Buod ng kumpanya

| J.P. Morgan Buod ng Pagsusuri | |

| Itinatag | 1921 |

| Nakarehistrong Bansa/Rehiyon | China Hong Kong |

| Regulasyon | SFC, Labuan FSA |

| Mga Produkto at Serbisyo | Komersyal na Bangko, Kredito at Pautang, Institusyonal na Pamumuhunan, Investment Banking, Mga Bayad |

| Suporta sa Customer | +86 10 5931 8888, +86 21 5200 2368 |

J.P. Morgan Impormasyon

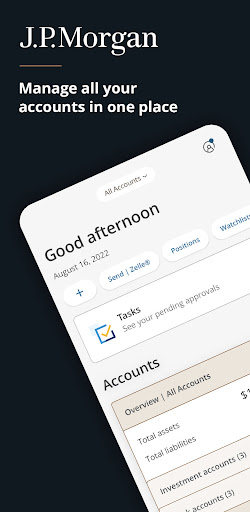

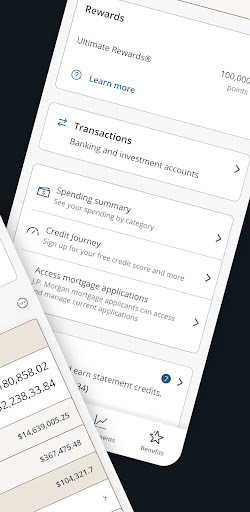

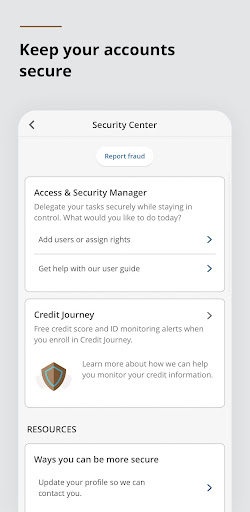

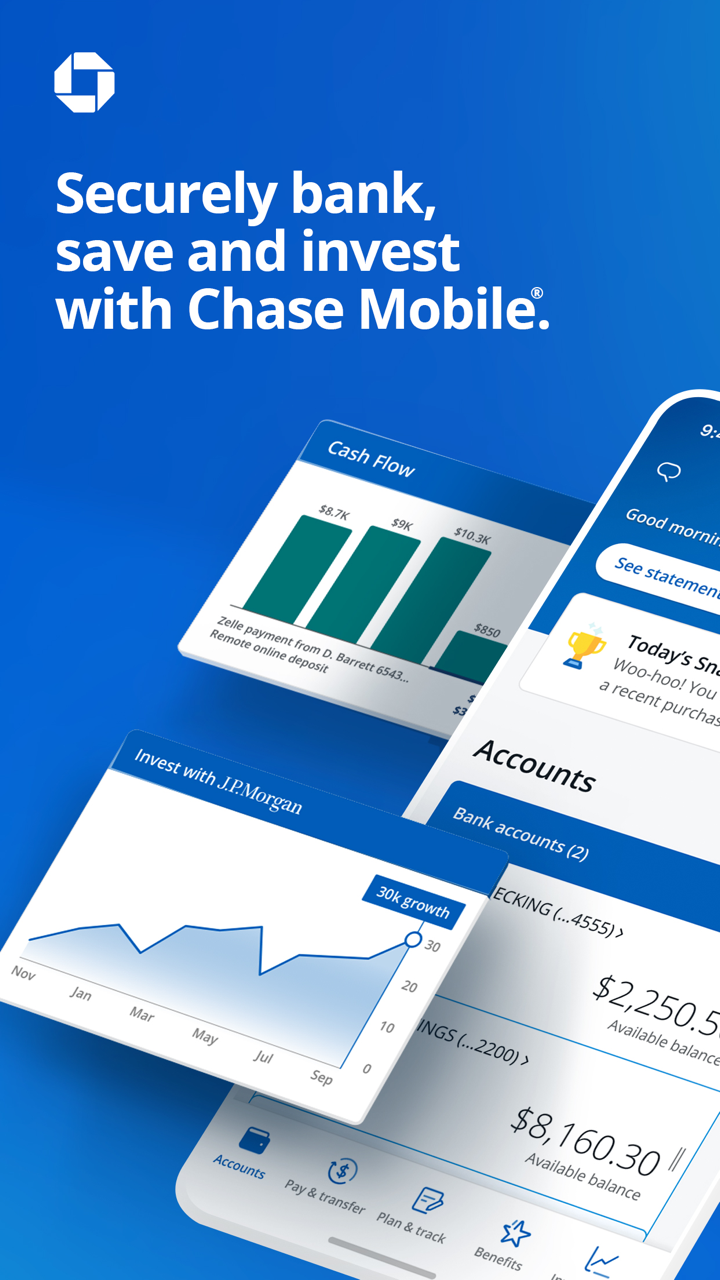

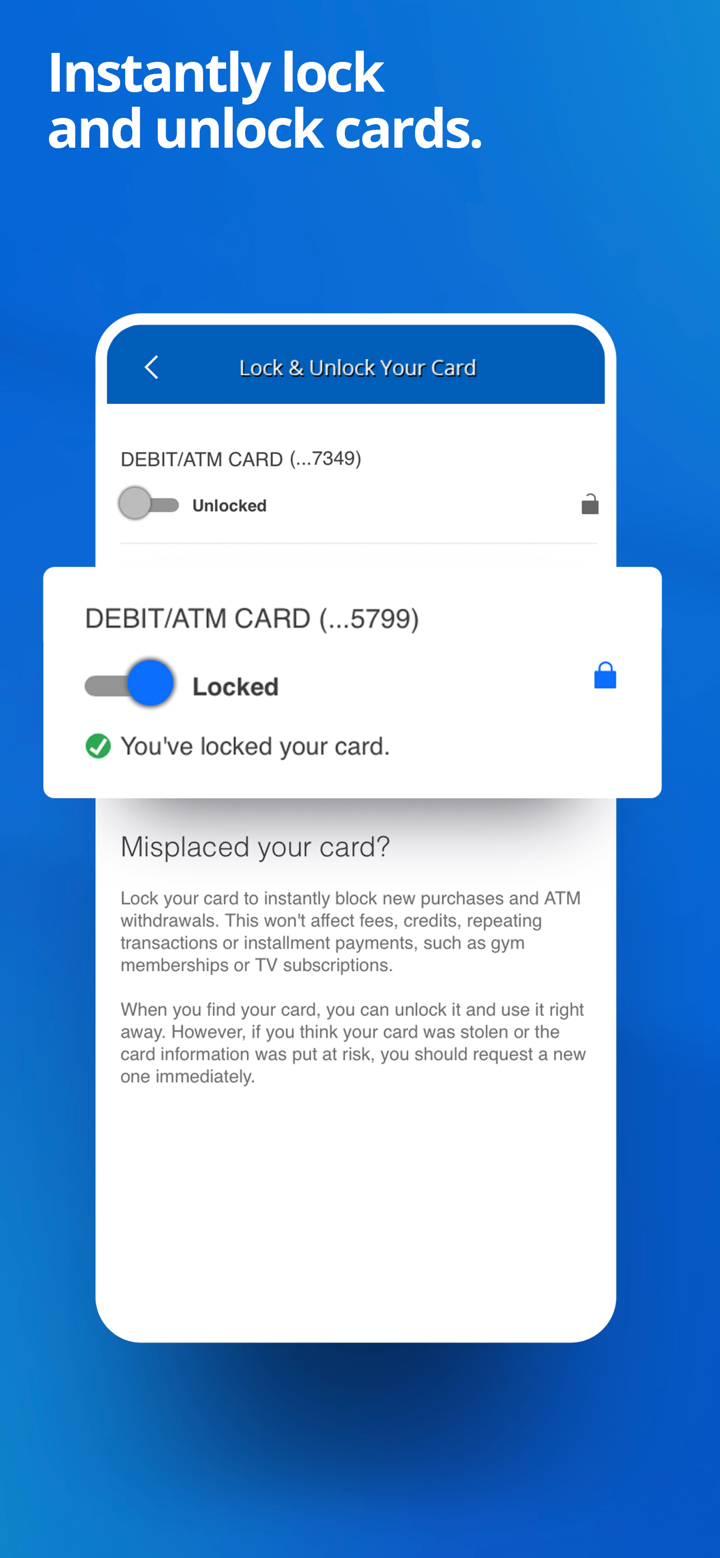

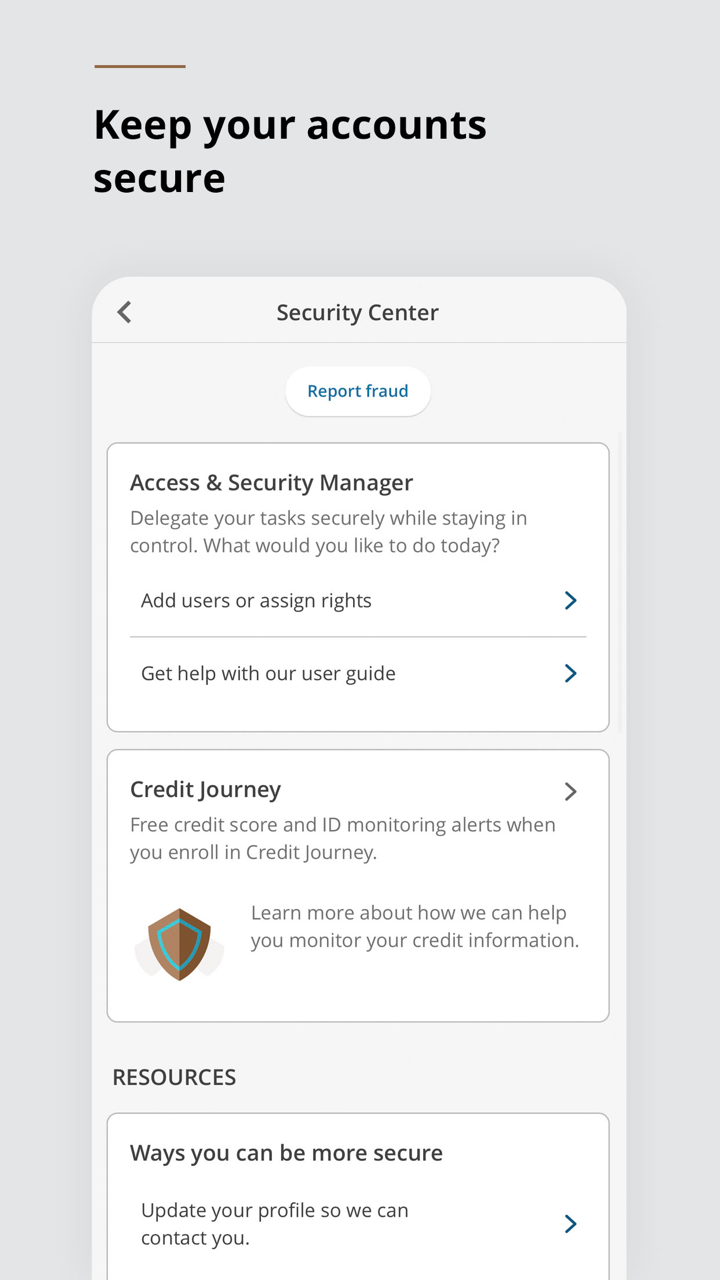

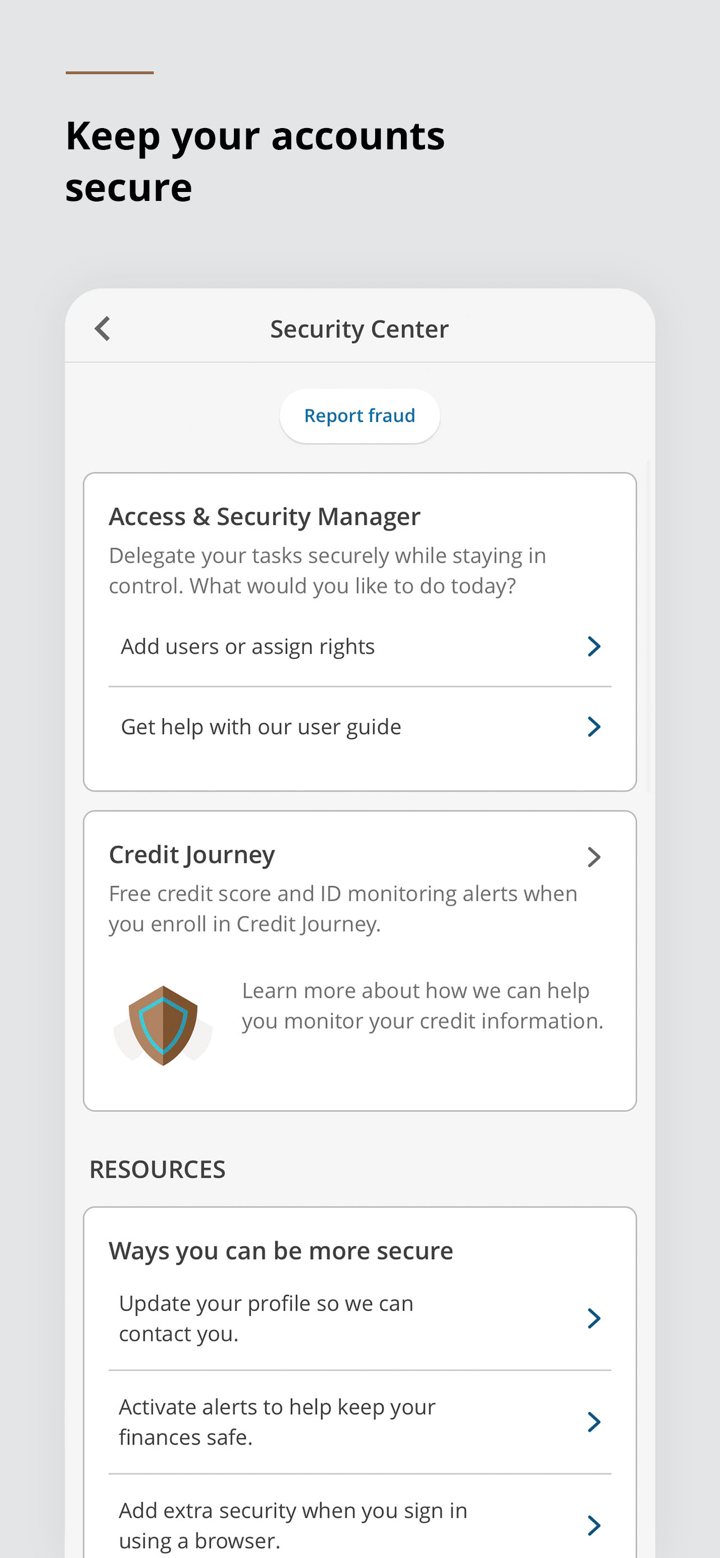

J.P. Morgan, na regulado ng SFC sa China, Hong Kong, at ng Labuan FSA sa Malaysia, ay isang pandaigdigang lider sa pinansyal na nagbibigay ng iba't ibang serbisyo kabilang ang komersyal na bangko, investment banking, kredito at pautang, institusyonal na pamumuhunan, at mga bayad. Ang plataporma ay naglilingkod sa iba't ibang industriya, nag-aalok ng mga hinuhugot na solusyon sa pinansyal para sa mga korporasyon, institusyon, at mga mamumuhunan.

Mga Kalamangan at Disadvantages

| Kalamangan | Disadvantages |

|

|

|

Totoo ba ang J.P. Morgan?

J.P. Morgan ay regulado sa China, Hong Kong ng Securities and Futures Commission (SFC) para sa pakikipag-deal sa mga kontrata sa hinaharap sa ilalim ng mga lisensya na AAB027 at AAA121, at regulado rin sa Malaysia ng Labuan Financial Services Authority (Labuan FSA) bilang isang Market Maker.

| Kalagayan sa Pagganap | Regulado | Regulado | Regulado |

| Regulado ng | China Hong Kong | China Hong Kong | Malaysia |

| Lisensyadong Institusyon | Ang Securities and Futures Commission (SFC) | Ang Securities and Futures Commission (SFC) | Labuan Financial Services Authority (Labuan FSA) |

| Uri ng Lisensya | Pakikipag-deal sa mga kontrata sa hinaharap | Pakikipag-deal sa mga kontrata sa hinaharap | Market Maker (MM) |

