Profil perusahaan

| Securities Japan Ringkasan Ulasan | |

| Dibentuk | 1944 |

| Negara Terdaftar | Jepang |

| Regulasi | FSA |

| Produk dan Layanan | Saham domestik & asing, trust investasi, obligasi, futures, opsi, asuransi |

| Akun Demo | / |

| Platform Perdagangan | Perdagangan Online |

| Deposit Minimum | / |

| Dukungan Pelanggan | Telepon: 03-3668-3446 |

| Email: online@secjp.co.jp | |

Informasi Securities Japan

Otoritas Jasa Keuangan Jepang mengatur dan memberikan lisensi kepada Securities Japan, yang dibentuk pada tahun 1944. Organisasi ini menjual berbagai produk keuangan, seperti saham, obligasi, trust investasi, futures, opsi, dan asuransi. Namun, biayanya bisa cukup tinggi tergantung pada jenis transaksi.

Kelebihan dan Kekurangan

| Kelebihan | Kekurangan |

| Berdiri sejak lama (sejak 1944) | Biaya sedikit lebih tinggi untuk beberapa jenis transaksi |

| Diatur oleh FSA | Tidak ada MT4/5 |

| Beragam produk termasuk asuransi | Informasi terbatas tentang deposit dan penarikan |

Apakah Securities Japan Legal?

Ya, Securities Japan diatur. Perusahaan ini memegang Lisensi Forex Ritel yang dikeluarkan oleh Otoritas Jasa Keuangan Jepang, dengan nomor lisensi 関東財務局長(金商)第170号.

