회사 소개

| GMO CLICK 리뷰 요약 | |

| 설립 연도 | 2005 |

| 등록 국가 | 일본 |

| 규제 | FSA |

| 시장 상품 | 주식, 투자 신탁, 외환, CFD, 주가 지수, 채권 |

| 데모 계정 | / |

| 레버리지 | / |

| 스프레드 | / |

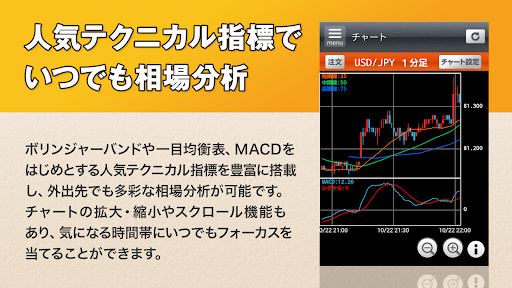

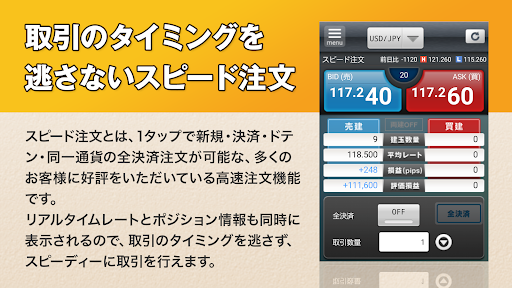

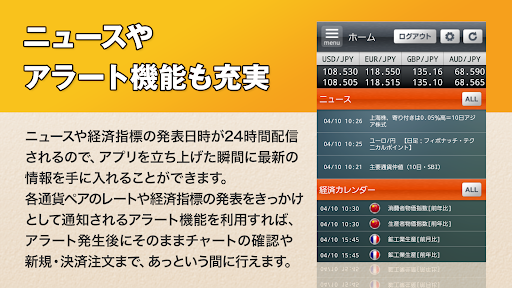

| 거래 플랫폼 | 13개 플랫폼 (GMO Click FX, Hatchu-kun FX Plus, PLATINUM CHART 등) |

| 최소 입금액 | / |

| 고객 지원 | 유선전화: 0120-727-930 |

| 휴대전화: 03-6221-0190 | |

GMO CLICK 정보

2005년 설립된 GMO Click Securities는 일본 FSA의 라이선스를 받은 금융 서비스 기관입니다. FX, 주식, CFD 및 세제 혜택이 있는 NISA 계정 등 다양한 투자 옵션을 제공합니다. 이 회사는 초보자부터 숙련된 트레이더까지 모두를 대상으로 한 여러 거래 시스템을 운영합니다.

장단점

| 장점 | 단점 |

| 일본 FSA 규제 | 일부 플랫폼 세부 정보가 분산되어 있음 |

| FX 및 CFD를 포함한 거래 수수료가 매우 낮음 | 외화 인출 수수료가 부과됨 |

| 무료 계정 관리 및 비활성 수수료 없음 | |

| 운영 시간이 길다 | |

| 다양한 거래 플랫폼 |

GMO CLICK 합법인가요?

네, GMO CLICK은 합법적이고 규제된 금융 기관입니다. 일본의 금융 서비스 기관인 금융 서비스 규제청 (FSA)로부터 소매 외환 라이선스를 받았으며, 2007년 9월 30일부터 유효한 라이선스 번호인 関東財務局長(金商)第77号을 보유하고 있습니다.

