Resumo da empresa

| Shikoku Resumo da Revisão | |

| Fundação | 2002 |

| País/Região Registrada | Japão |

| Regulação | Regulado pela FSA (Japão) |

| Instrumentos de Mercado | Trustes de Investimento, Ações, Obrigações, Forex, Commodities |

| Conta Demonstrativa | / |

| Spread EUR/USD | de 10 a 75 sen |

| Plataforma de Negociação | Web Trader |

| Suporte ao Cliente | Tel: 089-921-5200 |

| Endereço: Prefeitura de Ehime, Cidade de Matsuyama, Sanbancho 5-10-1 | |

Informações sobre Shikoku

Shikoku é uma corretora com sede no Japão fundada em 2002, regulamentada pela FSA. Oferece uma ampla gama de instrumentos de mercado, como: Trustes de Investimento, Ações, Obrigações, Forex e Commodities.

Prós e Contras

| Prós | Contras |

| Regulado pela FSA | Canais de contato limitados |

| Diversos ativos de negociação | Sem suporte para MT4 e MT5 cTrader |

| Tempo de operação longo | Contas demo não disponíveis |

| Diversas taxas cobradas |

Shikoku é Legítimo?

Shikoku é regulado pela Agência de Serviços Financeiros (FSA), sob Shikoku, com número de licença 四国財務局長(金商)第21号.

| Status Regulatório | Regulado Por | Instituição Licenciada | Tipo de Licença | Número de Licença |

| Regulado | Agência de Serviços Financeiros (FSA) | Shikoku | Licença de Forex de Varejo | 四国財務局長(金商)第21号 |

Pesquisa de Campo WikiFX

A equipe de pesquisa de campo do WikiFX visitou o endereço da Shikoku no Japão e encontramos seu escritório no local, o que significa que a empresa opera com um escritório físico.

O que posso negociar na Shikoku?

