Company Summary

| Trading212 Review Summary | |

| Founded | 2006 |

| Registered Region | United Kingdom |

| Regulation | ASIC, FCA, CySEC, VFSC (Revoked), FSC (Exceeded) |

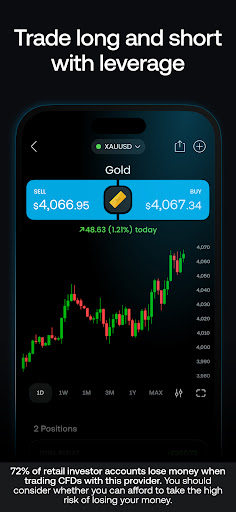

| Market Instruments | CFDs on stocks, indices, commodities, and forex |

| Demo Account | / |

| Trading Platform | Trading 212 App, Trading 212 Web Platform |

| Minimum Deposit | £/€/$1 |

| Customer Support | Email: info@trading212.com |

| Address: Aldermary House, 10-15 Queen Street, London, EC4N 1TX | |

Trading212 Information

Trading 212, a UK-based fintech business launched in 2006, is licensed by both the FCA and CySEC. You can trade CFDs on a lot of different markets, such as equities, indices, commodities, and more than 180 FX pairs. It works with both web and mobile platforms and has a clear, low-cost fee structure.

Pros and Cons

| Pros | Cons |

| Regulated by FCA and CySEC | No support for MetaTrader (MT4/MT5) platforms |

| Commission-free trading on stocks & ETFs | Card deposits over £2,000 incur a 0.7% fee |

| User-friendly mobile and web apps | |

| Low minimum deposit requirement |

Is Trading212 Legit?

Yes, Trading 212 is a legitimate and regulated financial services provider.

| Regulatory Authority | License Type | License Number | Licensed Entity | Current Status |

| Australia Securities & Investment Commission (ASIC) | Market Maker (MM) | 000541122 | Trading 212 AU PTY LTD | ✅ Regulated |

| UK Financial Conduct Authority (FCA) | Market Maker (MM) | 609146 | Trading 212 UK Limited | ✅ Regulated |

| Cyprus Securities and Exchange Commission (CySEC) | Market Maker (MM) | 398/21 | Trading 212 Markets Ltd | ✅ Regulated |

| Vanuatu Financial Services Commission (VFSC) | Retail Forex License | 40517 | Trading 212 Global Ltd | ❌ Revoked |

| Financial Supervision Commission (FSC) | Common Financial Service License | RG-03-0237 | TRADING 212 EOOD | ❌ Exceeded |

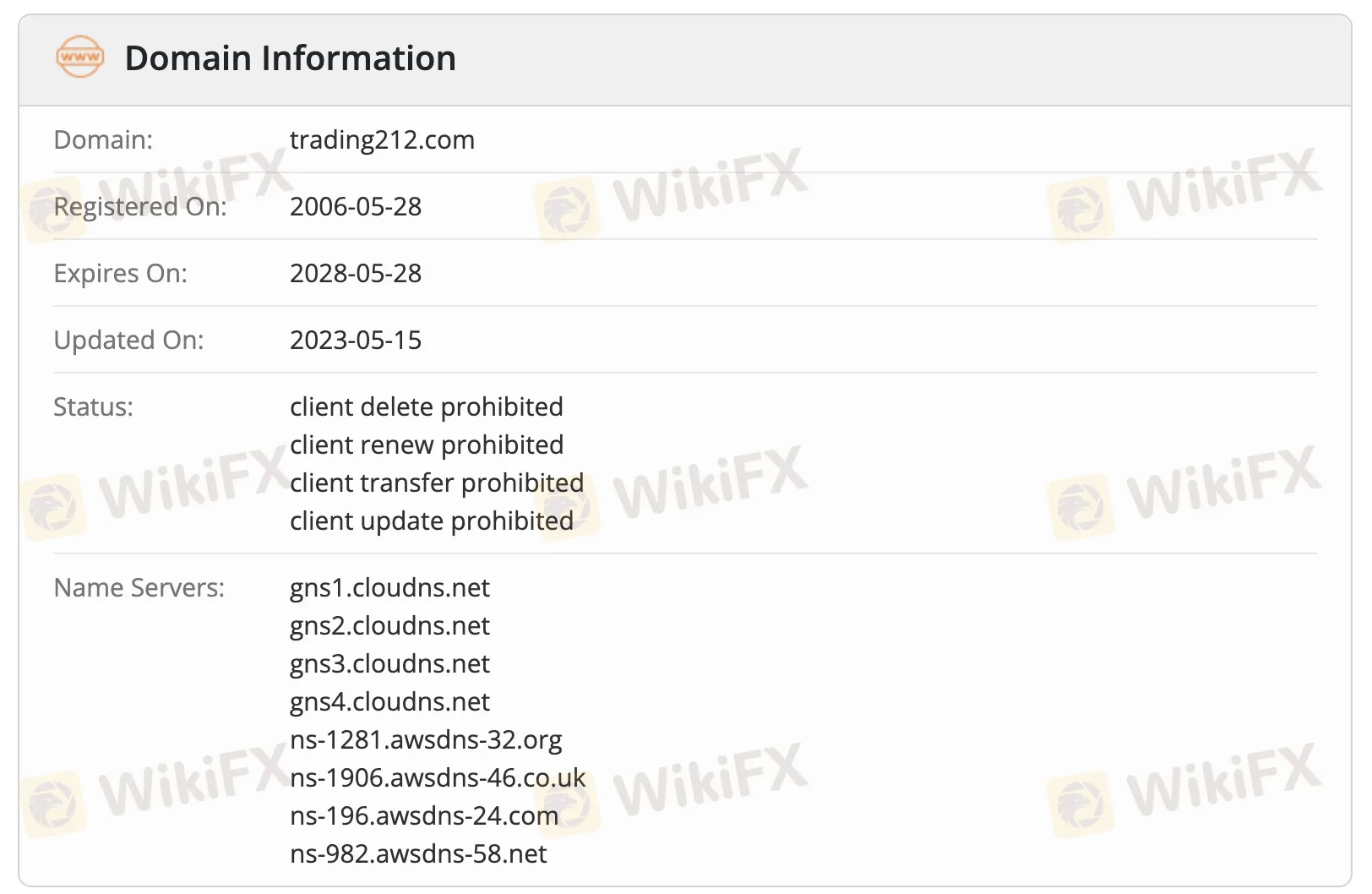

The WHOIS database says that the domain trading212.com was registered on May 28, 2006, and that it was last updated on May 15, 2023. It will end on May 28, 2028.