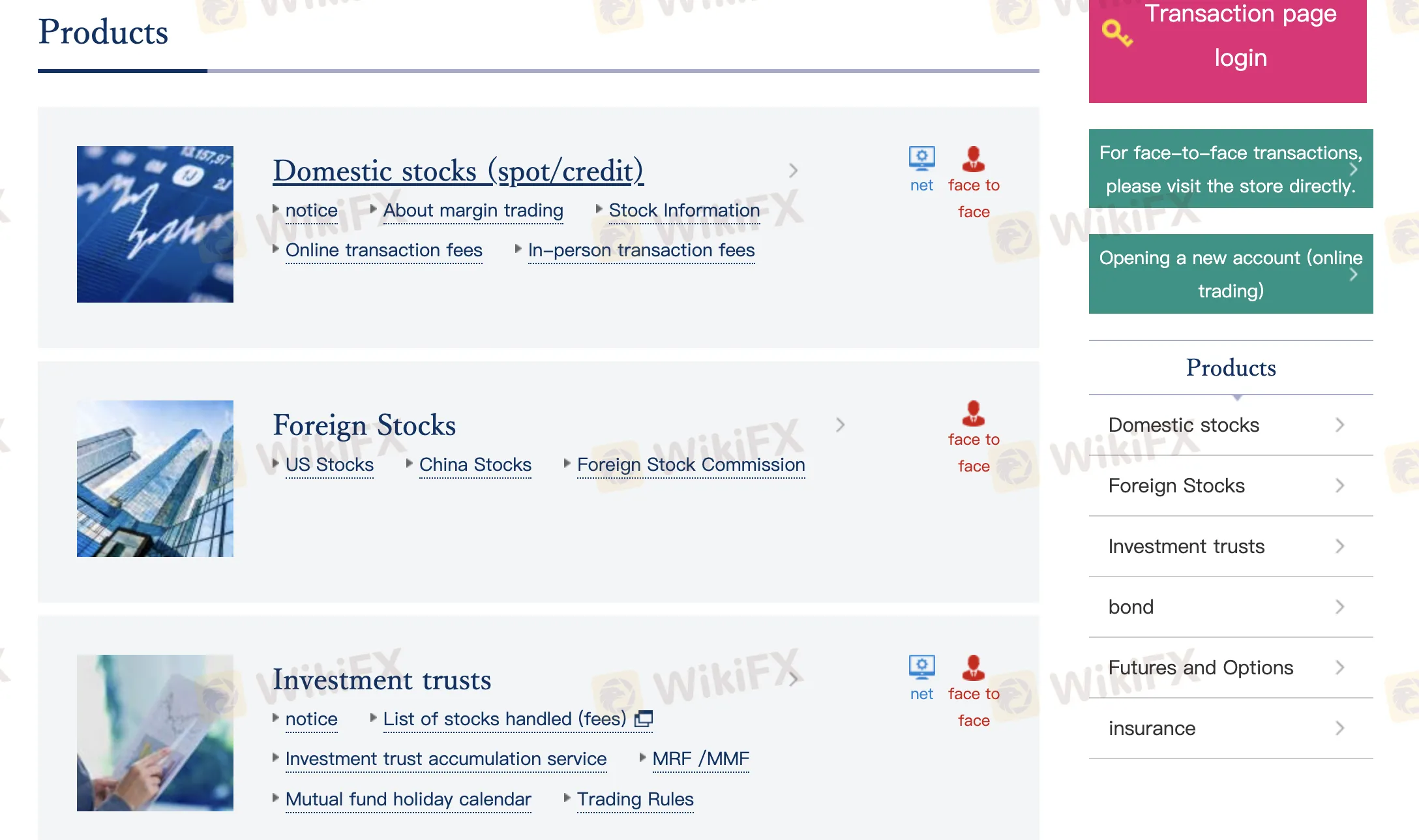

Apa yang Dapat Saya Perdagangkan di Securities Japan?

Securities Japan menawarkan beragam produk dan layanan keuangan, mencakup pasar domestik dan internasional. Layanan-layannya meliputi saham, trust investasi, obligasi, futures, opsi, dan asuransi.

| Produk Perdagangan | Didukung |

| Saham | ✔ |

| Trust Investasi | ✔ |

| Obligasi | ✔ |

| Futures | ✔ |

| Opsi | ✔ |

| Asuransi | ✔ |

| Forex | × |

| Komoditas | × |

| Indeks | × |

| Kripto | × |

| ETF | × |

Biaya Securities Japan

Biaya Securities Japan umumnya moderat hingga sedikit di atas rata-rata dibandingkan standar industri, terutama tergantung pada apakah Anda melakukan perdagangan secara online, tatap muka, atau melalui telepon.

| Biaya Perdagangan | Jumlah |

| Perdagangan Spot Online (<1 juta yen) | 1.100 yen per transaksi |

| Perdagangan Spot Online (>1 juta yen) | 1.650 yen per transaksi |

| Perdagangan Margin Online | 1.100 yen per transaksi |

| Biaya Tetap Harian Online | 2.200 yen per volume harian 3 juta yen (+22.000 yen jika lebih dari 30 perdagangan/hari) |