| Numero ng Lisensya | AAB027 | AAA121 | Hindi pa nailabas |

Mga Produkto at Serbisyo

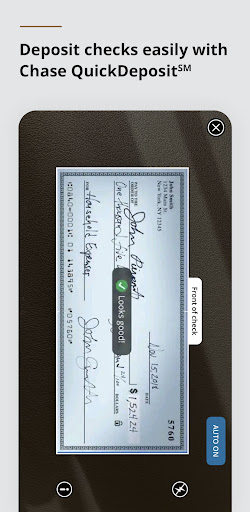

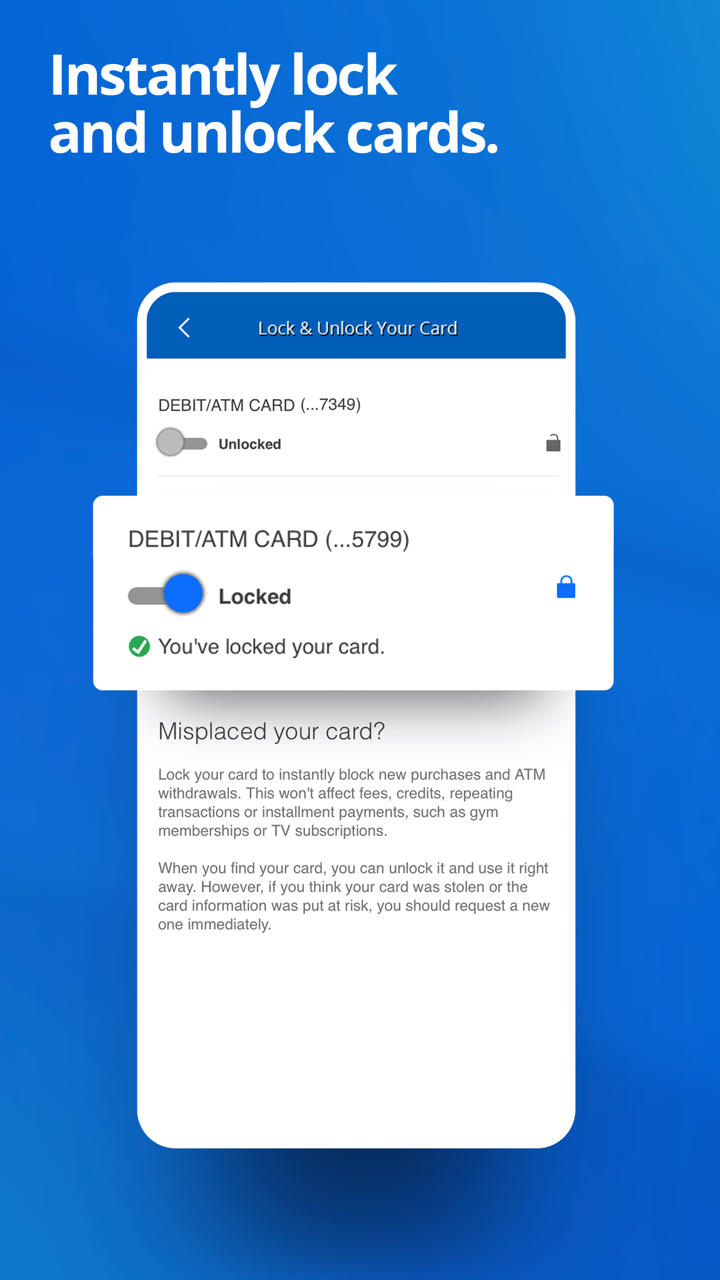

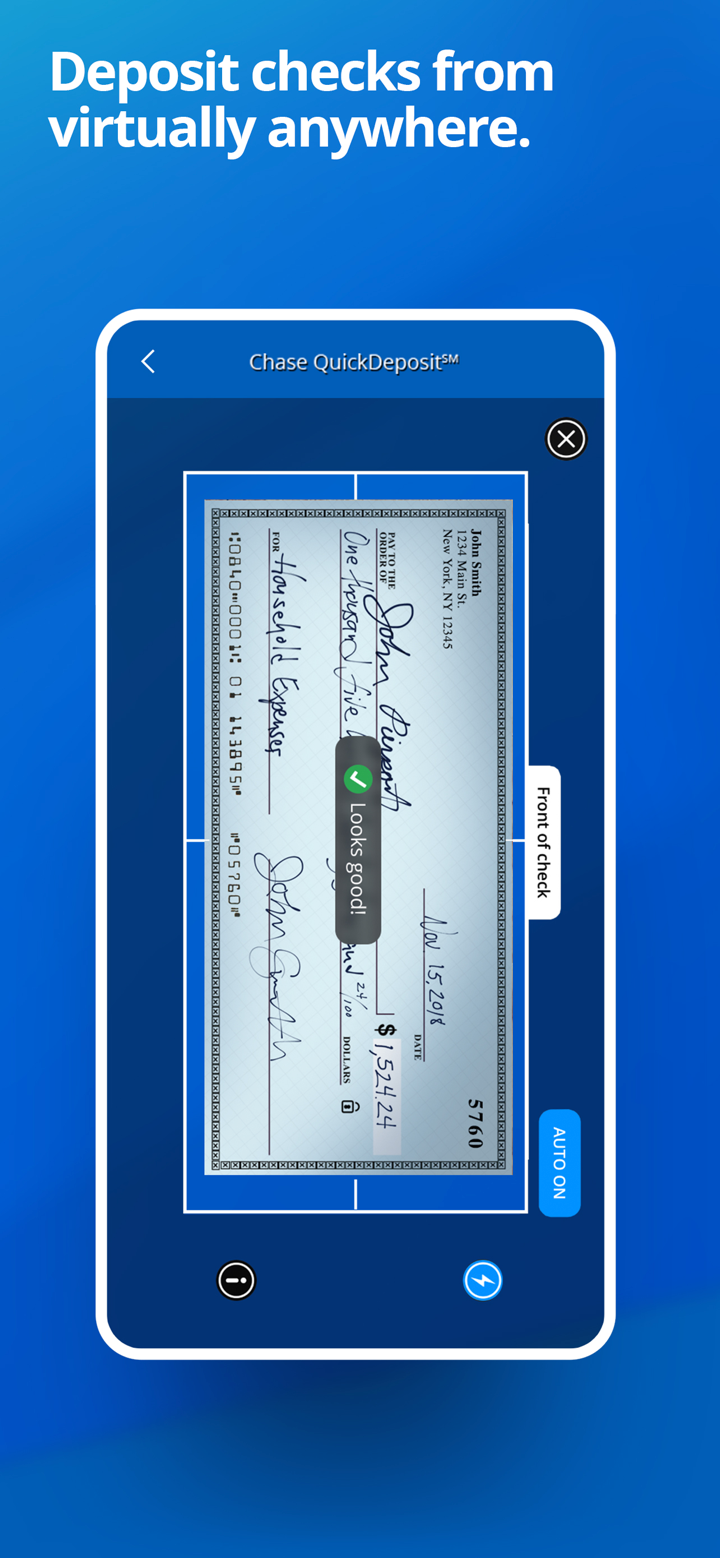

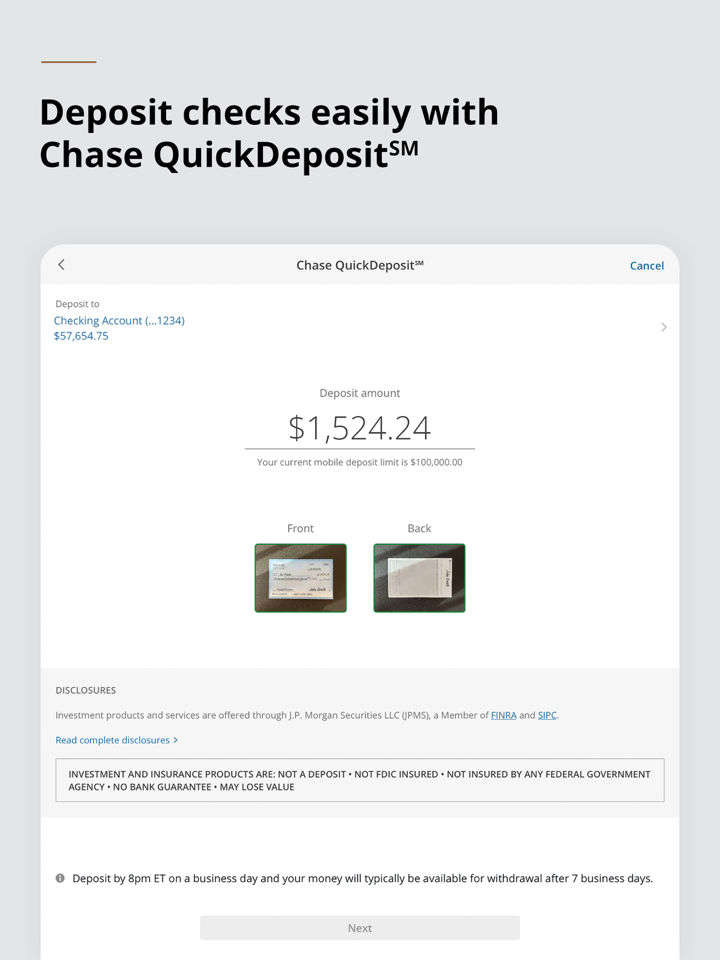

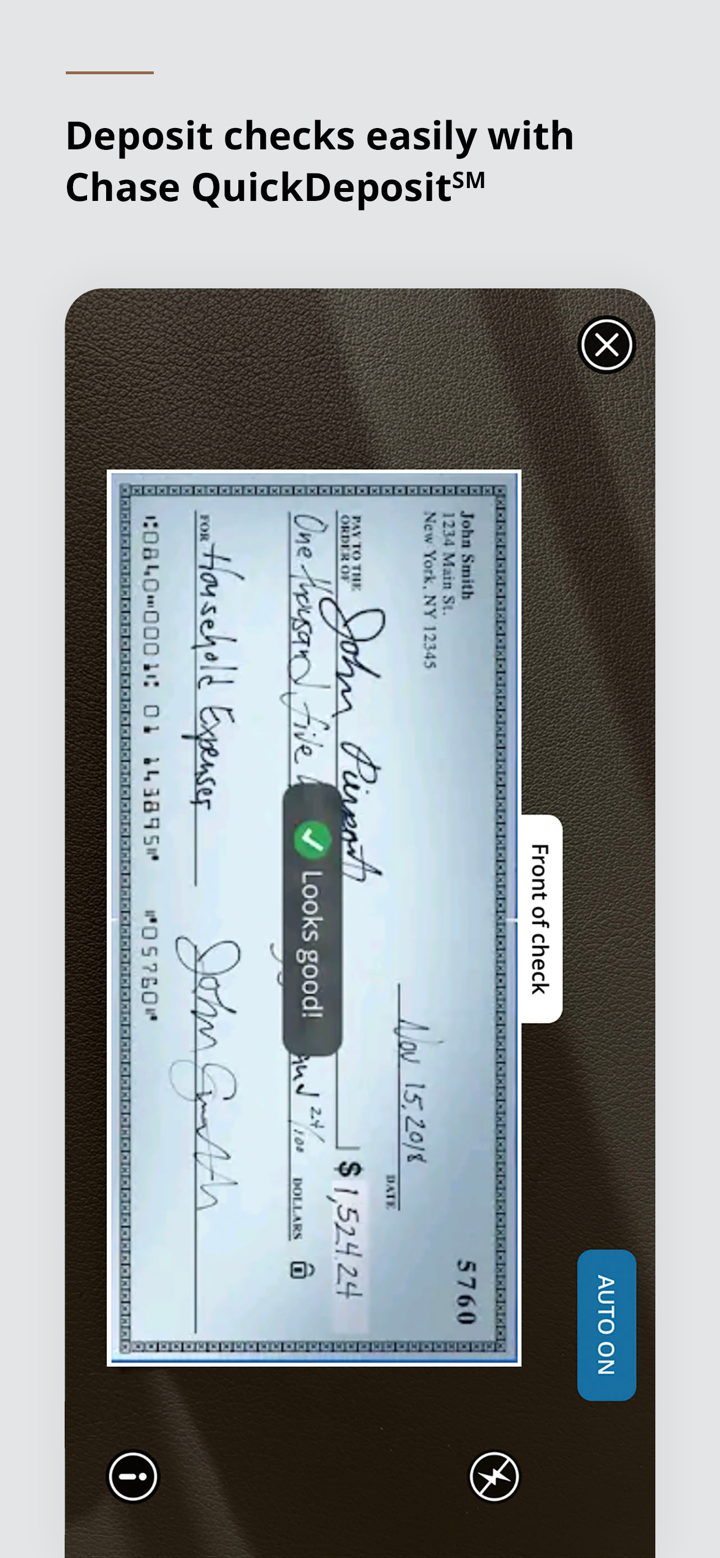

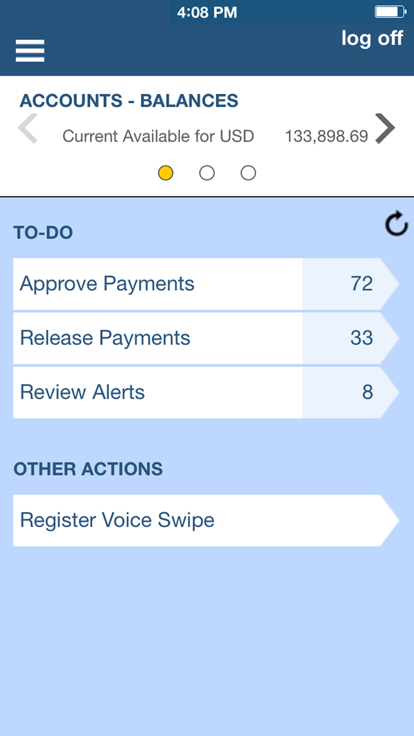

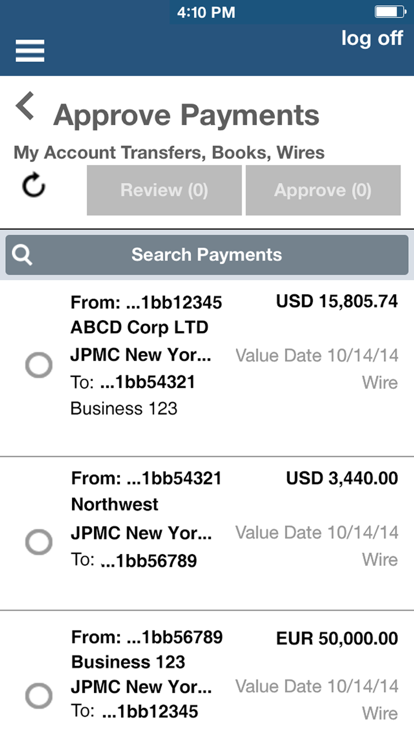

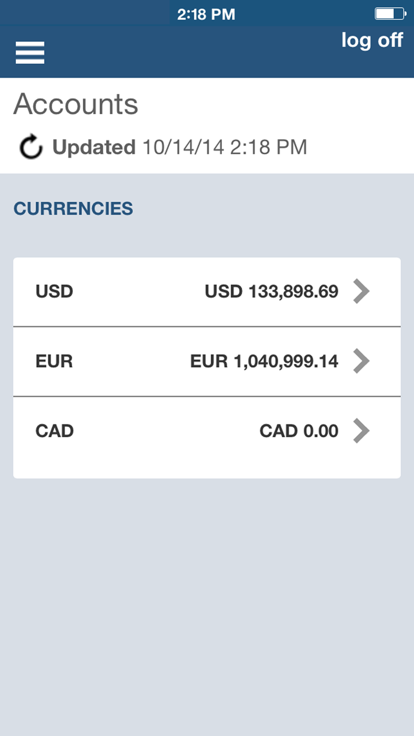

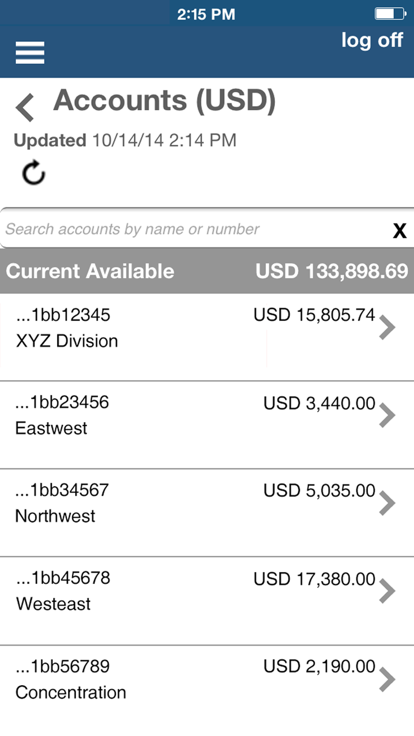

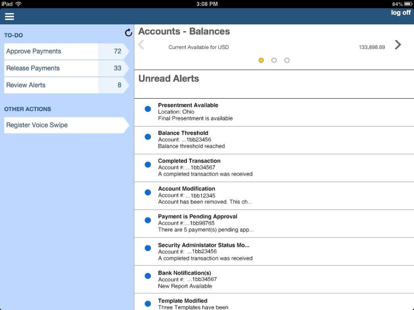

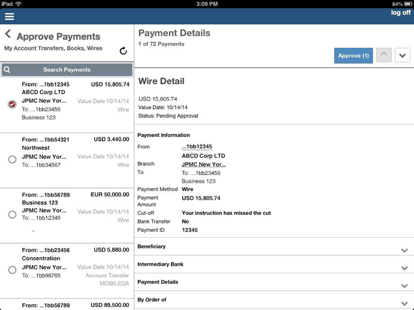

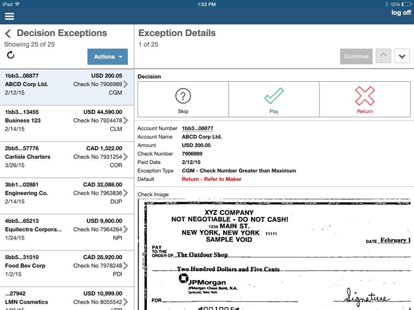

- Komersyal na Bangko: Nag-aalok si J.P. Morgan ng mga Serbisyong Komersyal na Bangko, nagbibigay ng kredito, pautang, kaban, at mga solusyon sa pagbabayad, pati na rin sa mga serbisyong pang-real estate para sa mga mamumuhunan at tagakatayuan.

- Investment Banking: Nagbibigay ng mga serbisyong pang-investment banking si J.P. Morgan sa mga korporasyon, pamahalaan, at institusyon. Kasama sa mga serbisyong ito ang payo sa mga pag-akma at pag-akwisisyon (M&A), pagtataas ng utang at ekwiti, pagbabago ng istraktura, payo sa estratehiya, at mga solusyon sa korporasyong pananalapi.

- Kredito at Pautang: Nag-aalok si J.P. Morgan ng mga pinakamahusay na opsyon sa kredito at pautang, kabilang ang Asset-Based Lending upang mapalakas ang liquidity, Equipment Financing para sa maluwag na kapital, Employee Stock Ownership Plans para sa negosyo at kinabukasan ng mga empleyado, at Syndicated Finance para sa mga pasadyang solusyon sa pautang.

