Informations de base

Japon

JaponNote

Japon

|

15 à 20 ans

|

Japon

|

15 à 20 ans

| https://www.fxbroadnet.com/

Site officiel

Indice de notation

Ratio de capital

Good

Capital

Influence

C

Indice d'influence NO.1

Japon 6.44

Japon 6.44Ratio de capital

Good

Capital

Influence

C

Indice d'influence NO.1

Japon 6.44

Japon 6.44 Licences

LicencesEntité agréée:株式会社FXブロードネット

N° de réglementation:関東財務局長(金商)第244号

Mono-cœur

1G

40G

1M*ADSL

Japon

Japon fxbroadnet.com

fxbroadnet.com Japon

Japon

| FX Broadnet Résumé de l'examen | |

| Fondé | 1993 |

| Pays/Région enregistré | Japon |

| Régulation | Non réglementé |

| Services | FX de gré à gré/Click 365/Outils de trading |

| Compte de démonstration | ✅ |

| Spread | À 0,2 sen (écart dollar-yen) |

| Outils de trading | FX BroadNe (Navigateur/Android/iPhone/Tablette/Mobile) |

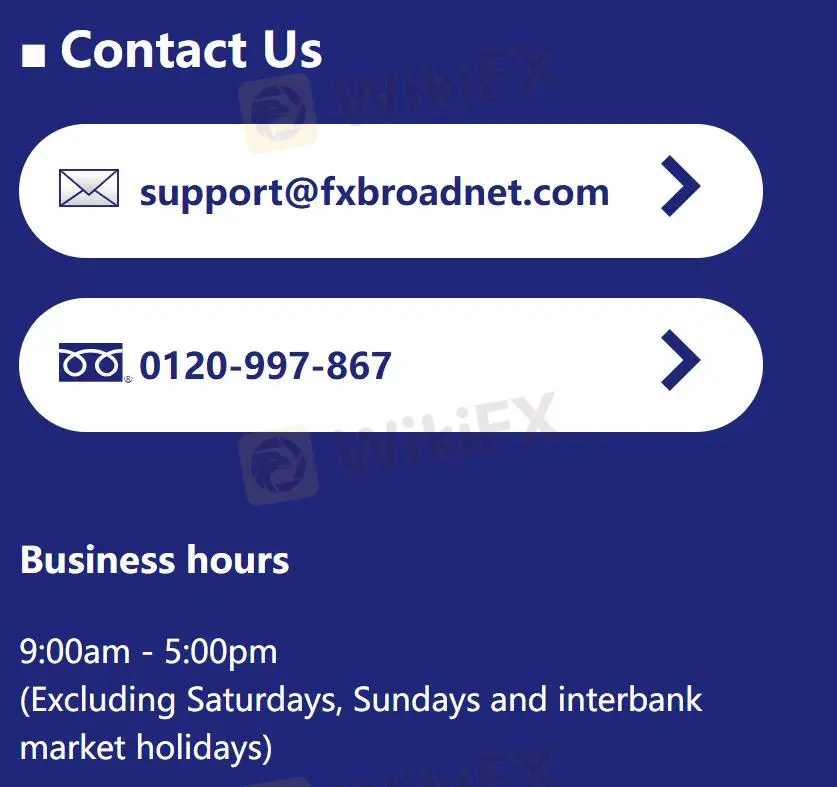

| Assistance clientèle | Hotline : 0120-997-867 |

| Email : support@fxbroadnet.com | |

| Réseaux sociaux : Facebook, Twitter | |

FX Broadnet a été fondé en 1993 en tant que société d'information qui fournit des services liés au marché des changes depuis plus de vingt ans. La société propose "FX Broadnet", un service en ligne avec un faible spread pour le trading de change de gré à gré basé sur une technologie de pointe en matière de TI, et gère "Click 365", un service de trading de change de marge négocié en bourse sur la Bourse financière de Tokyo. Expliquez-le avec des vidéos simples et faciles à comprendre sur YouTube : https://www.youtube.com/watch?reload=9&v=vYHJCADGt5k

https://www.youtube.com/watch?v=2P1tX5SCdkg

https://www.youtube.com/watch?v=2P1tX5SCdkg

https://www.youtube.com/watch?v=2P1tX5SCdkg

FX Broadnet est autorisé et réglementé par l'Agence des services financiers (FSA). Le numéro de licence est 関東財務局長(金商)第244号, ce qui le rend plus sûr que les courtiers réglementés.

FX Broadnet propose des services dans trois domaines majeurs : FX de gré à gré, Click 365 et Outils de trading.

Le FX de gré à gré offre des transactions à faible différence de points. Des ordinateurs aux outils de trading dédiés aux changes, des ordinateurs aux smartphones, en passant par le suivi des transactions, les transactions à partir de 4 000 yens, permettant des transactions à 10 000 types. Par conséquent, il convient aux débutants et aux personnes qui souhaitent réduire les risques.

"CLICK 365" est le premier service de trading de dépôt de change (FX) au Japon à offrir à ses clients des prix préférentiels grâce au mécanisme des méthodes commerciales du marché.

Outre le compte réel pour le trading FX de gré à gré, FX Broadnet propose également des comptes de démonstration pour se familiariser avec les plateformes et le contenu lié à l'apprentissage.

La force des spreads de FX Broadnet est que l'écart dollar-yen est de 0,2 sen. Plus l'écart est faible, plus la liquidité est rapide. Click 365 LARGE utilise 100 000 unités de devise, et le swap d'achat baisse de 0,08. Pour plus de détails, veuillez consulter https://www.fxbroadNet.com/click/composition/swap/.

