Profil perusahaan

| GMO CLICK Ringkasan Ulasan | |

| Didirikan | 2005 |

| Negara Terdaftar | Jepang |

| Regulasi | FSA |

| Instrumen Pasar | Saham, trust investasi, forex, CFD, indeks saham, obligasi |

| Akun Demo | / |

| Daya Ungkit | / |

| Spread | / |

| Platform Perdagangan | 13 platform (GMO Click FX, Hatchu-kun FX Plus, PLATINUM CHART, dll.) |

| Deposit Minimum | / |

| Dukungan Pelanggan | Telepon Rumah: 0120-727-930 |

| Ponsel: 03-6221-0190 | |

Informasi GMO CLICK

Didirikan pada tahun 2005, GMO Click Securities adalah perusahaan layanan keuangan yang berlisensi dan terkendali di bawah FSA Jepang. Di antara banyak pilihan investasinya adalah FX, ekuitas, CFD, dan akun NISA yang menguntungkan dari segi pajak. Perusahaan ini menjalankan beberapa sistem perdagangan yang dirancang untuk siapa pun mulai dari pemula hingga trader berpengalaman.

Kelebihan dan Kekurangan

| Kelebihan | Kekurangan |

| Diatur oleh FSA Jepang | Beberapa detail platform tersebar |

| Biaya perdagangan yang sangat rendah, terutama untuk FX dan CFD | Biaya penarikan mata uang asing berlaku |

| Manajemen akun gratis & tidak ada biaya ketidakaktifan | |

| Waktu operasi panjang | |

| Berbagai platform perdagangan |

Apakah GMO CLICK Legal?

Ya, GMO CLICK adalah lembaga keuangan yang legal, teregulasi. Itu diotorisasi oleh Otoritas Jasa Keuangan (FSA) Jepang dengan Lisensi Forex Ritel, dengan nomor lisensi 関東財務局長(金商)第77号, efektif sejak 30 September 2007.

