Company Summary

| J.P. Morgan Review Summary | |

| Founded | 1921 |

| Registered Country/Region | China Hong Kong |

| Regulation | SFC, Labuan FSA |

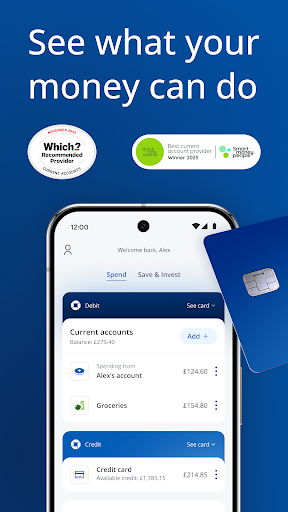

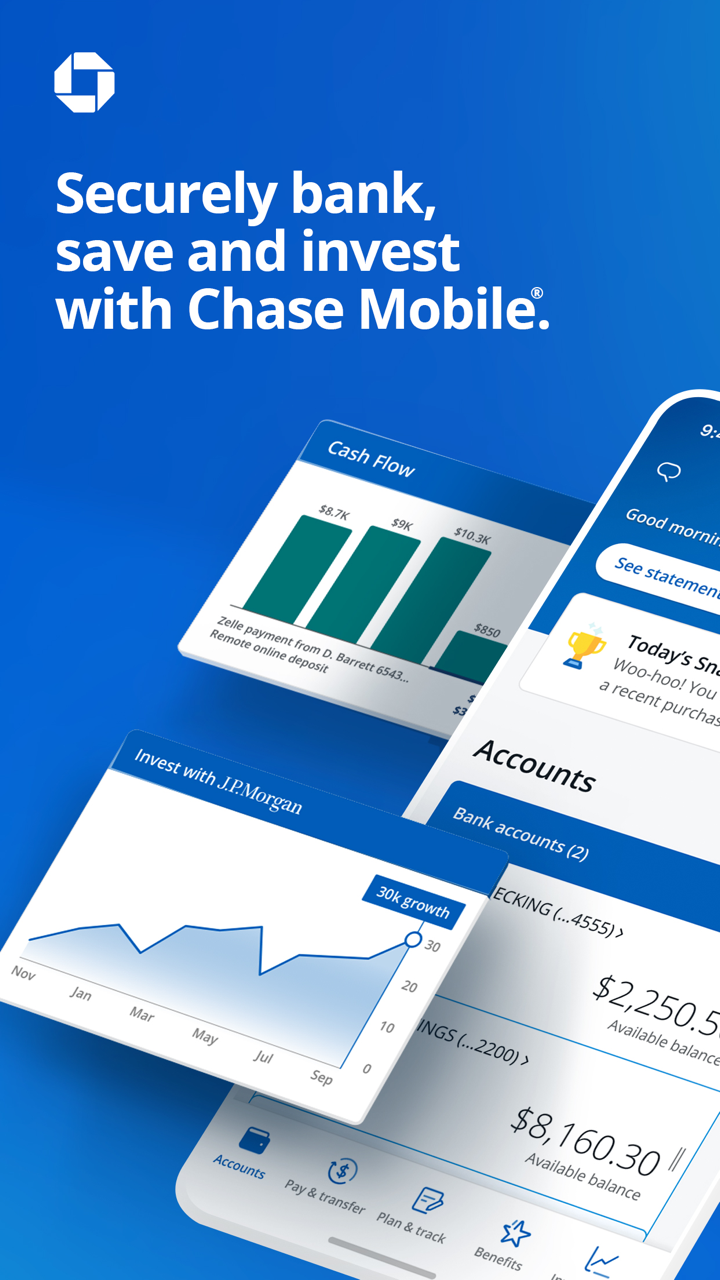

| Products and Services | Commercial Banking, Credit and Financing, Institutional Investing, Investment Banking, Payments |

| Customer Support | +86 10 5931 8888, +86 21 5200 2368 |

J.P. Morgan Information

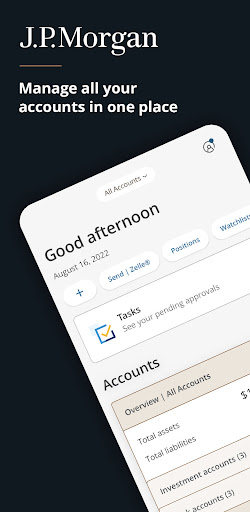

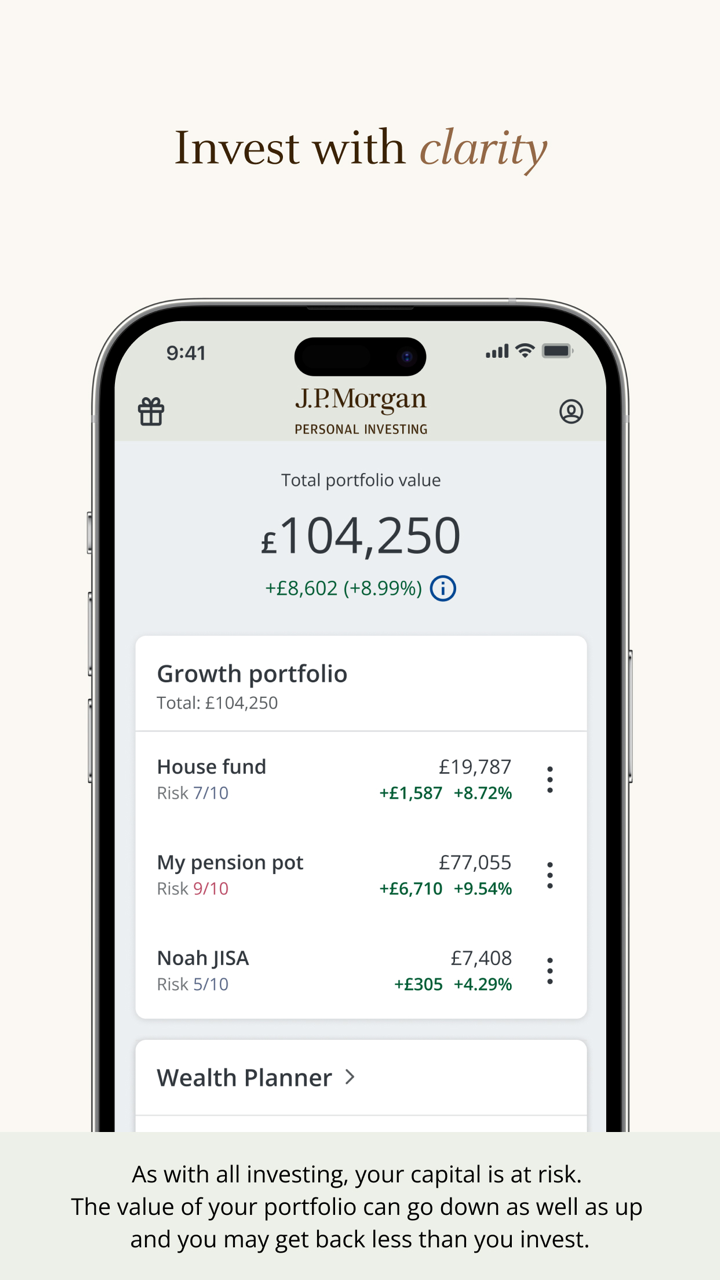

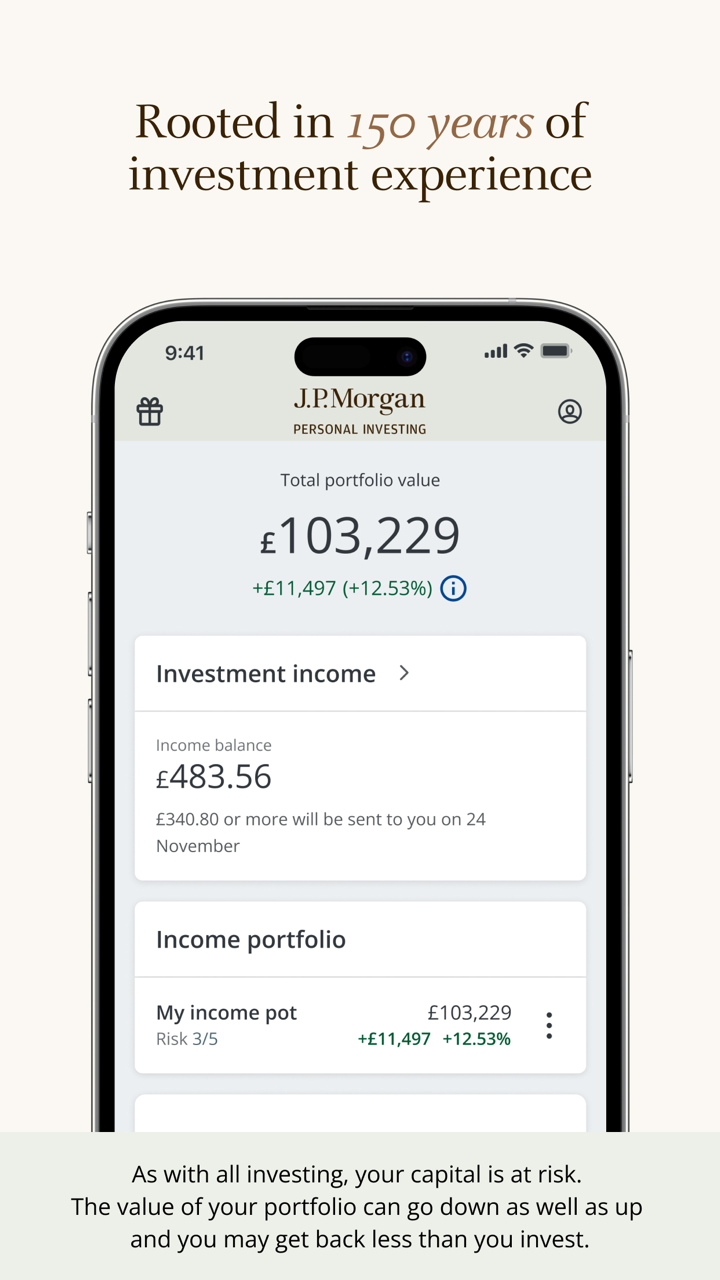

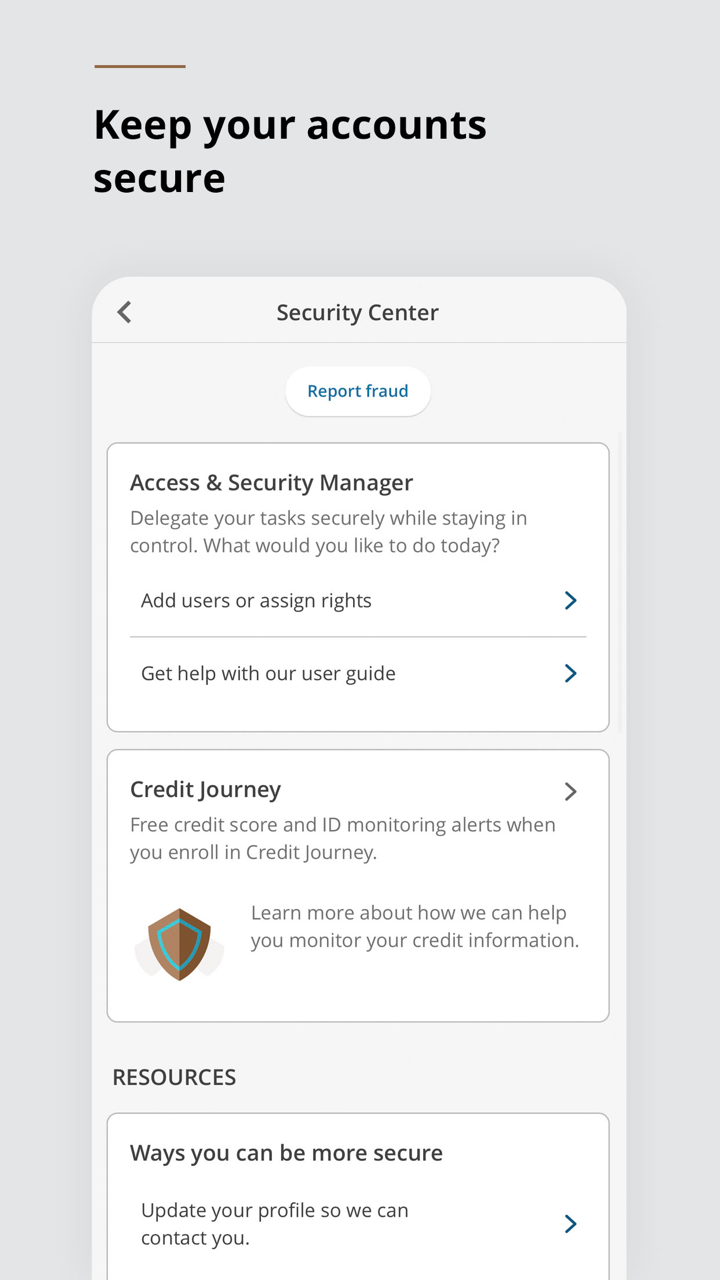

J.P. Morgan, regulated by the SFC in China, Hong Kong, and the Labuan FSA in Malaysia, is a global financial leader providing diverse services including commercial banking, investment banking, credit and financing, institutional investing, and payments. The platform serve diverse industries, offering tailored financial solutions to corporations, institutions, and investors.

Pros and Cons

| Pros | Cons |

|

|

|

Is J.P. Morgan Legit?

J.P. Morgan is regulated in China, Hong Kong by the Securities and Futures Commission (SFC) for dealing in futures contracts under license numbers AAB027 and AAA121, and also regulated in Malaysia by the Labuan Financial Services Authority (Labuan FSA) as a Market Maker.

| Regulatory Status | Regulated | Regulated | Regulated |

| Regulated by | China Hong Kong | China Hong Kong | Malaysia |

| Licensed Institution | The Securities and Futures Commission (SFC) | The Securities and Futures Commission (SFC) | Labuan Financial Services Authority (Labuan FSA) |

| Licensed Type | Dealing in futures contracts | Dealing in futures contracts | Market Maker (MM) |

