Company Summary

| Mega SecuritiesReview Summary | |

| Founded | / |

| Registered Country/Region | China (Taiwan) |

| Regulation | TPEx |

| Products & Services | Stocks, futures, financial management, trusts |

| Customer Support | AI Chat |

| Tel: (02)2351-7017; (02)4055-3355 | |

| Address: 台北市中正區忠孝東路二段95號 | |

Mega Securities was registered in Taiwan. This company specializes in stocks, futures, financial management, and trusts. Moreover, it is regulated by TPEx in Taiwan.

Pros and Cons

| Pros | Cons |

| Regulated by TPEx | Unclear fee structure |

| Multiple trading platforms |

Is Mega Securities Legit?

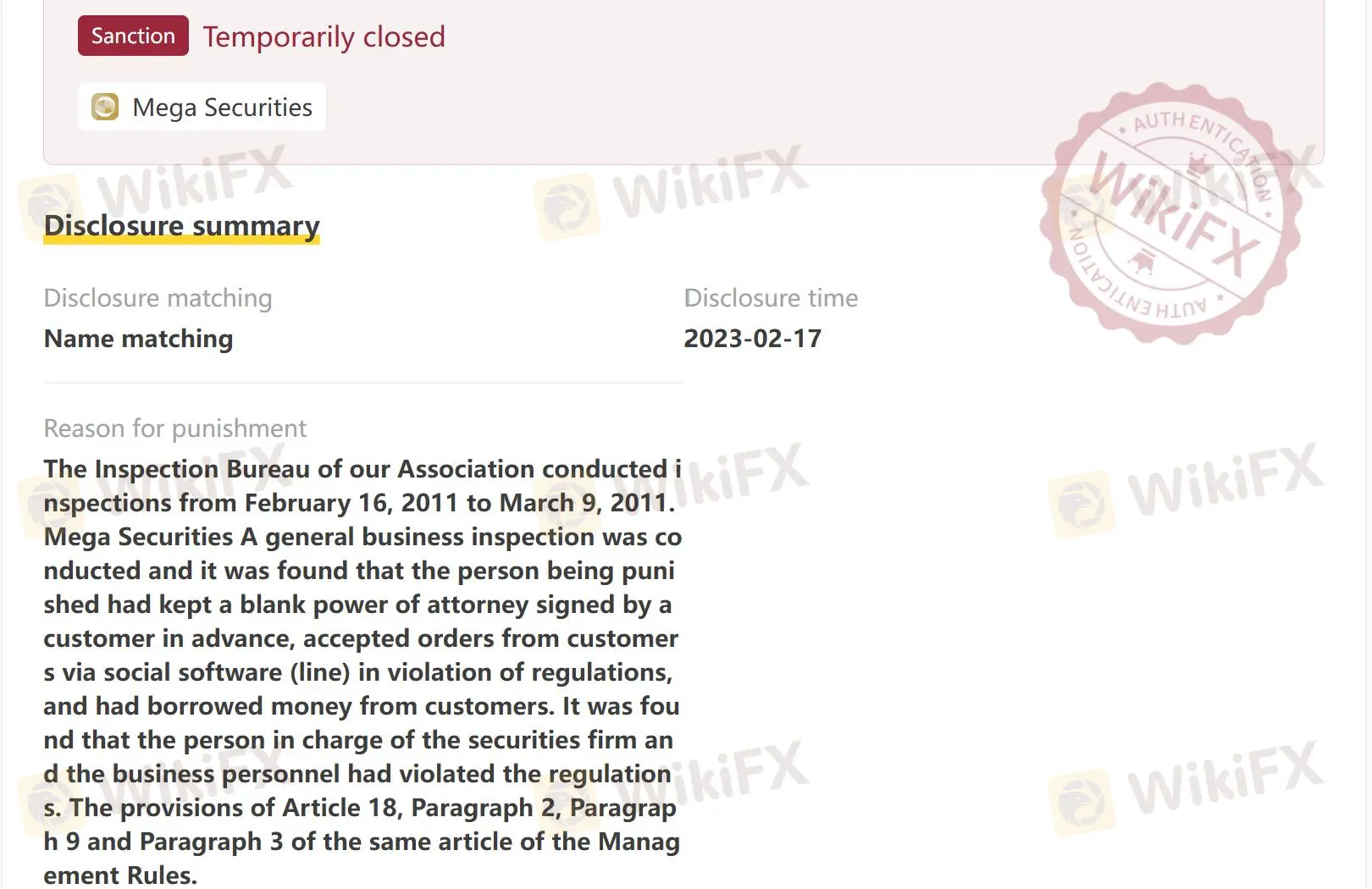

