Company Summary

| OkiginReview Summary | |

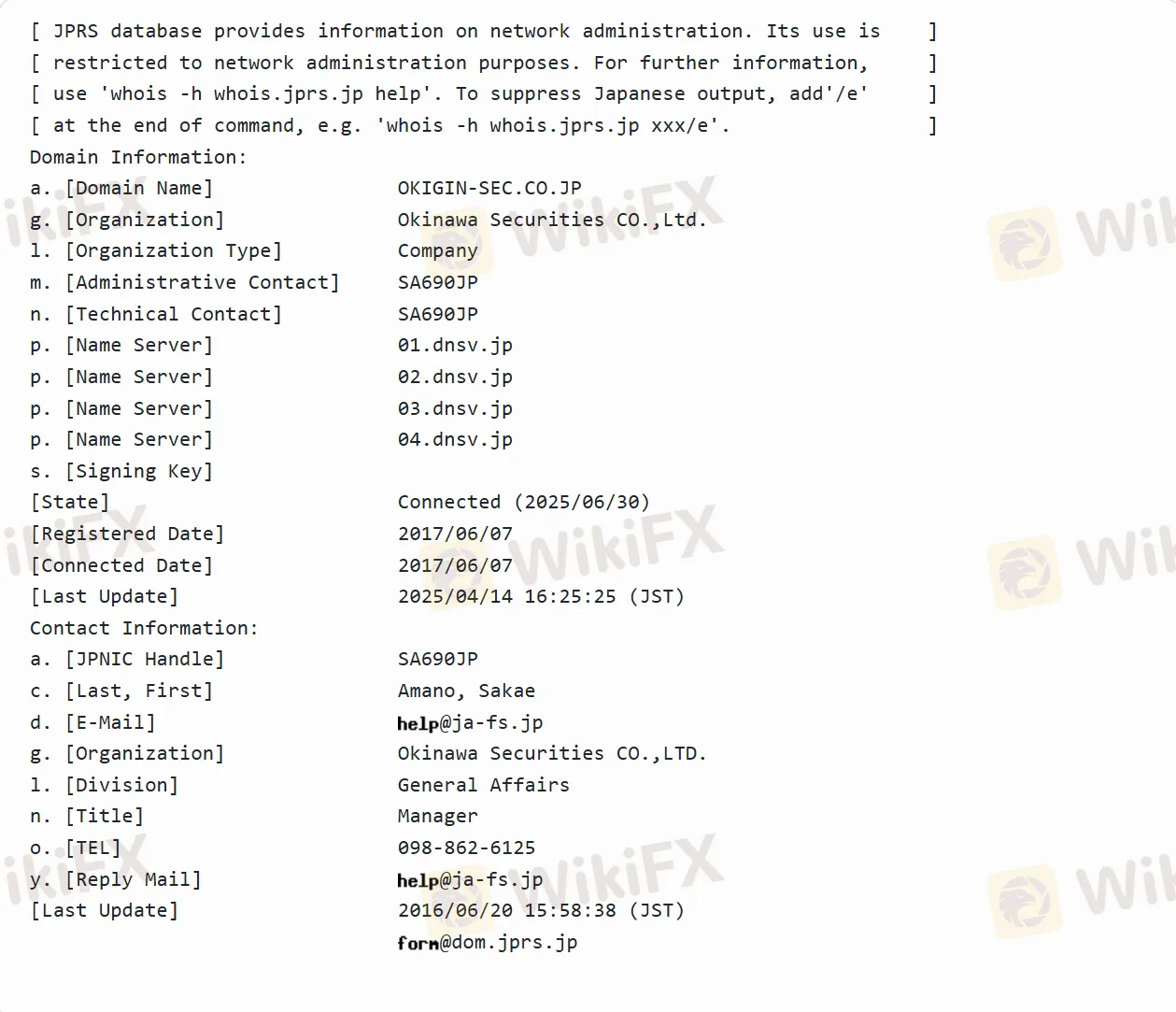

| Founded | 2017-06-07 |

| Registered Country/Region | Japan |

| Regulation | Regulated |

| Market Instruments | Stocks, Bonds, and Investment trusts |

| Customer Support | / |

Okigin Information

Okigin is a Japanese financial services provider, whose parent company is Okinawa Bank and has a certain influence in the local financial field. The platform is committed to providing investors with diversified financial investment services, covering a variety of financial products such as stocks, bonds, and investment trusts. The platform has formulated a series of legal-related guidelines, such as the guidelines for soliciting financial products, the declaration and handling guidelines for the protection of personal information, etc., to safeguard the rights and interests of customers and standardize business operations.

Pros and Cons

| Pros | Cons |

| Regulated | Language limitation (Japanese) |

| Various financial products | Limitations in international business for investors |

| Clear risk warnings | Complex fee standards |

| Diverse service channels (over-the-counter business, telephone reception, online services) | |

| Backed by Okinawa Bank |

Is Okigin Legit?

Okigin is a legal and compliant financial services platform. Its parent company, Okinawa Bank, has the legal operation qualification in the Japanese financial market. The platform itself is also regulated by the Financial Services Agency, and its regulatory license number is No. 1 issued by the Director of the Okinawa General Affairs Bureau (Financial Merchants).

What Can I Trade on Okigin?

On the Okigin platform, investors can trade a variety of financial products, including stocks (both domestic and foreign stocks), bonds, and investment trusts.

| Tradable Instruments | Supported |

| Stocks | ✔ |

| Bonds | ✔ |

| Investment trusts | ✔ |

Okigin Fees

Stock trading fees are divided into domestic stocks and foreign stocks.

For domestic stocks, if the agreed consideration is less than 1 million yen, the handling fee rate is 1.210% of the agreed consideration (with a minimum of 2,750 yen); if it exceeds 1 million yen but is less than or equal to 3 million yen, the handling fee rate is 0.880% of the agreed consideration plus 3,300 yen, and so on.

For foreign stocks, when entrusting the purchase and sale, a domestic agency handling fee of 2.20% (including tax, with a minimum of 5,500 yen) of the agreed consideration will be charged; for over-the-counter domestic transactions, only the purchase consideration needs to be paid, and the foreign currency exchange is carried out according to the exchange rate determined by the company.

In addition, for bond trading fees, if the agreed consideration is less than 1 million yen, the handling fee rate is 1.045% (with a minimum of 2,750 yen); if it exceeds 1 million yen but is less than or equal to 5 million yen, the handling fee rate is 0.935% of the agreed consideration plus 1,100 yen, and so on. When purchasing bonds through related transactions such as fundraising and selling, only the purchase consideration needs to be paid.