Buod ng kumpanya

| DGCX Buod ng Pagsusuri | |

| Itinatag | 2005 |

| Nakarehistrong Bansa/Rehiyon | United Arab Emirates |

| Regulasyon | Walang regulasyon |

| Mga Instrumento sa Merkado | Mga Pera, Ekitya, Hidrokarbon, Metal |

| Demo Account | / |

| Leverage | / |

| Spread | / |

| Platform ng Paggagalaw | Cinnober (sa pamamagitan ng Nasdaq) via FIX API |

| Minimum na Deposit | / |

| Suporta sa Customer | Tel: +971 4361 1600 |

| Email: info@dgcx.ae | |

Impormasyon Tungkol sa DGCX

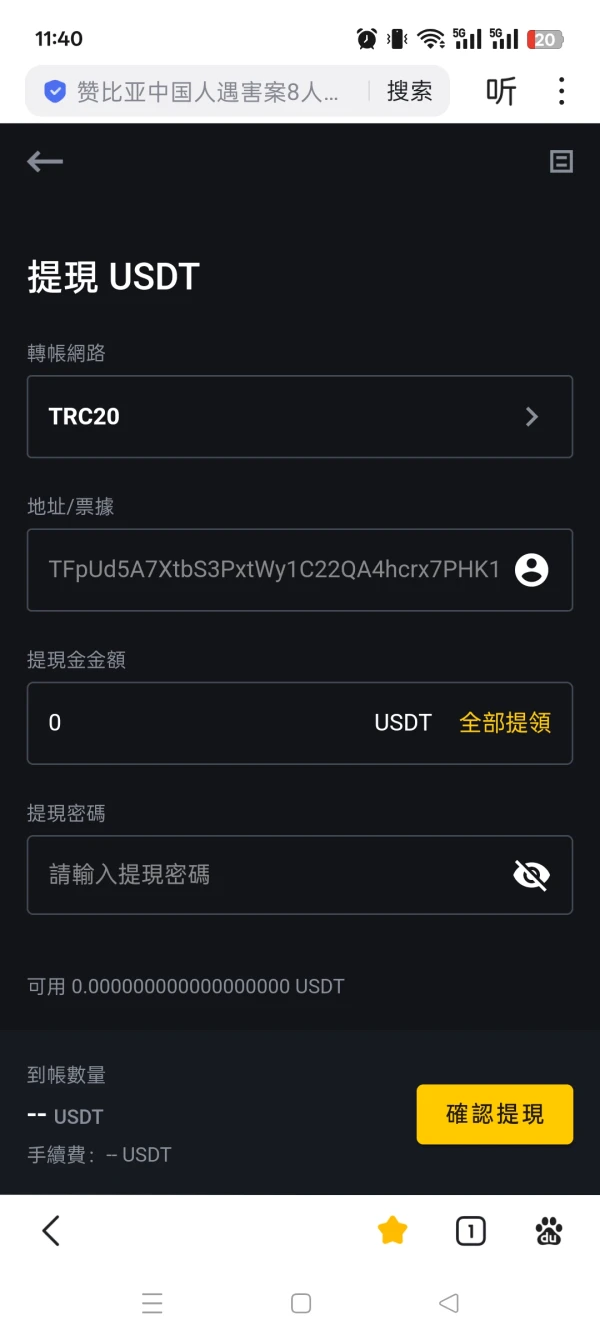

Ang DGCX ay isang UAE-based na palitan ng mga derivatives na itinatag noong 2005, nag-aalok ng kalakalan sa mga kontrata ng hinaharap sa mga pera, metal, hidrokarbon, at ekitya. Ito ay gumagana sa isang matibay na institusyonal na plataporma (Cinnober ng Nasdaq) ngunit pangunahing makakamit ng mga miyembro at hindi pabor sa retail.

Mga Kalamangan at Disadvantages

| Mga Kalamangan | Mga Disadvantages |

| Malawak na hanay ng mga instrumento sa hinaharap | Walang regulasyon |

| Transparente ang listahan ng bayad | Mataas na bayad sa kalakalan at pagiging miyembro |

| Matatag na presensya sa rehiyonal sa mga merkado ng Gitnang Silangan | Limitadong impormasyon sa mga kondisyon ng kalakalan |

Tunay ba ang DGCX?