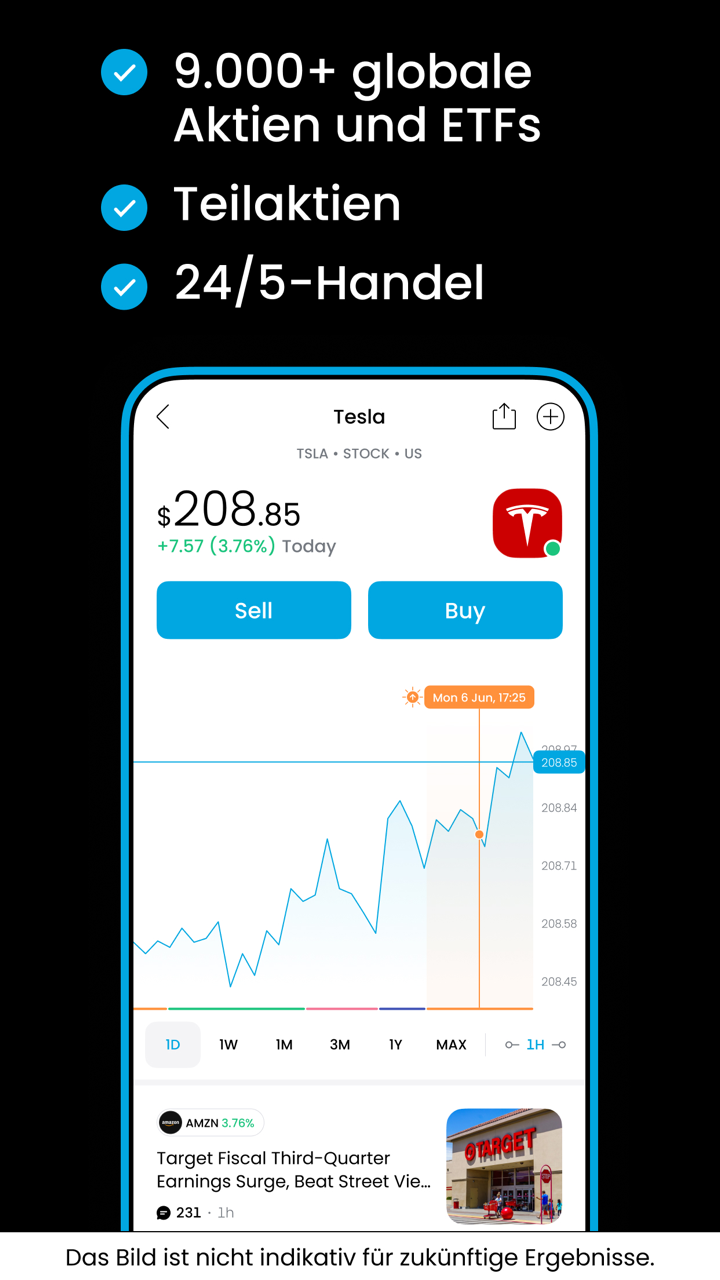

What Can I Trade on Trading 212?

Trading 212 lets you trade CFDs on a lot of different global markets. Investors can trade CFDs on stocks, indices, commodities, and more than 180 FX pairs.

