公司简介

| 摩根大通 评论摘要 | |

| 成立时间 | 1921 |

| 注册国家/地区 | 中国香港 |

| 监管 | SFC, Labuan FSA |

| 产品和服务 | 商业银行、信贷和融资、机构投资、投资银行、支付 |

| 客户支持 | +86 10 5931 8888, +86 21 5200 2368 |

摩根大通 信息

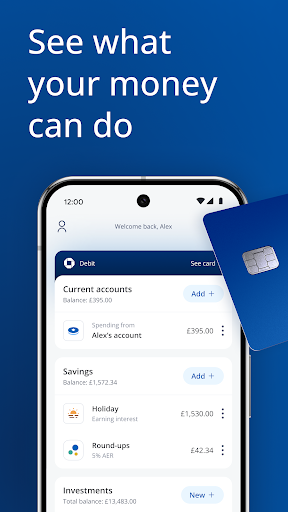

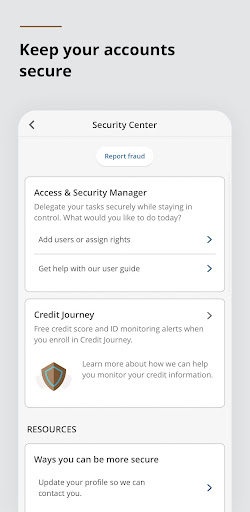

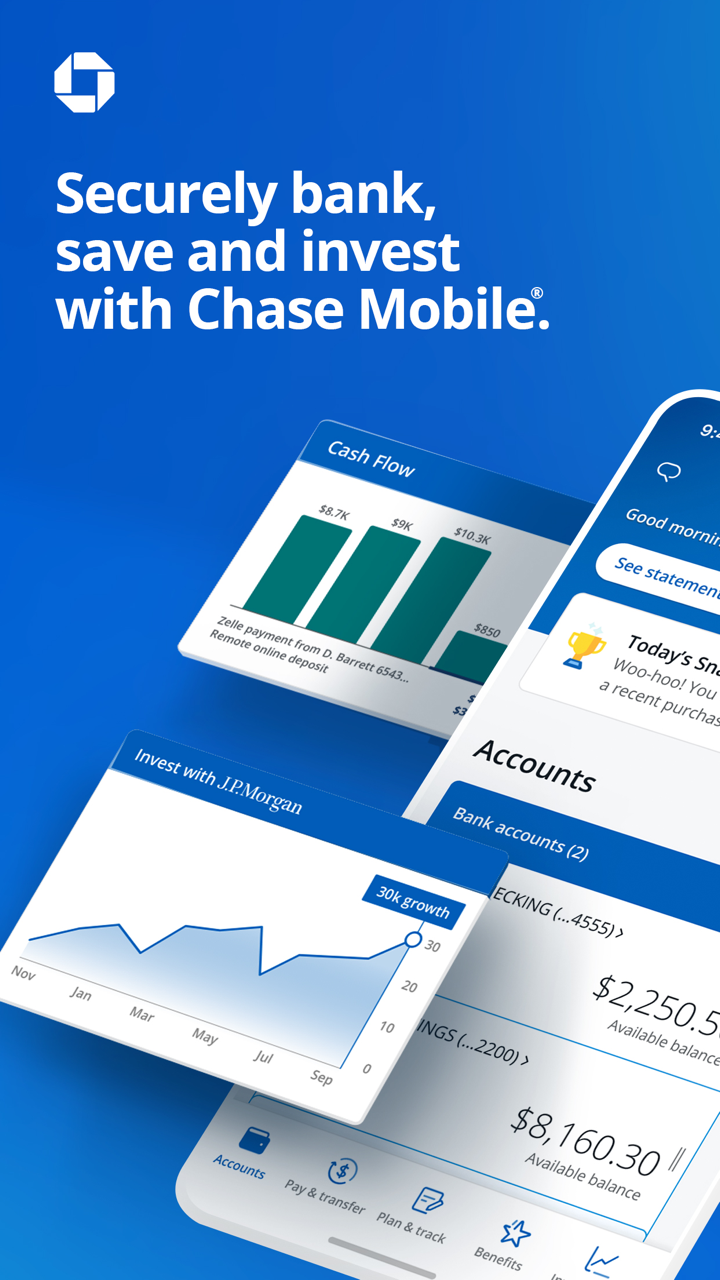

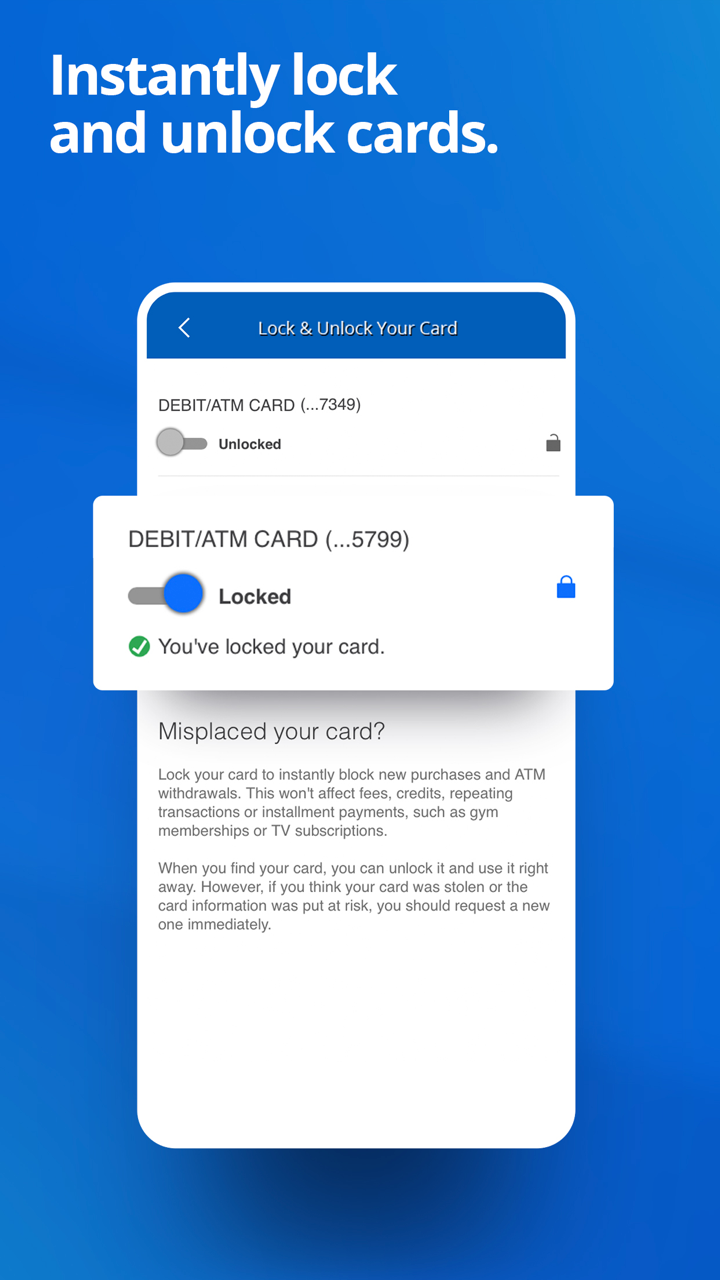

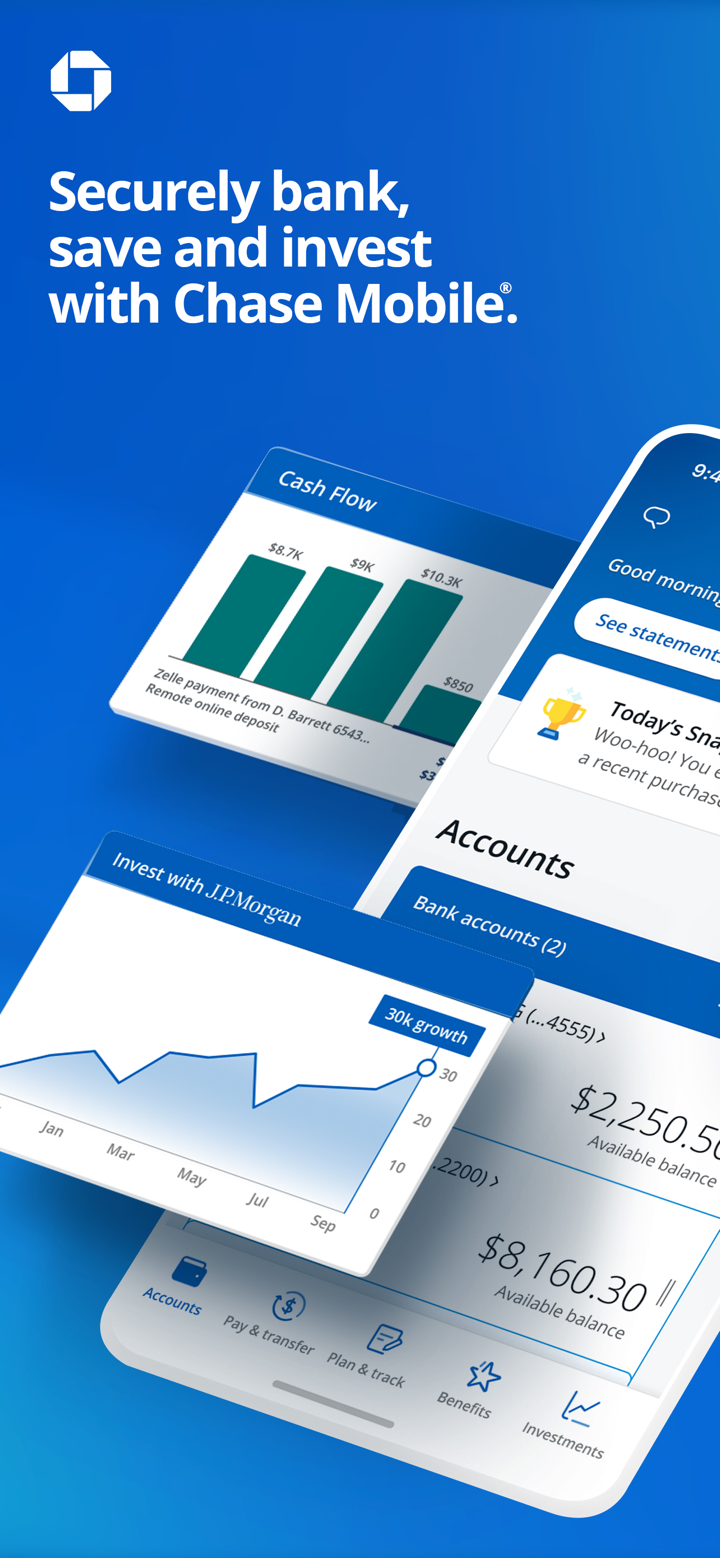

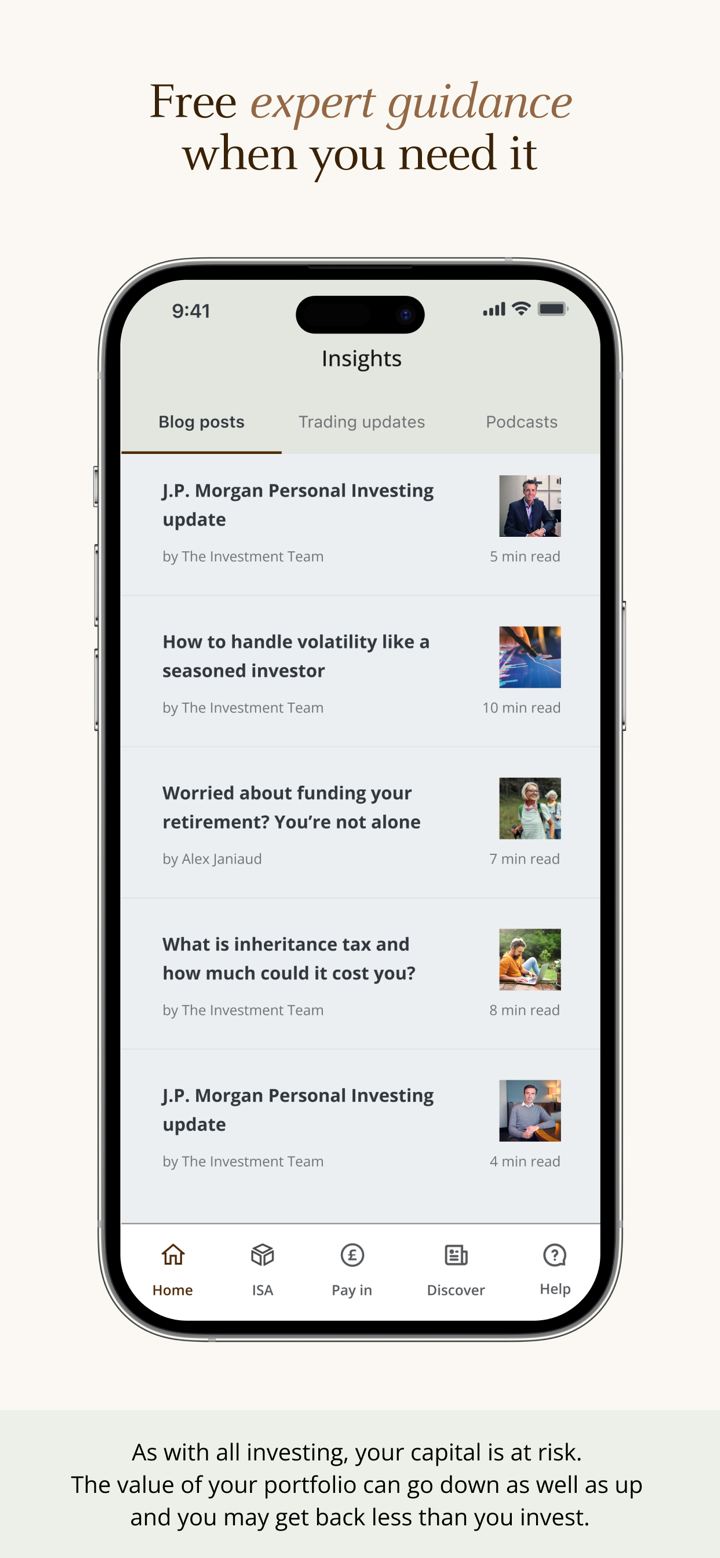

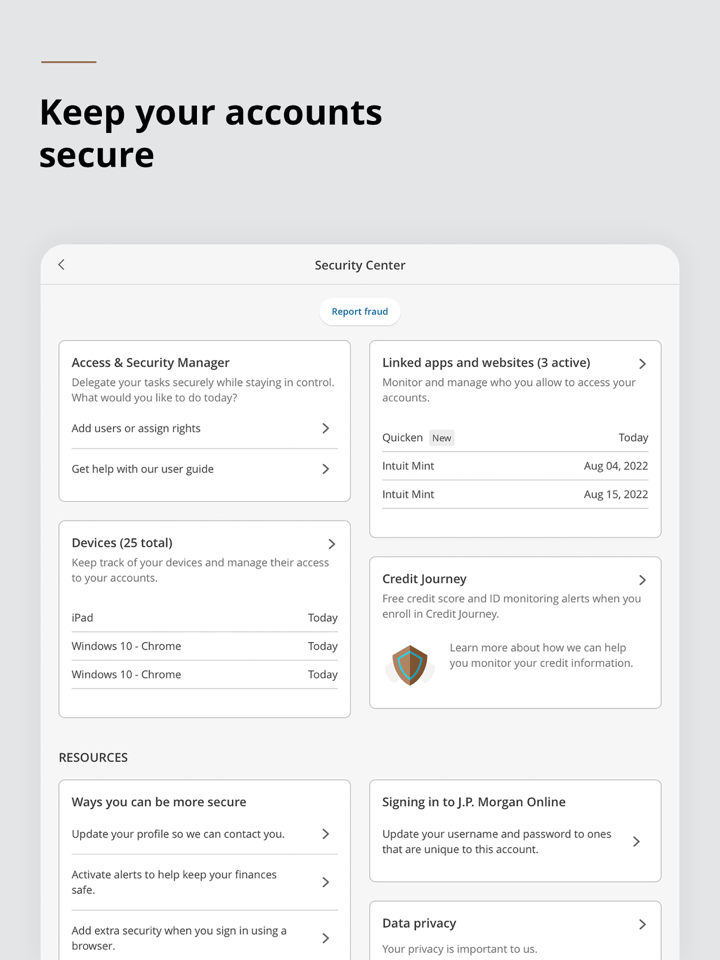

摩根大通 受中国香港的SFC和马来西亚Labuan FSA监管,是一家全球金融领导者,提供包括商业银行、投资银行、信贷和融资、机构投资以及支付在内的多样化服务。该平台为不同行业提供量身定制的金融解决方案,面向企业、机构和投资者。

优点和缺点

| 优点 | 缺点 |

|

|

|

摩根大通 是否合法?

摩根大通在中国香港由证券及期货事务监察委员会(SFC)监管,持有期货合同交易许可证号码AAB027和AAA121,在马来西亚由Labuan金融服务管理局(Labuan FSA)监管。

| 监管状态 | 受监管 | 受监管 | 受监管 |

| 监管机构 | 中国香港 | 中国香港 | 马来西亚 |

| 许可机构 | 证券及期货事务监察委员会(SFC) | 证券及期货事务监察委员会(SFC) | Labuan金融服务管理局(Labuan FSA) |

| 许可类型 | 期货合同交易 | 期货合同交易 | 做市商 (MM) |

| 许可证号码 | AAB027 | AAA121 | 未公布 |

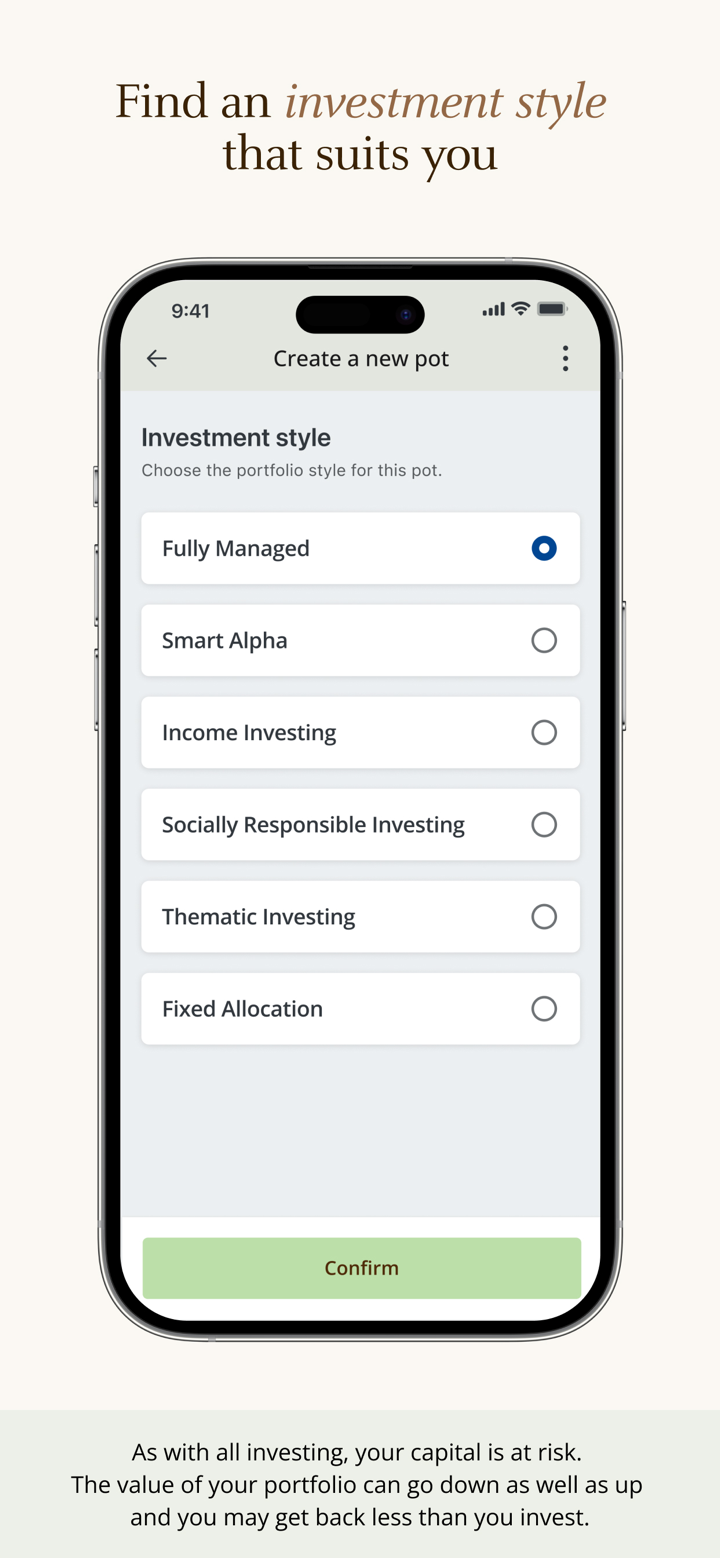

产品与服务

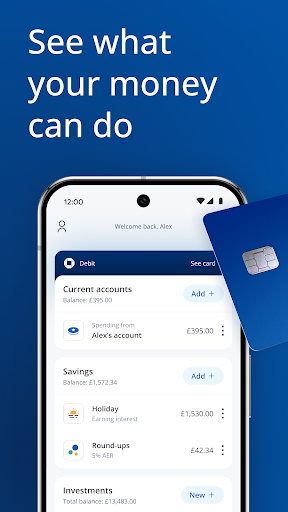

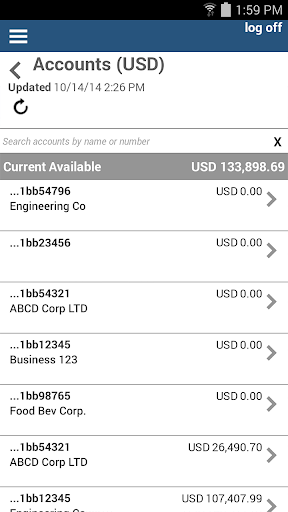

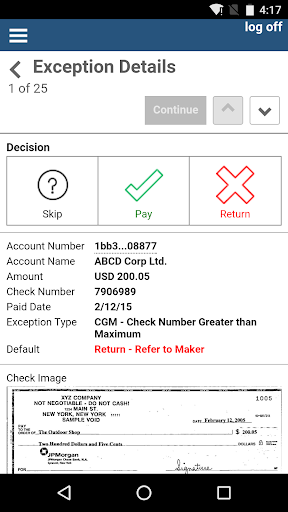

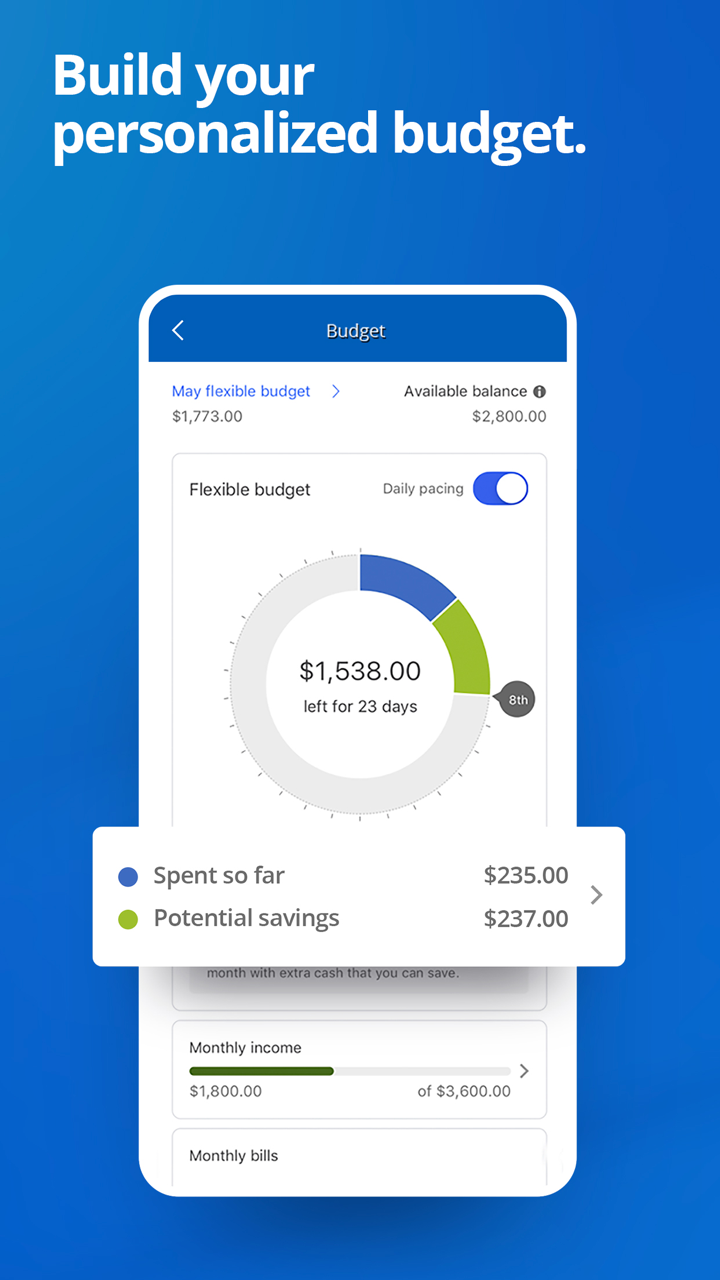

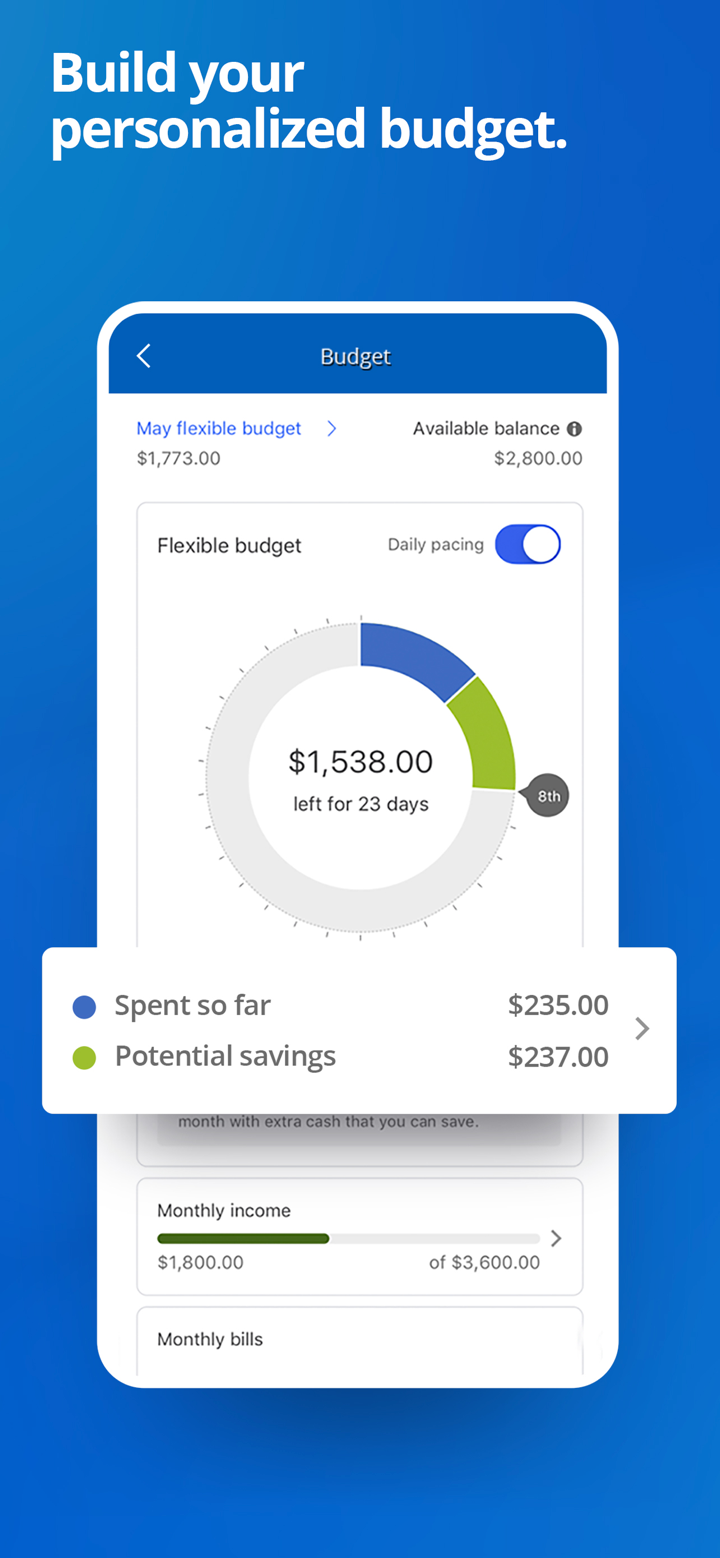

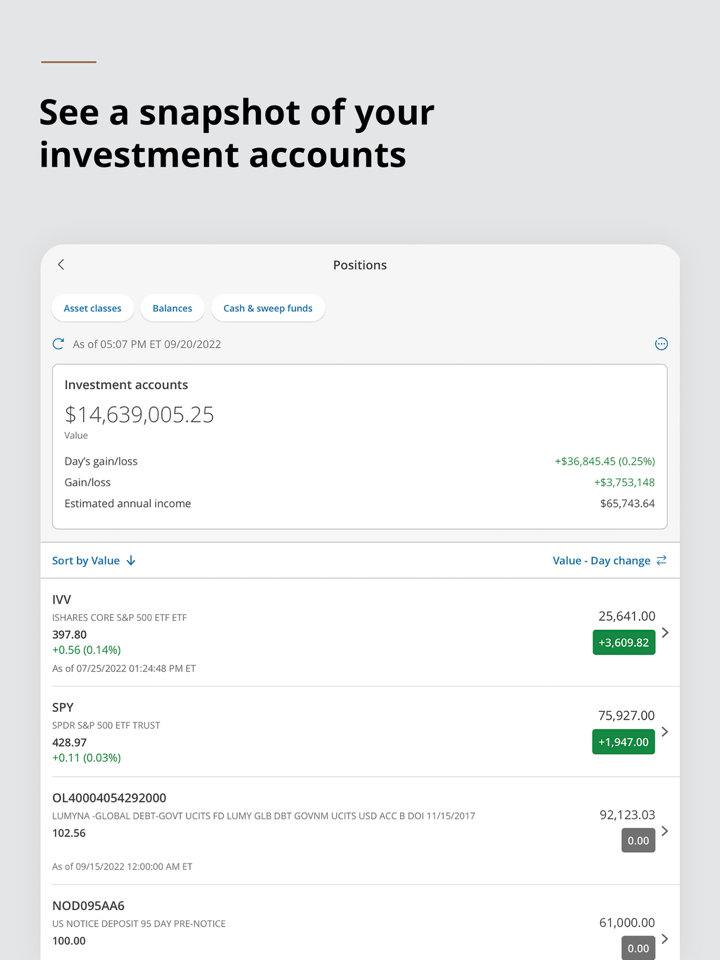

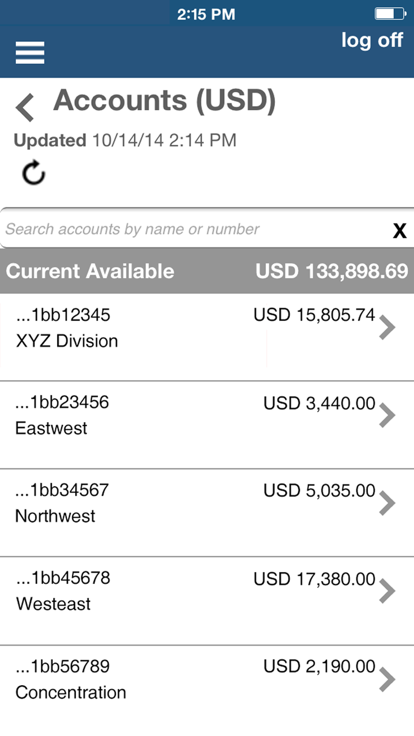

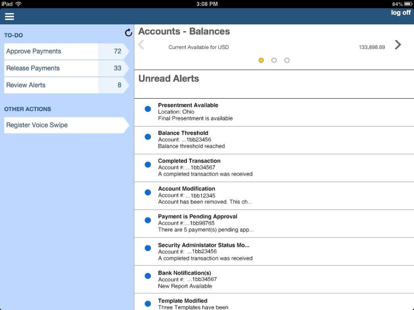

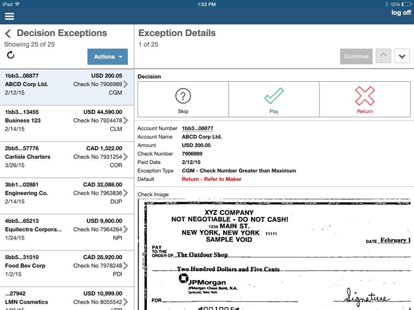

- 商业银行: 摩根大通提供商业银行服务,提供信贷、融资、资金管理和支付解决方案,以及为投资者和开发商提供商业房地产服务。

- 投资银行: 摩根大通为企业、政府和机构提供投资银行服务。这些服务包括并购咨询、债务和股权融资、重组、战略咨询和企业金融解决方案。

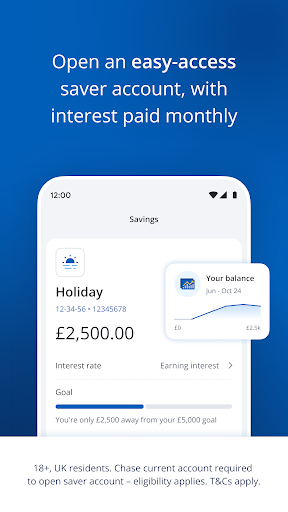

- 信贷和融资: 摩根大通提供最优质的信贷和融资选择,包括基于资产的贷款以增强流动性、设备融资以获得灵活资金、员工持股计划以支持企业和员工未来发展,以及为定制贷款解决方案提供的联合融资。