| Licensed Number | AAB027 | AAA121 | Unreleased |

Products and Services

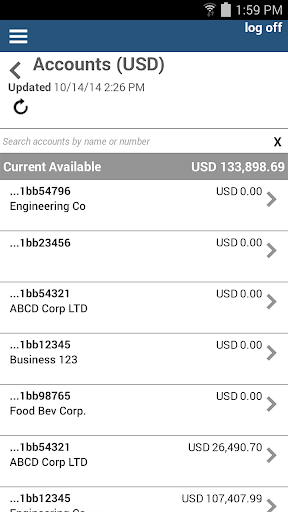

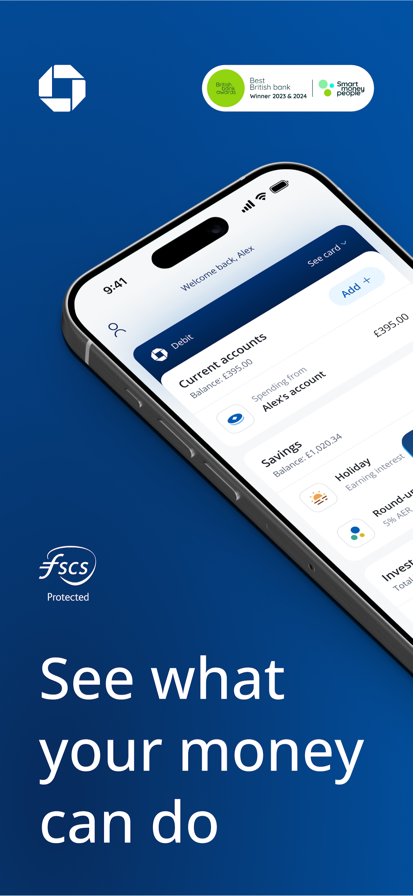

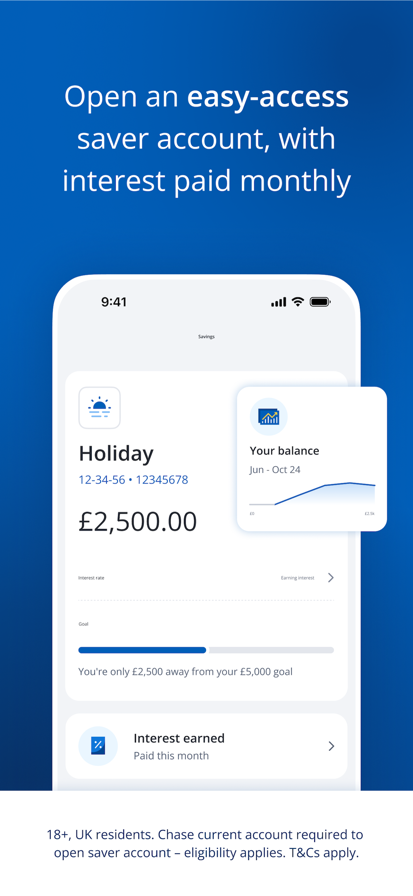

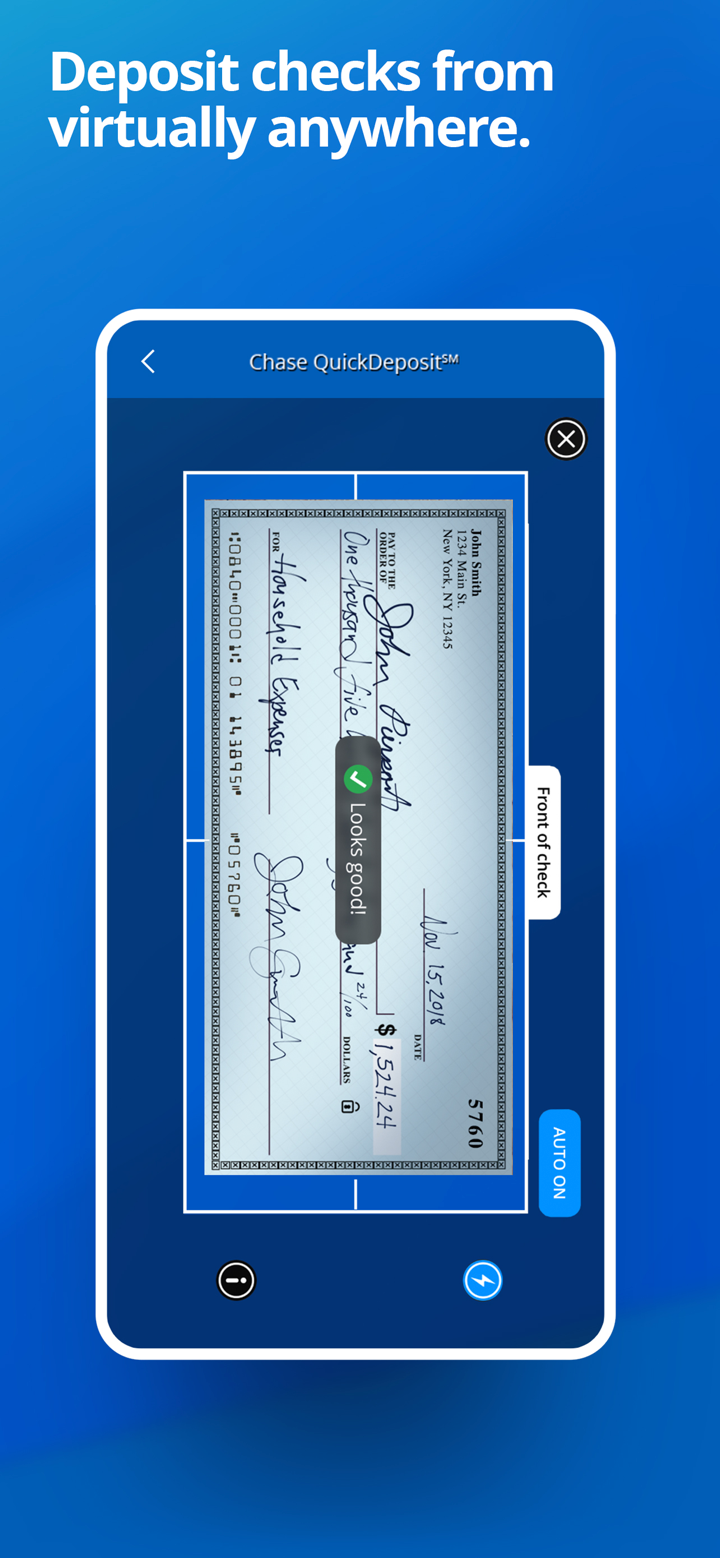

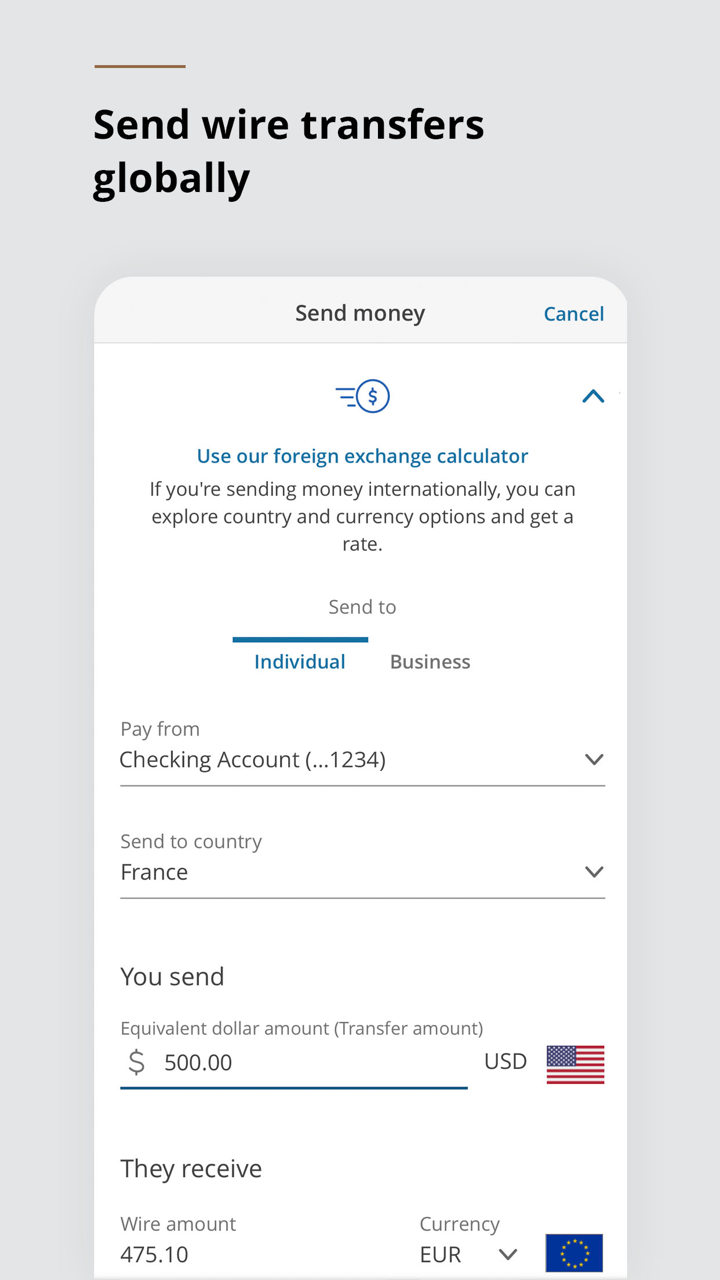

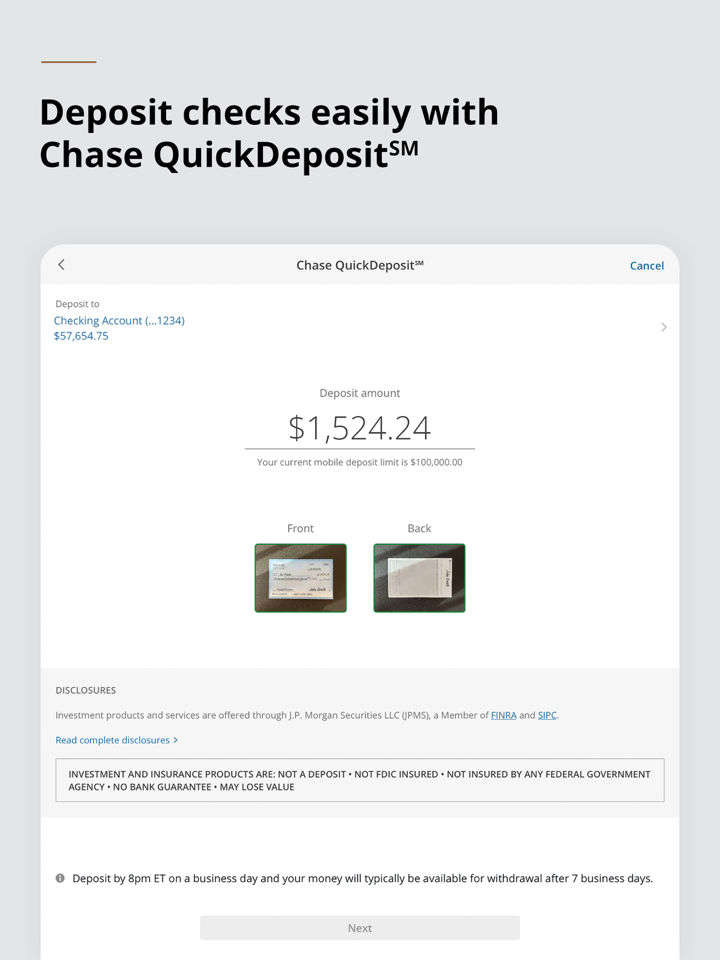

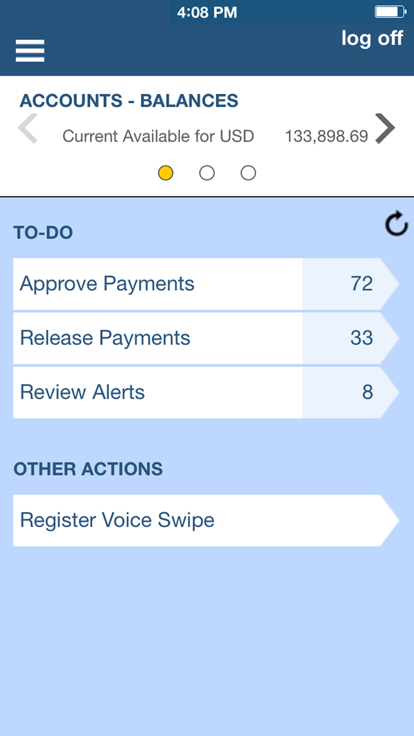

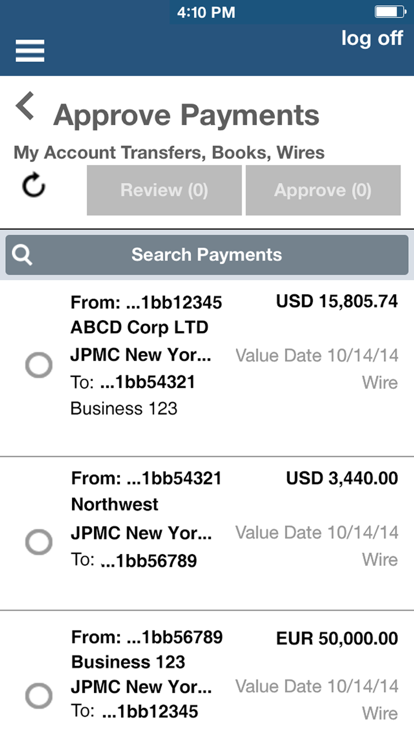

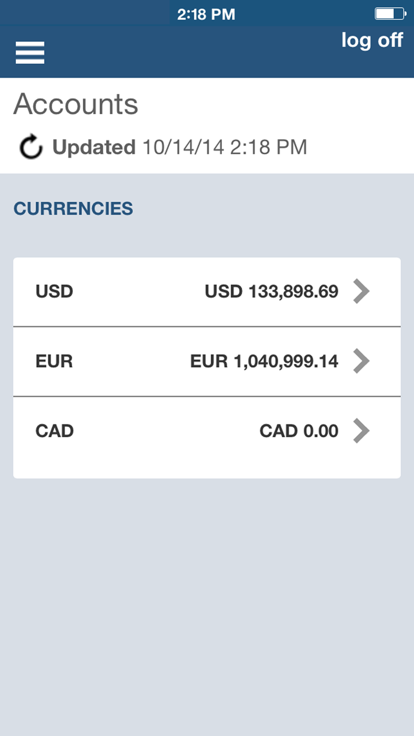

- Commercial Banking: J.P. Morgan offers Commercial Banking Services, providing credit, financing, treasury, and payment solutions, as well as commercial real estate services for investors and developers.

- Investment Banking: J.P. Morgan provides investment banking services to corporations, governments, and institutions. These services include mergers and acquisitions (M&A) advisory, debt and equity capital raising, restructuring, strategic advisory, and corporate finance solutions.

- Credit and Financing: J.P. Morgan offers best-in-class credit and financing options, including Asset-Based Lending to enhance liquidity, Equipment Financing for flexible capital, Employee Stock Ownership Plans for business and employee futures, and Syndicated Finance for customized loan solutions.

