Buod ng kumpanya

| Securities Japan Buod ng Pagsusuri | |

| Itinatag | 1944 |

| Rehistradong Bansa | Hapon |

| Regulasyon | FSA |

| Mga Produkto at Serbisyo | Domestic & foreign stocks, investment trusts, bonds, futures, options, insurance |

| Demo Account | / |

| Platform ng Paggawa ng Kalakalan | Online Trading |

| Minimum na Deposito | / |

| Suporta sa Customer | Telepono: 03-3668-3446 |

| Email: online@secjp.co.jp | |

Impormasyon Tungkol sa Securities Japan

Ang Financial Services Agency ng Hapon ang nagreregula at naglilisensya sa Securities Japan, na itinatag noong 1944. Ang organisasyon ay nagbebenta ng iba't ibang mga produkto sa pananalapi, tulad ng mga stocks, bonds, investment trusts, futures, options, at insurance. Gayunpaman, maaaring mataas ang mga bayarin nito depende sa uri ng transaksyon.

Mga Kalamangan at Disadvantages

| Kalamangan | Disadvantages |

| Matagal nang itinatag (mula 1944) | Medyo mataas na bayarin para sa ilang uri ng transaksyon |

| Regulado ng FSA | Walang MT4/5 |

| Malawak na hanay ng mga produkto kasama ang insurance | Limitadong impormasyon tungkol sa deposito at pag-withdraw |

Tunay ba ang Securities Japan?

Oo, ang Securities Japan ay isang regulado. May Retail Forex License ito na inisyu ng Financial Services Agency ng Hapon, sa ilalim ng lisensyang numero 関東財務局長(金商)第170号.

