公司简介

| GMO CLICK评论摘要 | |

| 成立时间 | 2005 |

| 注册国家 | 日本 |

| 监管机构 | FSA |

| 市场工具 | 股票、投资信托、外汇、差价合约、股指、债券 |

| 模拟账户 | / |

| 杠杆 | / |

| 点差 | / |

| 交易平台 | 13个平台(GMO Click FX、Hatchu-kun FX Plus、PLATINUM CHART等) |

| 最低存款 | / |

| 客户支持 | 座机:0120-727-930 |

| 手机:03-6221-0190 | |

GMO CLICK信息

GMO Click Securities成立于2005年,是日本FSA监管的持牌金融服务公司。其众多投资选择包括外汇、股票、差价合约和税收优惠的NISA 账户。该公司运营多个交易系统,旨在服务从新手到经验丰富的交易者。

优缺点

| 优点 | 缺点 |

| 受日本FSA监管 | 部分平台细节分散 |

| 交易费用非常低手续费,尤其是外汇和差价合约 | 外币提现费用适用 |

| 免费账户管理和无不活跃费 | |

| 营业时间长 | |

| 多样的交易平台 |

GMO CLICK是否合法?

是的,GMO CLICK是一家合法的、受监管的金融机构。它由日本金融厅(FSA)授权,持有零售外汇牌照,许可证号为关东财务局长(金商)第77号,自2007年9月30日起生效。

我可以在GMO CLICK上交易什么?