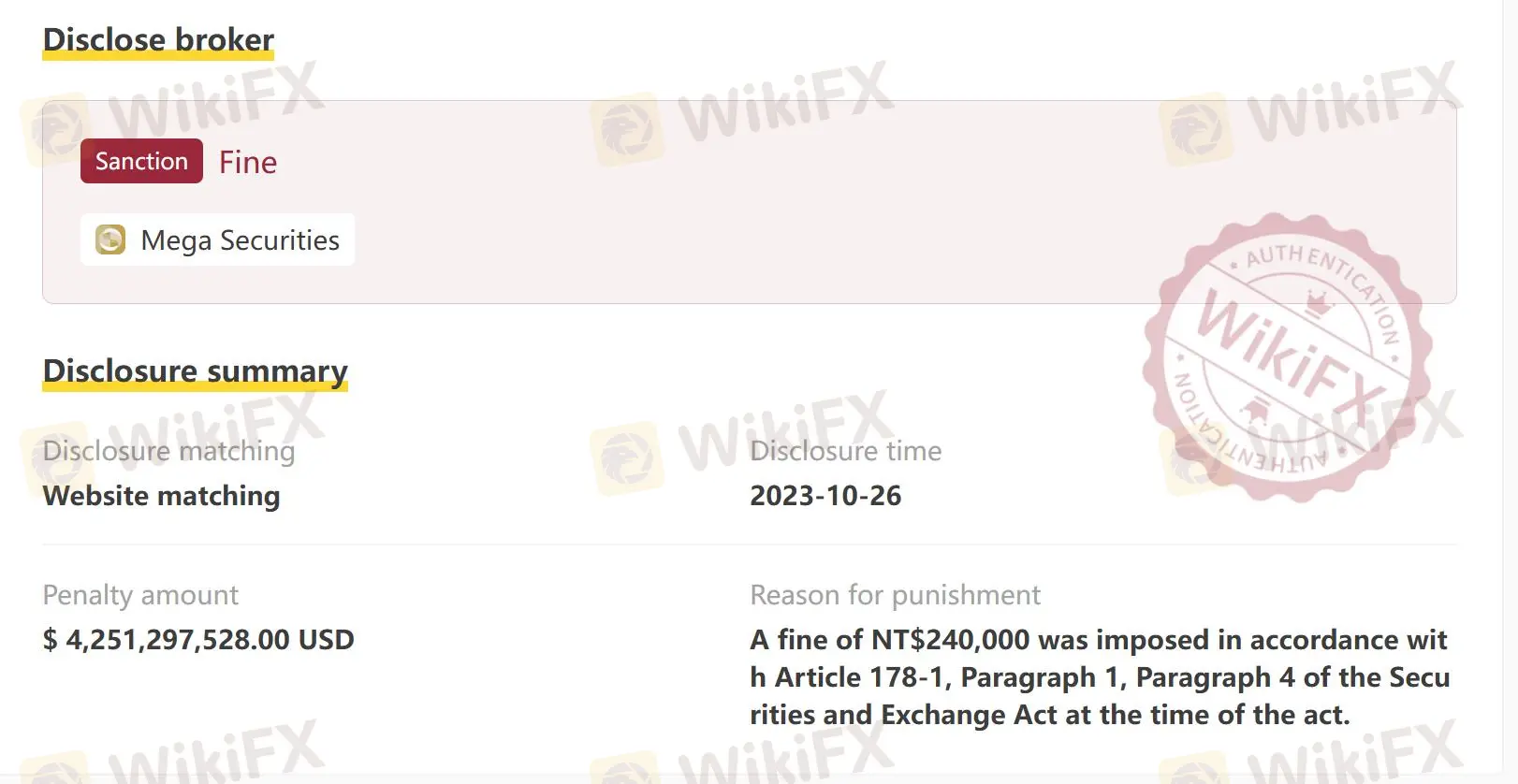

Yes, Mega Securities is regulated by Taipei Exchange (TPEx). However, the Securities and Futures Bureau inssued sanction on Mega Securities for twice. Please be aware of the potential risks!

| Regulated Authority | Current Status | Regulated Country | License Type | License No. |

| Taipei Exchange (TPEx) | Regulated | China (Taiwan) | Dealing in securities | Unreleased |

WikiFX Field Survey

WikiFX field survey team visited Mega Securities' regulatory address in Taiwan, and we found its physical address.

What Can I Trade on Mega Securities?

Mega Securities provides trading in stocks, futures, and trusts.

