Company Summary

| AC Capital Review Summary | |

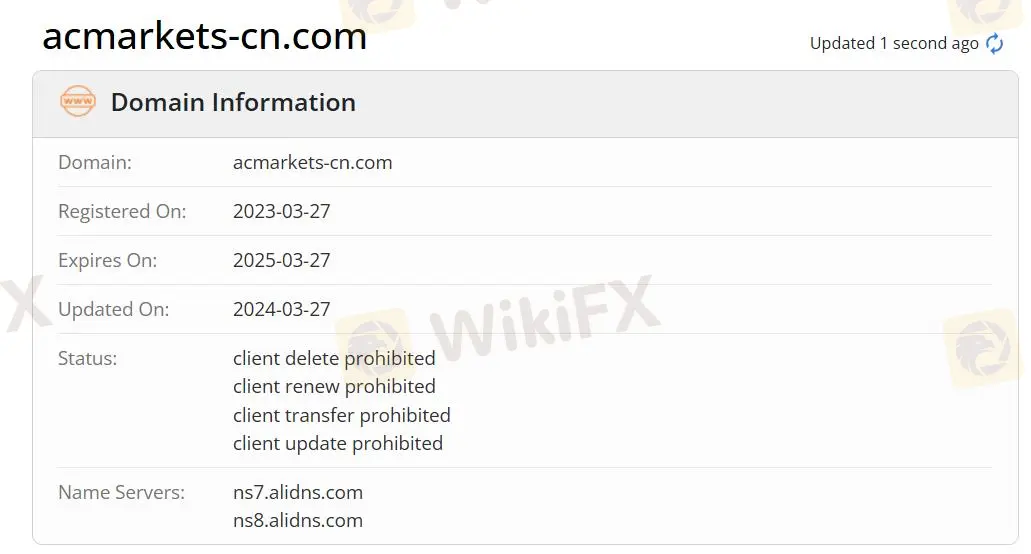

| Founded | 2023-03-27 |

| Registered Country/Region | Australia |

| Regulation | Regulated (ASIC), Offshore regulates (VFSC) |

| Market Instruments | Forex/Precious metals/Indices/Commodities |

| Demo Account | ✅ |

| Leverage | Up to 1:800 |

| Spread | Competitive spread |

| Trading Platform | MT5(PC(Windows/Mac OS)/Mobile(iOS/Android)) |

| Min Deposit | $500 |

| Customer Support | Phone: +61 (02) 8056 9475, +678 541 3519, +248 4303953 |

| Email: cs@accapital.com | |

| Facebook/Twitter/Instagram/YouTube | |

| Live chat | |

AC Capital Information

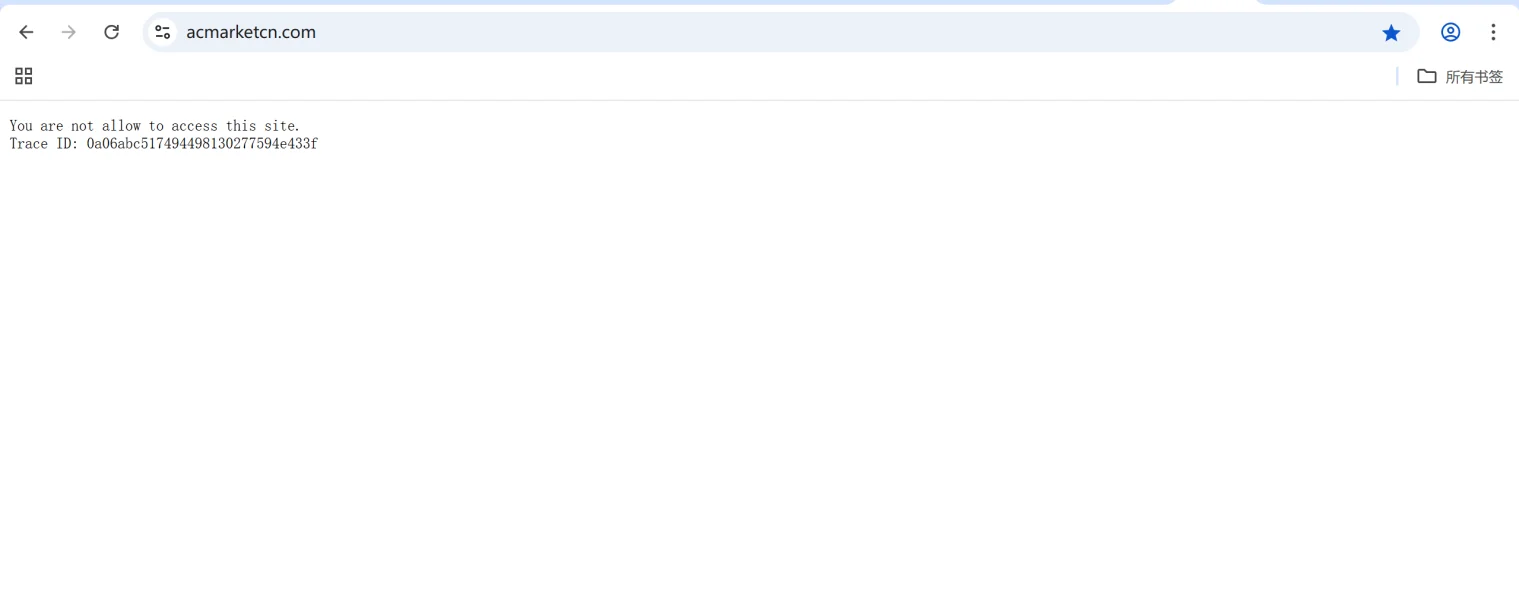

AC Capital is a CFD broker that provides one-stop trading services for global investors in forex, precious metals, indices, commodities as well as various financial derivatives. The broker also provides up to 800x leverage, and different account type options with a minimum deposit of $500. Traders can also access the popular MT5 trading platform through AC Capital. However, it is not possible to access https://www.acmarkets-cn.com/en

Pros and Cons

| Pros | Cons |

| Leverage up to 1:800 | No swap information |

| 24/5 customer support | No withdrawal fee information |

| Regulated (ASIC) | Unable to access the official website |

| MT5 available | |

| Demo account available | |

| Various tradable instruments |

Is AC Capital Legit?