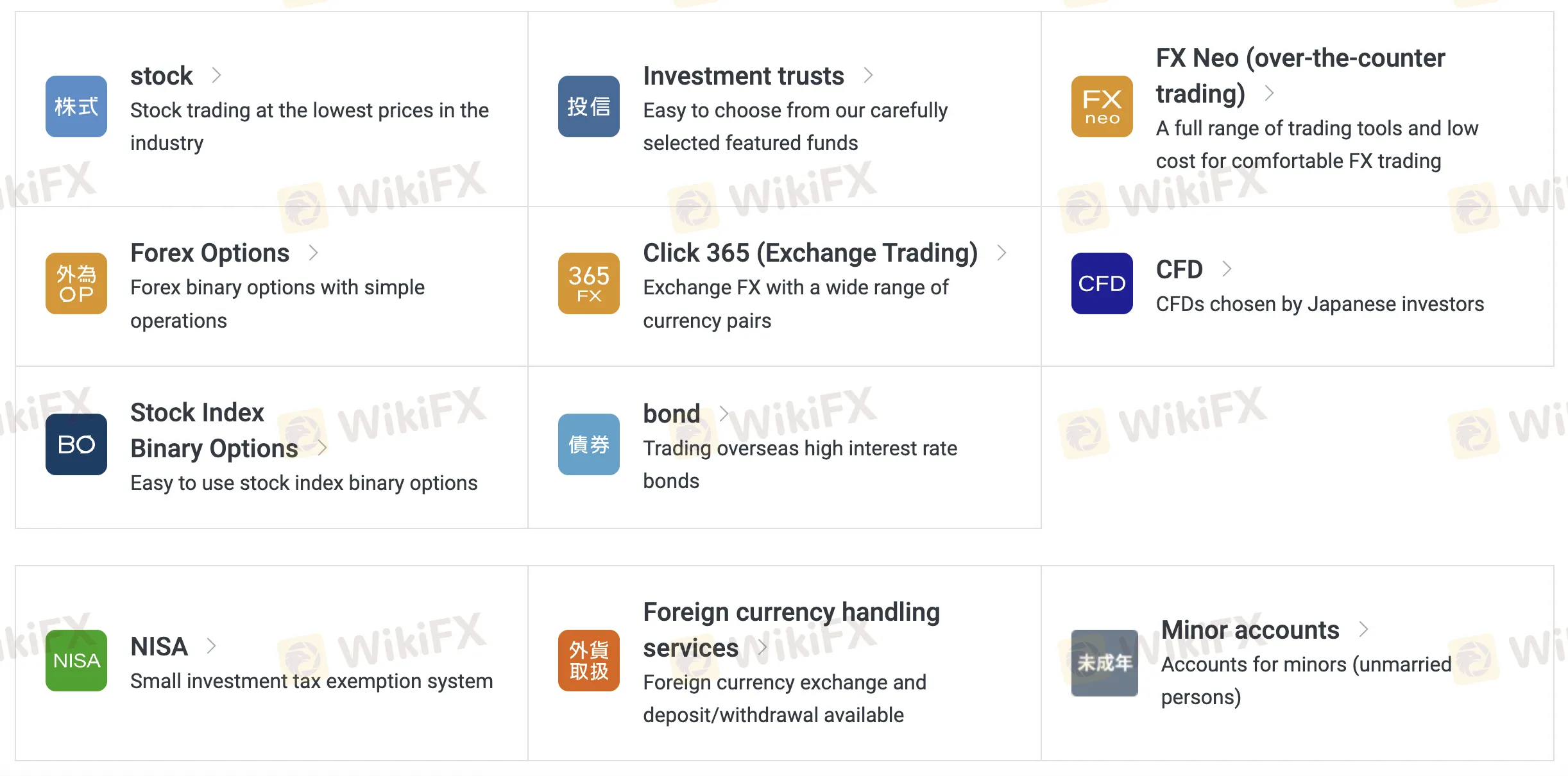

在其众多投资和交易工具中,GMO Click Securities提供股票、外汇、期权、差价合约、债券等。其产品适合普通投资者以及寻求税收优惠的人士。

| 交易工具 | 支持 |

| 股票 | ✔ |

| 投资信托 | ✔ |

| 外汇 | ✔ |

| 差价合约 | ✔ |

| 股指 | ✔ |

| 债券 | ✔ |

| 期权 | ❌ |

| ETFs | ❌ |

GMO CLICK 费用

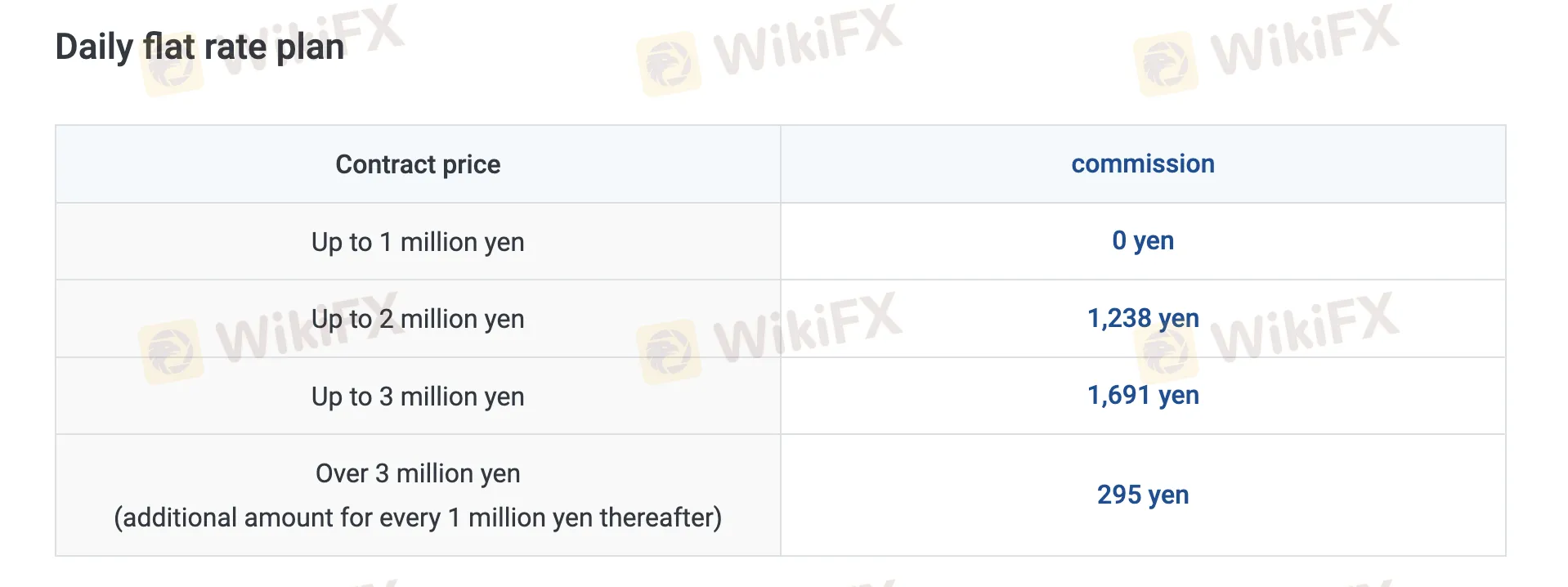

GMO Click 以提供行业内一些最低的费用而闻名,特别是在外汇、差价合约和股票交易方面,许多产品零佣金,并提供紧密的点差。

| 交易产品 | 费用 |

| 现货股票 | 每日固定计划:¥0(每日最高¥1百万),然后按比例 |

| 每笔交易计划:从¥50起 | |

| 保证金股票 | 固定计划:¥0(最高¥1百万),然后按比例 |

| 每笔交易计划:从¥97起 | |

| FX Neo | 0,点差适用 |

| 外汇期权 | 0 |

| Click365 | 标准合约为0;Click365大额票价为¥770–990/张 |

| 差价合约 | 0 |

| 股指二元期权 | 0 |

| 债券 | 0 |

掉期利率

| 类型 | 年度利率 |

| 买方利息(一般) | 2.00% |

| 卖方利息 | 0.00% |

| 股票借贷费(一般信用 - 短期) | 3.85% |

| VIP计划(机构买方) | 1.80% |

非交易费用

| 费用类型 | 金额 |

| 存款费 | 0(即时存款);ATM/银行 手续费 适用 |

| 取款费 | 0(JPY) ¥1,500 用于外汇取款 |

| 不活跃费 | 0 |

| 呼叫中心 订单 费用 | 交易金额的0.11%(最低 ¥3,520,最高 ¥220,000) |

| 零股销售费 | 合同价格的2.2% |