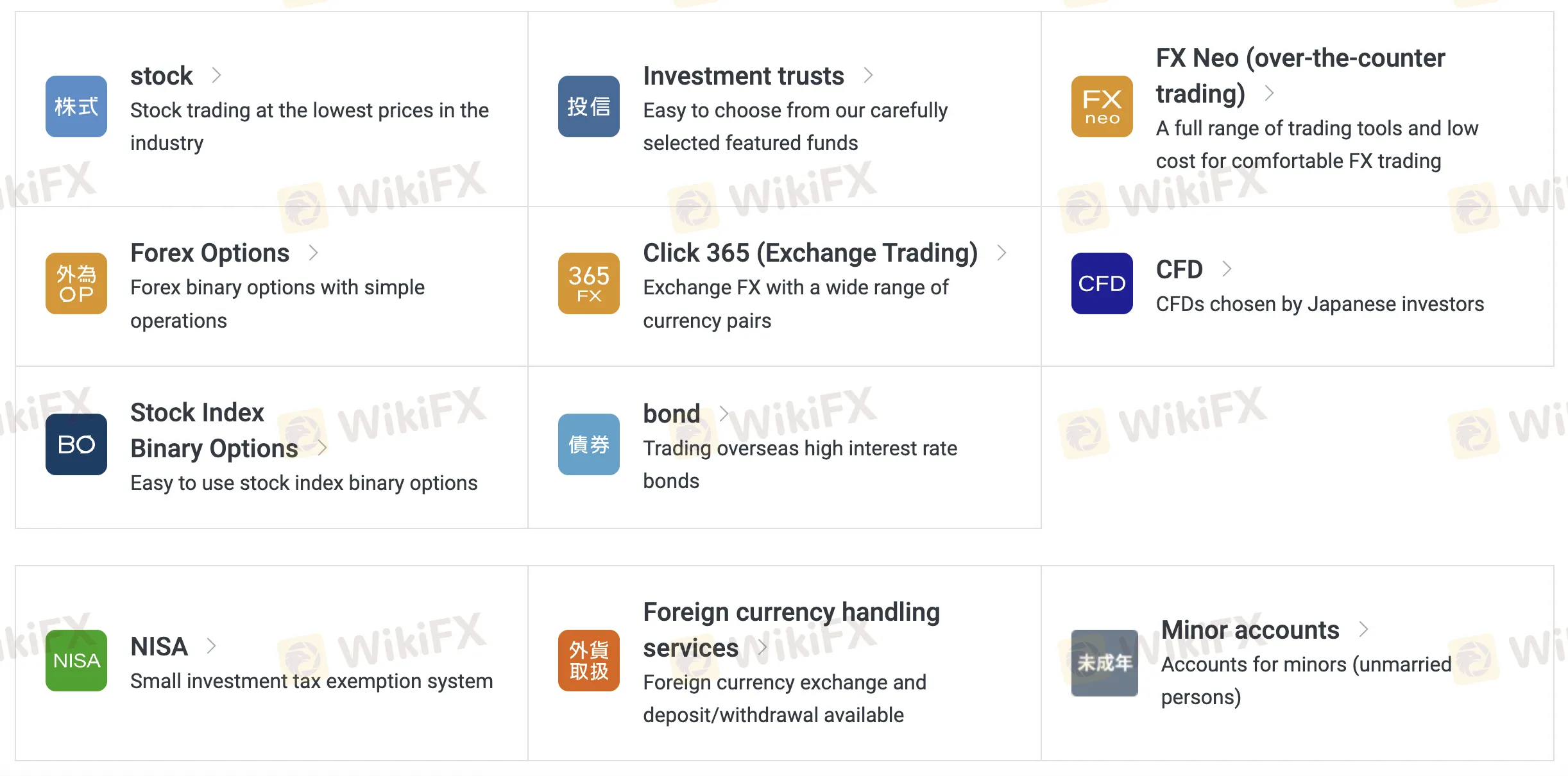

Apa yang Bisa Saya Perdagangkan di GMO CLICK?

Di antara banyak alat investasi dan perdagangan, GMO Click Securities menyediakan saham, FX, opsi, CFD, obligasi, dan lainnya. Produk-produknya cocok untuk investor biasa maupun mereka yang mencari akun sederhana dengan manfaat pajak.