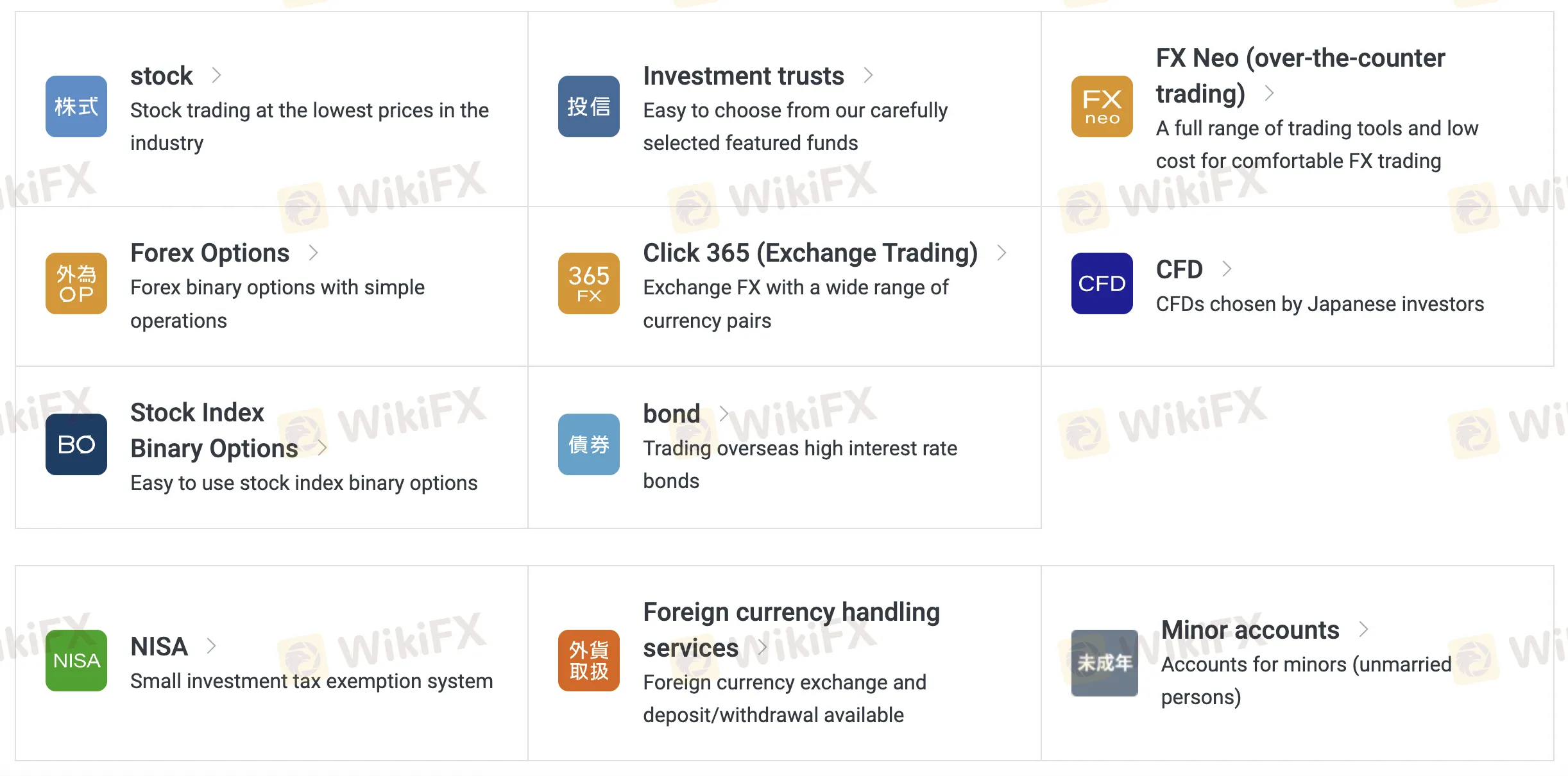

GMO CLICK에서 무엇을 거래할 수 있나요?

다양한 투자 및 거래 도구 중 GMO Click Securities는 주식, 외환, 옵션, CFD, 채권 등을 제공합니다. 그 제품은 일반 투자자뿐만 아니라 세제 혜택이 있는 소규모 계정을 찾는 사람들에게 적합합니다.

