公司簡介

| Shikoku 綜述 | |

| 成立年份 | 2002 |

| 註冊國家/地區 | 日本 |

| 監管 | 受日本金融廳監管 |

| 市場工具 | 投資信託、股票、債券、外匯、商品 |

| 模擬帳戶 | / |

| EUR/USD 差價 | 從 10 - 75 sen |

| 交易平台 | Web Trader |

| 客戶支援 | 電話:089-921-5200 |

| 地址:愛媛縣松山市三番町5-10-1 | |

Shikoku 資訊

Shikoku 是一家成立於2002年的日本經紀商,受日本金融廳監管。它提供多元化的市場工具,例如:投資信託、股票、債券、外匯和商品。

優缺點

| 優點 | 缺點 |

| 受日本金融廳監管 | 聯絡途徑有限 |

| 多樣化的交易資產 | 不支援MT4和MT5 cTrader |

| 長時間運作 | 沒有模擬帳戶 |

| 收取各種費用 |

Shikoku 是否合法?

Shikoku 受日本金融廳監管,根據Shikoku,牌照號碼為四國財務局長(金商)第21號。

| 監管狀態 | 監管機構 | 牌照機構 | 牌照類型 | 牌照號碼 |

| 受監管 | 日本金融廳 | Shikoku | 零售外匯牌照 | 四國財務局長(金商)第21號 |

WikiFX 實地調查

WikiFX 地勘團隊訪問了 Shikoku 的日本地址,我們在現場找到了該公司的辦公室,這意味著該公司設有實體辦公室。

我可以在 Shikoku 交易什麼?