| Instrumentos de Negociação | Suportado |

| Trustes de Investimento | ✔ |

| Ações | ✔ |

| Obrigações | ✔ |

| Forex | ✔ |

| Commodities | ✔ |

| Índices | ❌ |

| Criptomoedas | ❌ |

| Opções | ❌ |

| ETFs | ❌ |

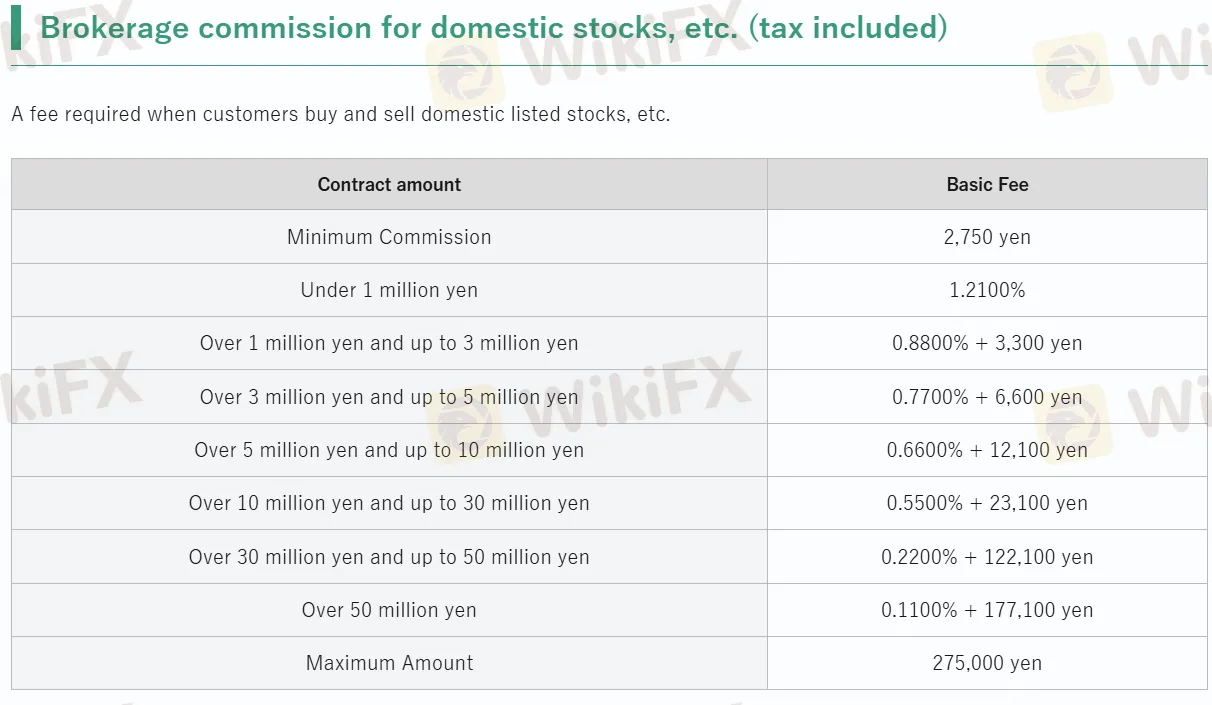

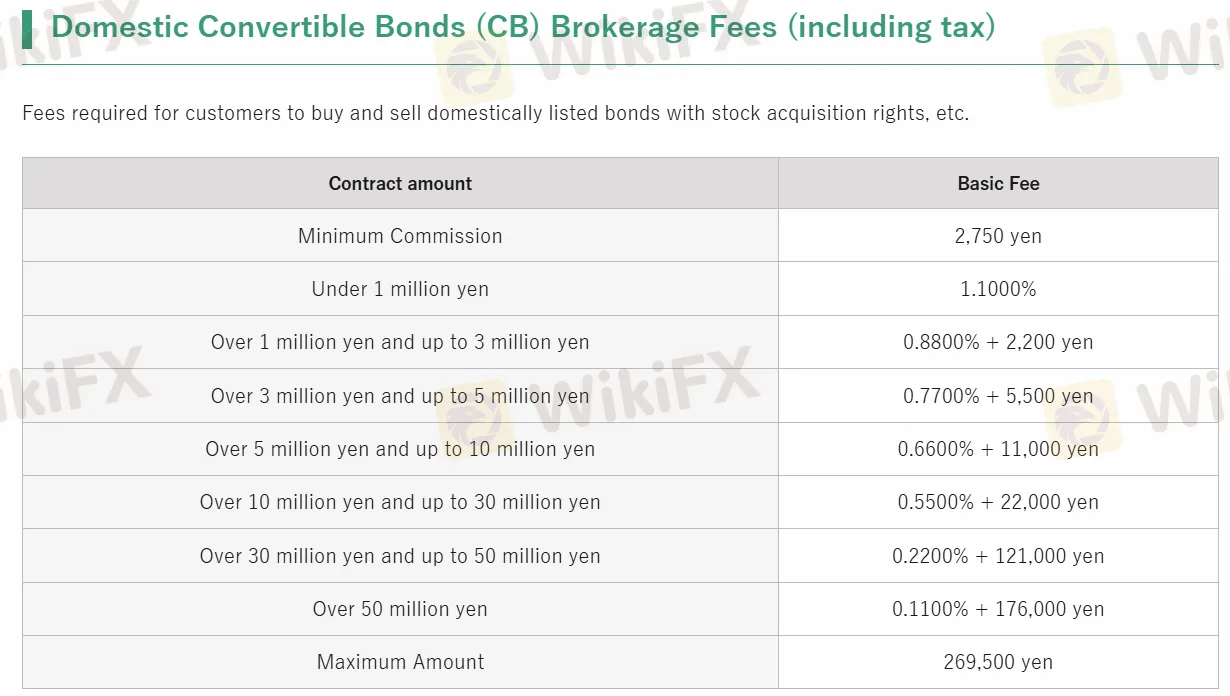

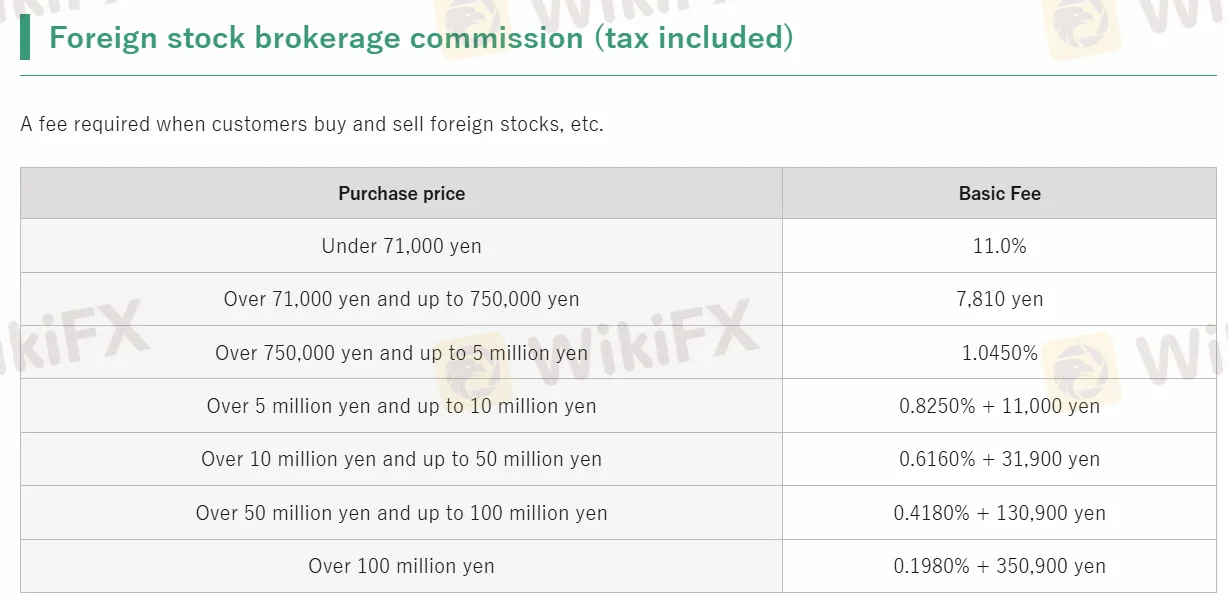

Taxas da Shikoku

| Tipo de Serviço | Taxa Básica |

| Corretagem de Ações Domésticas | JPY 2,750 - 275,000 |

| Corretagem de Títulos Conversíveis Domésticos | JPY 2,750 - 269,500 |