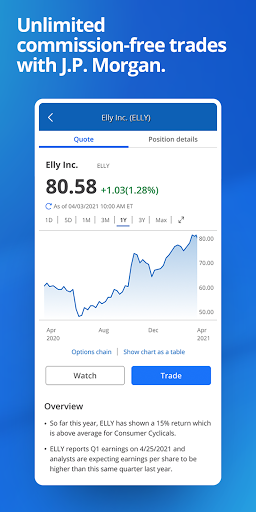

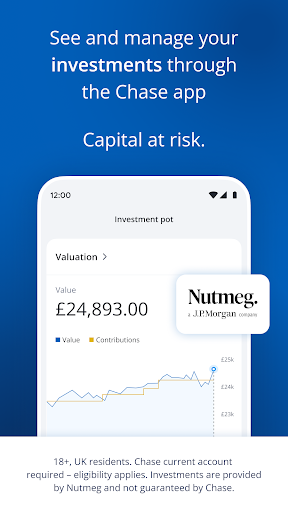

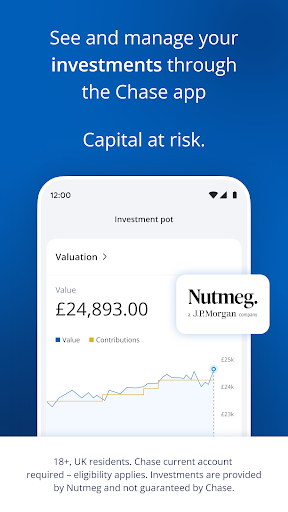

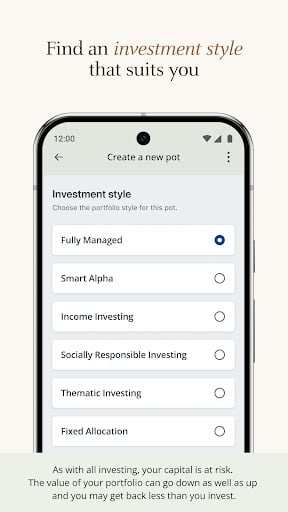

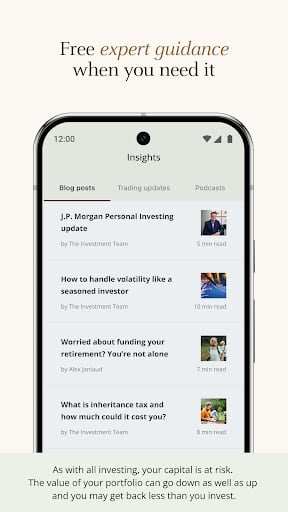

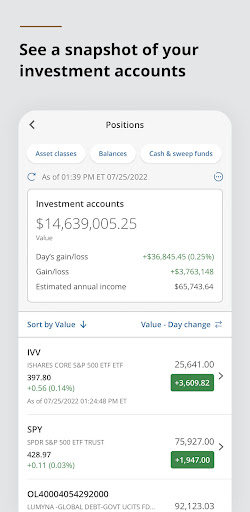

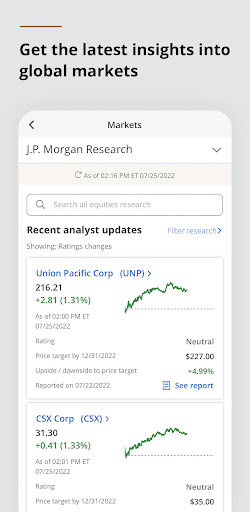

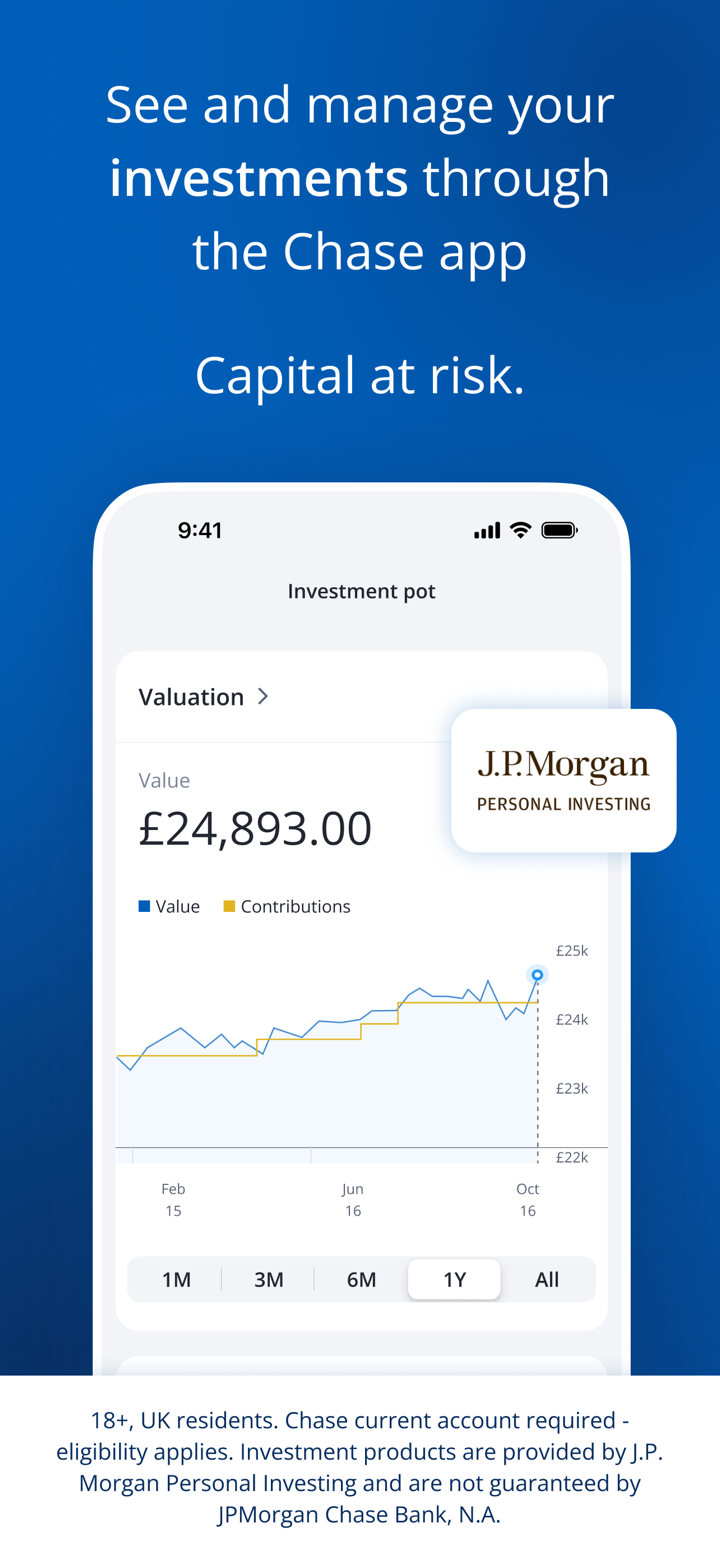

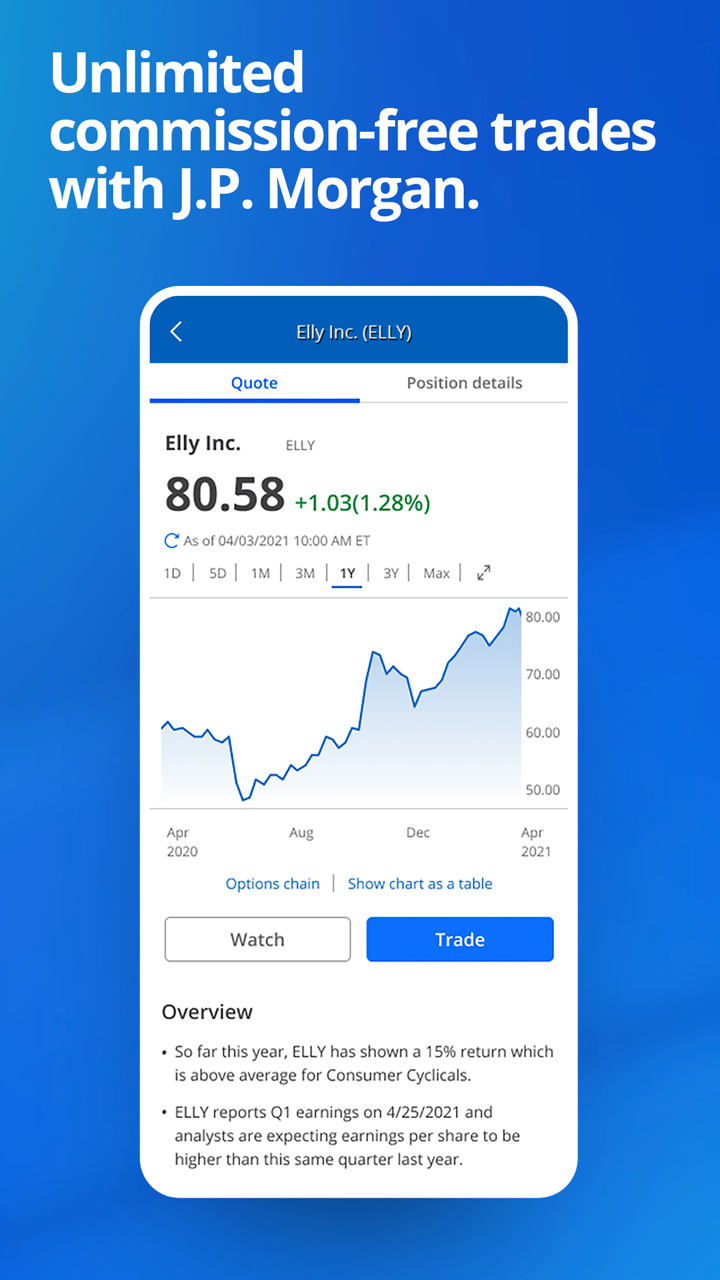

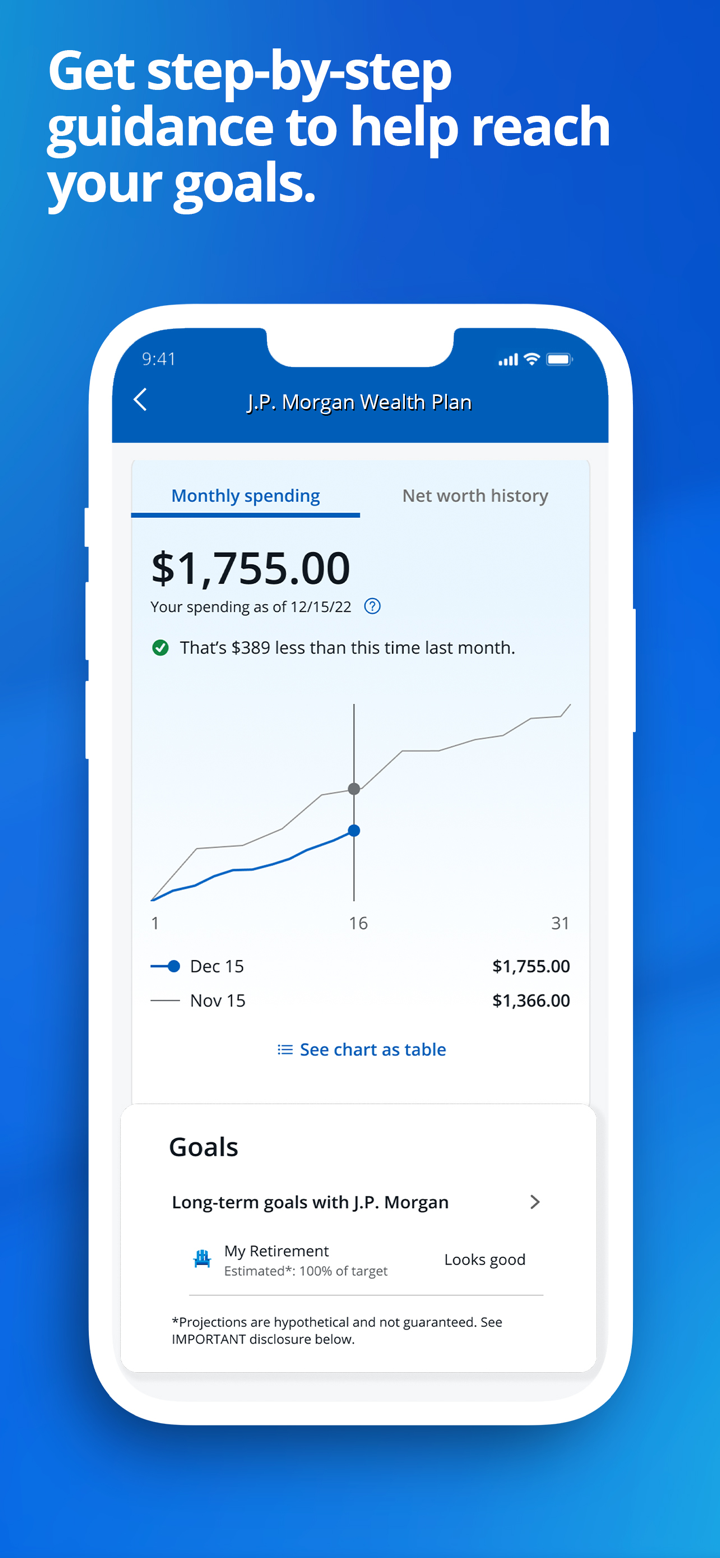

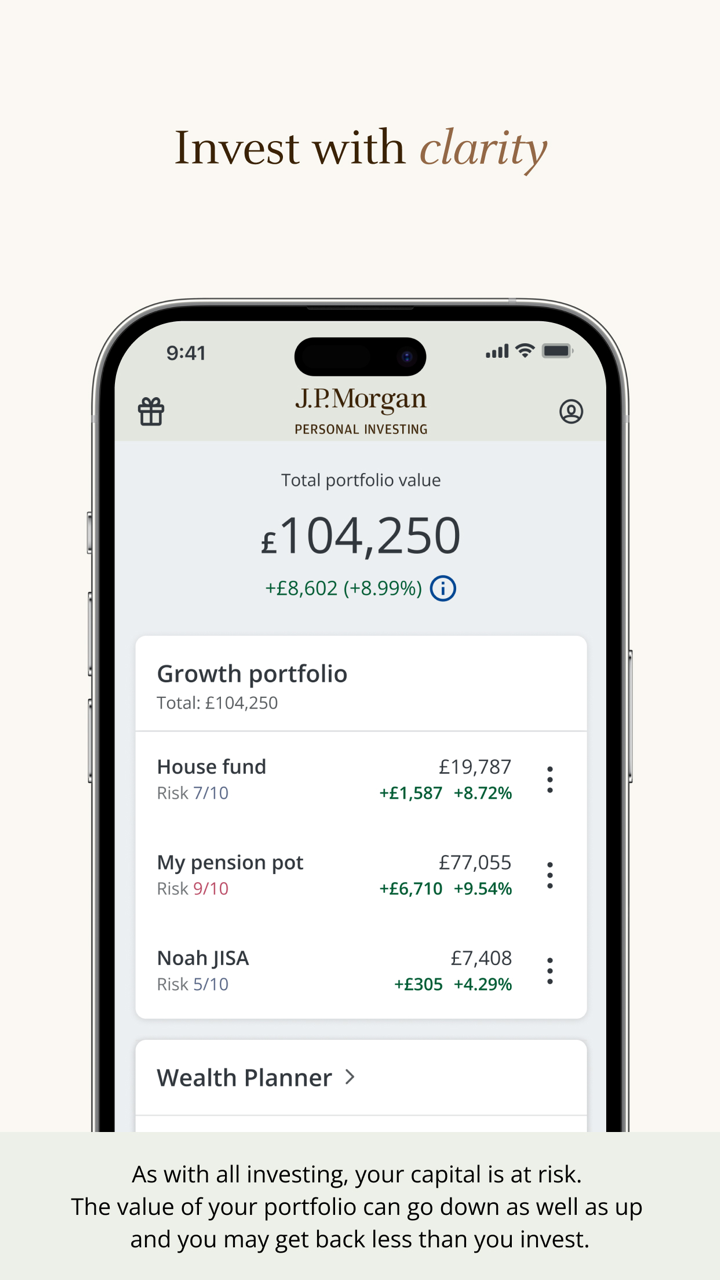

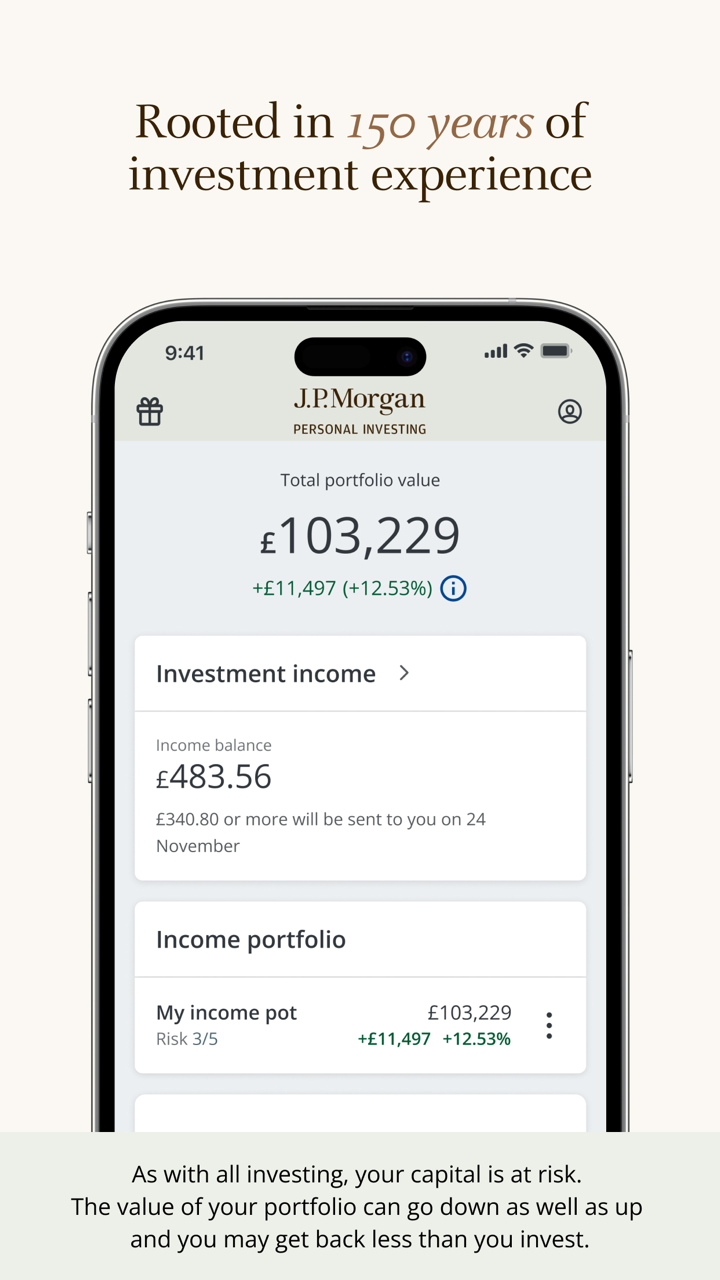

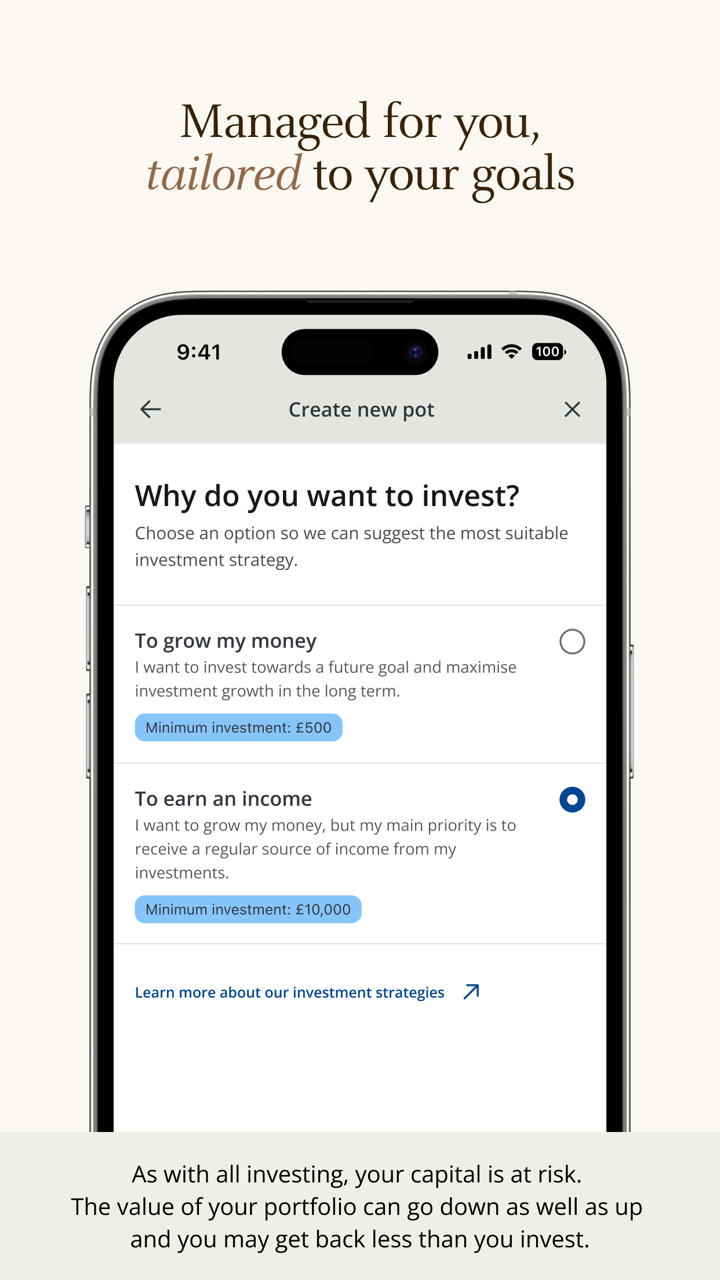

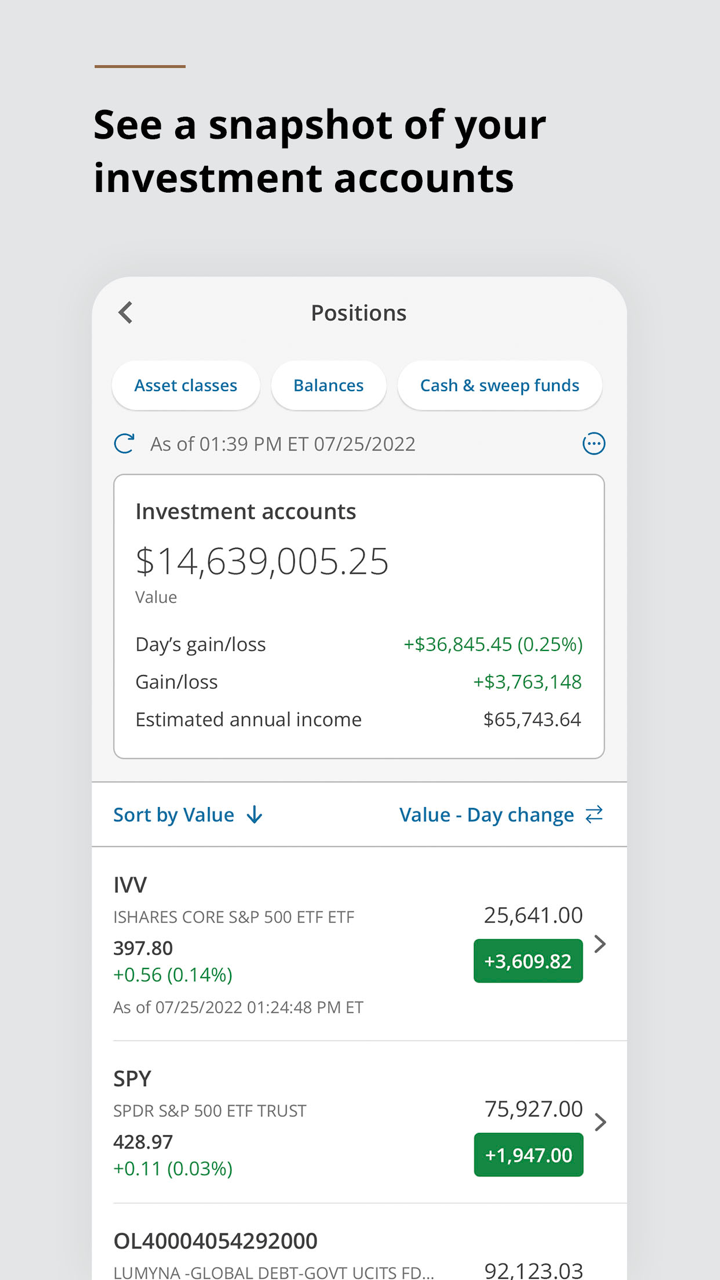

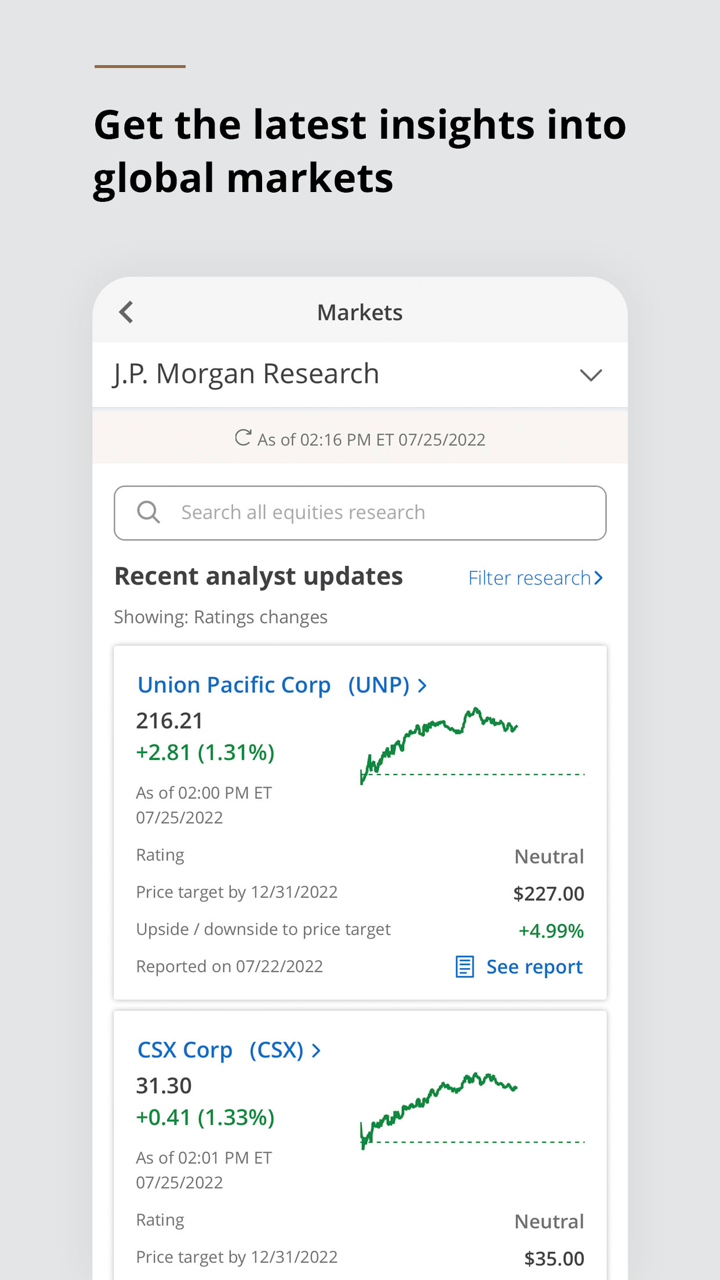

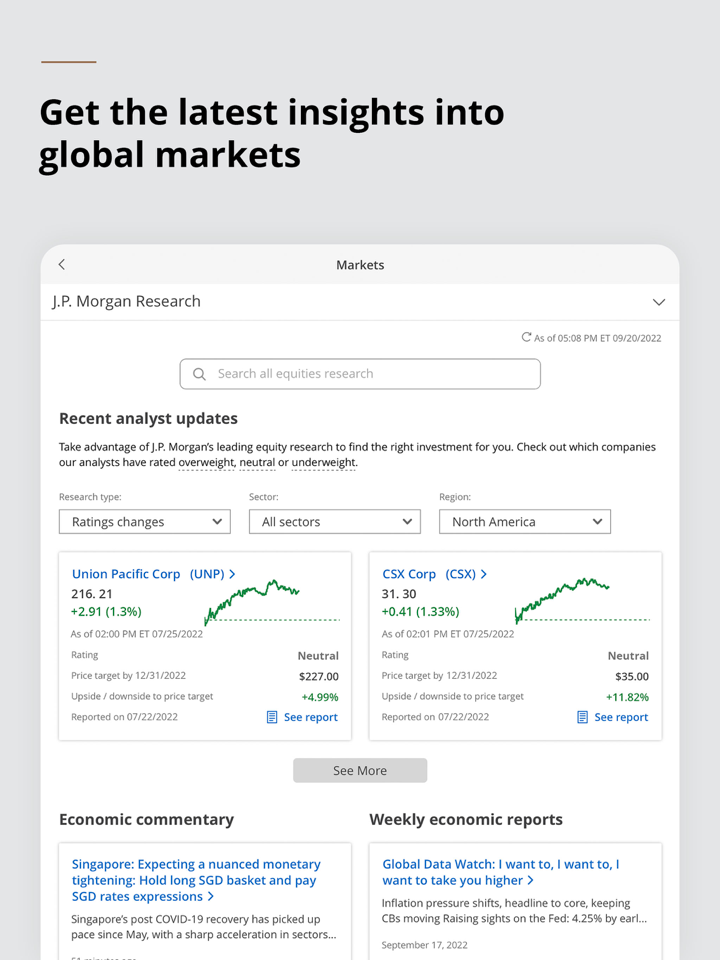