| Pemesanan Telepon (<500.000 yen) | 2.750 yen |

| Pemesanan Telepon (500k–1 juta yen) | 6.050 yen |

| Pemesanan Telepon (1–5 juta yen) | 19.800 yen |

| Pemesanan Telepon (5–10 juta yen) | 42.900 yen |

| Pemesanan Telepon (10–30 juta yen) | 69.300 yen |

| Pemesanan Telepon (>30 juta yen) | 132.000 yen |

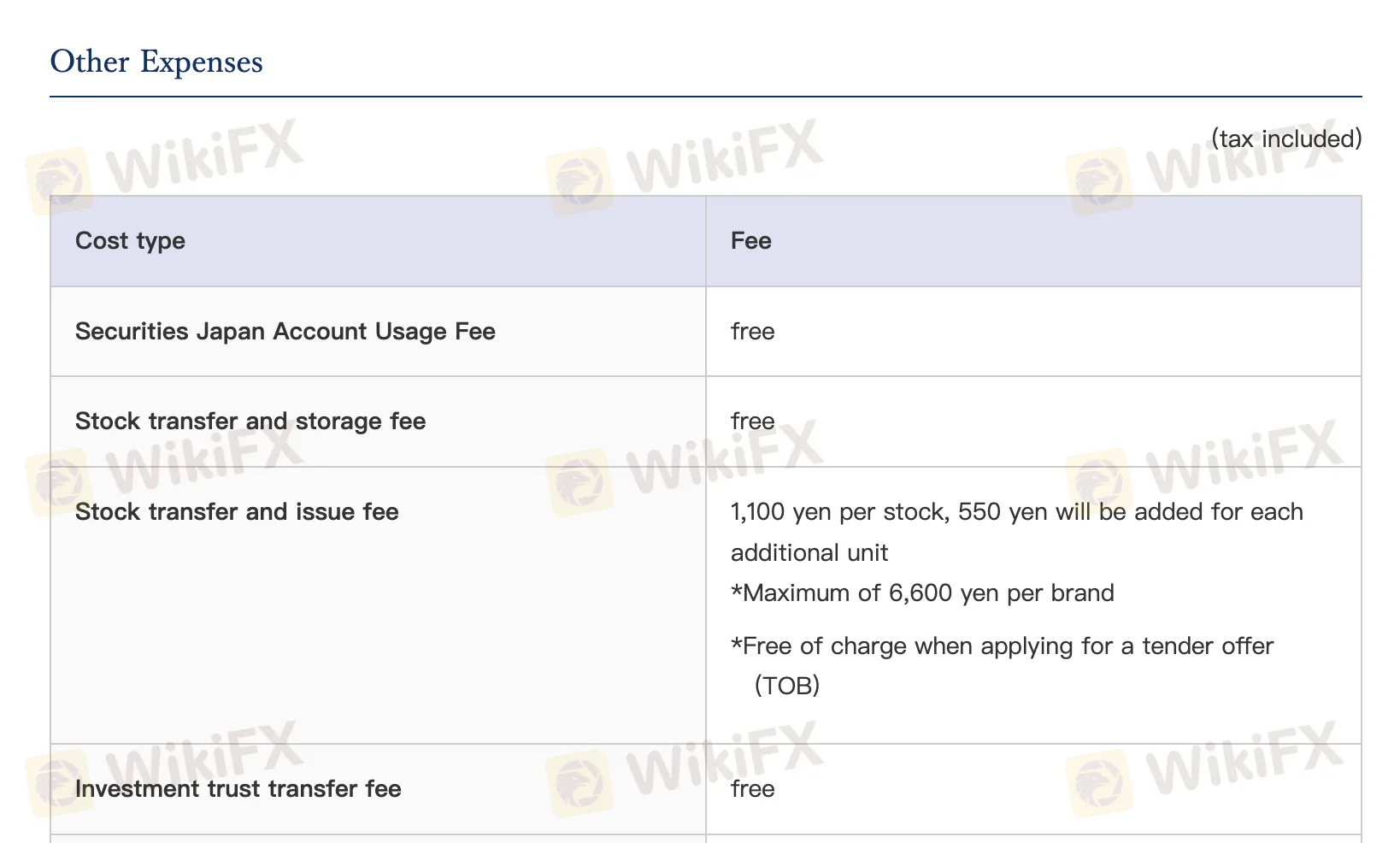

Biaya Non-Penjualan

| Biaya Non-Penjualan | Jumlah |

| Biaya Penggunaan Akun | 0 |

| Biaya Transfer/Penyimpanan Saham | 0 |

| Biaya Transfer/Penerbitan Saham | 1.100 yen + 550 yen per unit tambahan (maks. 6.600 yen) |

| Biaya Transfer Dana Investasi | 0 |

| Biaya Transfer/Penarikan Dana Investasi | 3.300 yen per saham |

| Biaya Transfer/Penarikan Obligasi Pemerintah | |

| Komisi Pembelian Saham Lot Ganjil | Harga kontrak × 1,5% + pajak |

| Biaya Pialang untuk Pembelian Lot Ganjil | 0 |

| Biaya Transfer Deposit | Pelanggan membayar (tanpa biaya untuk deposit instan) |