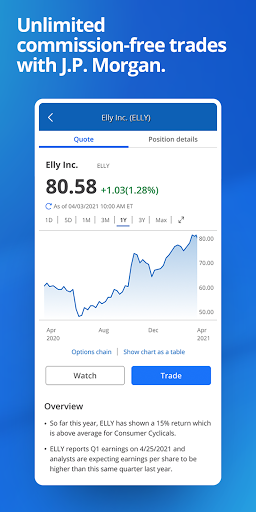

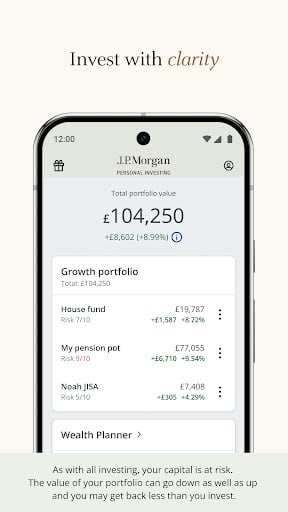

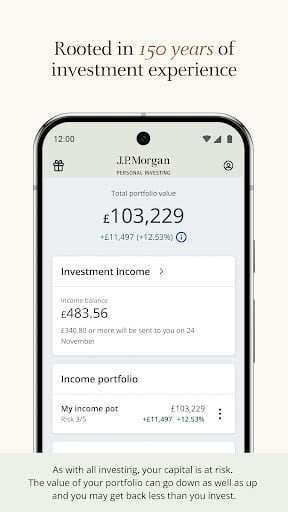

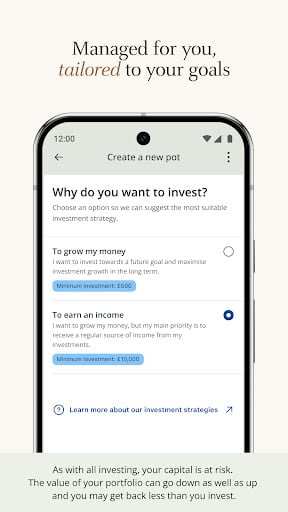

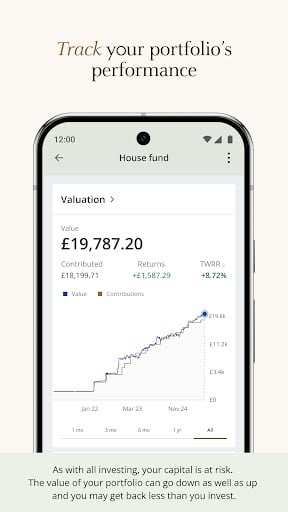

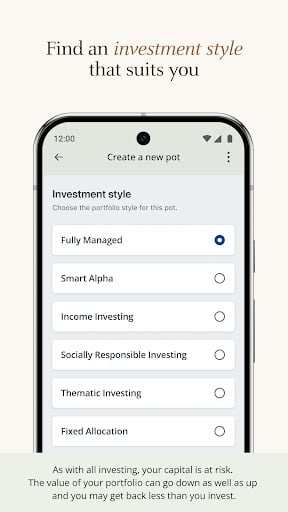

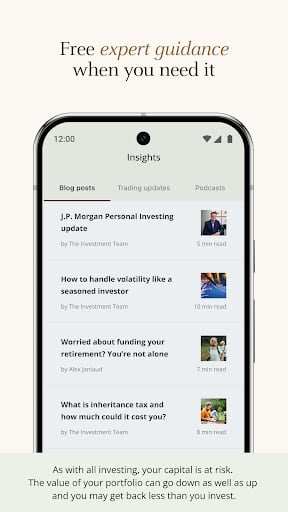

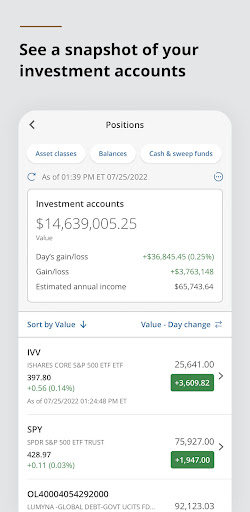

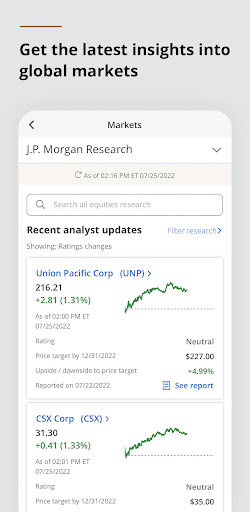

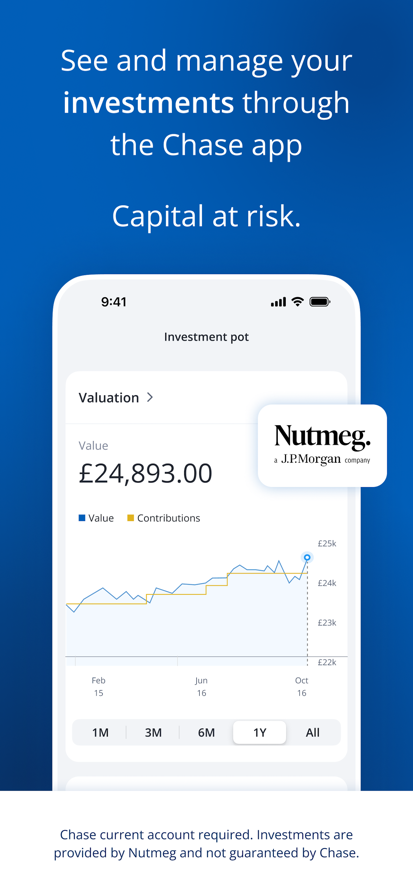

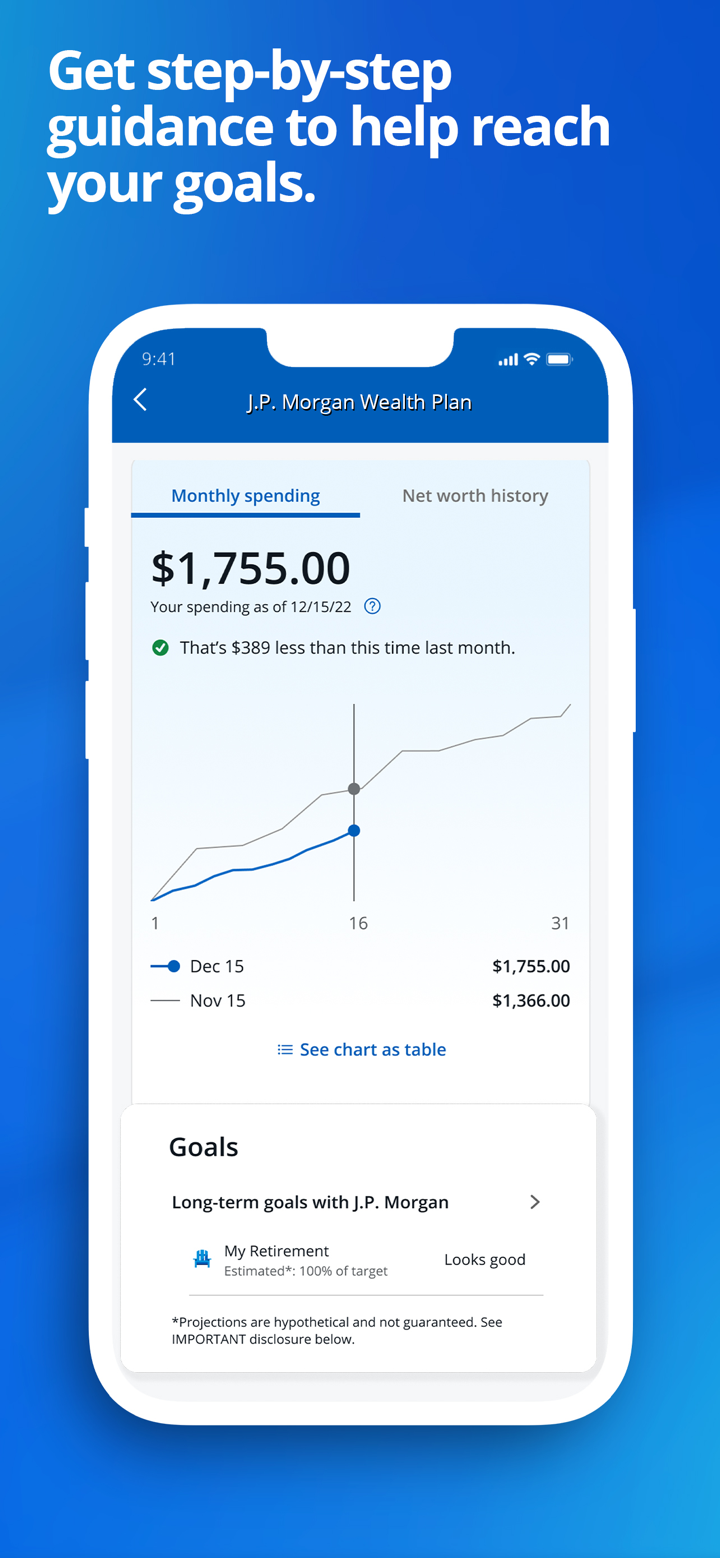

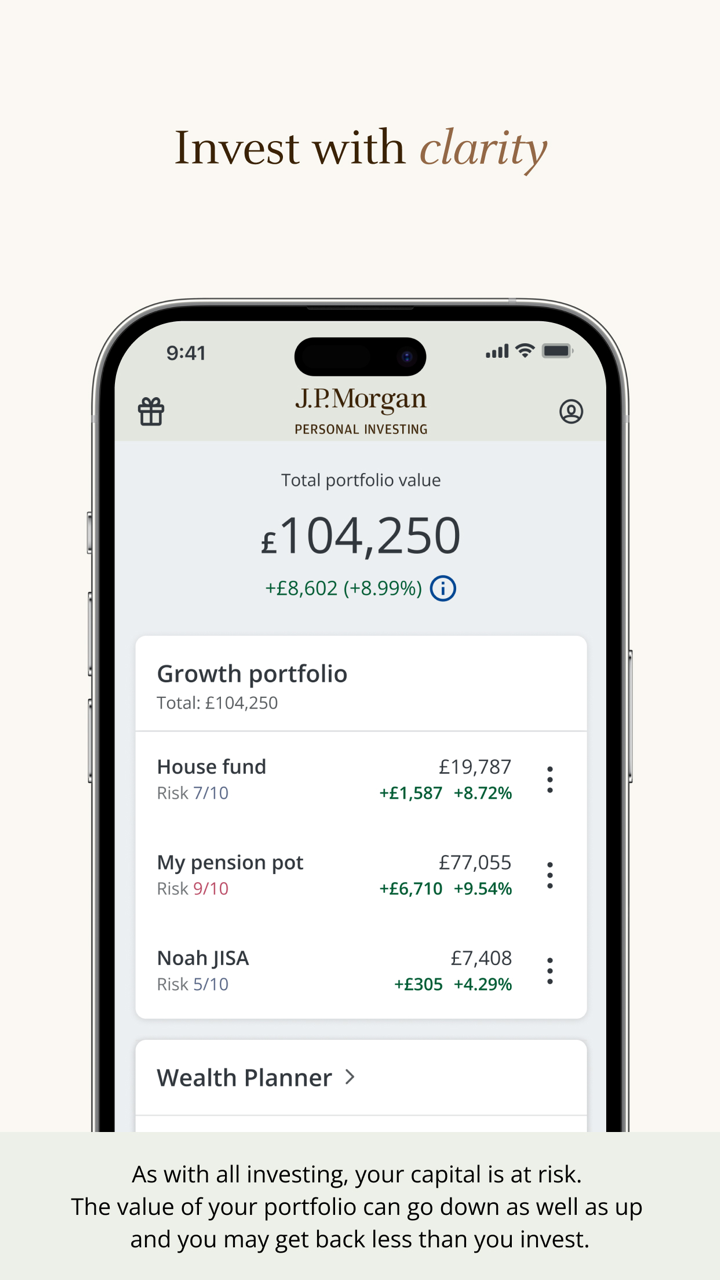

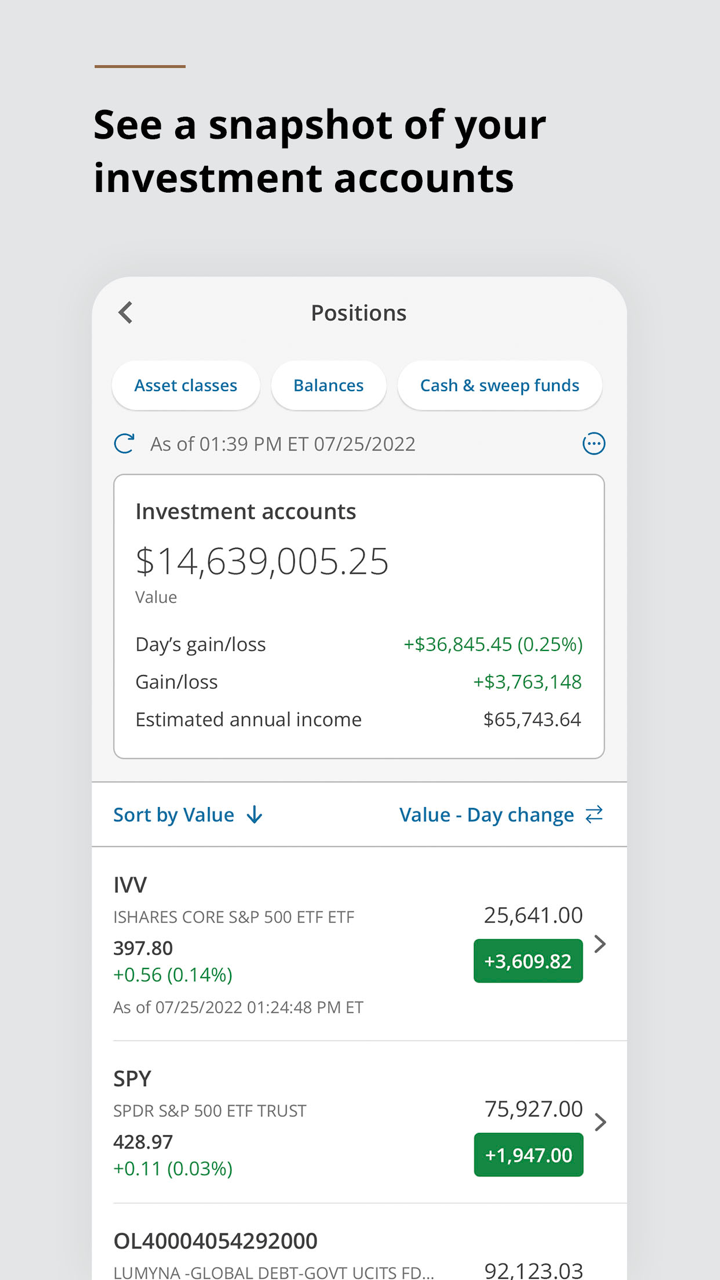

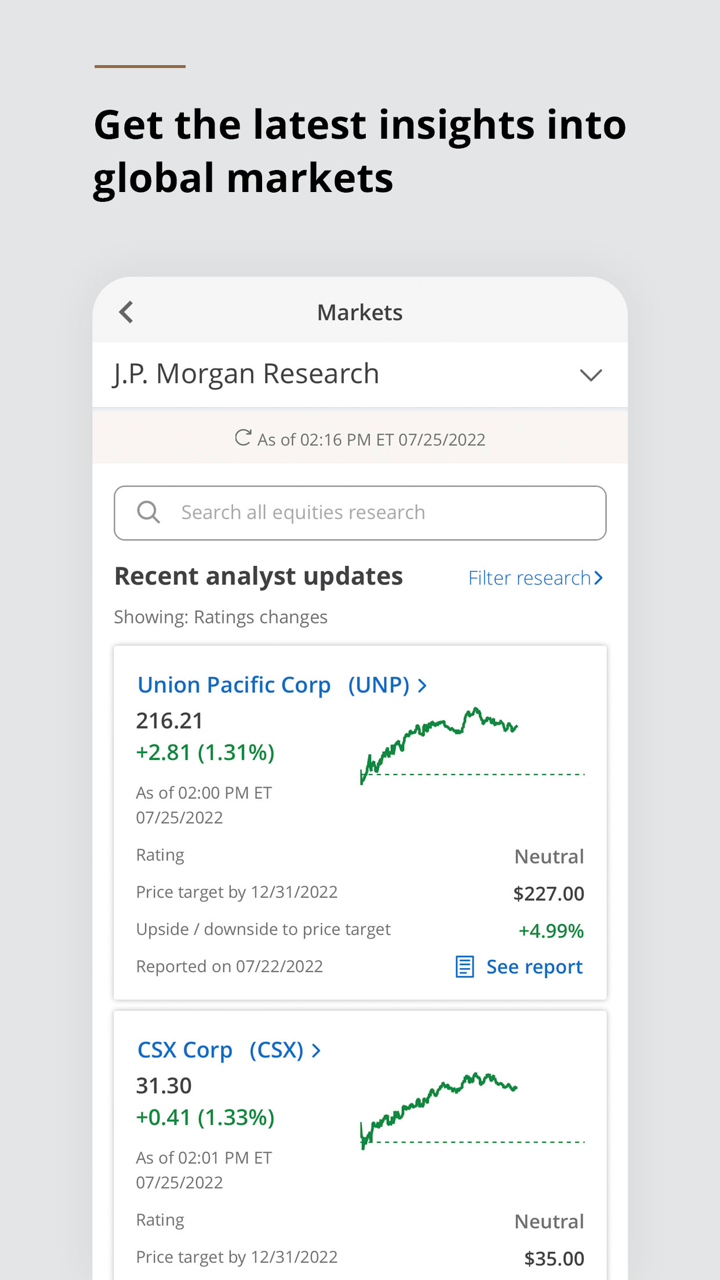

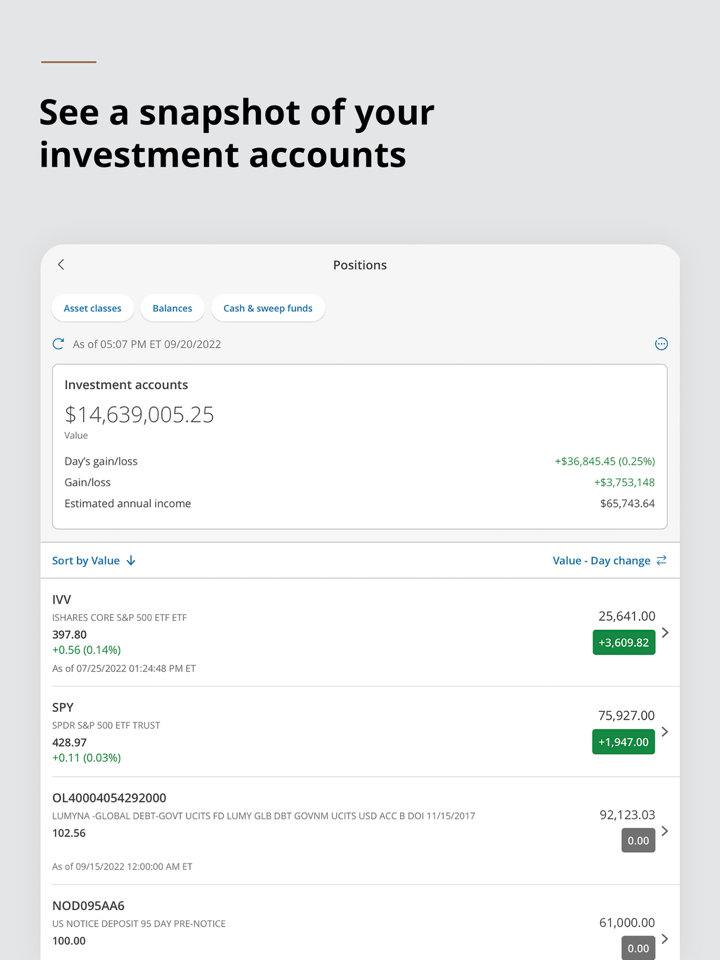

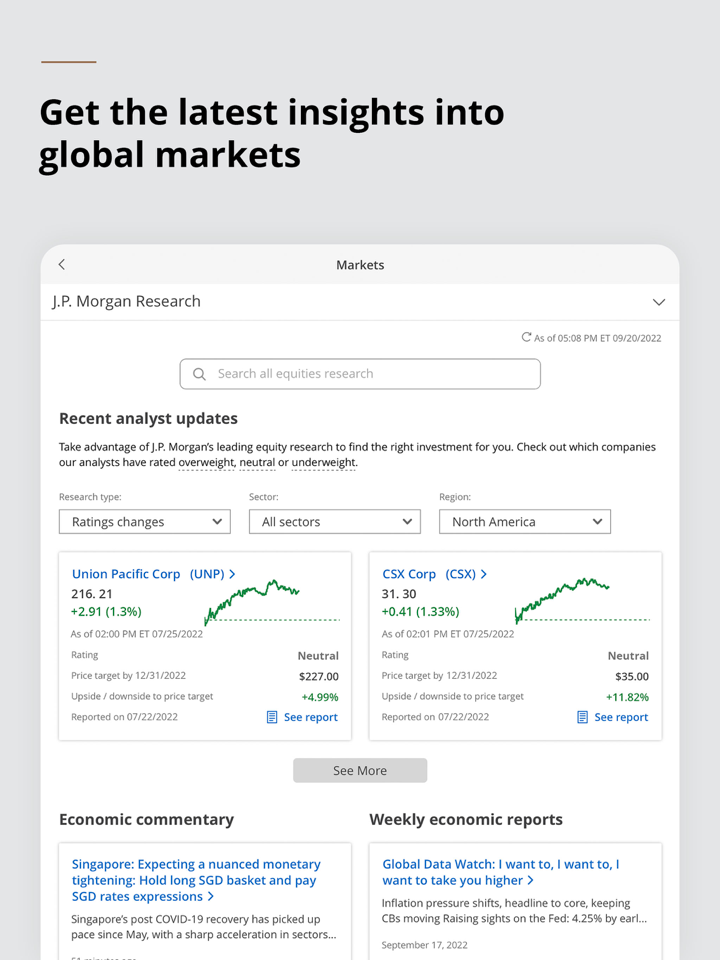

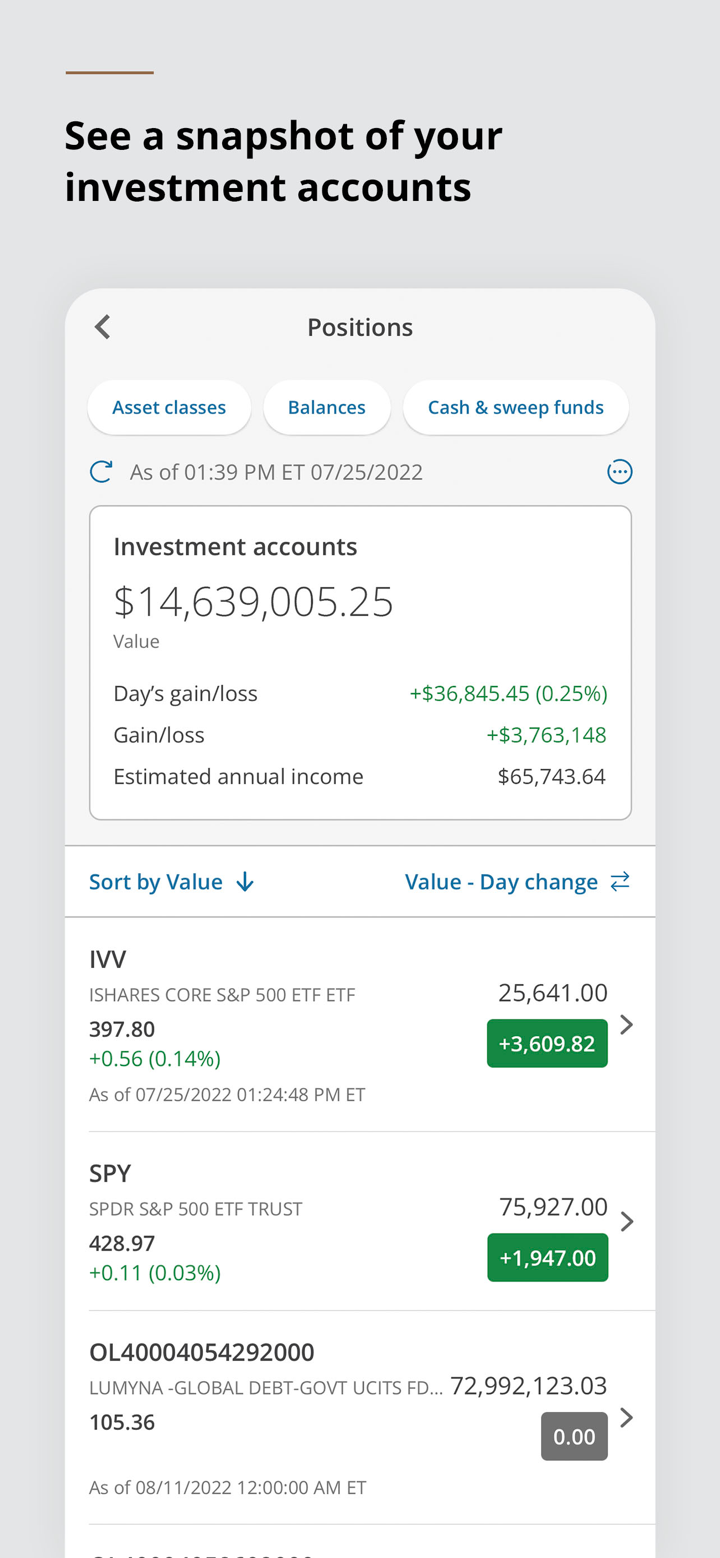

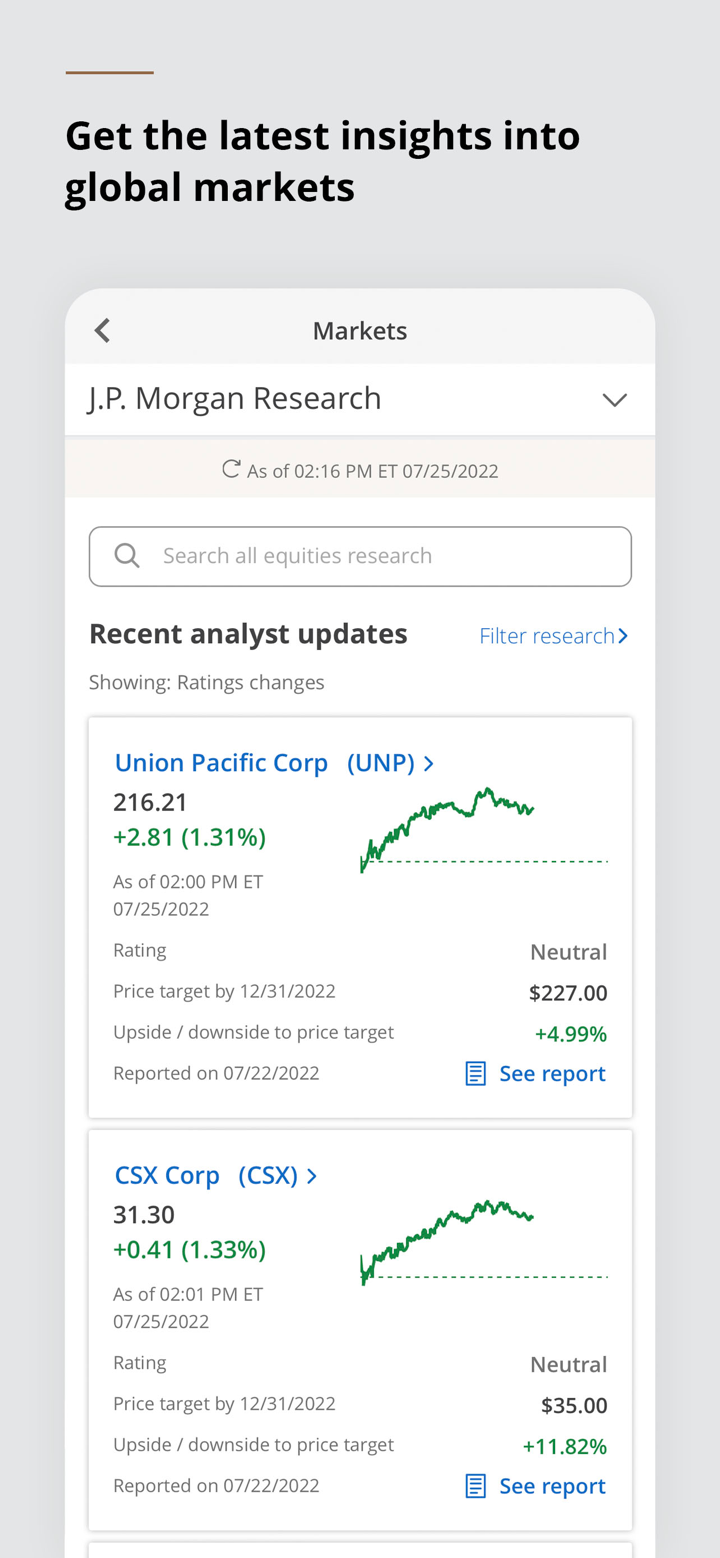

- Institutional Investing: Ang Institutional Investing ng J.P. Morgan ay naglilingkod sa pinakamalalaking korporasyon at institusyonal na mamumuhunan sa mundo sa pamamagitan ng pagsuporta sa buong siklo ng pamumuhunan sa pamamagitan ng pangunguna sa pananaliksik, analytics, pagpapatupad, at serbisyong pang-investor.