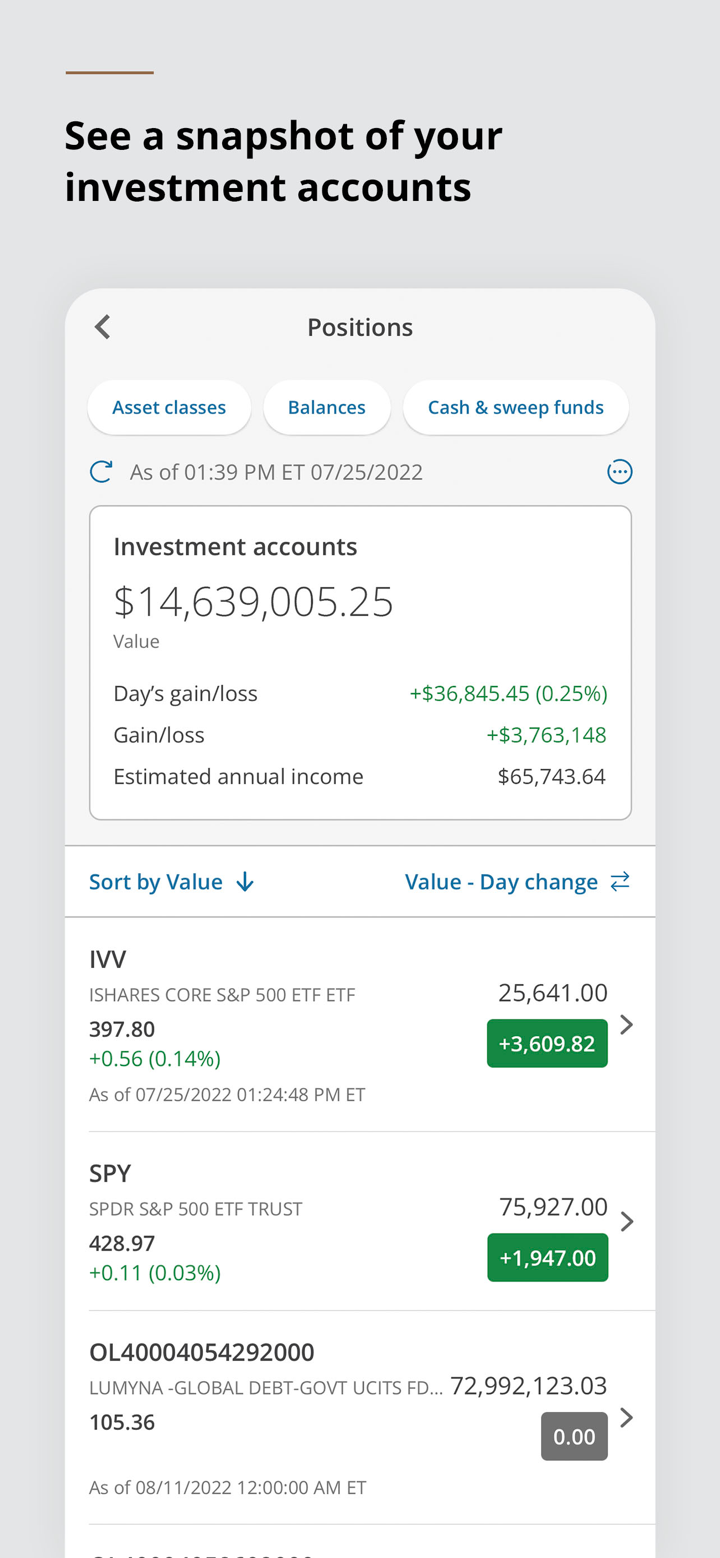

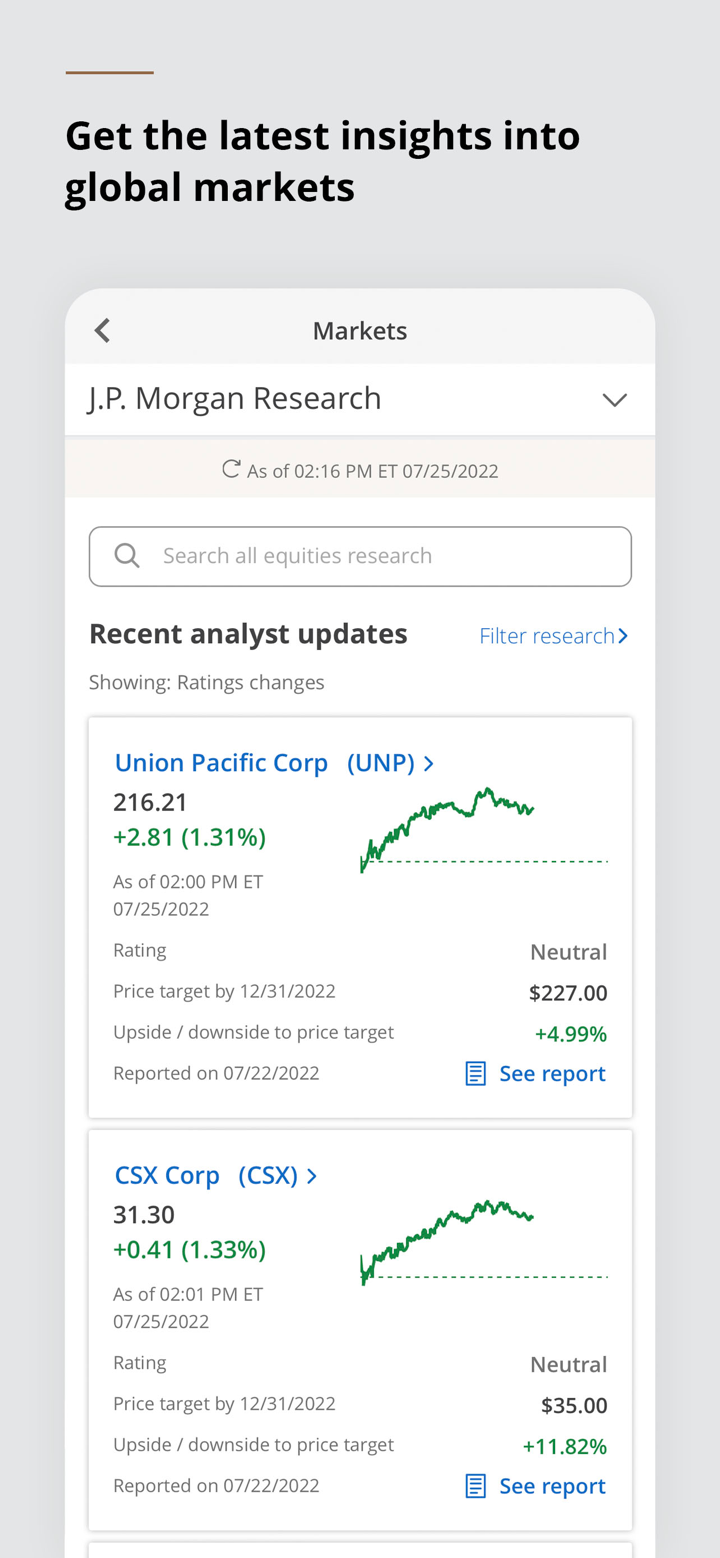

- 机构投资: 摩根大通的机构投资服务为全球最大的公司客户和机构投资者提供支持,通过市场领先的研究、分析、执行和投资者服务支持整个投资周期。

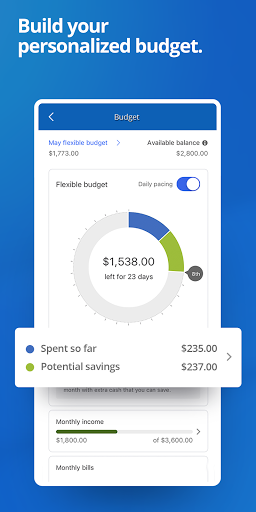

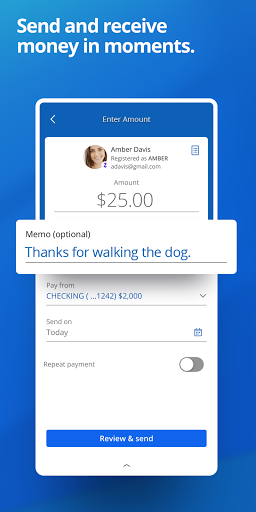

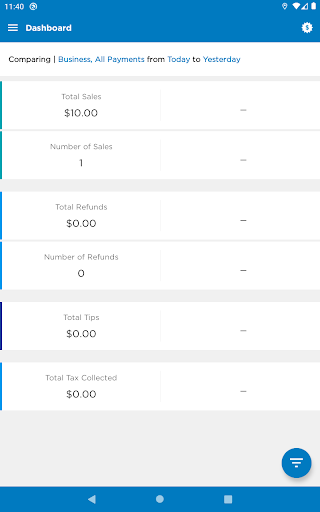

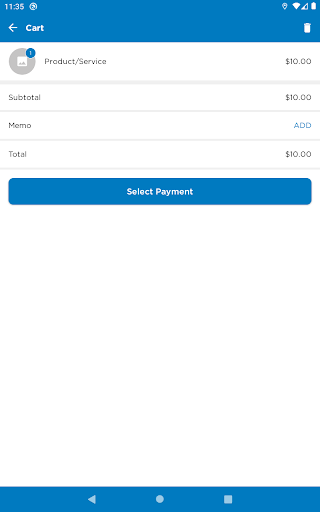

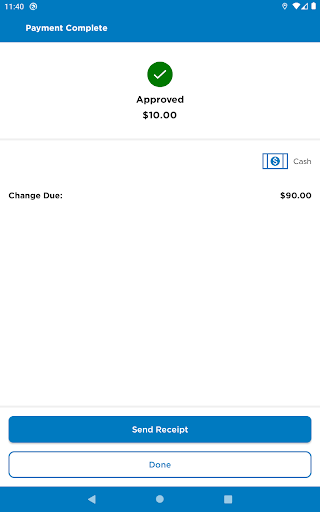

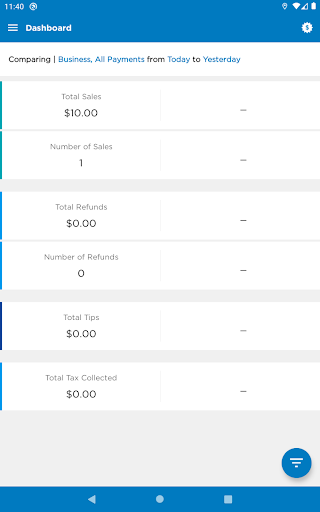

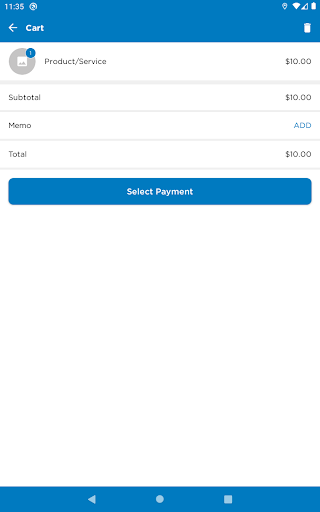

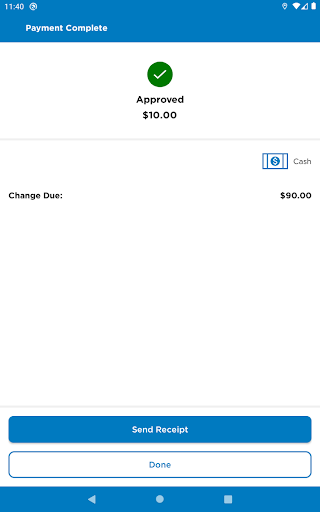

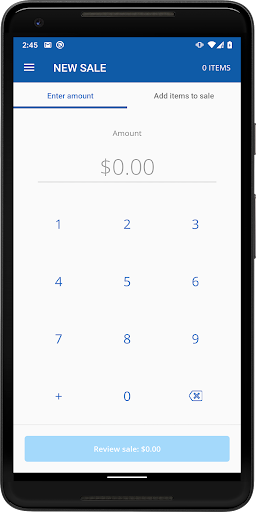

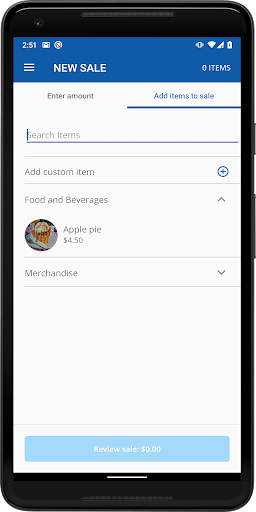

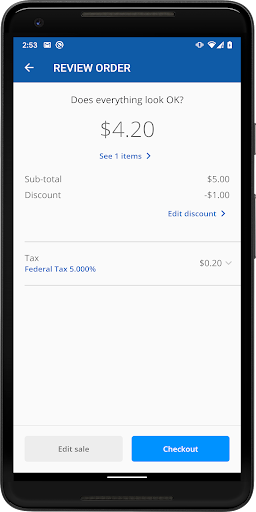

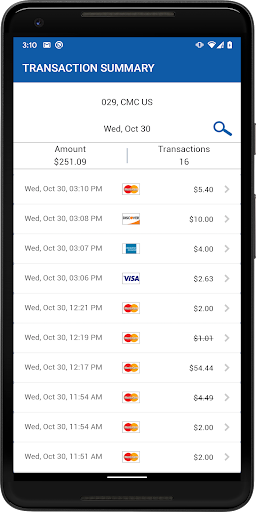

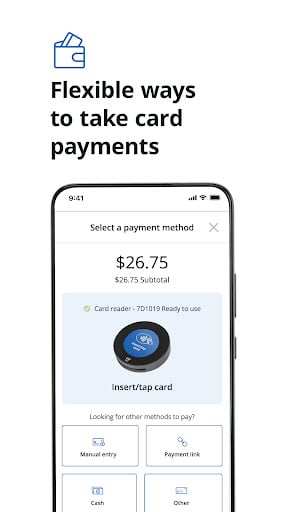