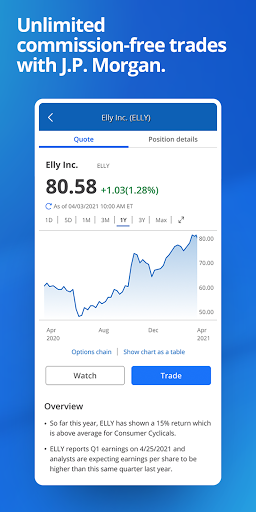

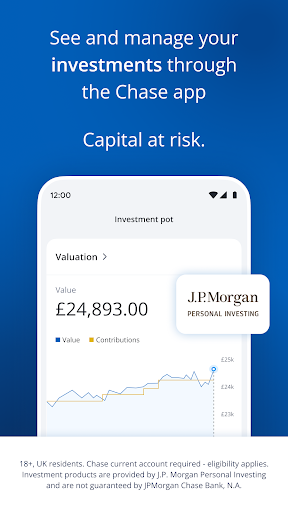

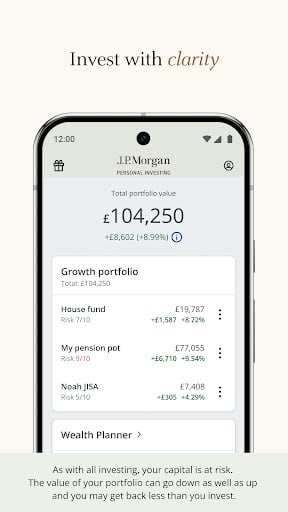

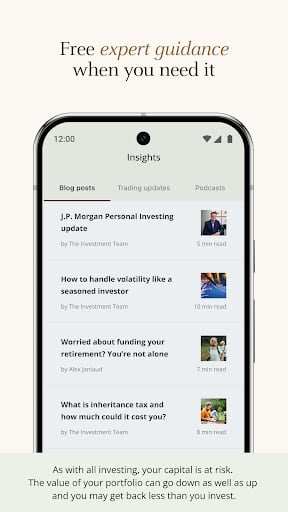

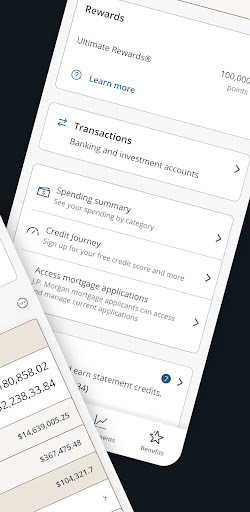

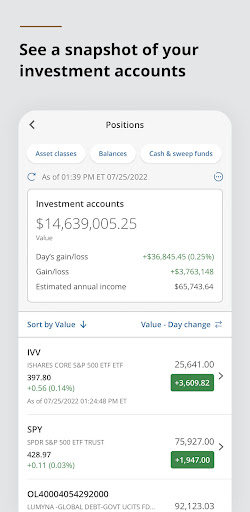

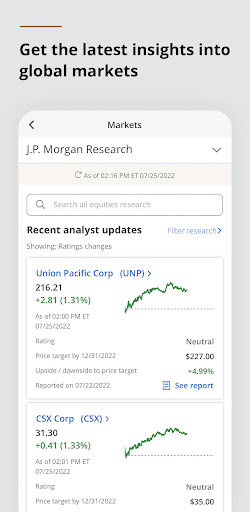

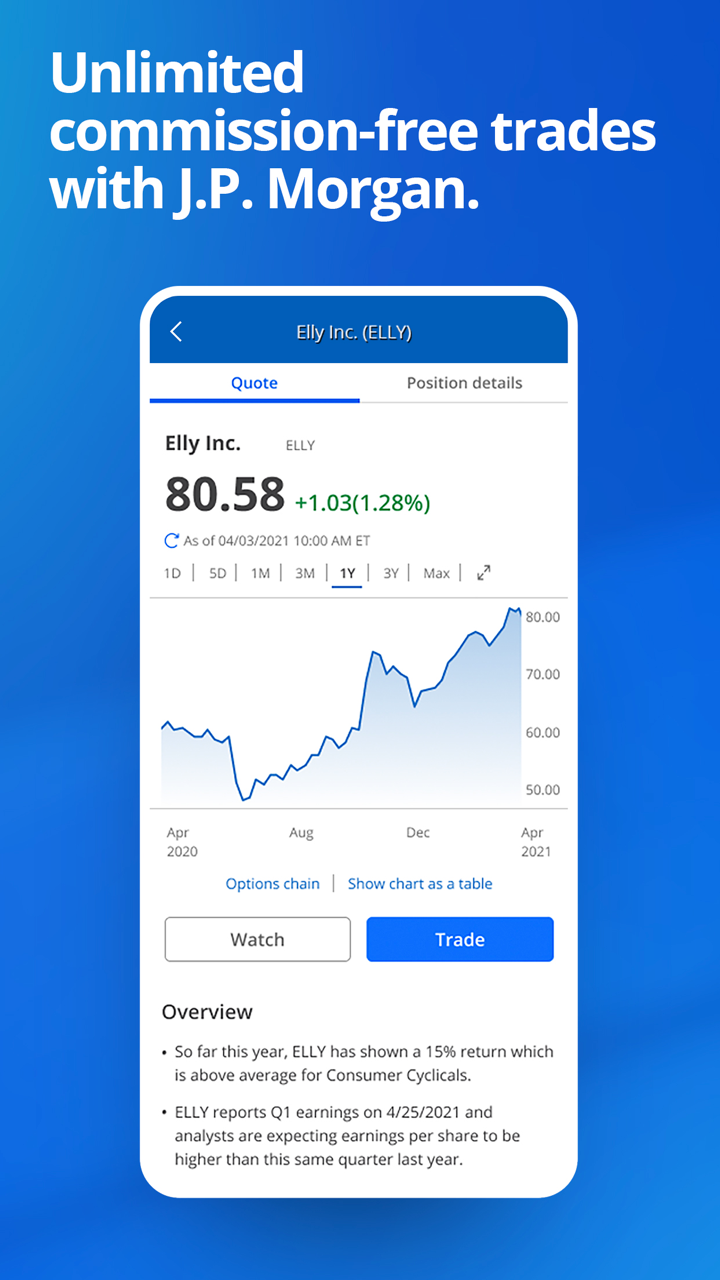

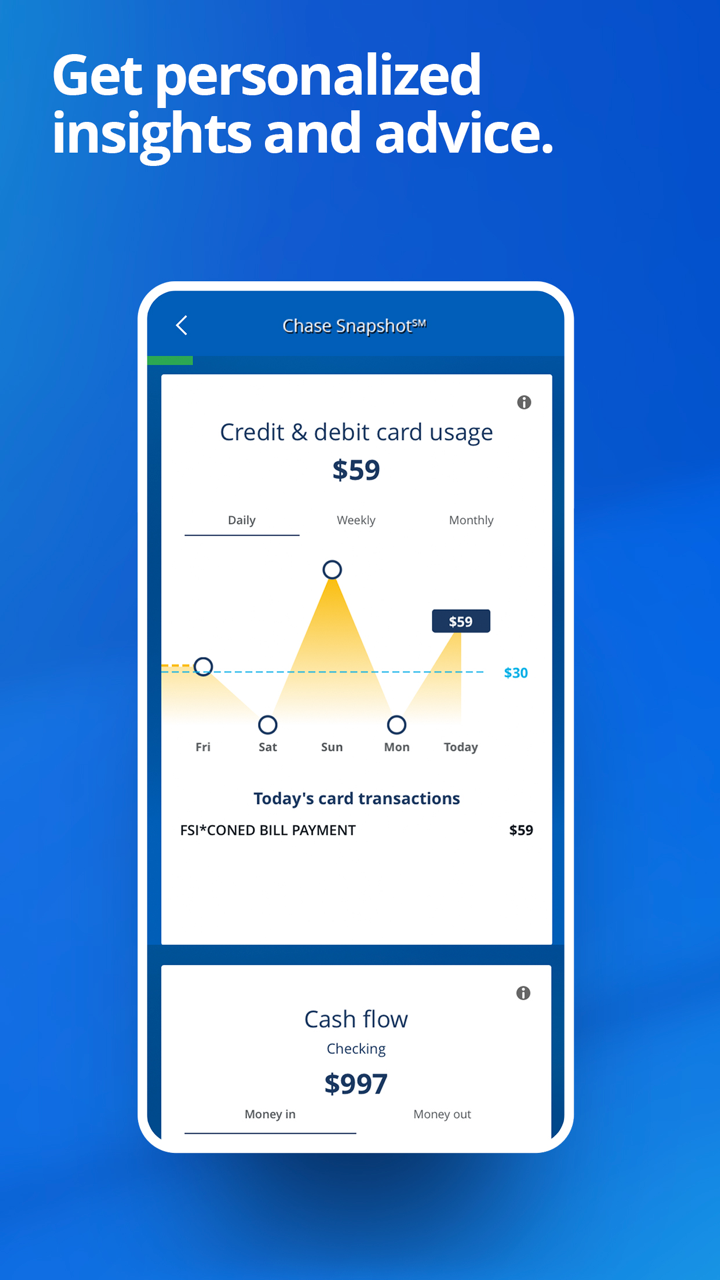

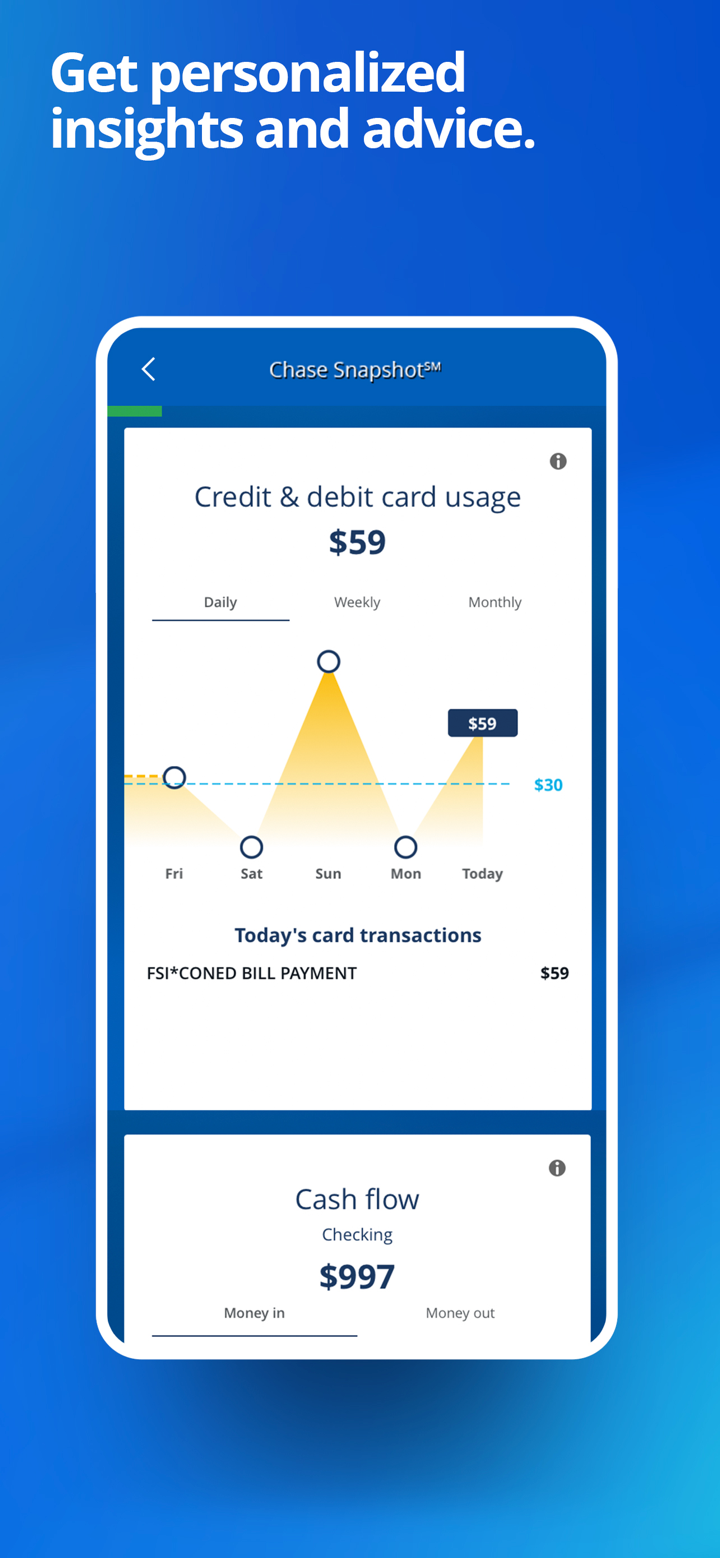

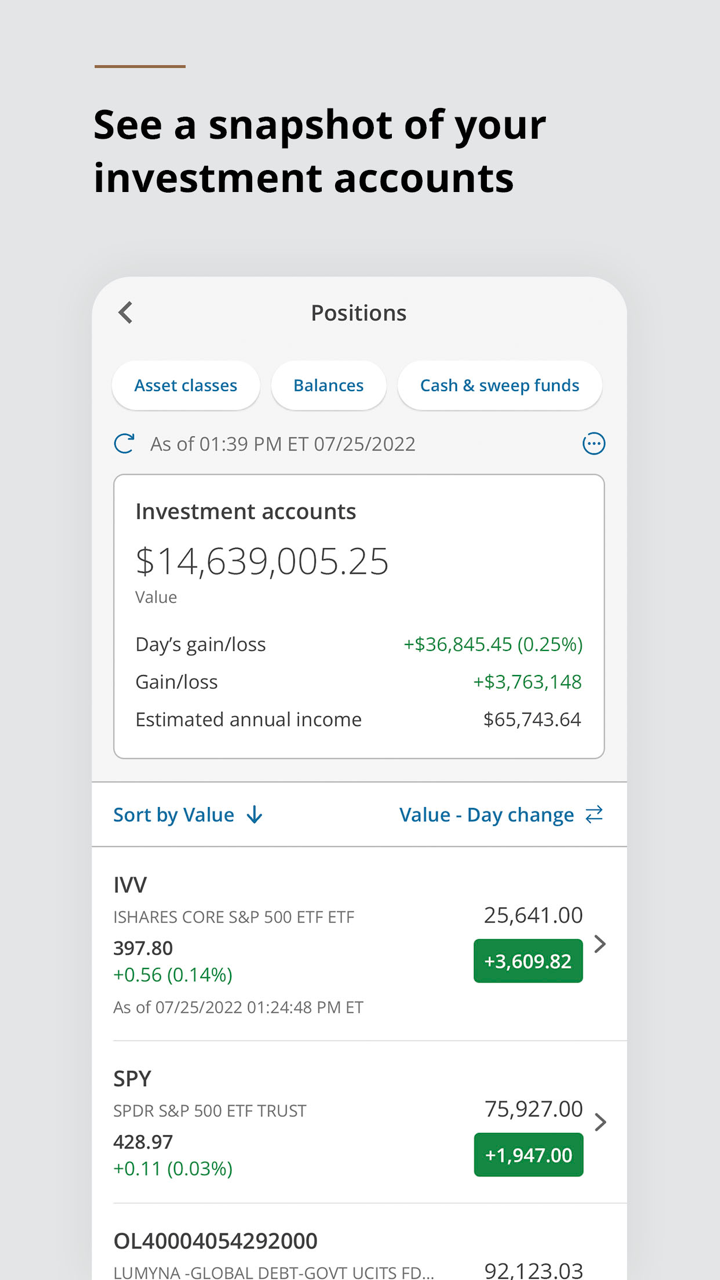

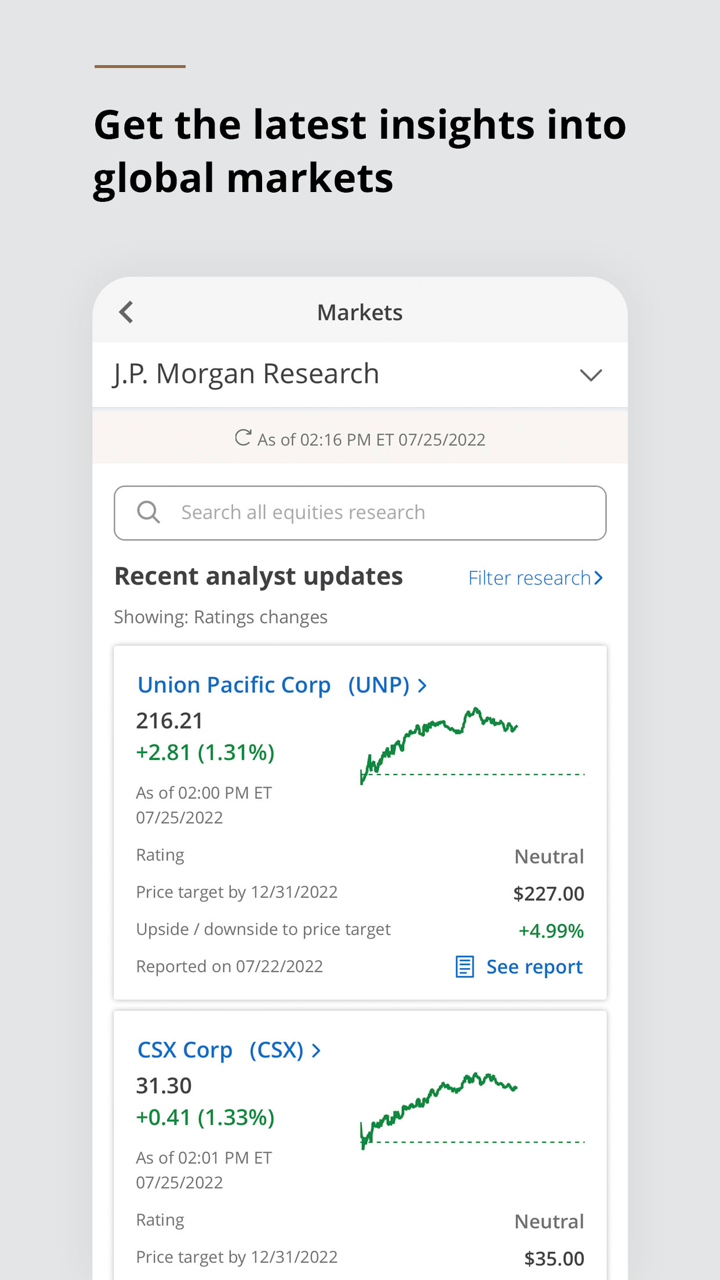

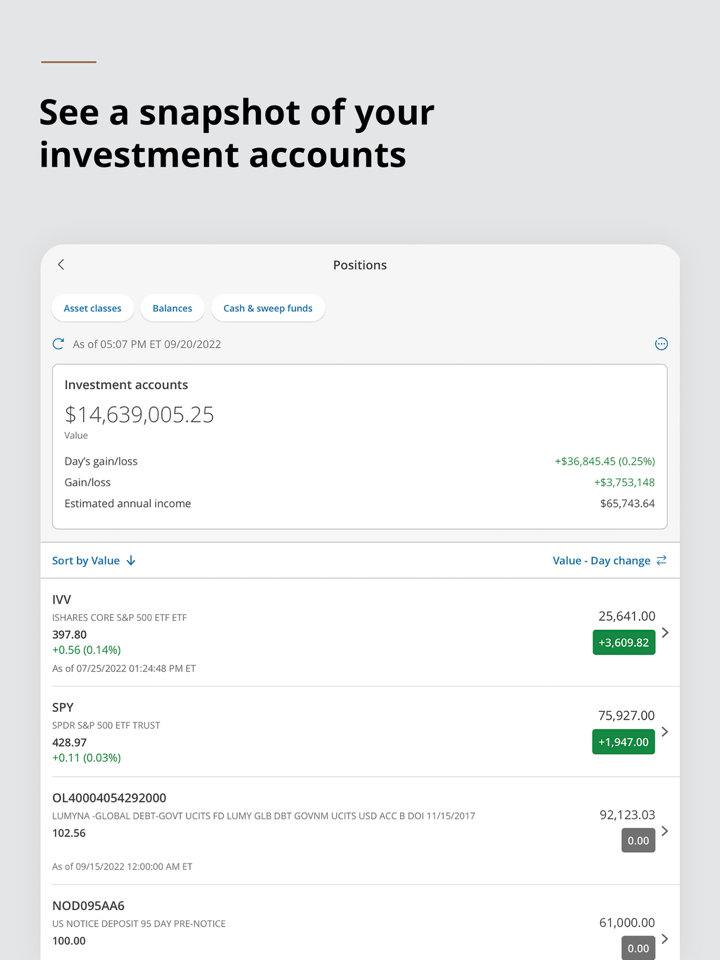

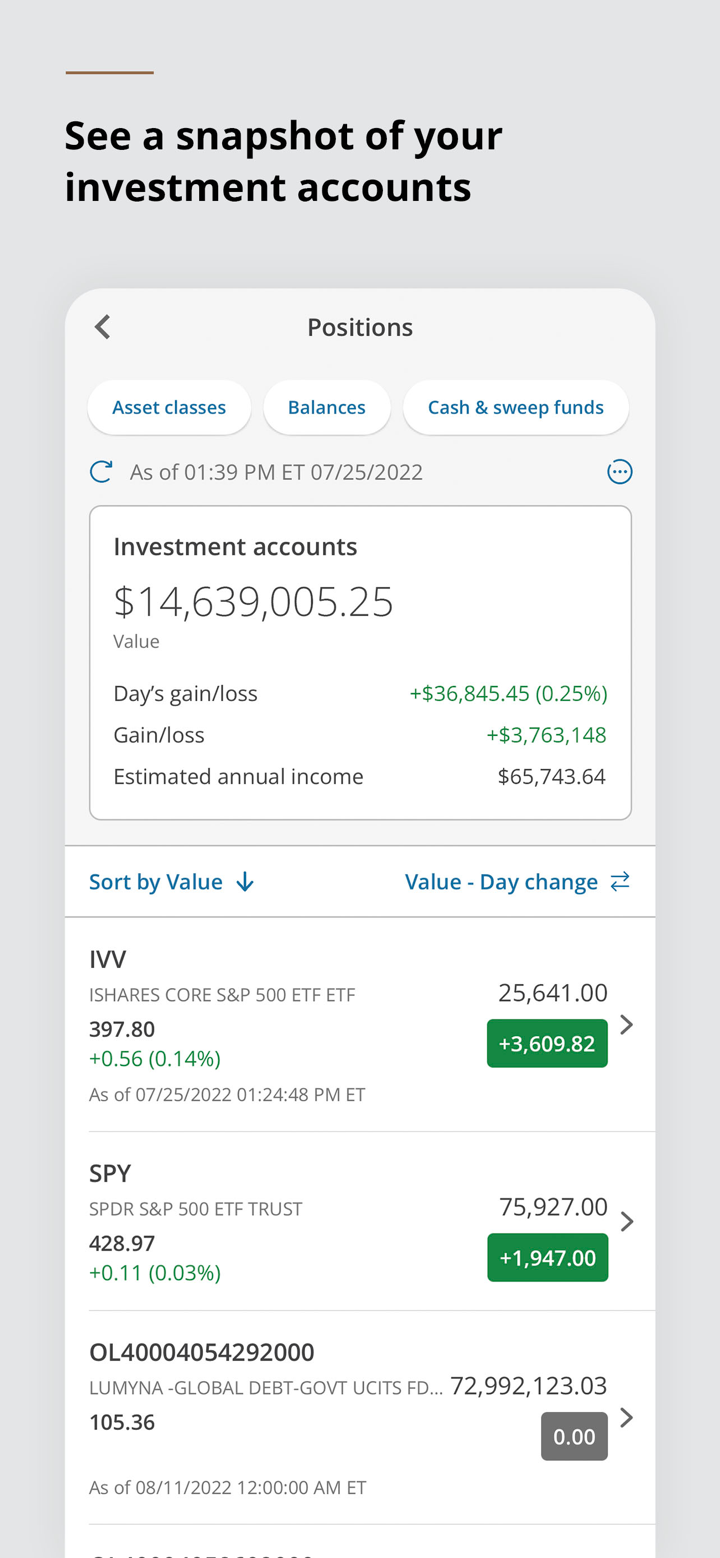

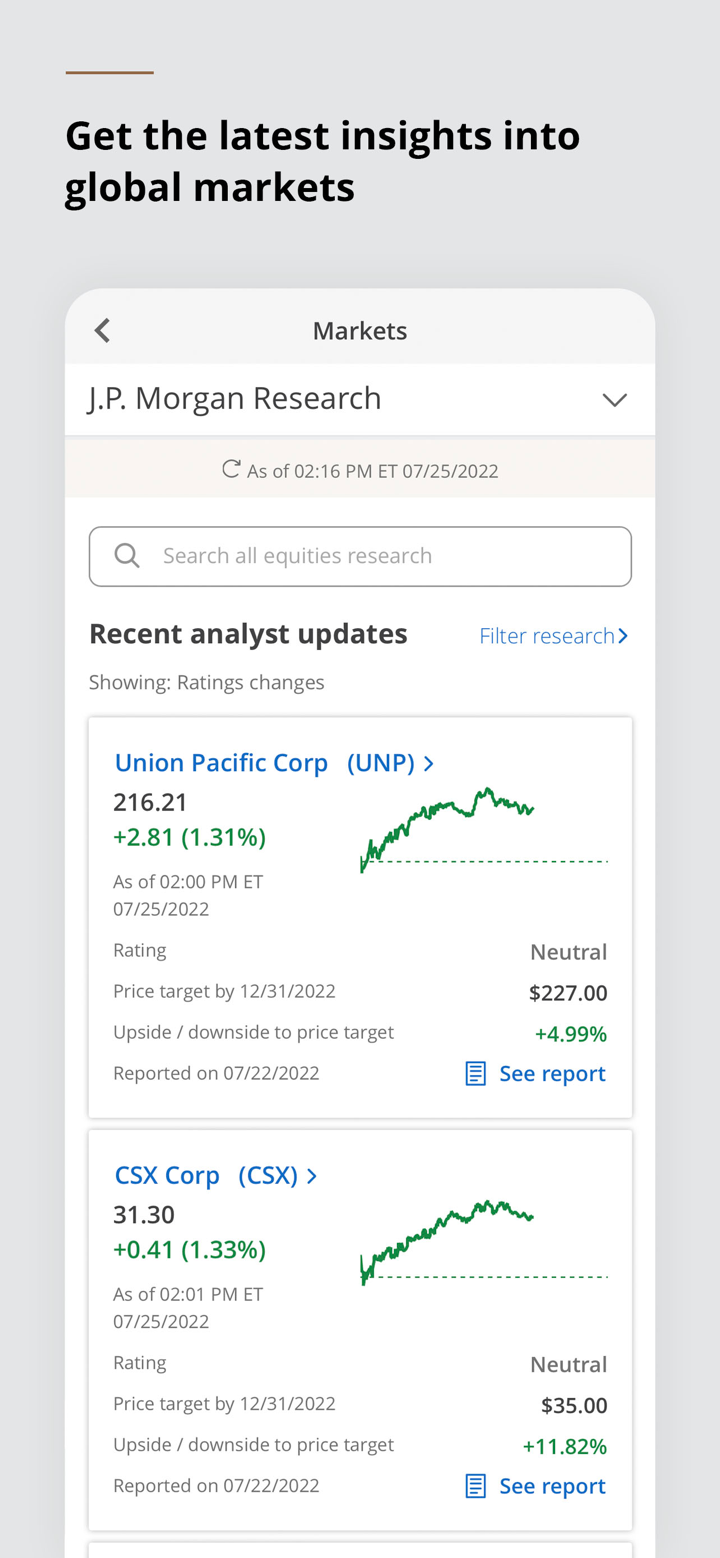

- Institutional Investing: J.P. Morgan's Institutional Investing serves the world's largest corporate clients and institutional investors by supporting the entire investment cycle with market-leading research, analytics, execution, and investor services.