Les utilisateurs peuvent télécharger les différentes versions de FX BroadNet, y compris Navigateur, Android/iPhone, Tablette et Mobile.

| Plateforme | Pris en charge | Appareils disponibles |

| FX BroadNet | ✔ | Navigateur/Android/iPhone/Tablette/Mobile |

Les traders peuvent suivre la plateforme sur Facebook, Twitter et plus encore et la contacter par téléphone et e-mail. Les heures de travail sont de 9h00 à 17h00 (hors jours fériés du marché interbancaire) du lundi au vendredi.

| Options de contact | Détails |

| Ligne directe | 0120-997-867 |

| support@fxbroadnet.com | |

| Réseaux sociaux | Facebook, Twitter |

| Langue prise en charge | Japonais |

| Langue du site web | Japonais |

| Adresse physique | 〒100-6217 東京都千代田区丸の内1-11-1 |

Based on my years of trading experience and a thorough review of FX Broadnet’s details, I can say the broker presents strong indicators of legitimacy, especially for those seeking a regulated environment. FX Broadnet holds an official retail forex license issued by Japan’s Financial Services Agency (FSA), which is one of the most respected regulators in the industry. In my view, regulation like this is critical because it means the broker must follow strict operational and client protection standards. This significantly lowers the probability of major misconduct compared to unregulated entities. In addition, FX Broadnet has operated for over 15 years, has a physical office confirmed in Tokyo, and provides transparent contact channels. From what I see, these factors suggest an established presence and a certain degree of reliability. The trading platform is also self-developed, with versions for various devices, and their spreads—such as 0.2 sen for USD/JPY—are competitive for the Japanese market. However, I always approach anonymous feedback and isolated complaints, such as one report about withdrawal issues, with caution. While regulation increases confidence, no broker is entirely risk-free, and individual experiences can vary widely. For me, the combination of long-term operation, domestic regulation, and diverse trading tools makes FX Broadnet appear legitimate, but I advise all traders to perform their own due diligence and start with smaller amounts if testing any new service.

Having traded independently for years and evaluated numerous brokers, I find FX Broadnet’s fee structure noteworthy for its transparency, especially concerning spreads. For me, understanding costs is essential for both strategy and risk management. FX Broadnet advertises a dollar-yen spread as low as 0.2 sen, which is indeed competitive in the Japanese retail FX market. In my experience, such low spreads can lead to more efficient execution and reduce the friction cost of entering and exiting trades, but it’s always prudent to remember that spreads are variable, often widening under volatile market conditions. As for commissions, from all the available data, FX Broadnet seems to focus mainly on its tight spreads and does not openly list separate commission charges for standard over-the-counter FX trading via its online platform. This could indicate that the broker operates with a spread-only fee model for regular forex trades, which is fairly common among Japan-regulated FX providers. For the Click 365 product, utilized by some traders for its exchange-traded structure, there may be swap-related costs and different trading conditions, so I always review these specifics on the official site before committing funds. Ultimately, from my perspective, the visible costs at FX Broadnet mostly come from the spread, with limited public evidence of added commission charges for standard retail accounts. However, as with any broker, I recommend reviewing the latest fee schedules directly and factoring in swap rates and possible administrative charges, as these can impact long-term trading performance. Comprehensive understanding of costs is a cornerstone of responsible trading.

Based on my thorough experience with brokers operating under the Japanese FSA, and the available information about FX Broadnet, I have learned to evaluate leverage policies primarily by referencing regulatory requirements and the broker’s transparency. However, the context provided does not specify exact leverage ratios for FX Broadnet’s major currency pairs or for other asset classes. For me, this lack of published leverage figures is not uncommon among Japan-based brokers, since the Financial Services Agency (FSA) maintains strict oversight and typically caps retail forex leverage at 25:1. In my own trading, I take such regulatory standards seriously, as they reflect a broader goal of client protection and risk management. Although some international brokers advertise higher leverage, my approach has always been one of caution—especially given Japan’s strong regulatory environment. It’s reasonable to infer that FX Broadnet adheres to FSA limits, and, historically, leverage on more exotic or riskier products is often set even lower by Japanese brokers. However, without specific figures, I would not assume or rely on higher leverage, and would recommend prospective clients confirm directly with FX Broadnet regarding detailed leverage for each trading instrument before opening or funding an account. For me, fully understanding these parameters is vital for managing risk responsibly in any trading strategy.

Based on my own thorough review of FX Broadnet’s available services and tools, I did not find clear evidence supporting the ability to trade popular commodities like Gold (XAU/USD) or Crude Oil on this platform. My evaluation focused on what is formally disclosed: FX Broadnet primarily emphasizes over-the-counter forex trading and "Click 365," both centered around currency pairs and the Japanese foreign exchange market. While the broker is well-established in Japan and holds proper regulation from the Financial Services Agency (FSA), all indications point towards a strong focus on forex rather than a broader range of asset classes. For me, the lack of any explicit mention of commodities such as gold or oil in their platform features or trading instrument lists is telling. In my experience, trustworthy brokers are usually transparent about what asset classes are available, and the absence of commodity references gives me pause. Additionally, the trading tools and mobile apps promoted appear tailored specifically for forex trading, not for multi-asset access. Anyone considering trading other asset classes like gold or crude oil should exercise caution and confirm directly with FX Broadnet’s support team. I always advise verifying with the broker before funding an account when the range of available instruments isn’t crystal clear, especially with assets involving higher risk and volatility.

Veuillez saisir...

TOP

TOP

Chrome

Extension chromée

Enquête réglementaire sur les courtiers Forex du monde entier

Parcourez les sites Web des courtiers forex et identifiez avec précision les courtiers légitimes et frauduleux

Installer immédiatement