Company Summary

| DGCX Review Summary | |

| Founded | 2005 |

| Registered Country/Region | United Arab Emirates |

| Regulation | No regulation |

| Market Instruments | Currencies, Equities, Hydrocarbons, Metals |

| Demo Account | / |

| Leverage | / |

| Spread | / |

| Trading Platform | Cinnober (by Nasdaq) via FIX API |

| Minimum Deposit | / |

| Customer Support | Tel: +971 4361 1600 |

| Email: info@dgcx.ae | |

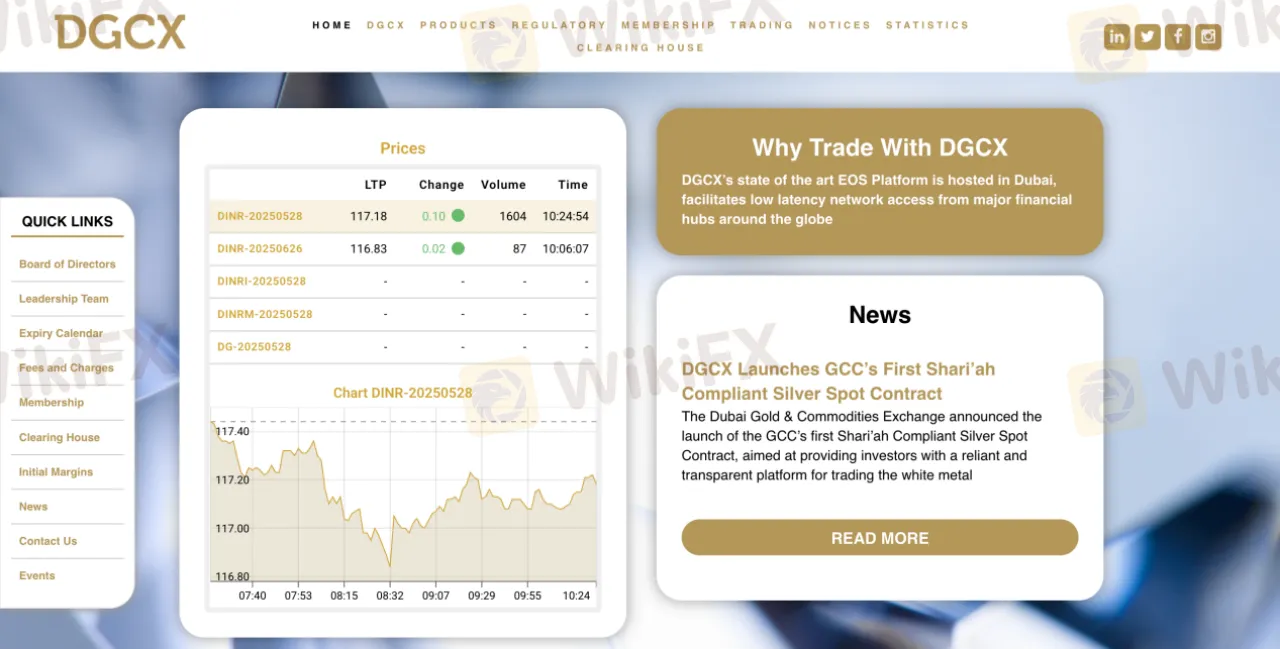

DGCX Information

DGCX is a UAE-based derivatives exchange established in 2005, offering trading in futures contracts across currencies, metals, hydrocarbons, and equities. It operates on a robust institutional platform (Cinnober by Nasdaq) but is primarily accessible to members and not retail-friendly.

Pros and Cons

| Pros | Cons |

| Wide range of futures instruments | No regulation |

| Transparent fee schedule | High trading and membership fees |

| Strong regional presence in Middle East markets | Limited info on trading conditions |

Is DGCX Legit?