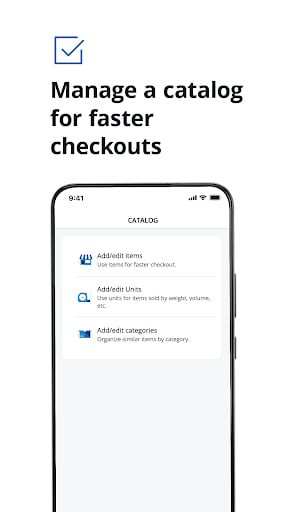

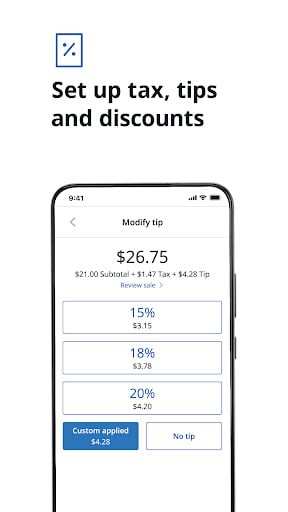

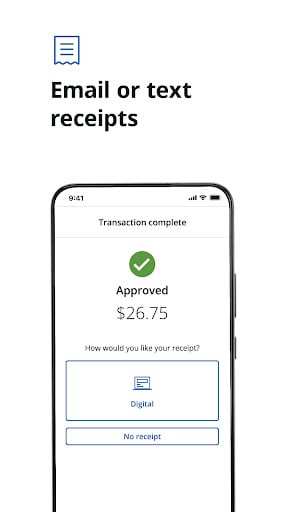

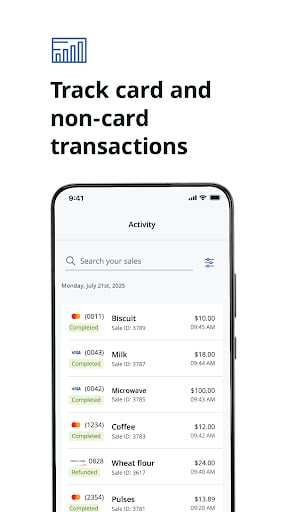

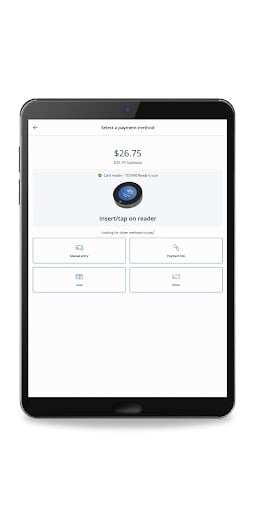

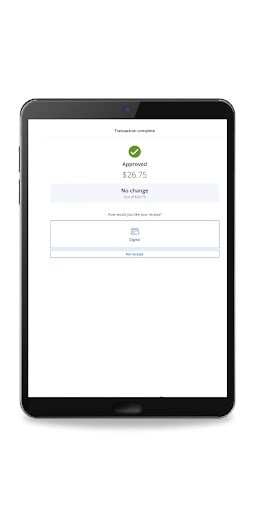

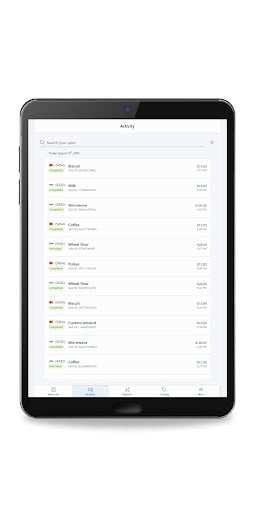

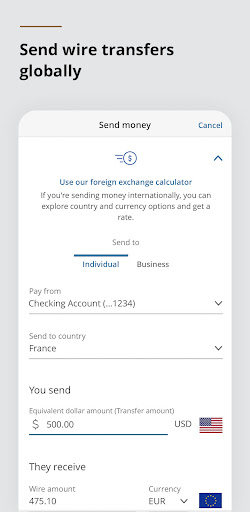

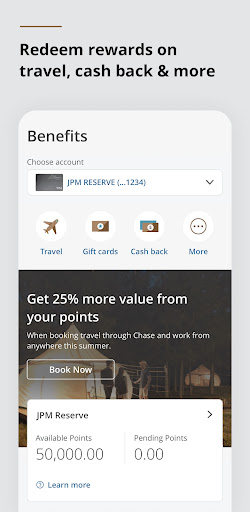

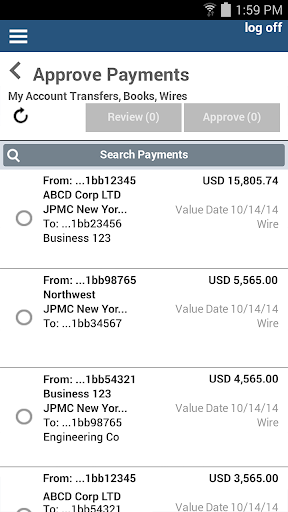

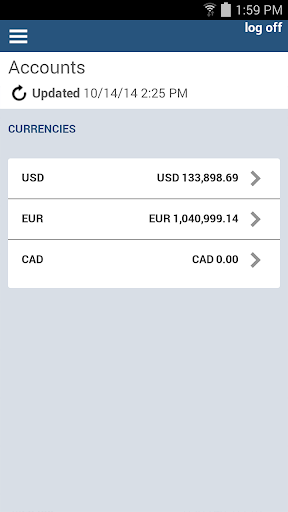

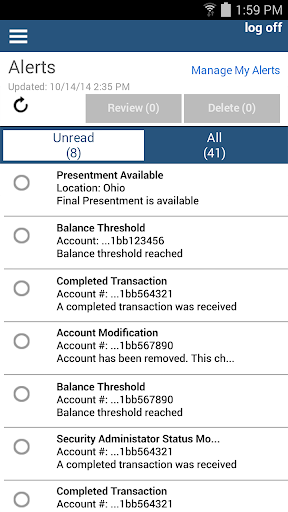

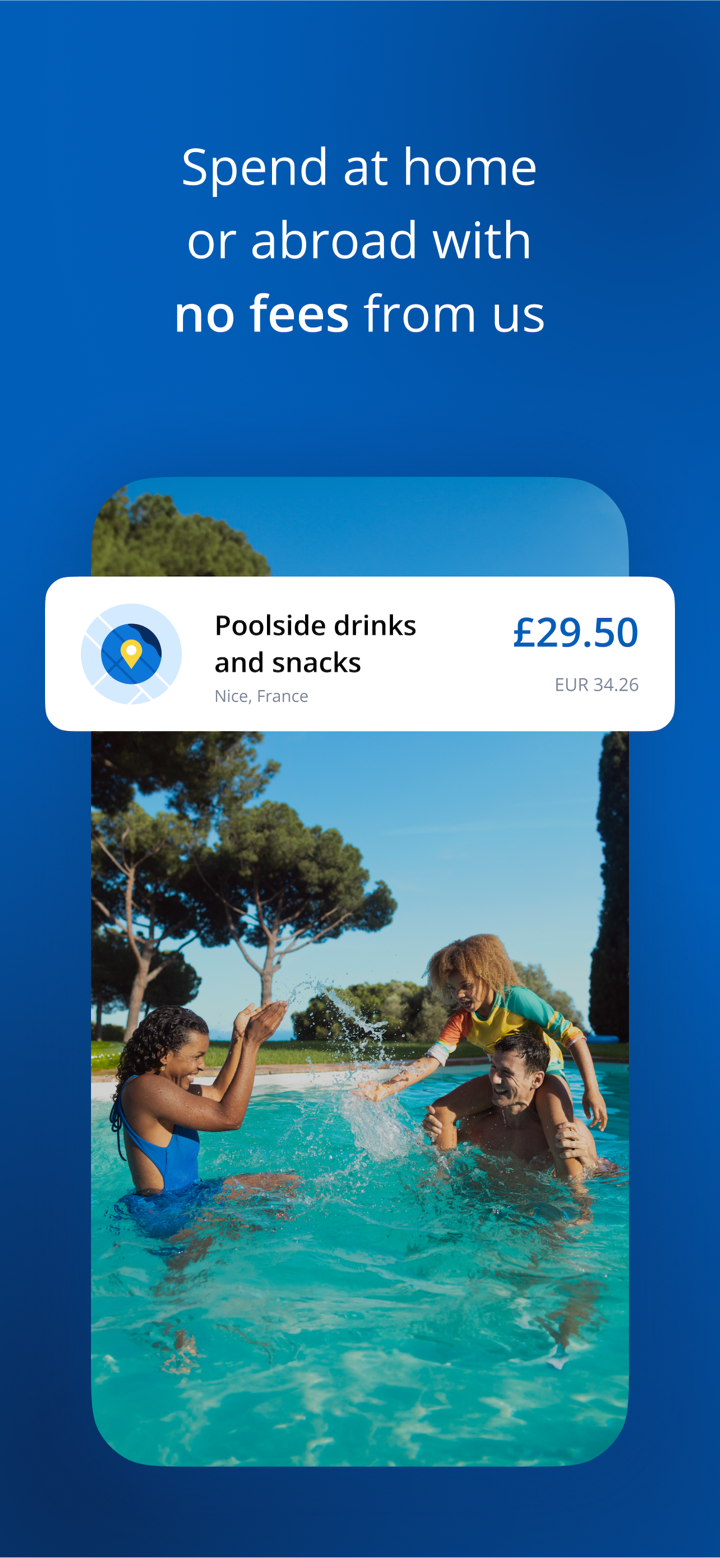

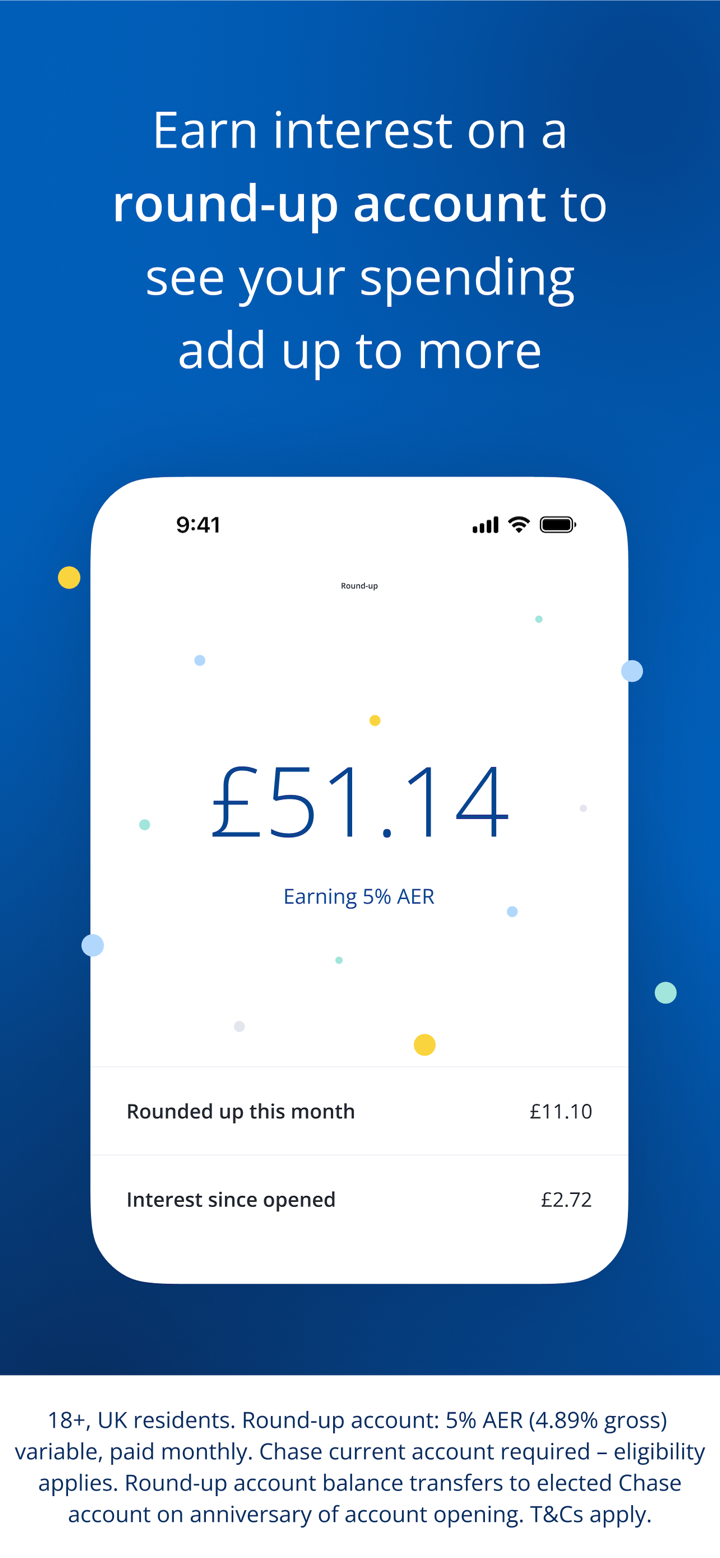

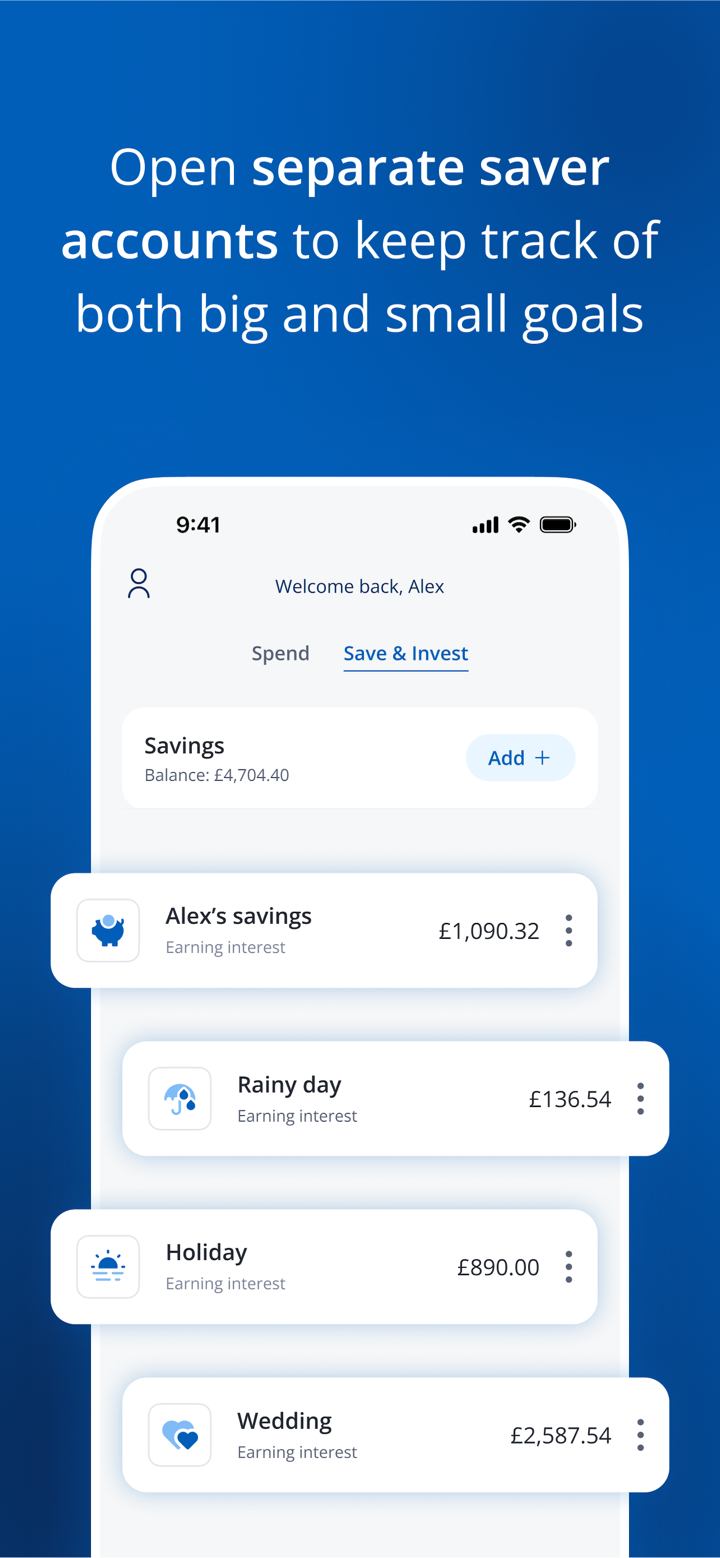

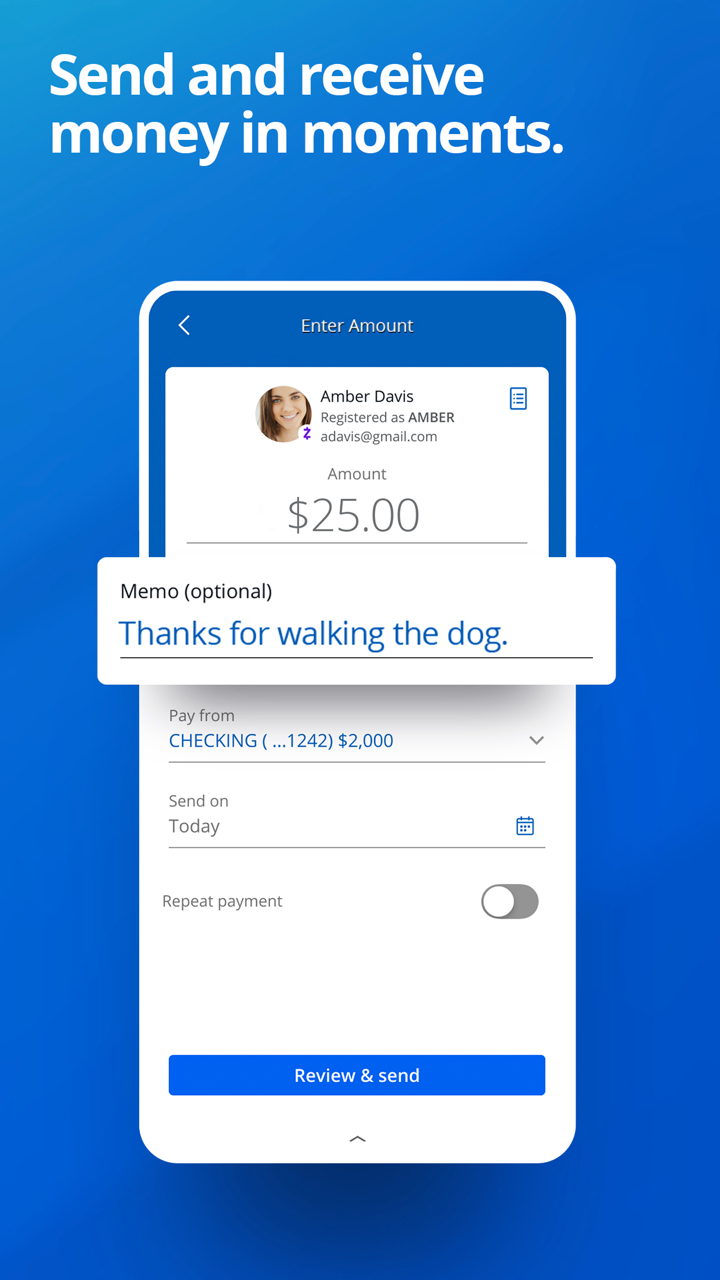