| 零头购买费 | ¥1,100/品牌 |

| 账户管理费 | 0 |

| 文件签发费 | ¥1,100(报告、个人数据等) |

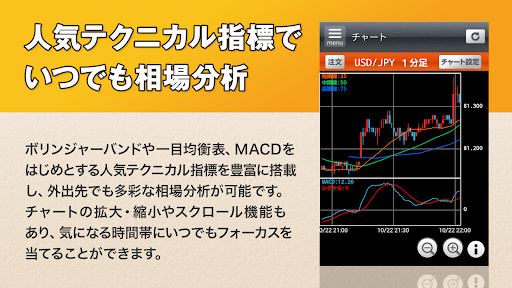

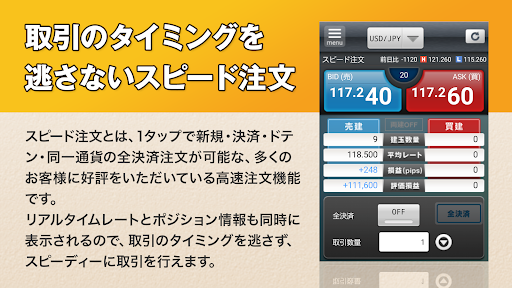

交易平台

| 平台/应用 | 支持 | 可用设备 | 适用于 |

| GMO Click FX | ✔ | iPhone / Android / Apple Watch | 外汇交易者(各级别) |

| Hatchu-kun FX Plus | ✔ | Windows | 需要高级功能的外汇交易者 |

| PLATINUM CHART | ✔ | Windows / Mac | 外汇和差价合约技术图表用户 |

| FX Watch! | ✔ | Wear OS | 智能手表上的外汇提醒 |

| GMO Click CFD | ✔ | iPhone / Android / Apple Watch | 差价合约交易者 |

| Hatchu-kun CFD | ✔ | Windows / Mac | 需要基于PC的工具的差价合约交易者 |

| GMO Click Stock | ✔ | iPhone / Android | 股票交易者(移动访问) |

| GMO Click Stocks for iPad | ✔ | iPad / Mac | 更喜欢平板电脑的股票交易者 |

| Super Hatchu-kun | ✔ | Windows | 需要桌面交易的股票交易者 |

| iClick Forex | ✔ | iPhone / Android | 外汇初学者或随时随地交易者 |

| GMO Click Stock BO | ✔ | iPhone / Android | 股票二元期权交易者 |

| iClickFX365 | ✔ | iPhone | FX365交易者(移动) |

| FXroid365 | ✔ | Android | FX365交易者(移动) |