DGCX (Dubai Gold & Commodities Exchange) is based in Dubai and operates under the supervision of the Dubai Multi Commodities Centre (DMCC). However, it does not hold a license from any of the major international financial regulators such as the FCA (UK), ASIC (Australia), or NFA (USA).

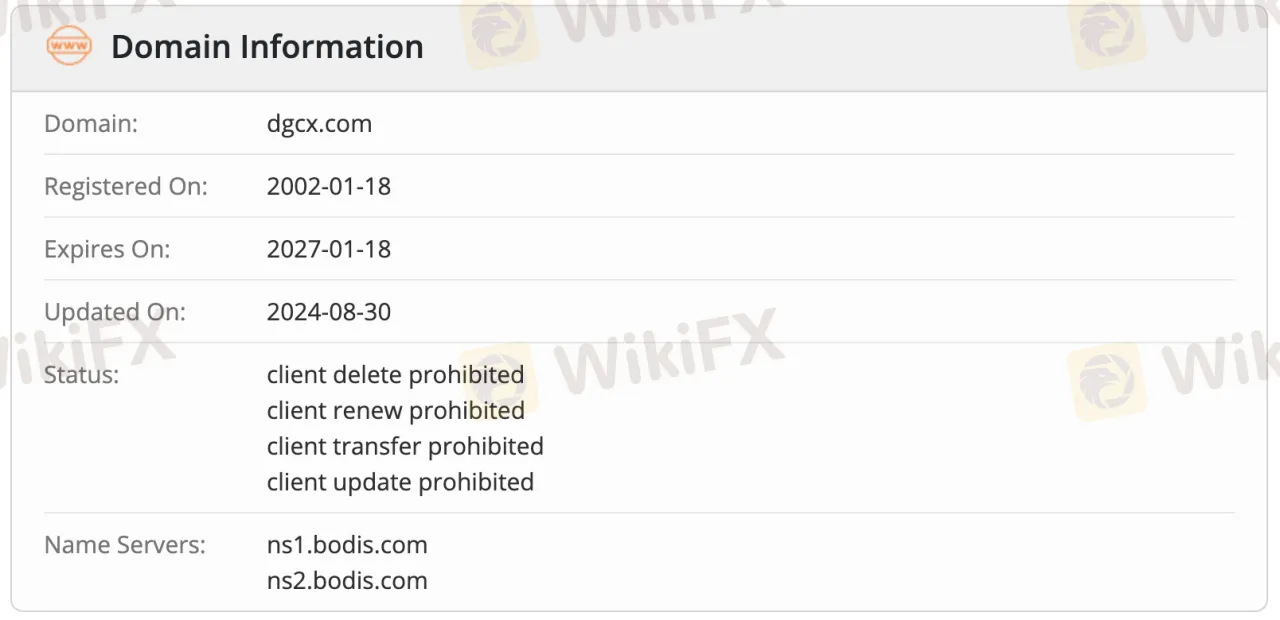

The domain dgcx.com was registered on January 18, 2002, and will expire on January 18, 2027. It was last updated on August 30, 2024. The domain is currently in a locked status that prevents deletion, renewal, transfer, or updates. Its name servers are listed under Bodis, which suggests the site might be parked or inactive.

What Can I Trade on DGCX?

DGCX offers a total of 4 types of products, which include a variety of currency pairs, metal futures, hydrocarbon contracts, and equity-related instruments.

| Tradable Instruments | Supported |

| Currencies | ✔ |

| Equities | ✔ |

| Hydrocarbons | ✔ |

| Metals | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Stocks | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