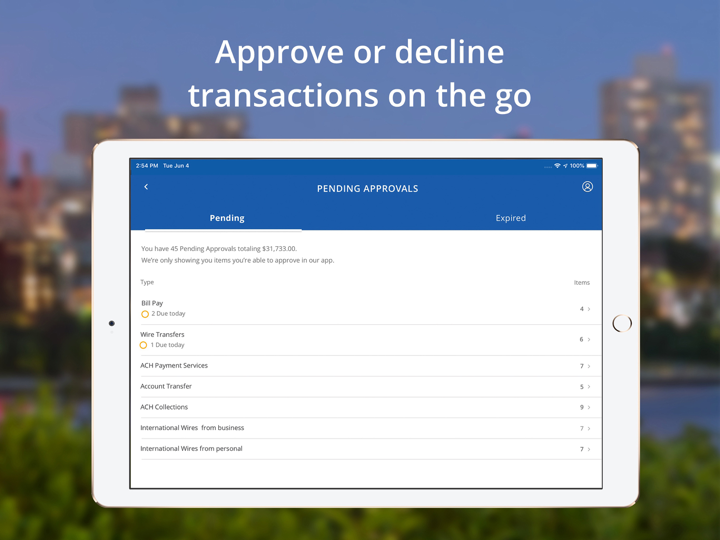

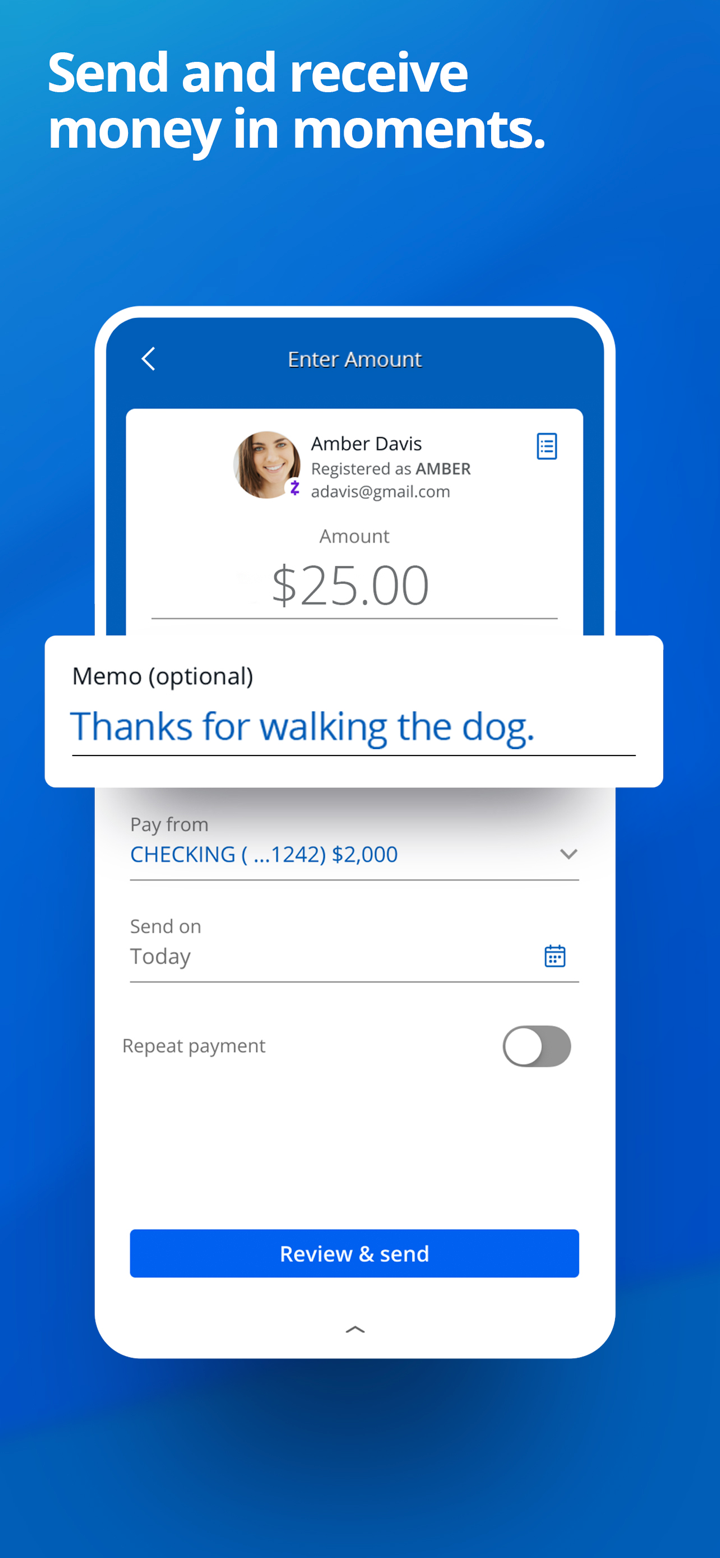

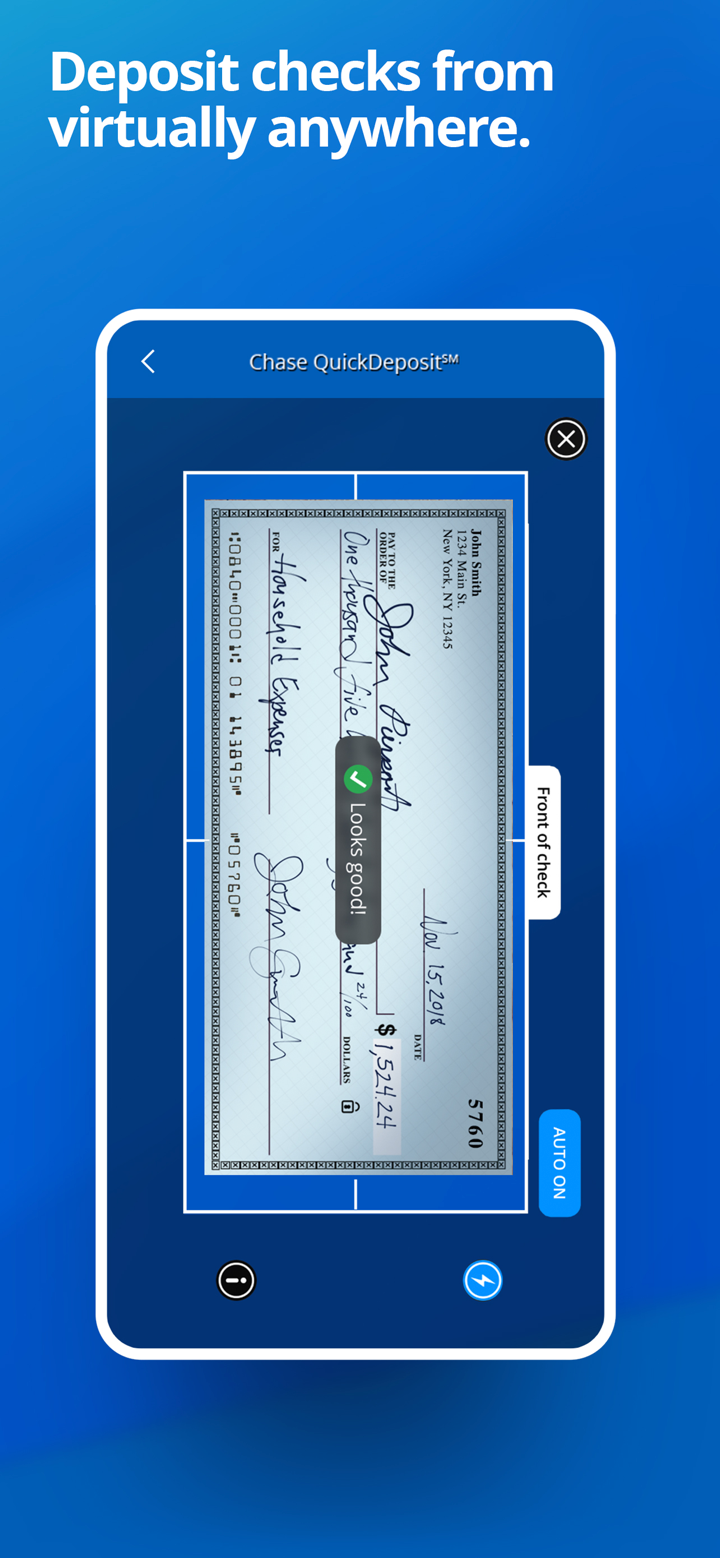

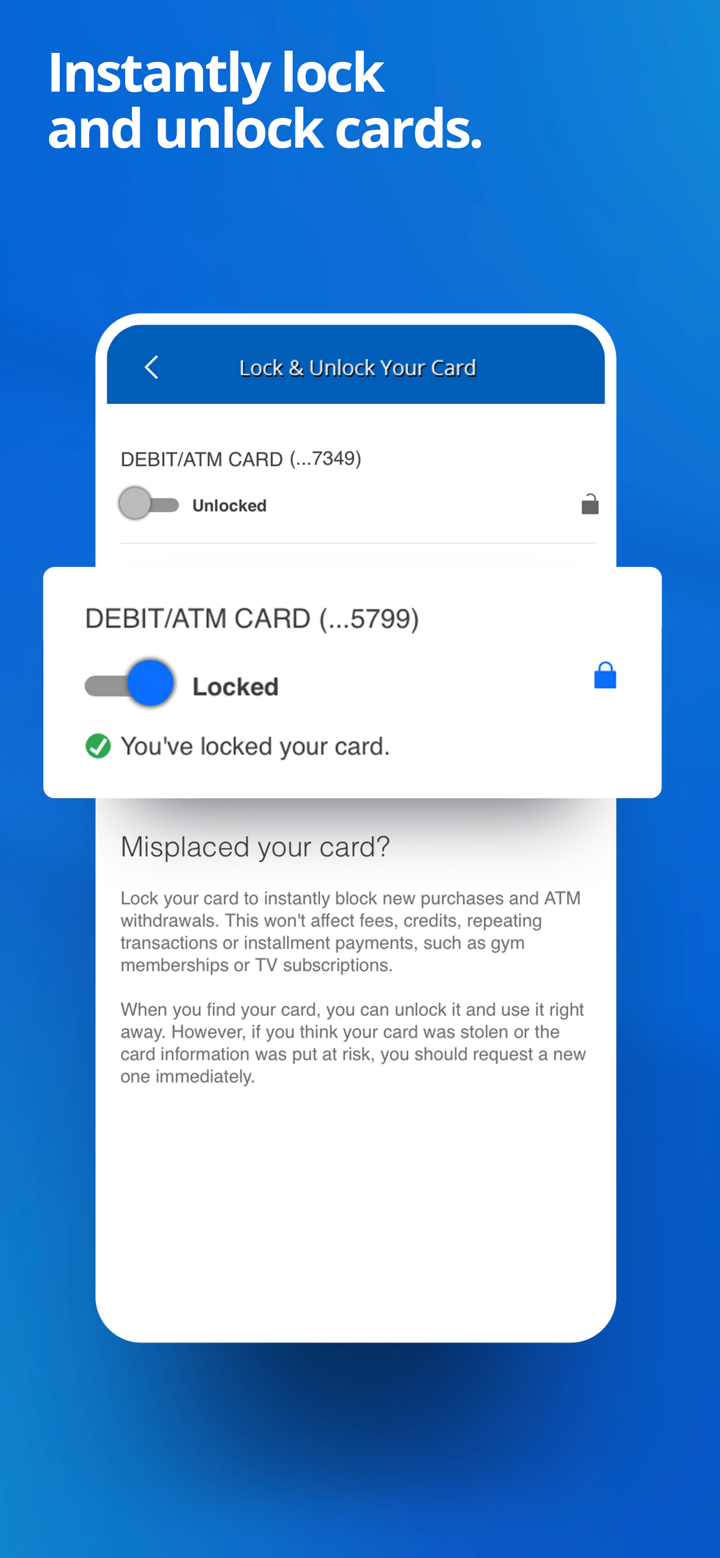

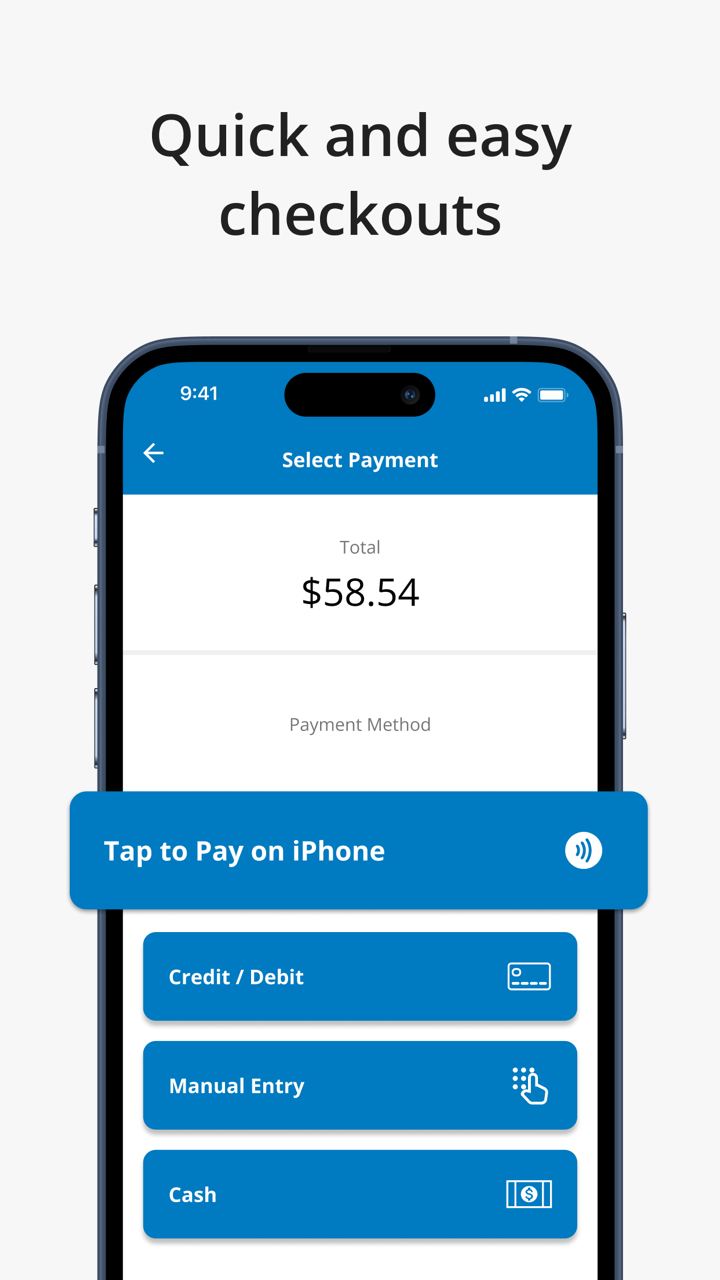

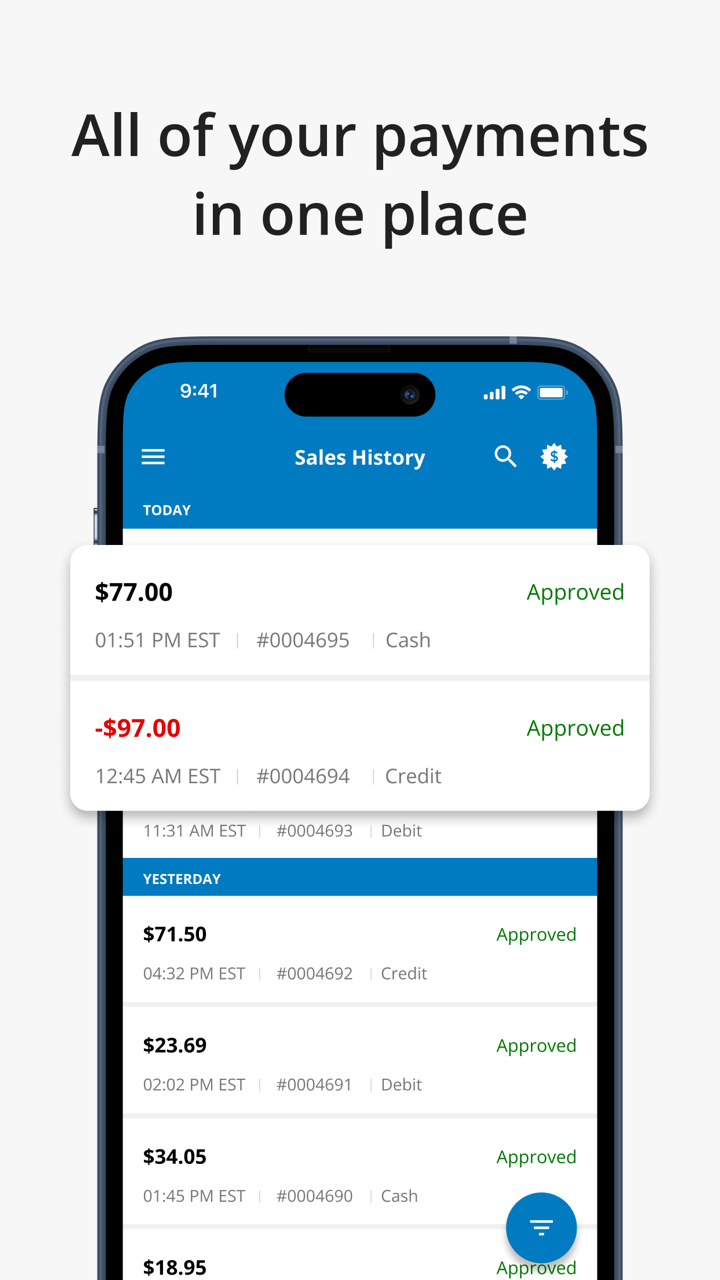

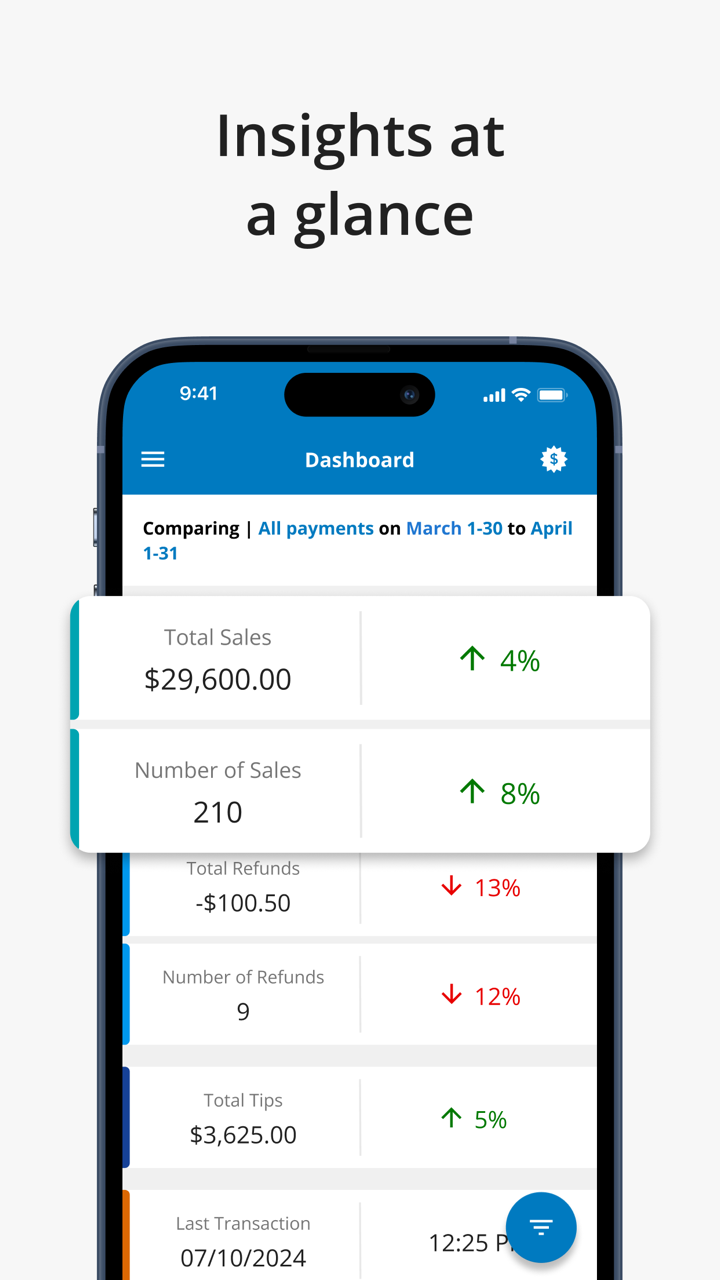

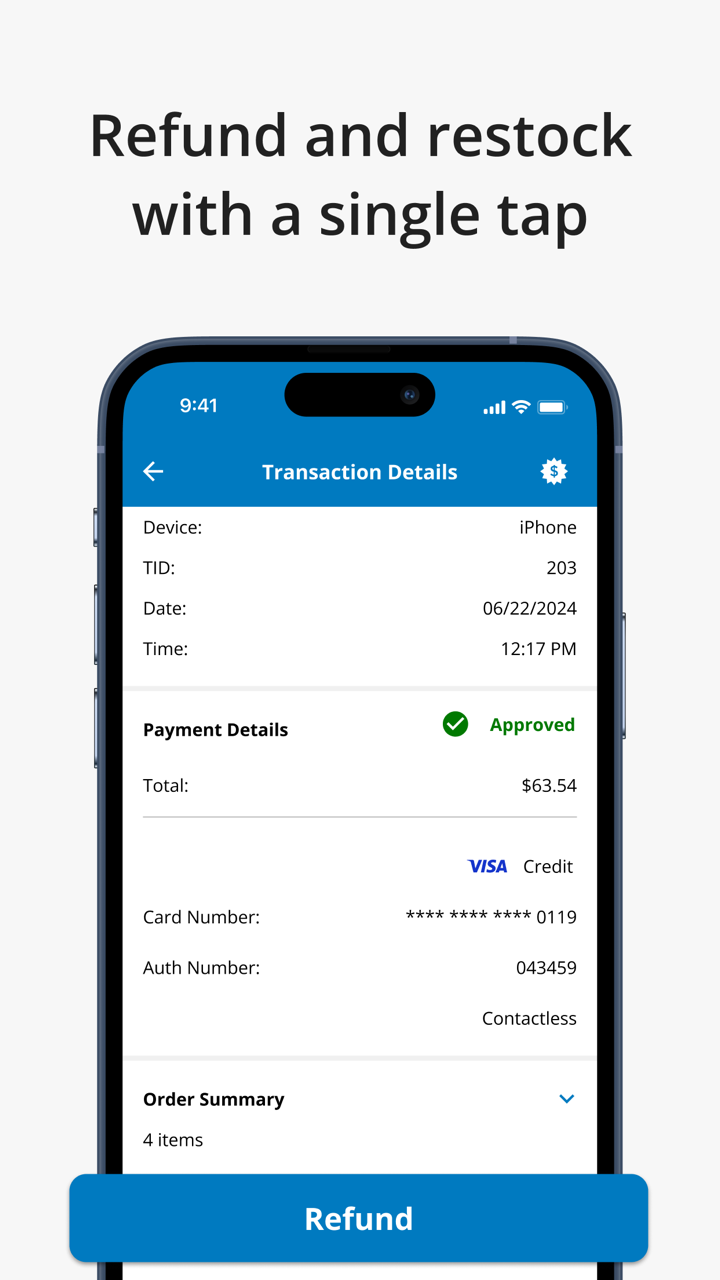

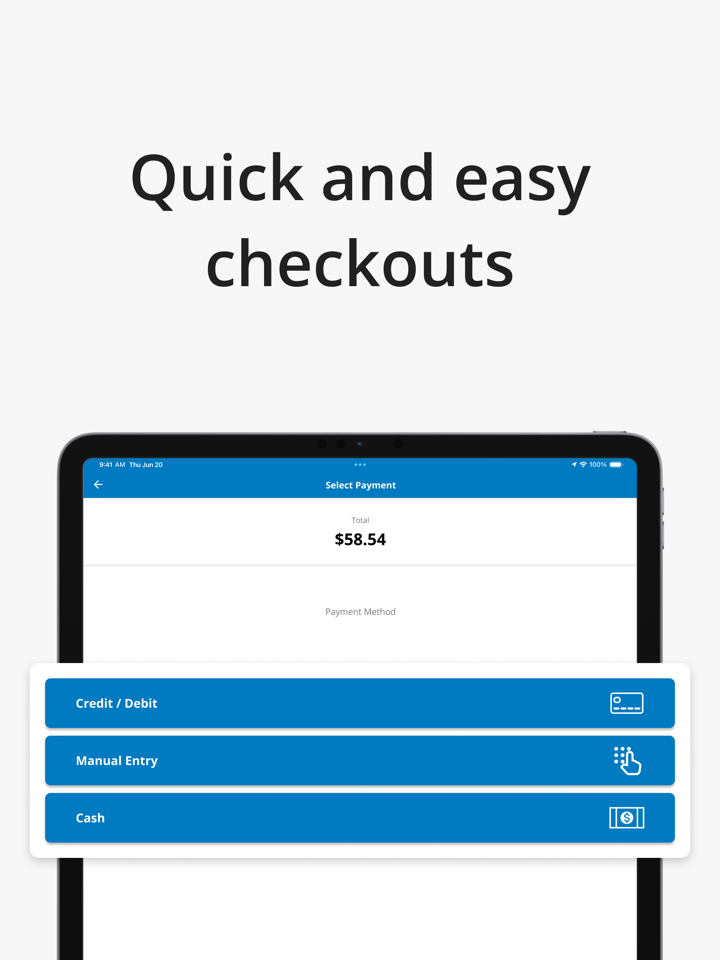

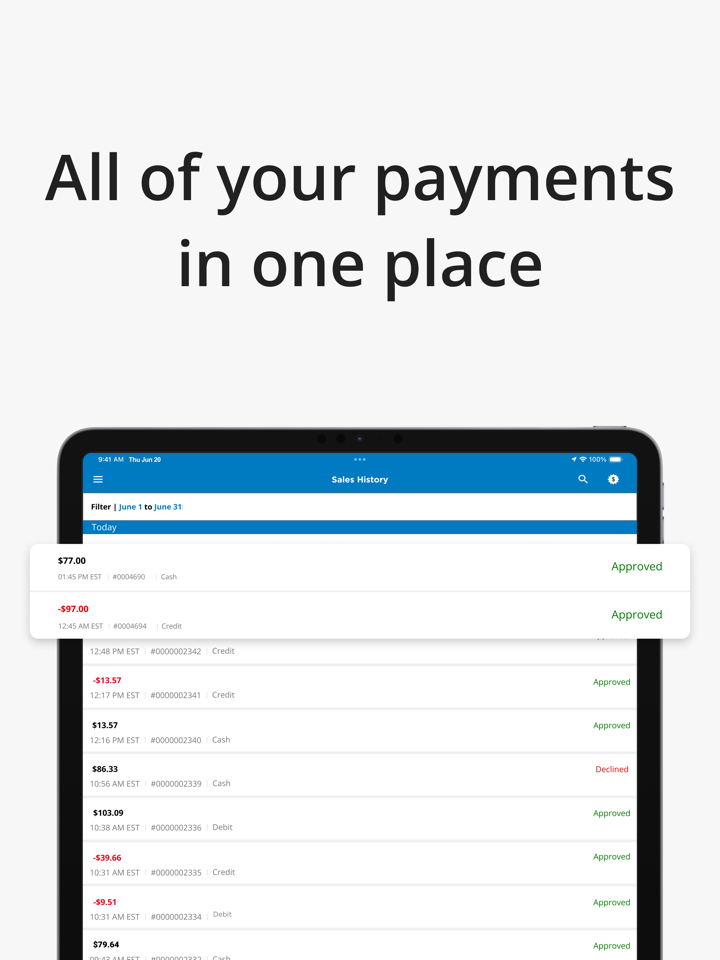

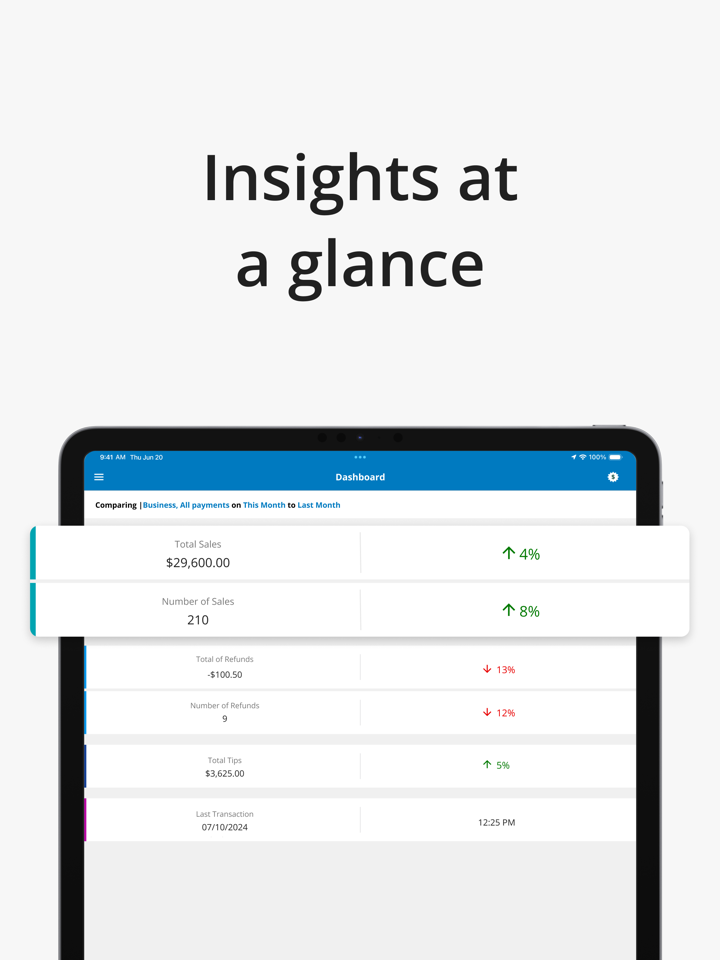

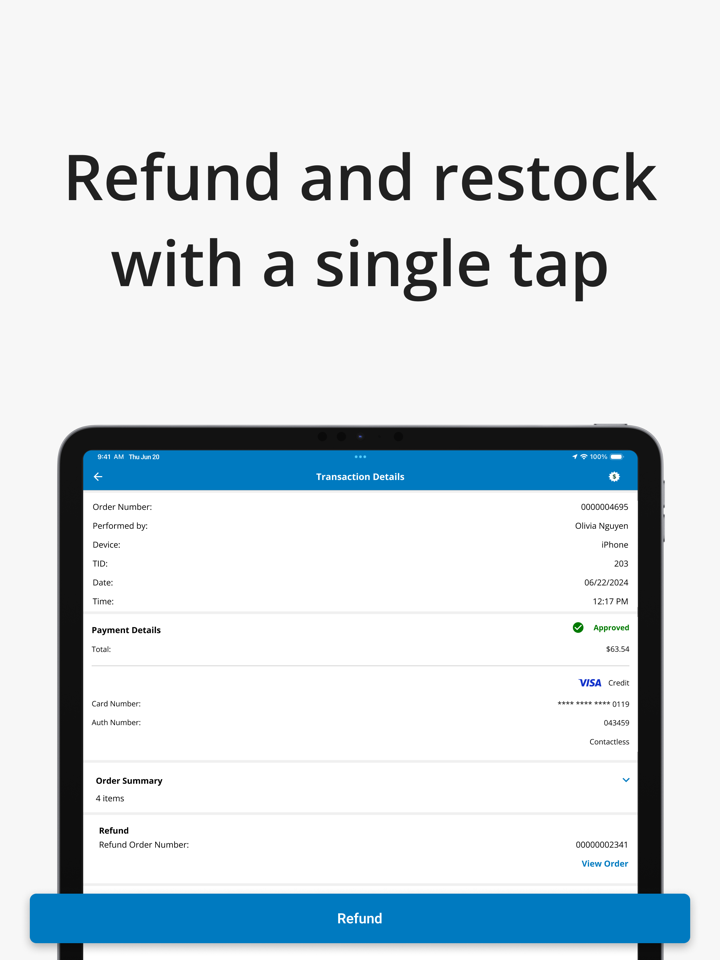

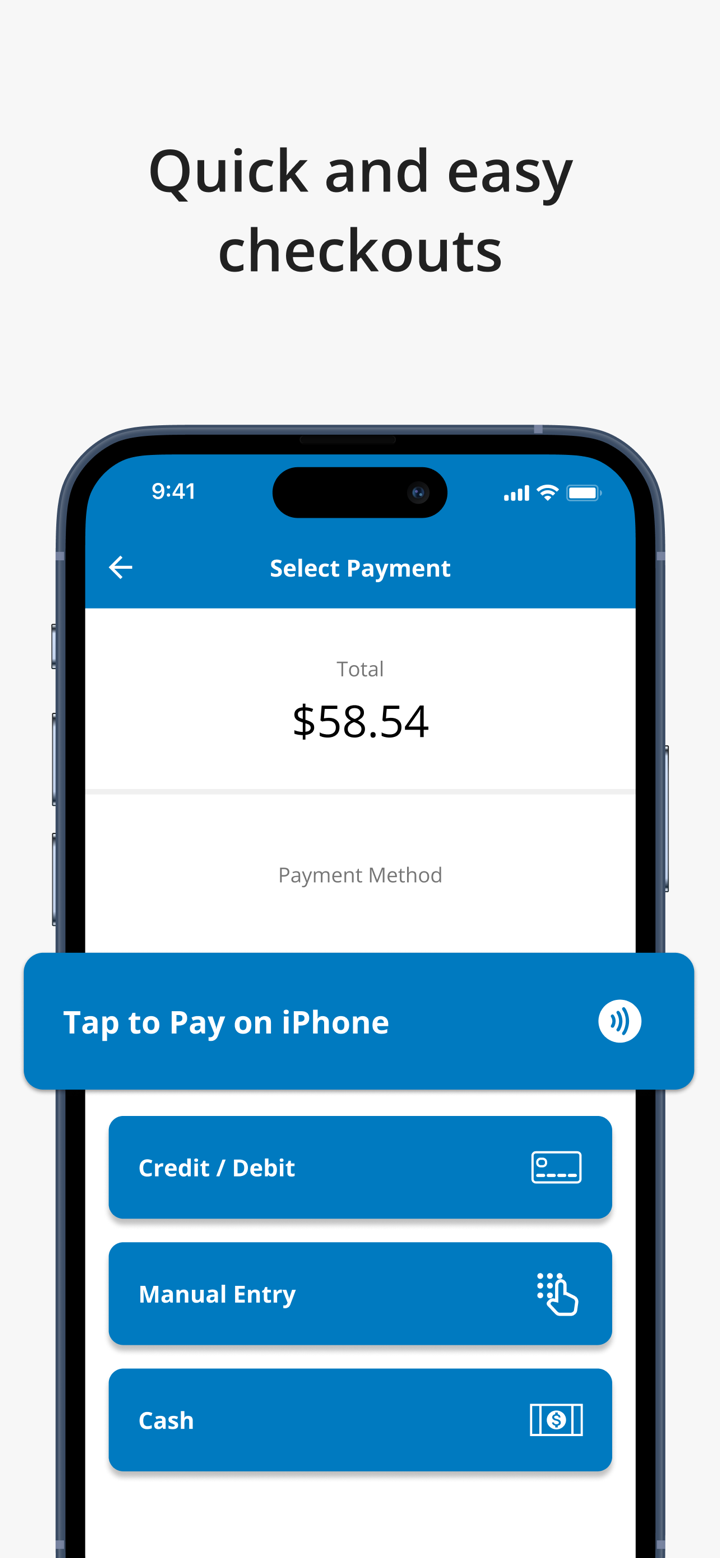

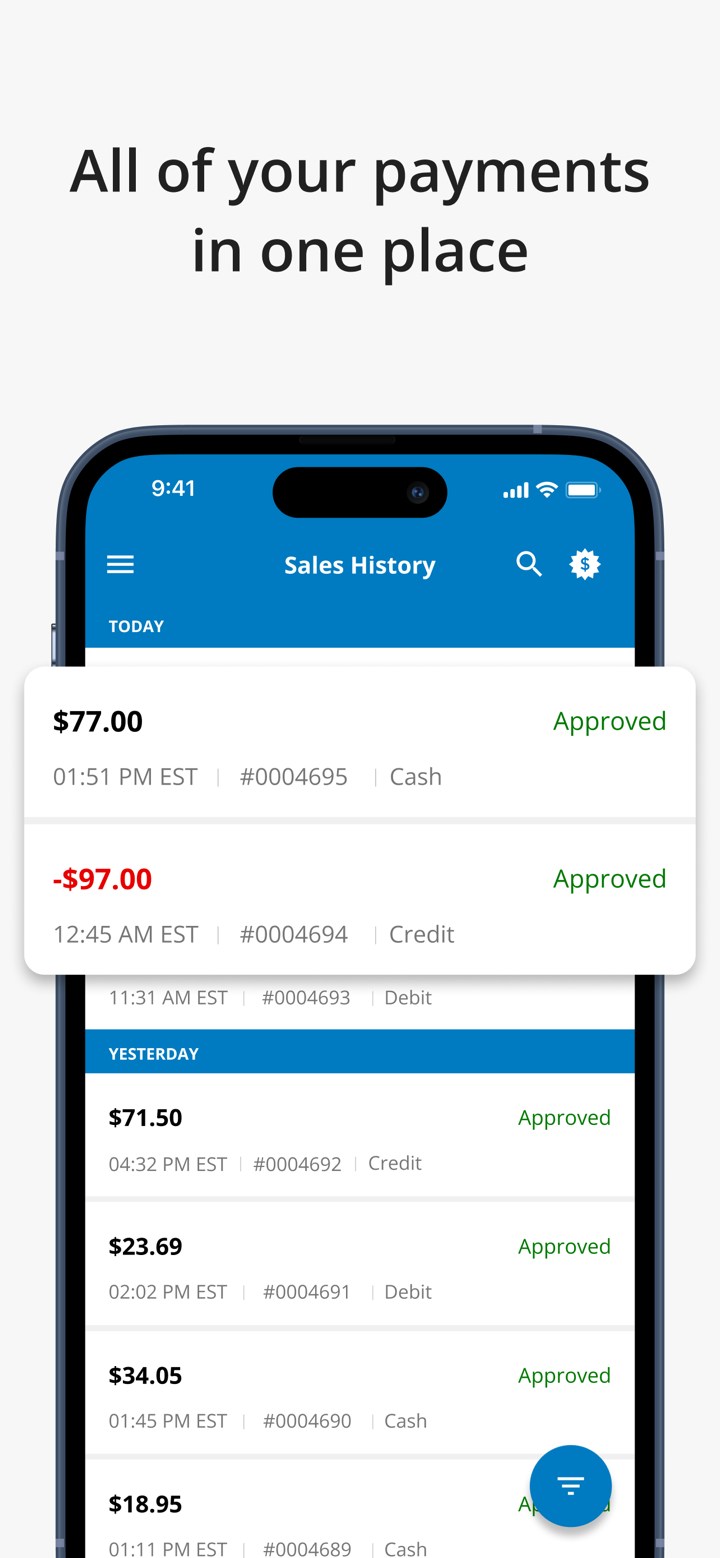

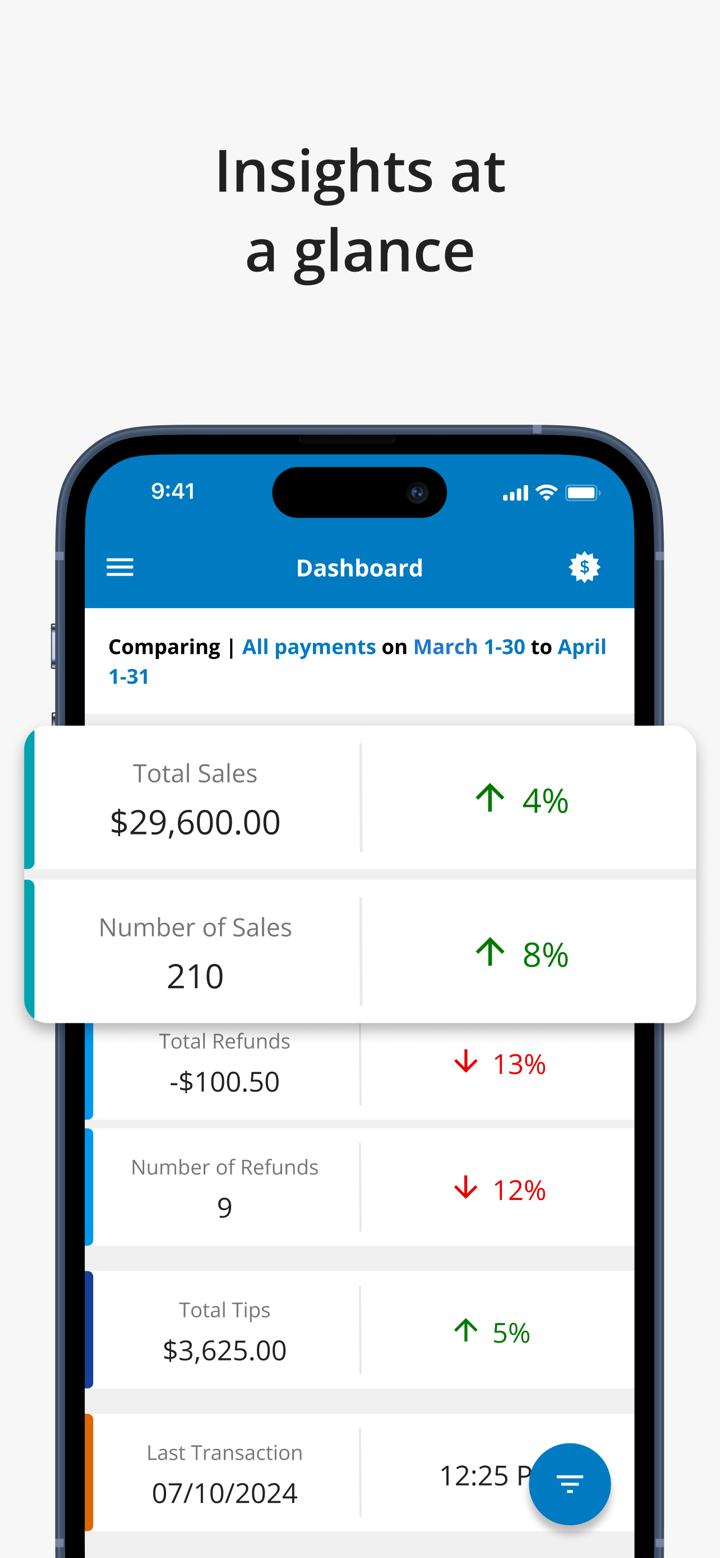

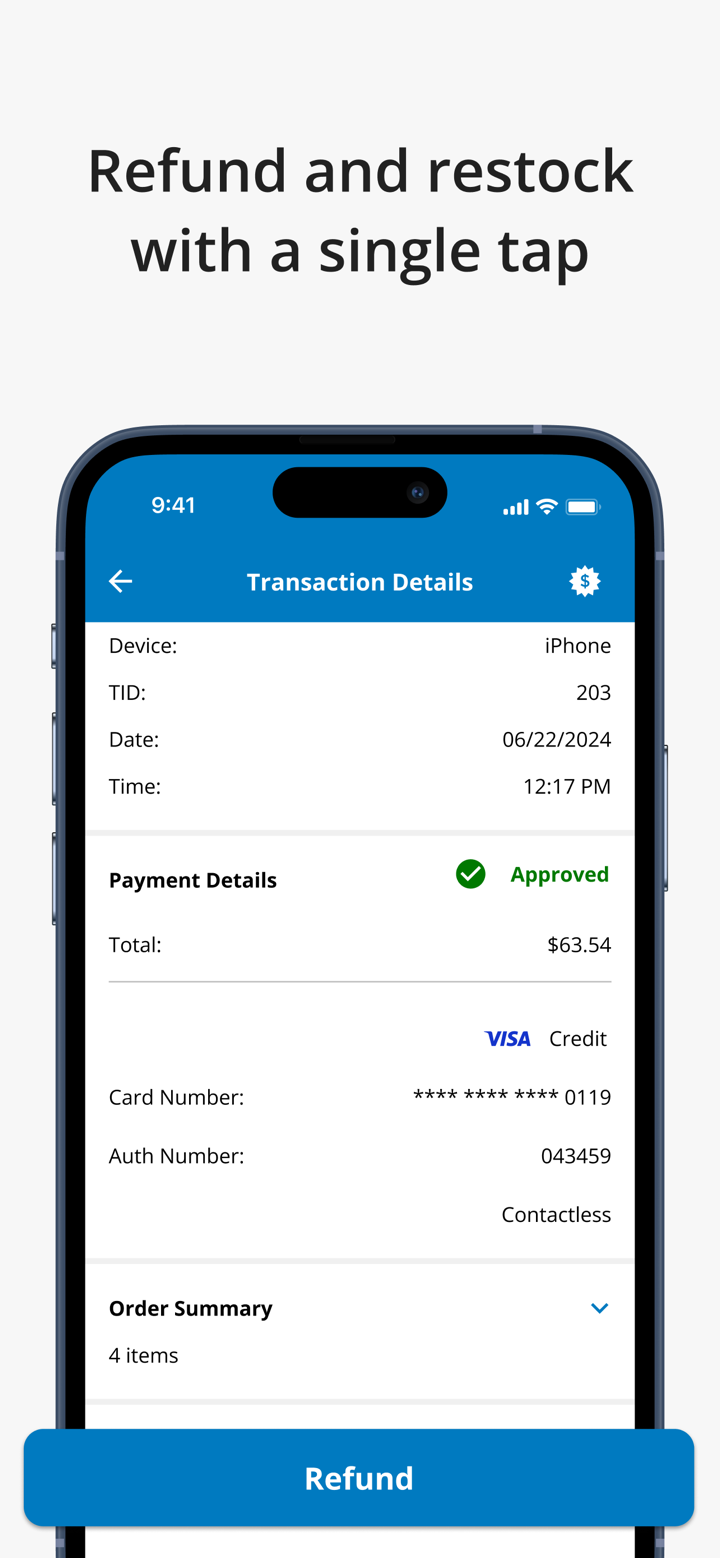

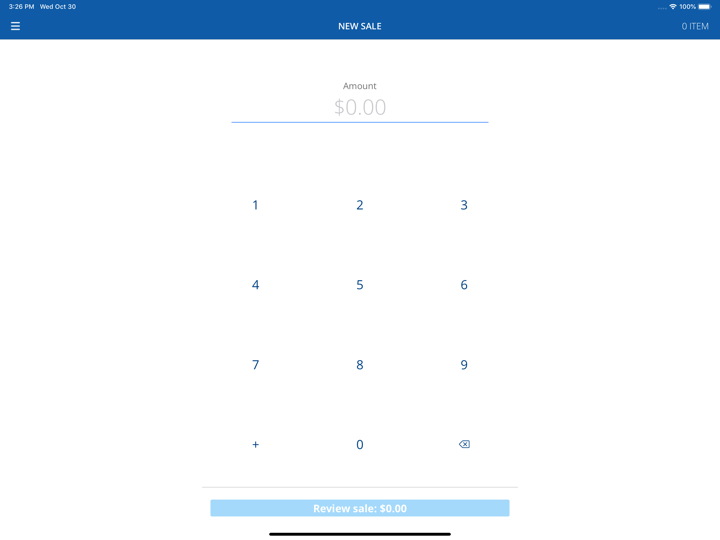