| Instrumen Perdagangan | Didukung |

| Saham | ✔ |

| Trust Investasi | ✔ |

| Forex | ✔ |

| CFD | ✔ |

| Indeks Saham | ✔ |

| Obligasi | ✔ |

| Opsi | ❌ |

| ETF | ❌ |

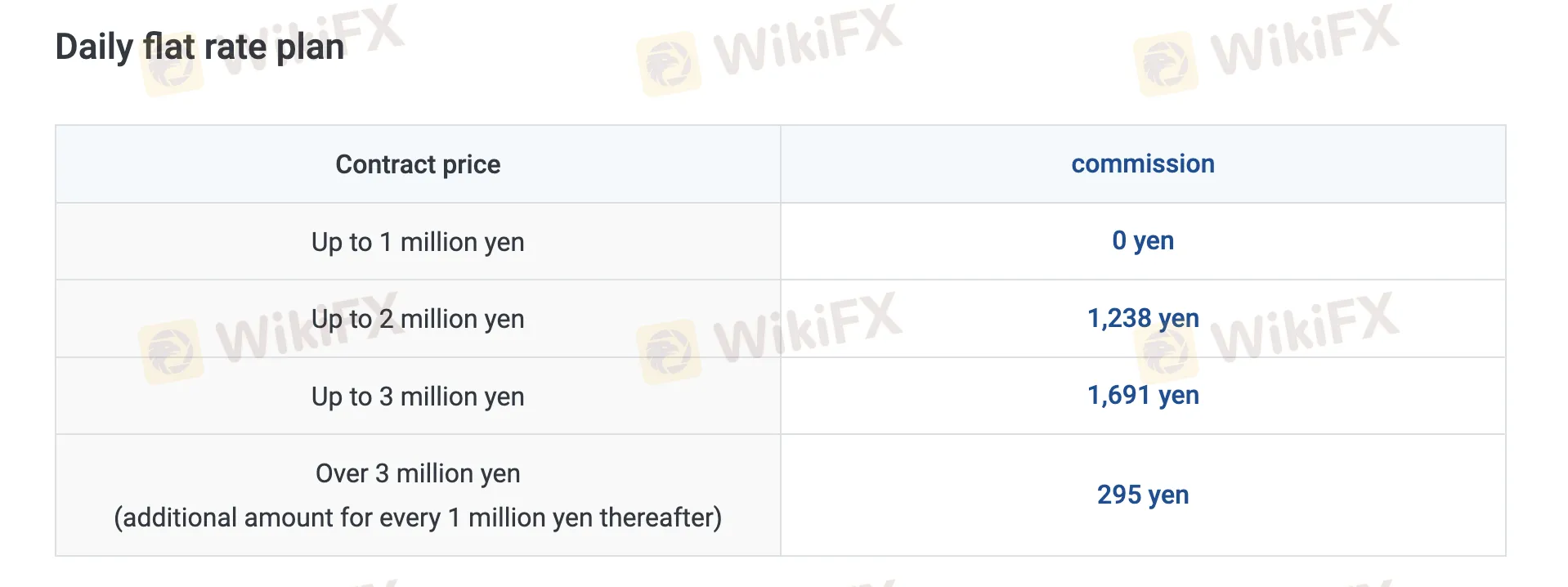

GMO CLICK Biaya

GMO Click dikenal karena menawarkan beberapa biaya terendah di industri, terutama untuk FX, CFD, dan perdagangan saham, dengan komisi nol untuk banyak produk dan spread ketat.

| Produk Perdagangan | Biaya |

| Saham Spot | Rencana Flat Harian: ¥0 (hingga ¥1M/hari), kemudian disesuaikan |

| Rencana Perdagangan: Mulai dari ¥50 | |

| Saham Marjin | Rencana Flat: ¥0 (hingga ¥1M), kemudian disesuaikan |

| Rencana Perdagangan: Mulai dari ¥97 | |

| FX Neo | 0, berlaku spread |

| Opsi Forex | 0 |

| Click365 | 0 untuk kontrak standar; ¥770–990/tiket untuk Click365 Large |

| CFD | 0 |

| Opsi Biner Indeks Saham | 0 |

| Obligasi | 0 |

Biaya Swap

| Tipe | Biaya Tahunan |

| Bunga Pembeli (Umum) | 2.00% |

| Bunga Penjual | 0.00% |

| Biaya Peminjaman Saham (Kredit Umum - Jangka Pendek) | 3.85% |

| Rencana VIP (Pembeli Institusional) | 1.80% |

Biaya Non-Trading

| Jenis Biaya | Jumlah |

| Biaya Deposit | 0 (Deposit instan); Biaya ATM/bank berlaku |

| Biaya Penarikan | 0 (JPY) ¥1,500 untuk penarikan mata uang asing FX |

| Biaya Tidak Aktif | 0 |

| Biaya Pemesanan Call Center | 0,11% dari jumlah perdagangan (min ¥3.520, maks ¥220.000) |

| Penjualan Saham Pecahan | 2,2% dari harga kontrak |

| Biaya Pembelian Lot Ganjil | ¥1.100/merek |

| Biaya Manajemen Akun | 0 |

| Biaya Penerbitan Dokumen | ¥1.100 (laporan, data pribadi, dll.) |

Platform Perdagangan

| Platform/Aplikasi | Didukung | Perangkat Tersedia | Cocok untuk |

| GMO Click FX | ✔ | iPhone / Android / Apple Watch | Pedagang FX (semua tingkatan) |

| Hatchu-kun FX Plus | ✔ | Windows | Pedagang FX yang memerlukan fungsi lanjutan |

| PLATINUM CHART | ✔ | Windows / Mac | Pengguna grafik teknis FX & CFD |

| FX Watch! | ✔ | Wear OS | Peringatan FX pada smartwatch |

| GMO Click CFD | ✔ | iPhone / Android / Apple Watch | Pedagang CFD |

| Hatchu-kun CFD | ✔ | Windows / Mac | Pedagang CFD yang memerlukan alat berbasis PC |

| GMO Click Stock | ✔ | iPhone / Android | Pedagang Saham (akses seluler) |

| GMO Click Stocks for iPad | ✔ | iPad / Mac | Pedagang Saham yang lebih suka tablet |

| Super Hatchu-kun | ✔ | Windows | Pedagang Saham yang memerlukan perdagangan desktop |

| iClick Forex | ✔ | iPhone / Android | Pemula FX atau pedagang yang selalu bepergian |

| GMO Click Stock BO | ✔ | iPhone / Android | Pedagang Opsi Biner Saham |

| iClickFX365 | ✔ | iPhone | Pedagang FX365 (seluler) |

| FXroid365 | ✔ | Android | Pedagang FX365 (seluler) |