| 交易工具 | 支援 |

| 投資信託 | ✔ |

| 股票 | ✔ |

| 債券 | ✔ |

| 外匯 | ✔ |

| 大宗商品 | ✔ |

| 指數 | ❌ |

| 加密貨幣 | ❌ |

| 期權 | ❌ |

| 交易所交易基金 | ❌ |

Shikoku 費用

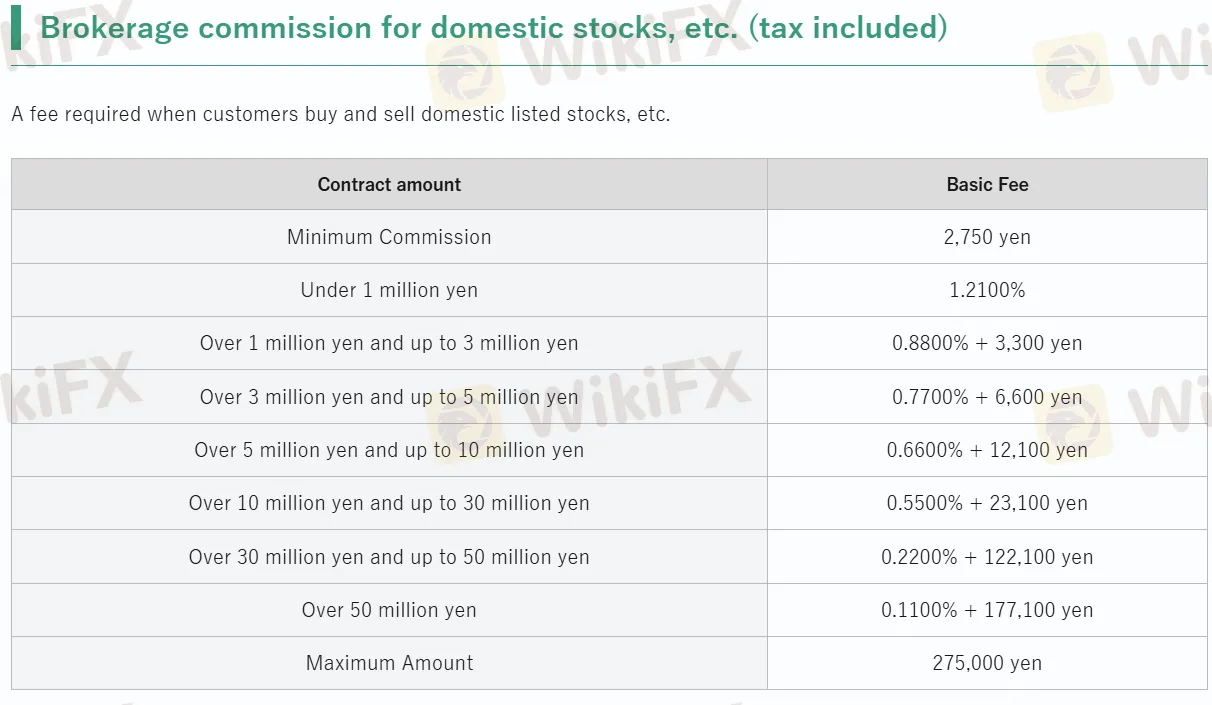

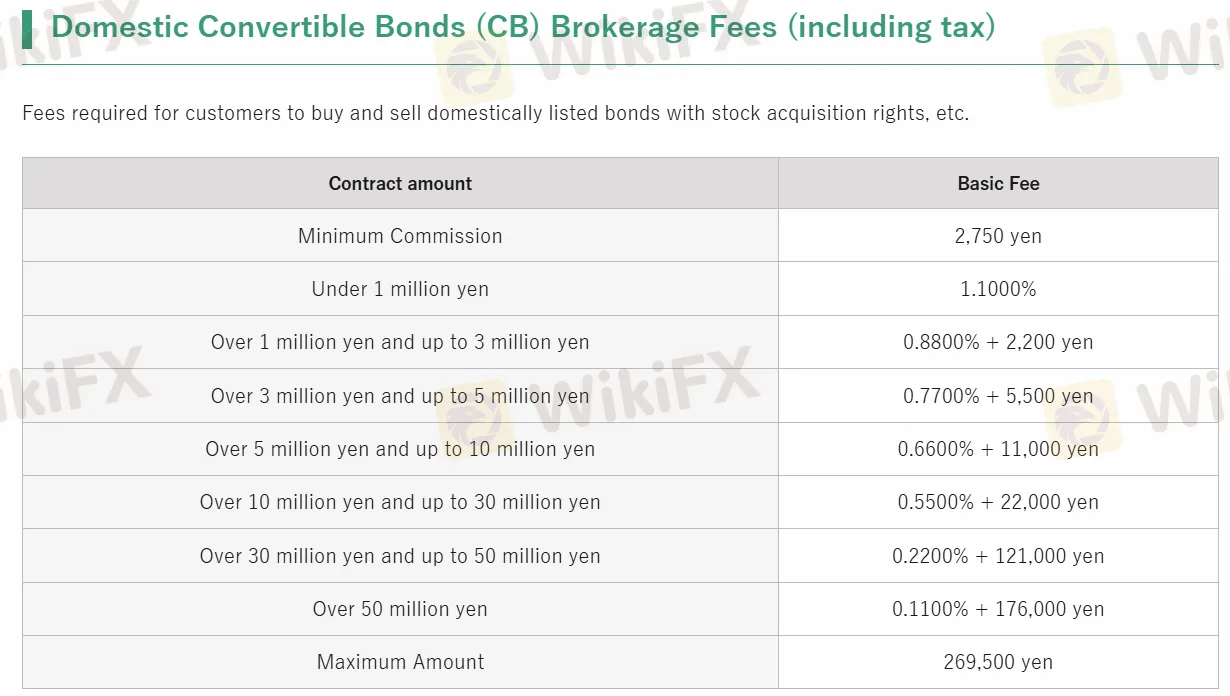

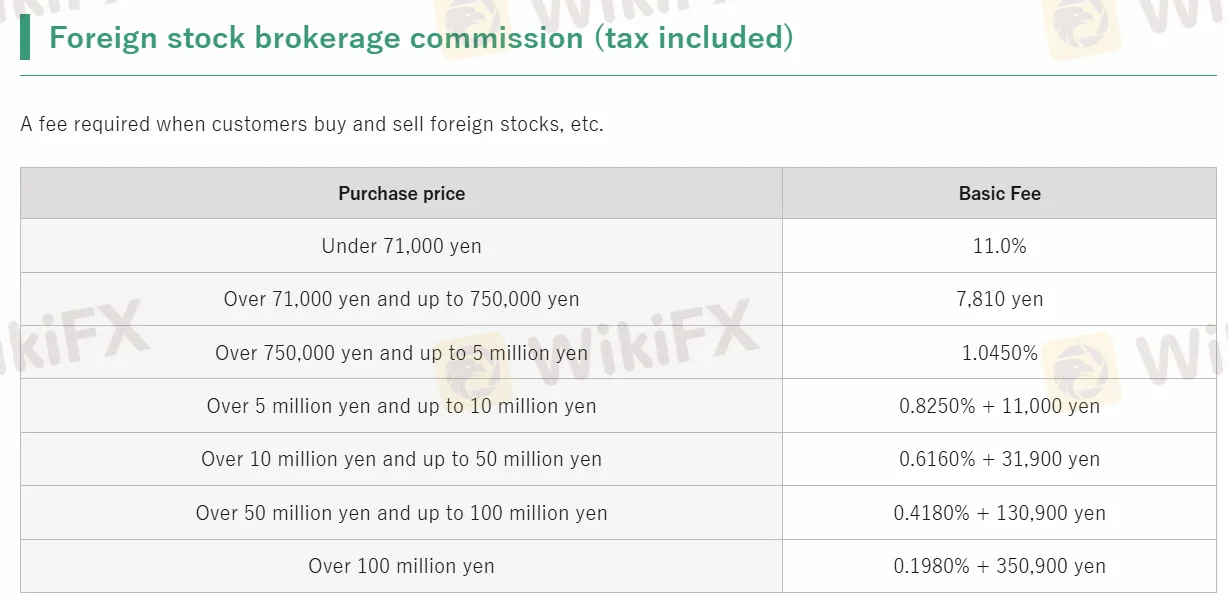

| 服務類型 | 基本費用 |

