公司簡介

| Securities Japan 評論摘要 | |

| 成立年份 | 1944 |

| 註冊國家 | 日本 |

| 監管 | FSA |

| 產品和服務 | 國內和國外股票、投資信託、債券、期貨、期權、保險 |

| 模擬帳戶 | / |

| 交易平台 | 線上交易 |

| 最低存款 | / |

| 客戶支援 | 電話:03-3668-3446 |

| 電郵:online@secjp.co.jp | |

Securities Japan 資訊

日本金融廳監管並許可 Securities Japan,該公司成立於1944年。該機構銷售各種金融產品,如股票、債券、投資信託、期貨、期權和保險。但根據交易類型,其費用可能相當高。

優缺點

| 優點 | 缺點 |

| 歷史悠久(自1944年起) | 某些交易類型的費用略高 |

| 受FSA監管 | 無MT4/5 |

| 產品範圍廣泛,包括保險 | 有關存款和提款的信息有限 |

Securities Japan 是否合法?

是的,Securities Japan 是受監管的。根據日本金融廳發放的零售外匯牌照,牌照號碼為関東財務局長(金商)第170号。

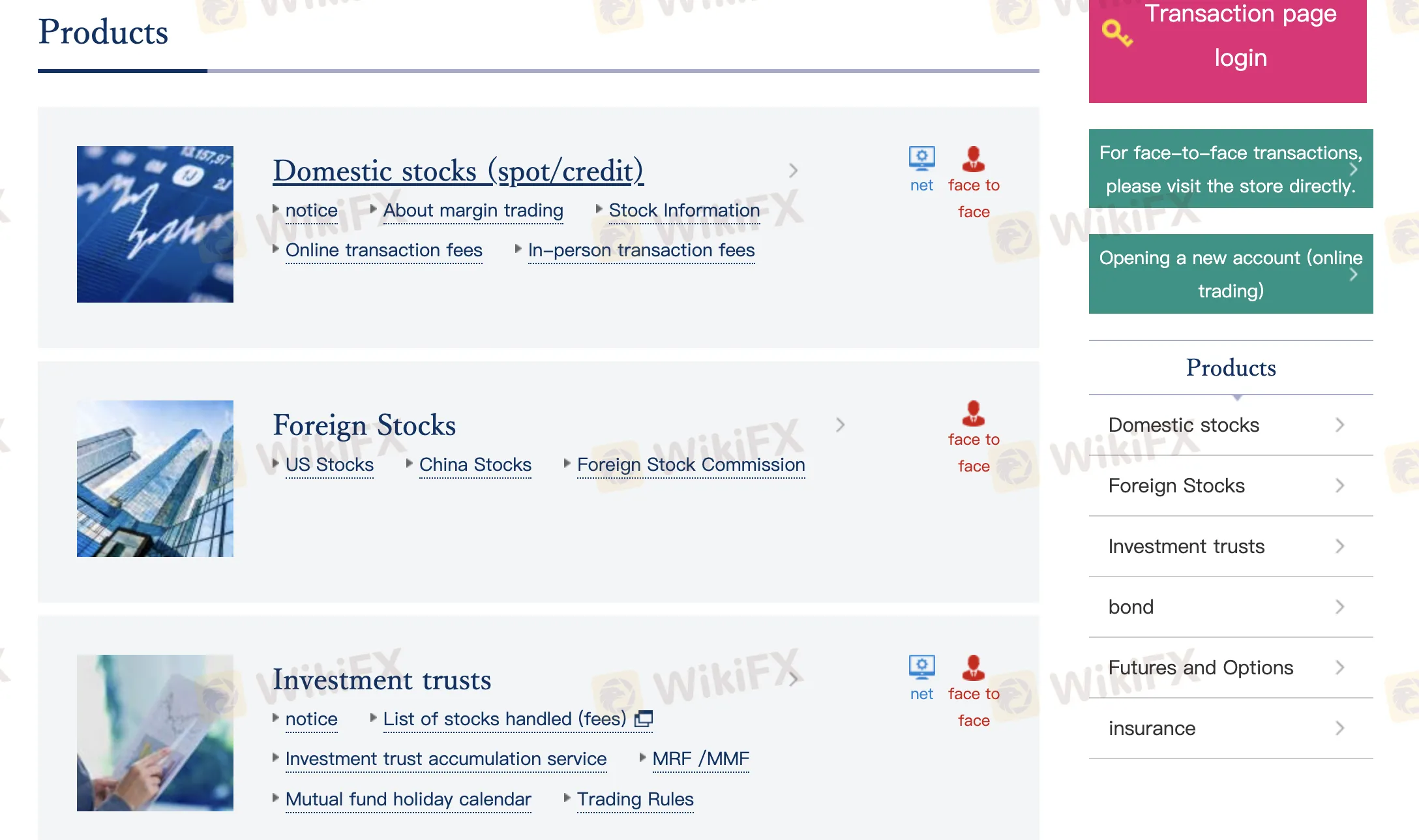

我可以在 Securities Japan 上交易什麼?