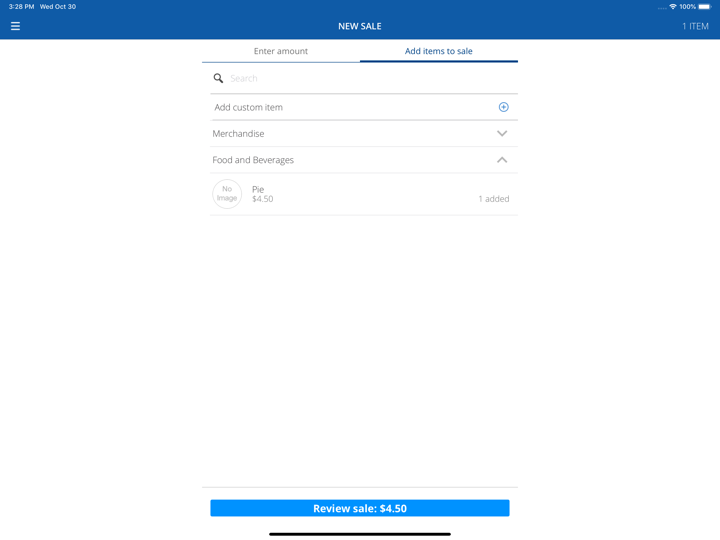

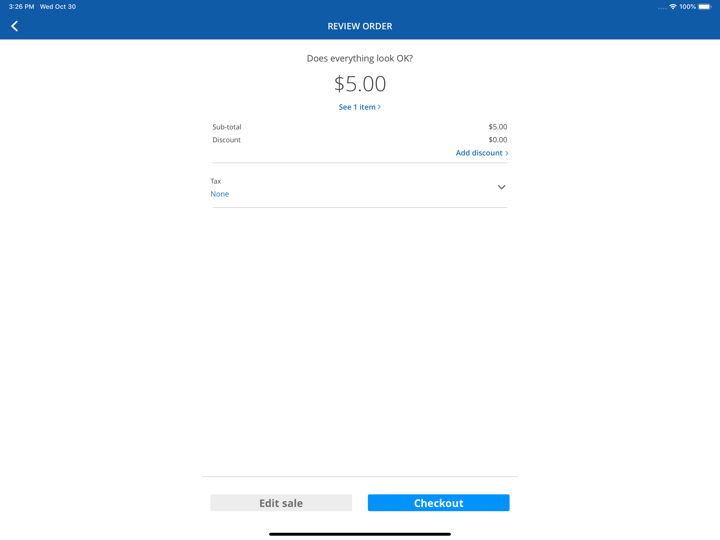

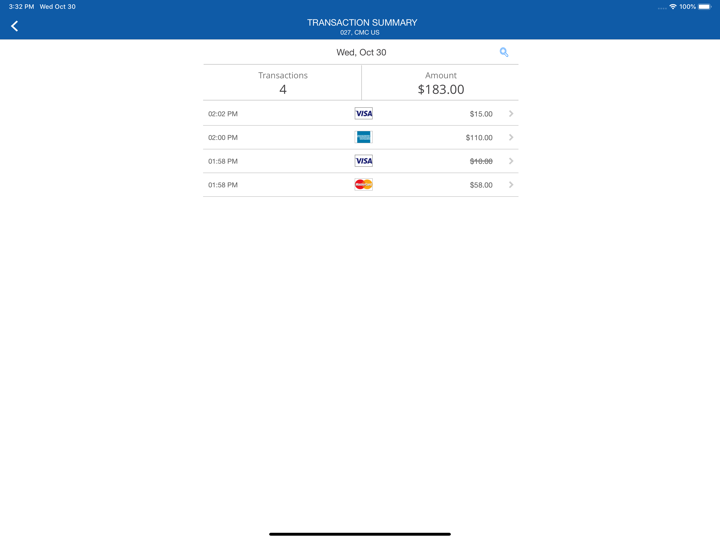

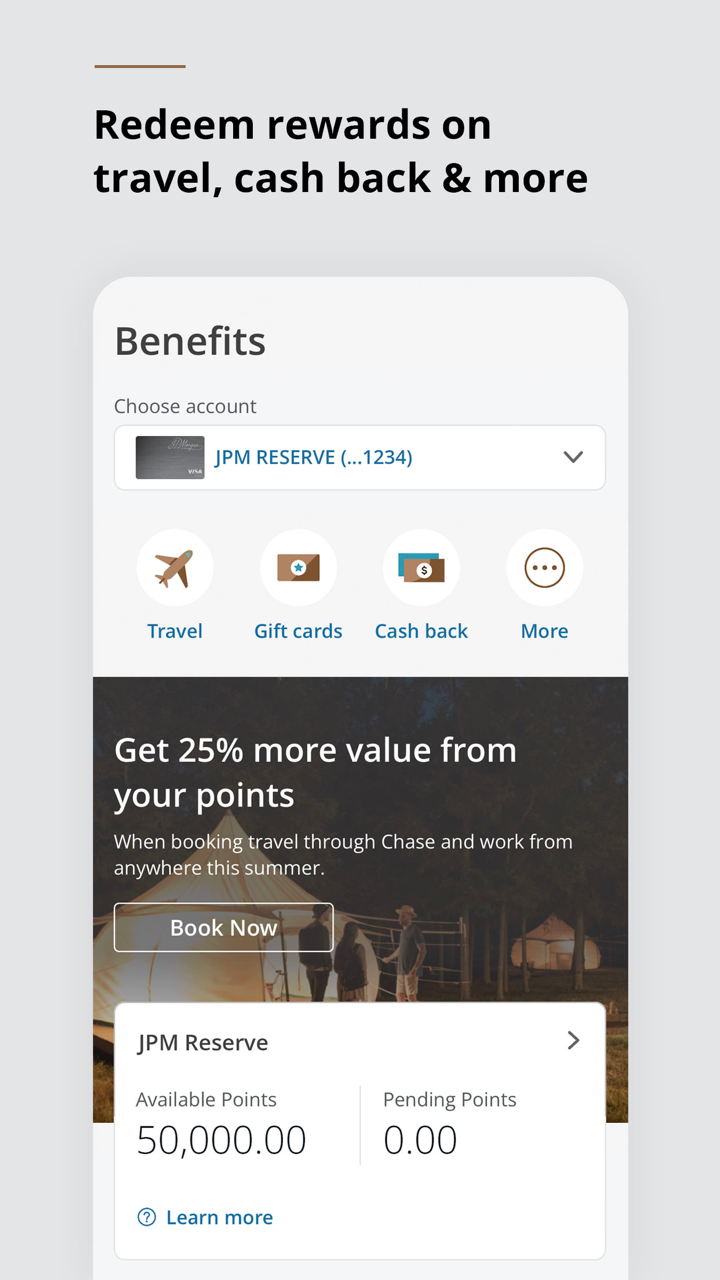

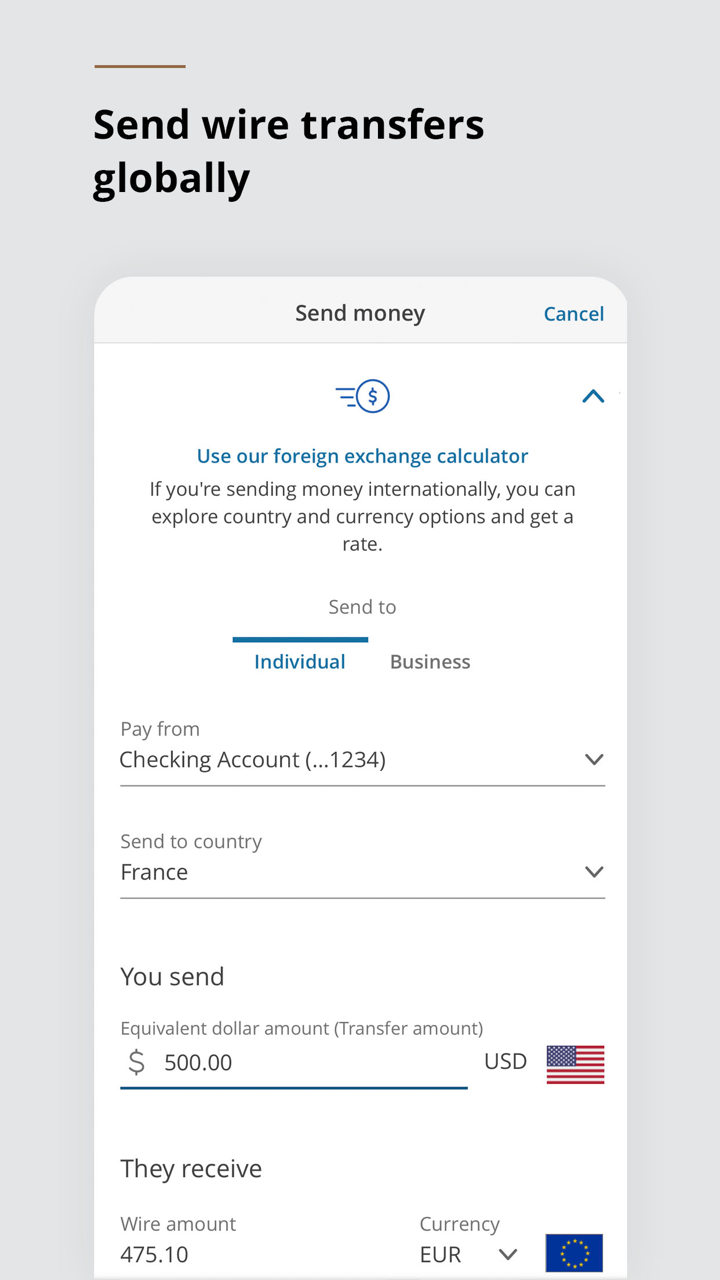

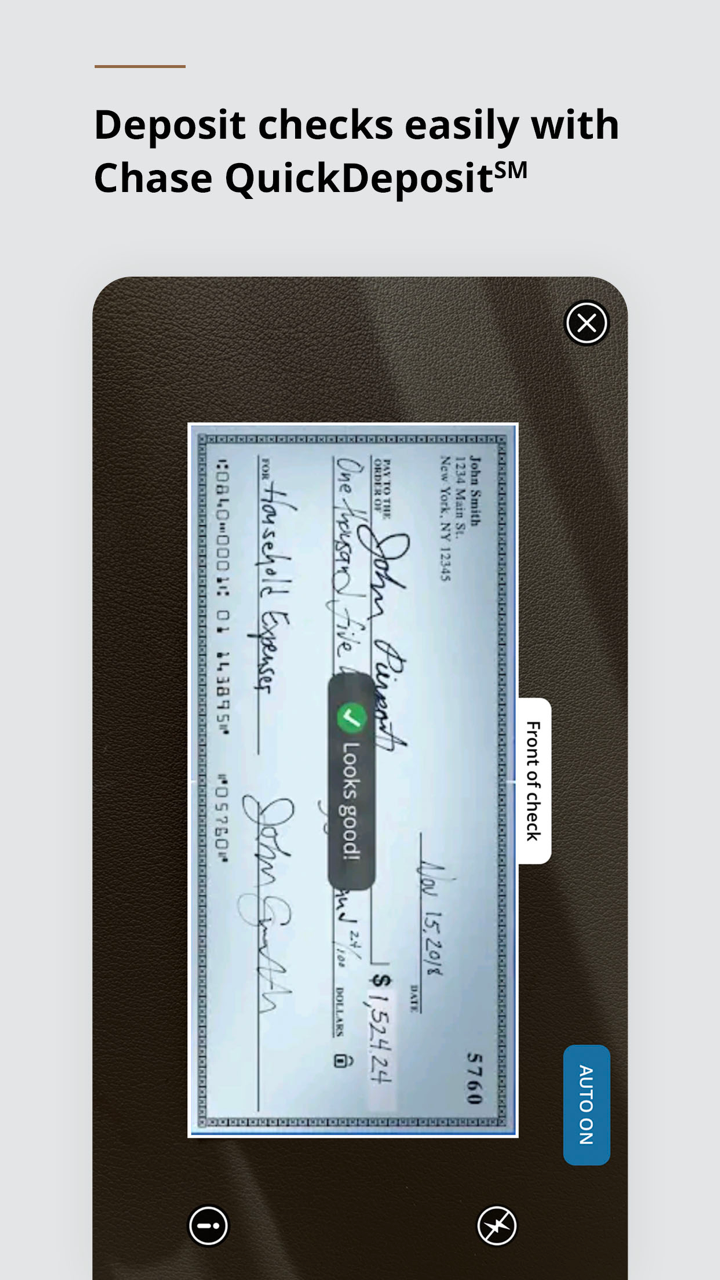

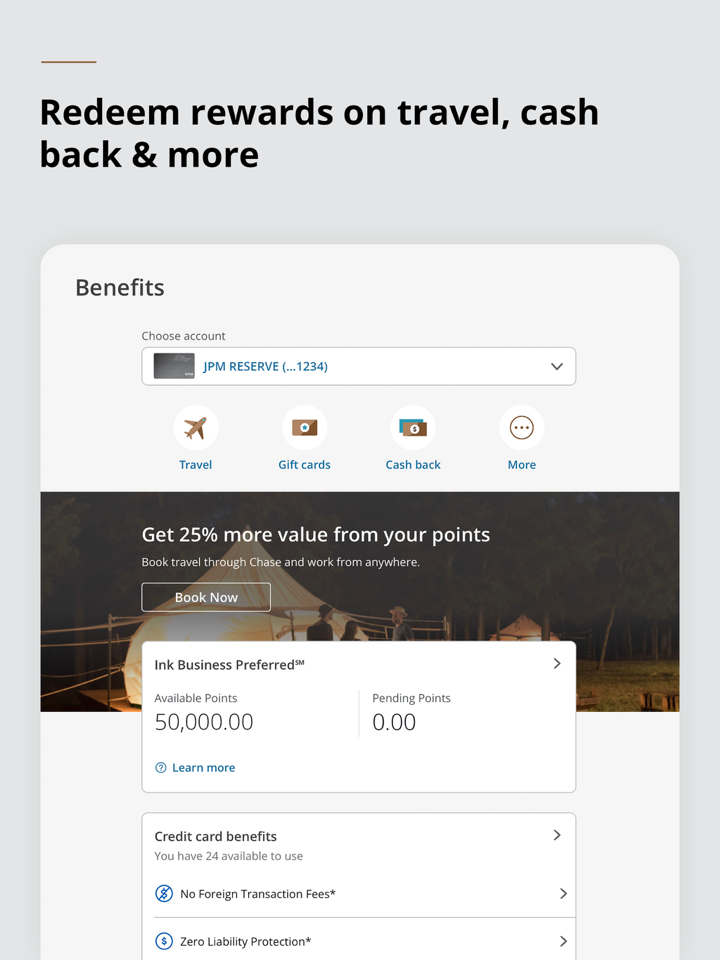

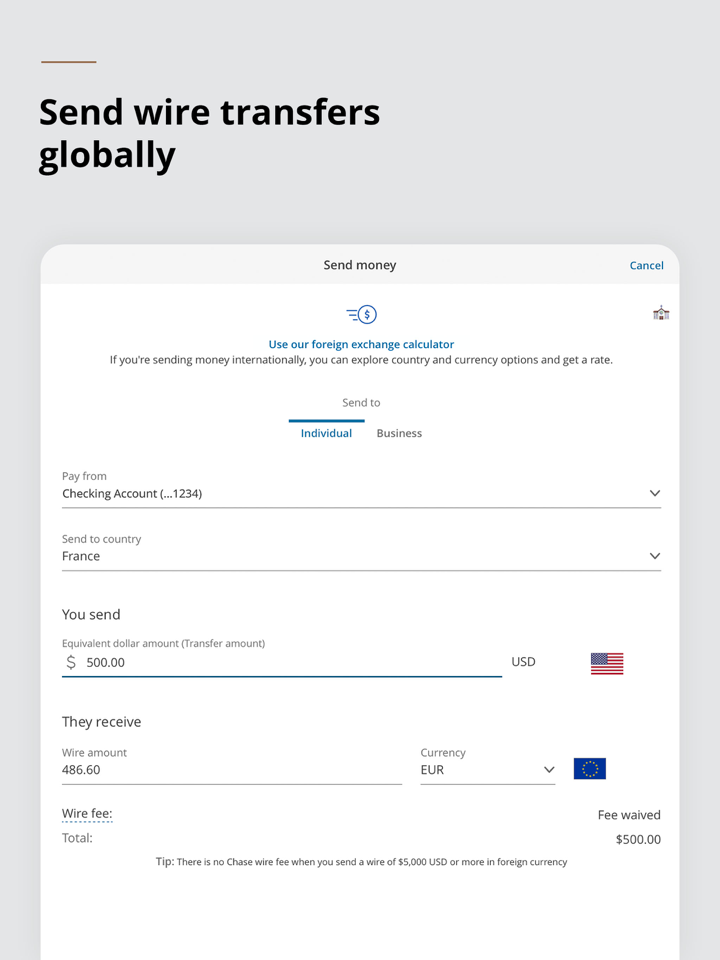

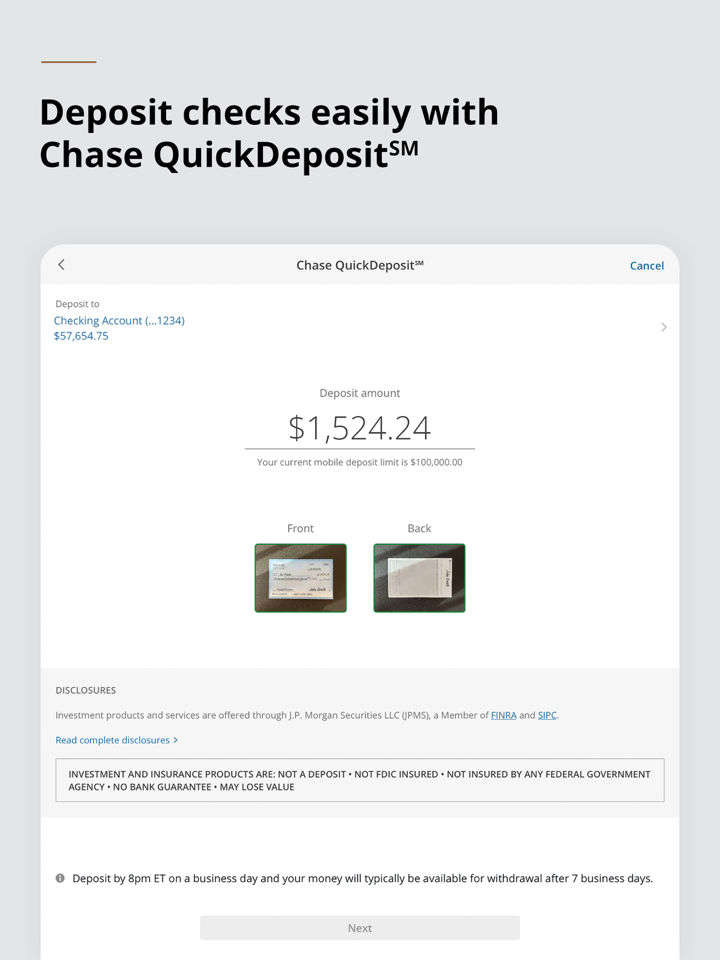

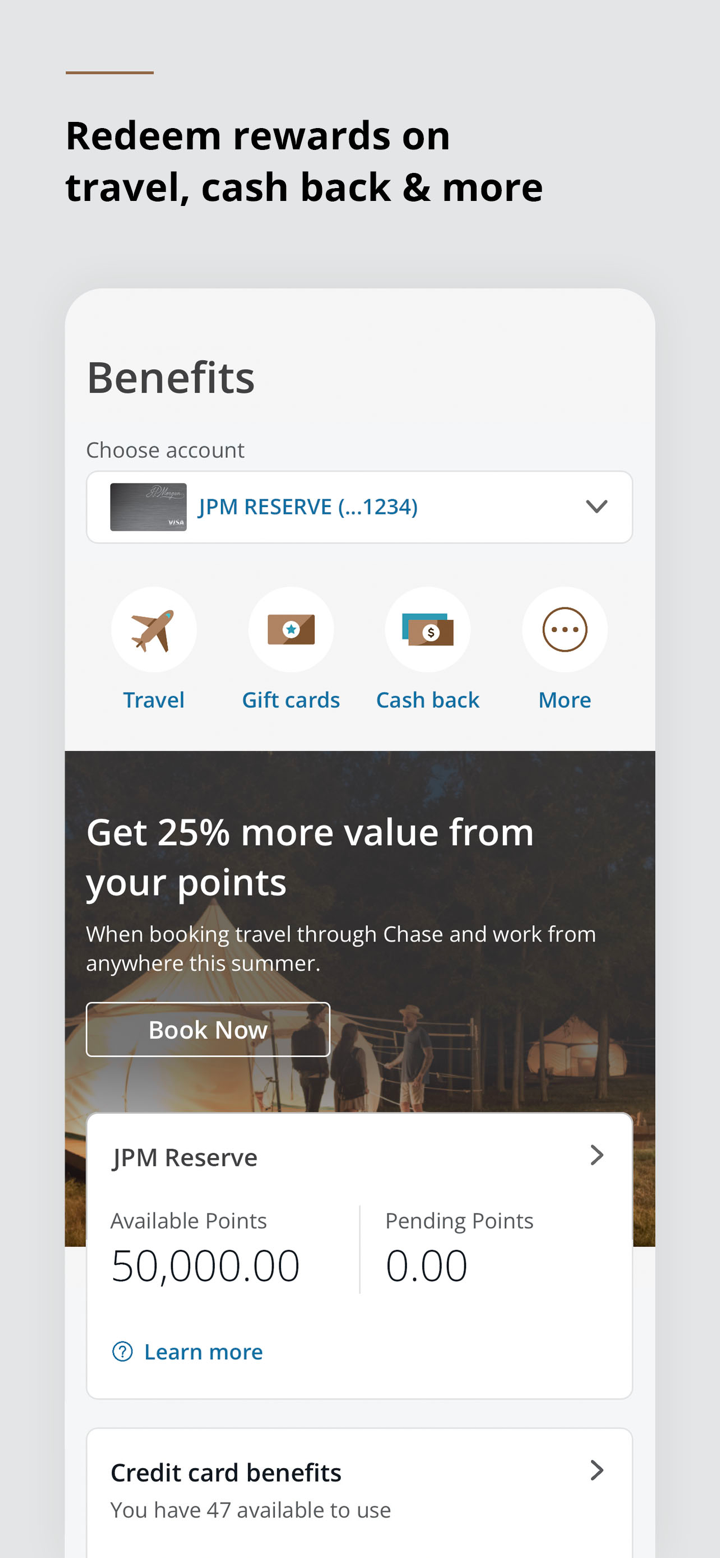

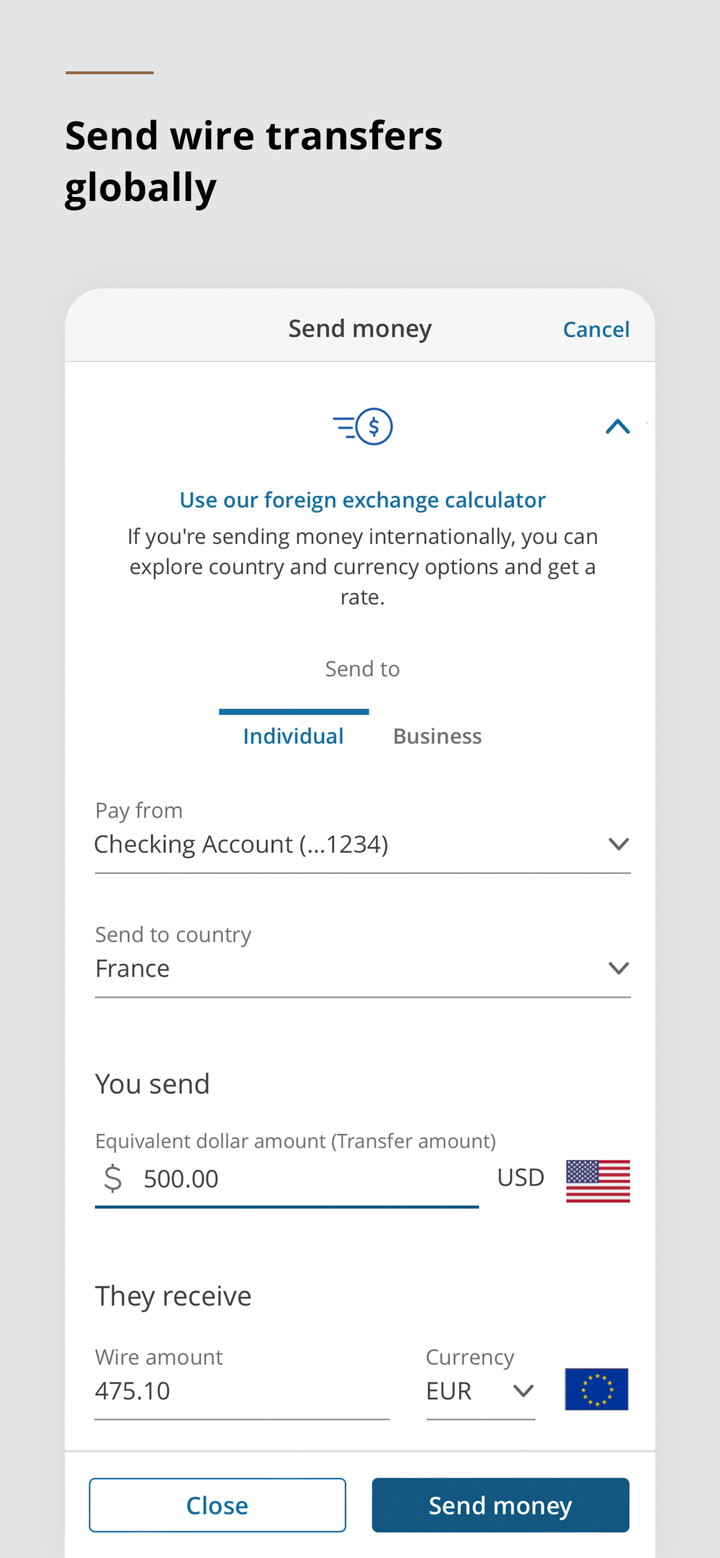

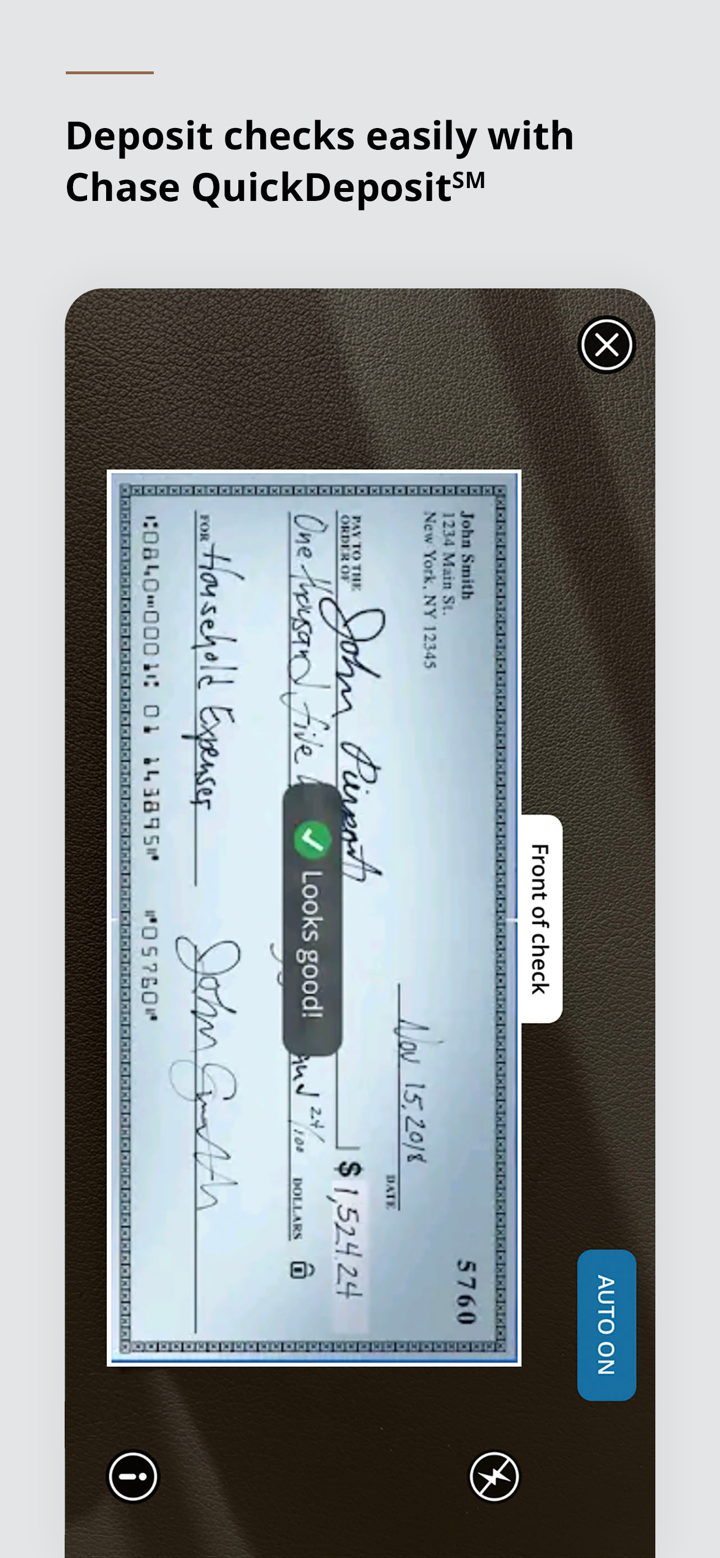

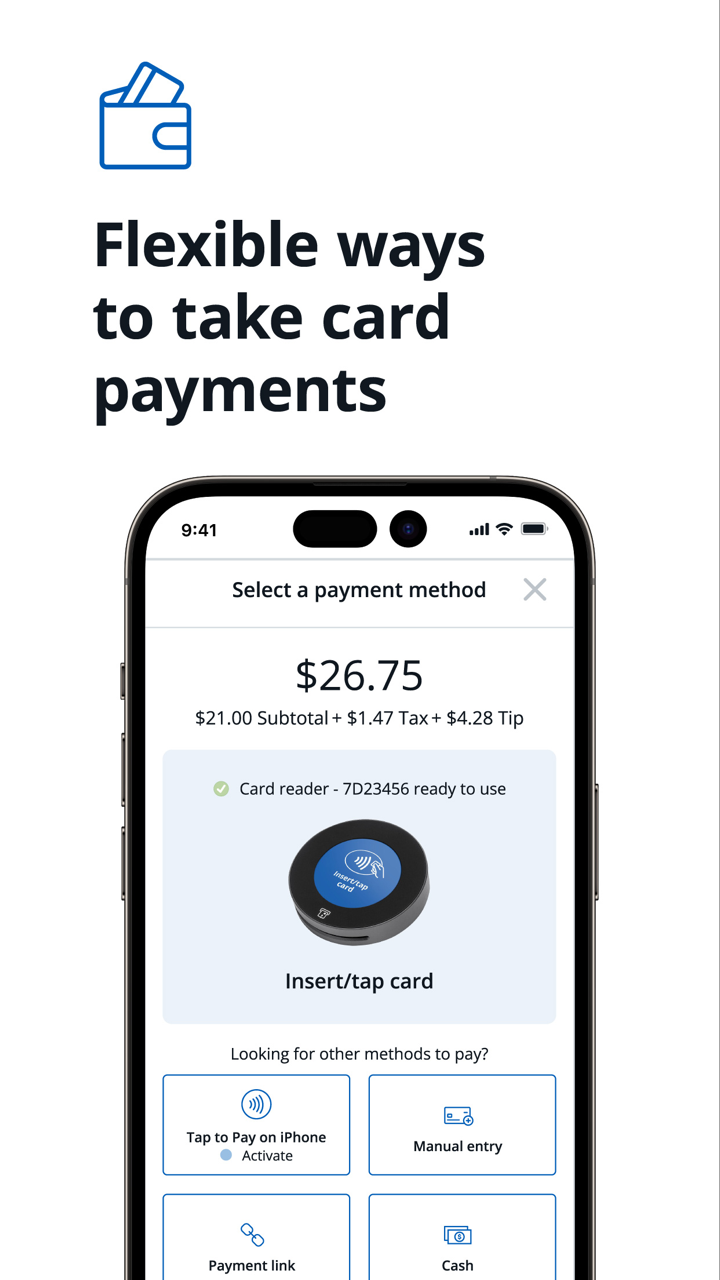

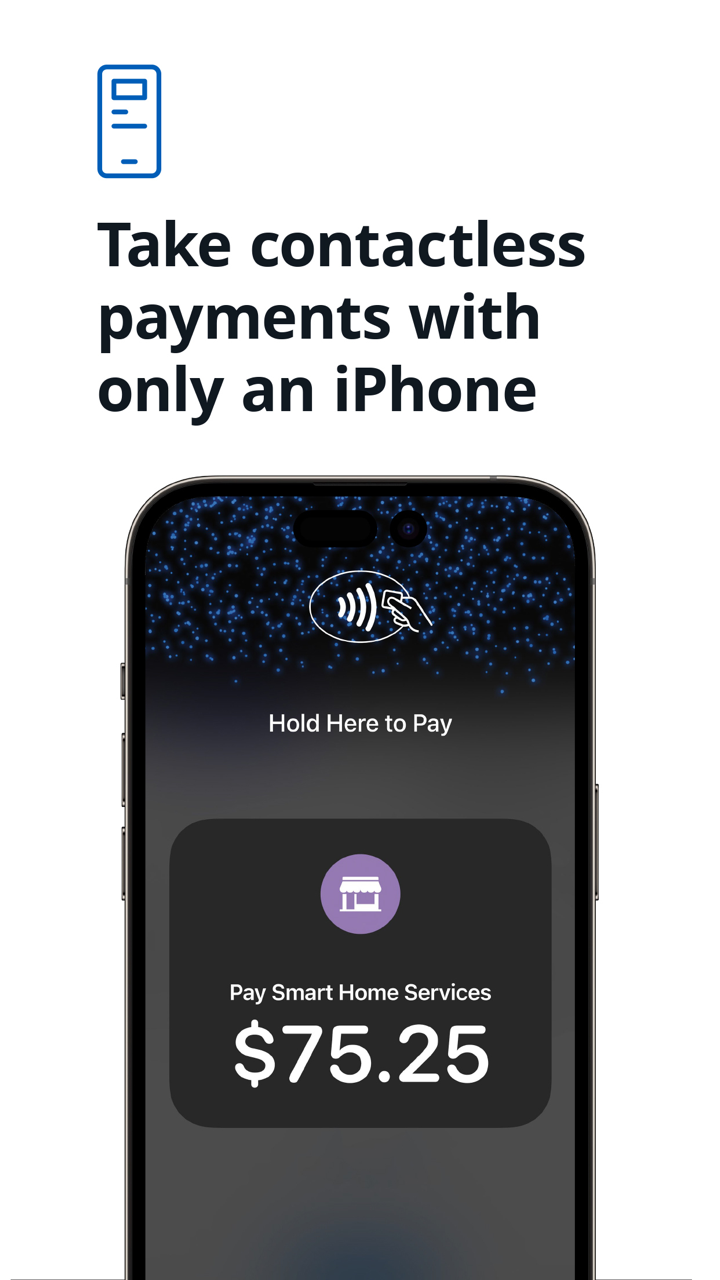

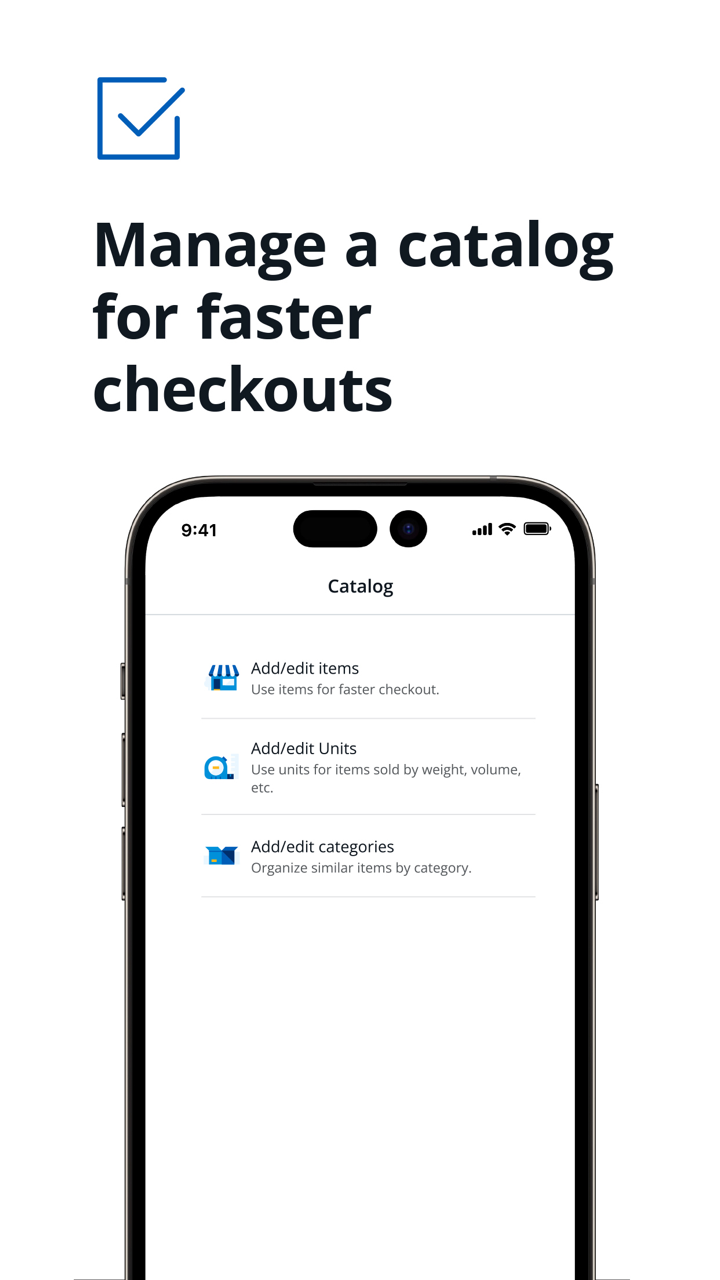

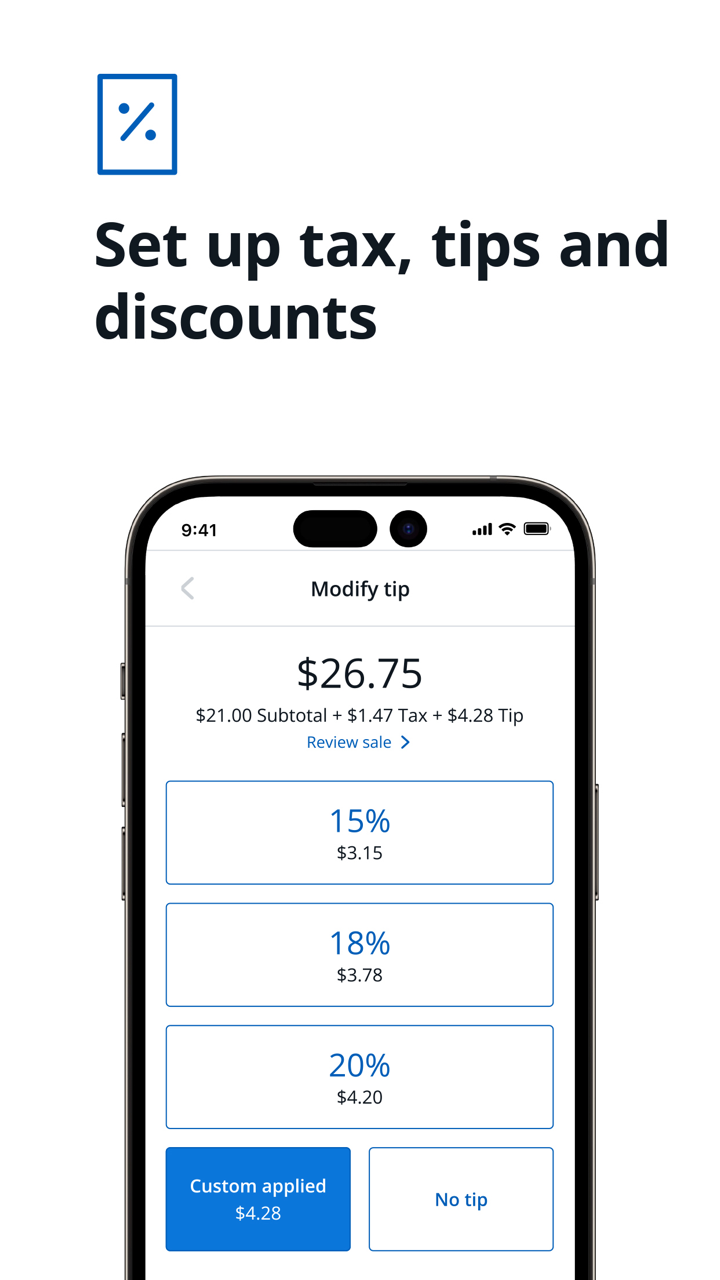