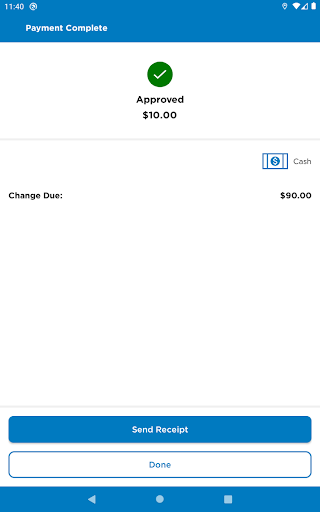

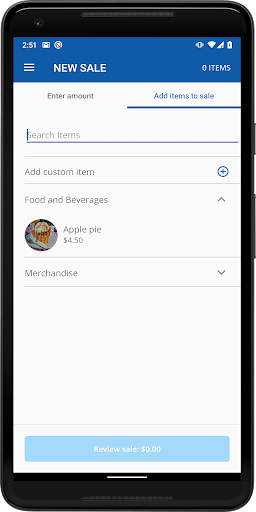

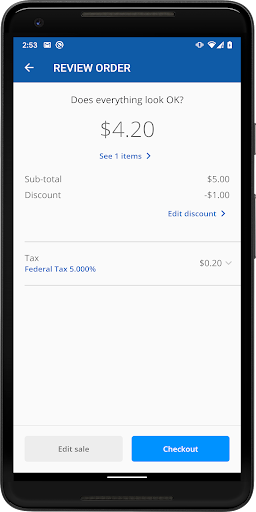

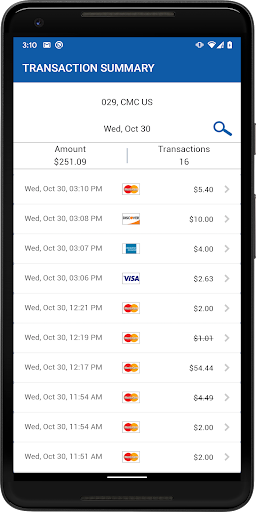

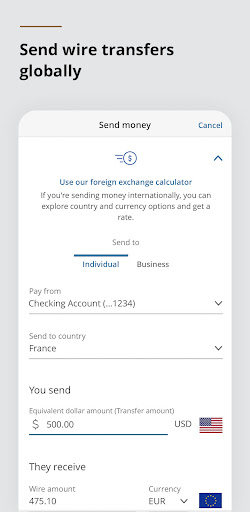

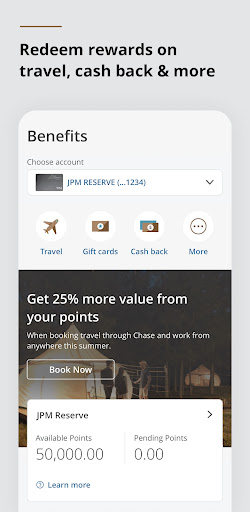

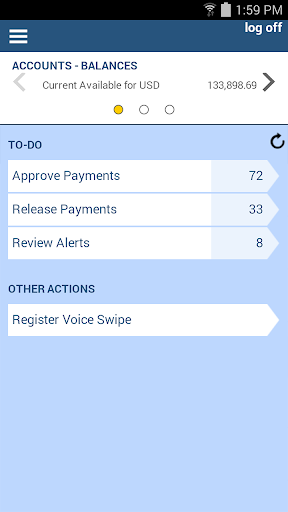

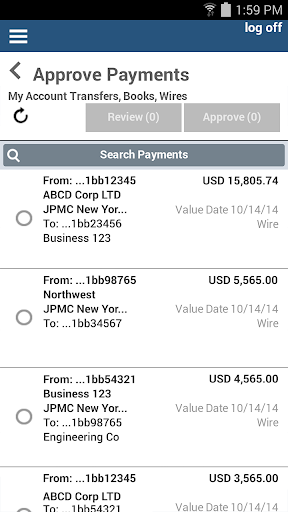

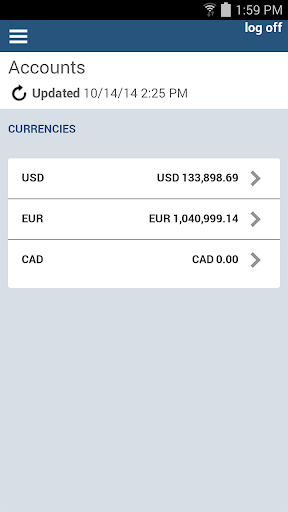

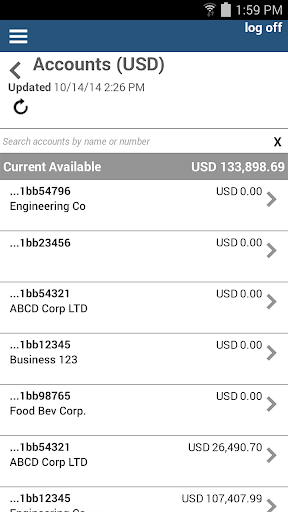

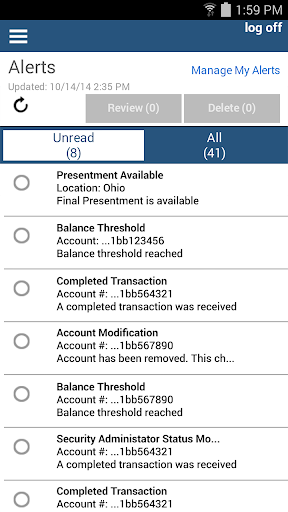

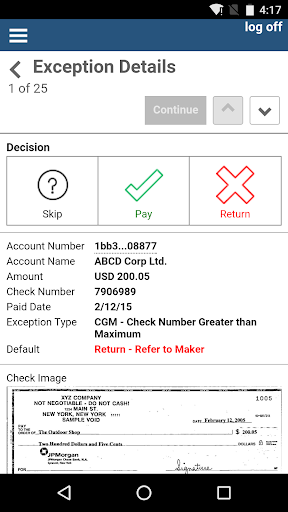