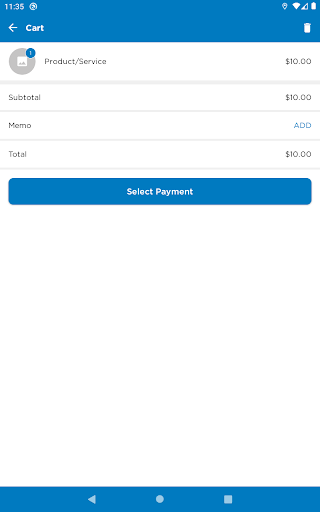

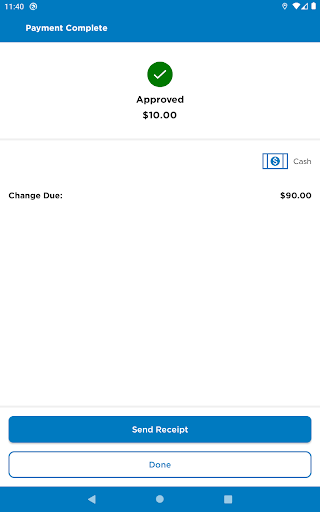

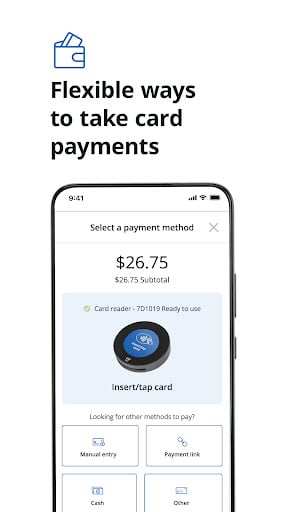

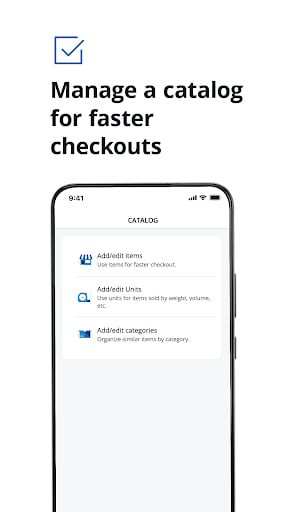

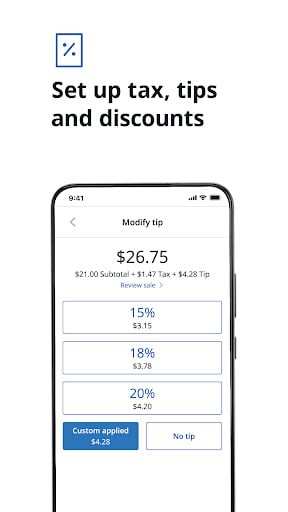

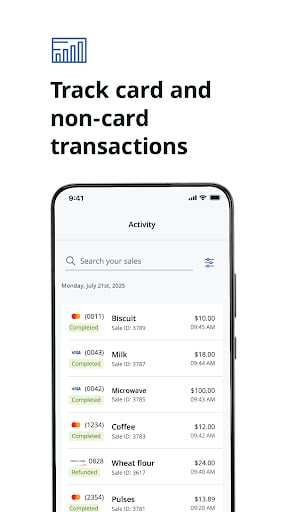

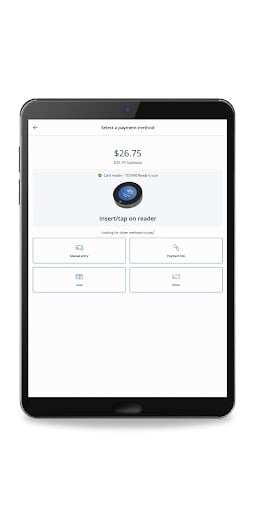

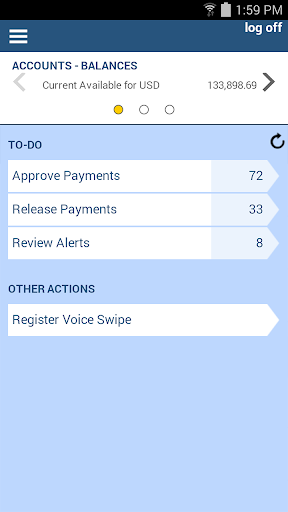

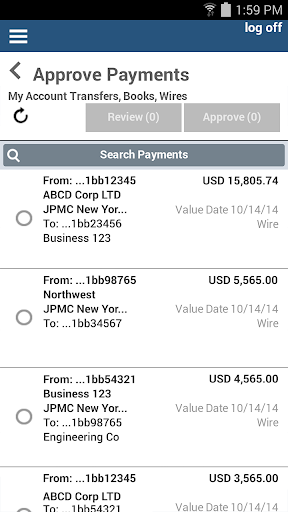

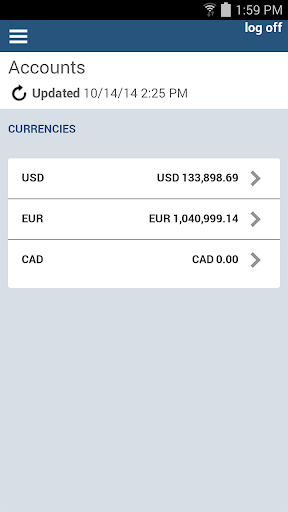

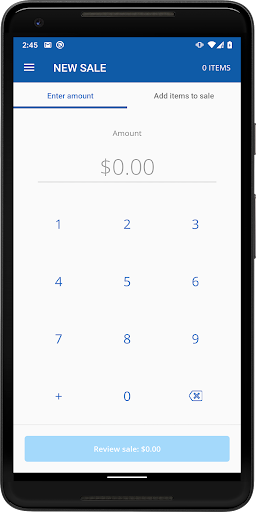

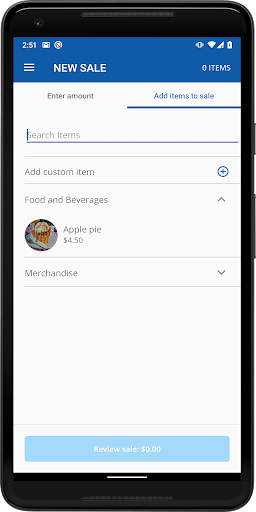

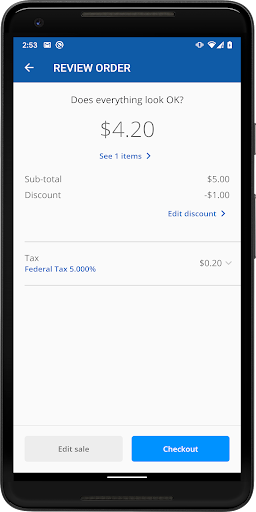