Ang DGCX (Dubai Gold & Commodities Exchange) ay nakabase sa Dubai at gumagana sa ilalim ng pangangasiwa ng Dubai Multi Commodities Centre (DMCC). Gayunpaman, hindi ito may lisensya mula sa anumang pangunahing internasyonal na mga tagapamahala ng pananalapi tulad ng FCA (UK), ASIC (Australia), o NFA (USA).

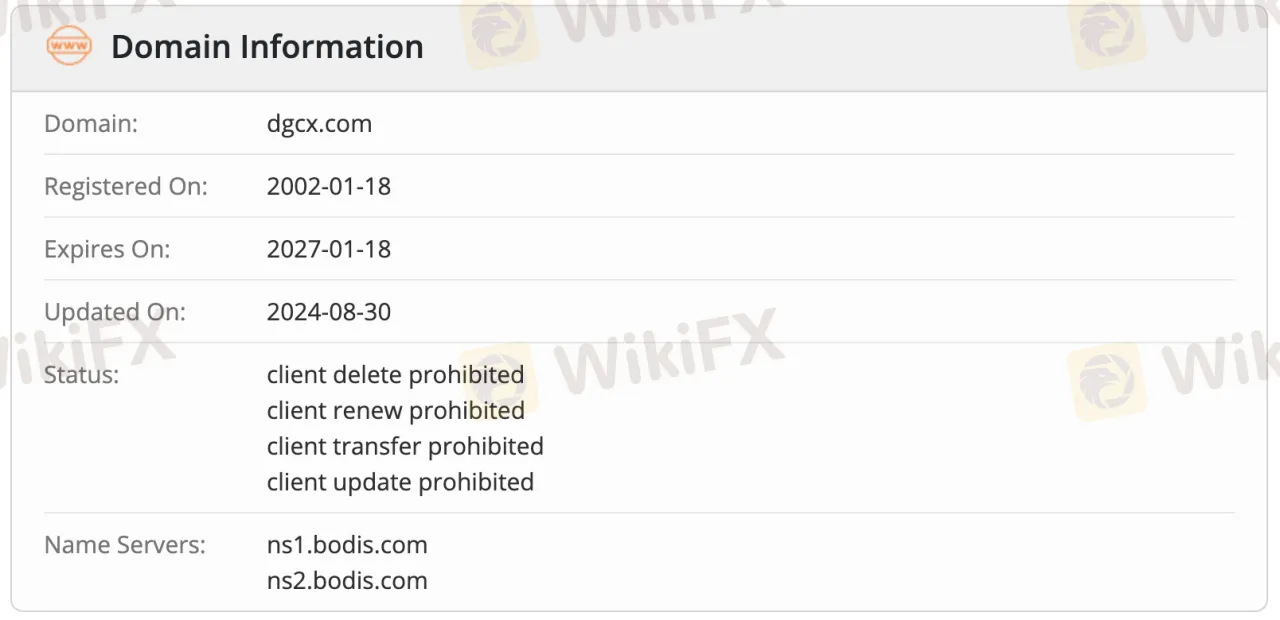

Ang domain na dgcx.com ay narehistro noong Enero 18, 2002, at mag-eexpire sa Enero 18, 2027. Ito ay huling na-update noong Agosto 30, 2024. Ang domain ay kasalukuyang nasa isang nakasara na kalagayan na nagpapigil sa pagtanggal, pag-renew, paglilipat, o mga update. Ang mga name server nito ay nakalista sa ilalim ng Bodis, na nagpapahiwatig na ang site ay maaaring naka-park o hindi aktibo.

Ano ang Maaari Kong Kalakalan sa DGCX?

DGCX ay nag-aalok ng kabuuang 4 uri ng mga produkto, na kinabibilangan ng iba't ibang currency pairs, metal futures, hydrocarbon contracts, at equity-related instruments.

