Company Summary

| Aspect | Information |

| Company Name | Sierra Futures |

| Registered Country/Area | United States |

| Founded Year | 2018 |

| Regulation | Unregulated |

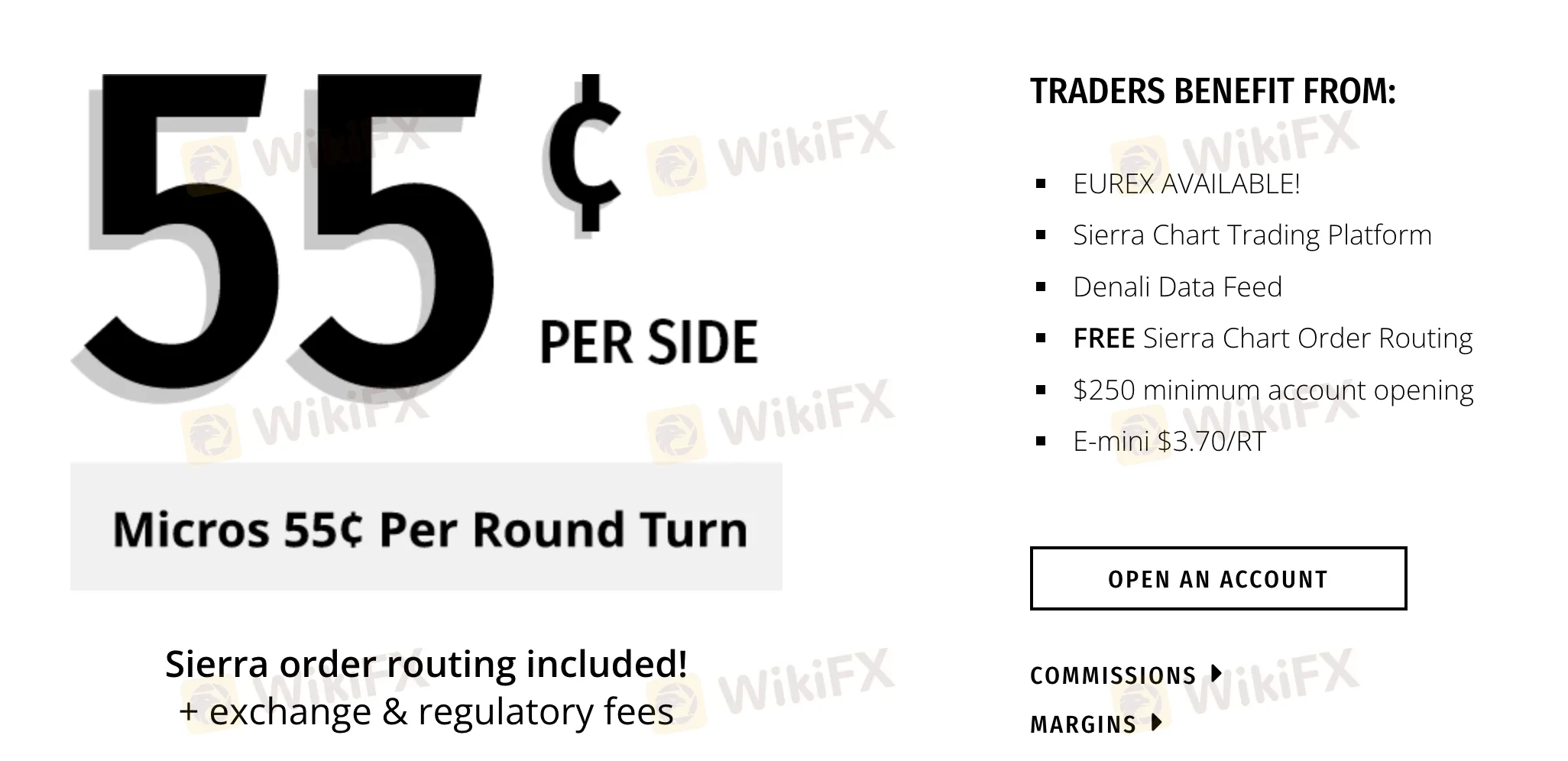

| Minimum Deposit | $250 |

| Maximum Leverage | Up to 1:20 |

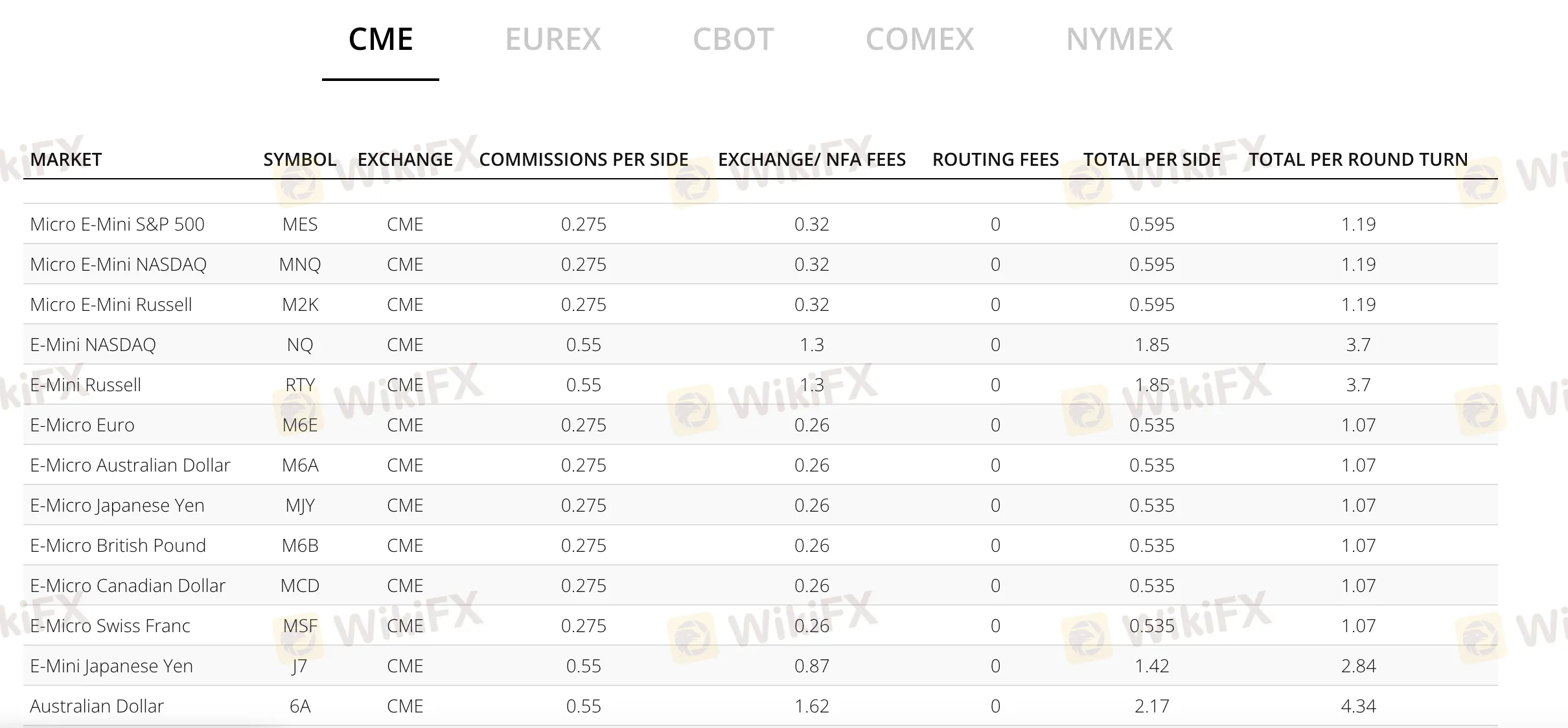

| Spreads&commissions | $0.275~$0.55 per side |

| Trading Platforms | Sierra Chart Trading Platform |

| Tradable Assets | Futures contracts such as Micro E-Mini S&P 500, E-Mini NASDAQ |

| Account Types | Single account type |

| Customer Support | Phone:(312) 896-9897 |

| Deposit & Withdrawal | Wire transfer, ACH transfer, Credit card, Debit card, PayPal |

| Educational Resources | Limited educational resources |

Overview of Sierra Futures

Sierra Futures, established in the United States in 2018, operates in the field of futures trading. However, it's important to note that Sierra Futures currently operates without regulatory oversight, which raises concerns about its compliance and monitoring. It falls under the category of a “Suspicious Clone” and holds a Common Financial Service License in the United States with license number 0444666. Sierra Futures specializes in providing a variety of futures contracts, catering to traders' needs. These contracts encompass popular instruments such as the Micro E-Mini S&P 500, E-Mini NASDAQ, E-Mini Russell, E-Micro Euro, E-Mini Japanese Yen, Australian Dollar, Euro FX, and more.