| Biaya Transfer Penarikan | 0 |

| Salinan Buku Besar Pelanggan | 3.300 yen per sesi |

| Penerbitan Sertifikat Saldo | 1.100 yen per sesi |

| Penerbitan Laporan Transaksi Tahunan | 1.100 yen per sesi |

| Biaya Permintaan Materi Tulisan | 550 yen per merek |

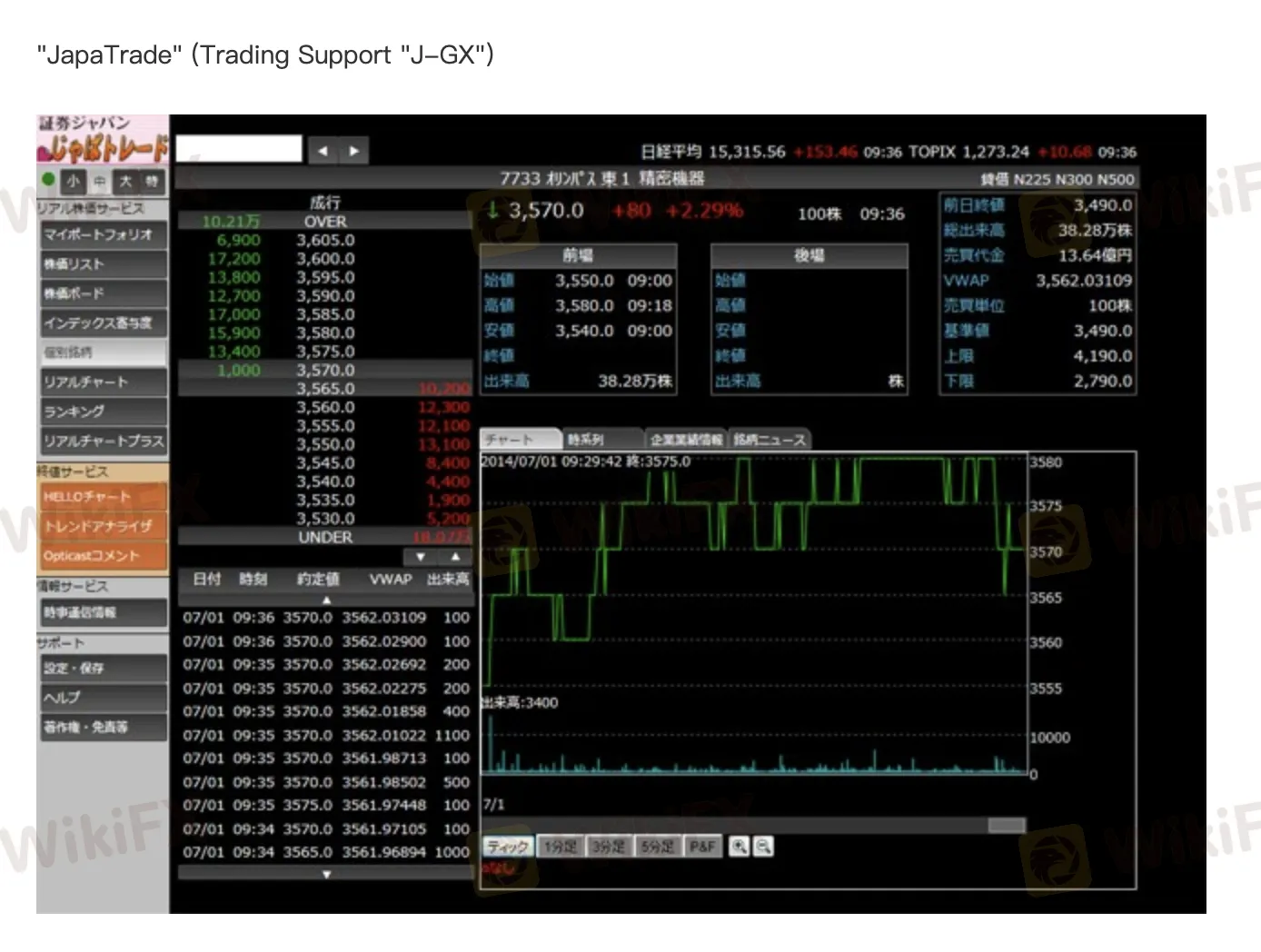

Platform Perdagangan

| Platform Perdagangan | Dukungan | Perangkat Tersedia | Cocok untuk |

| Perdagangan Online | ✔ | PC, Smartphone, Tablet | / |

| MetaTrader 4 | ✔ | / | Pemula |

| MetaTrader 5 | ✔ | / | Trader berpengalaman |