| 거래 상품 | 지원됨 |

| 주식 | ✔ |

| 투자 신탁 | ✔ |

| 외환 | ✔ |

| CFD | ✔ |

| 주가 지수 | ✔ |

| 채권 | ✔ |

| 옵션 | ❌ |

| ETFs | ❌ |

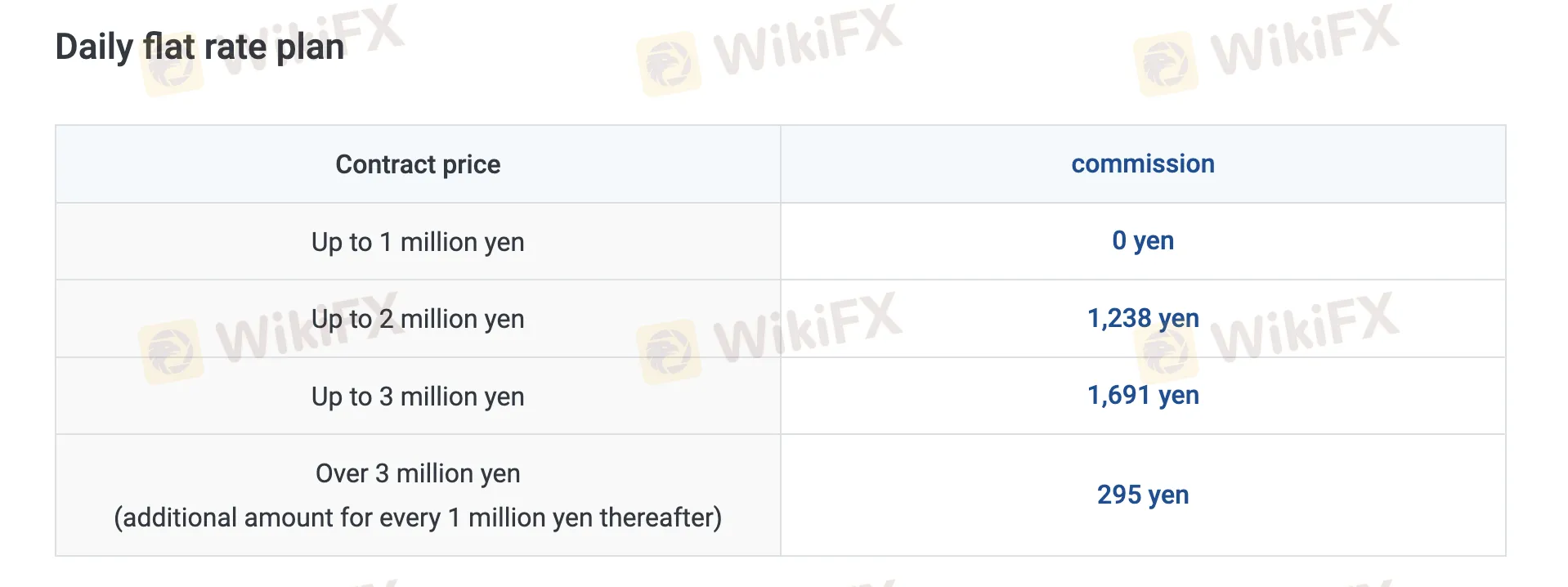

GMO CLICK 수수료

GMO Click은 FX, CFD, 및 주식 거래에 대해 특히 낮은 수수료를 제공하여 업계에서 알려져 있으며, 많은 제품에 대해 수수료가 없고 낮은 스프레드를 제공합니다.

| 거래 제품 | 수수료 |

| 현물 주식 | 일일 고정 요금제: ¥0 (일당 최대 ¥1백만), 그 후 가변 |

| 거래당 요금제: ¥50부터 | |

| 마진 주식 | 고정 요금제: ¥0 (최대 ¥1백만까지), 그 후 가변 |

| 거래당 요금제: ¥97부터 | |

| FX Neo | 0, 스프레드 별도 |

| 외환 옵션 | 0 |

| Click365 | 표준 계약에 대해 0; Click365 Large에 대해 ¥770–¥990/티켓 |

| CFD | 0 |

| 주식 지수 바이너리 옵션 | 0 |

| 채권 | 0 |

스왑 금리

| 유형 | 연간 금리 |

| 매수자 이자 (일반) | 2.00% |

| 매도자 이자 | 0.00% |

| 주식 대여료 (일반 신용 - 단기) | 3.85% |

| VIP 플랜 (기관 매수자) | 1.80% |

비거래 수수료

| 수수료 유형 | 금액 |

| 입금 수수료 | 0 (즉시 입금); ATM/은행 수수료 별도 |

| 출금 수수료 | 0 (JPY) 외환 환전 출금 시 ¥1,500 |

| 비활성 수수료 | 0 |

| 콜센터 주문 수수료 | 거래 금액의 0.11% (최소 ¥3,520, 최대 ¥220,000) |

| 소액 주식 매출 수수료 | 계약 가격의 2.2% |

| 잔량 매수 수수료 | ¥1,100/브랜드 |

| 계좌 관리 수수료 | 0 |

| 문서 발급 수수료 | ¥1,100 (리포트, 개인 데이터 등) |

거래 플랫폼

| 플랫폼/앱 | 지원 | 사용 가능한 장치 | 적합 대상 |

| GMO Click FX | ✔ | iPhone / Android / Apple Watch | FX 트레이더 (모든 레벨) |

| Hatchu-kun FX Plus | ✔ | Windows | 고급 기능이 필요한 FX 트레이더 |

| PLATINUM CHART | ✔ | Windows / Mac | FX 및 CFD 기술 차트 사용자 |

| FX Watch! | ✔ | Wear OS | 스마트워치에서 FX 알림 필요한 트레이더 |

| GMO Click CFD | ✔ | iPhone / Android / Apple Watch | CFD 트레이더 |

| Hatchu-kun CFD | ✔ | Windows / Mac | PC 기반 도구 필요한 CFD 트레이더 |

| GMO Click Stock | ✔ | iPhone / Android | 주식 트레이더 (모바일 접근) |

| GMO Click Stocks for iPad | ✔ | iPad / Mac | 태블릿 선호하는 주식 트레이더 |

| Super Hatchu-kun | ✔ | Windows | 데스크톱 거래 필요한 주식 트레이더 |

| iClick Forex | ✔ | iPhone / Android | FX 초보자 또는 이동 중인 트레이더 |

| GMO Click Stock BO | ✔ | iPhone / Android | 주식 바이너리 옵션 트레이더 |

| iClickFX365 | ✔ | iPhone | FX365 트레이더 (모바일) |

| FXroid365 | ✔ | Android | FX365 트레이더 (모바일) |