| Mga Tradable Instruments | Supported |

| Mga Currency | ✔ |

| Mga Equities | ✔ |

| Hydrocarbons | ✔ |

| Mga Metal | ✔ |

| Forex | ❌ |

| Mga Commodity | ❌ |

| Mga Indices | ❌ |

| Mga Stocks | ❌ |

| Mga Cryptocurrencies | ❌ |

| Mga Bonds | ❌ |

| Mga Options | ❌ |

| Mga ETFs | ❌ |

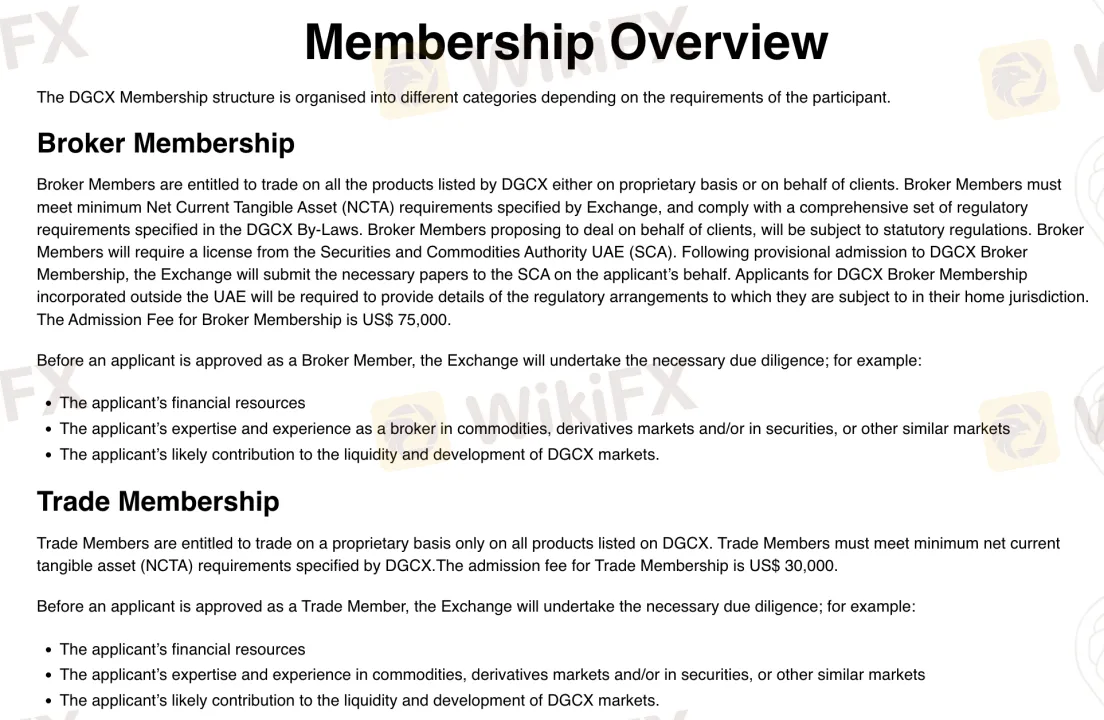

Pagiging Miyembro

| Pagiging Miyembro | Bayad sa Aplikasyon | Feature | Angkop para sa |

| Broker Membership | $75,000 | Mag-trade para sa mga kliyente; nangangailangan ng lisensiyang SCA | Lisensiyadong mga broker, mga kumpanyang pinansyal |

| Trade Membership | $30,000 | Mag-trade lamang para sa sariling account | Institutional o proprietary traders |