Is Sierra Futures legit or a scam?

Sierra Futures currently operates without regulation, raising concerns about its oversight and compliance. It is categorized as a “Suspicious Clone” and holds a Common Financial Service License in the United States with license number 0444666.

Traders should exercise caution when dealing with unregulated entities due to potential risks associated with their operations.

Pros and Cons

| Pros | Cons |

| Diverse Market Instruments | Lack of Regulation |

| User-friendly Trading Platform | Limited Educational Resources |

| Leverage Options | Commission Variability |

| Multiple Payment Methods |

Pros of Sierra Futures:

Diverse Market Instruments: Sierra Futures offers a variety of futures contracts, including popular options like Micro E-Mini S&P 500, E-Mini NASDAQ, and E-Micro Euro, allowing traders to diversify their portfolios.

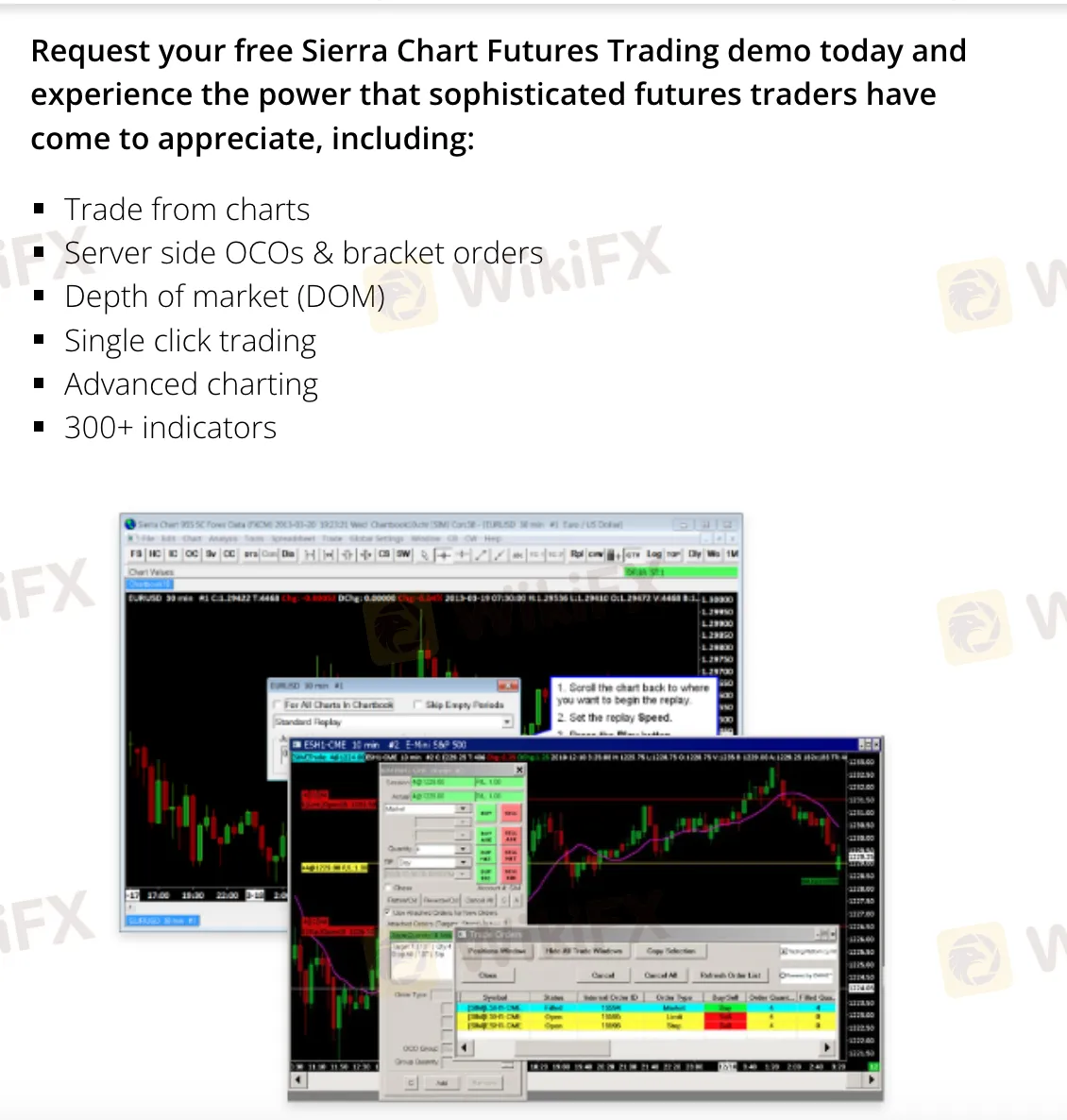

User-friendly Trading Platform: Sierra Futures provides traders with the Sierra Chart Trading Platform, which offers features like trading directly from charts, server-side OCOs, Depth of Market (DOM) data, single-click trading, and over 300 customizable indicators.

Leverage Options: Sierra Futures offers leverage of 5-15%, allowing traders to amplify their positions, although it's important to consider the associated risks.

Multiple Payment Methods: The platform supports various payment methods, including wire transfers, ACH transfers, credit and debit cards, and PayPal, providing flexibility for deposits and withdrawals.

Cons of Sierra Futures:

Lack of Regulation: Sierra Futures currently operates without regulatory oversight, which raises concerns about its compliance and monitoring. Traders should exercise caution when dealing with unregulated entities.

Limited Educational Resources: Sierra Futures lacks comprehensive educational materials and tools, which can be a limitation for traders seeking to enhance their trading knowledge and skills.

Commission Variability: Commission costs vary depending on the market and symbol being traded, potentially making it challenging for traders to predict their trading expenses accurately.

Market Instruments

Sierra Futures specializes in futures trading, offering a range of futures contracts for traders. These contracts include popular instruments such as Micro E-Mini S&P 500, E-Mini NASDAQ, E-Mini Russell, E-Micro Euro, E-Mini Japanese Yen, Australian Dollar, Euro FX, and more.