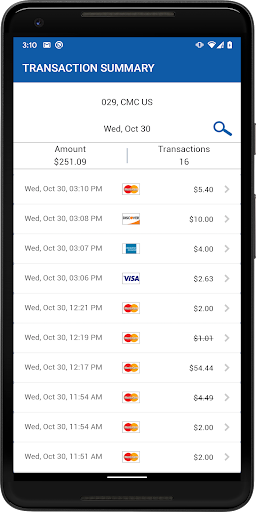

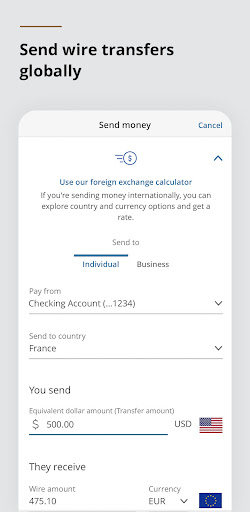

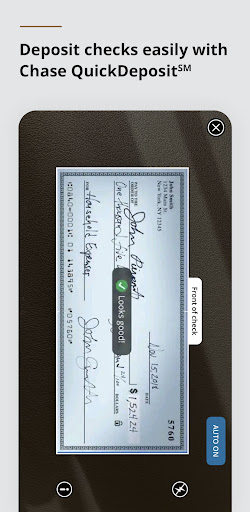

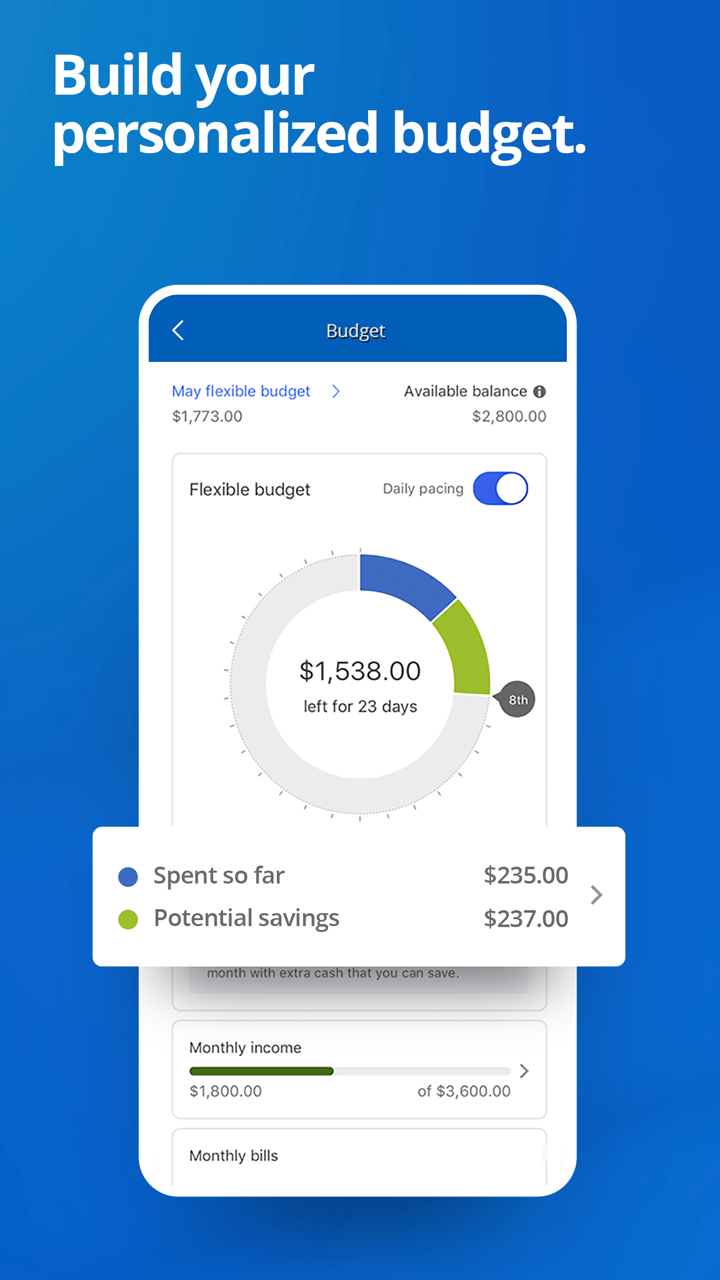

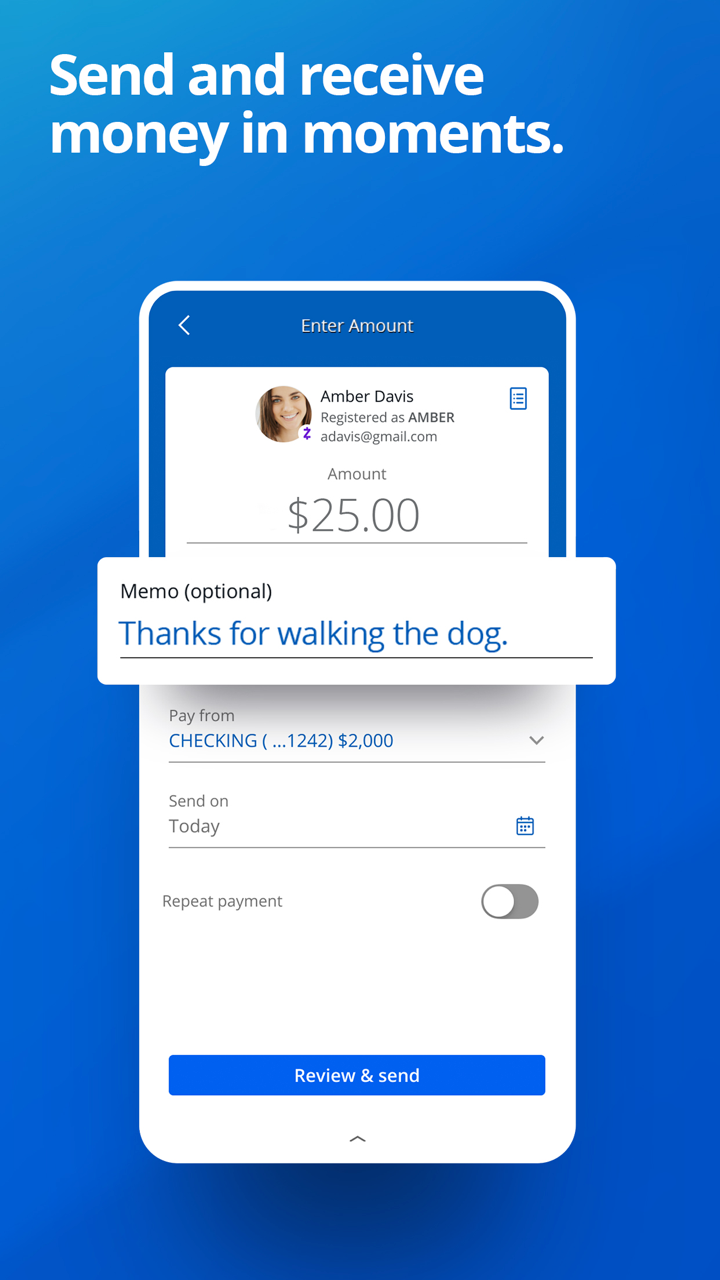

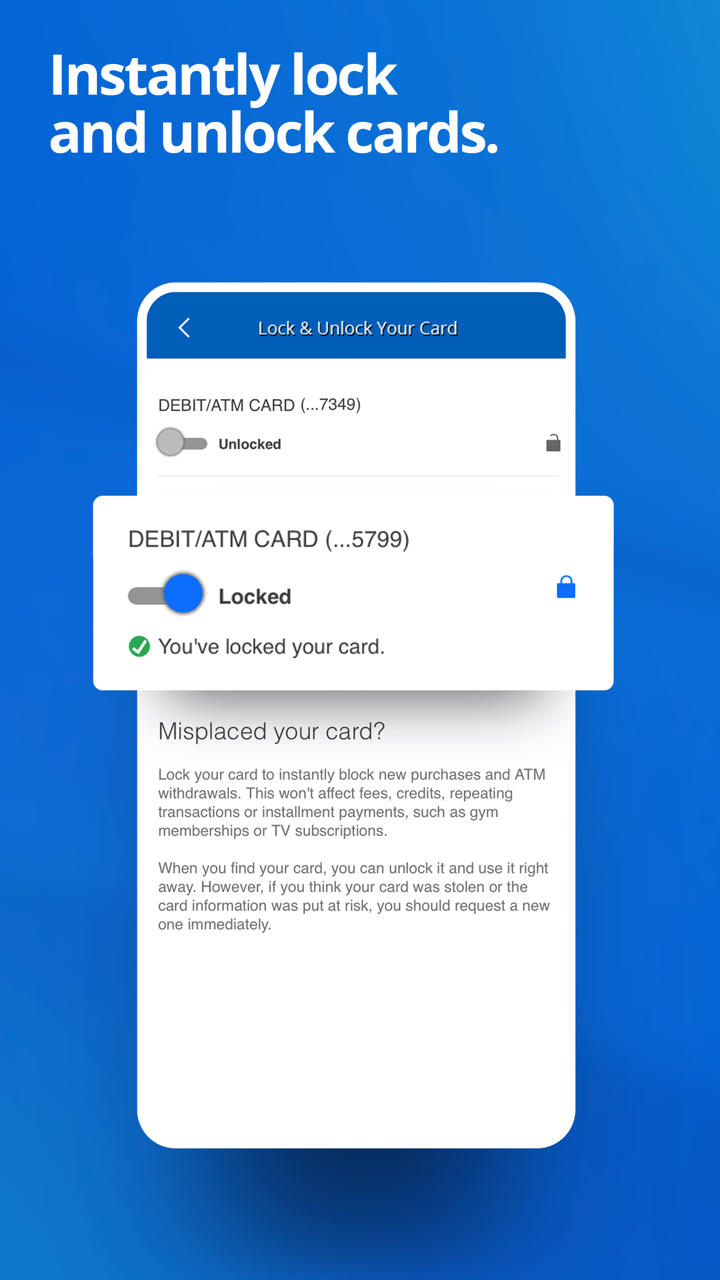

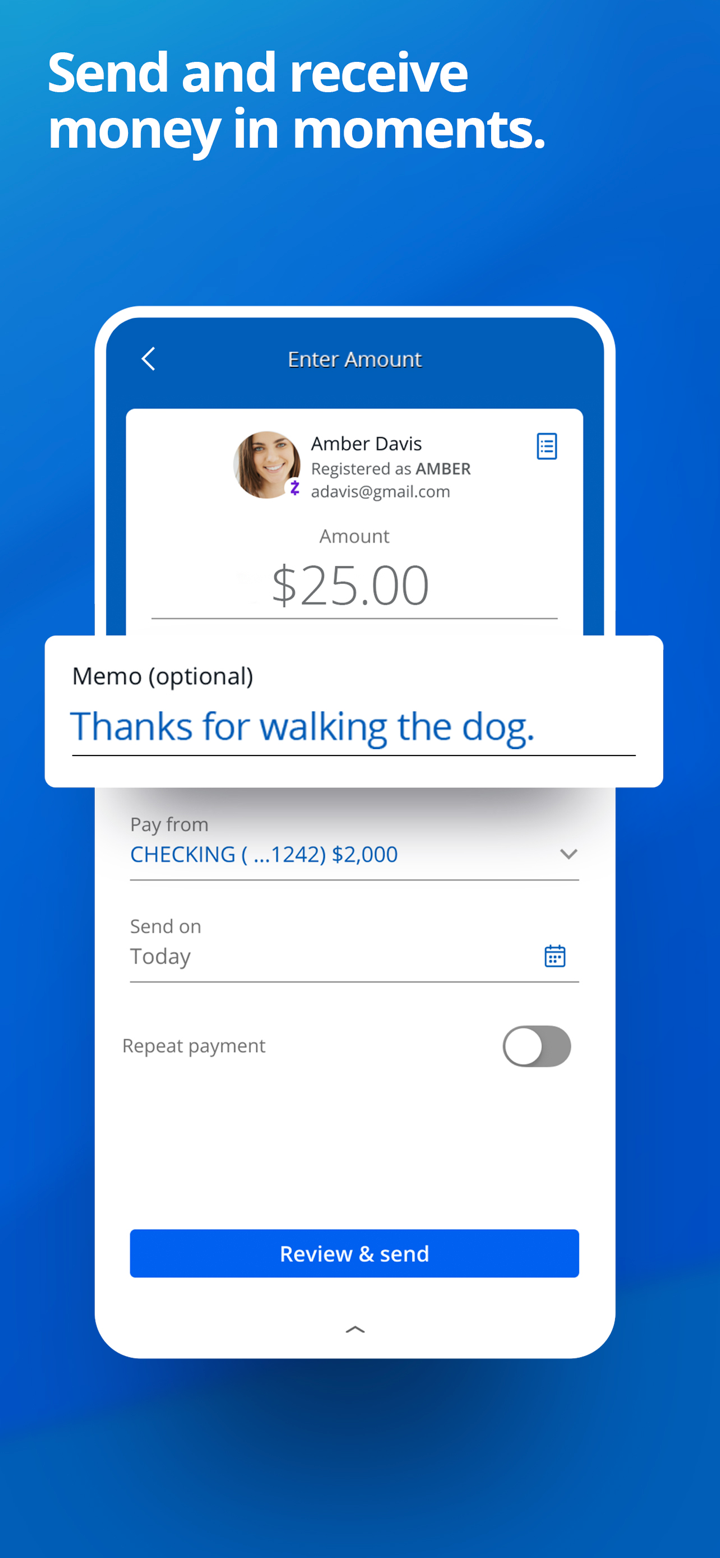

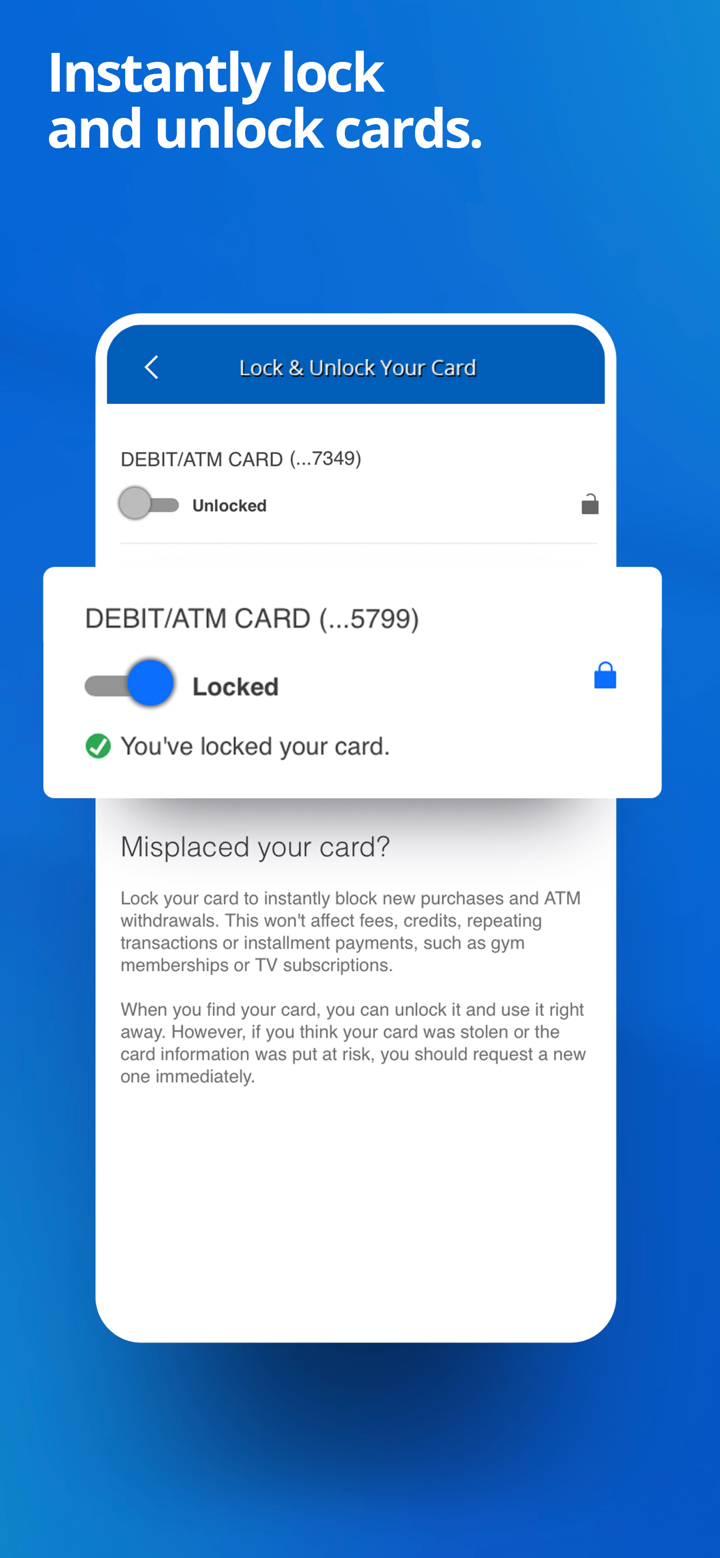

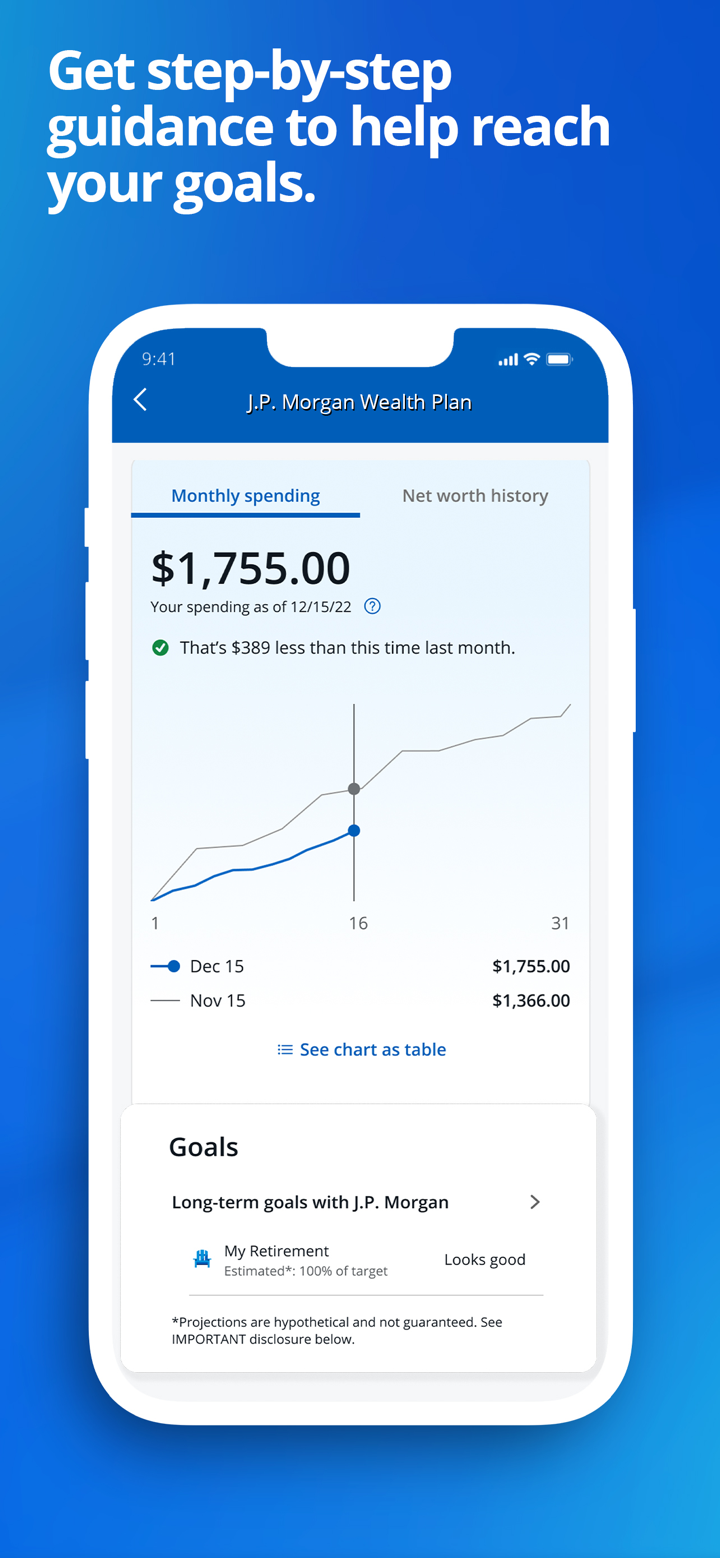

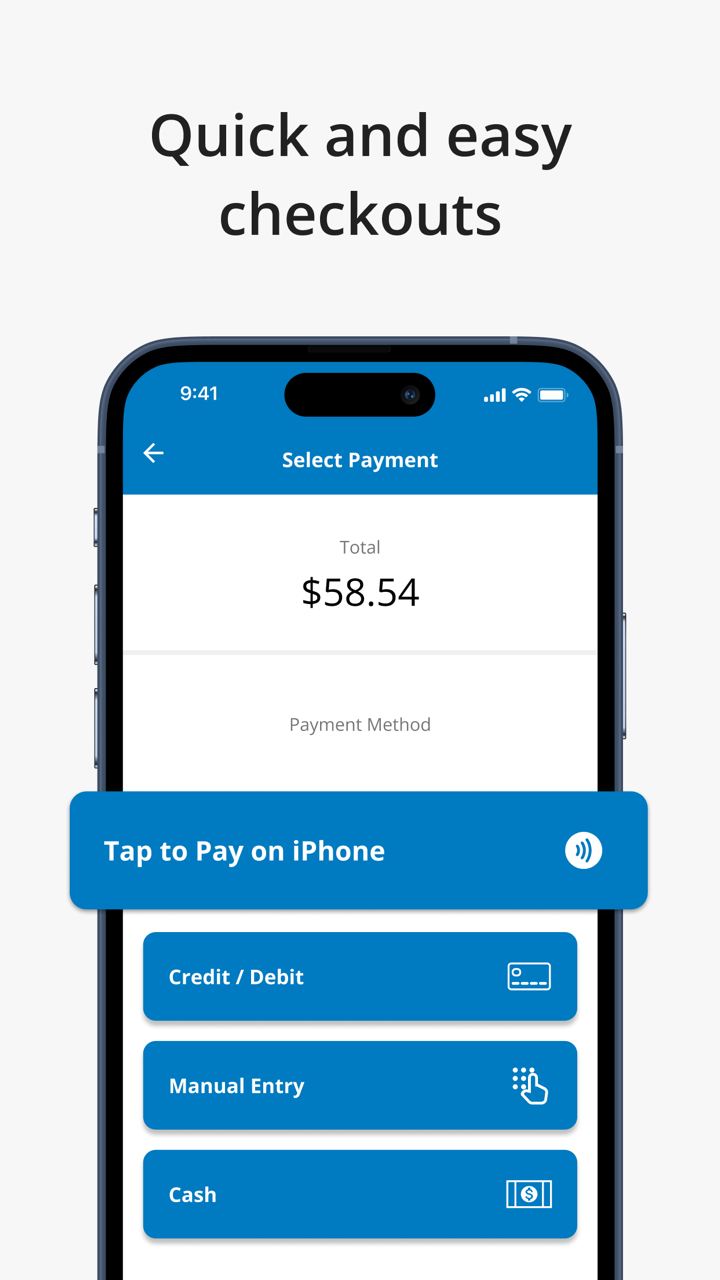

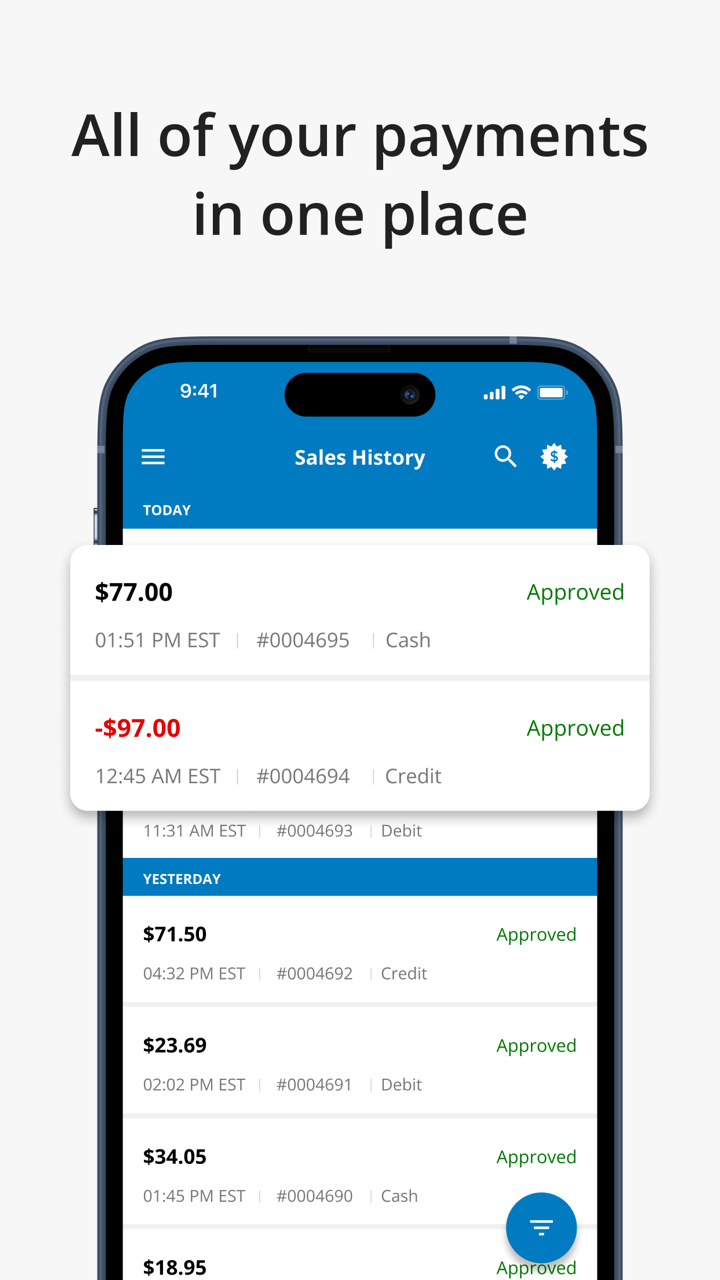

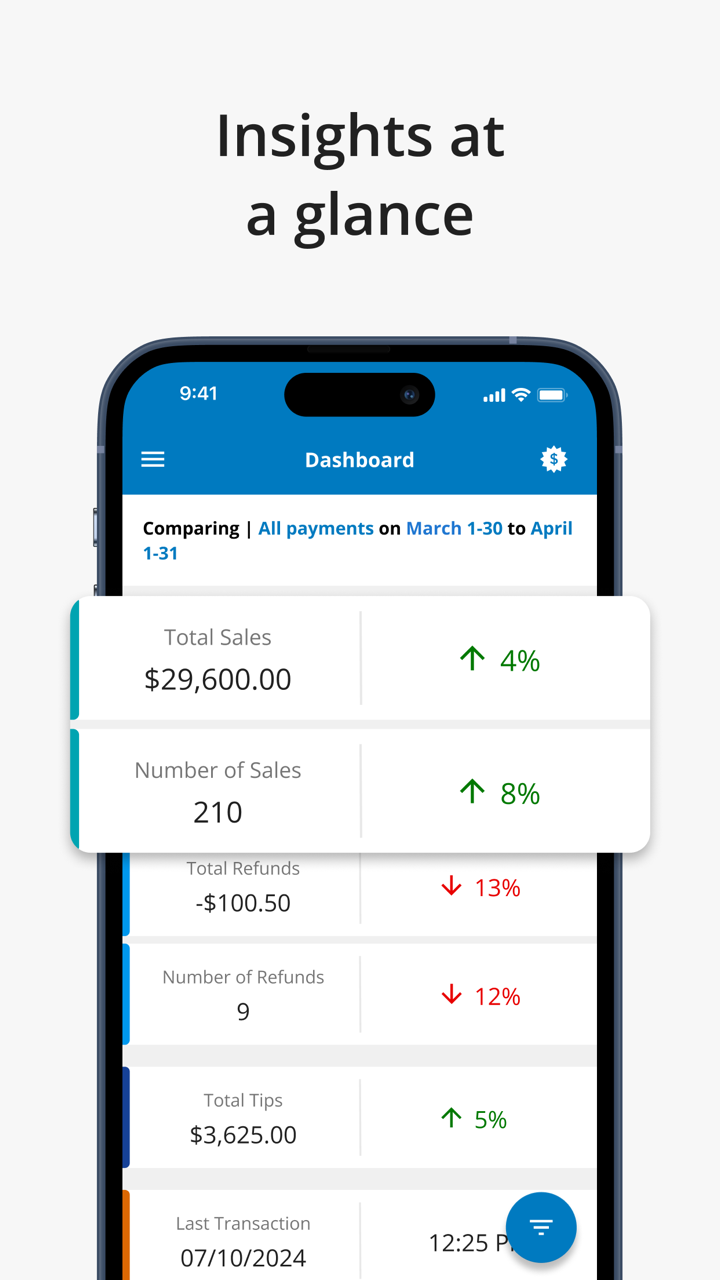

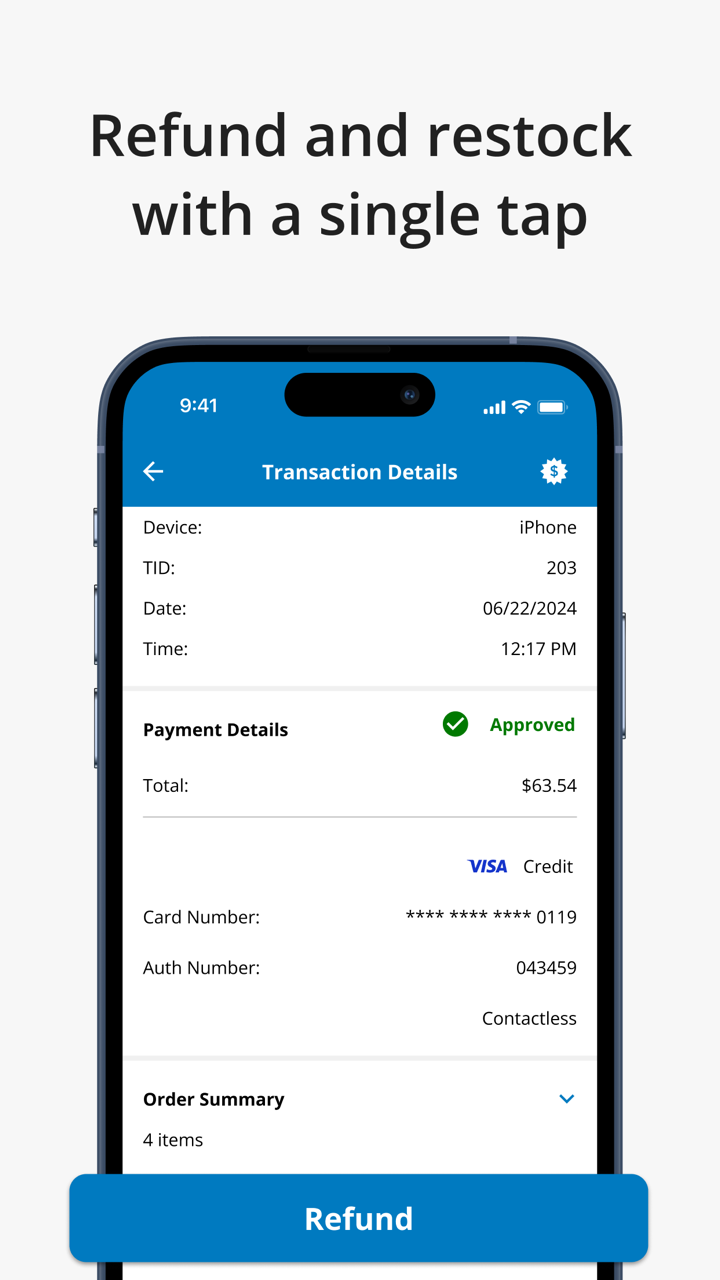