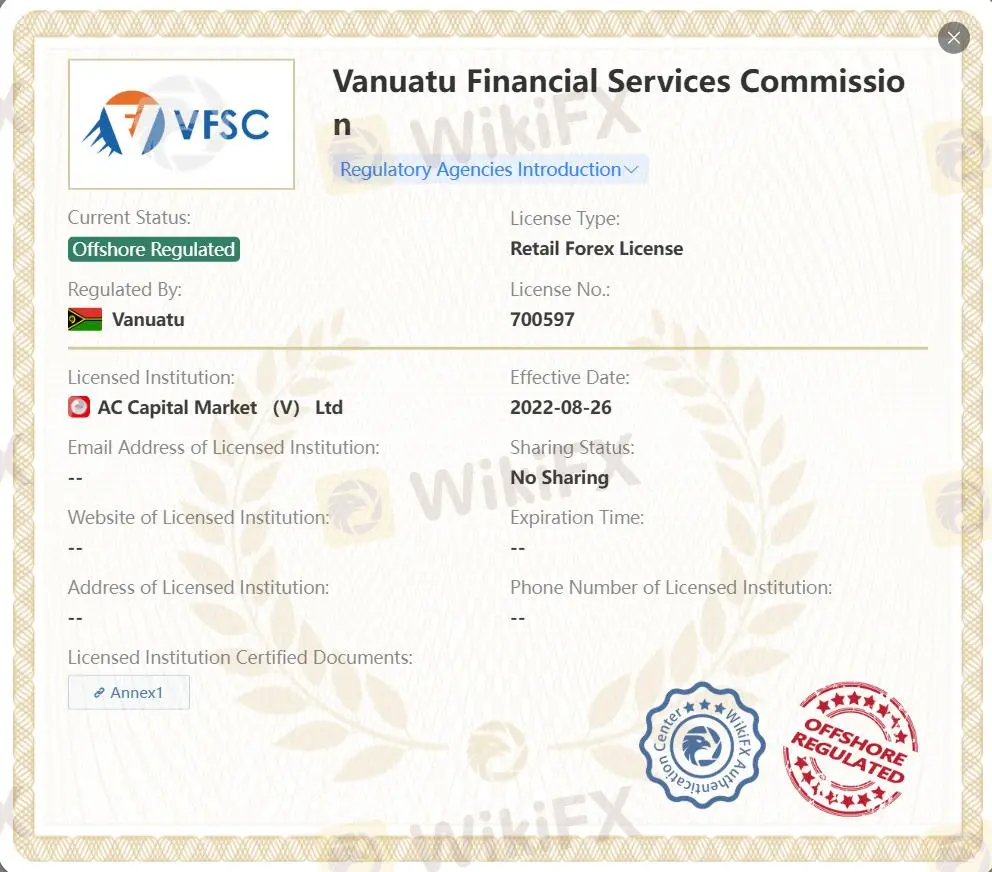

AC Capital is authorized and regulated by ASIC, with License No. is 000308159 and the License Type is Straight Through Processing(STP), VFSC offshore regulates AC Capital with license number 700597 and License Type Retail Forex.

What Can I Trade on AC Capital?

AC Capital offers various market instruments, including forex, precious metals, indices, commodities, and more.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Precious Metals | ✔ |

| Indices | ✔ |

Account Type

AC Capital has three account types: standard, professional, and ECN. The standard account is suitable for a wider range of people, whether beginners or experienced traders. The professional account is ideal for experienced traders. AC Capital Market also provides ECN accounts for high-frequency traders to achieve highly automated trading processes. The demo account is predominantly used to familiarize traders with the trading platform and for educational purposes only.

| Account Type | Standard | Professional | ECN |

| Minimum deposits | $500 | $500 | $500 |

| Spread | Competitive spread | Lower Spread | Raw spreads |

| Fee | No | No | $6/lot |

| Maximum leverage | 1:800 | 1:800 | 1:800 |

Leverage

The maximum leverage is 1:800 meaning that profits and losses are magnified 800 times.

Trading Platform

Traders can conduct financial activities in MT5 available on PC(Windows/Mac OS) and mobile(iOS/Android) through AC Capital. Traders with rich experience are more suitable for using MT5. Both MT4 and MT5 provide various trading strategies and implement EA systems.

Copy trading is also available, a way for inexperienced traders or followers who dont have the time to do extensive research or want to diversify their portfolio to copy the trades of experienced traders (also known as money managers or copy trading gurus).

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | PC(Windows/Mac OS)/Mobile(iOS/Android) | Experienced traders |

Deposit and Withdrawal

The first deposit amount must be $500 or above. AC Capital accepts WebPays, Wire Transfer, Kakao, FastPay, Skrill, Paystack, Neteller, Paytm, etc. for deposit and withdrawal. AC Capital processes the client's deposit and withdrawal application within one working day, depending on the bank's processing speed, usually in 1-5 working days.