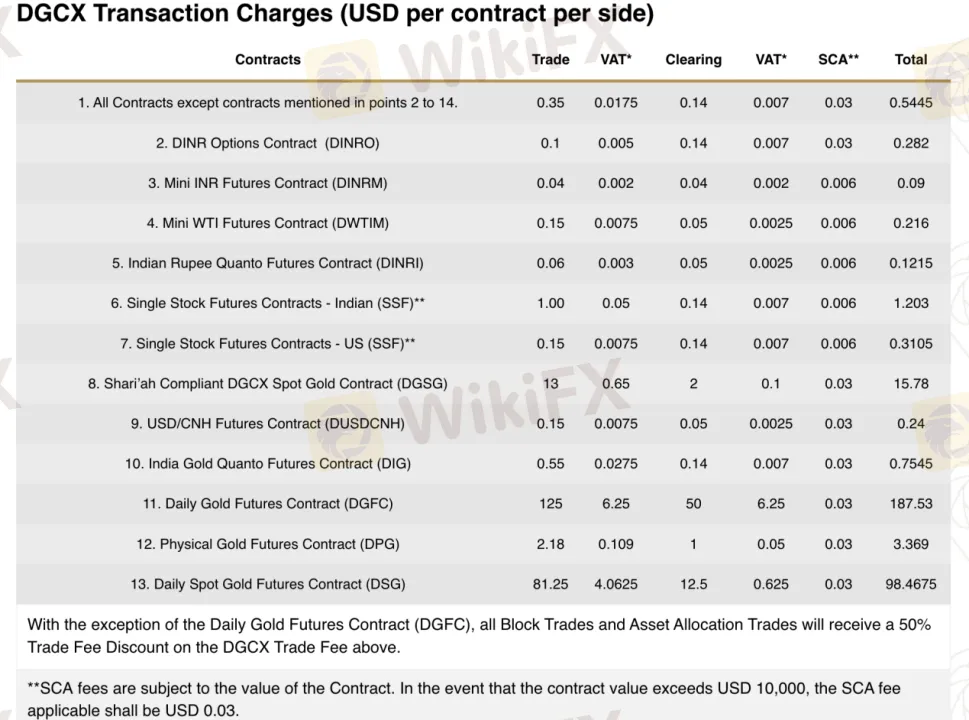

Mga Bayad ng DGCX

Ang mga bayad sa trading ng DGCX ay mataas kumpara sa karaniwang mga retail broker, lalo na para sa precious metals. Ito ay inaasahan dahil ang DGCX ay gumagana bilang isang institutional-level futures exchange kaysa sa isang retail CFD broker. Nagpapataw ang DGCX ng fixed per-side fees bawat kontrata. Ito ay nag-iiba depende sa produkto.

| Kontrata | Bayad sa Trade | Clearing Fee | Kabuuan (Excl. VAT/SCA) |

| Daily Gold Futures Contract (DGFC) | $125.00 | $50.00 | $175.00 |

| Mini INR Futures Contract (DINRM) | $0.04 | $0.04 | $0.08 |

| USD/CNH Futures Contract (DUSDCNH) | $0.15 | $0.05 | $0.20 |

| Single Stock Futures – Indian (SSF) | $1.00 | $0.14 | $1.14 |

| Shariah Spot Gold Contract (DGSG) | $13.00 | $2.00 | $15.00 |

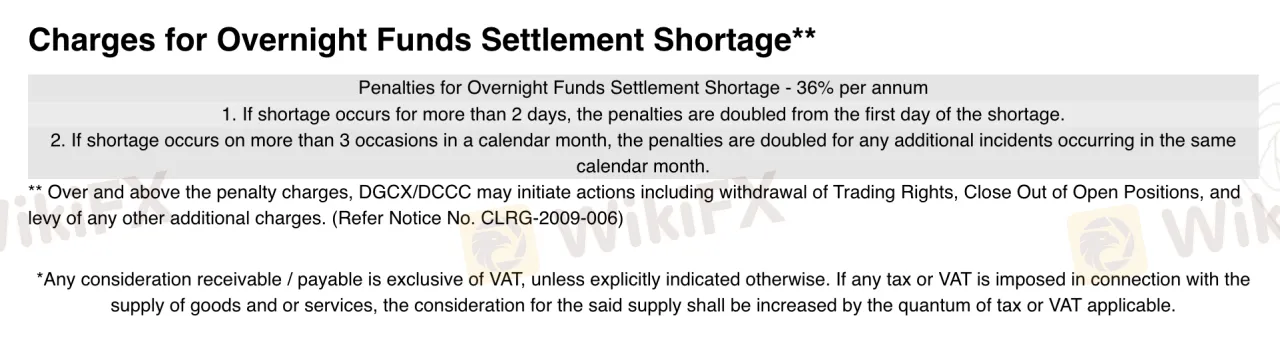

Mga Swap Rates

DGCX ay hindi gumagamit ng tradisyunal na mga swap rate tulad ng ginagamit ng mga retail CFD brokers. Sa halip, ito ay nagpapataw ng multa para sa overnight funds settlement shortages sa rate na 36% kada taon.

| Kondisyon | Multa |

| Standard penalty rate | 36% kada taon |

| Shortage lasts more than 2 days | Multa doblado mula araw 1 |

| More than 3 shortages in a calendar month | Mga susunod na multa doblado |

| Karagdagang mga epekto | Pagkawala ng karapatan sa kalakalan, pwersahang pagsasara ng posisyon |

Plataforma ng Kalakalan

| Plataforma ng Kalakalan | Supported | Available Devices | Angkop para sa |

| Cinnober (by Nasdaq) | ✔ | Desktop / Institutional Systems (via FIX API) | Institutional at propesyonal na mga mangangalakal na nangangailangan ng direktang access sa merkado |