Futures trading involves speculating on the future price movements of these assets without owning them outright. Sierra Futures provides access to various futures markets, allowing traders to diversify their portfolios and engage in different sectors of the financial markets.

Account Types

Sierra Futures offers a single account type with leverage up to 1:20, providing traders with flexibility in managing their positions. The spreads vary depending on the specific market being traded. To get started, a minimum deposit of $250 is required, making it accessible to a wide range of traders. Additionally, Sierra Futures provides a demo account for those who wish to practice their trading strategies risk-free. Traders can utilize the Sierra Chart Trading Platform, known for its robust features and functionality.

| Aspect | Sierra Futures |

| Account Type | Sierra Futures |

| Leverage | Up to 1:20 |

| Spread | Varies on the market |

| Minimum Deposit | $250 |

| Demo Account | Yes |

| Trading Tool | Sierra Chart Trading Platform |

| Customer Support | 24/7 |

How to Open an Account?

To open an account with Sierra Futures, follow these six steps:

Visit the Sierra Futures Website: Start by accessing Sierra Futures' official website using a web browser. https://sierrafutures.com/

Locate the “Open an Account” Option: Once on the website's homepage, search for the “Open an Account” or a similar option. This is often prominently displayed and may be found in the top menu or on the homepage.

Select Your Account Type: Choose the type of trading account that aligns with your needs and trading style. Sierra Futures may offer a single account type or multiple options, each with distinct features.

Complete the Registration Form: Fill out the registration form with accurate and required information. This typically includes personal details such as your name, contact information, and may involve identity verification as per regulatory requirements.

Fund Your Account: After your registration is successfully completed, you'll need to deposit funds into your trading account. Sierra Futures will specify the minimum deposit amount required for your chosen account type.

Begin Trading: Once your account is funded, you can commence trading. If necessary, download the trading platform, log in with your account credentials, and you're ready to execute trades, manage your portfolio, and access trading resources.

By following these steps, you can efficiently open an account with Sierra Futures and start your trading journey.