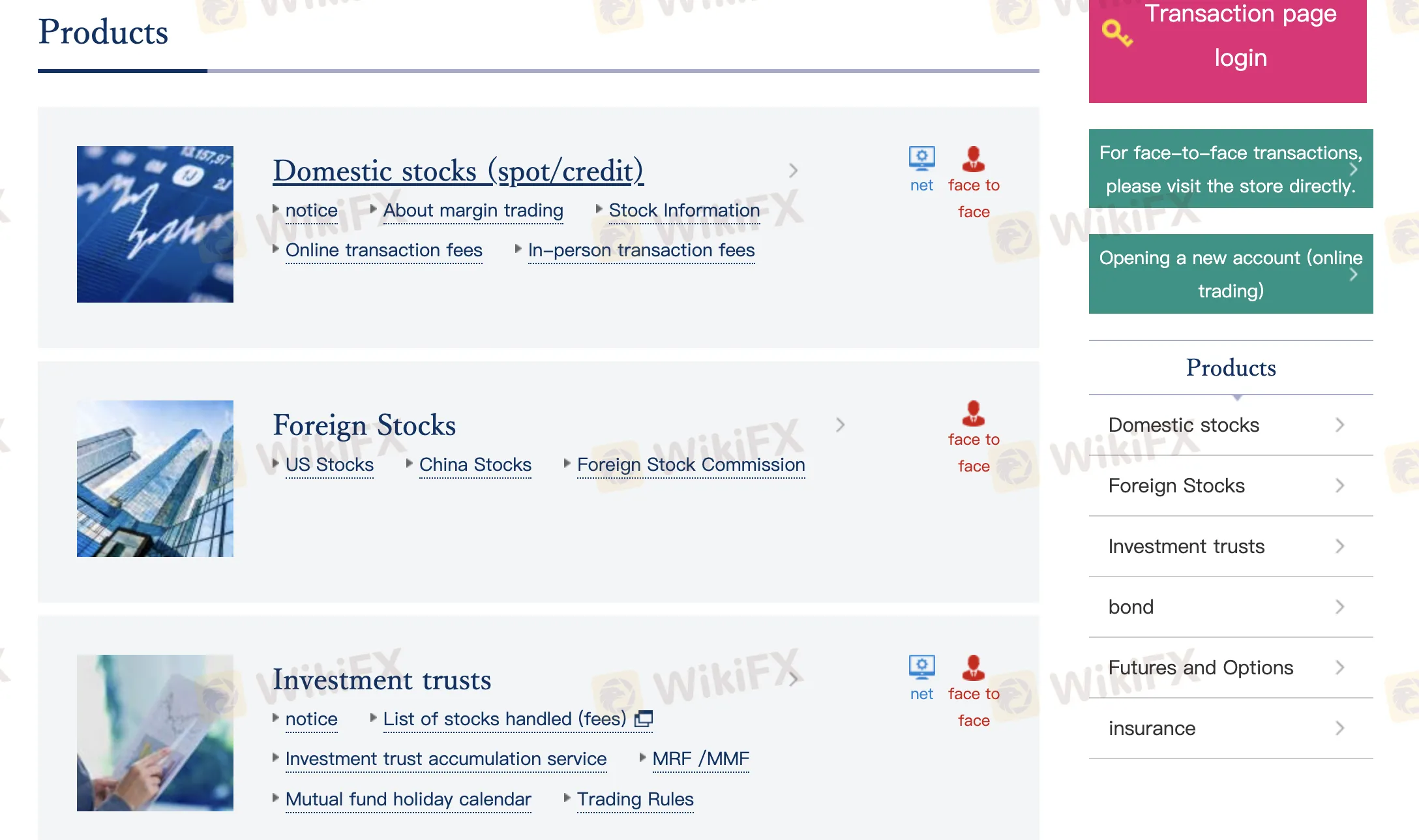

Ano ang Maaari Kong I-trade sa Securities Japan?

Nag-aalok ang Securities Japan ng malawak na hanay ng mga produkto at serbisyo sa pananalapi, saklaw ang domestic at international markets. Kasama sa kanilang mga serbisyo ang mga stocks, investment trusts, bonds, futures, options, at insurance.

| Mga Produkto sa Kalakalan | Supported |

| Stocks | ✔ |

| Investment Trusts | ✔ |

| Bonds | ✔ |

| Futures | ✔ |

| Options | ✔ |

| Insurance | ✔ |

| Forex | × |

| Commodities | × |

| Indices | × |

| Cryptocurrencies | × |

| ETFs | × |

Mga Bayarin sa Securities Japan

Ang mga bayad ng Securities Japan ay karaniwang katamtaman hanggang medyo mas mataas kaysa sa pamantayan ng industriya, lalo na depende sa kung ikaw ay nagtetrade online, harap-harapan, o sa telepono.

| Mga Bayad sa Paghahalal | Halaga |

| Online Spot Trading (<1 milyong yen) | 1,100 yen bawat transaksyon |

| Online Spot Trading (>1 milyong yen) | 1,650 yen bawat transaksyon |

| Online Margin Trading | 1,100 yen bawat transaksyon |

| Online Daily Flat Rate | 2,200 yen bawat 3 milyong yen na araw-araw na dami ng transaksyon (+22,000 yen kung lampas sa 30 trades/day) |