| 國內股票經紀 | JPY 2,750 - 275,000 |

| 國內可轉換債券交易經紀 | JPY 2,750 - 269,500 |

| 外國股票經紀 | 0.1980% - 11% |

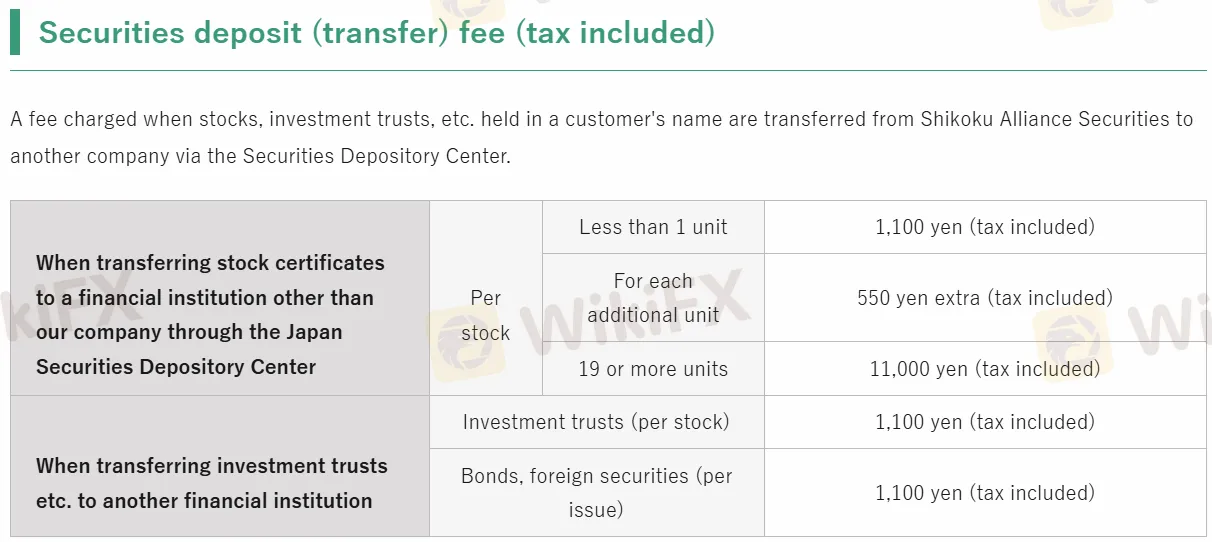

| 證券存款 | JPY 550 - 11,000 |

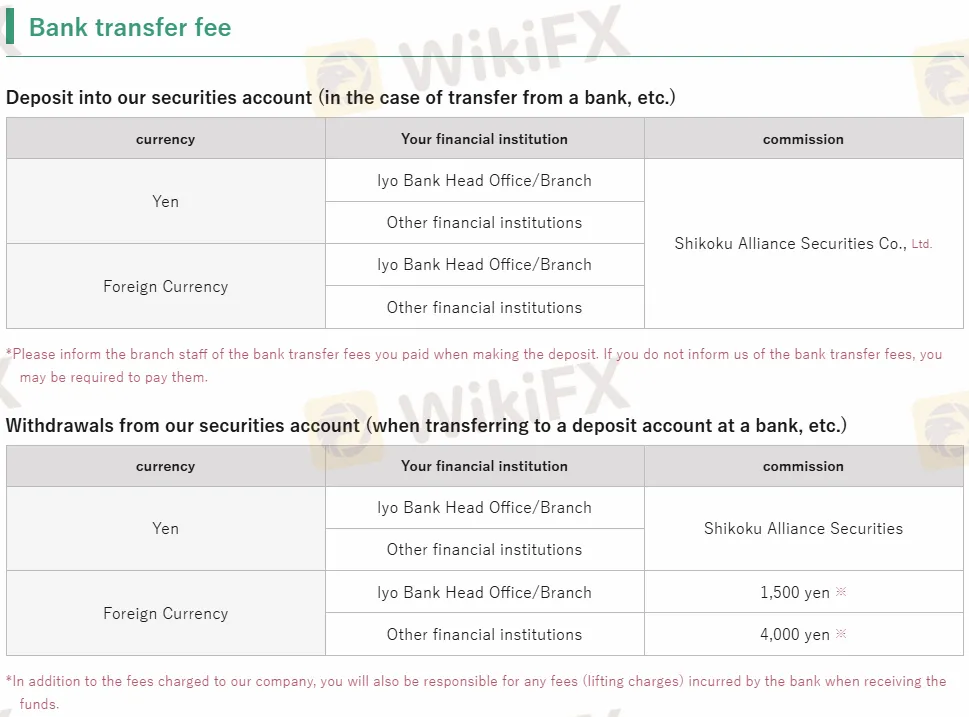

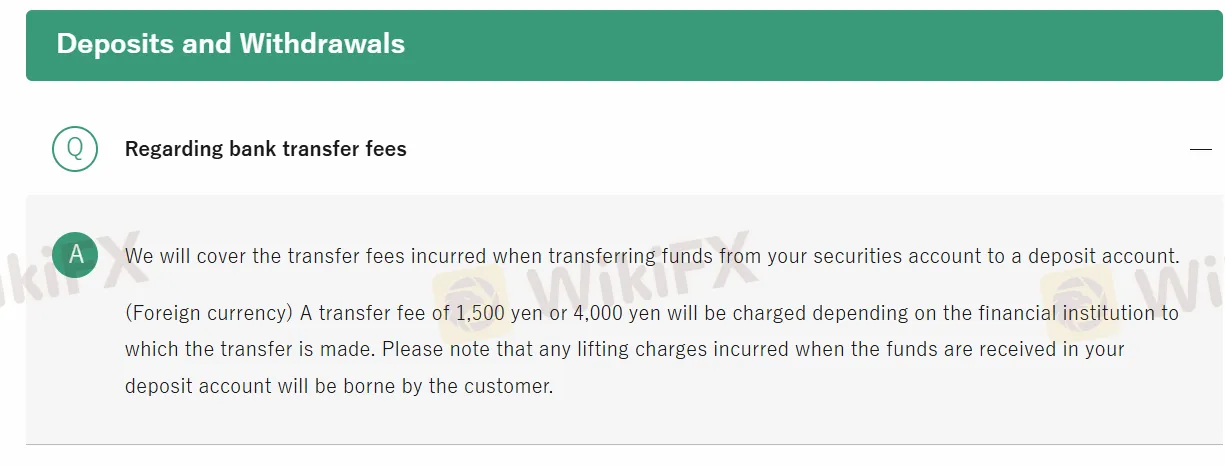

| 銀行轉帳費 | JPY 0 - 4,000 |