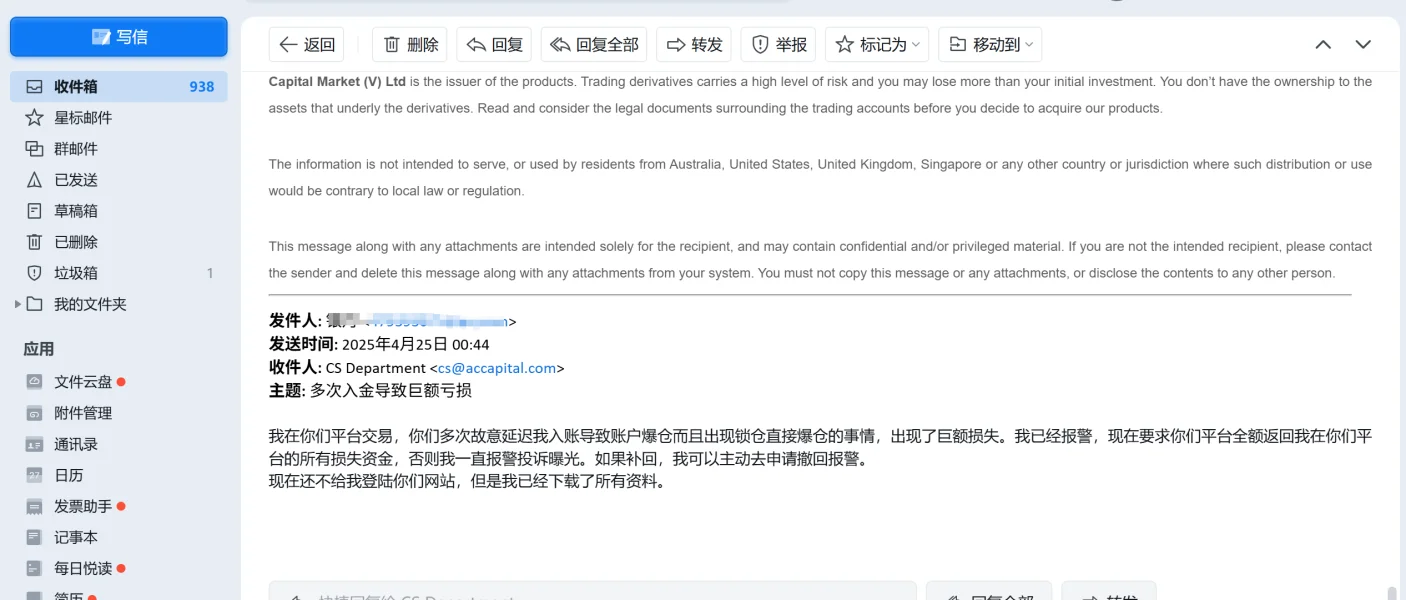

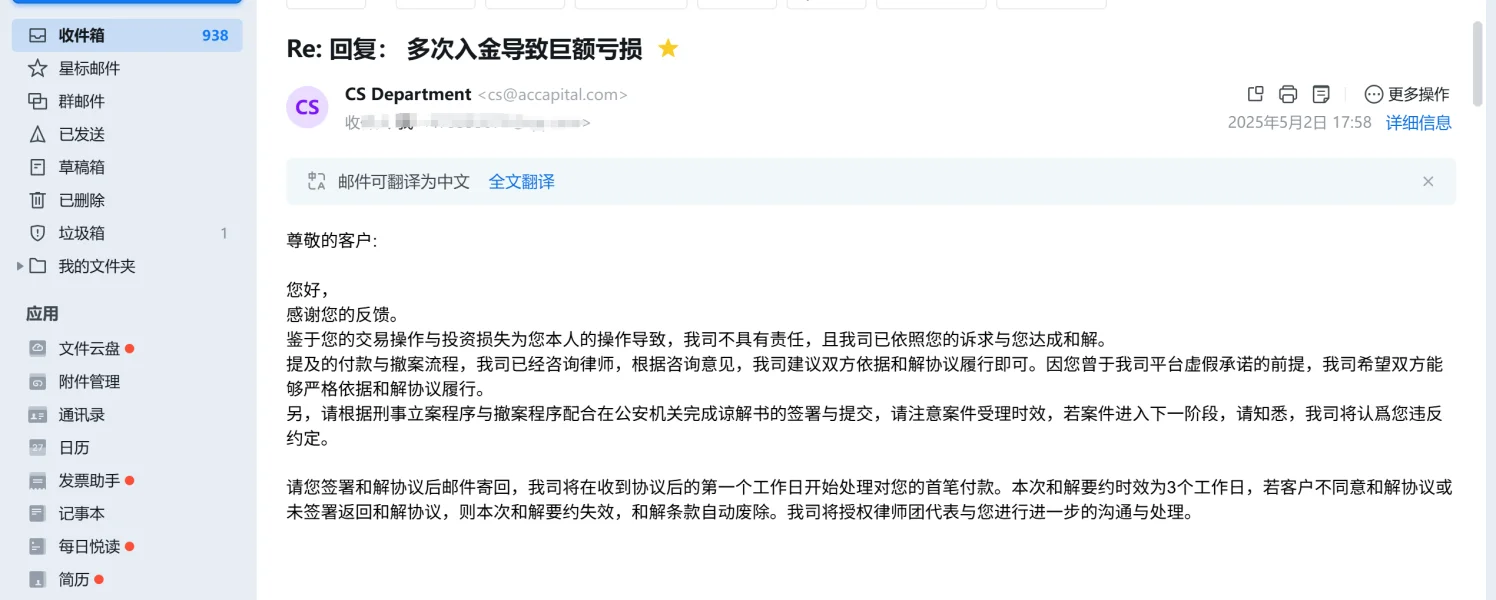

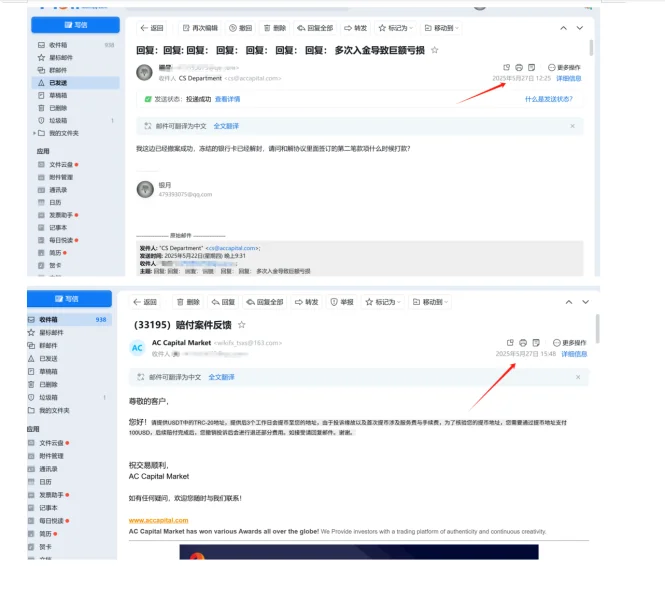

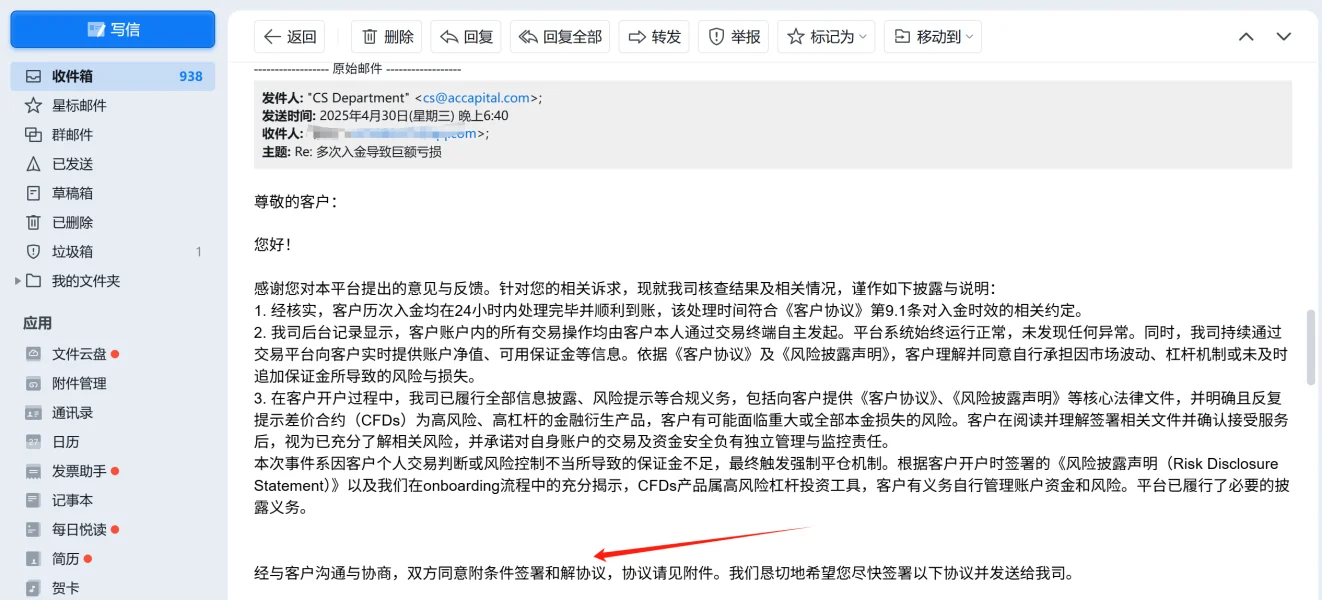

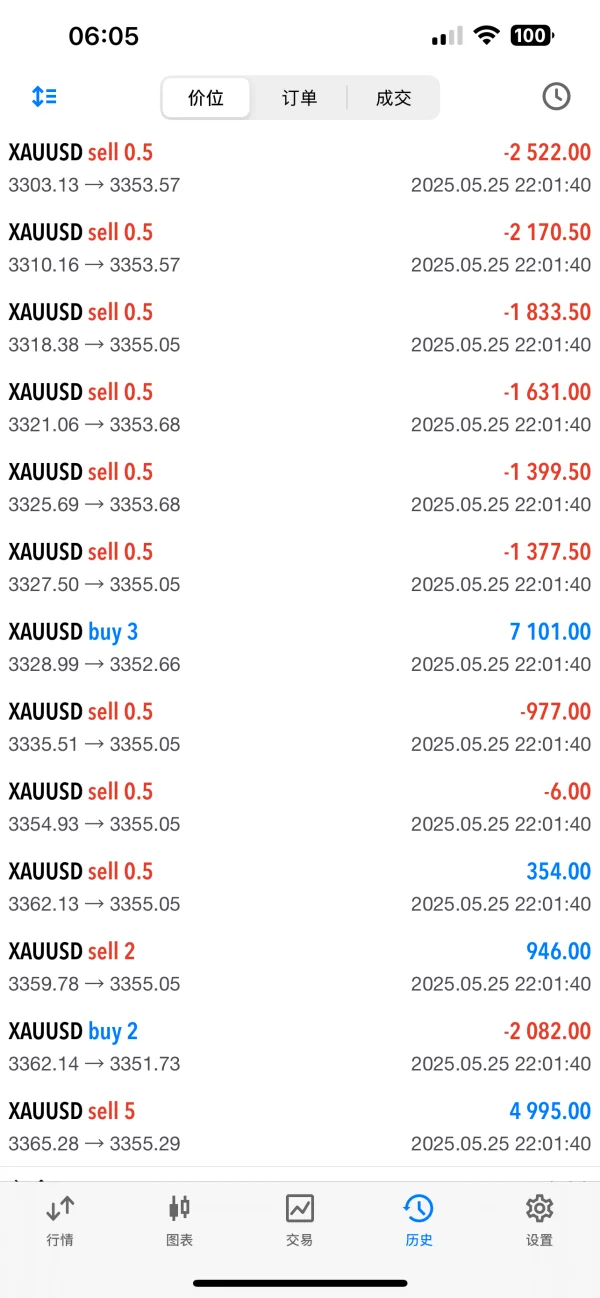

FX2887137558

United States

AC invested $30,000, but maliciously manipulated the locked positions to liquidate all positions over the weekend, and deliberately delayed the deposit when additional margin