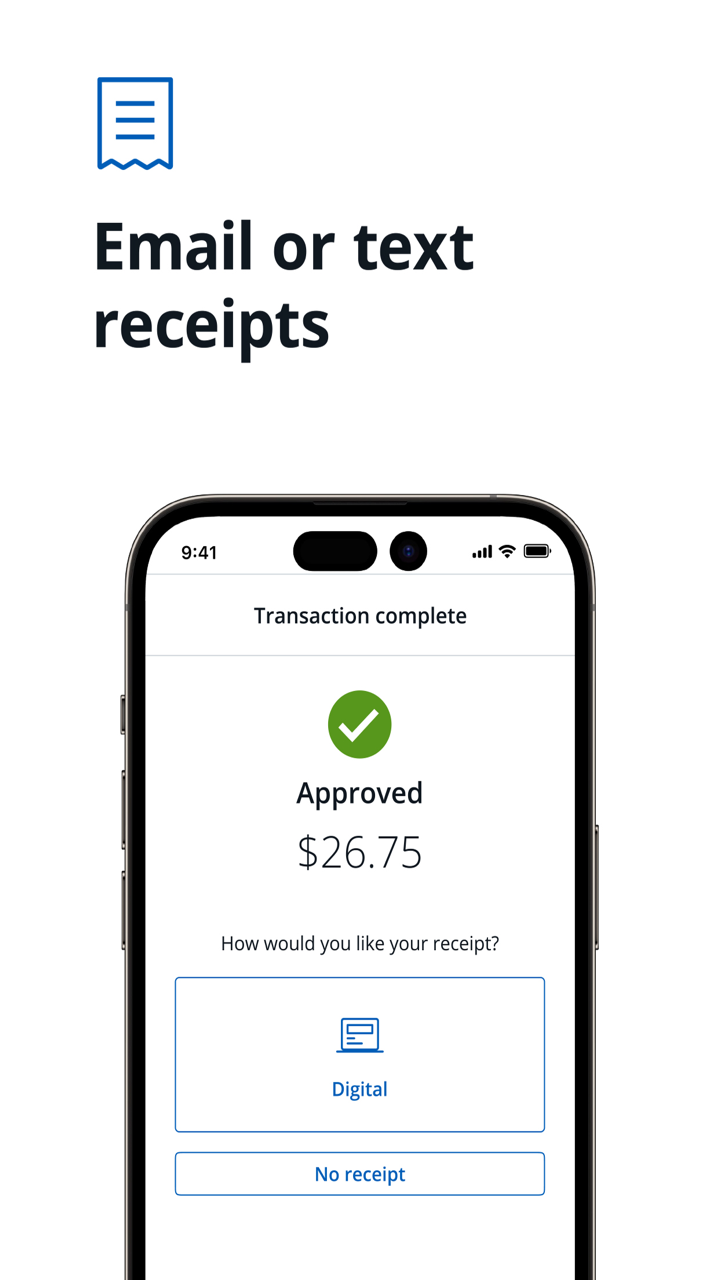

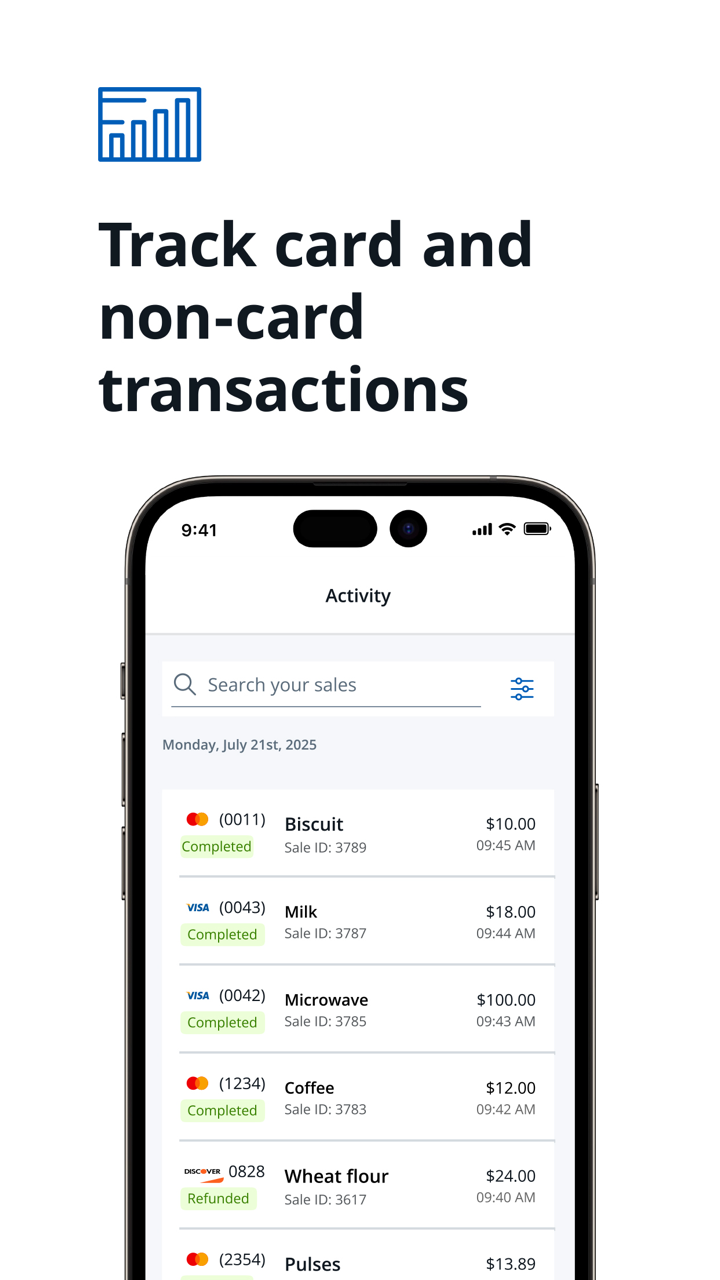

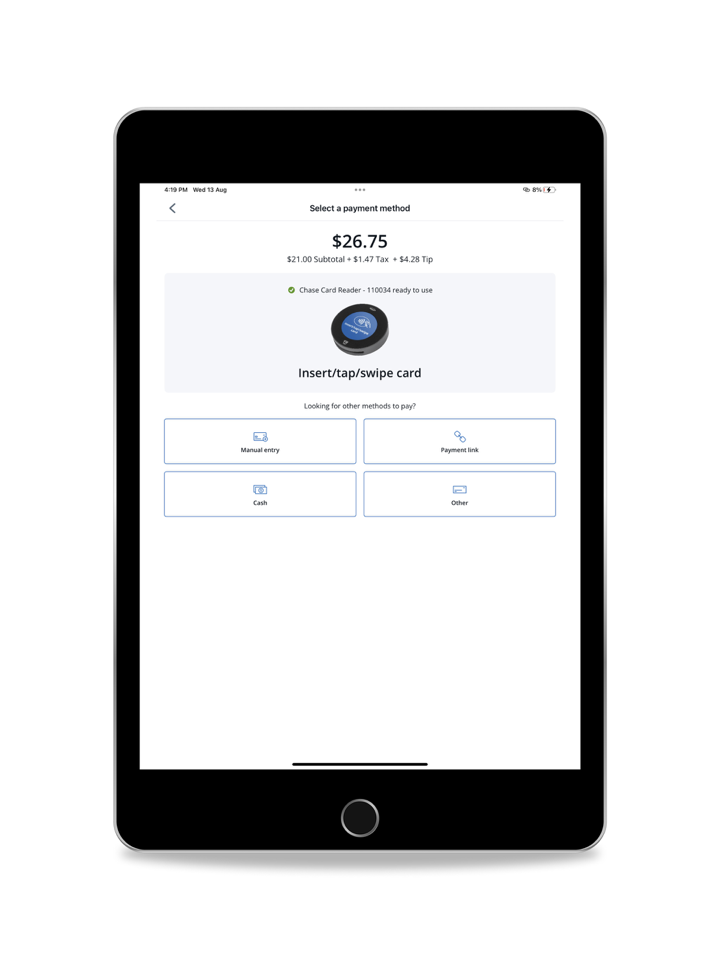

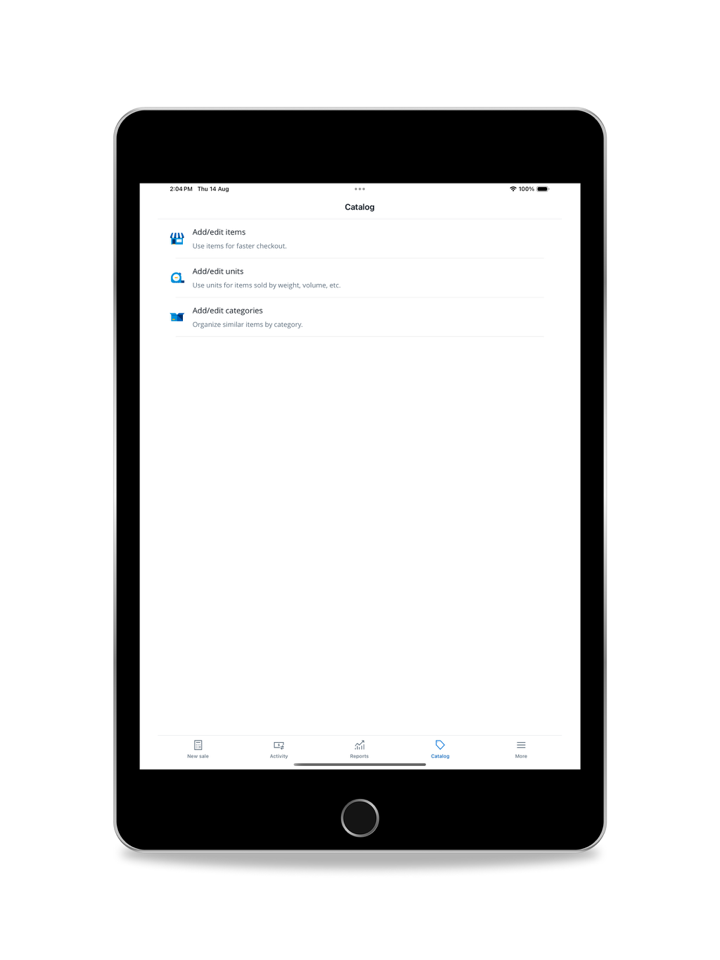

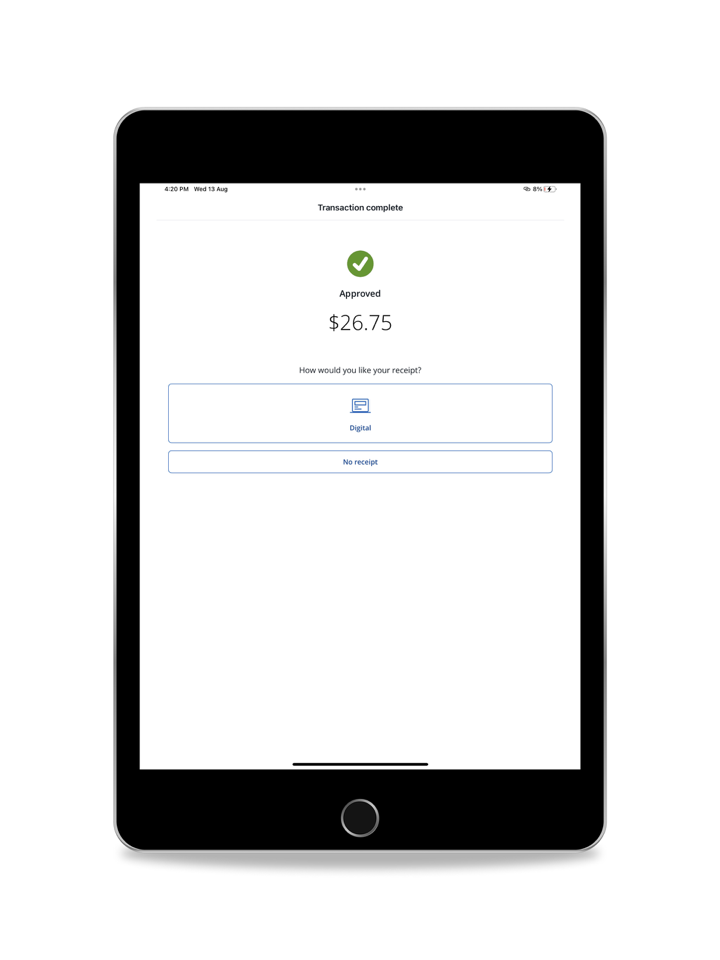

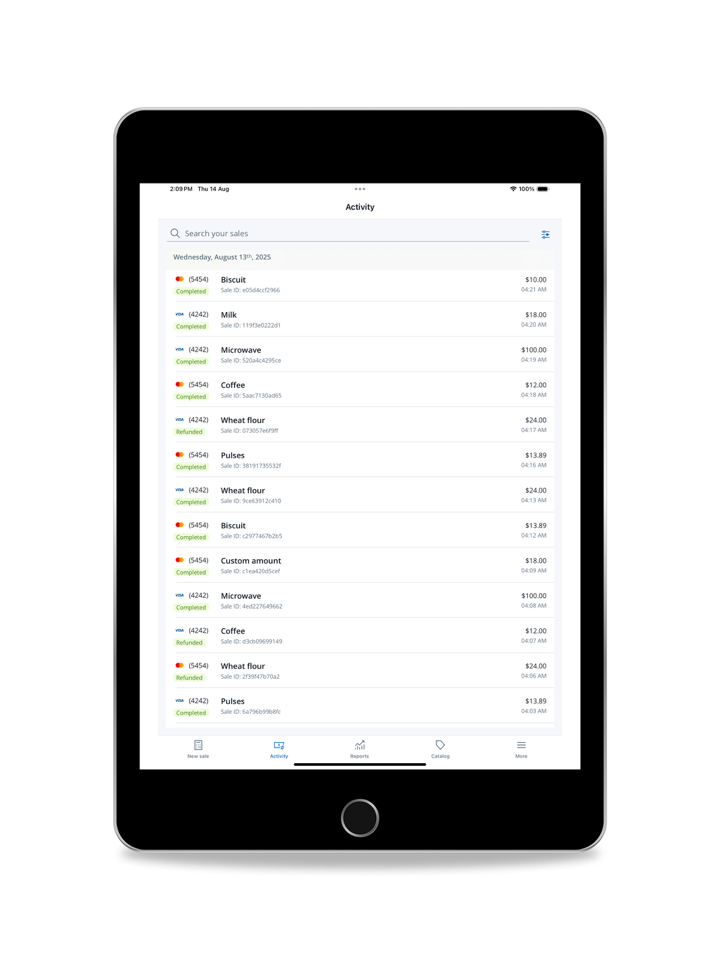

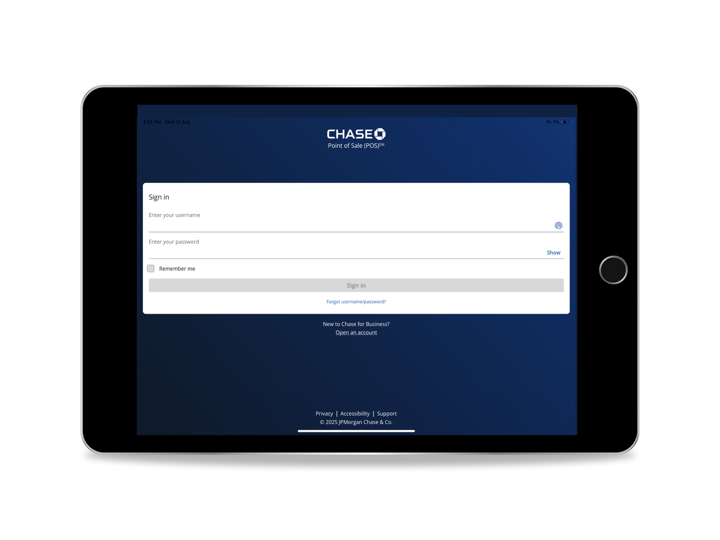

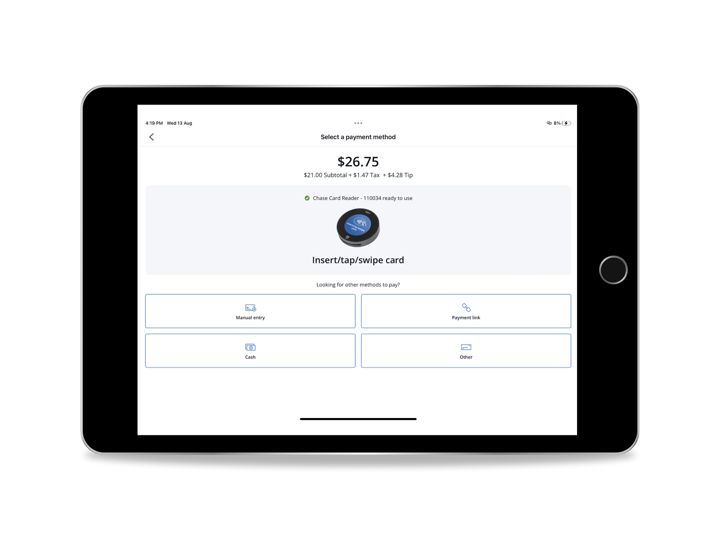

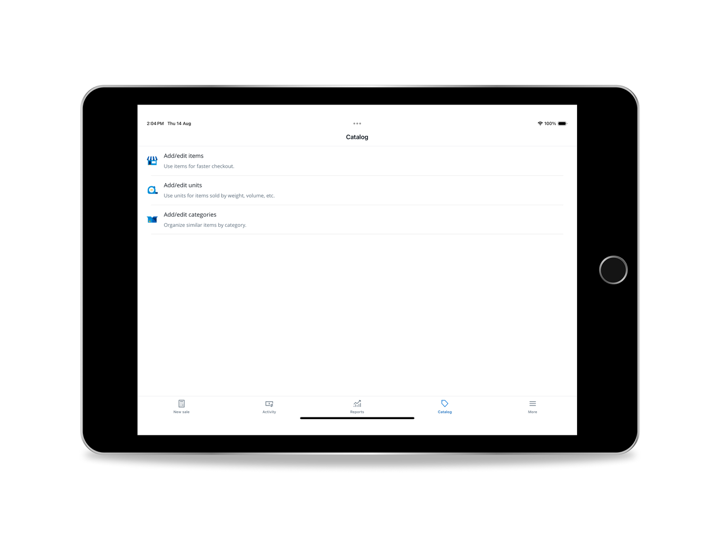

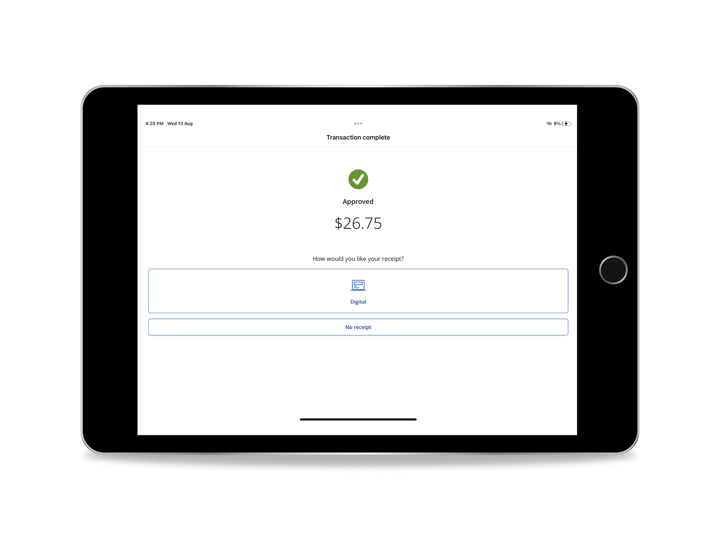

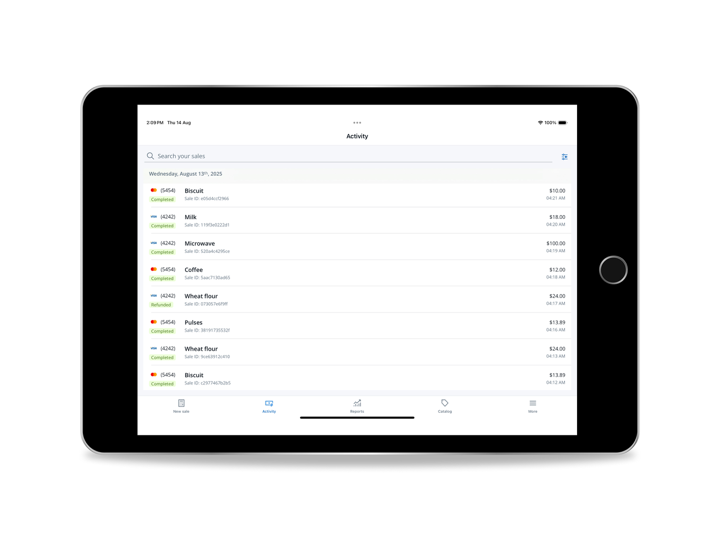

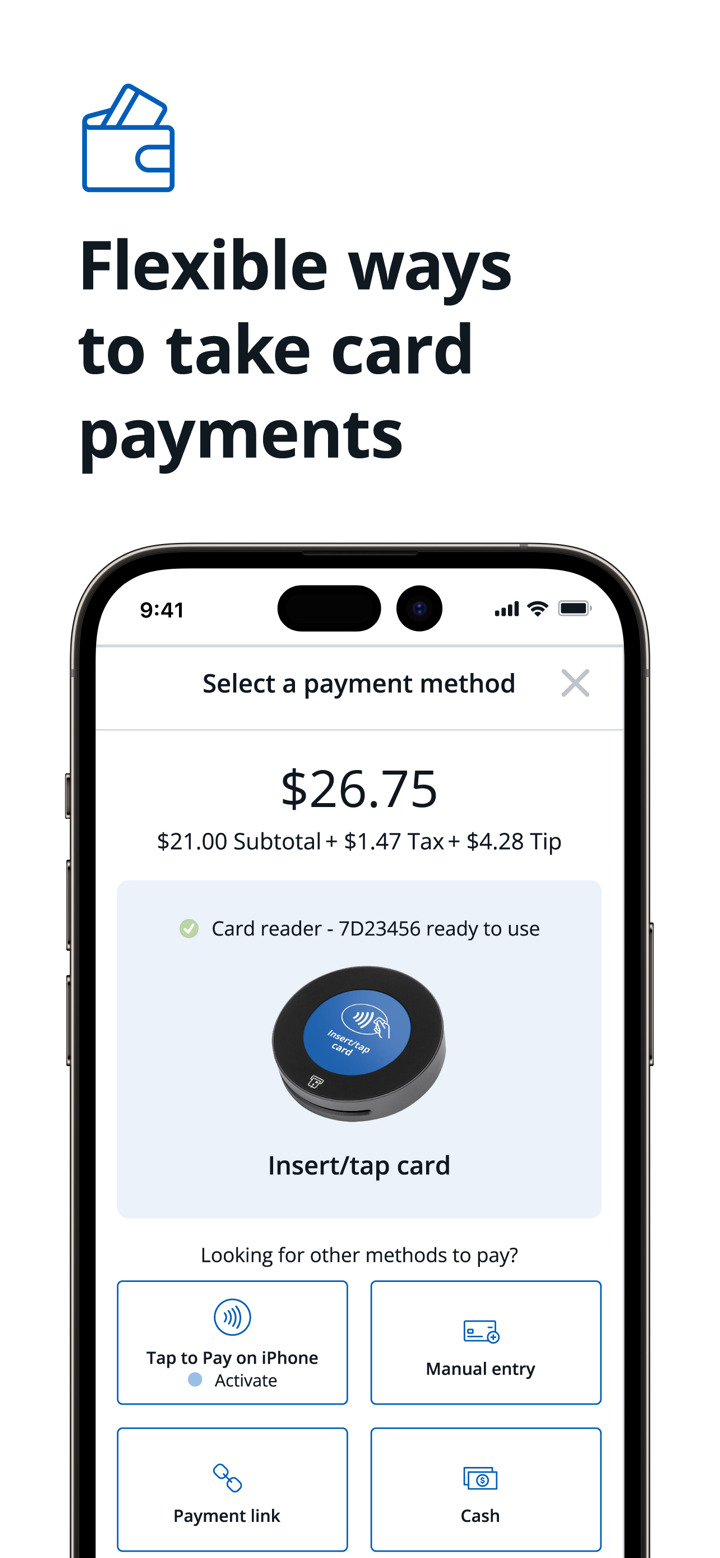

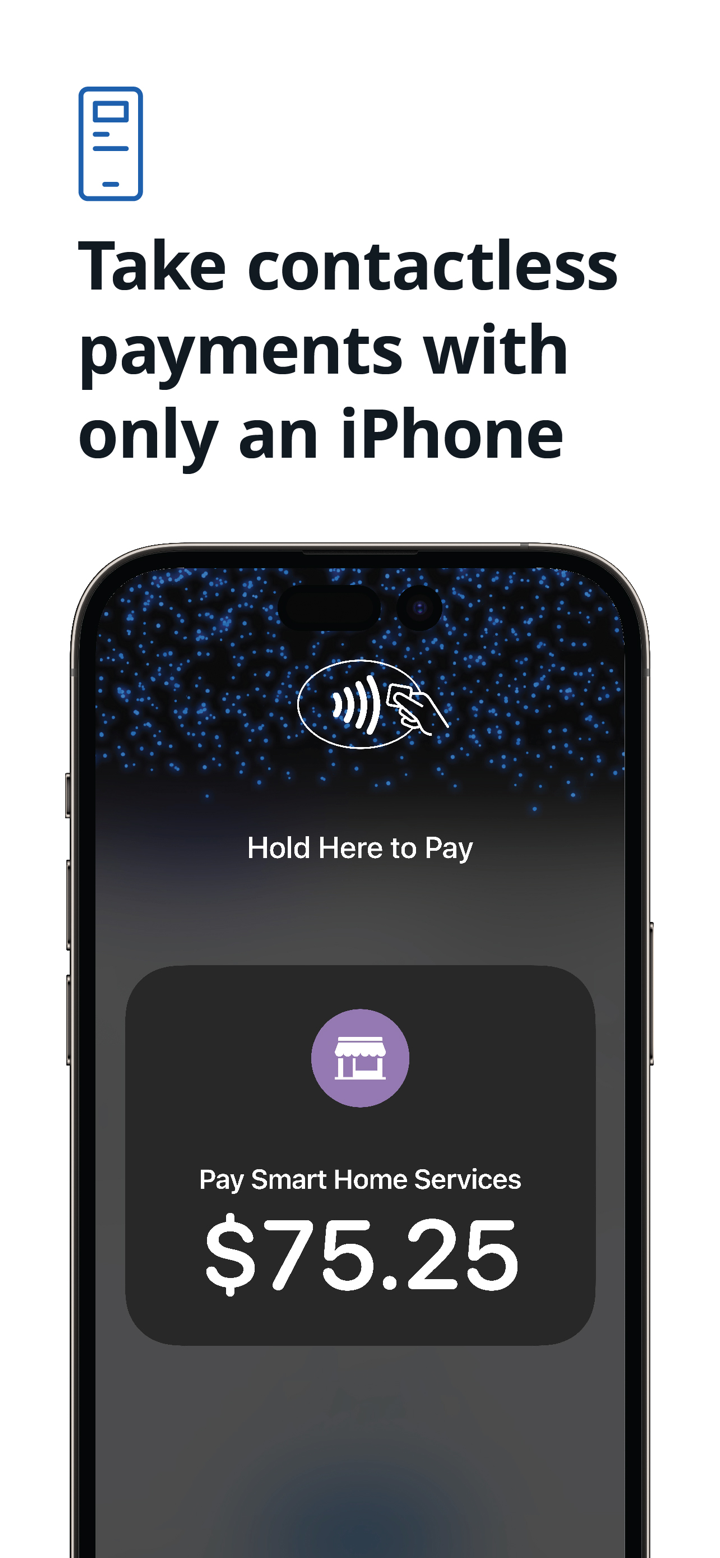

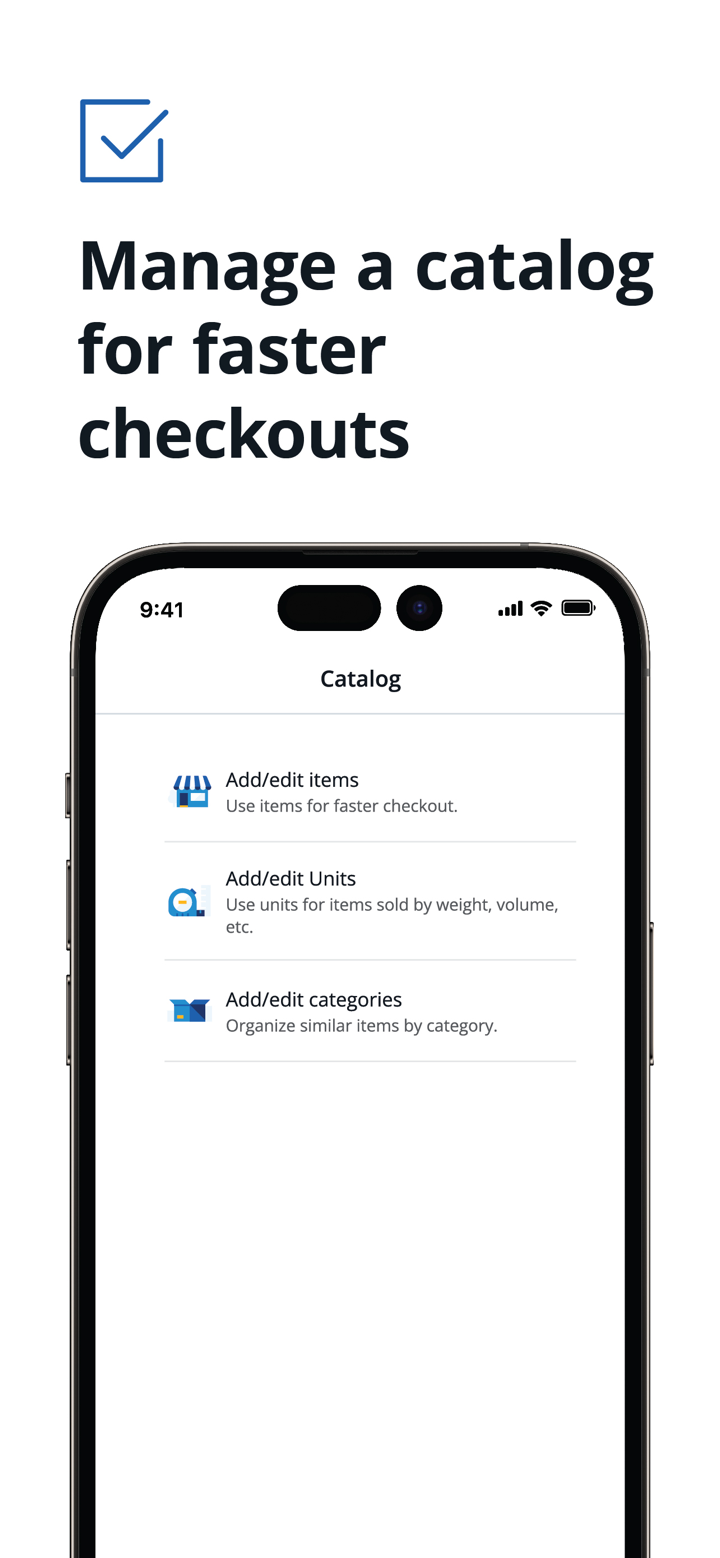

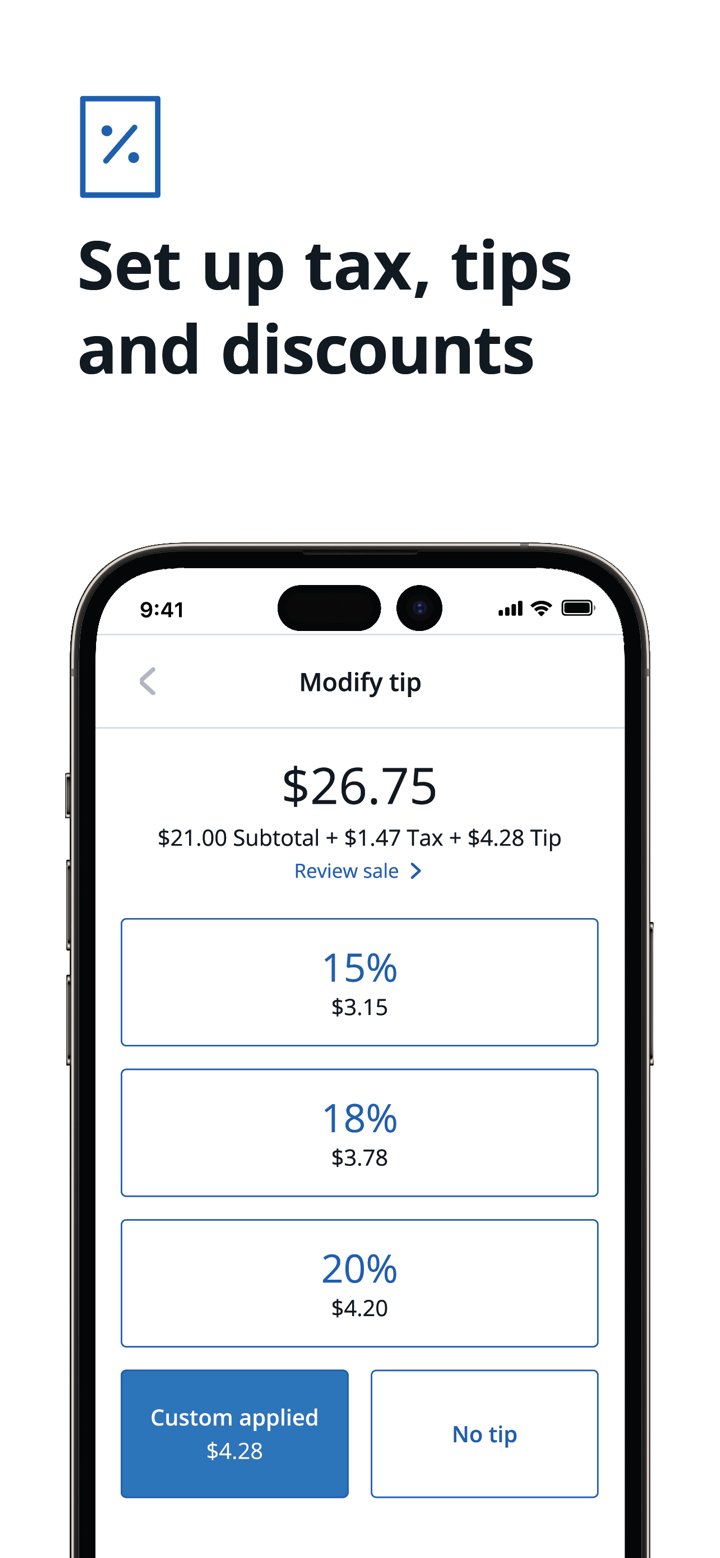

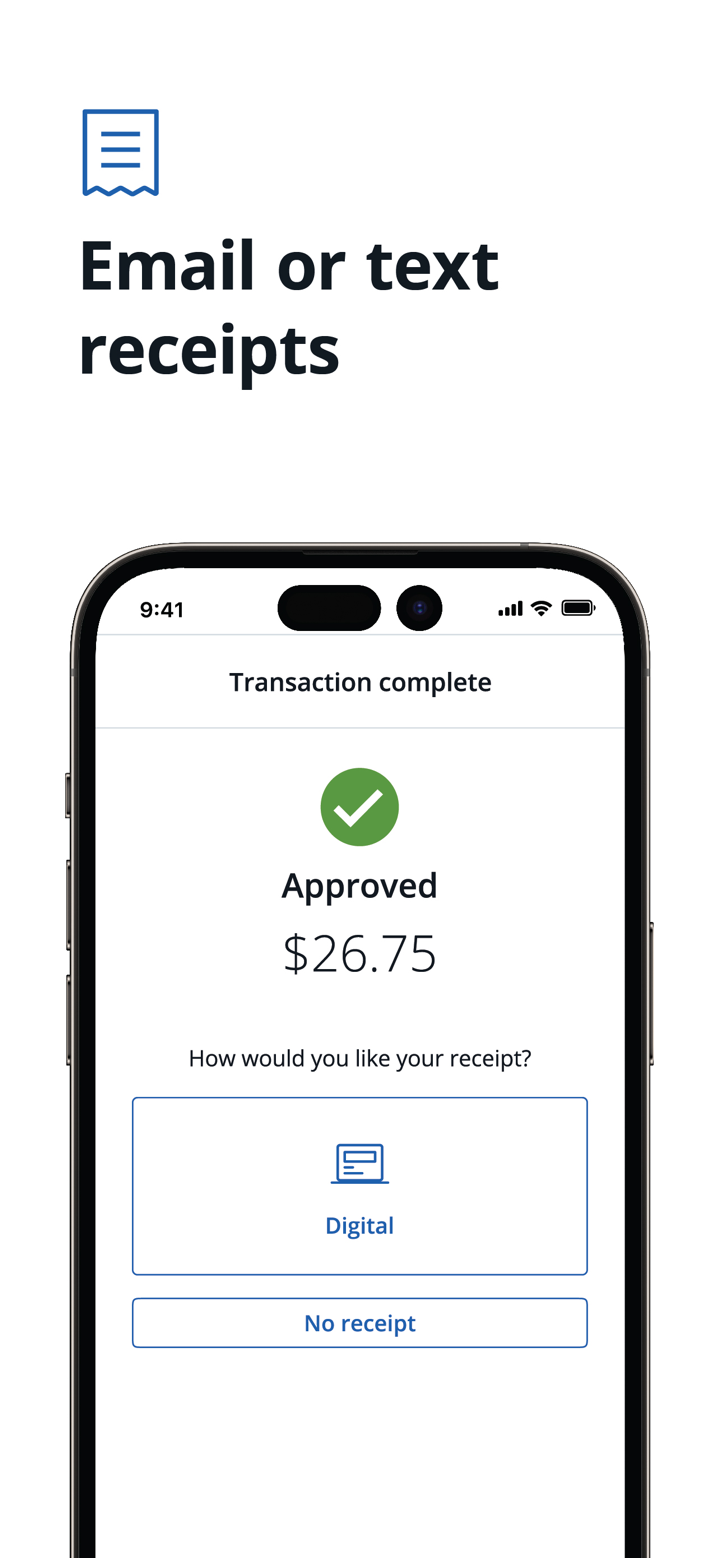