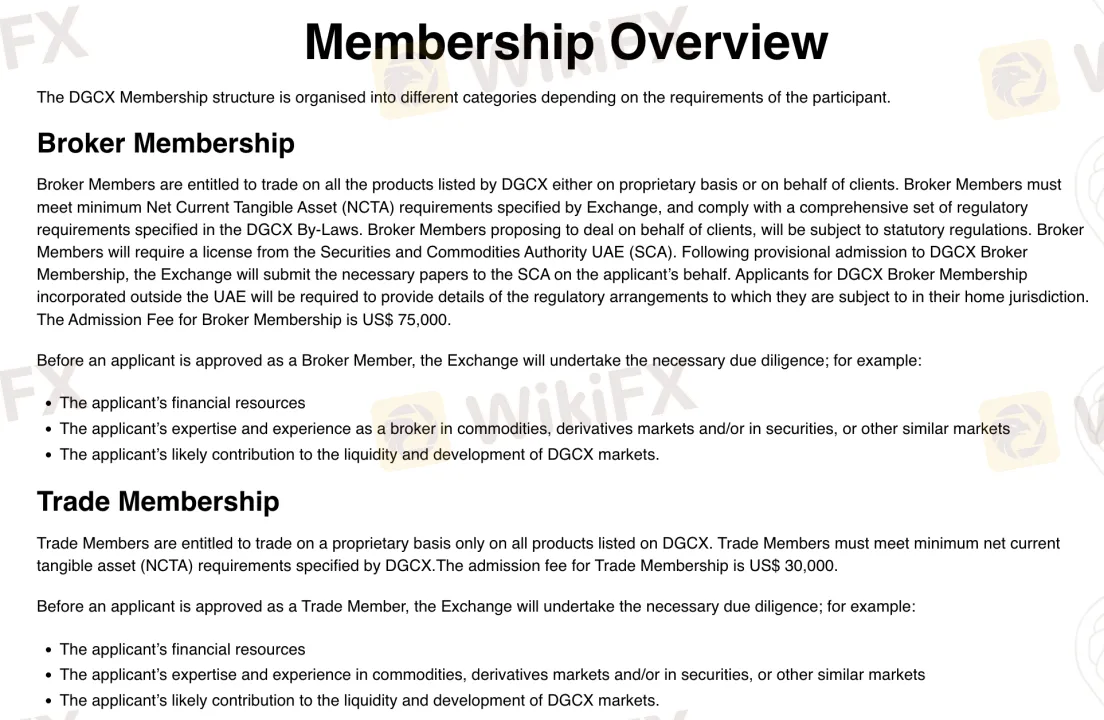

Membership

| Membership | Application Fee | Feature | Suitable for |

| Broker Membership | $75,000 | Trade on behalf of clients; requires SCA license | Licensed brokers, financial firms |

| Trade Membership | $30,000 | Trade only for own account | Institutional or proprietary traders |