| Trading Instruments | Supported |

| CFDs | ✔ |

| Stocks | ✔ |

| Indices | ✔ |

| Commodities | ✔ |

| Forex | ✔ |

| Cryptos | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

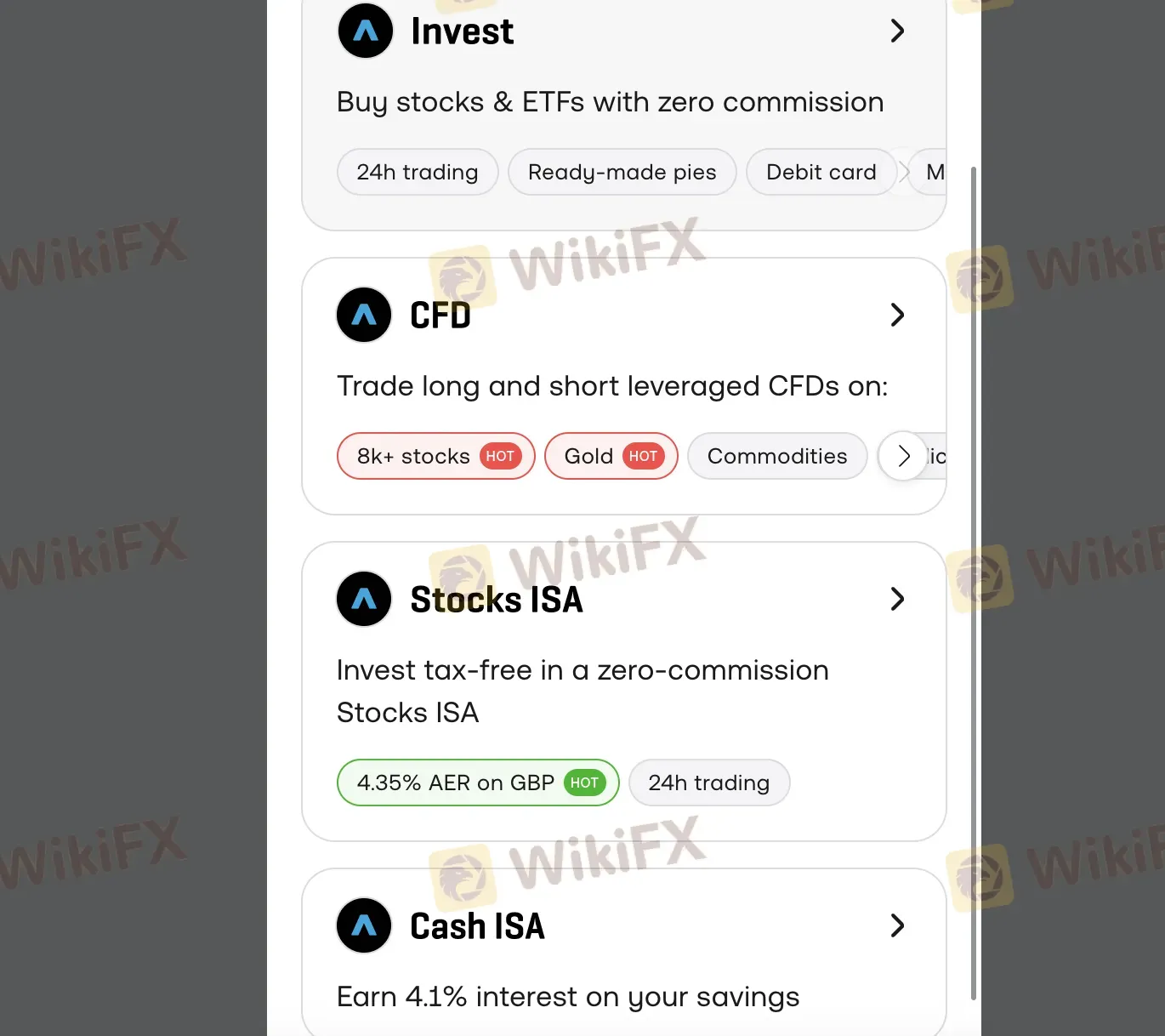

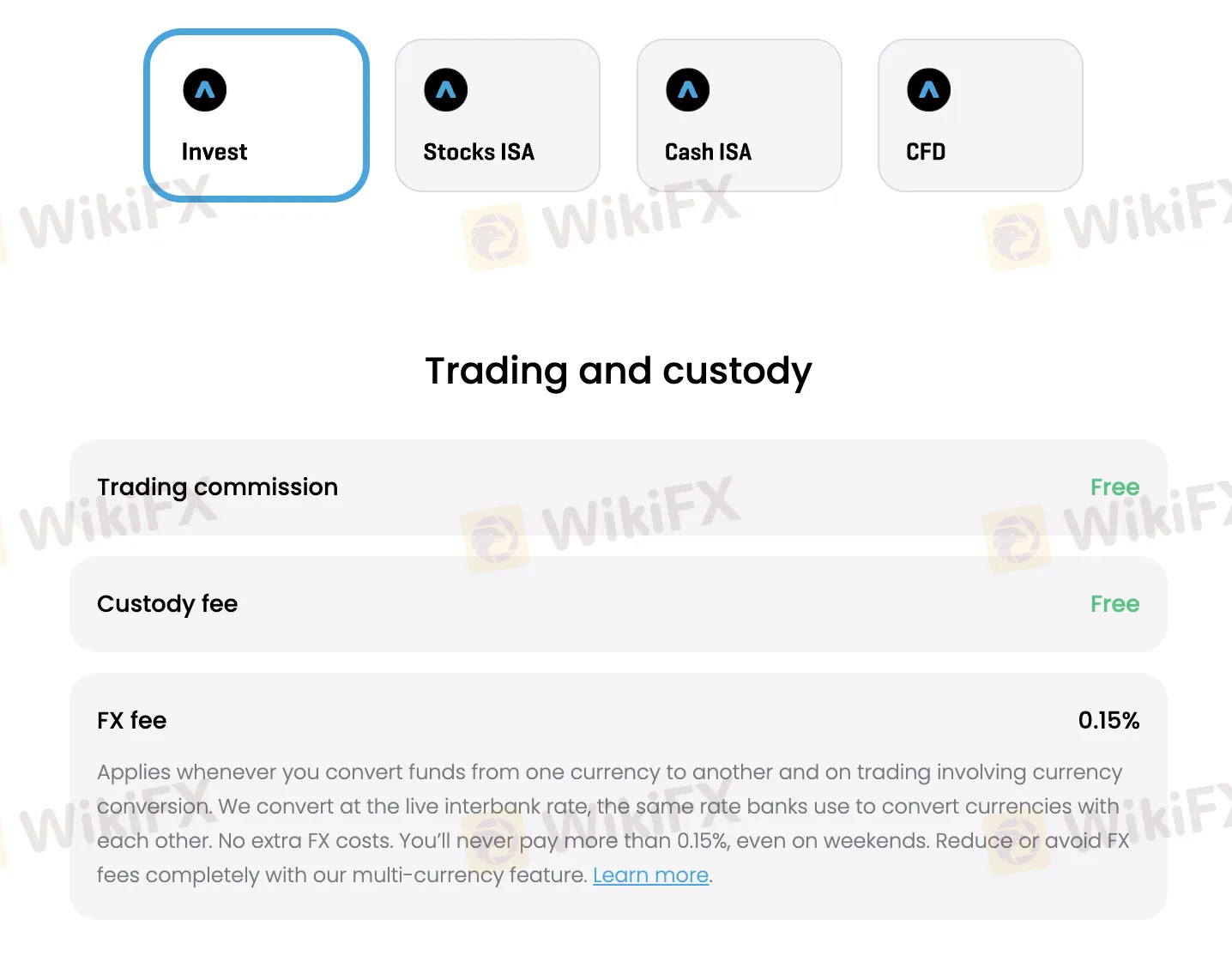

Account Type

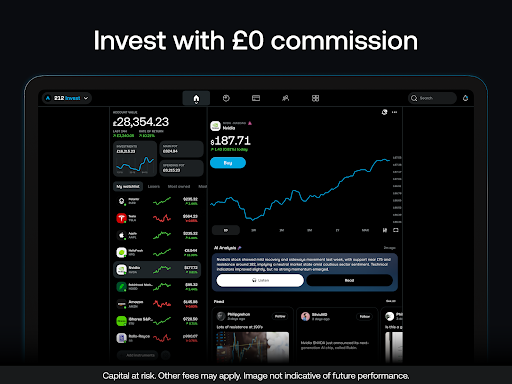

Trading 212 offers four live account types: Invest, CFD, Stocks ISA, and Cash ISA — each suited for different investor needs. No Demo or Islamic account is mentioned.

| Account Type | Feature | Suitable for |

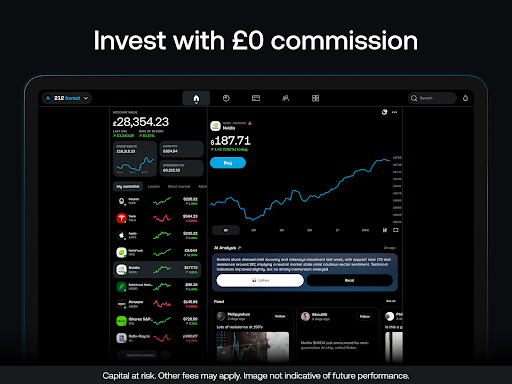

| Invest | Buy stocks & ETFs commission-free | Long-term investors & beginners |

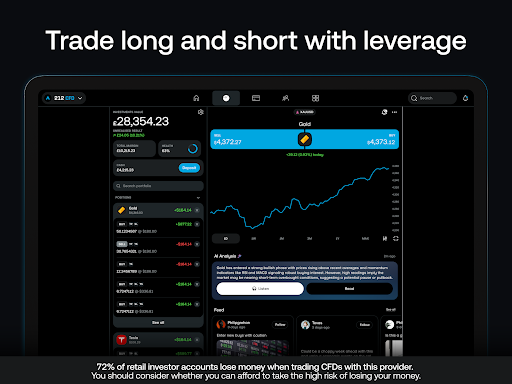

| CFD | Trade CFDs with leverage on multiple asset classes | Active traders & speculators |

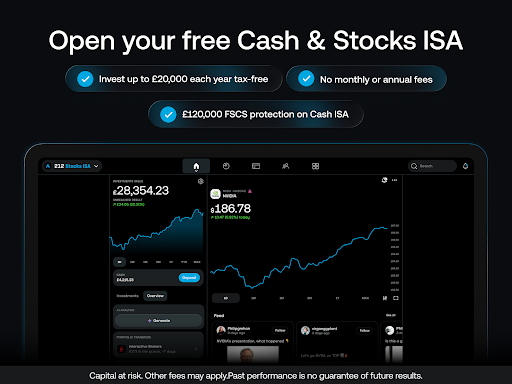

| Stocks ISA | Tax-free stock & ETF investments (UK only) | UK investors seeking tax advantages |

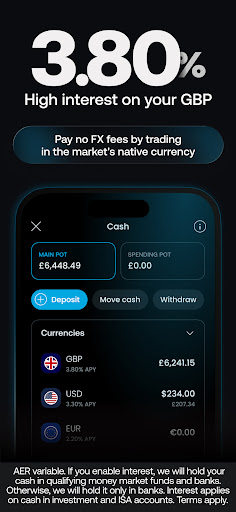

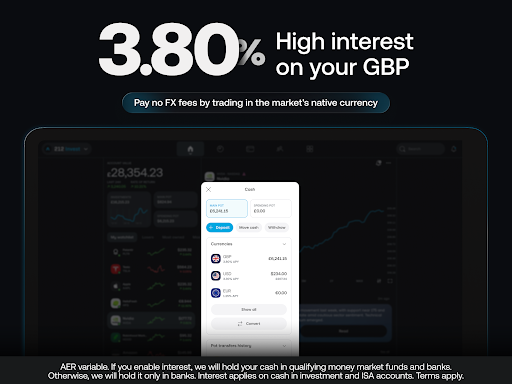

| Cash ISA | Earn interest on uninvested cash (GBP only) | UK residents looking for safe returns |