was needed, leading to liquidation again. Contacted official customer service, no response, and after reporting to the police, they induced us to reach an agreement. After I requested the police to withdraw the case, they sent the police withdrawal document to AC. AC actually arranged a fake account to scam me. After I exposed it, they blocked my IP address from logging into the official website, locked my account to prevent logging in and withdrawals, did not reply to emails on the official website, and did not reply through online chat. I hope to expose this bad behavior of fraud and also hope the platform provides a channel to complain to the regulatory authorities. Thank you!

Exposure

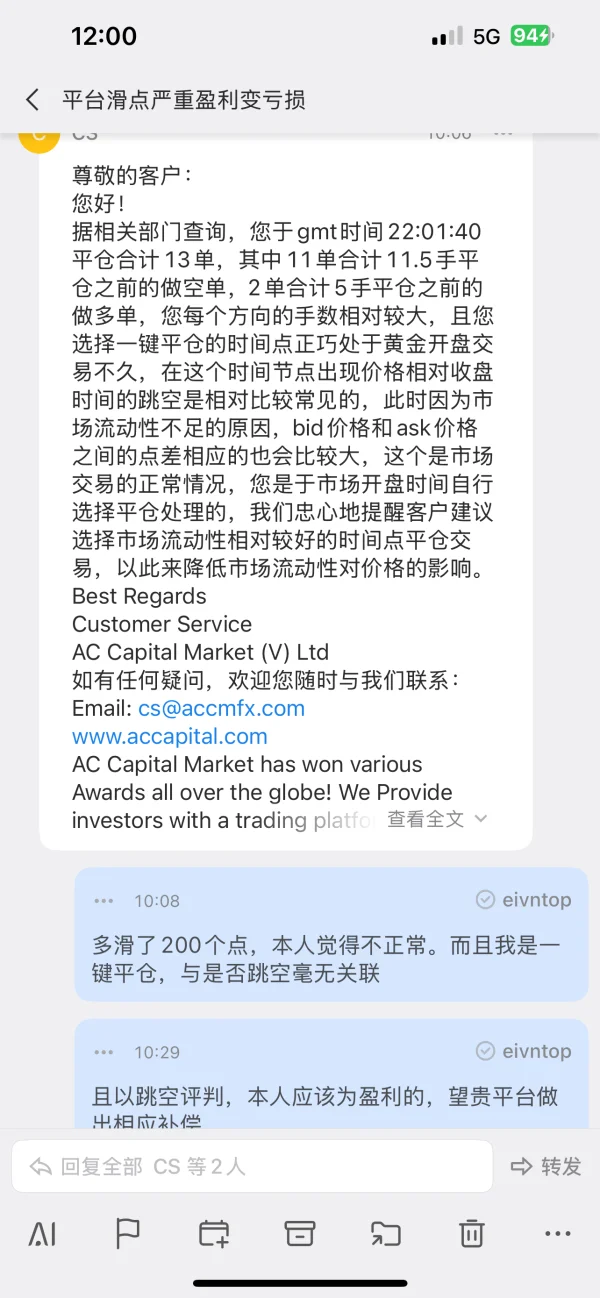

Leo8954

Singapore

When I closed the trades in the morning, what was originally a profitable order turned into a loss when closing. The spread was nearly 300 points, and I can accept larger liquidity spreads in the morning, but I can't accept malicious slippage that turns a profit into a loss. The average close price for the buy orders was 52.2, the sell orders should have closed around 53.5, not above 55. I cannot understand the platform's reply. I hope the platform will provide compensation.