| Phone Orders (<500,000 yen) | 2,750 yen |

| Phone Orders (500k–1 milyong yen) | 6,050 yen |

| Phone Orders (1–5 milyong yen) | 19,800 yen |

| Phone Orders (5–10 milyong yen) | 42,900 yen |

| Phone Orders (10–30 milyong yen) | 69,300 yen |

| Phone Orders (>30 milyong yen) | 132,000 yen |

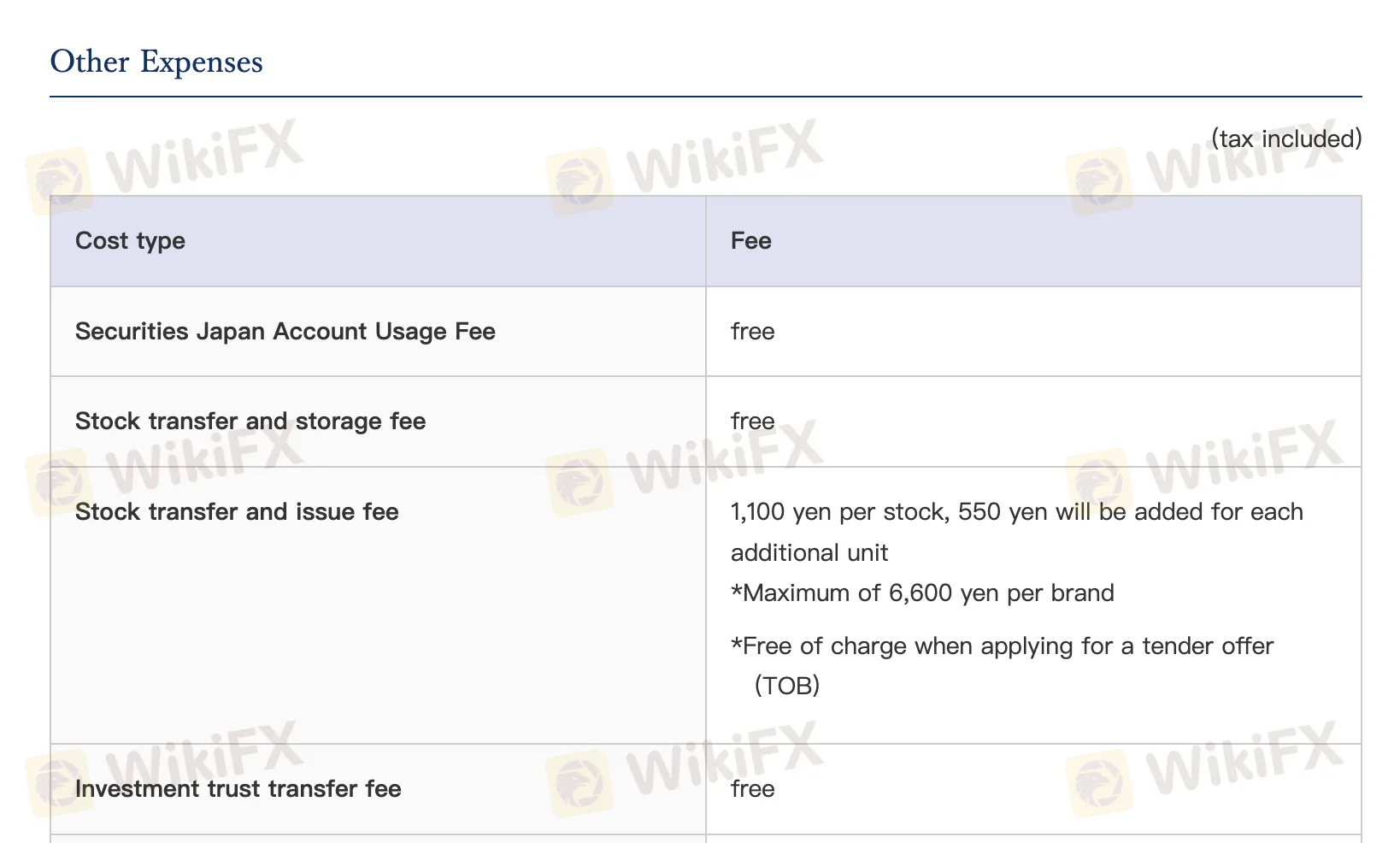

Mga Bayad sa Hindi Paghahalal

| Mga Bayad sa Hindi Paghahalal | Halaga |

| Bayad sa Paggamit ng Account | 0 |

| Bayad sa Paglipat/Storage ng Stock | 0 |

| Bayad sa Paglipat/Issue ng Stock | 1,100 yen + 550 yen bawat karagdagang unit (max 6,600 yen) |

| Bayad sa Paglipat ng Investment Trust | 0 |

| Bayad sa Paglipat/Withdrawal ng Investment Trust | 3,300 yen bawat stock |

| Bayad sa Paglipat/Withdrawal ng Government Bonds | |

| Odd Lot Share Purchase Commission | Halaga ng kontrata × 1.5% + buwis |

| Brokerage Fee para sa Odd Lot Purchase | 0 |

| Bayad sa Paglipat ng Deposit | Bayad ng customer (walang bayad para sa instant deposit) |