| Corretagem de Ações Estrangeiras | 0.1980% - 11% |

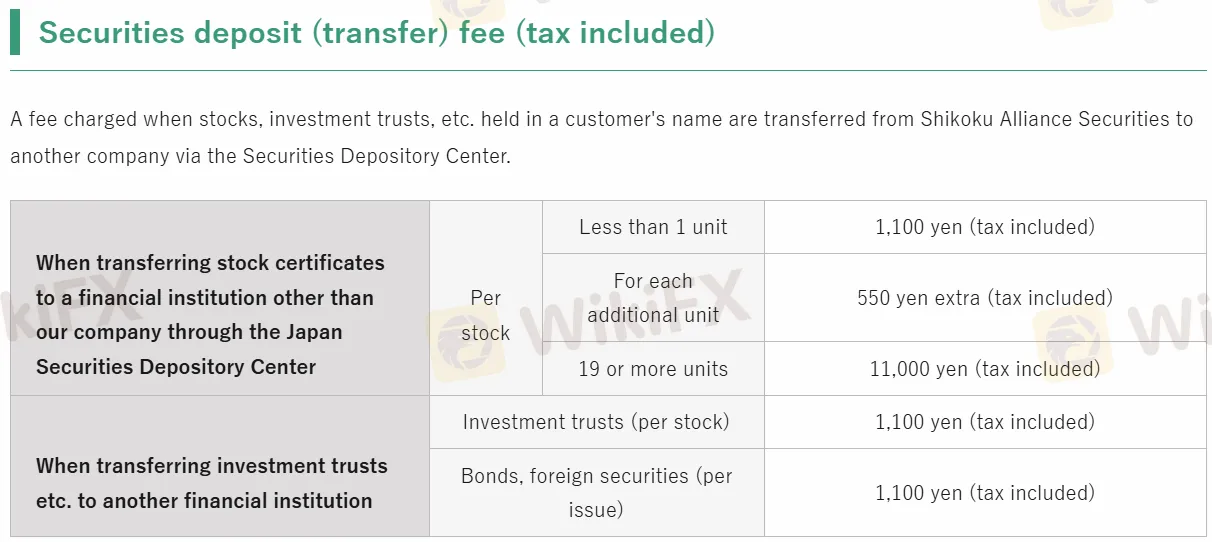

| Depósitos de Títulos | JPY 550 - 11,000 |

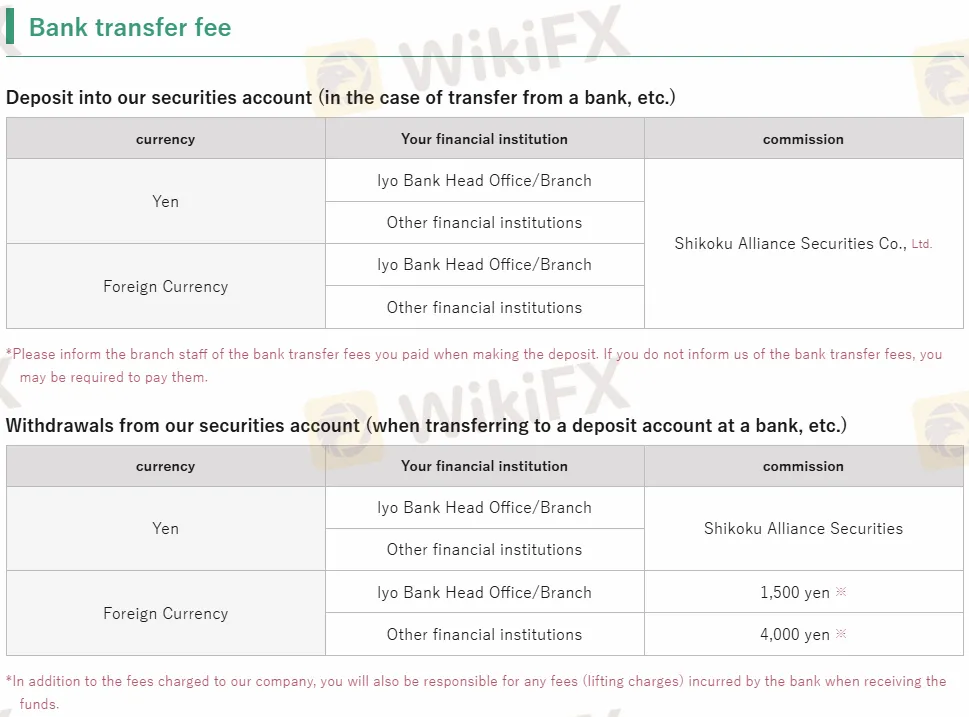

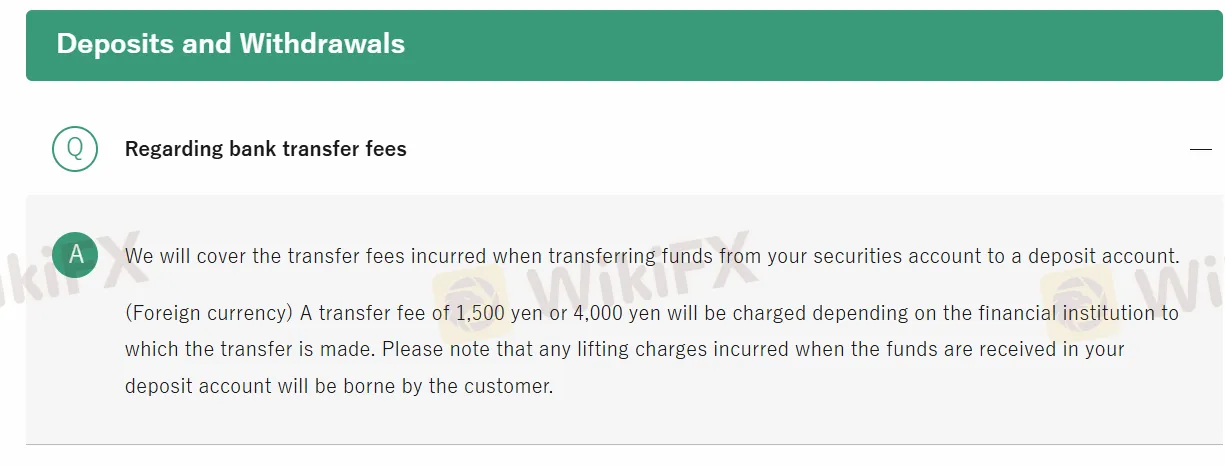

| Taxa de Transferência Bancária | JPY 0 - 4,000 |

Plataforma de Negociação

| Plataforma de Negociação | Suportado | Dispositivos Disponíveis | Adequado para |

| Web Trader | ✔ | Web | / |

| MT4 | ❌ | / | Iniciantes |

| MT5 | ❌ | / | Traders experientes |

Depósito e Saque

| Valor Mínimo | Taxa de Transferência Bancária | Tempo de Processamento | |