Exposure

卢炜

Singapore

The website is currently unable to process withdrawals.

Exposure

平安小马

Hong Kong

Must give a good review, fast withdrawals, excellent service.

Positive

FX3958113162

Japan

Withdrawals are quite fast.

Positive

Clintti

Netherlands

mt5 is fast and smooth👍I deposited $500 and used a leverage of 200x times, traders went smooth so far. I guess my success here partly because I choose a good account manager, James, always gives me wise instructions.

Positive

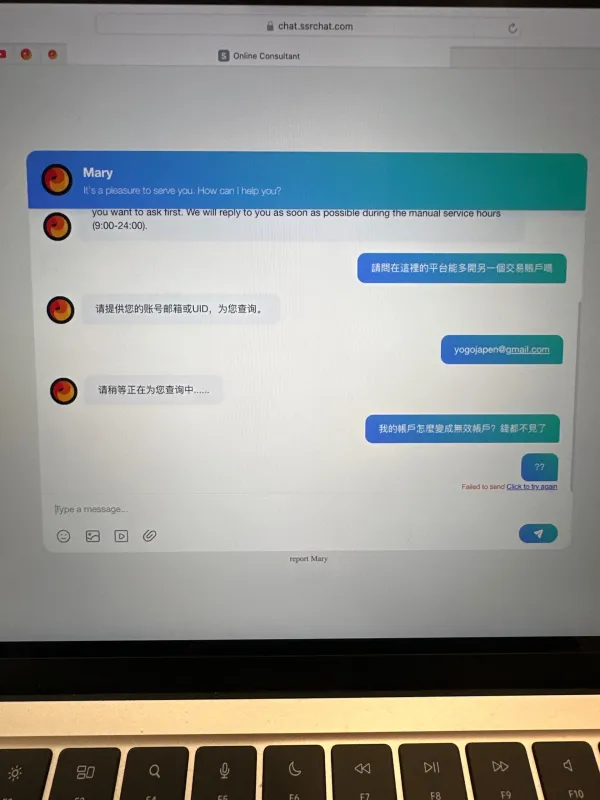

meghie

Taiwan

I logged in last night and found that my account had been completely canceled, and I discovered without notice that all the USDT 14,900 in the account was missing! Last year, I joined Kim Markets Limited at Accapital this year, the previous operations were normal. Until the platform was updated two weeks ago, I never received a letter asking the customer service platform how to deal with it, but the customer service was delayed! What I am angry about is that the rebate activity I joined in Kcm was merged into Acc due to the platform replacement. The activity is continuous, but because the recharge was not completed within 7 days, there is no rebate. However, I have repeatedly confirmed with customer service that the trading account is still operational. , I can't withdraw it until I complete the recharge. I still recharged and operated before the account was canceled. Until last night when I went to check it out, the account was canceled without warning. I couldn't log in and said it was an invalid account. So what is the 14900usdt in my account?! Being taken away by force like this is obvious, what is this but deception? I also asked customer service about the rules of the rebate activity. They were not clearly written and did not include what would happen if the goal was not achieved. When I asked customer service, I was told that our company reserves the right of final interpretation. The rules were not written and the right of final interpretation was not stated. In your case, it is obvious that you are the ones doing all the talking! If I complete the activity today, you can also tell me how much more you have to pay before you can withdraw it. Anyway, it’s up to you as a platform to do whatever you want! It is clearly stated that there is no time limit, and I cannot withdraw money until I complete the recharge goal. It is still operable even if the goal is not completed! It's all bullshit now! Such defrauding of hard-earned money...the above is my experience of being defrauded this time! Everyone, be careful.

Exposure

Givendoton

Ukraine

The $500 minimum deposit might seem high for some, but there's a Demo account for risk-free practice. Proceed with caution due to offshore regulation and thoroughly evaluate if AC Capital fits your trading preferences.

Neutral