Securities Japan 提供廣泛的金融產品和服務,涵蓋國內和國際市場。其服務包括股票、投資信託、債券、期貨、期權和保險。

| 交易產品 | 支援 |

| 股票 | ✔ |

| 投資信託 | ✔ |

| 債券 | ✔ |

| 期貨 | ✔ |

| 期權 | ✔ |

| 保險 | ✔ |

| 外匯 | × |

| 大宗商品 | × |

| 指數 | × |

| 加密貨幣 | × |

| ETFs | × |

Securities Japan 費用

Securities Japan的費用一般而言比行業標準略高,尤其取決於您是在線交易、面對面交易還是通過電話交易。

| 交易費用 | 金額 |

| 在線現貨交易(<1百萬日元) | 每筆1,100日元 |

| 在線現貨交易(>1百萬日元) | 每筆1,650日元 |

| 在線保證金交易 | 每筆1,100日元 |

| 在線每日固定費率 | 每3百萬日元每日交易量2,200日元(如果每天超過30筆交易,則再加22,000日元) |

| 電話訂單(<500,000日元) | 2,750日元 |

| 電話訂單(500k–1百萬日元) | 6,050日元 |

| 電話訂單(1–5百萬日元) | 19,800日元 |

| 電話訂單(5–10百萬日元) | 42,900日元 |

| 電話訂單(10–30百萬日元) | 69,300日元 |

| 電話訂單(>30百萬日元) | 132,000日元 |

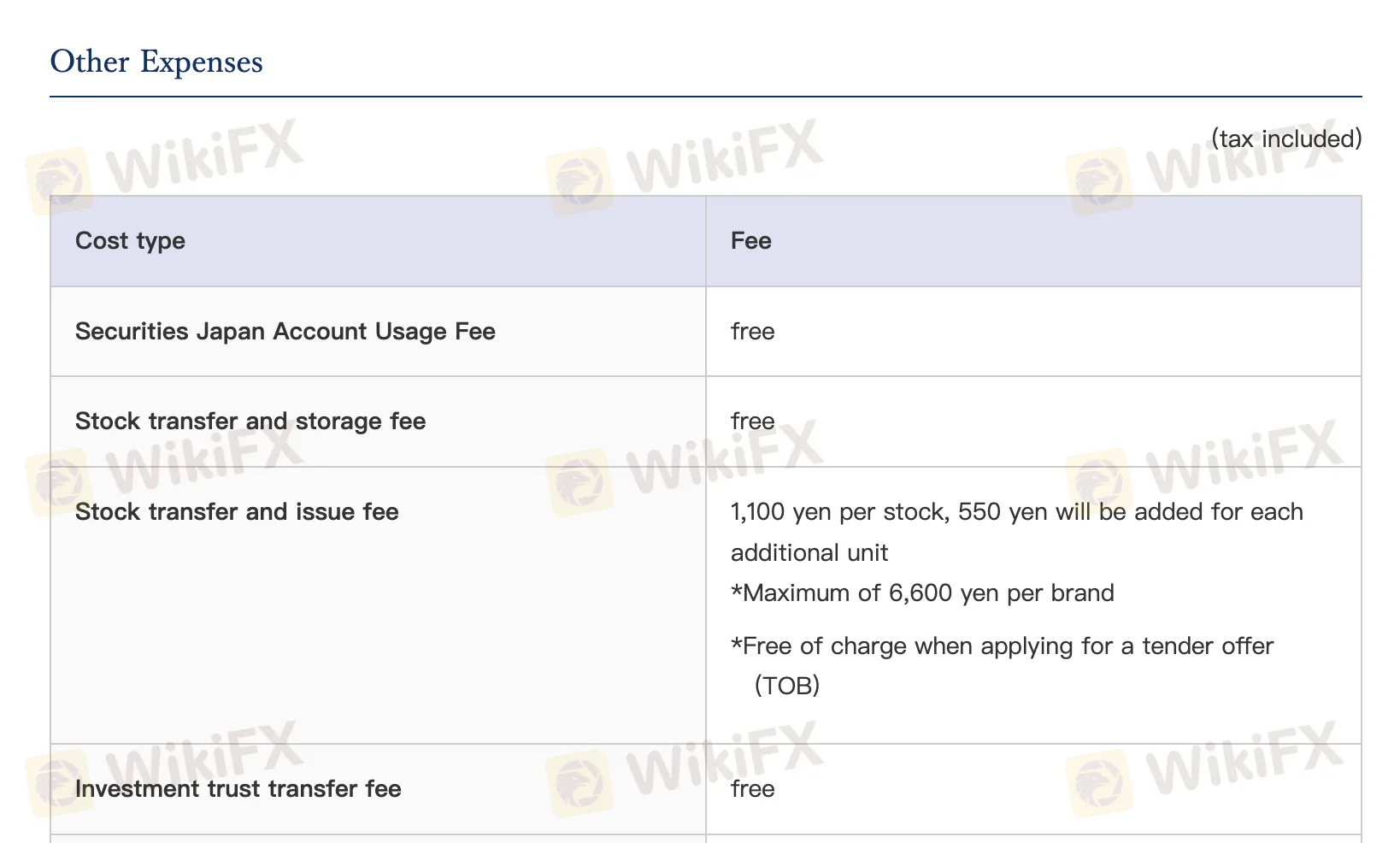

非交易費用

| 非交易費用 | 金額 |

| 帳戶使用費 | 0 |

| 股票轉移/存儲費 | 0 |

| 股票轉移/發行費 | 1,100日元 + 每額外單位550日元(最高6,600日元) |

| 投資信託轉移費 | 0 |