Leverage

Sierra Futures offers margin leverage on a variety of futures contracts, including energy, financials, indices, and metals. Initial day margins are typically 5-15% of the contract value, but reduced day margins are available from 6:00 PM EST to 4:45 PM EST.

It is important to note that margin leverage can amplify both profits and losses. Traders should carefully consider their risk tolerance before trading on margin.

Spreads & Commissions

Sierra Futures' commission structure varies depending on the market and symbol being traded. Here are some examples of commission costs per side for selected contracts:

Micro E-Mini S&P 500 (MES): $0.275 per side

E-Mini NASDAQ (NQ): $0.55 per side

E-Micro Euro (M6E): $0.275 per side

E-Mini Japanese Yen (J7): $0.55 per side

Australian Dollar (6A): $0.55 per side

Euro FX (6E): $0.55 per side

Trading Platform

Sierra Futures offers a comprehensive trading platform that caters to the needs of sophisticated futures traders. One notable feature is the ability to trade directly from charts, providing traders with a visual and intuitive way to execute orders. This feature enhances precision and efficiency in trading decisions.

The platform also supports server-side OCOs (One-Cancels-the-Other) and bracket orders. These advanced order types enable traders to manage their positions more effectively by setting predetermined exit and stop-loss levels. This risk management tool is crucial in the volatile world of futures trading.

Depth of Market (DOM) functionality is integrated into the platform, allowing traders to access real-time market depth data. This feature provides insights into market liquidity and order book dynamics, helping traders make informed decisions.

Single-click trading simplifies order execution, reducing the time it takes to enter and exit positions. This can be especially valuable in fast-moving markets where split-second decisions matter.

Sierra Futures offers an array of advanced charting tools, including access to over 300 indicators. Traders can customize their charts to suit their preferred trading strategies and styles, enhancing their technical analysis capabilities.

Deposit & Withdrawal

Sierra Futures offers a variety of payment methods, including:

Wire transfer

ACH transfer

Credit card

Debit card

PayPal

The minimum deposit for a Sierra Futures account is $250.

Payment processing times vary depending on the payment method chosen. Wire transfers typically take 1-2 business days to process, ACH transfers typically take 3-5 business days to process, and credit and debit card deposits are typically processed immediately. PayPal deposits may take up to 24 hours to process.

Customer Support

Sierra Futures offers customer support during Futures Trading Support Hours from Monday to Friday, 8 am to 4 pm Central Time.

Traders can reach out to their Futures Trading Support team via phone at 1.800.258.6675. Additionally, Sierra Futures is located at 700 N. Green Street, Suite 200, Chicago, IL 60642, with direct contact at (312) 896-9897 and a toll-free number at 800-258-6675.

Educational Resources

Sierra Futures, unfortunately, lacks comprehensive educational resources for traders. The platform does not provide a substantial range of educational materials or tools to support traders in enhancing their knowledge and skills.

This can be a limitation for individuals looking to expand their understanding of trading and financial markets. Traders seeking educational resources to aid in their trading journey may need to explore alternative sources or platforms that offer a more robust selection of educational materials and tools.

Conclusion

Sierra Futures specializes in futures trading. While it offers a diverse range of market instruments and a user-friendly trading platform, it operates without regulatory oversight, raising concerns about its compliance and monitoring. This lack of regulation categorizes it as a “Suspicious Clone,” which can be a risk for traders. On the positive side, Sierra Futures provides an accessible minimum deposit, various payment methods, and advanced trading features like leverage options and the Sierra Chart Trading Platform.

However, it falls short in terms of educational resources and limited customer support hours. Traders should weigh these pros and cons carefully when considering Sierra Futures for their trading needs.

FAQs

Q: Is Sierra Futures a regulated trading platform?

A: No, Sierra Futures currently operates without regulatory oversight.

Q: What is the minimum deposit required to open an account with Sierra Futures?

A: The minimum deposit is $250.

Q: Can I practice trading before depositing real funds?

A: Yes, Sierra Futures offers a demo account for practice.

Q: What trading platform does Sierra Futures provide?

A: Sierra Futures uses the Sierra Chart Trading Platform.

Q: Are there educational resources available for traders?

A: Unfortunately, Sierra Futures lacks comprehensive educational resources.

Q: What are Sierra Futures' customer support hours?

A: Customer support is available from Monday to Friday, 8 am to 4 pm Central Time.