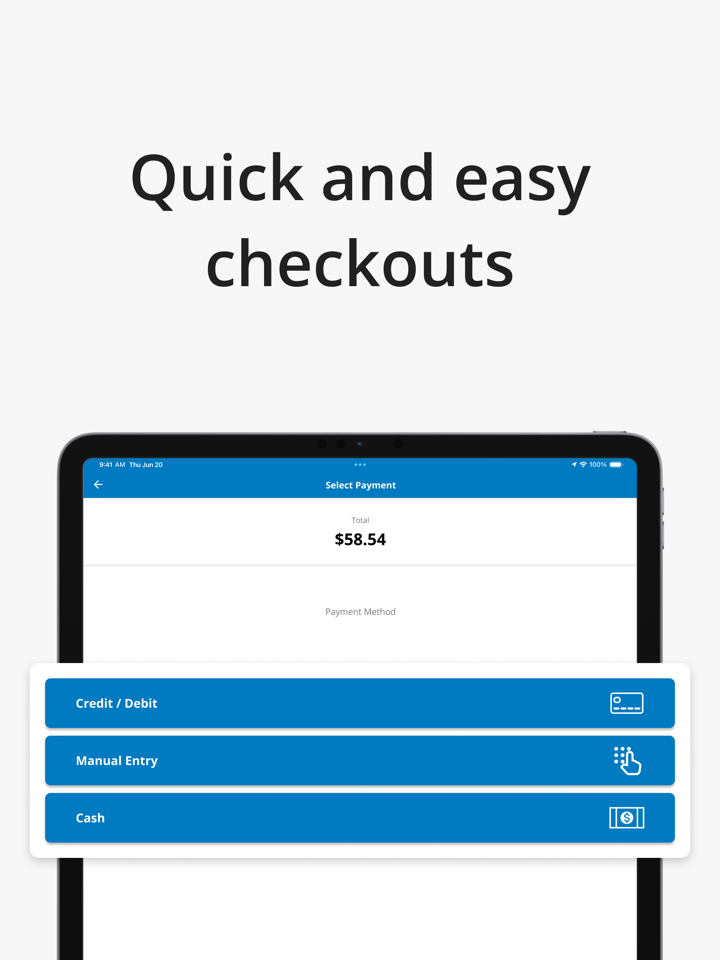

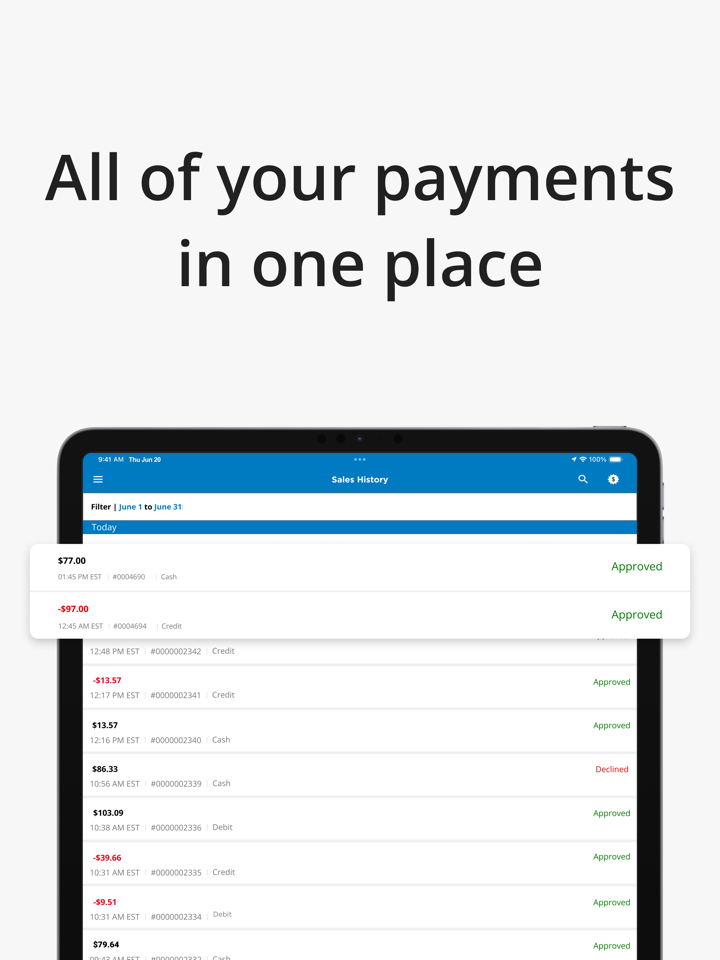

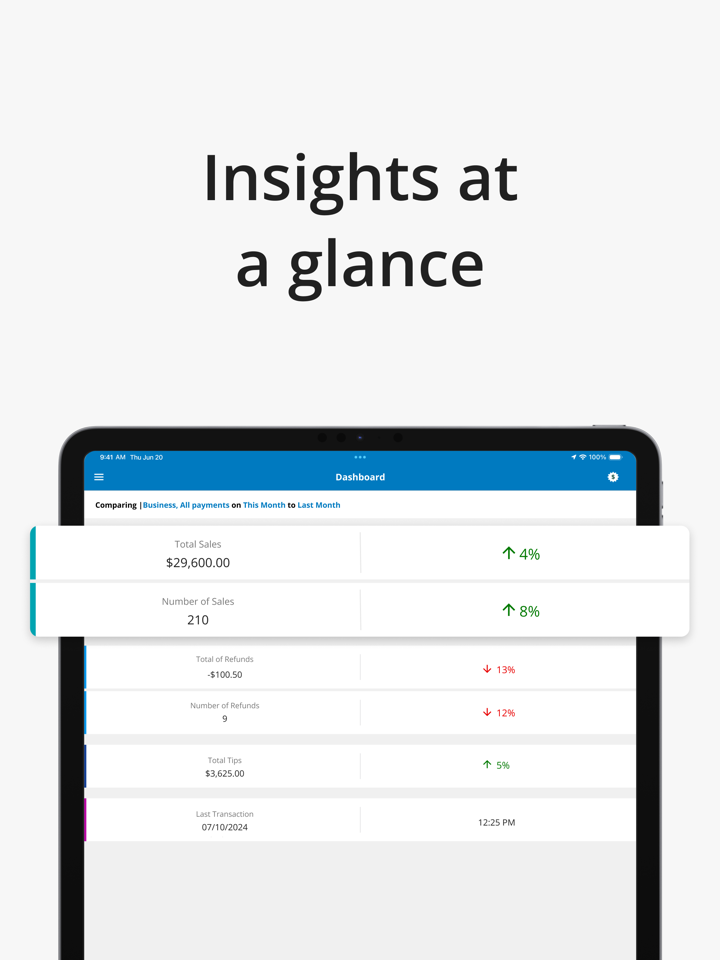

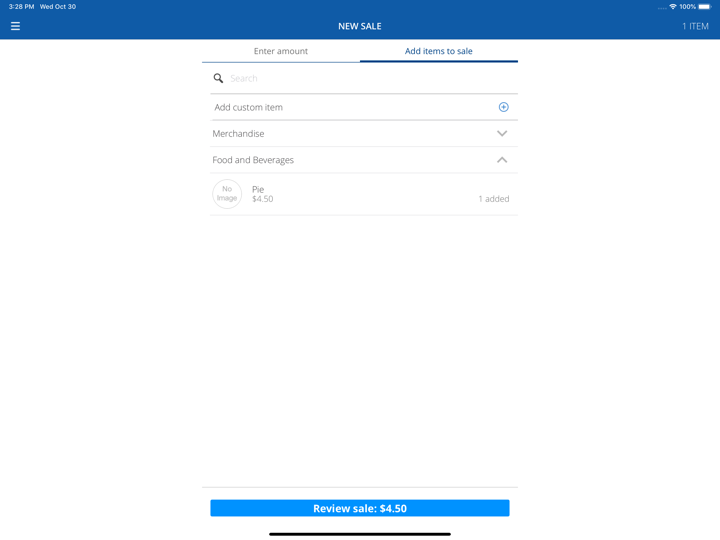

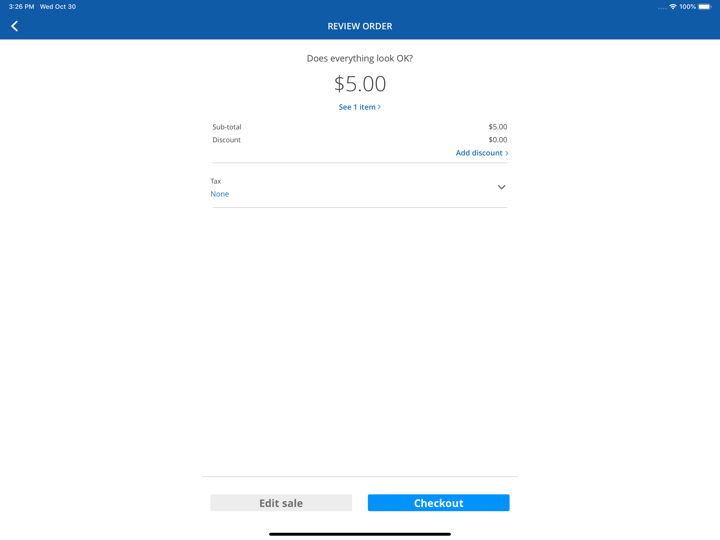

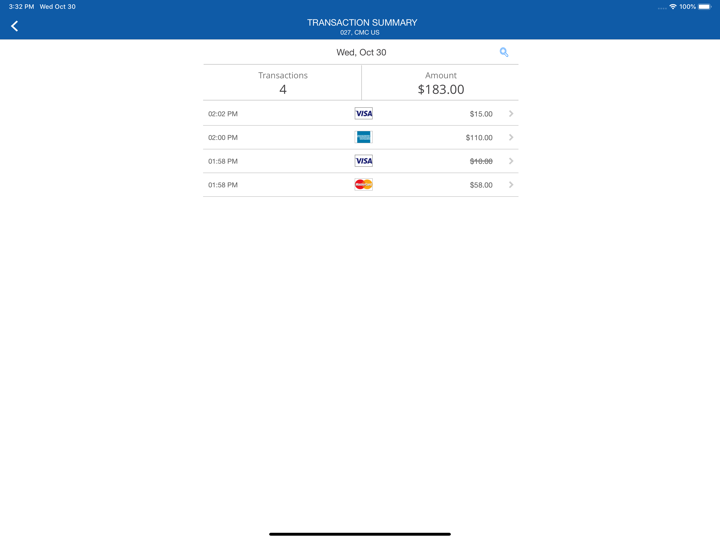

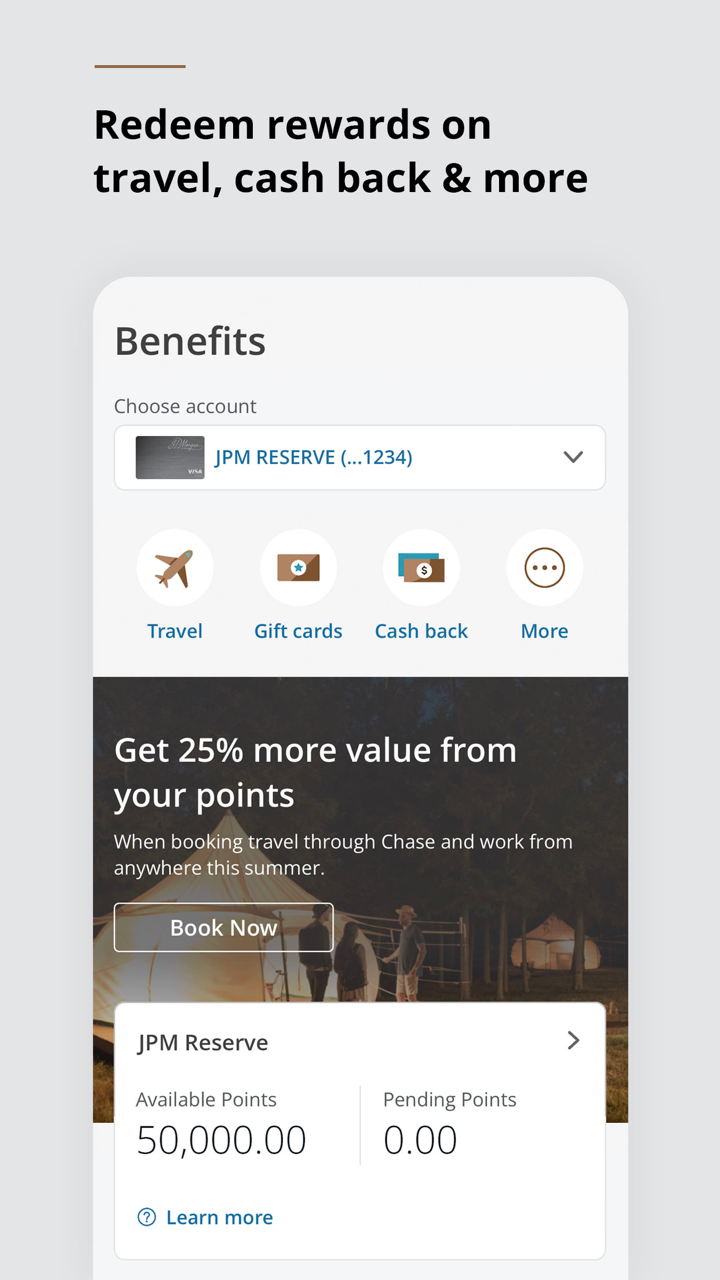

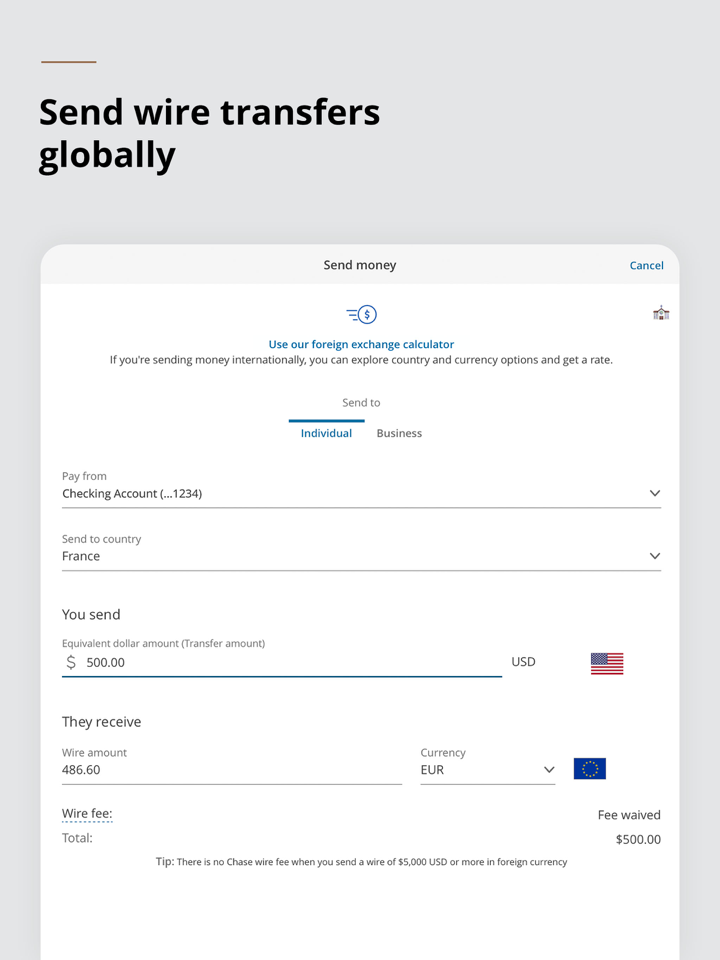

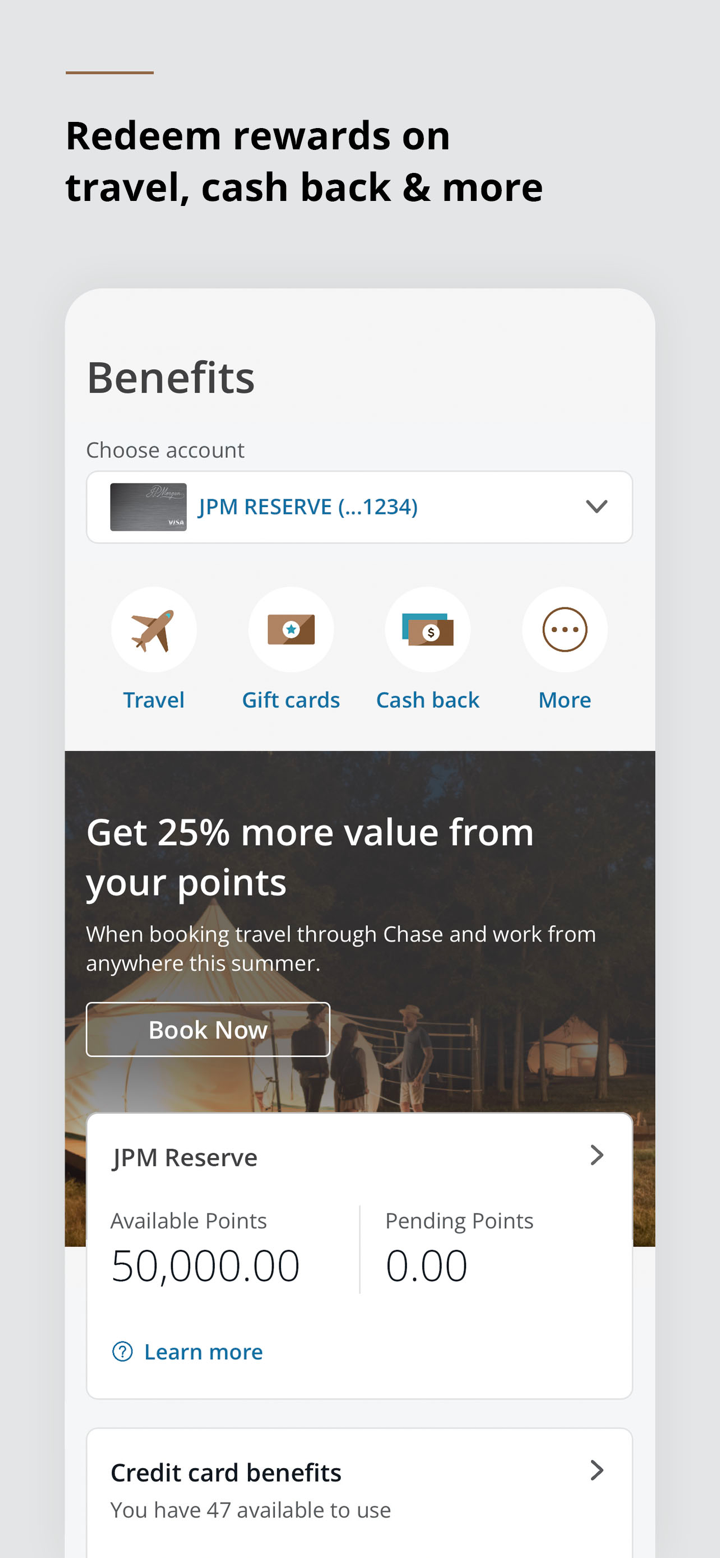

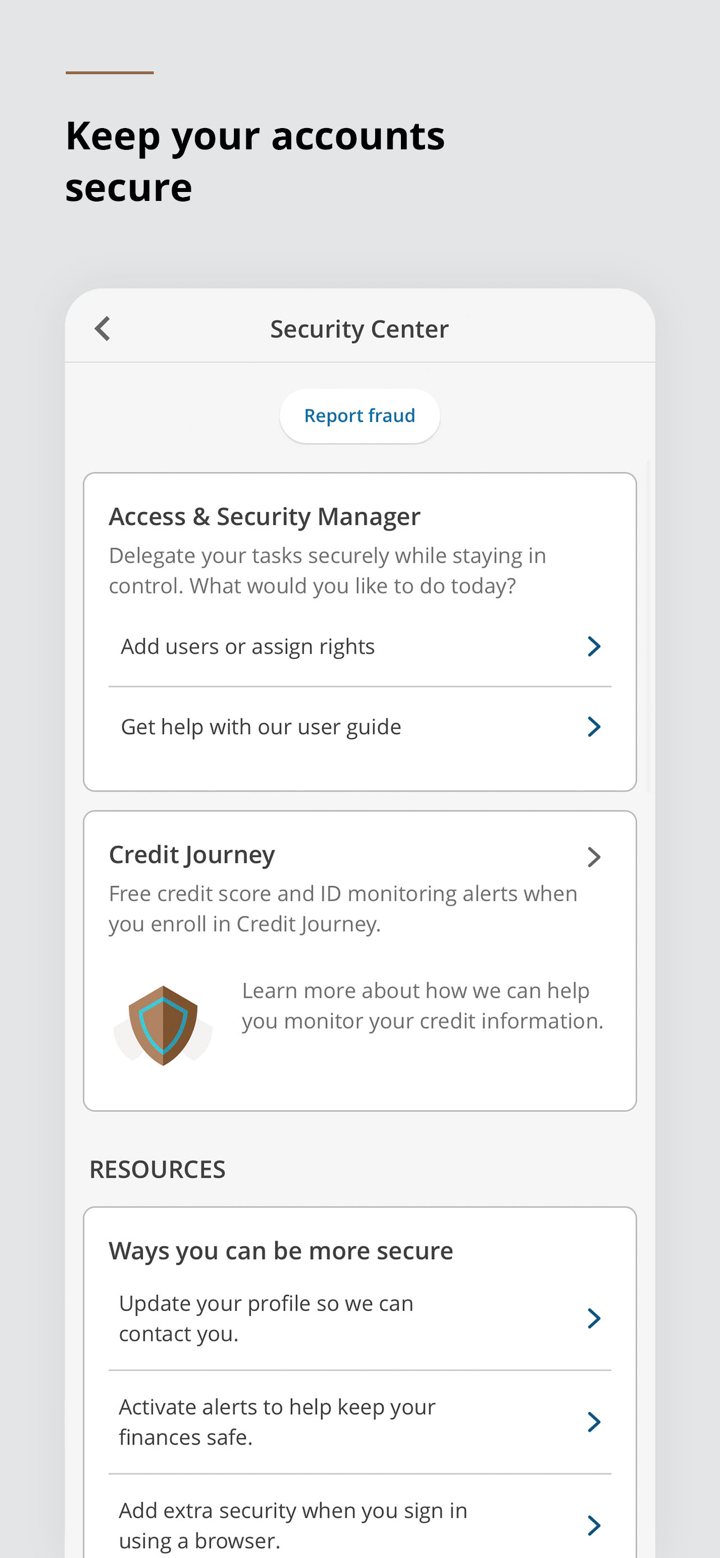

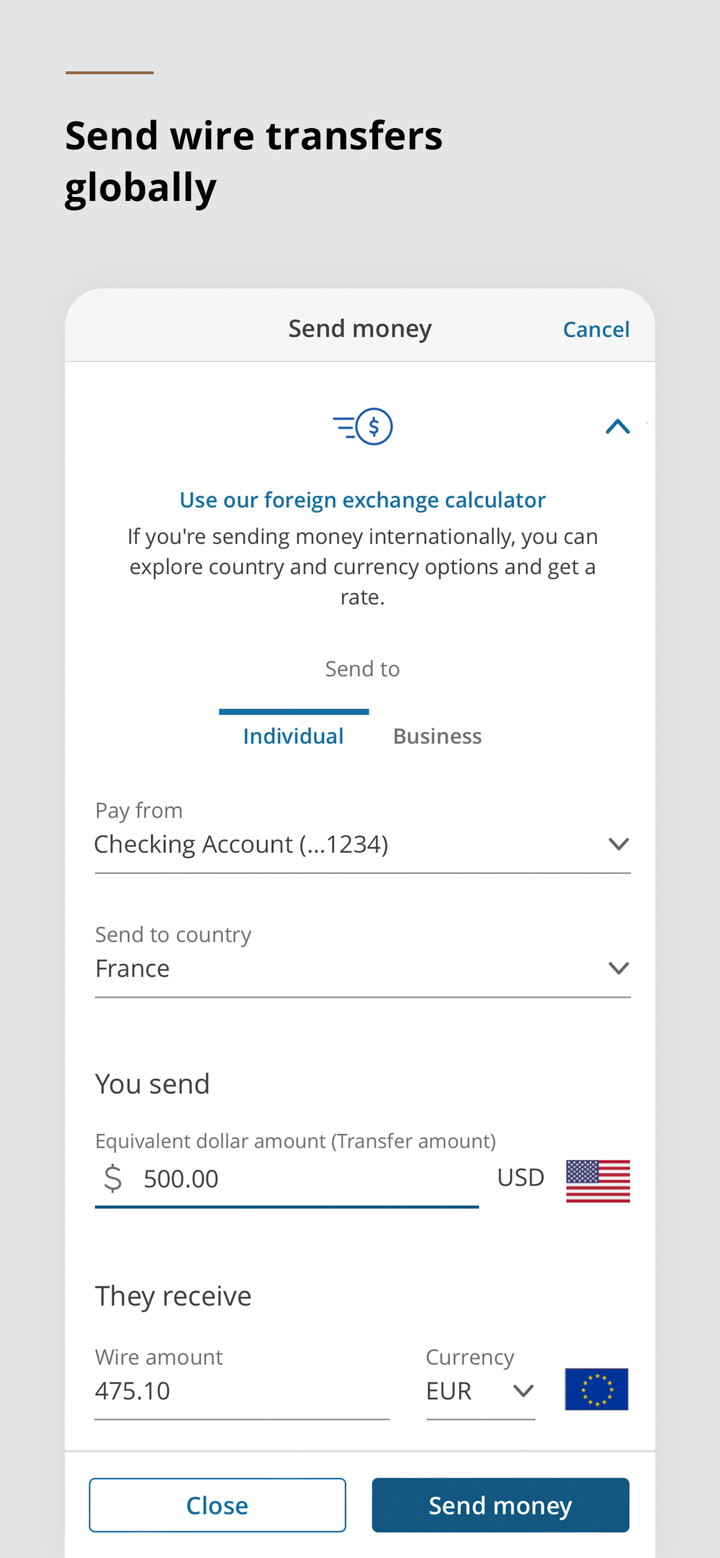

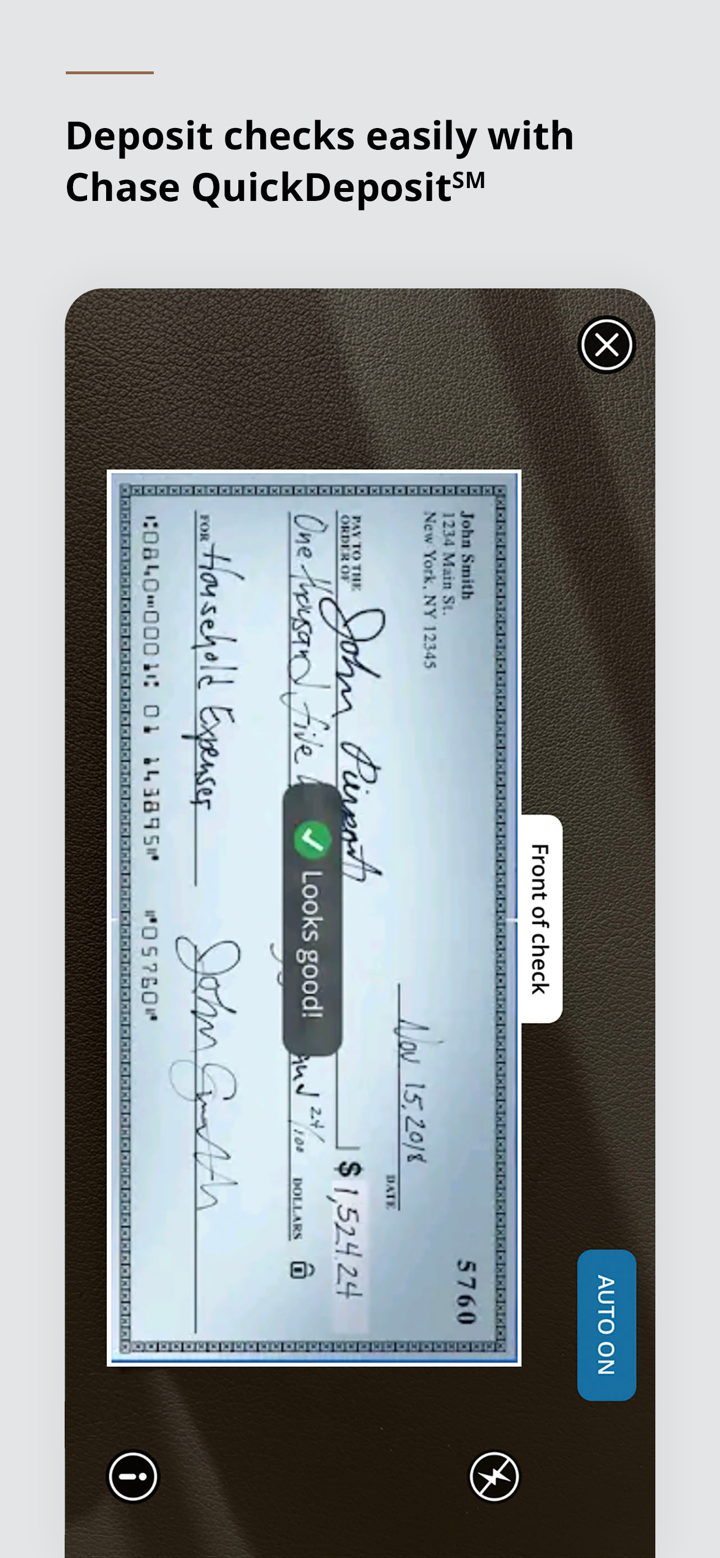

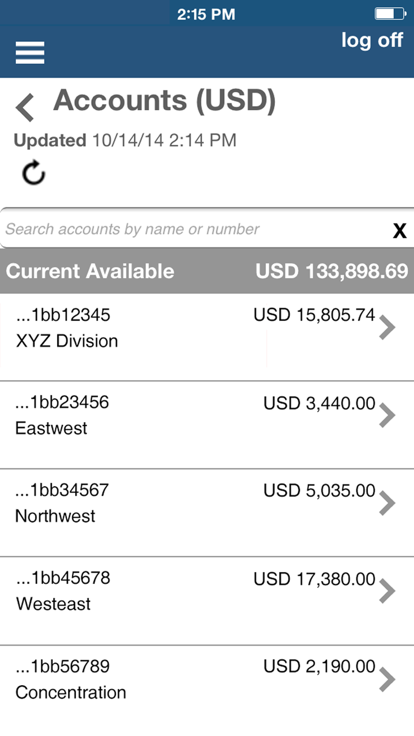