| Tradable Instruments | Supported |

| Stocks | ✔ |

| Futures | ✔ |

| Trusts | ✔ |

Trading Platform

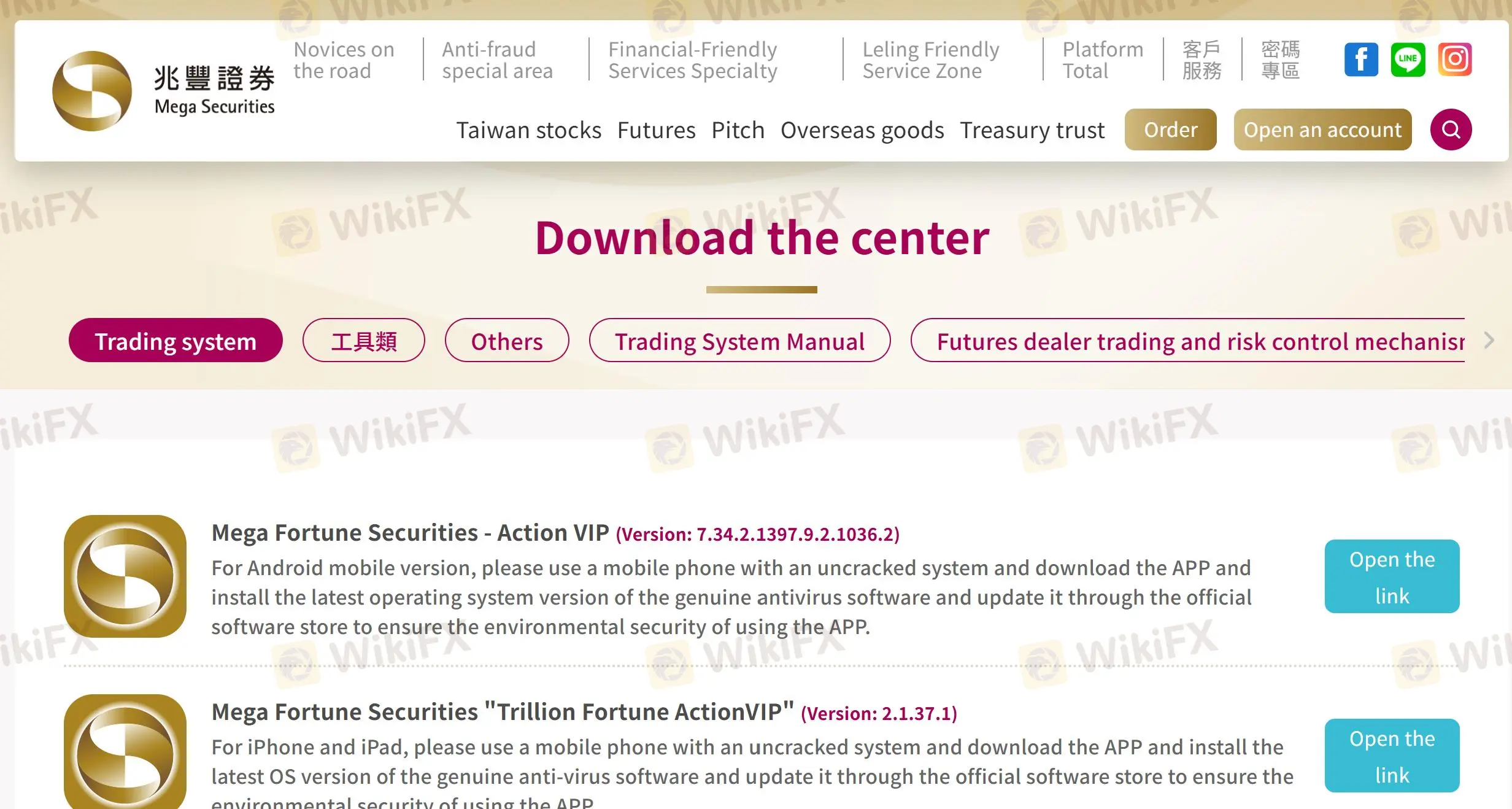

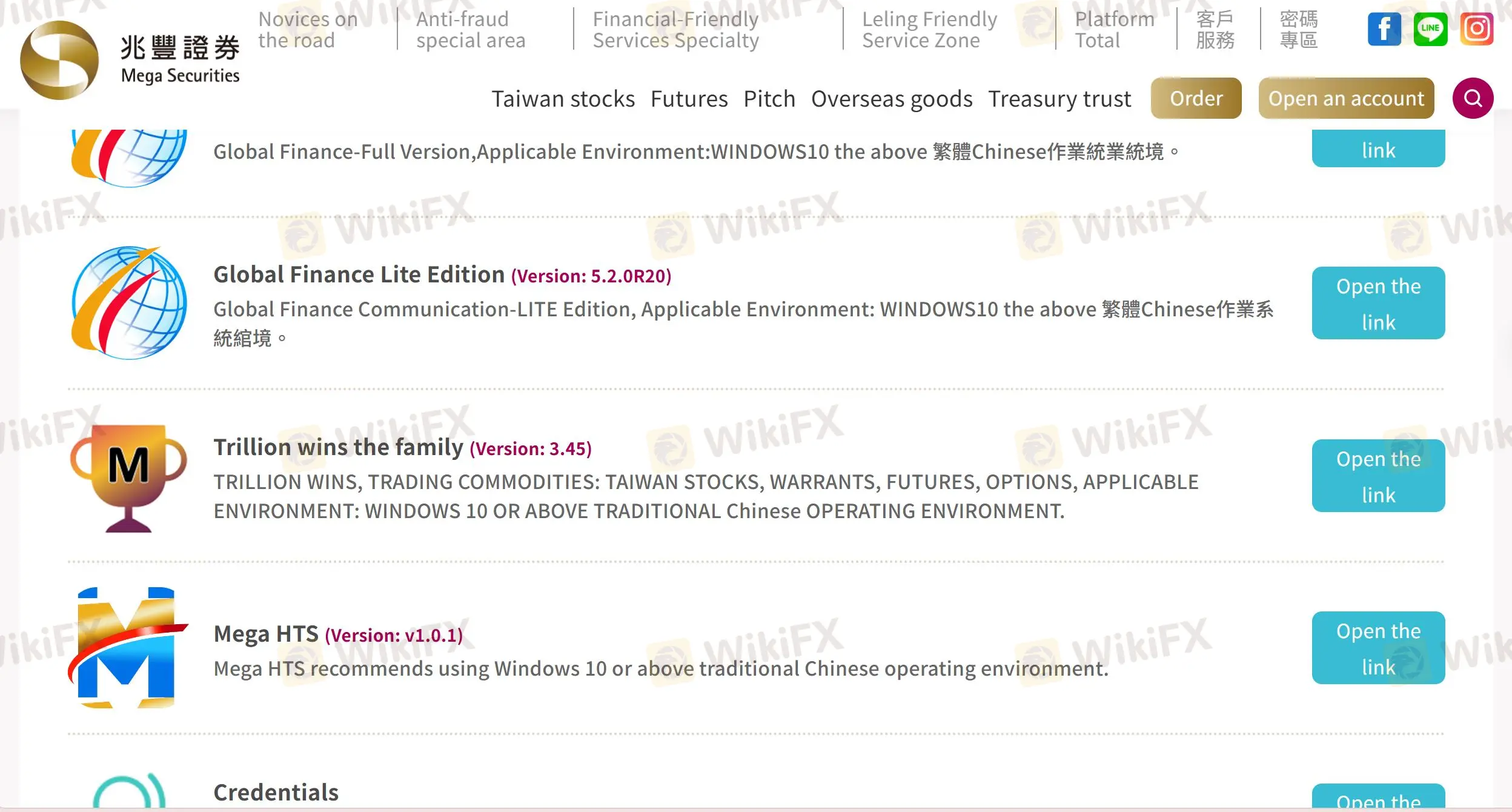