交易平台

| 交易平台 | 支援 | 可用設備 | 適合對象 |

| Web Trader | ✔ | Web | / |

| MT4 | ❌ | / | 初學者 |

| MT5 | ❌ | / | 經驗豐富的交易者 |

存款和提款

| 最低金額 | 銀行轉帳費 | 處理時間 | |

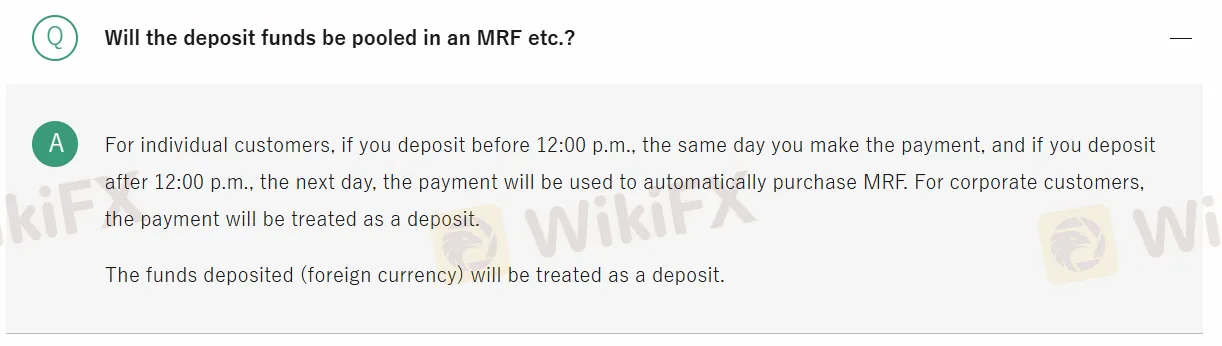

| 存款 | / | JPY 0 - 4,000 | 24小時內 |

| 提款 | / | / |

within

哥倫比亞

目前為止,我覺得四國是一家合格的公司,如果你需要的話,我覺得可以是你的選擇!各種交易條件合理,最重要的是不是非法公司,不會騙你的錢。

好評

文章

香港

我習慣在四國投資信託,我的經驗很棒!雖然出現了這麼多新經紀人,但無論如何,我更願意選擇有經驗的經紀人。

好評

FX1015868943

香港

有人說四國是投資各種股票交易的好平台。有沒有人願意告訴我它的收費是多少?我發了一個詢問,但沒有人回答我...

中評

FX1022619685

香港

它的網站設計不是我喜歡的,很難找到你想要關注的東西。有人找到這個了嗎?它可能更適合日本投資者。對我來說,我會找一些經紀人讓我感覺舒服……

中評