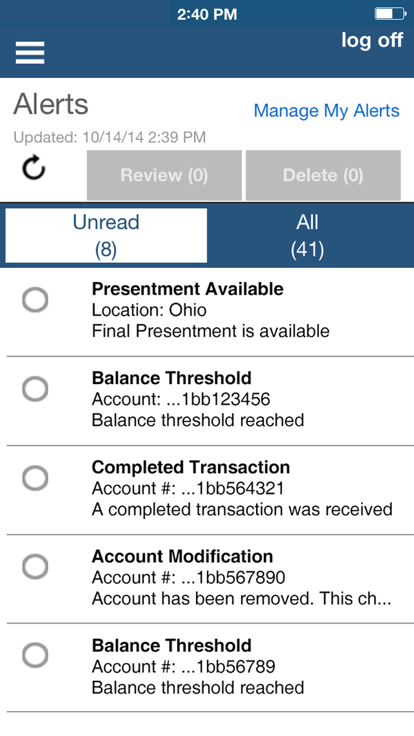

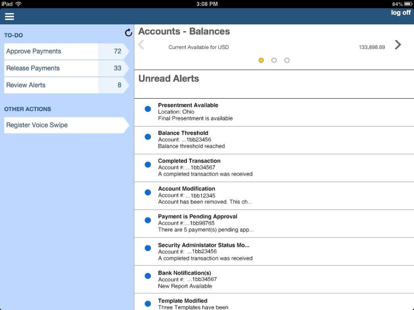

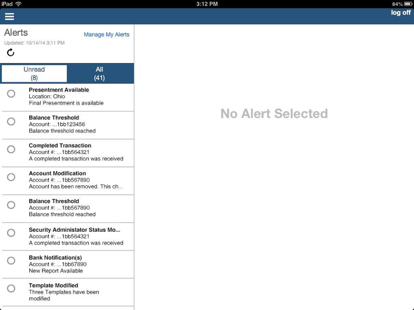

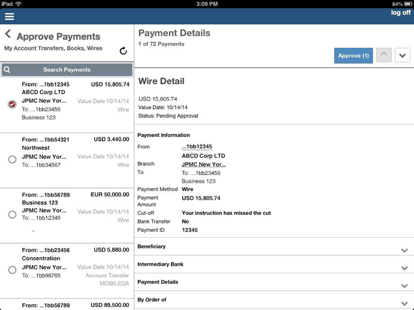

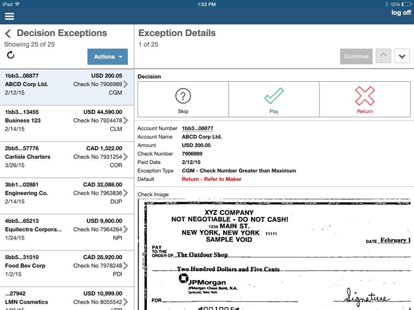

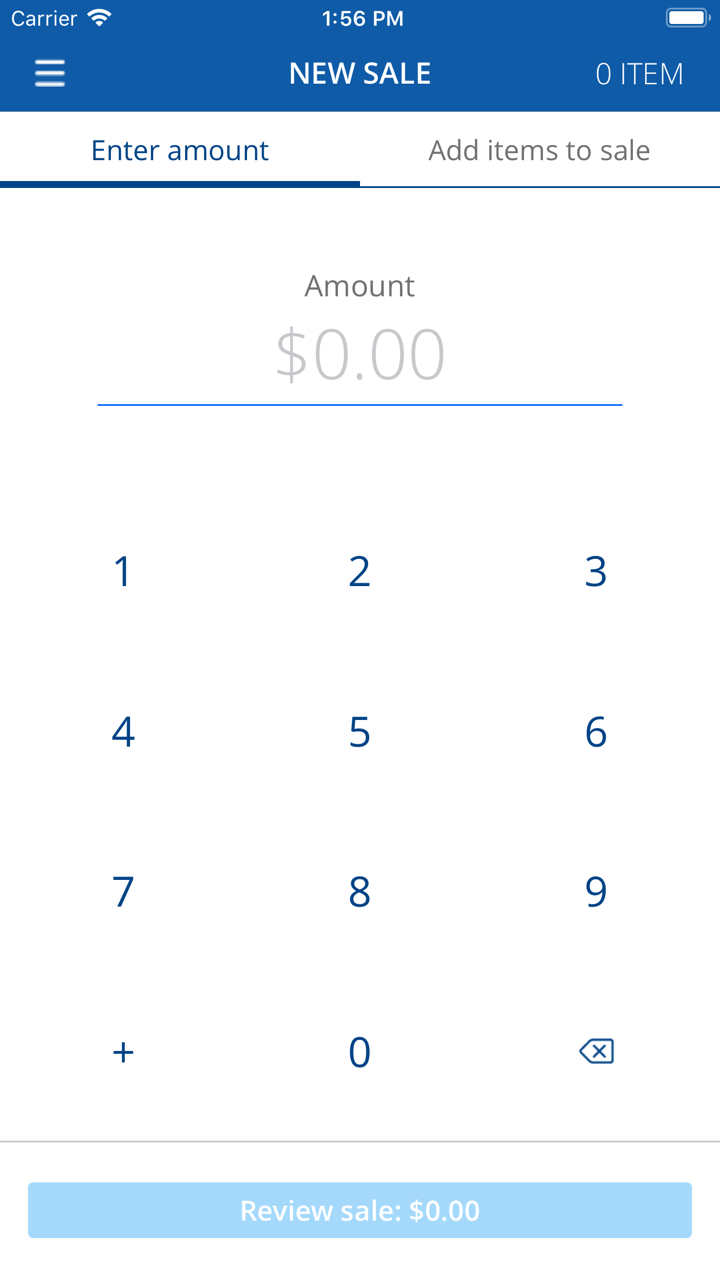

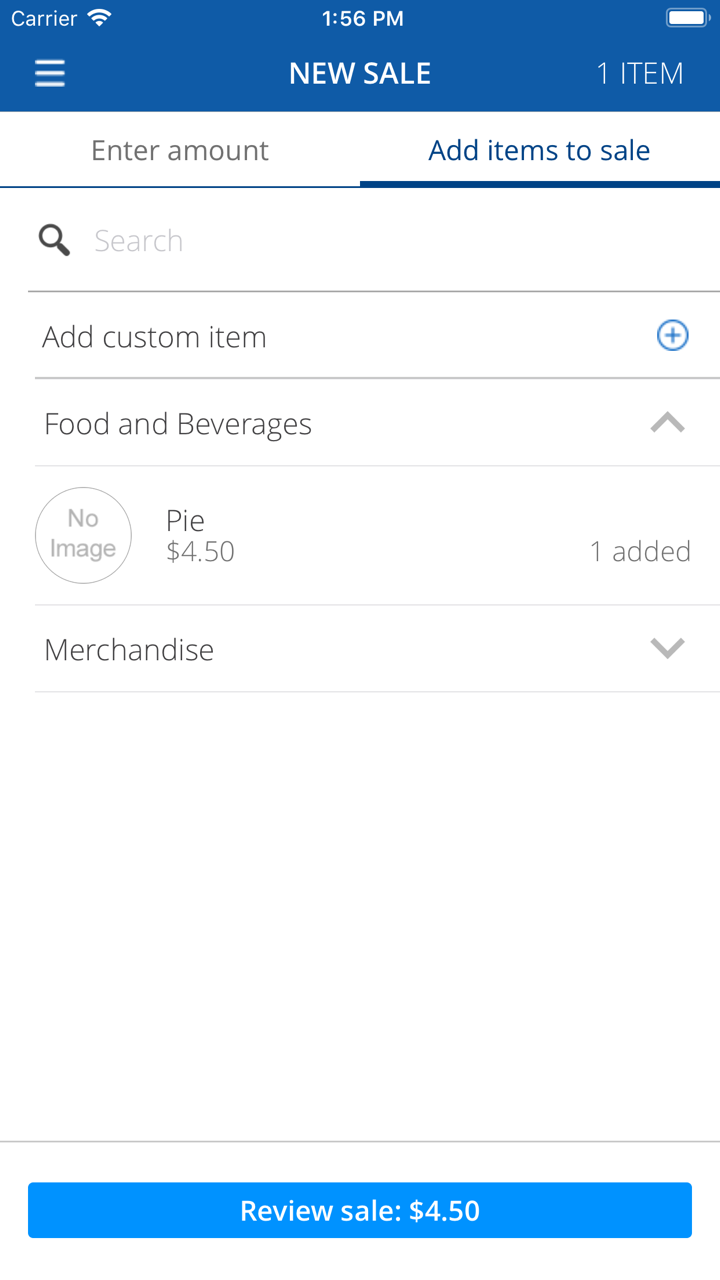

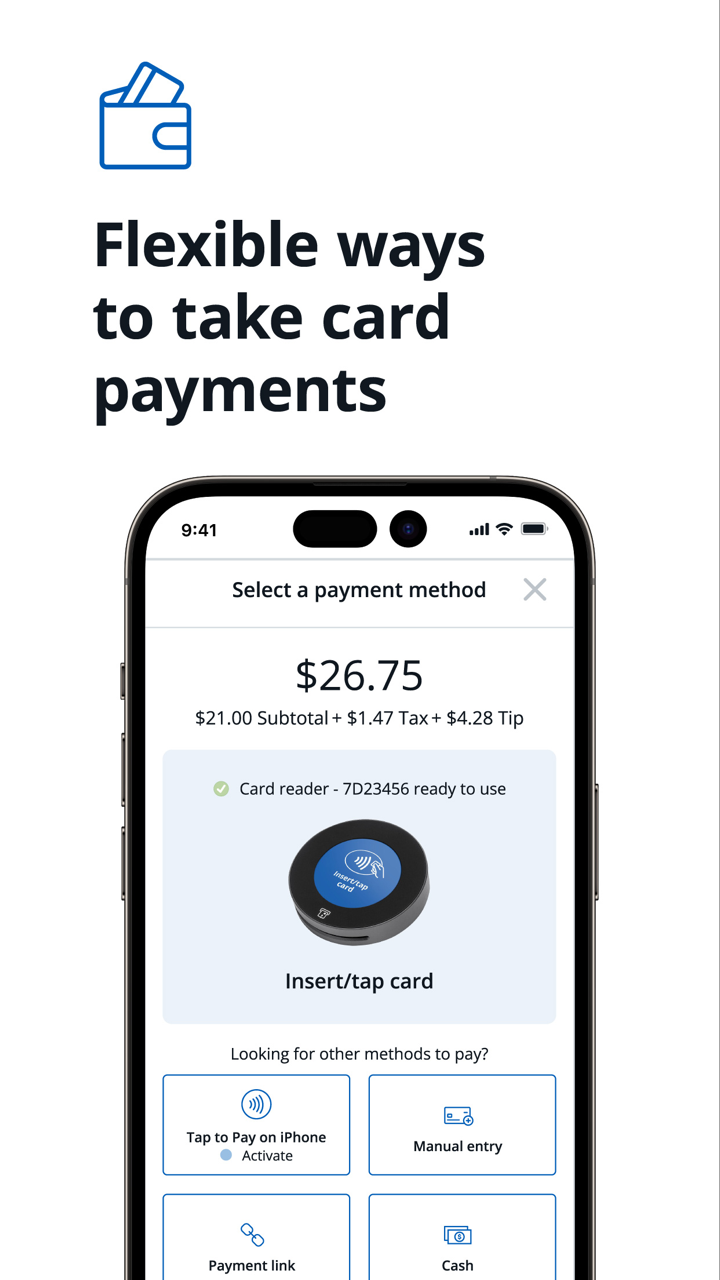

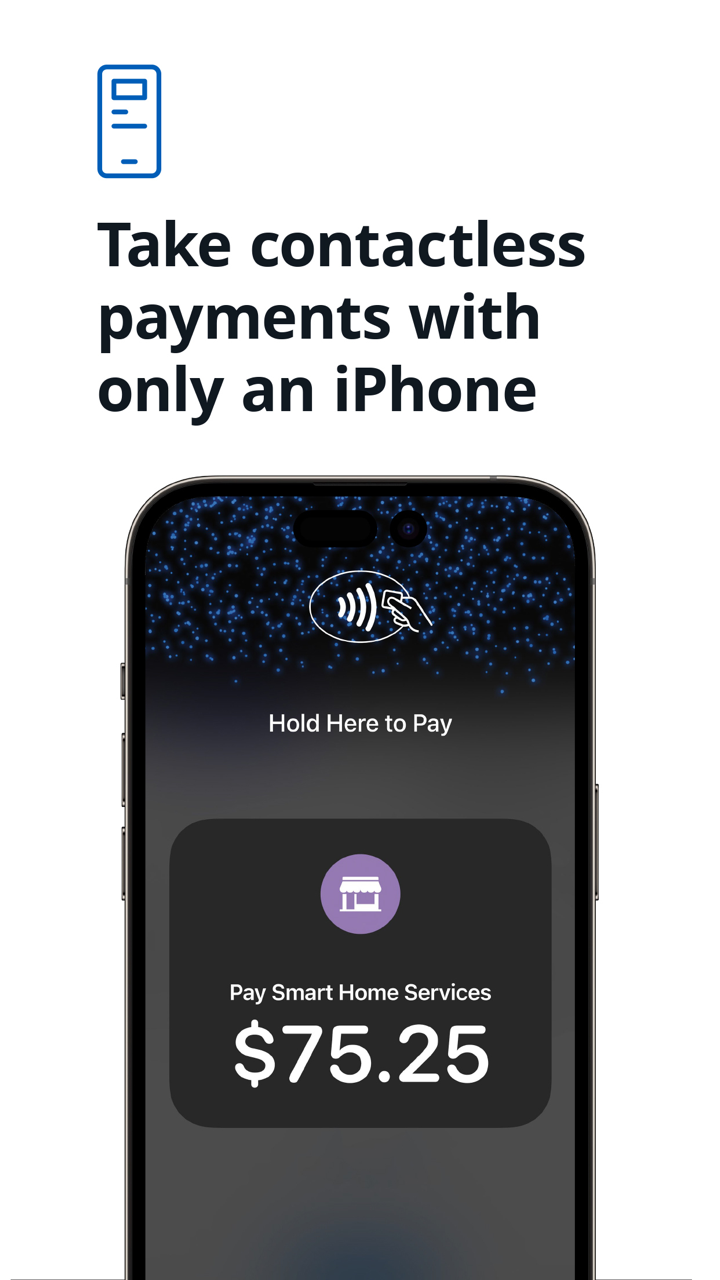

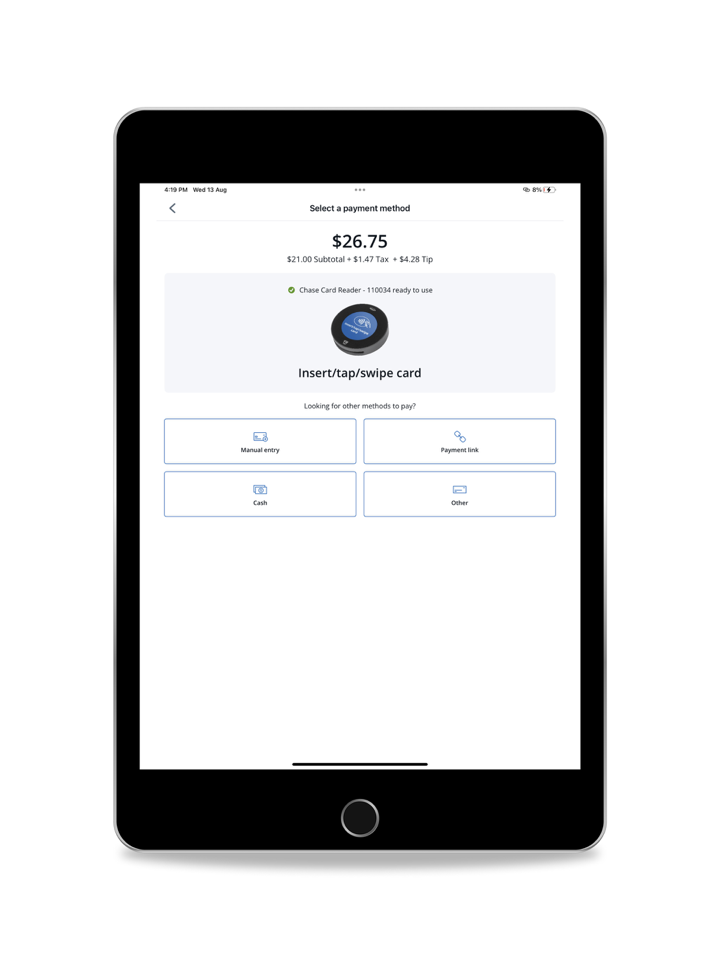

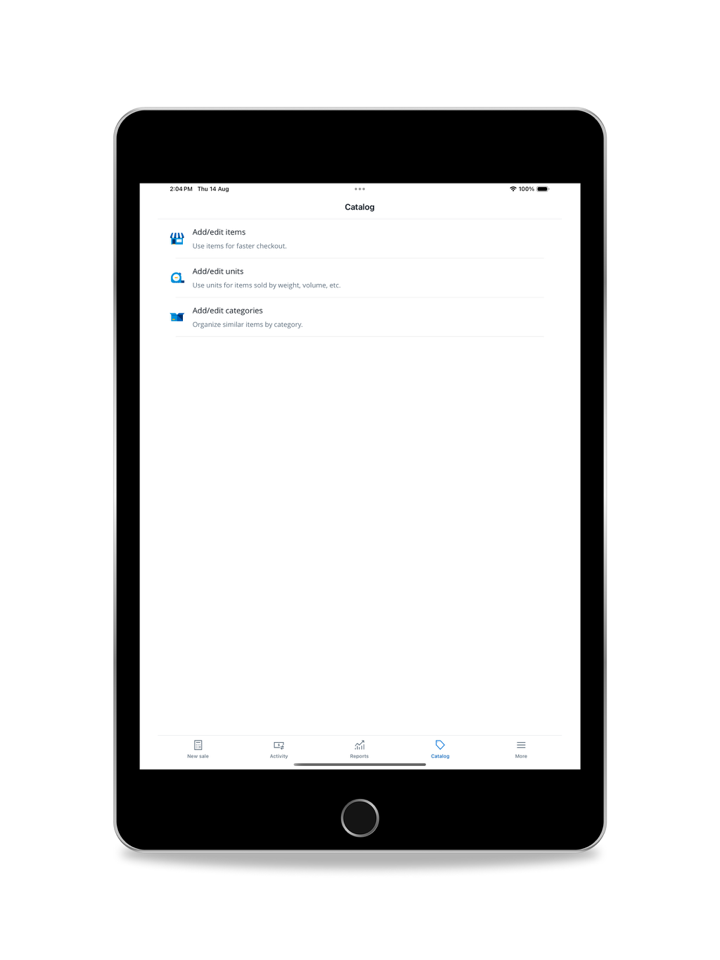

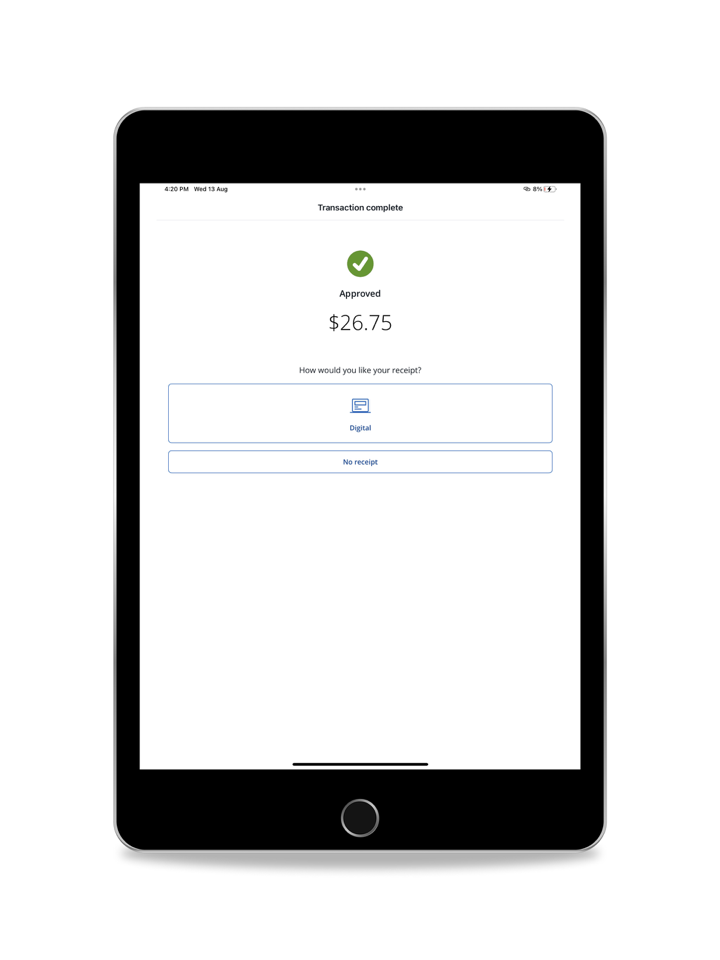

