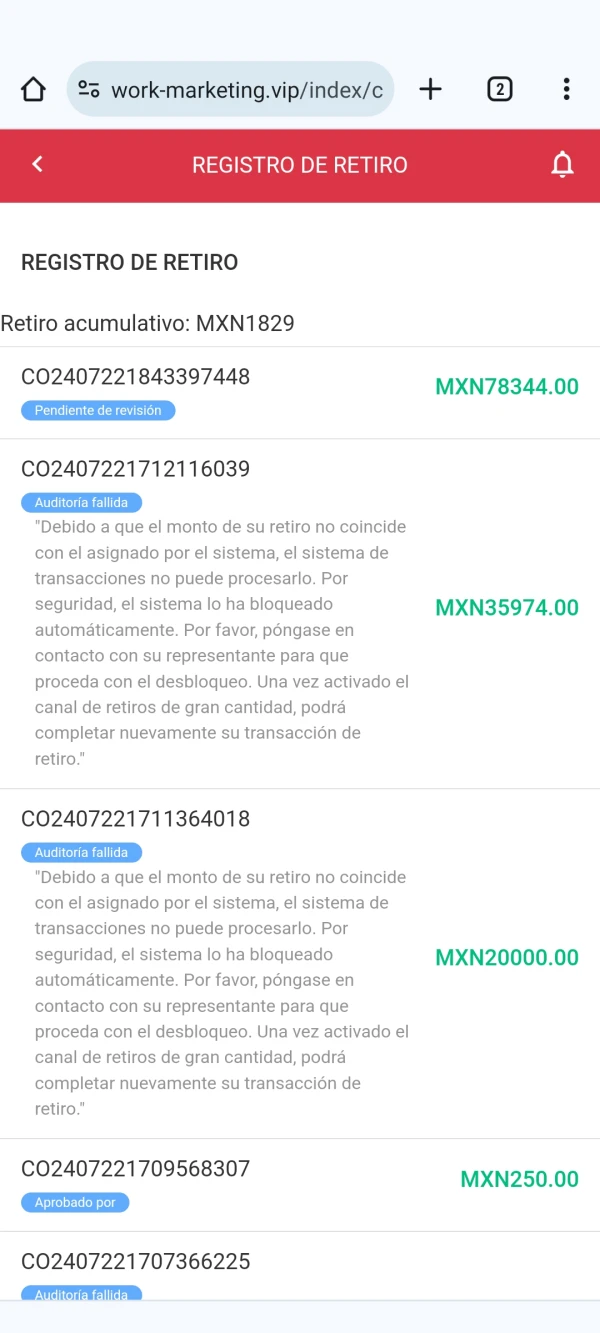

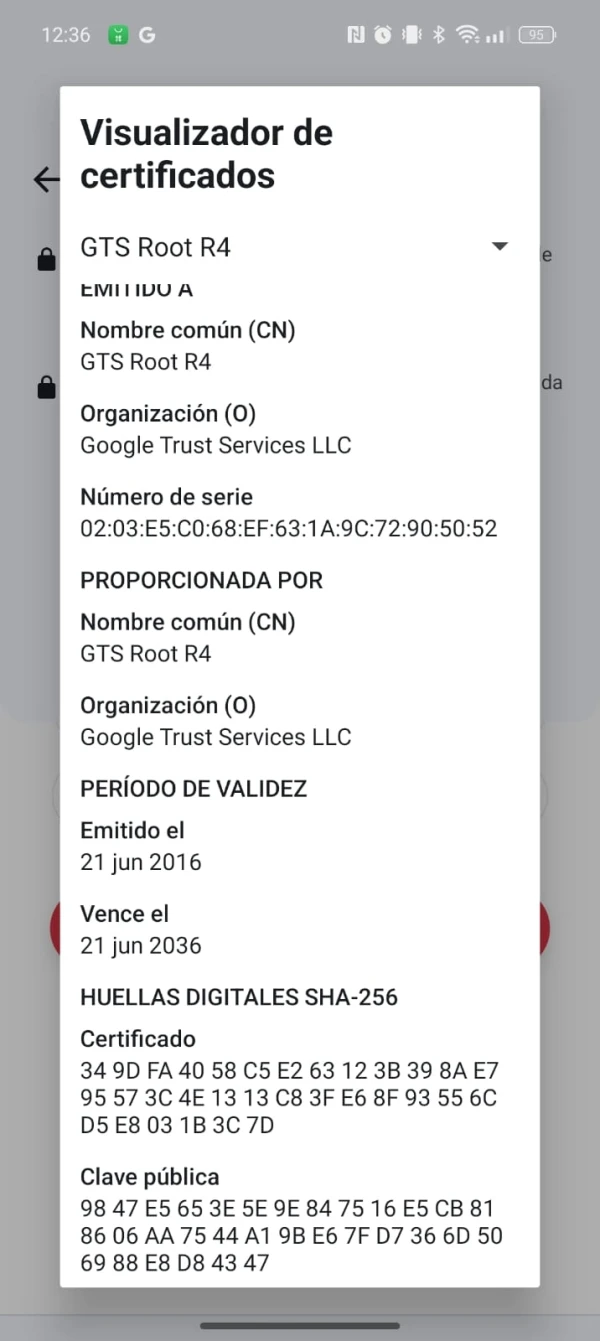

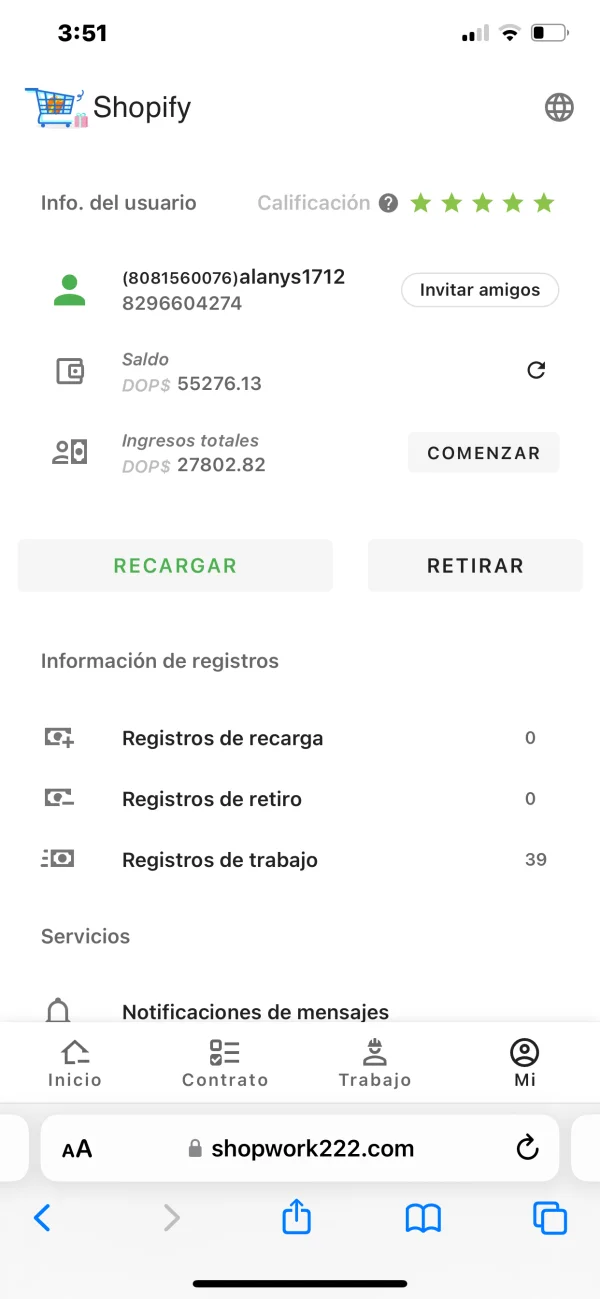

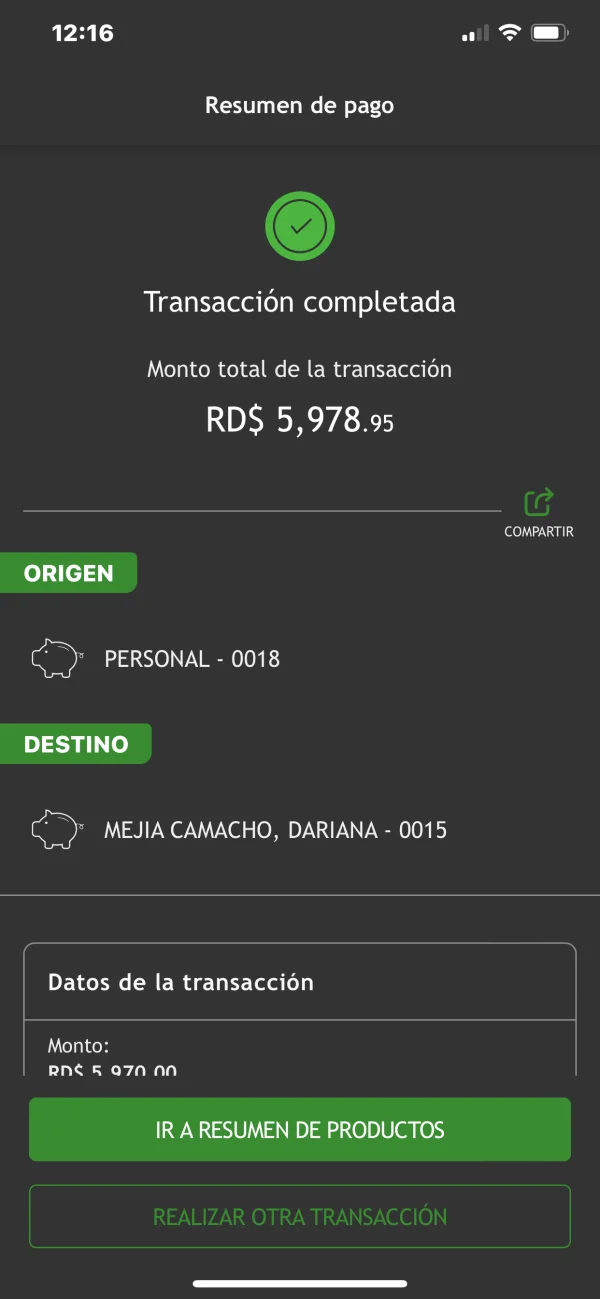

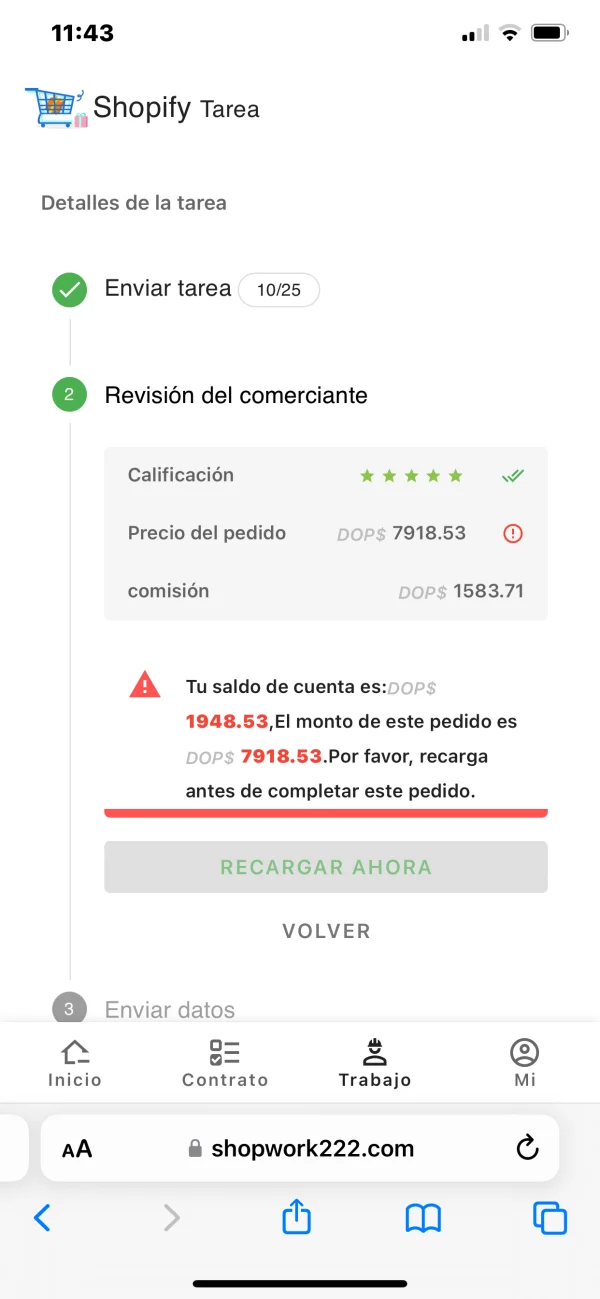

2024년 7월 22일, 페이스북 게시물을 통해 나는 WhatsApp에서 Jessica라는 이름으로 알려진 +221 77 059 1468 번호에 연락했습니다. 그녀는 ZipRecruiter Mall이라는 회사에서의 온라인 작업에 대한 정보를 제공했습니다. 등록을 위해 다음 링크를 받았습니다: https://work-marketing.vip. 전화번호와 그들이 제공한 코드인 HR948Q로 등록했습니다. 나중에 그들은 작업이 웹사이트와 함께 텔레그램을 통해 이루어진다고 알려주었고, 접수 직원인 Valeria라는 연락인을 주었으며, 그녀는 @ValeriaZM_SHEIN412라는 이름으로 텔레그램에서 응답합니다. 그녀를 추적하기 위한 링크는 https://t.me/ValeriaZM_SHEIN412입니다. 그녀는 SHEIN 미션을 완료하기 위해 작업 팀에 가입하라고 말하며, 클릭을 통해 수수료를 벌 수 있다고 말합니다. 그녀는 이 가짜 회사에서 결정한 금액을 입금할 기업가들의 연락처를 제공합니다. 나는 총 97,930을 잃었습니다.