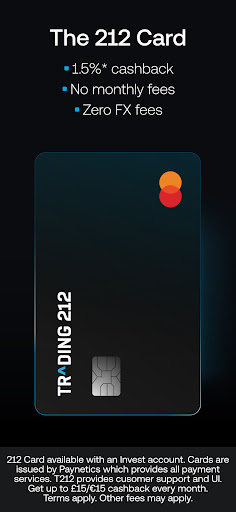

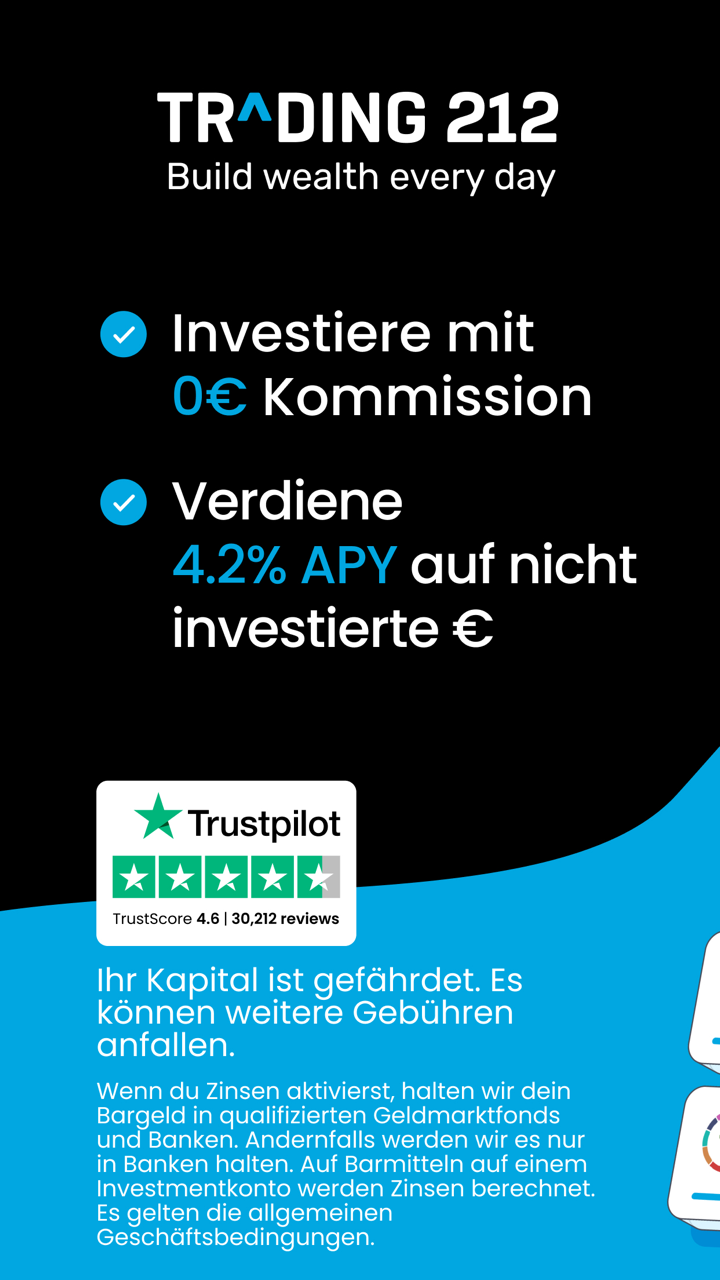

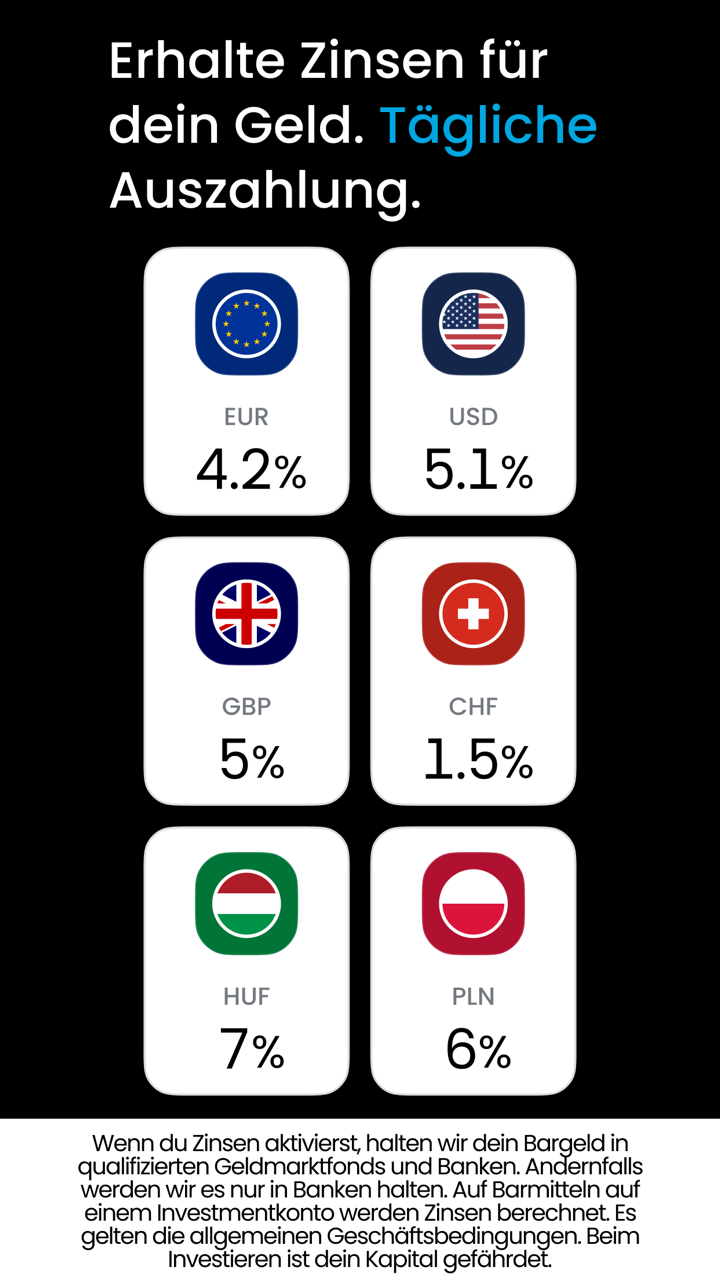

Trading212 Fees

Trading 212 has an extremely affordable and clear pricing structure. Most trades don't have any commissions, and there are no fees for deposits or withdrawals. The prices for converting currencies are also inexpensive. Its fees are usually lower than normal for the industry, especially for retail investors.