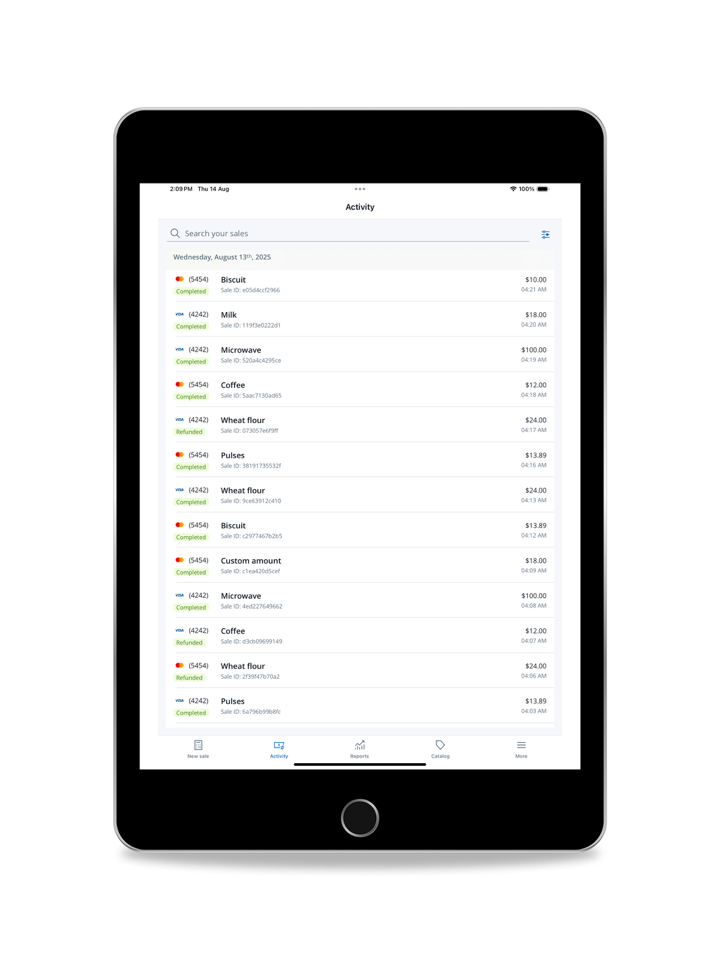

- Payments: J.P. Morgan offers Payments Solutions designed to help businesses navigate the complex and rapidly changing payments environment, enabling them to manage risk, innovate for growth, and deliver excellent customer experiences.

Industries Served

J.P. Morgan serves a wide array of industries, including Commercial Real Estate, Consumer and Retail, Diversified Industries, Energy, Power & Renewables, Financial, Health Care, Media, Telecom and Entertainment, Metals & Mining, Public Sector, and Technology.