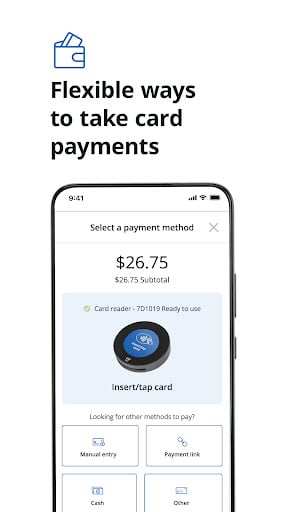

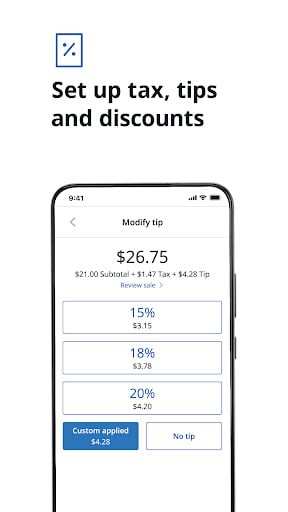

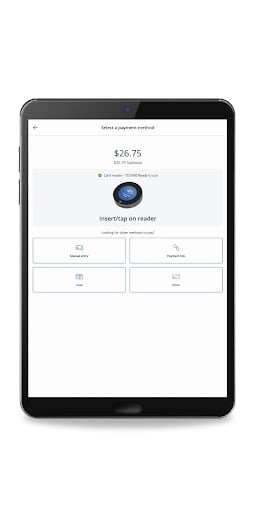

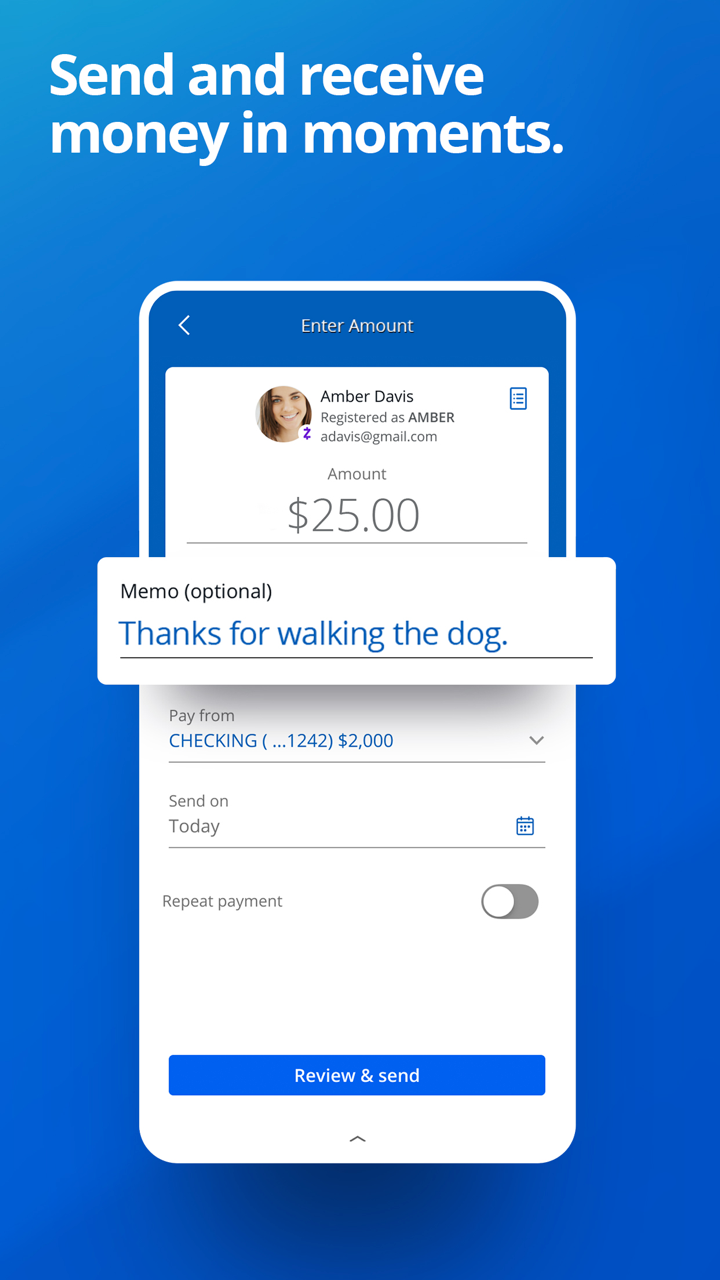

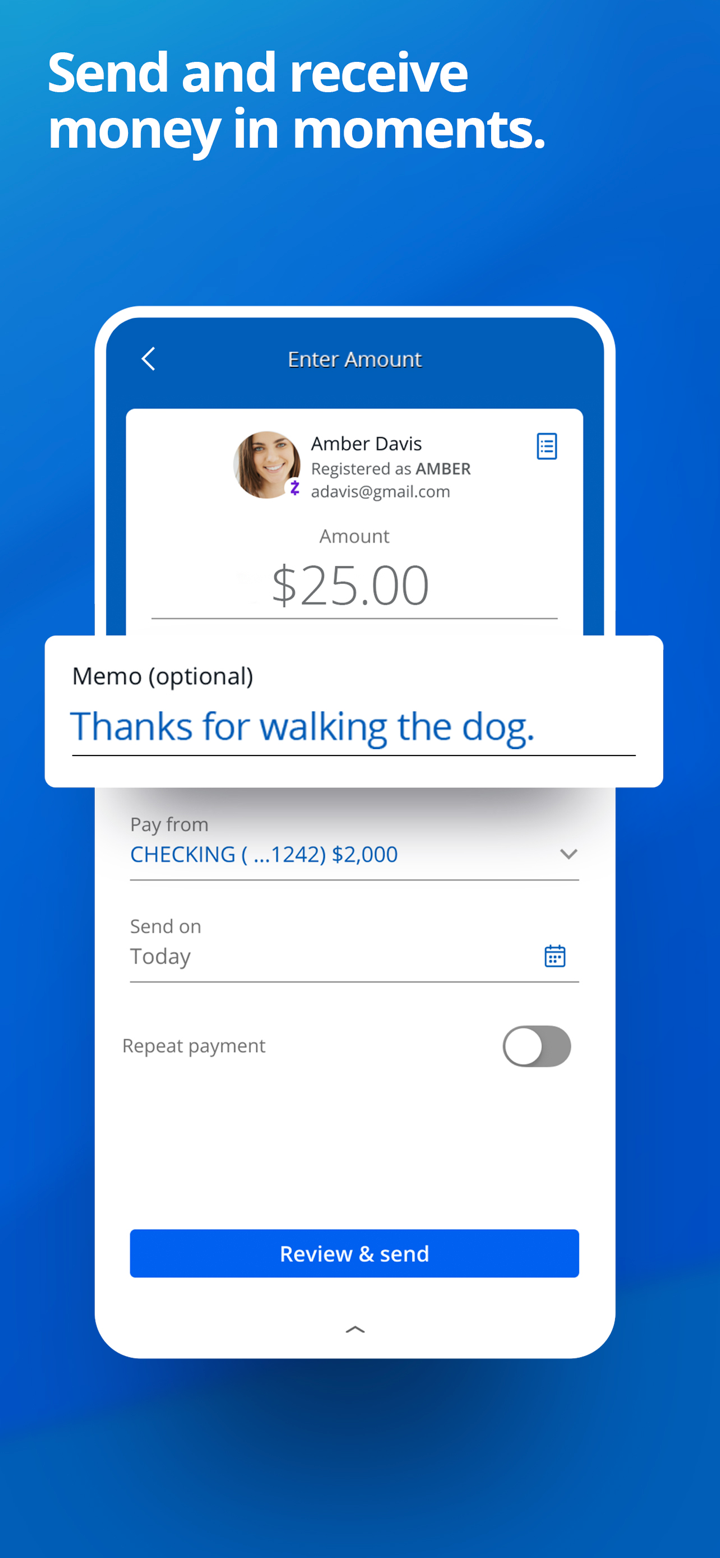

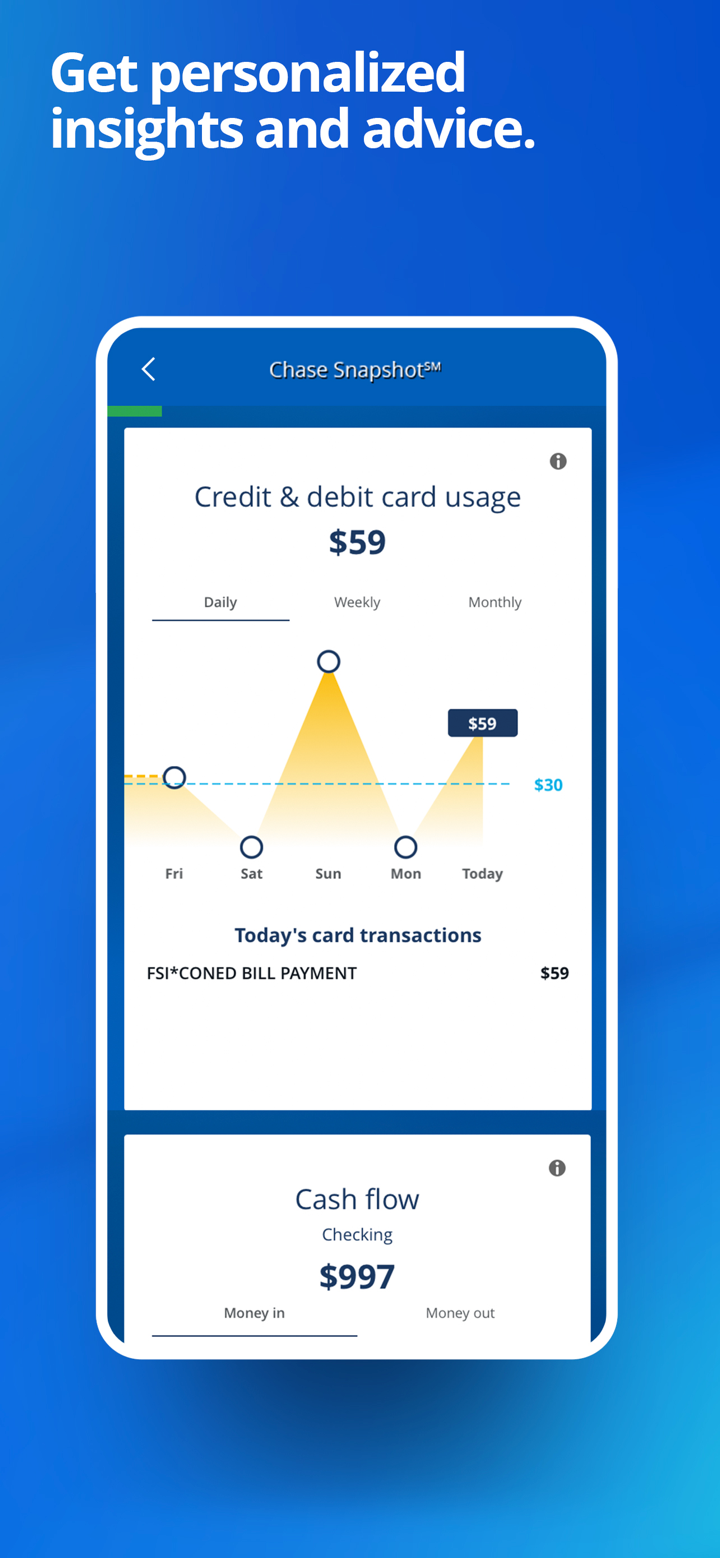

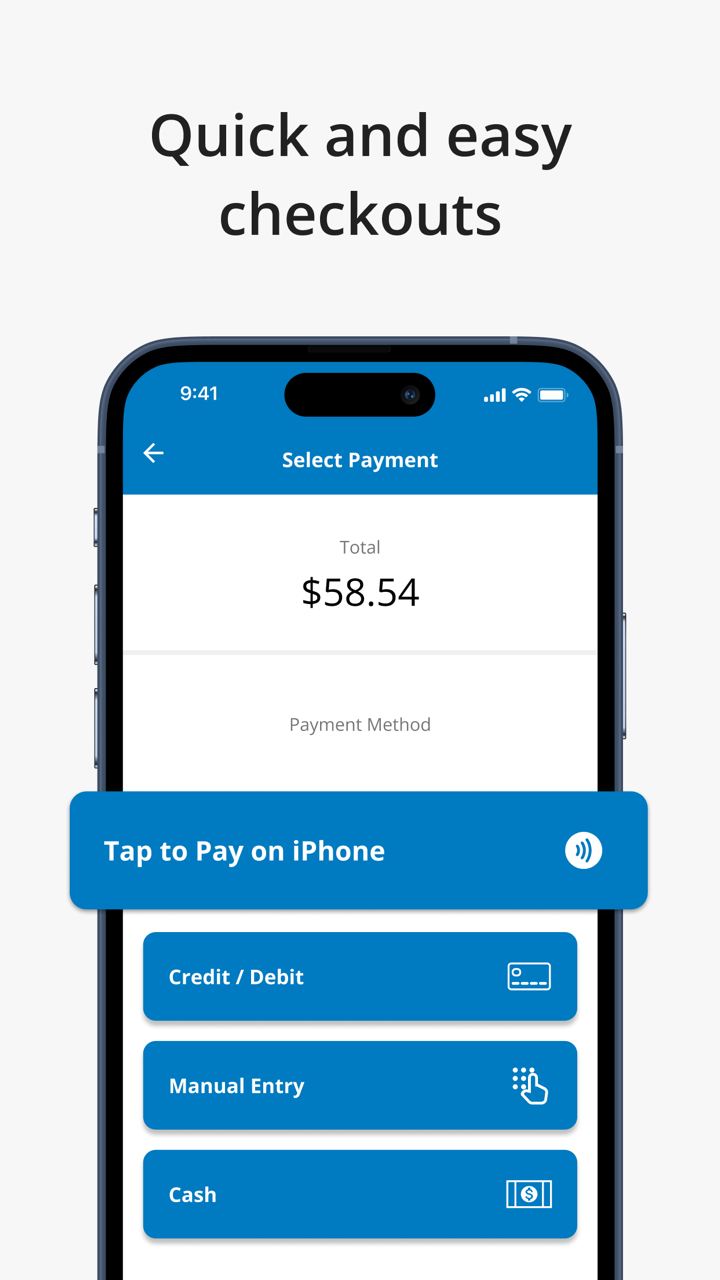

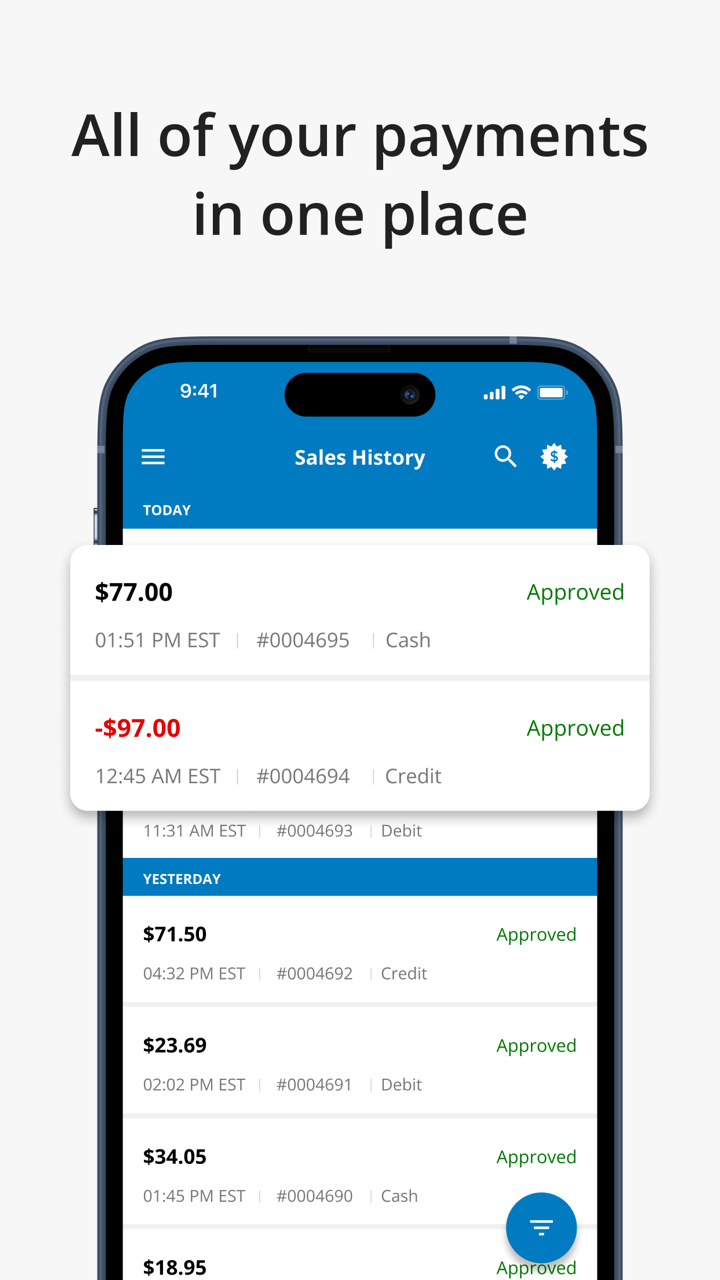

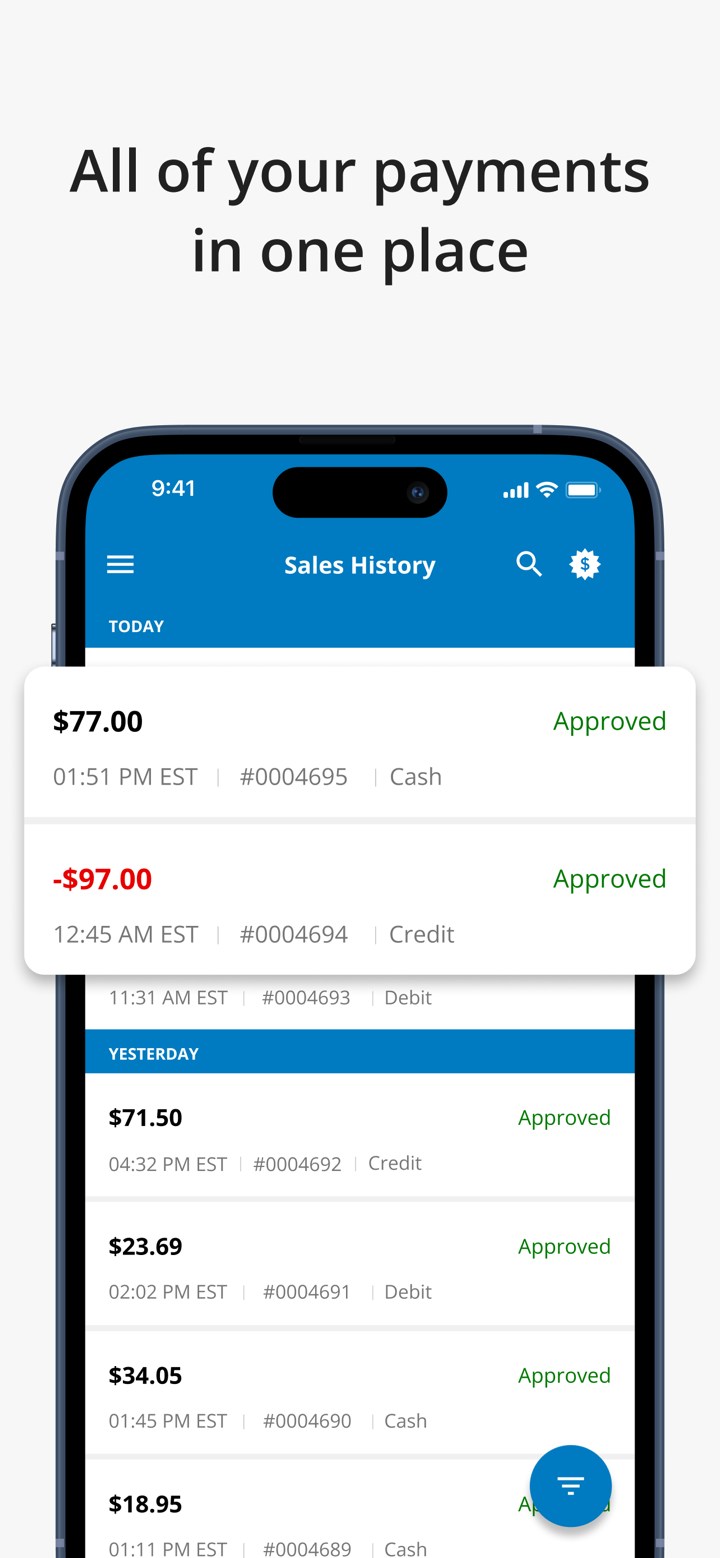

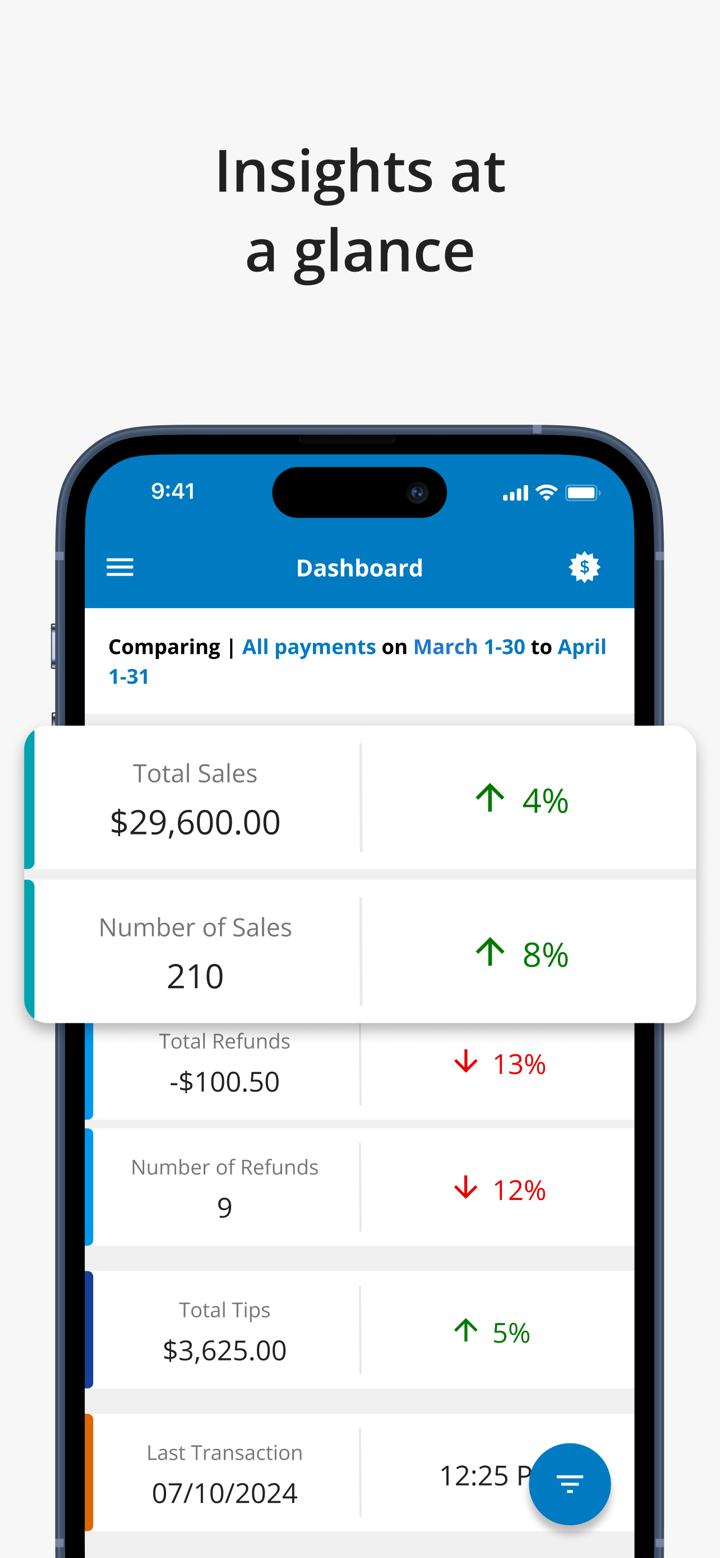

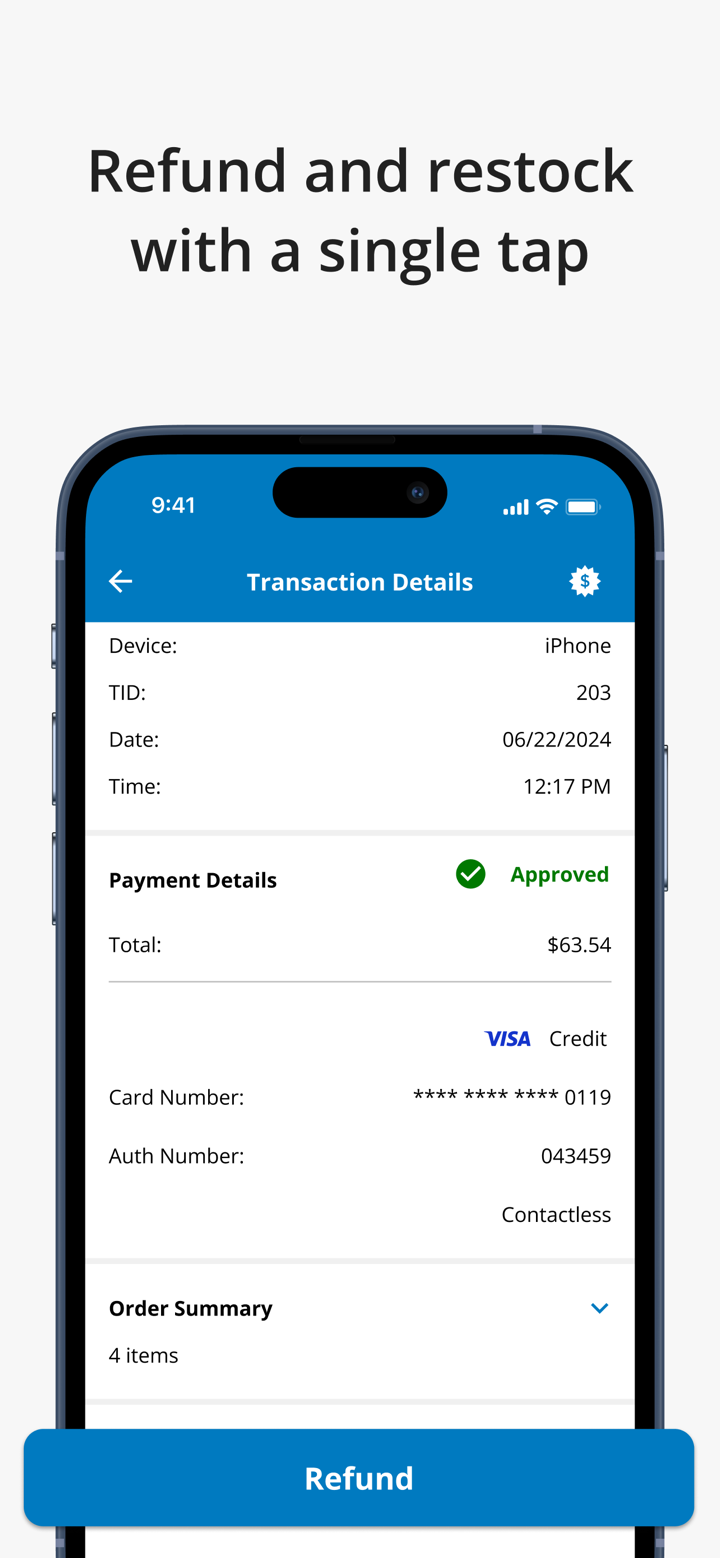

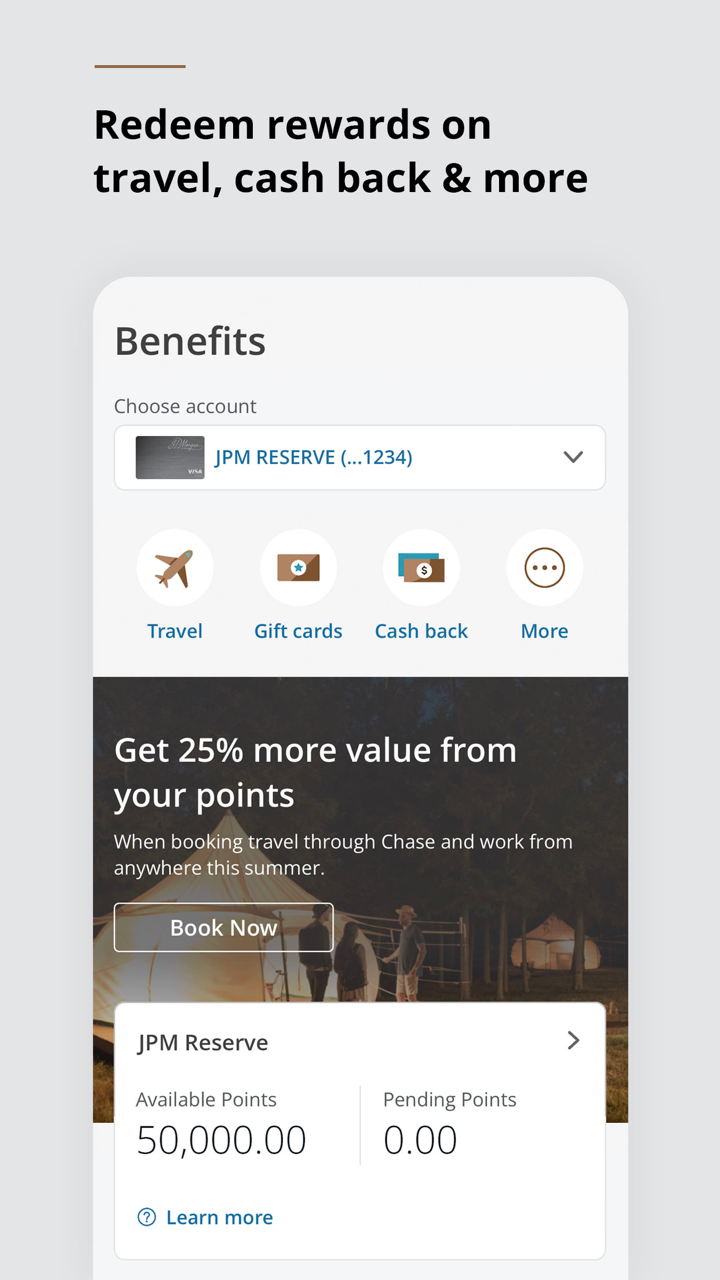