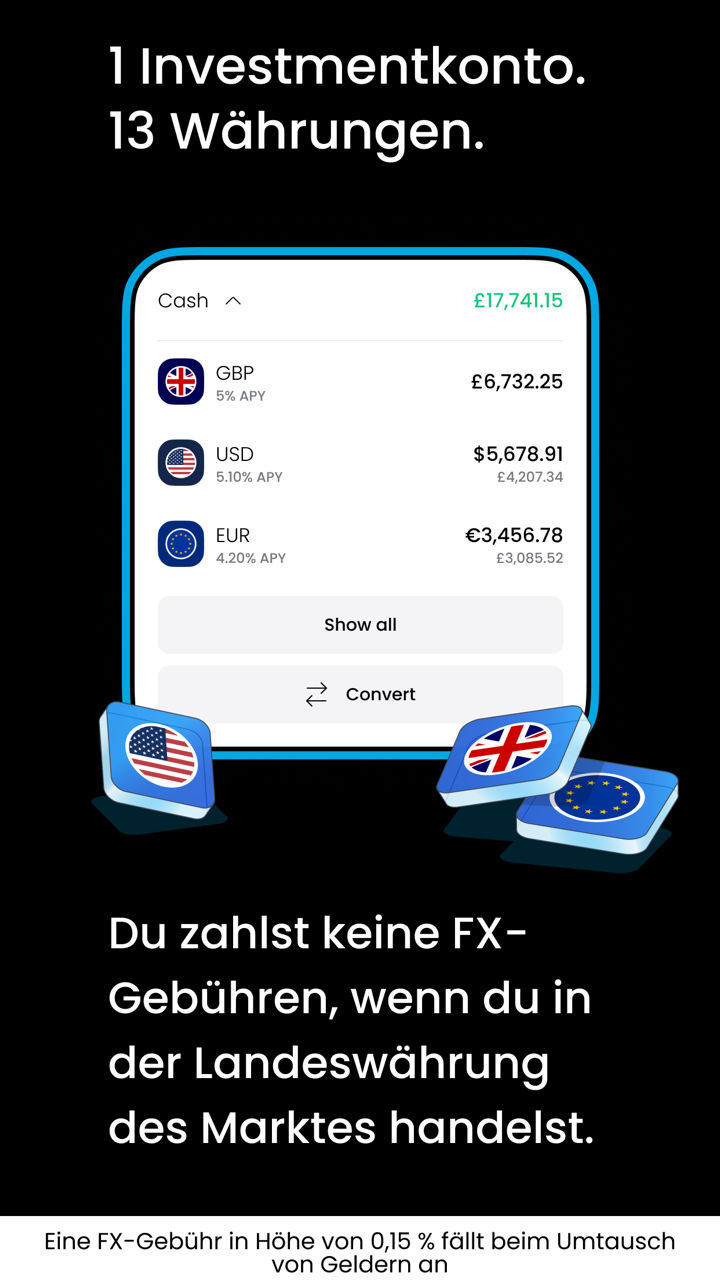

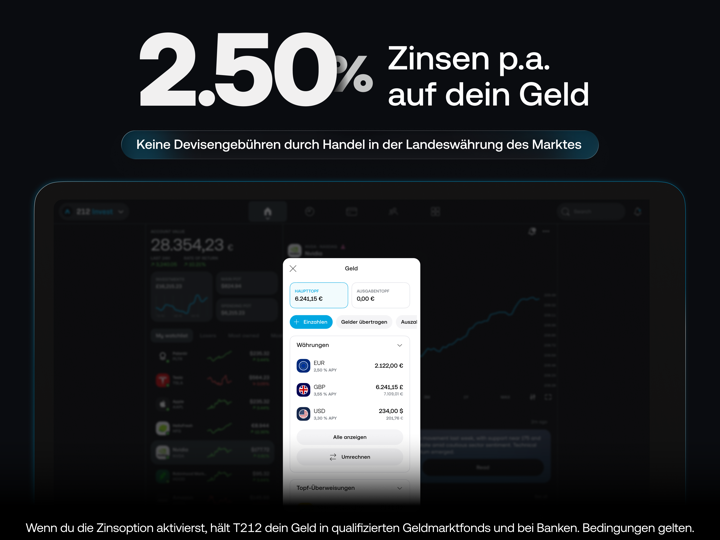

| Commission | FX Fee | Custody Fee | Overnight Fees | Spread | |

| Invest Account | 0 | 0.15% | 0 | 0 | Dynamic (instrument dependent) |

| CFD Account | 0 | 0.5% (on result) | 0 | Yes (varies by instrument, ± interest) | Dynamic (market conditions) |