| 投資信託轉移/提取 | 每股3,300日元 |

| 政府債券轉移/提取 | |

| 零股購買佣金 | 合同價格 × 1.5% + 稅 |

| 零股購買佣金 | 0 |

| 存款轉移費 | 客戶支付(即時存款免費) |

| 提款轉移費 | 0 |

| 客戶帳冊副本 | 每次3,300日元 |

| 餘額證明書發行 | 每次1,100日元 |

| 年度交易報告補發 | 每次1,100日元 |

| 書面資料請求費 | 每品牌550日元 |

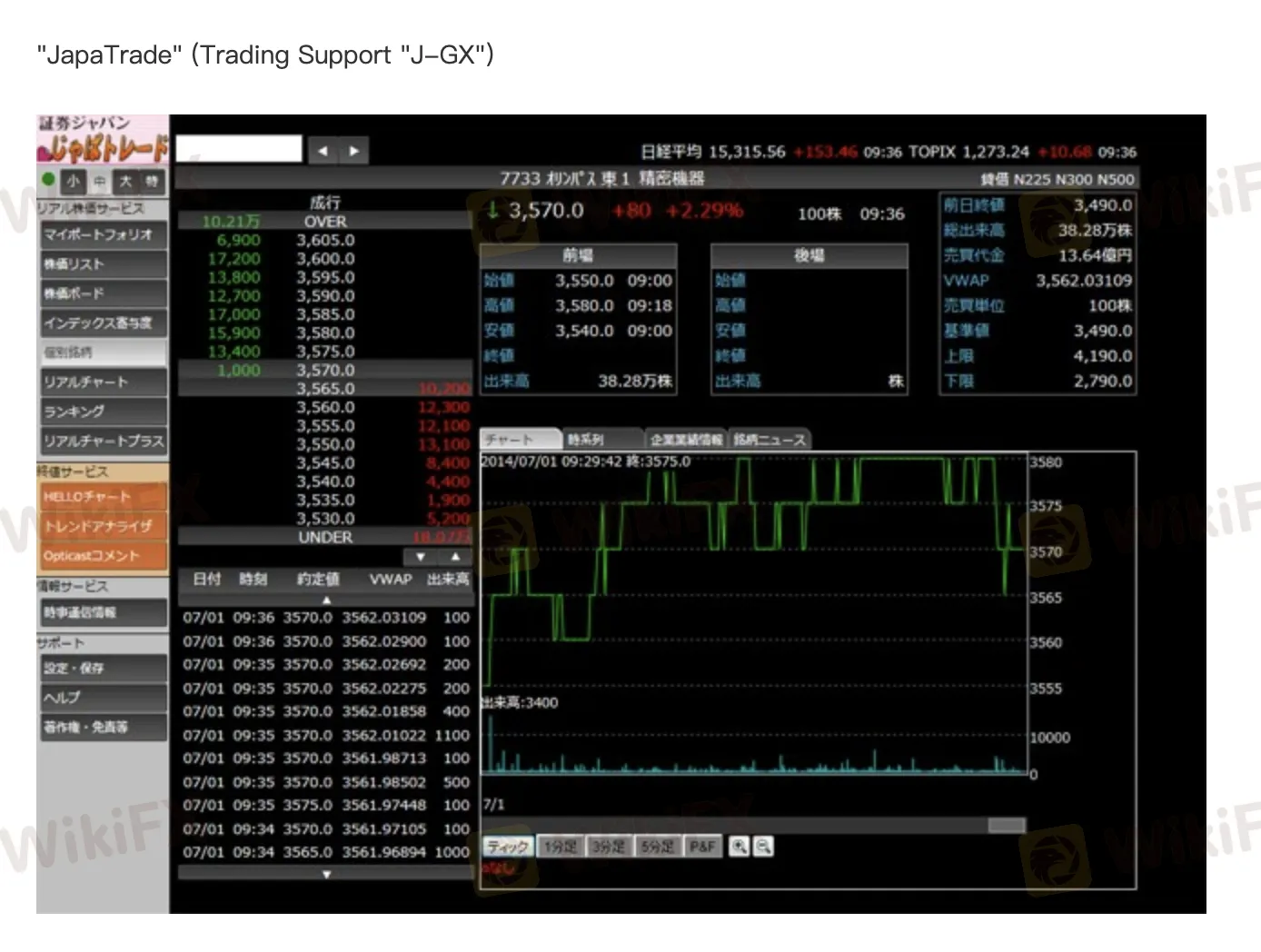

交易平台

| 交易平台 | 支援 | 可用設備 | 適合對象 |

| 在線交易 | ✔ | PC、智能手機、平板電腦 | / |

| MetaTrader 4 | ✔ | / | 初學者 |

| MetaTrader 5 | ✔ | / | 經驗豐富的交易者 |