Company Summary

| FX Broadnet Review Summary | |

| Founded | 1993 |

| Registered Country/Region | Japan |

| Regulation | Unregulated |

| Services | Over-the-Counter FX/Click 365/Trading Tools |

| Demo Account | ✅ |

| Spread | At 0.2 sen(dollar-yen spread) |

| Trading Tools | FX BroadNe(Browser/Android/iPhone/Tablet/Mobile) |

| Customer Support | Hotline: 0120-997-867 |

| Email: support@fxbroadnet.com | |

| Social Media: Facebook, Twitter | |

FX Broadnet Information

FX Broadnet was founded in 1993 as an information company that has been providing services related to the foreign exchange market for over twenty years. The company offers “FX Broadnet,” an online service with low spread trading for over-the-counter foreign exchange margin (FX) trading based on cutting-edge IT technology, and handles “Click 365,” an exchange-traded foreign exchange margin trading service on the Tokyo Financial Exchange. Explain it with videos simple and easy to understand on YouTube: https://www.youtube.com/watch?reload=9&v=vYHJCADGt5k

https://www.youtube.com/watch?v=2P1tX5SCdkg

https://www.youtube.com/watch?v=2P1tX5SCdkg

https://www.youtube.com/watch?v=2P1tX5SCdkg

Is FX Broadnet Legit?

FX Broadnet is authorized and regulated by the Financial Services Agency(FSA). The license No. is 関東財務局長(金商)第244号, which makes it safer than regulated brokers.

What services does FX Broadnet offer?

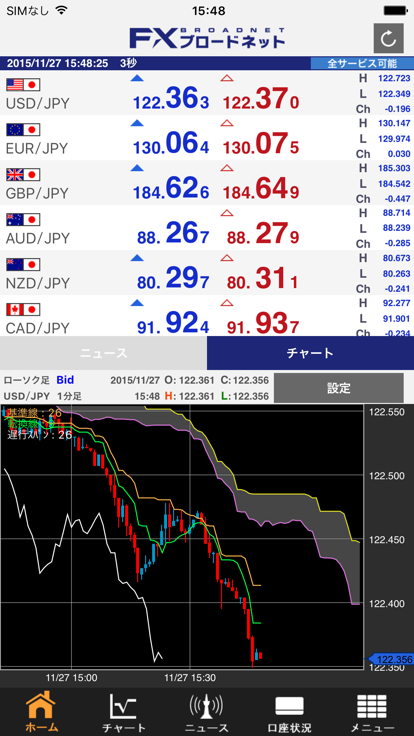

FX Broadnet provides services in three major aspects: Over-the-Counter FX, Click 365, and Trading Tools.

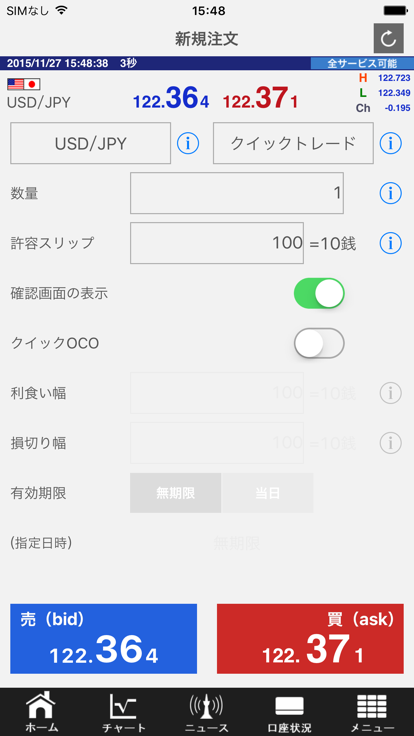

Over-The-Counter FX provides low-point difference transactions. Computers to foreign exchange dedicated trading tools from computers to smartphones, tracking transactions, transactions from 4,000 yen, allowing transactions to 10,000 kinds Therefore, beginners and people who want to reduce risks.

“CLICK 365” is Japan's first foreign exchange deposit trading (FX) to provide customers with preferential prices through the mechanism of market business methods.

Account Type

Apart from the live account for over-the-counterFX trading. FX Broadnet also provides demo accounts to be familiar with platforms and learning-related content.

FX Broadnet Fees

The strength of FX Broadnet spreads is the dollar-yen spread is at 0.2 sen. While the lower the spread, the faster the liquidity. Click 365 LARGE uses 100,000 currency units, and the Buy Swap drops 0.08. For details, please refer to https://www.fxbroadNet.com/click/composition/swap/.

Trading Tools

Users can download FX BroadNet's multiple versions including Browser, Android/iPhone, Tablet, and Mobile.

| Platform | Supported | Available Devices |

| FX BroadNe | ✔ | Browser/Android/iPhone/Tablet/Mobile |

Customer Support Options

Traders can follow the platform on Facebook, Twitter, and more and contact it via phone and email. Working hours are 9:00 am-5:00 pm (Excluding Interbankmarket Holidays) from Monday to Friday.

| Contact Options | Details |

| Hotline | 0120-997-867 |

| support@fxbroadnet.com | |

| Social Media | Facebook, Twitter |

| Supported Language | Japan |

| Website Language | Japan |

| Physical Address | 〒100-6217 東京都千代田区丸の内1-11-1 |