| Stocks ISA | 0 | 0.15% | 0 | 0 | / |

| Cash ISA | / | / | 0 | / | / |

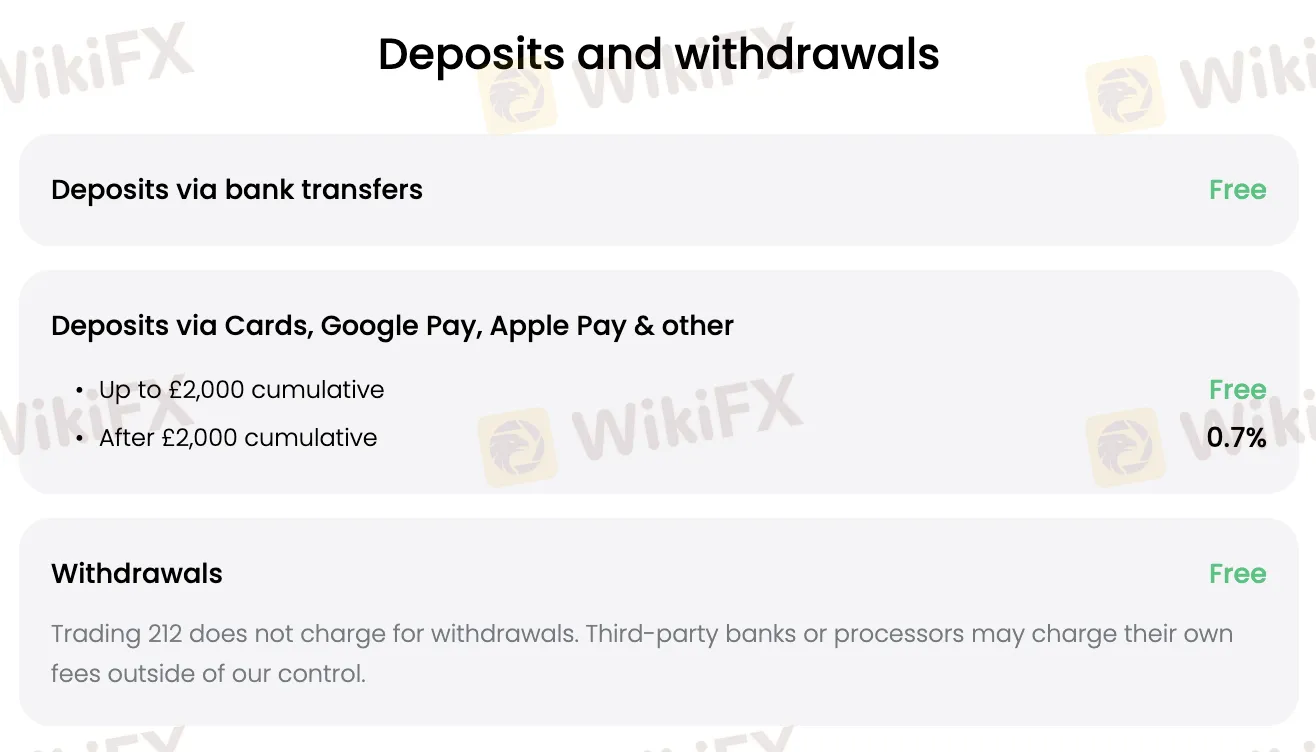

Non-Trading Fees

| Non-Trading Fee | Fee |

| Deposit Fee (bank transfer) | 0 |

| Deposit Fee (card, Apple/Google Pay) | Free up to £2,000, then 0.7% |

| Withdrawal Fee | Free (3rd party bank fees may apply) |

| Inactivity Fee | 0 |

| Account Closure | 0 |

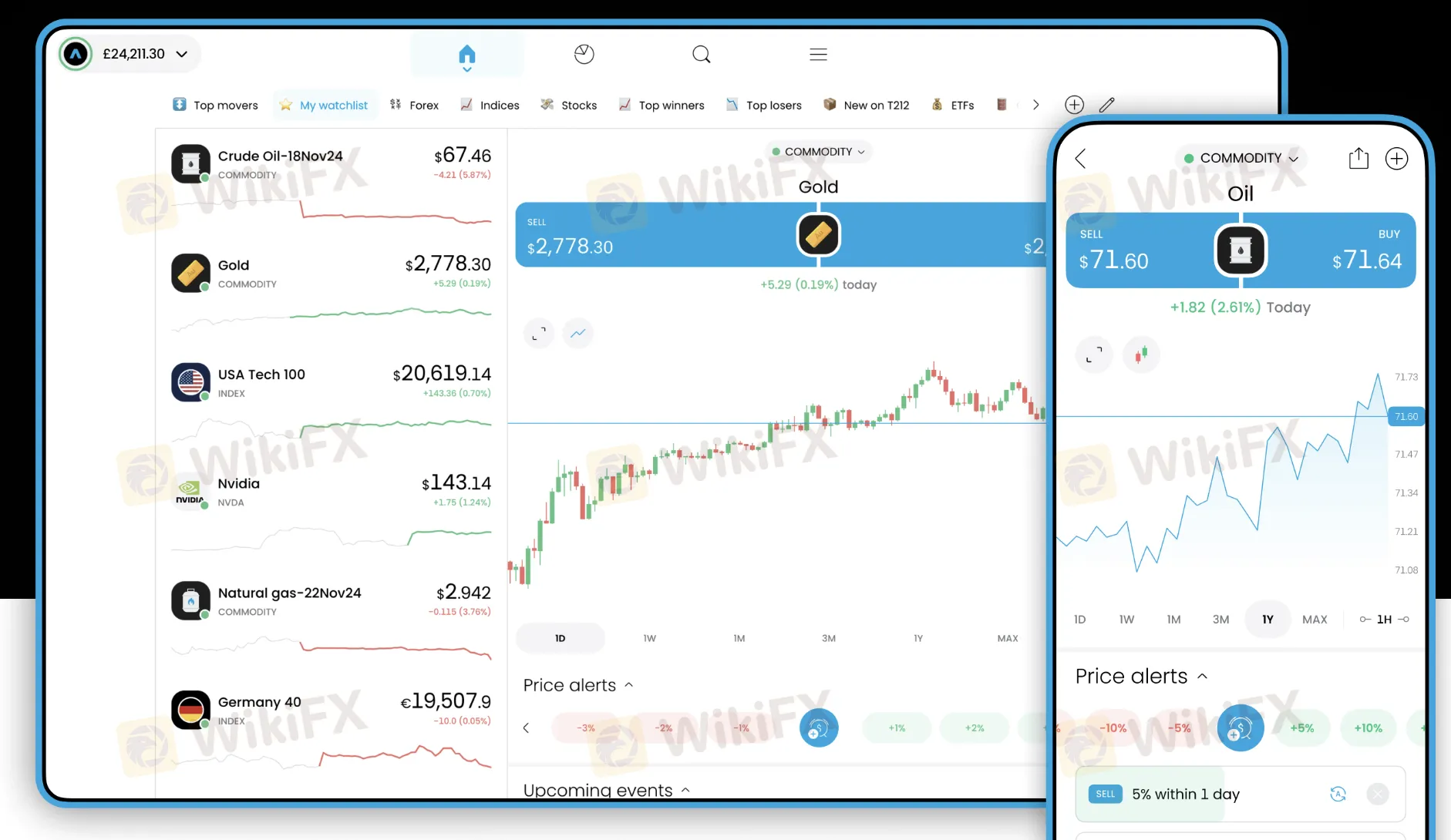

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| Trading 212 App | ✔ | iOS, Android | / |