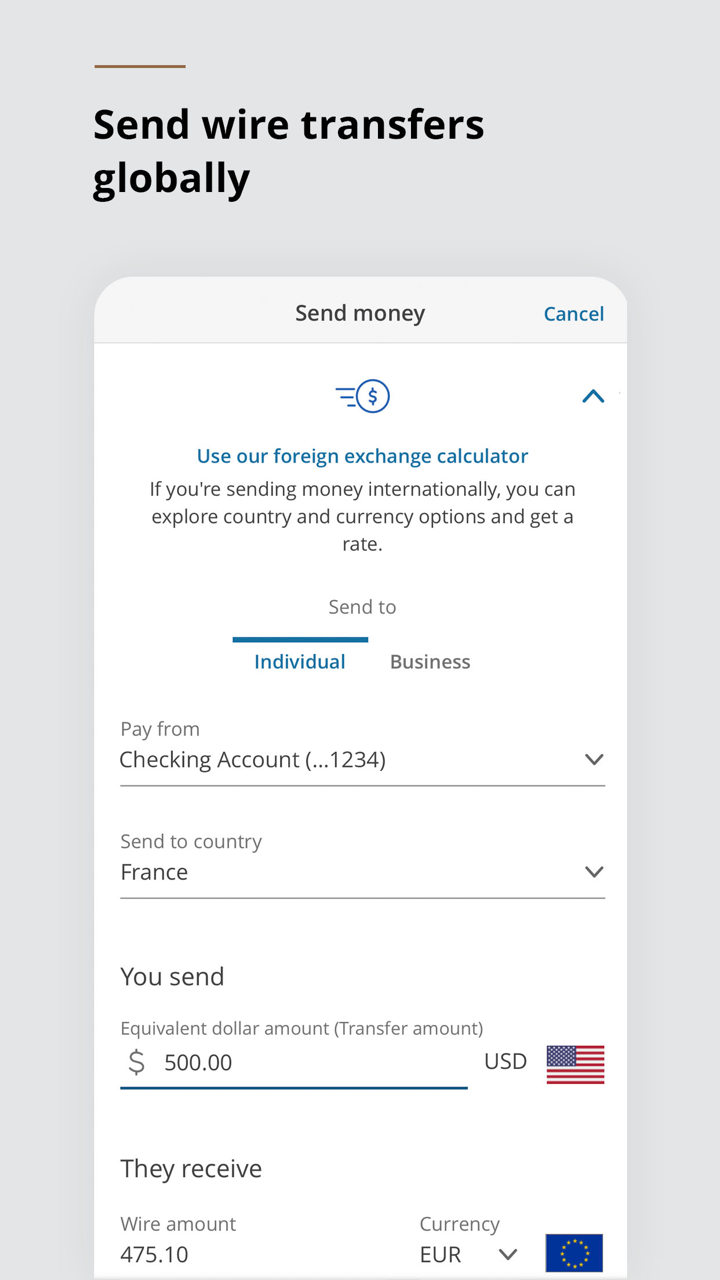

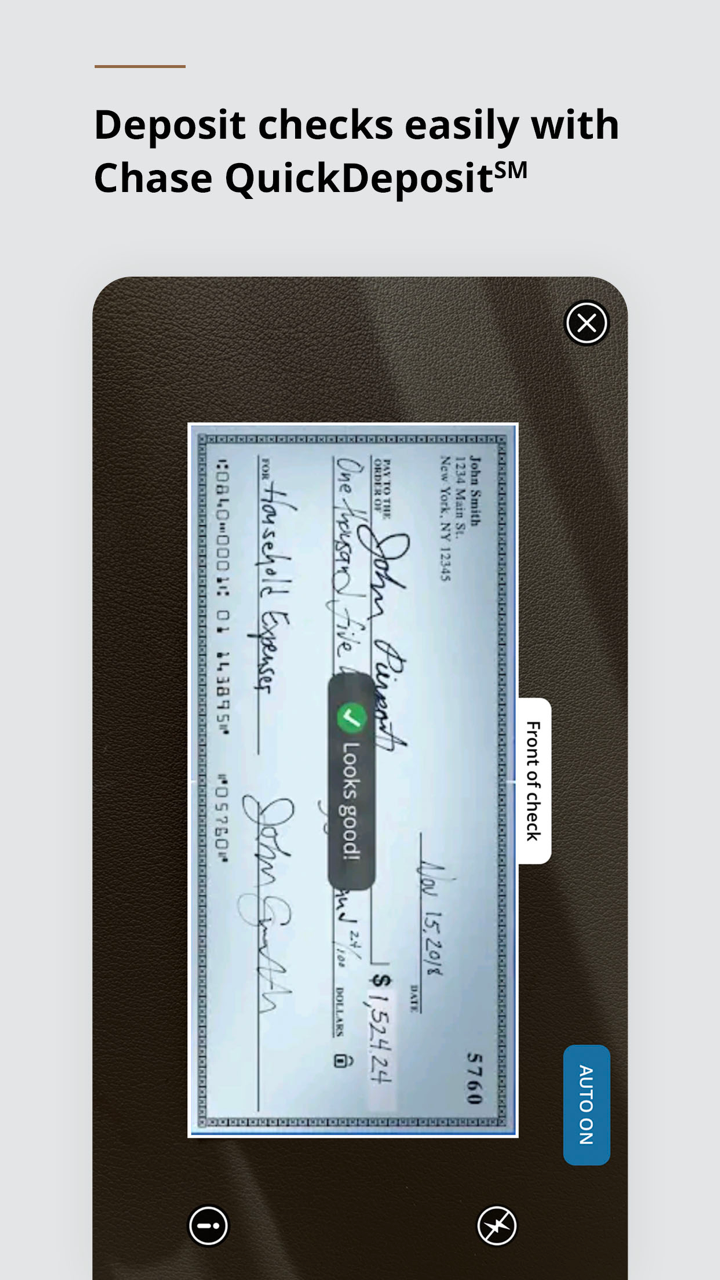

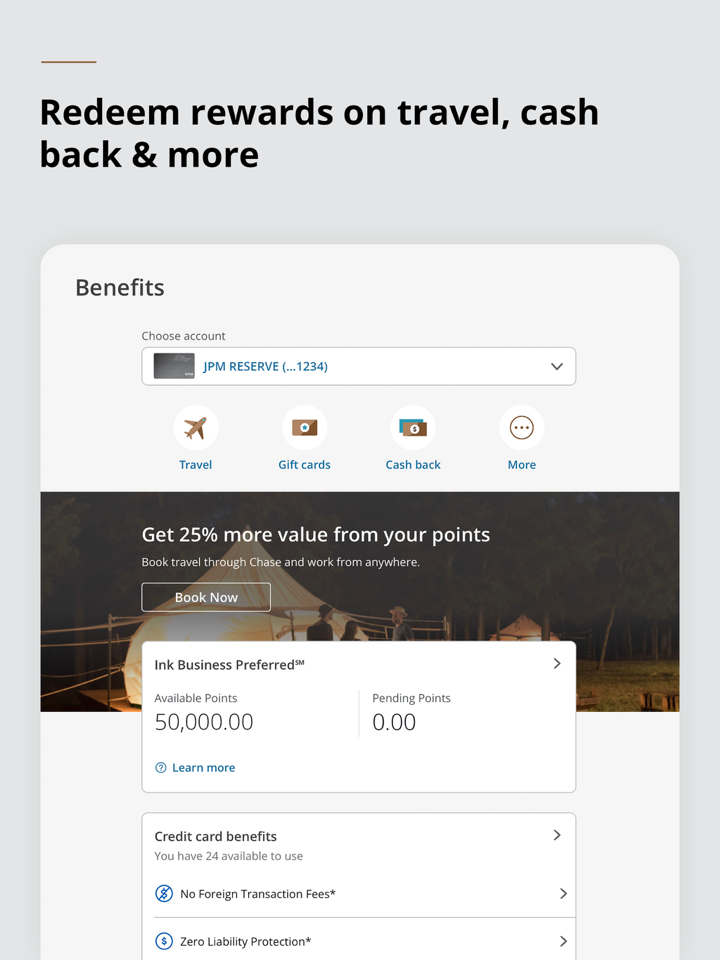

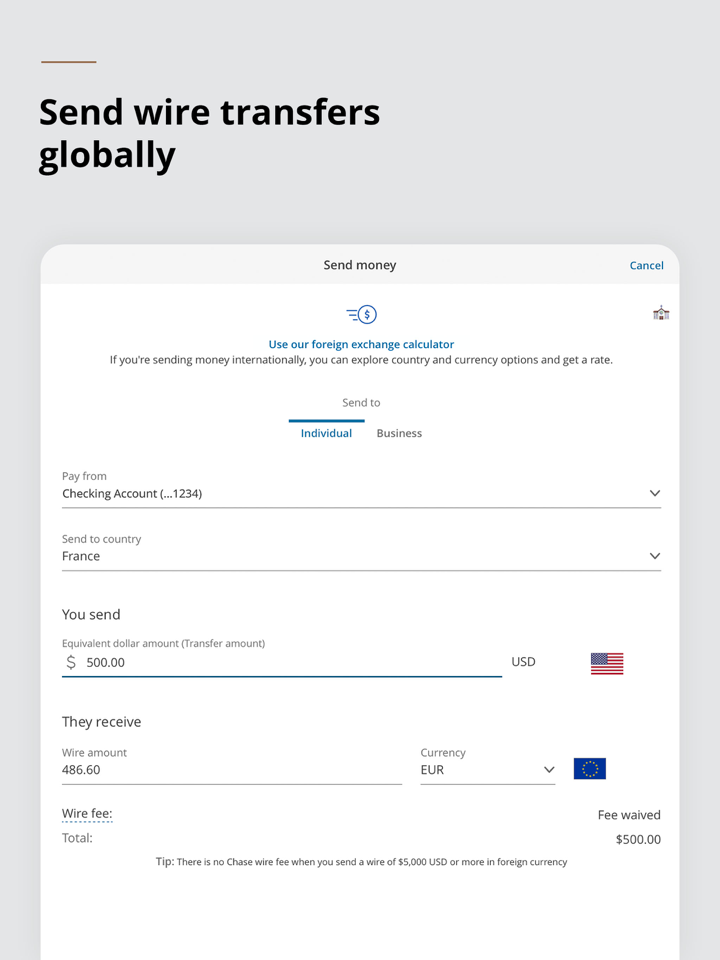

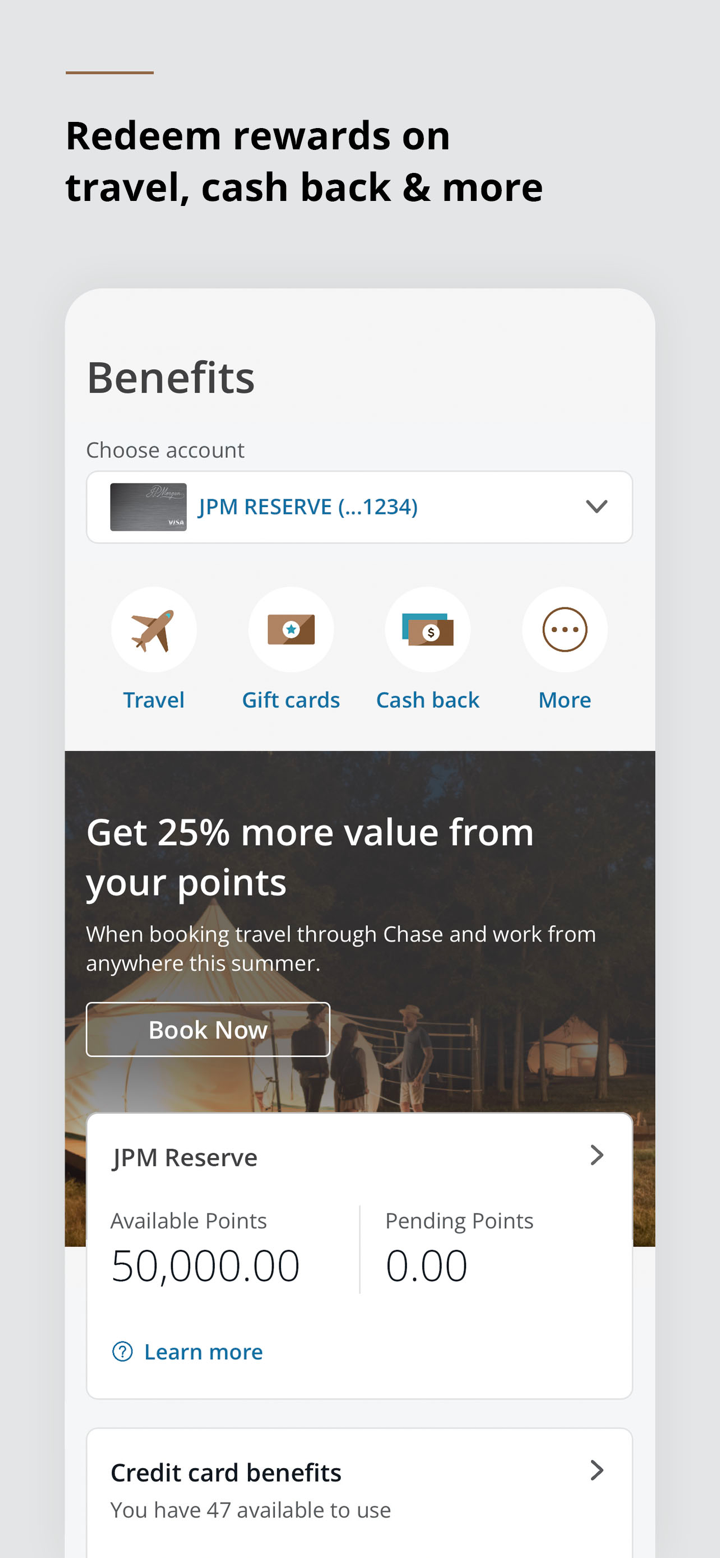

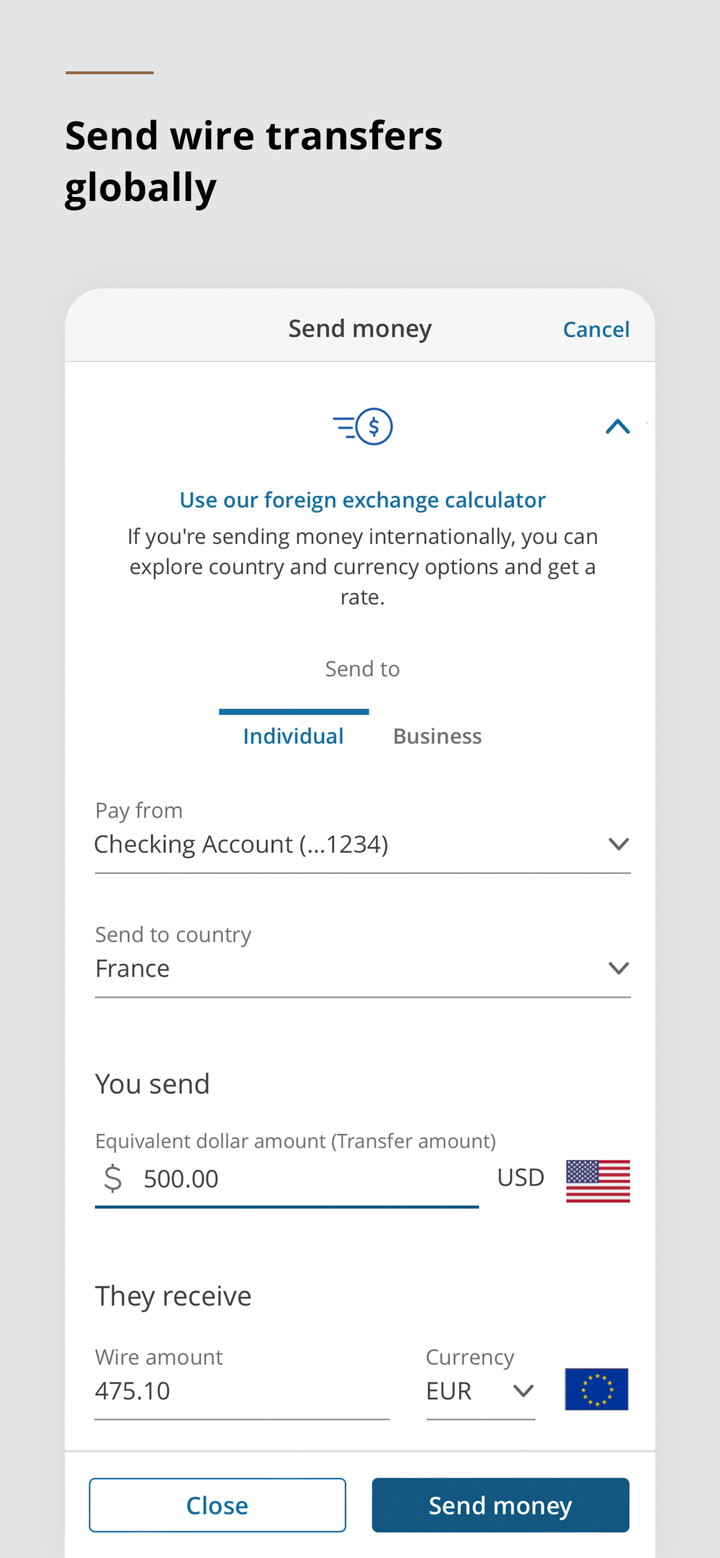

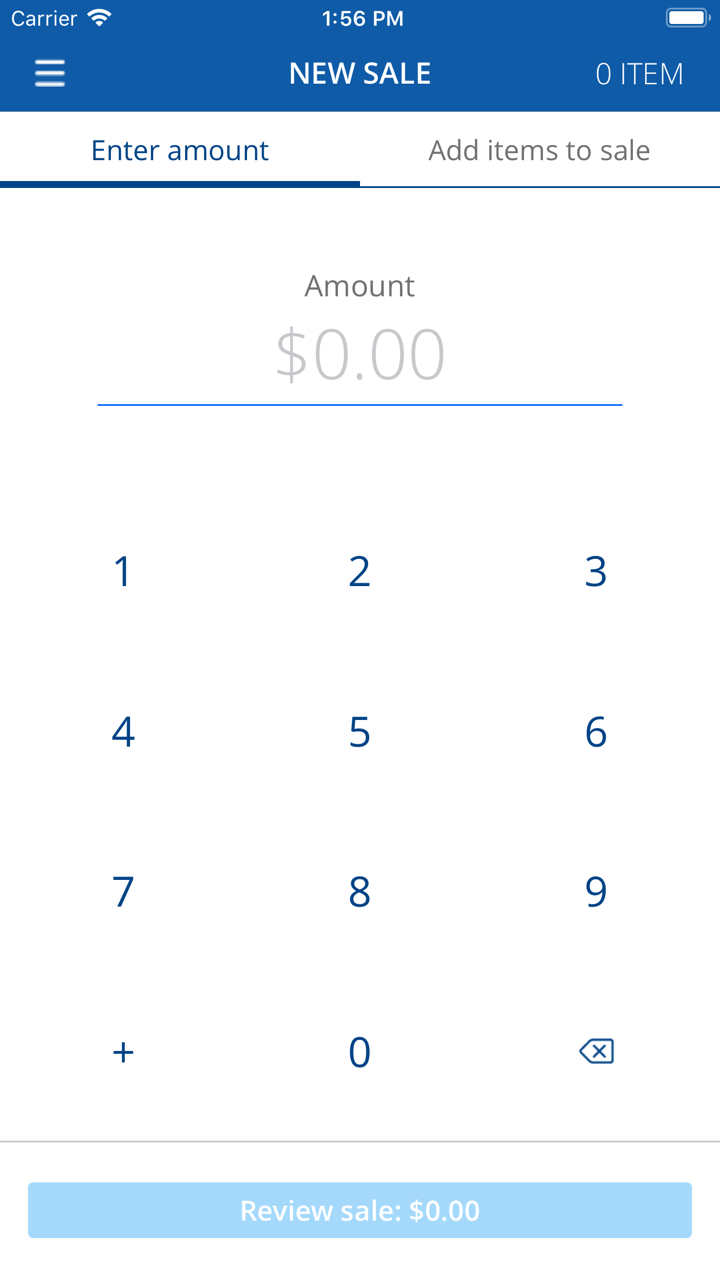

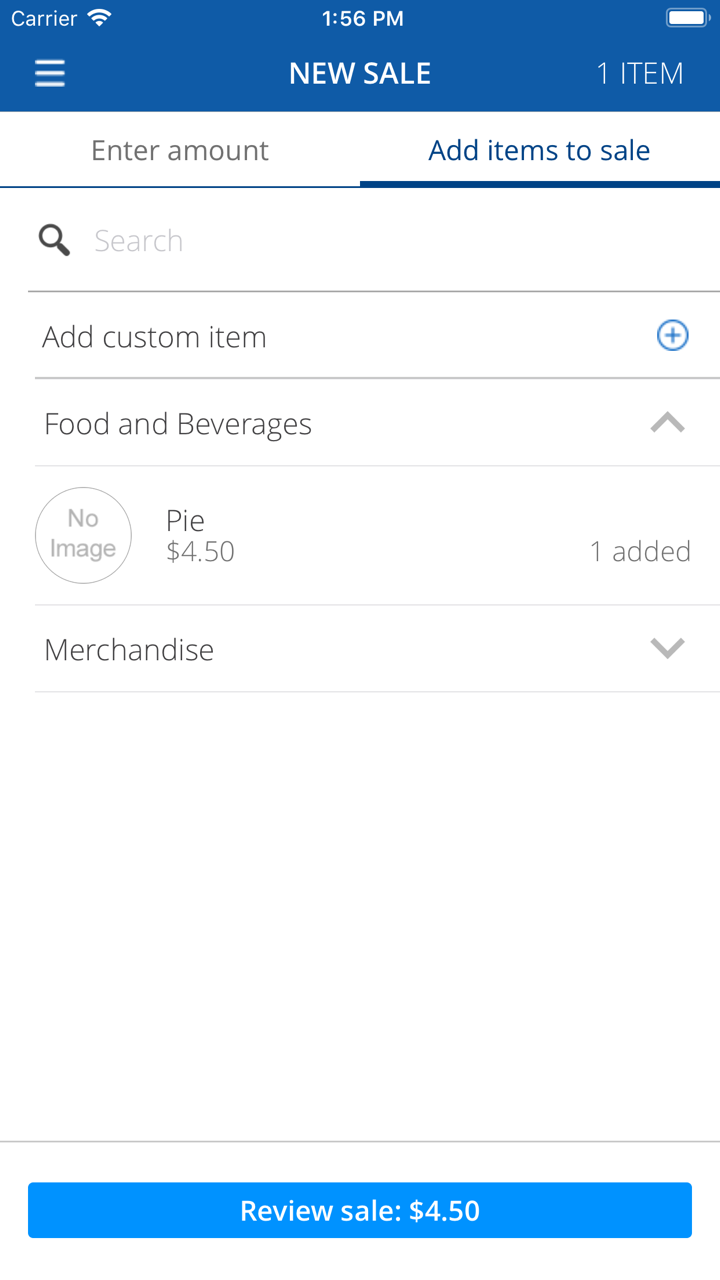

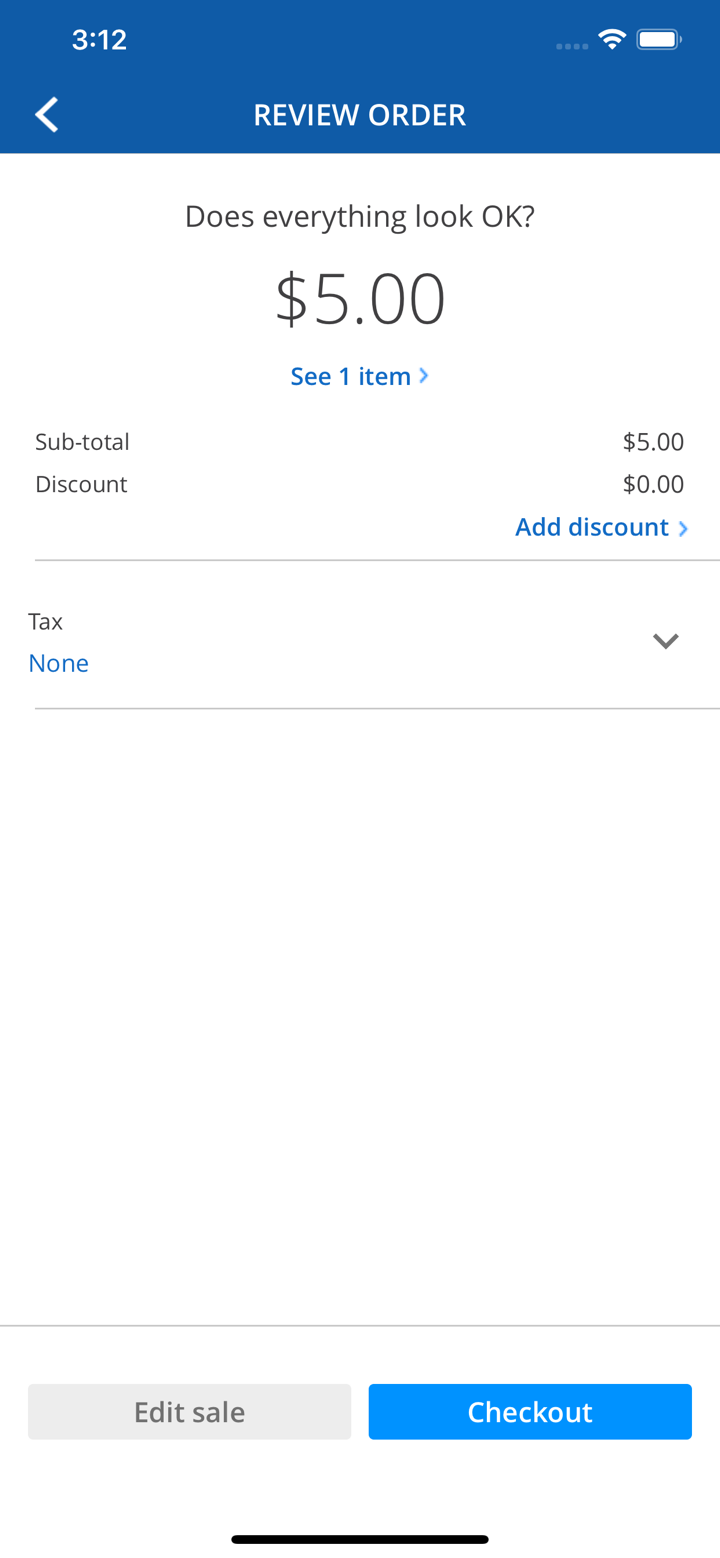

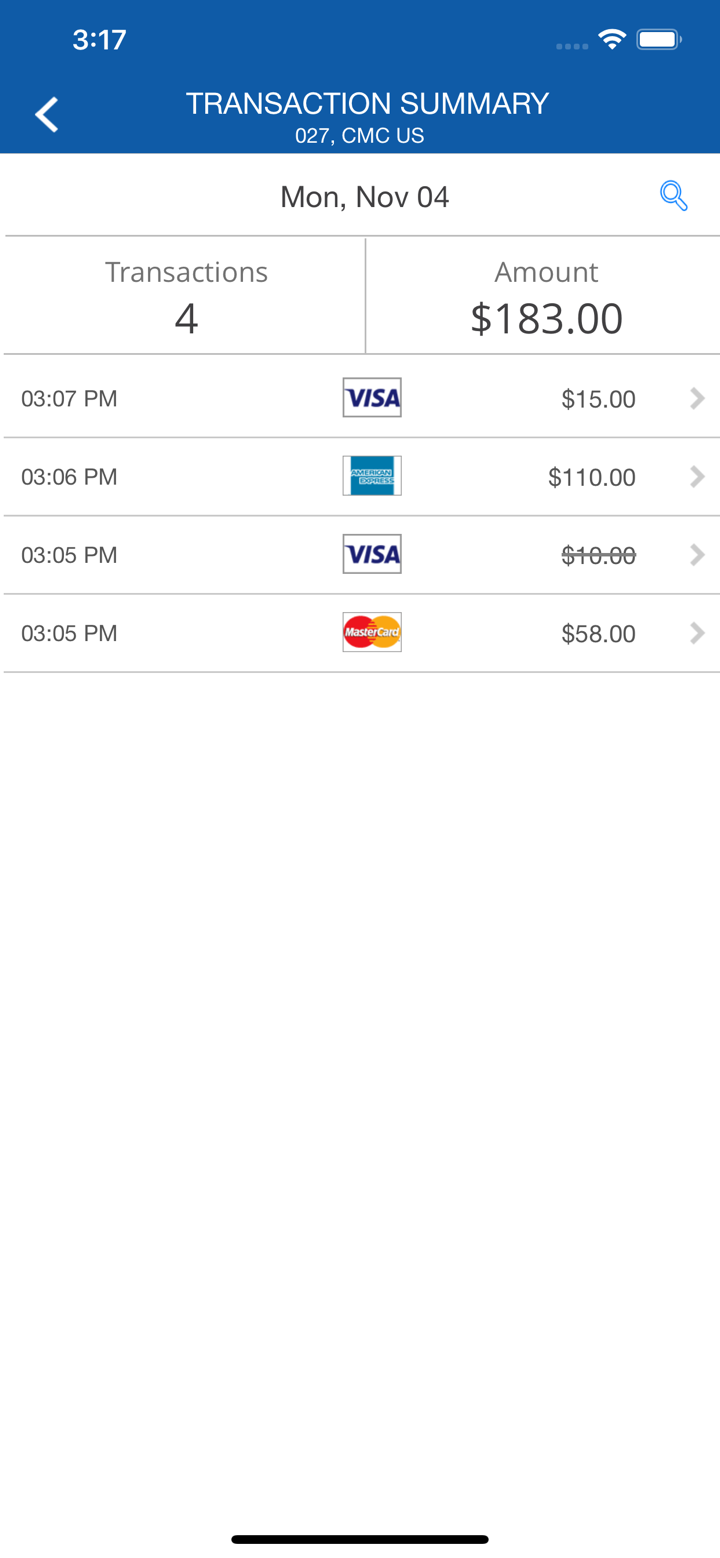

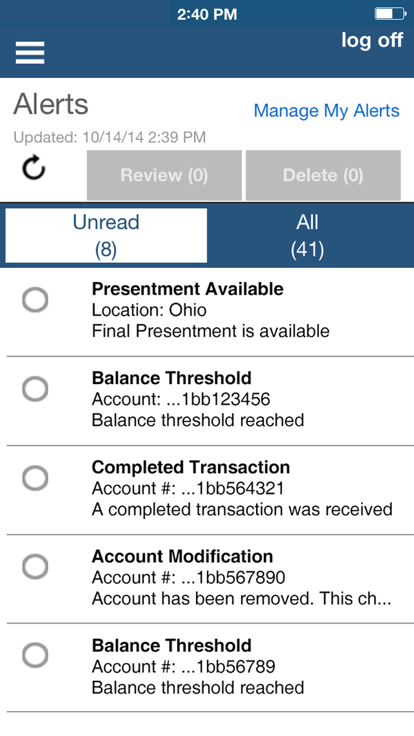

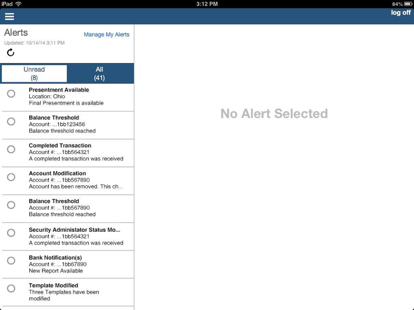