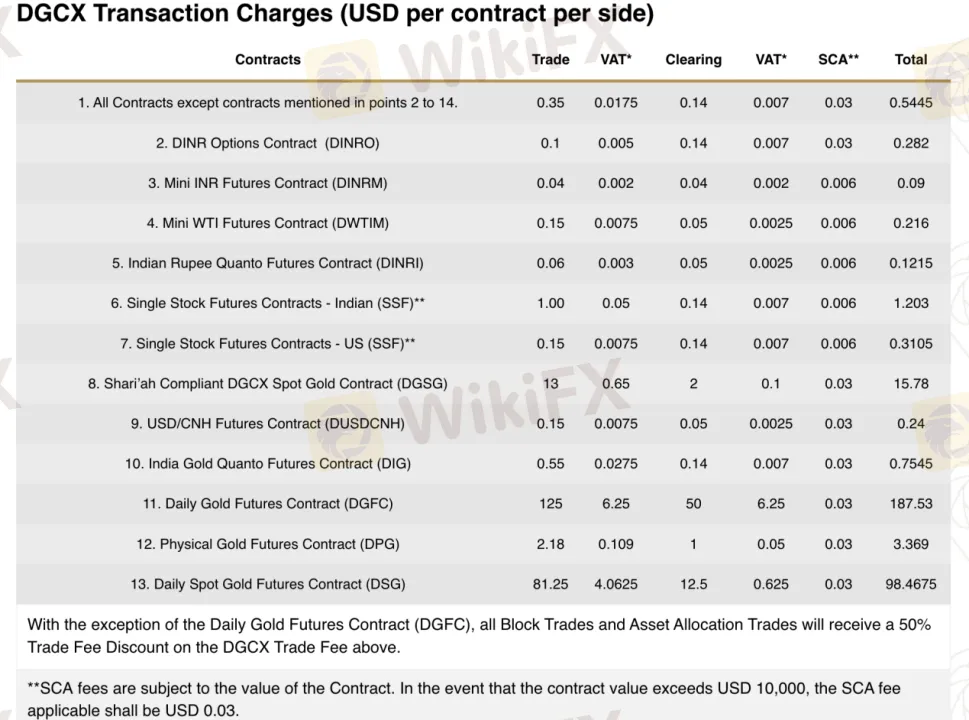

DGCX Fees

DGCXs trading fees are high compared to typical retail brokers, especially for precious metals. This is expected as DGCX operates as an institutional-level futures exchange rather than a retail CFD broker. DGCX charges fixed per-side fees per contract. These vary by product.

| Contract | Trade Fee | Clearing Fee | Total (Excl. VAT/SCA) |

| Daily Gold Futures Contract (DGFC) | $125.00 | $50.00 | $175.00 |

| Mini INR Futures Contract (DINRM) | $0.04 | $0.04 | $0.08 |

| USD/CNH Futures Contract (DUSDCNH) | $0.15 | $0.05 | $0.20 |

| Single Stock Futures – Indian (SSF) | $1.00 | $0.14 | $1.14 |

| Shariah Spot Gold Contract (DGSG) | $13.00 | $2.00 | $15.00 |

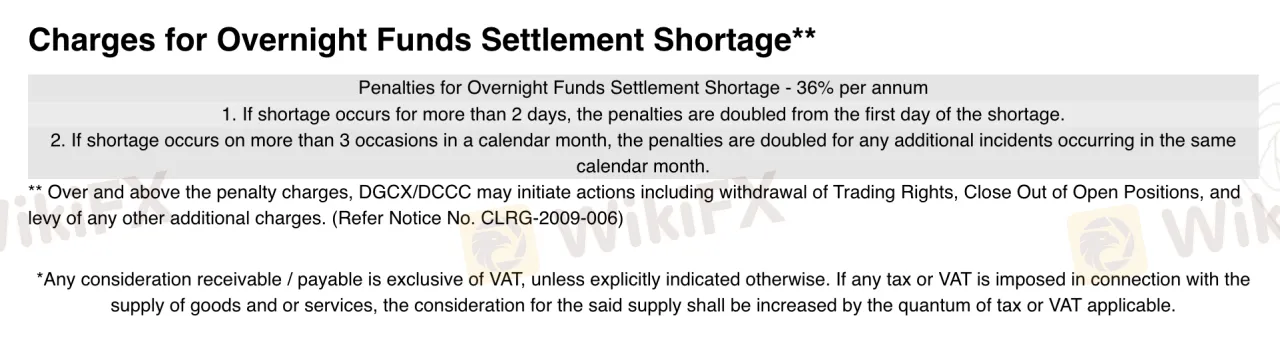

Swap Rates

DGCX does not apply traditional swap rates like those used by retail CFD brokers. Instead, it charges a penalty for overnight funds settlement shortages at a rate of 36% per annum.

| Condition | Penalty |

| Standard penalty rate | 36% per annum |

| Shortage lasts more than 2 days | Penalty doubled from day 1 |

| More than 3 shortages in a calendar month | Future penalties doubled |

| Additional consequences | Loss of trading rights, forced position closure |

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| Cinnober (by Nasdaq) | ✔ | Desktop / Institutional Systems (via FIX API) | Institutional and professional traders requiring direct market access |