| Trading 212 Web Platform | ✔ | Web browsers (Windows, macOS) | / |

| MetaTrader 4 (MT4) | ❌ | – | Beginners |

| MetaTrader 5 (MT5) | ❌ | – | Experienced traders |

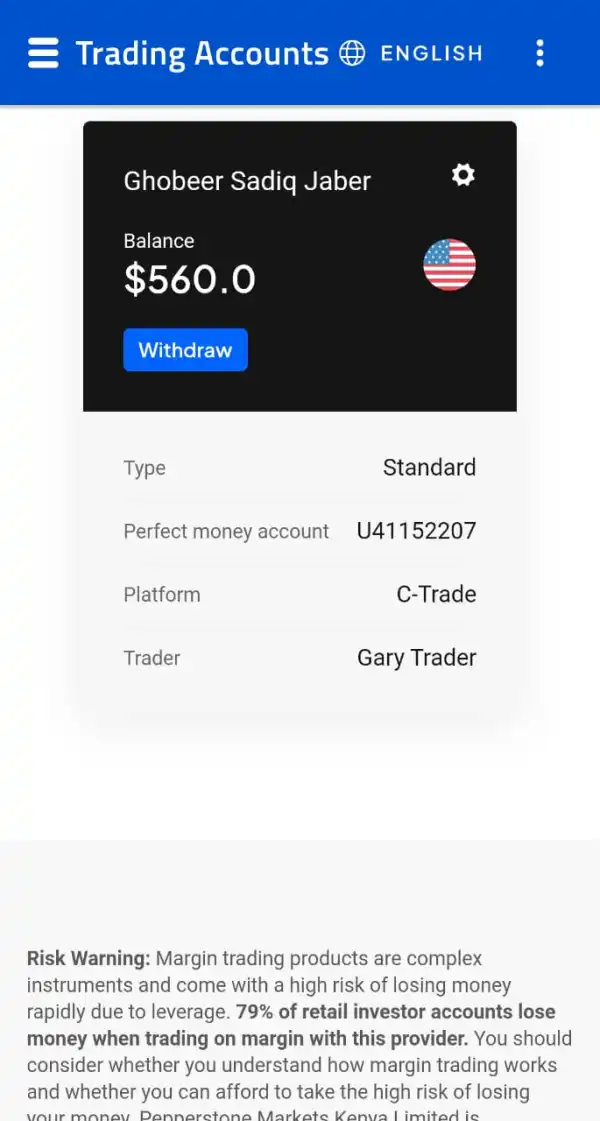

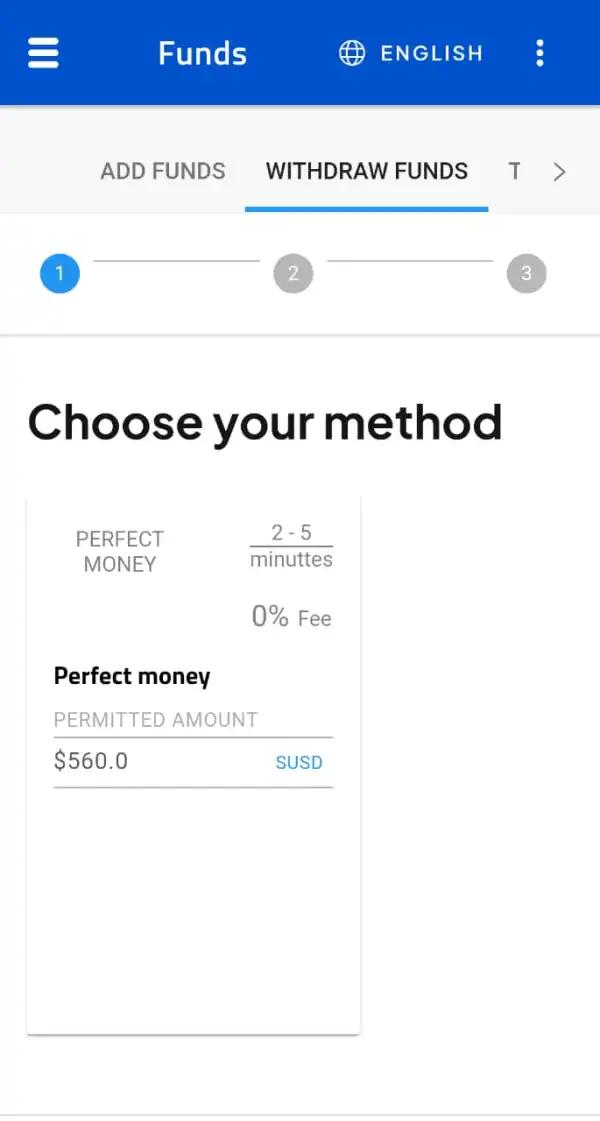

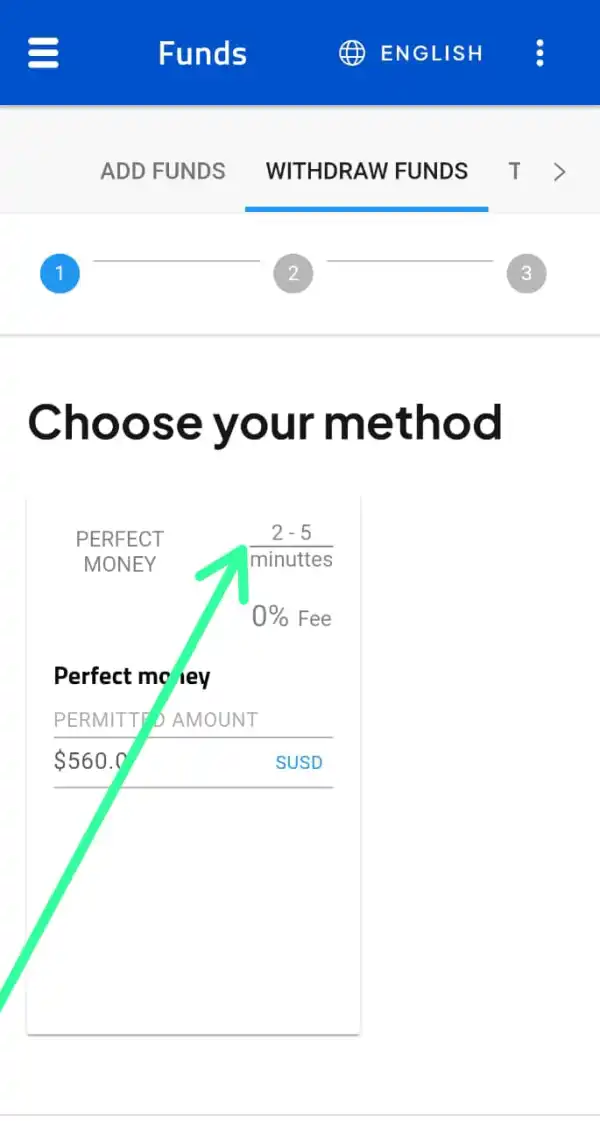

Deposit and Withdrawal

Most of the time, Trading212 doesn't impose fees for deposits or withdrawals. Card payments, like Apple Pay and Google Pay, are free up to a total of £2,000. After that, a 0.7% cost applies. Bank transfers are still free. You can also withdraw money for free, although third-party banks or payment processors may charge you fees. The minimum deposit and withdrawal amount is £/€/$1.

| Payment Method | Minimum Deposit | Minimum Withdrawal | Fees | Processing Time |

| Visa / Visa Electron | £/€/$1 | Free up to £2,000, 0.7% afterward | Instant | |

| Mastercard | ||||

| Maestro | ||||

| Apple Pay | ||||

| Google Pay | ||||

| Bank Wire | 0 | 0–2 business days | ||

FX1698946984

United Kingdom

Trading 212 UK LTD claim to be “UK FCA Regulated” in fact they ARE a SCAM and DONT trade from the UK. Previously traded in UK from an offshore company under the name Gobaba FXLTD (previously AVUS CAPITAL- now Trading 212 UK) CySEC license REVOKED in 2018 & UK FCA license cancelled NOT to Trade in the UK! Not surprisingly it didn’t stop their scam.Registering Trading 212 UK using UK London address for their “offices”(Address not occupied just empty warehouse) They continue to scam! STAY AWAY !

Exposure

FX1698946984

United Kingdom

Do yourself a favour and do not deal with scam company.They are not based in the UK despite their claims. They are a Scam company that traded from Cyprus and had their licensees Revoked in Cyprus (where they traded from) & also by the UK FCA.They set up another company claiming to operate from the UK which is a forwarding Address & not offices!No proof of ID or Tax details were request which is mandatory by Law in the UK prior to opening a trading account or allowing deposits.£45.000 was scammed

Exposure

刘辉9345

Hong Kong

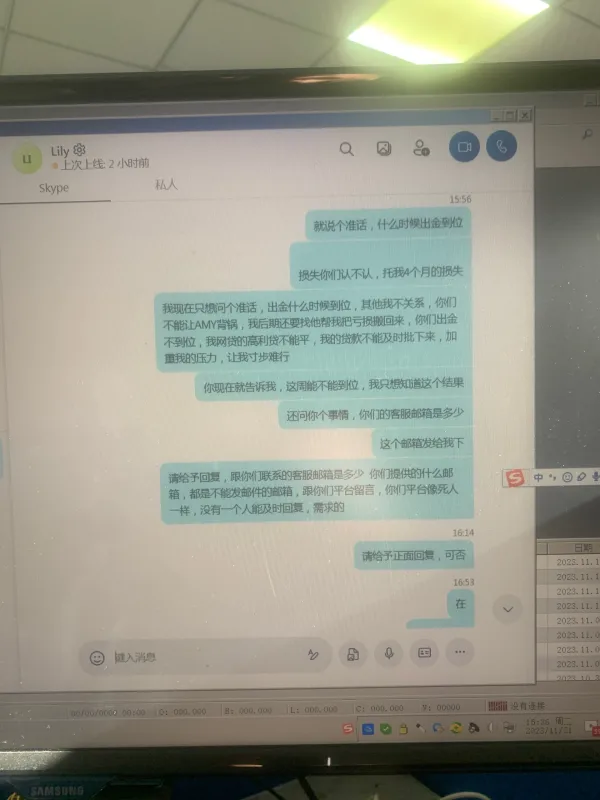

I started applying for withdrawal on August 17th, but it took 4 months. I asked the platform customer service. The platform customer service was like a robot, saying please wait.

Exposure

FX1348692970

Yemen

Unable to withdraw. Scammer. I was scammed by the broker.

