公司簡介

| FX Broadnet 評論摘要 | |

| 成立年份 | 1993 |

| 註冊國家/地區 | 日本 |

| 監管 | 未受監管 |

| 服務 | 場外外匯/Click 365/交易工具 |

| 模擬帳戶 | ✅ |

| 點差 | 0.2銭(美元/日元點差) |

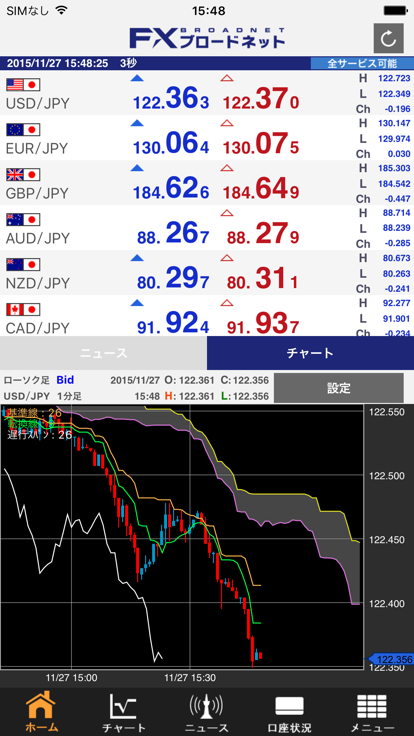

| 交易工具 | FX BroadNe(瀏覽器/Android/iPhone/平板電腦/手機) |

| 客戶支援 | 熱線電話:0120-997-867 |

| 電子郵件:support@fxbroadnet.com | |

| 社交媒體:Facebook、Twitter | |

FX Broadnet 資訊

FX Broadnet 成立於1993年,是一家提供與外匯市場相關服務的信息公司,已有二十多年的經驗。該公司提供基於尖端IT技術的場外外匯保證金(FX)交易的低點差交易的網上服務“FX Broadnet”,並處理東京金融交易所上的交易所外匯保證金交易服務“Click 365”。在YouTube上通過簡單易懂的視頻進行解釋:https://www.youtube.com/watch?reload=9&v=vYHJCADGt5k

https://www.youtube.com/watch?v=2P1tX5SCdkg

https://www.youtube.com/watch?v=2P1tX5SCdkg

https://www.youtube.com/watch?v=2P1tX5SCdkg

FX Broadnet 是否合法?

FX Broadnet 獲得金融服務廳(FSA)的授權和監管。許可證號碼為関東財務局長(金商)第244号,使其比受監管的經紀商更安全。

FX Broadnet 提供哪些服務?

FX Broadnet 在三個主要方面提供服務:場外外匯、Click 365和交易工具。

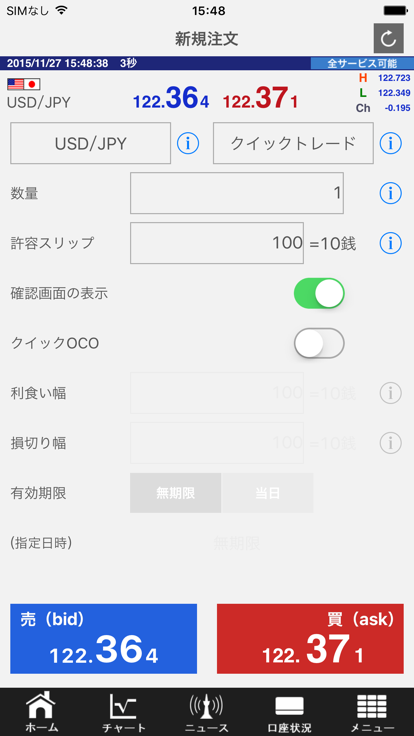

場外外匯提供低點差交易。從電腦到智能手機的外匯專用交易工具,跟踪交易,交易從4,000日元起,允許交易10,000種,因此適合初學者和希望降低風險的人。

“CLICK 365”是日本首個通過市場業務方法機制為客戶提供優惠價格的外匯存款交易(FX)。

帳戶類型

除了場外外匯交易的實盤帳戶外,FX Broadnet 還提供模擬帳戶,以熟悉平台和相關學習內容。

FX Broadnet 費用

FX Broadnet 的點差優勢在於美元/日元點差為0.2銭。點差越低,流動性越快。Click 365 LARGE使用100,000貨幣單位,買入掉期下降0.08。詳情請參閱https://www.fxbroadNet.com/click/composition/swap/。

交易工具

用戶可以下載FX BroadNet的多個版本,包括瀏覽器、Android/iPhone、平板電腦和手機。

| 平台 | 支援 | 可用設備 |

| FX BroadNe | ✔ | 瀏覽器/Android/iPhone/平板電腦/手機 |

客戶支援選項

交易者可以在Facebook、Twitter等社交媒體平台上關注該平台,並通過電話和電子郵件與其聯繫。工作時間為週一至週五上午9:00至下午5:00(不包括銀行間市場假期)。

| 聯繫選項 | 詳細信息 |

| 熱線電話 | 0120-997-867 |

| 電子郵件 | support@fxbroadnet.com |

| 社交媒體 | Facebook、Twitter |

| 支援語言 | 日本語 |

| 網站語言 | 日本語 |

| 實體地址 | 〒100-6217 東京都千代田区丸の内1-11-1 |