| Bayad sa Pag-withdraw | 0 |

| Customer Ledger Copy | 3,300 yen bawat sesyon |

| Sertipiko ng Balanse ng Customer | 1,100 yen bawat sesyon |

| Pagpapalabas ng Taunang Ulat sa Transaksyon | 1,100 yen bawat sesyon |

| Bayad sa Paghingi ng Mga Materyales | 550 yen bawat brand |

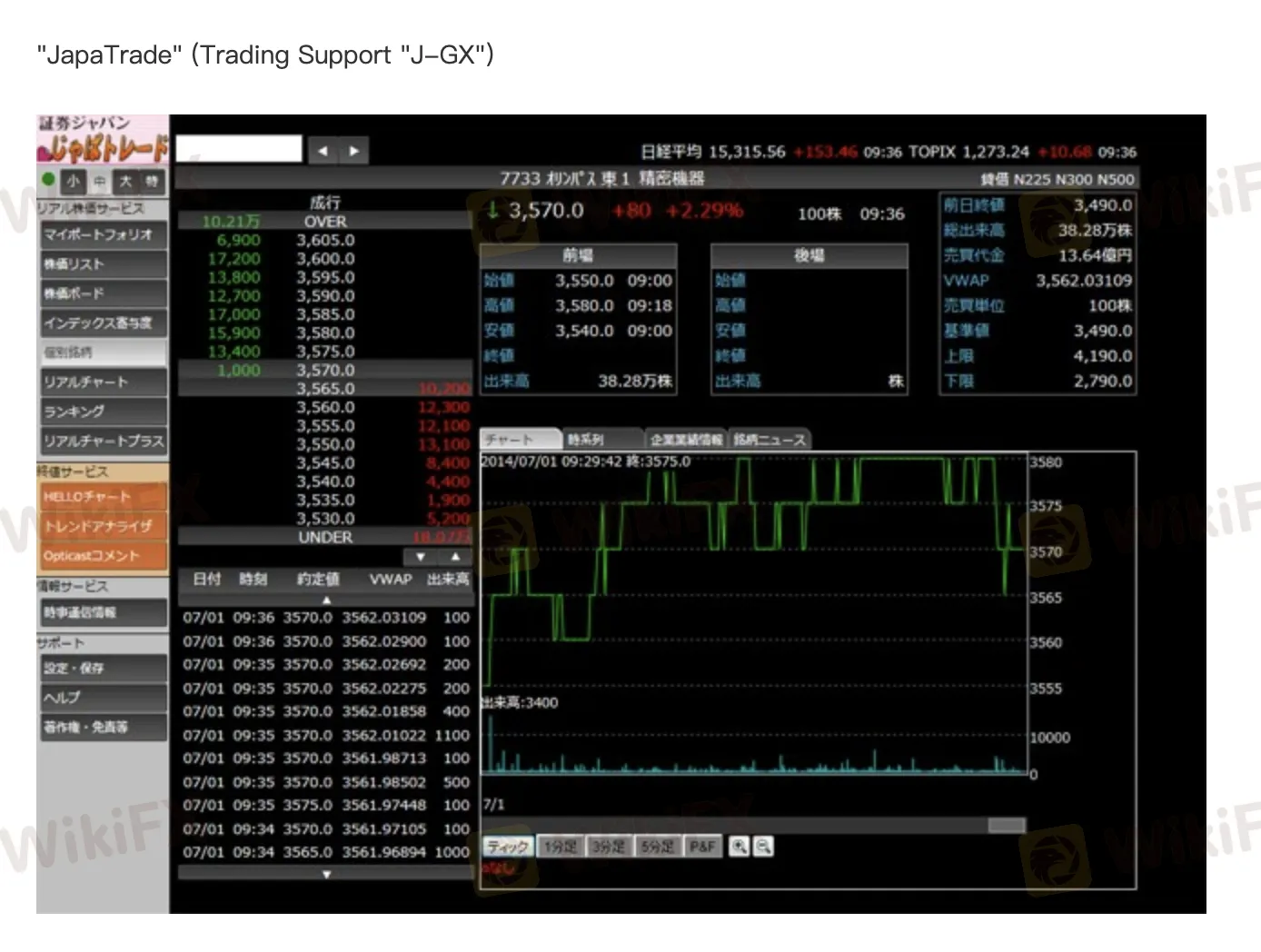

Platform ng Paghahalal

| Platform ng Paghahalal | Supported | Available Devices | Angkop para sa |

| Online Trading | ✔ | PC, Smartphone, Tablet | / |

| MetaTrader 4 | ✔ | / | Mga Baguhan |

| MetaTrader 5 | ✔ | / | Mga may karanasan na trader |