Exposure

Mick890

Czech Republic

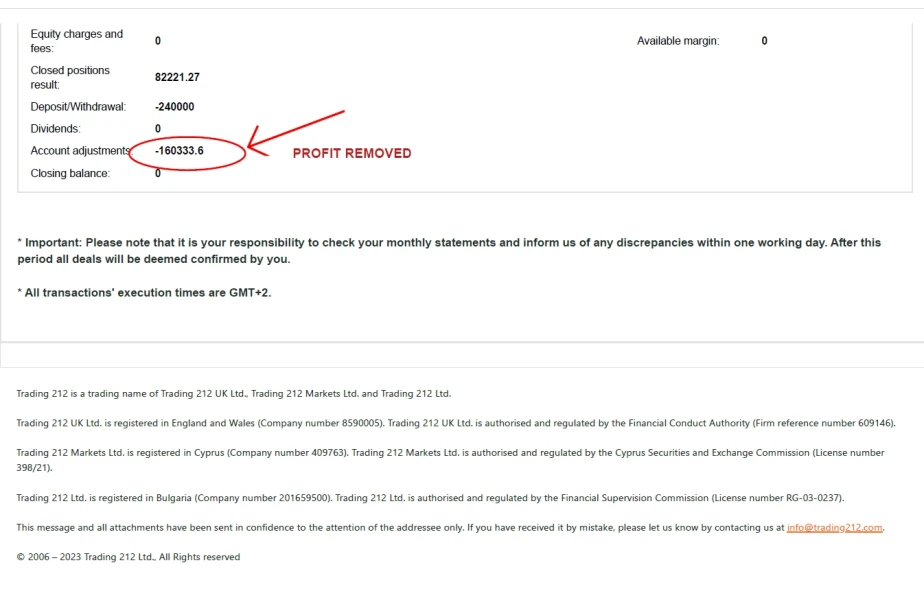

As a retail client, I opened a live account with broker Trading212 on August 4th, 2023.Trading 212 UK Ltd. is registered in England and Wales (Company number 8590005). Trading 212 UK Ltd. is authorised and regulated by the Financial Conduct Authority (Firm reference number 609146). Registered address: 107 Cheapside, London, EC2V 6DN, United Kingdom.After 4 months of live trading, on 27th November 2023, without any previous notice, I was informed by the broker that I "breached" their T&C with "a high volume of transactions that are opened and closed within an unusually short period of time as compared to the ‘average’ client, with a disproportionate number placed advantageously between the price of trade and the price of the underlying market instead of the 'random distribution' that would be expected when the Trading Platform is used "fairly"...And for this "reason", they unilaterally decided to close my live account. All 17 trades I made in 4 months were voided and all the profit I made (approx. 5000 GBP) was canceled.I feel I wasn't treated fairly by Trading212. 1. It's obvious and very easy to prove, that (according to my trading history) I didn't use any short, tick-scalping strategies. Almost all my trades lasted more than 3+ minutes and some trades even 20+ minutes, which can hardly be seen as something "unusual" and also can not be defined as a few seconds scalping...2. They accused me of "high volume of transactions"... checking my trading history, it's obvious I made only 17 trades in 4 months and I always traded max. 1 open position/trade at the time. 3. They accused me of "latency" or "price" manipulation. My trading is based purely on price action (and volatility) following major fundamental news or events, which is generally seen as a standard trading strategy. I don't know a single EU/UK broker that wouldn't allow this kind of trading. I trade exactly the same way with many other FCA/CySec/ASIC regulated and reputable brokers without any issues. Trading212 is the first broker having a "problem" with my trading style. As for "platform misuse", I can only work/trade with price quotes provided via broker's trading platform. I see unfair that the same broker accused me of "misusing" his own platform and price quotes. I, as a retail client, have no chance to "manipulate" what price quotes I receive on the broker's platform - nor I can be responsible for any discrepancy between prices Trading212 should've been providing, and the ones that were in fact being streamed. Providing accurate quotes is the broker's risk, not clients' risk and the client should not be penalized for broker's mispricing errors if they occur. If the broker isn't able to provide accurate and stable pricing of market instruments, they shouldn't offer them at all.Still, it's worth noting here that if we compare prices (my trades were executed at) with 3rd party quotes, we will see these prices were absolutely realistic and similar to my other brokers at the time of trades.4. I double-checked Trading212 T&C and I haven't found any information about specific trading strategies that would be prohibited. Also, I haven't found any specific information to comply with, e.g. minimum trading holding time, max orders open, max volume, etc. If this is so important for them and can lead to closing clients' accounts (or even voiding ALL the profits), why didn't they specify these parameters in T&C clearly? so I or anyone else could comply with them? In their T&C, I found only uncertain and vague clauses that leave the decision entirely up to broker's discretion.5. Finally, I wish to emphasize, that my trading history with Trading212 started in August 2023 and lasted more than 4 months, with no issues. Since August, there has been zero notice from broker's side that there is anything wrong with my trades or that they have problems with my orders. Then suddenly, after 4 months of trading, they unilaterally closed my account without any previous warning and voided all my trades and profits.Probably not trading itself, but my constantly growing profit was a "real" problem here for Trading212. I assume if I lost money with Trading212, no account closure would ever happen.It seems that some forex brokers (even regulated ones) operate in a very questionable way. Retail clients losing money are welcomed, while profitable accounts are simply closed and profits canceled. Flawless business for them. From my point of view, this practice is unfair.If the broker doesn't want me as a client anymore, I'm fine with that. But I strongly don't agree with removing all my profits for 4 months of trading. Regulated financial institutions should not work like that. I still hope I can find a reasonable solution with Trading212.

Exposure

FX1524913740

Pakistan

I've been actively trading forex for about three years now and switched to Trading212 about 8 months ago. The difference is like day and night! Firstly, I was quite surprised by their zero commission policy - they live up to the bill. Saving on costs allowed me to invest more without having to worry about cutting a slice of my profits. Their trading platform? Snazzy, lightweight and very user-friendly. You don't have to be a statistical whizz to navigate their tools. In fact, they actually explain complex stuff like candlestick patterns and Bollinger bands in an easy-to-understand manner. I've used a couple of platforms before but their trading charts are impressively intuitive and accurate. Oh and the cherry on top? Their customer service is fantastic! There was this one time I faced an issue with my withdrawal. Raised a ticket and within 2 hours, got a response. The issue was sorted shortly. If you’ve traded forex, you know how crucial quick, efficient customer service can be!

Positive

ㅤ84614

Malaysia

Spreads here are quite competitive which, coupled with their low commission structure, promises traders a more feasible profits margin. A standout trade that I'd like to share was on the EUR/USD pair. Based on this platform's reliable trading signals, I positioned a long order which, thanks to their responsive platform, was executed just at the right moment and I made a healthy profit. When it came to withdrawing my earnings, the process was mostly smooth, although the speed of the completion could be a tad quicker compared to some industry leaders.

Positive

FX1222910301

Morocco

Excellent service provided. I recently started trading with Trading212, and I'm pleased with the service they offer. They have shown a high level of professionalism, which is more than enough for my trading ambitions.

Positive

FX1209760213

India

Hello guys, Here I want to say, Trading212 is the best broker ever. During my five years’ trading here, I never met trading issues, like withdrawal problems, unstable trading platform, slippages, etc. My account managers are always patient and professional. I just love Trading212.

Positive

Derya

Hong Kong

Easy to use and in Trading 212's app verison, you can use the tools from trading view which seems good. You can lose money easily because they use a leveraged order system...

Positive