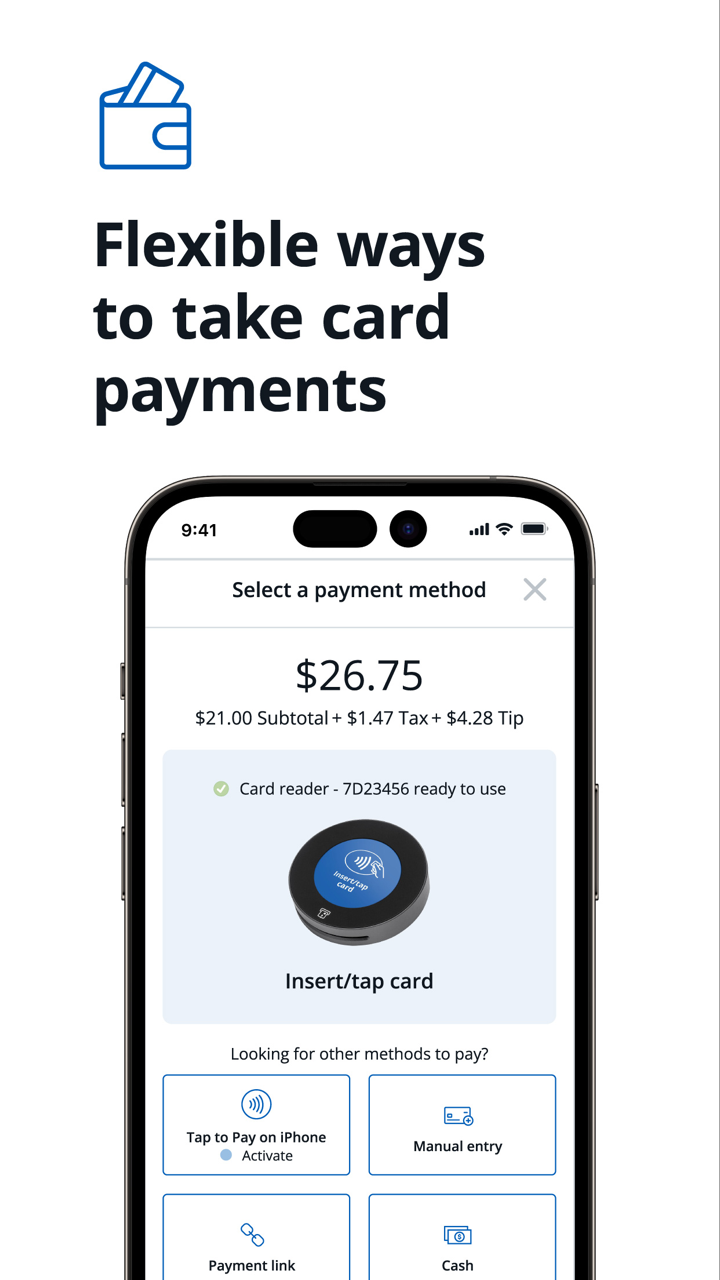

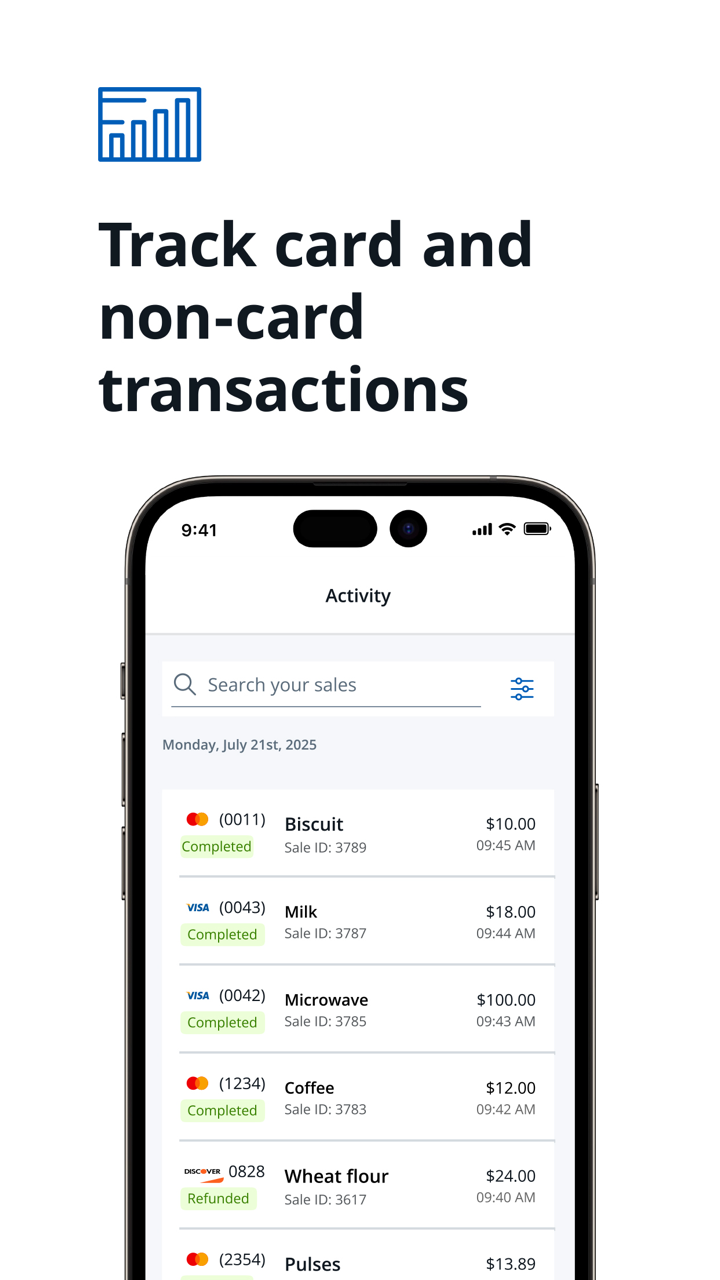

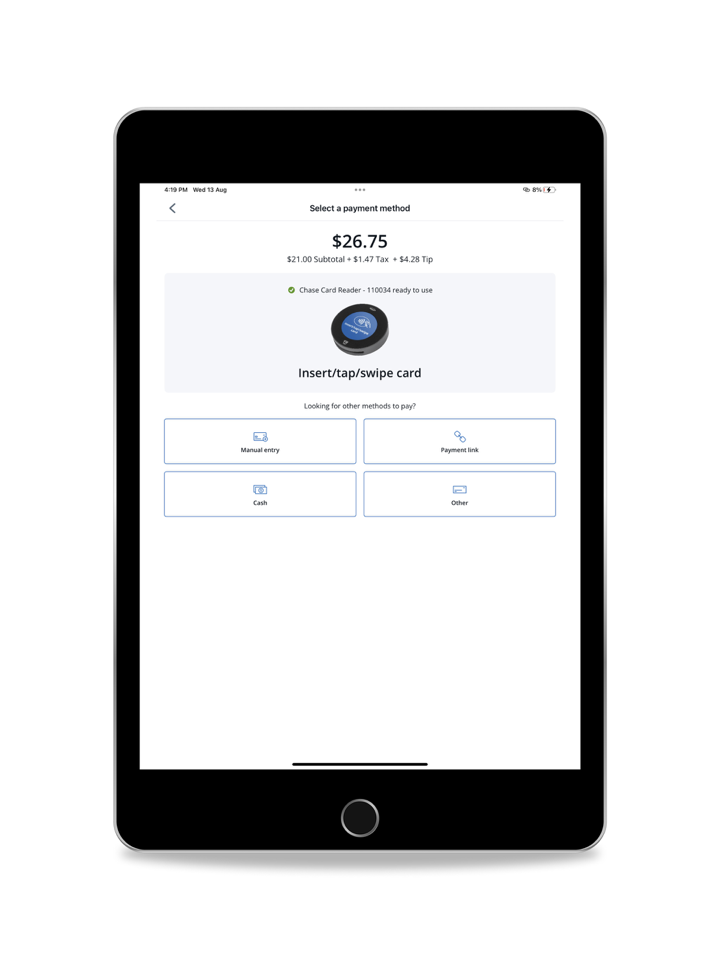

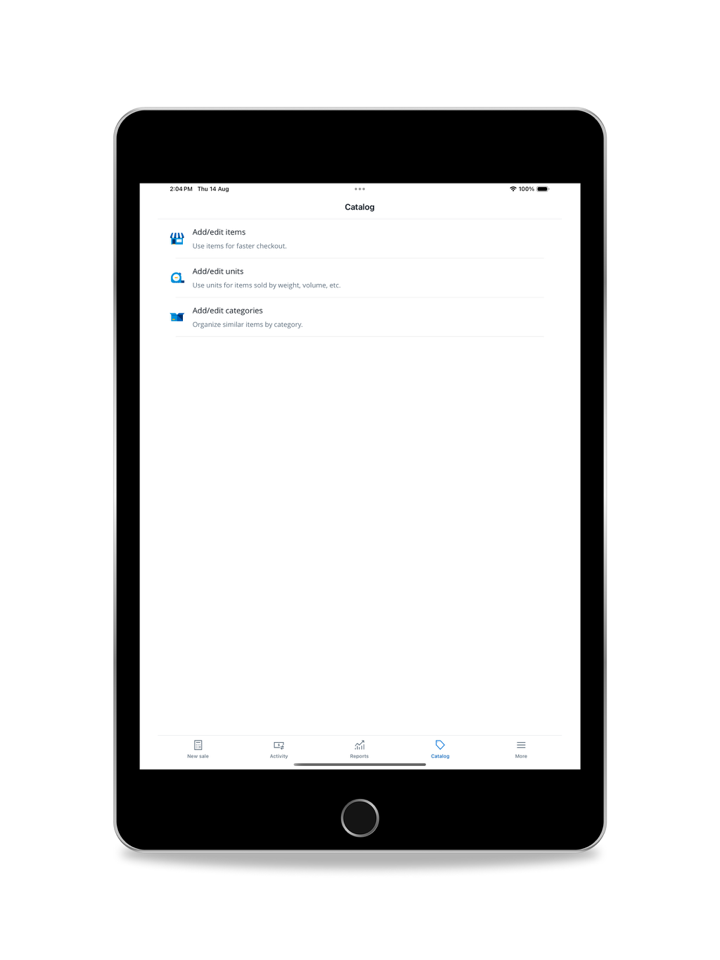

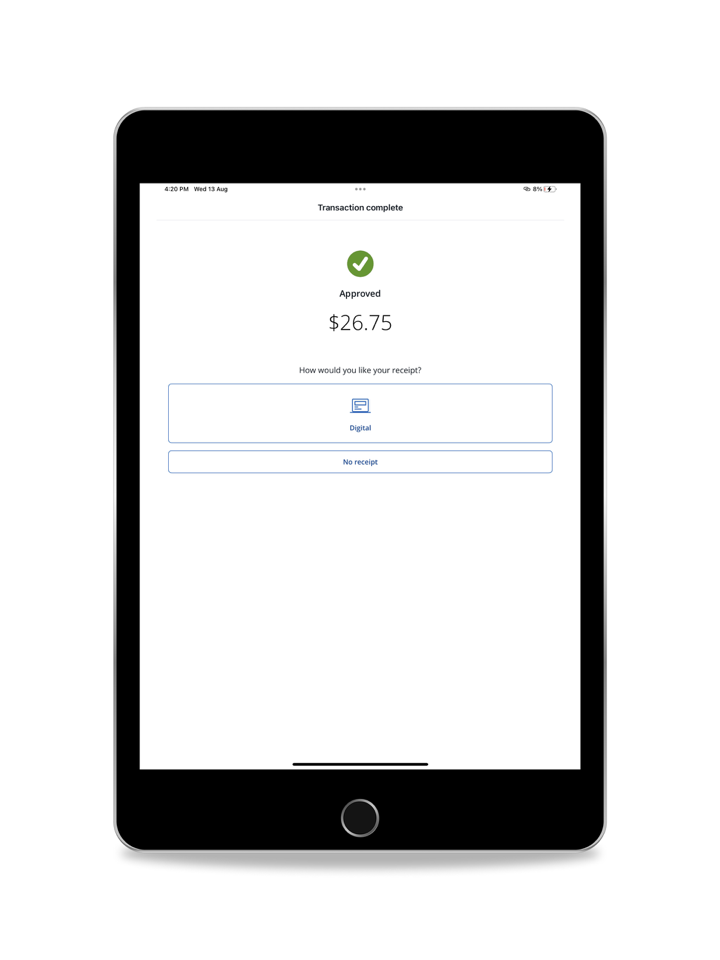

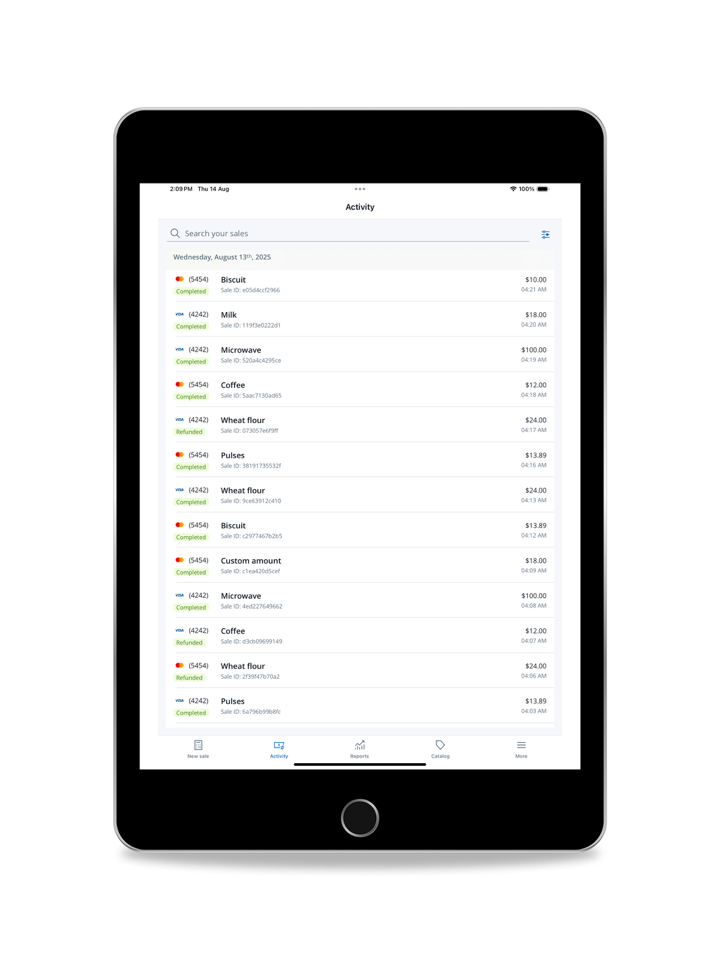

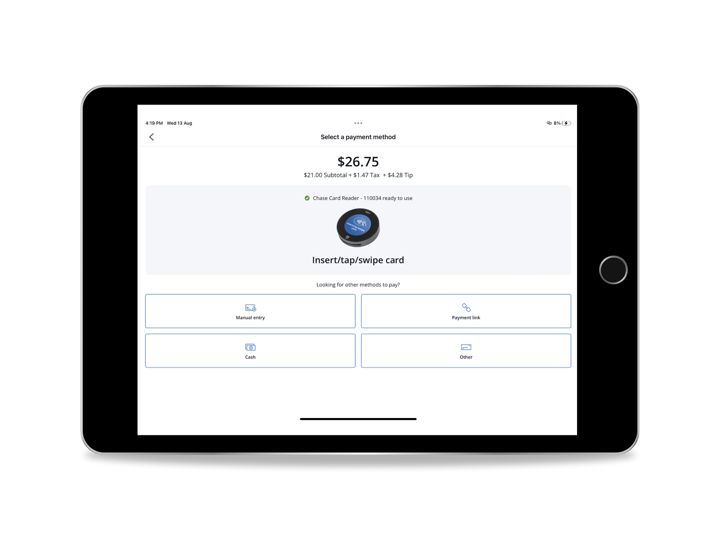

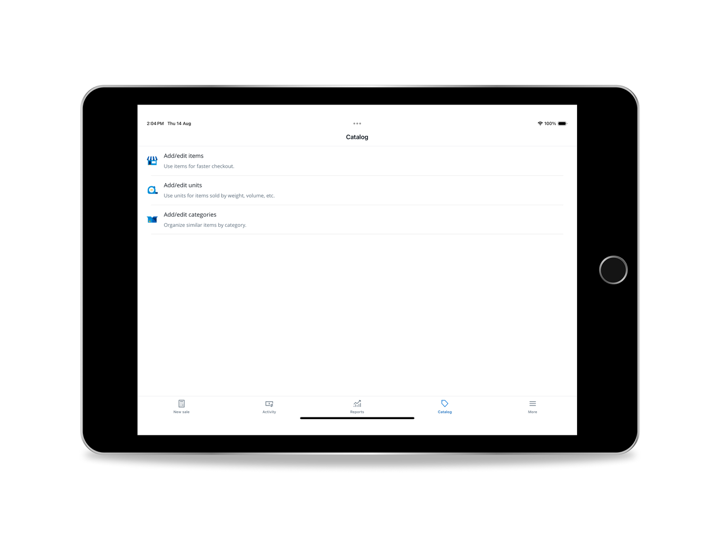

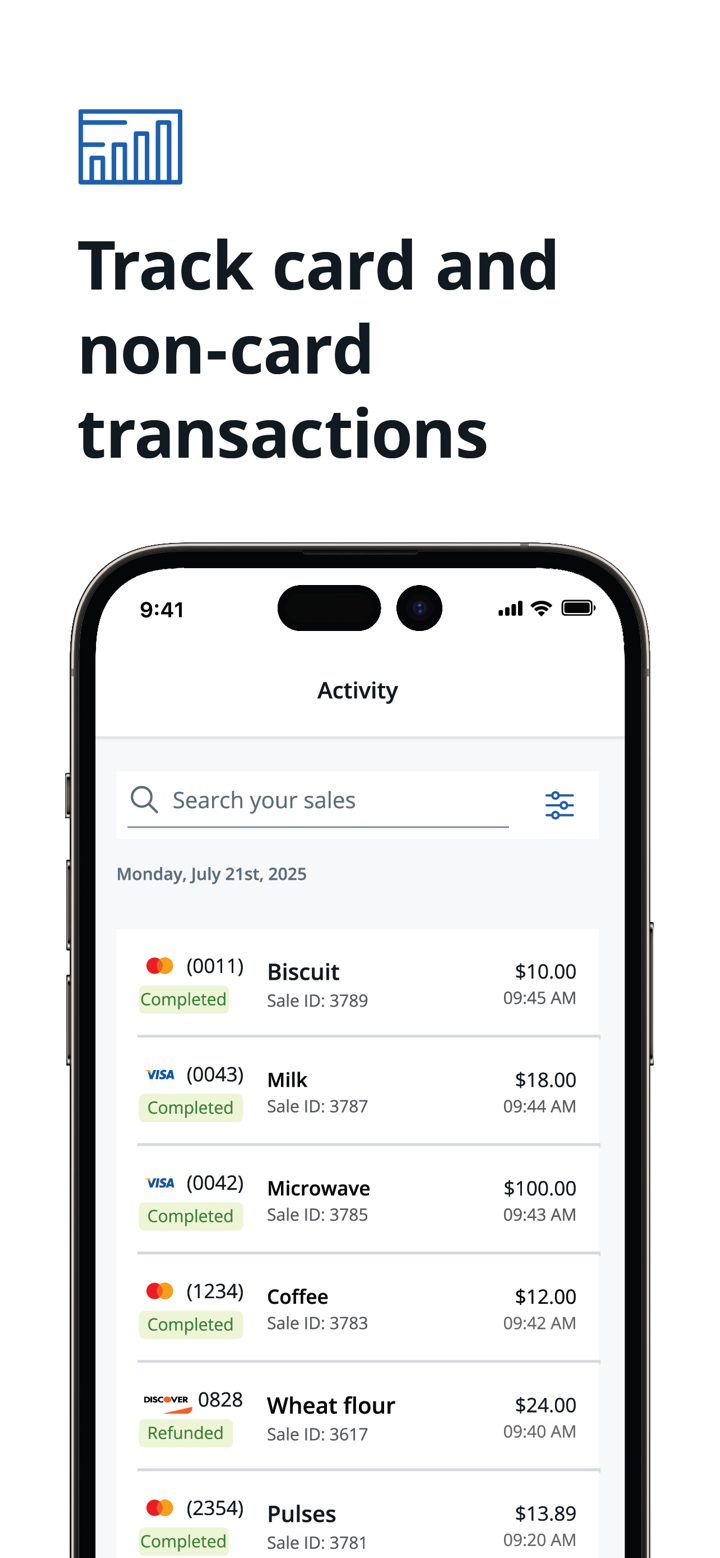

- Mga Bayad: Nag-aalok si J.P. Morgan ng mga Solusyong Pangbayad na idinisenyo upang tulungan ang mga negosyo sa pag-navigate sa kumplikadong at mabilis na nagbabagong kapaligiran ng pagbabayad, pinapayagan silang pamahalaan ang panganib, mag-inobate para sa paglago, at magbigay ng mahusay na karanasan sa mga customer.

Mga Industriyang Pinagsisilbihan

J.P. Morgan ay naglilingkod sa iba't ibang industriya, kabilang ang Commercial Real Estate, Consumer and Retail, Diversified Industries, Energy, Power & Renewables, Financial, Health Care, Media, Telecom and Entertainment, Metals & Mining, Public Sector, at Technology.