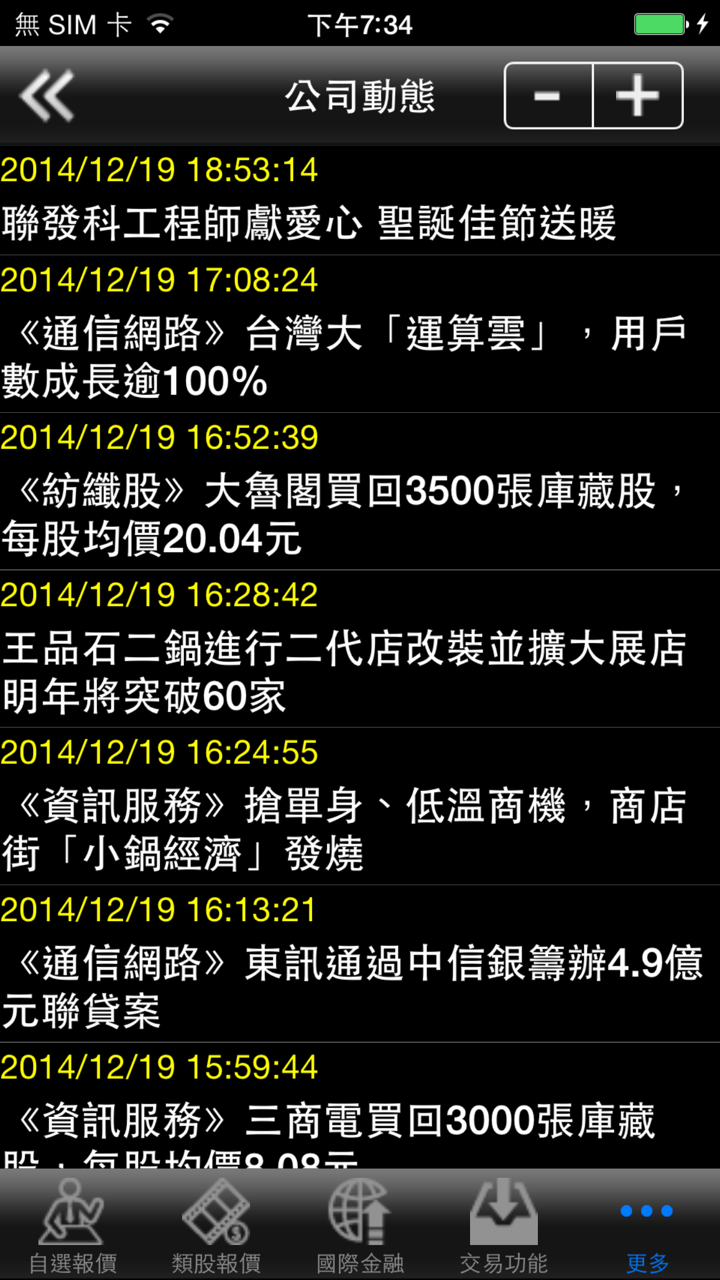

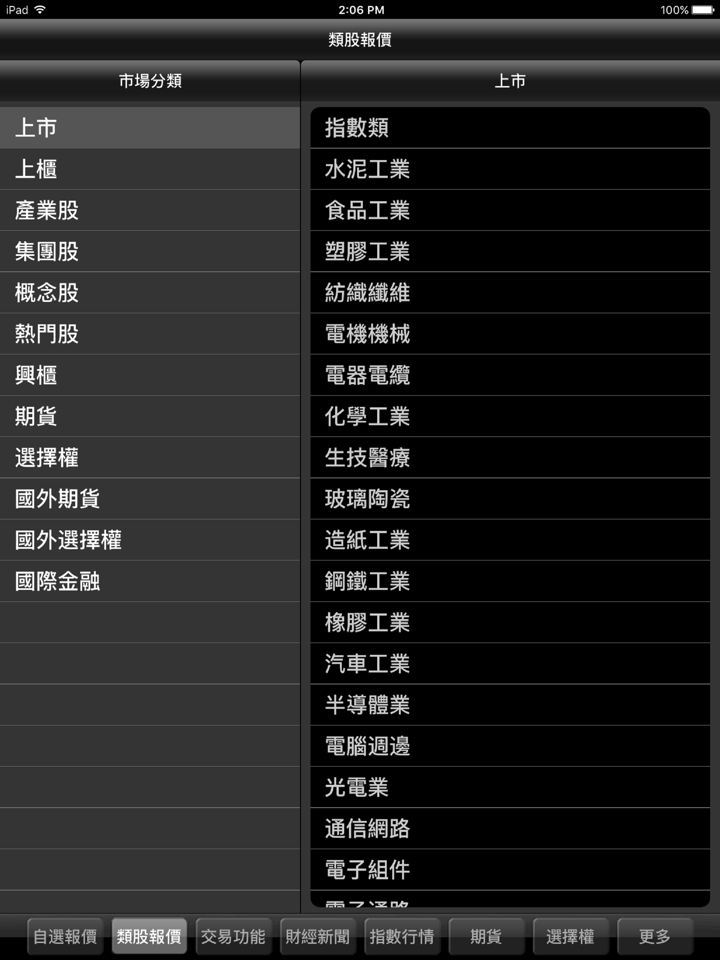

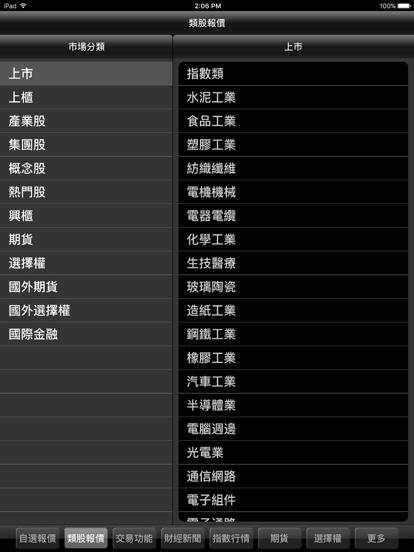

Mega Securities provides several types of platforms, including Mega Fortune Securities, Global Finance, Trillion Wins, Mega HTS, and Credentials.

| Trading Platform | Supported | Available Devices | Suitable for |

| Mega Fortune Securities | ✔ | Mobile | / |

| Global Finance | ✔ | PC | |

| Trillion Wins | ✔ | ||

| Mega HTS | ✔ | ||

| Credentials | ✔ |