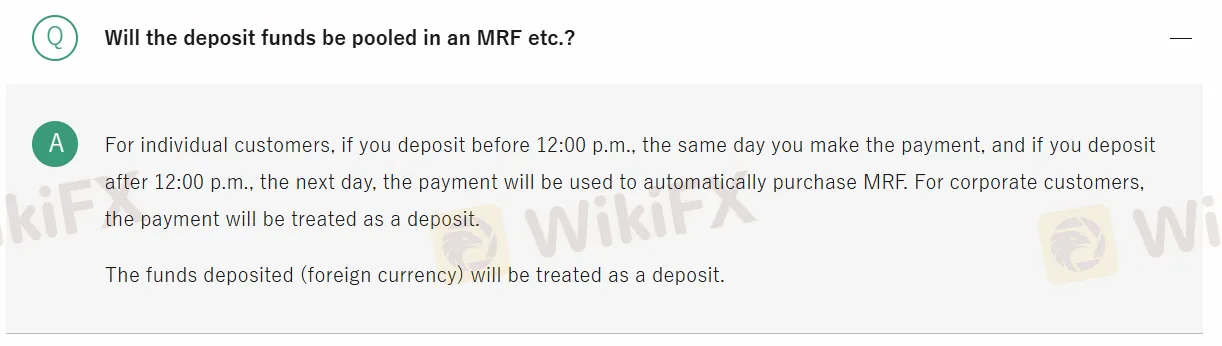

| Depósito | / | JPY 0 - 4,000 | Abaixo de 24 horas |

| Saque | / | / |

within

Colômbia

Até agora, acho que a shikoku é uma empresa qualificada, se precisar, acho que pode ser sua escolha! Várias condições de negociação são razoáveis, e o mais importante é que não é uma empresa ilegal, não enganará seu dinheiro.

Positivos

文章

Hong Kong

Estou acostumado a confiar na Shikoku, minha experiência é ótima! Embora apareçam tantos corretores novos, de qualquer forma, prefiro escolher o experiente.

Positivos

FX1015868943

Hong Kong

Alguém disse que Shikoku é uma boa plataforma para investir em várias negociações de ações. Existe alguém disposto a me dizer o que suas taxas são cobradas? Mandei uma pergunta, mas ninguém me responde...

Neutro

FX1022619685

Hong Kong

O design do site não é o que eu prefiro e é difícil encontrar o que você deseja focar. Alguém achou isso? Pode ser mais adequado para investidores japoneses. Para mim, eu encontraria alguns corretores para me deixar confortável…

Neutro