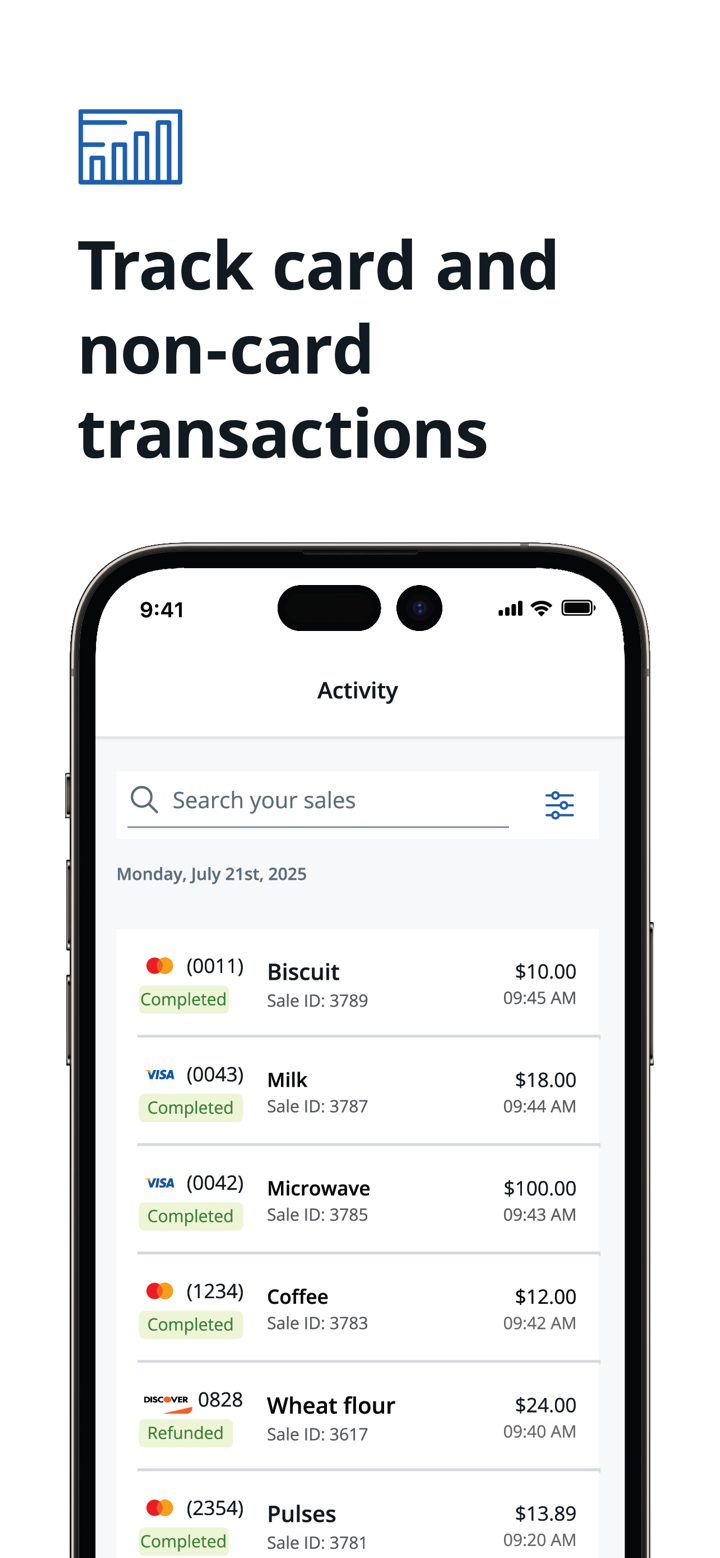

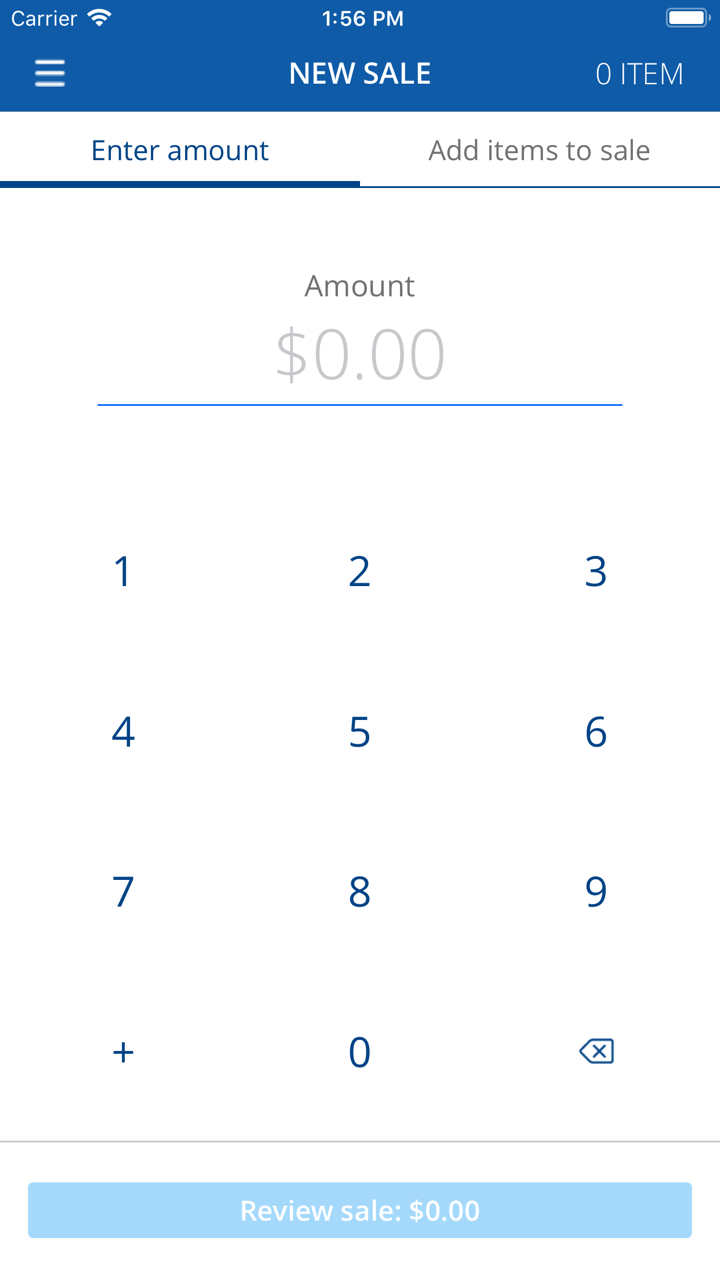

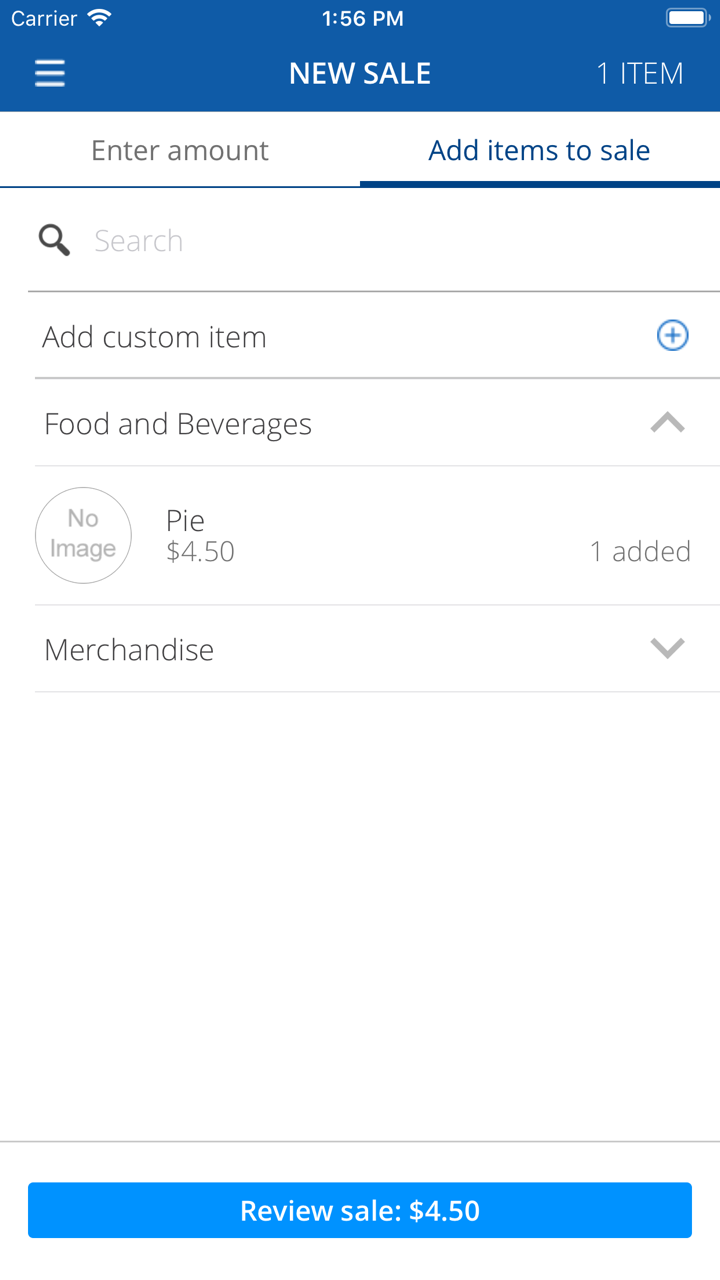

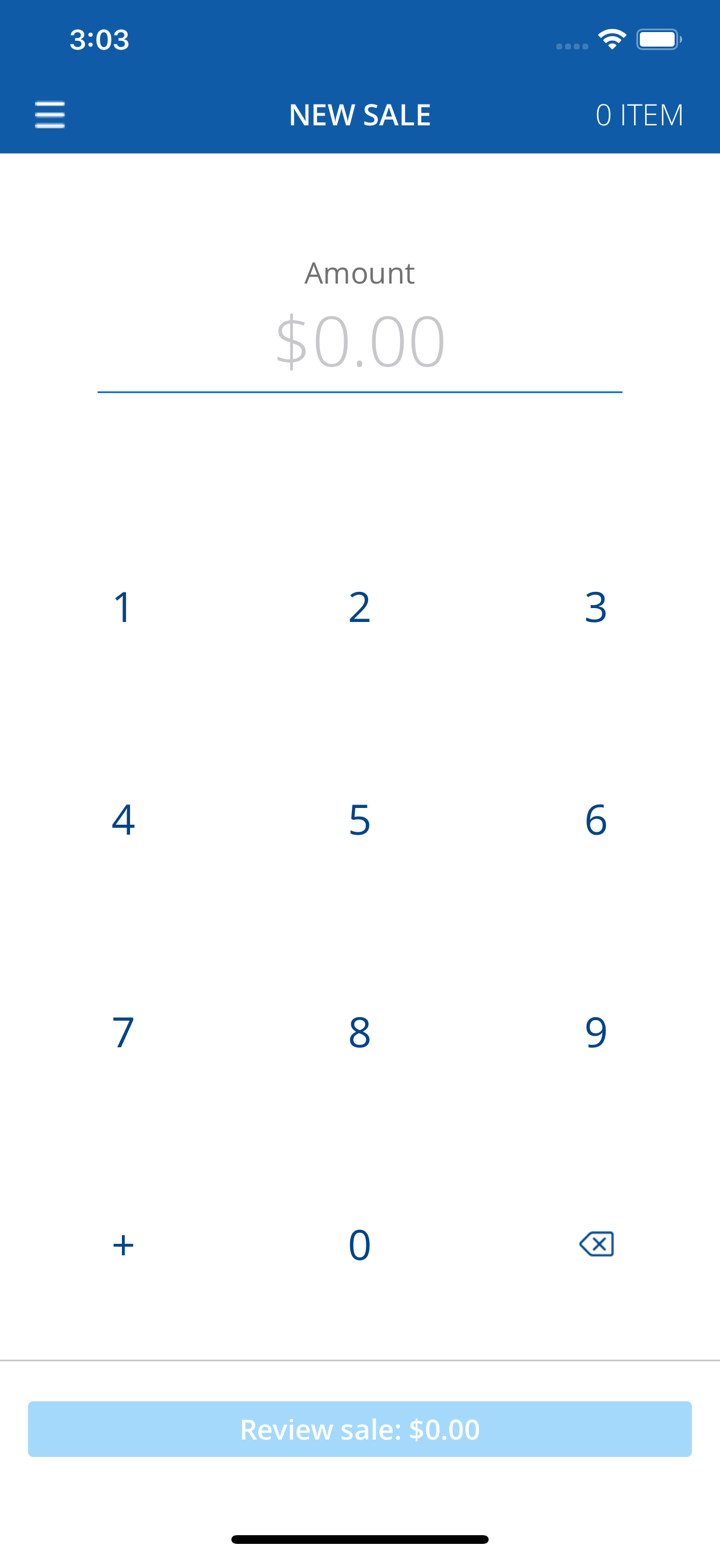

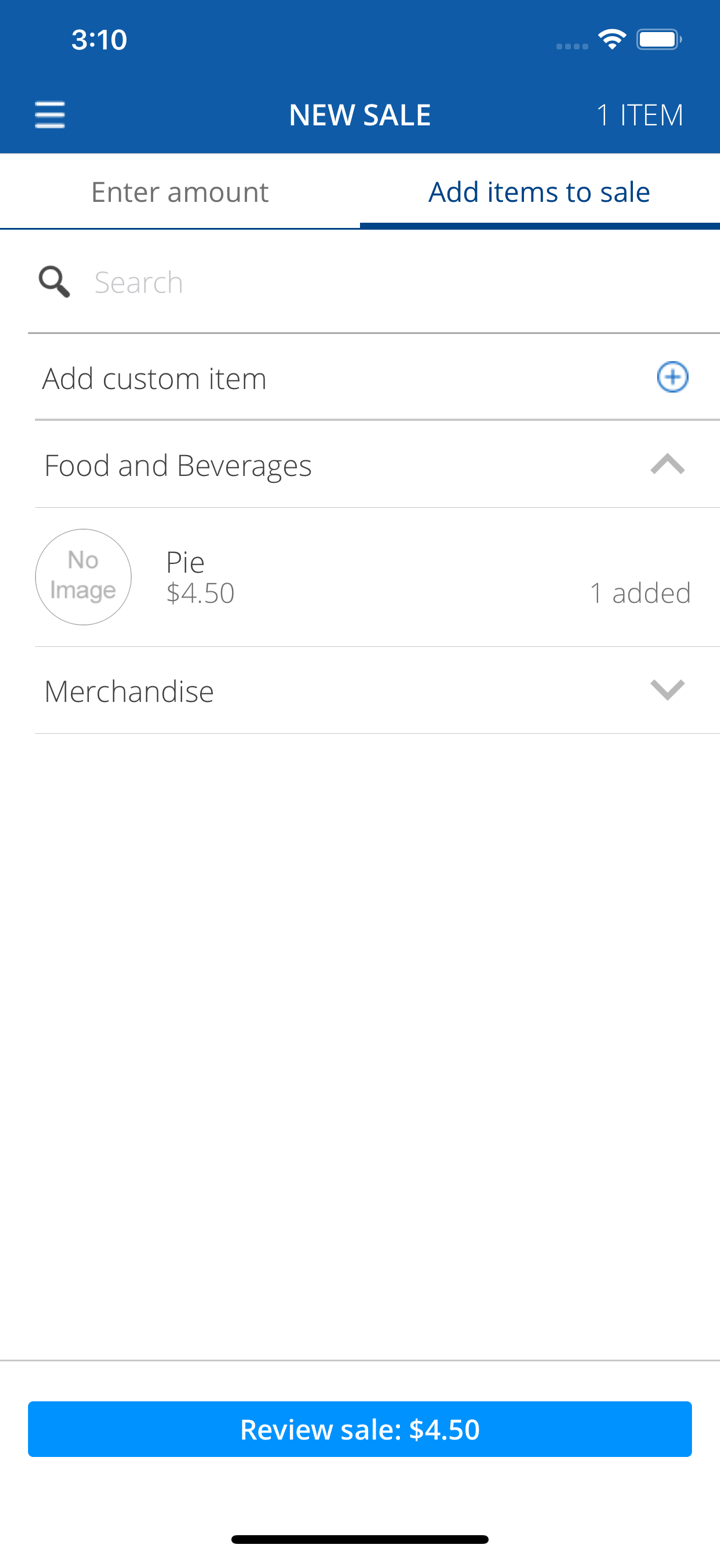

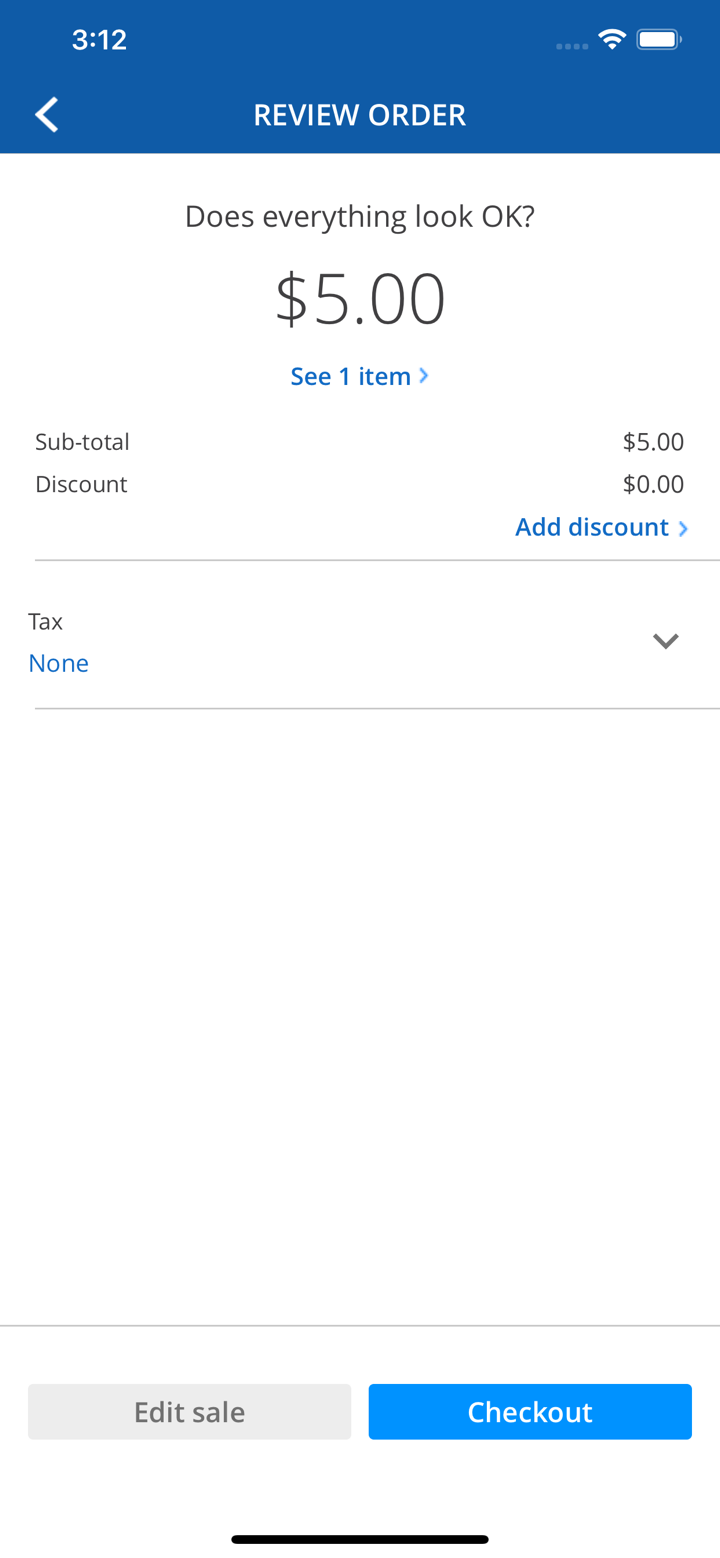

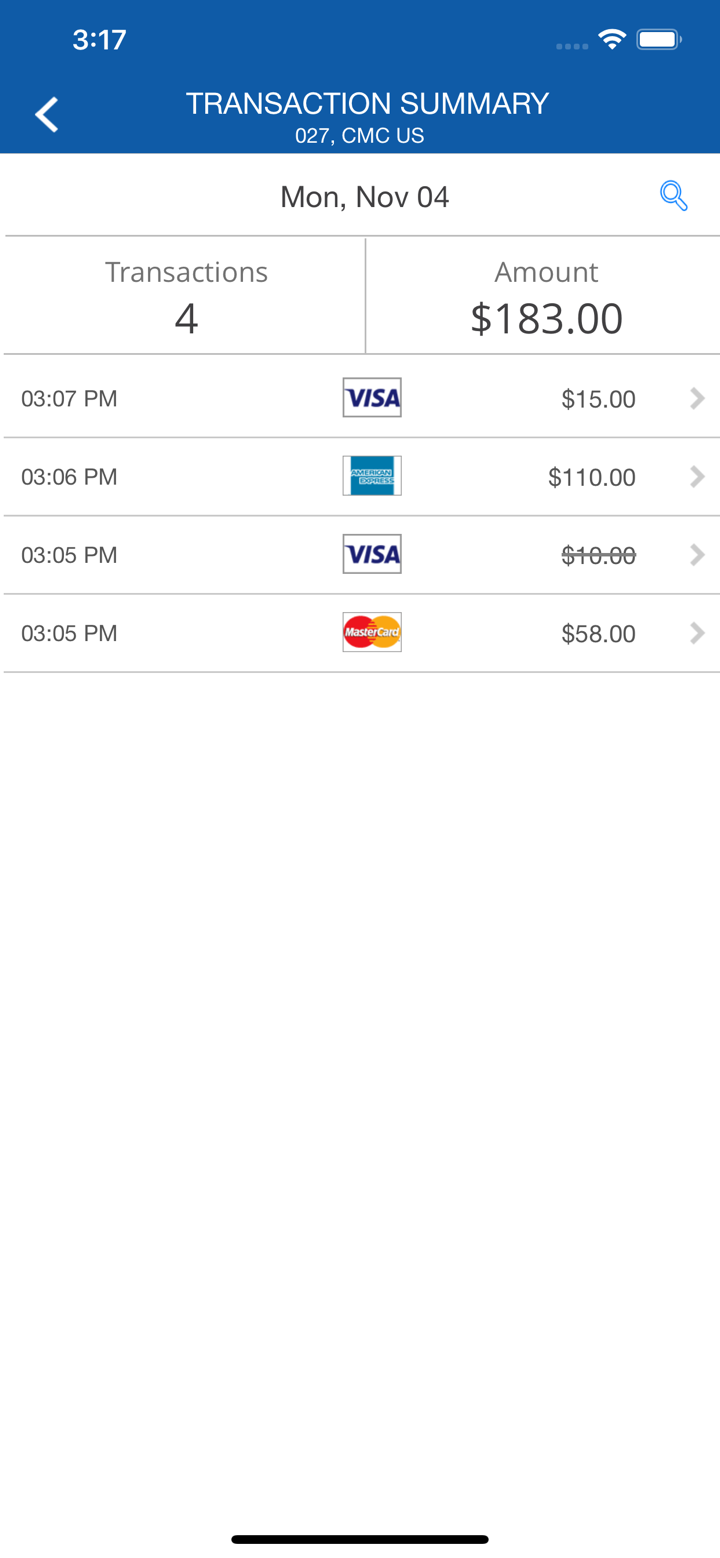

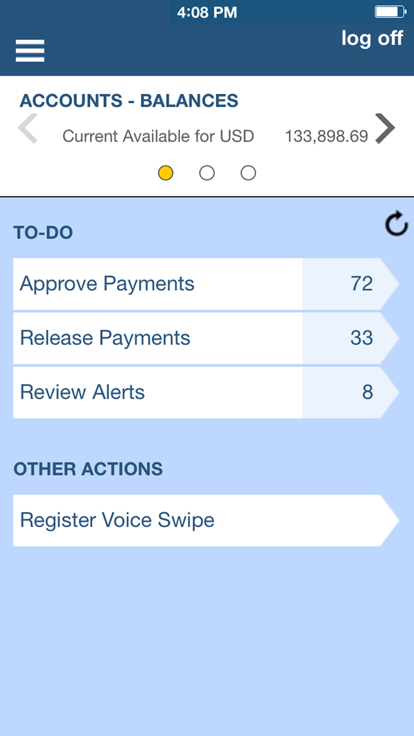

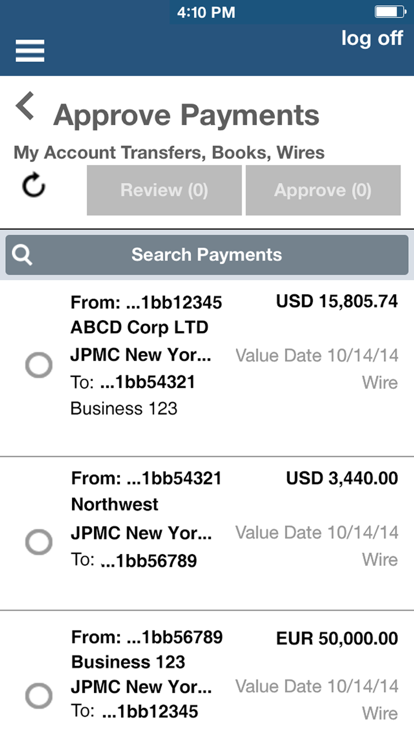

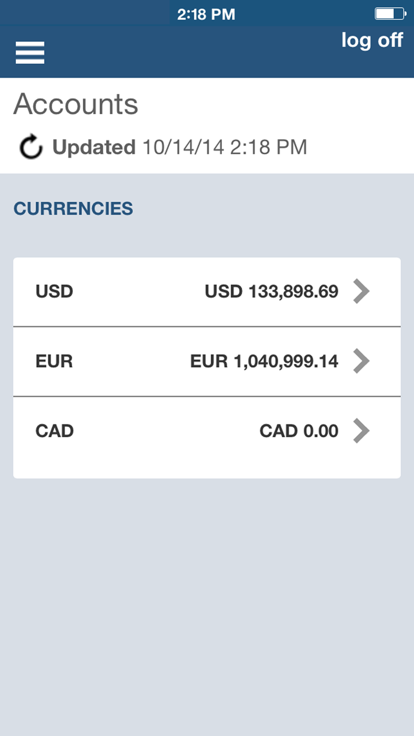

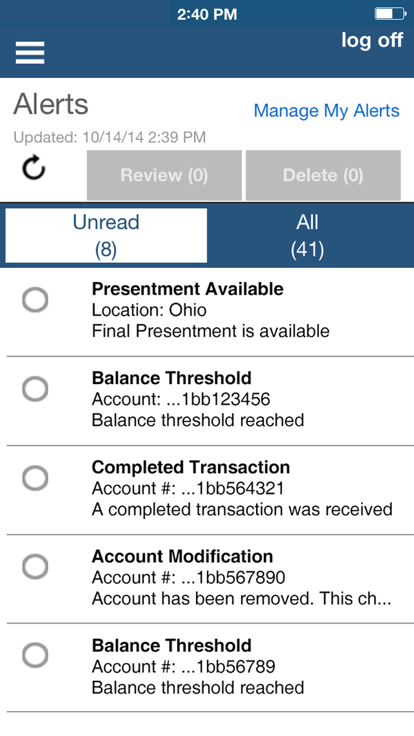

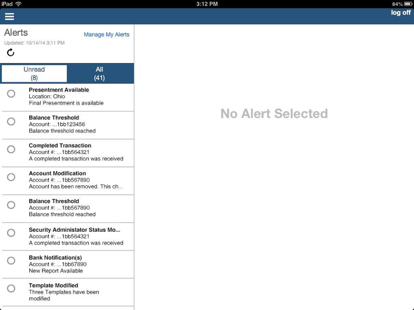

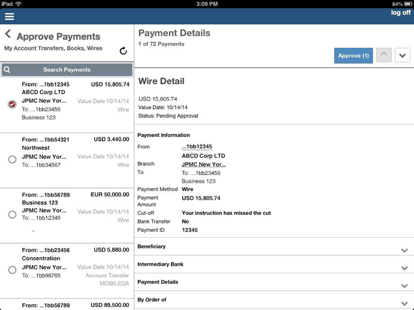

- 支付: 摩根大通提供支付解决方案,旨在帮助企业应对复杂和快速变化的支付环境,使其能够管理风险、创新增长,并提供卓越的客户体验。

服务行业

摩根大通 为包括商业地产、消费品和零售、多元化产业、能源、电力与可再生能源、金融、医疗保健、媒体、电信和娱乐、金属及挖矿、公共部门和技术在内的各行业提供服务。