Información básica

Japón

JapónCalificación

Japón

|

De 10 a 15 años

|

Japón

|

De 10 a 15 años

| http://www.shikoku-alliance-sec.co.jp/index.html

Sitio web

Índice de calificación

influencia

C

índice de influencia NO.1

Japón 4.89

Japón 4.89 Licencias

LicenciasInstitución autorizada:四国アライアンス証券株式会社

Número de regulación:四国財務局長(金商)第21号

Núcleo único

1G

40G

1M*ADSL

Japón

Japón

| Shikoku Resumen de la revisión | |

| Establecido | 2002 |

| País/Región Registrada | Japón |

| Regulación | Regulado por FSA (Japón) |

| Instrumentos de Mercado | Fondos de Inversión, Acciones, Bonos, Forex, Materias Primas |

| Cuenta Demo | / |

| Spread EUR/USD | Desde 10 - 75 sen |

| Plataforma de Trading | Web Trader |

| Soporte al Cliente | Tel: 089-921-5200 |

| Dirección: Prefectura de Ehime, Ciudad de Matsuyama, Sanbancho 5-10-1 | |

Shikoku es un corredor con sede en Japón fundado en 2002, regulado por FSA. Ofrece una amplia gama de instrumentos de mercado, como: Fondos de Inversión, Acciones, Bonos, Forex y Materias Primas.

| Pros | Contras |

| Regulado por FSA | Canales de contacto limitados |

| Varios activos de trading | Sin soporte para MT4 y MT5 cTrader |

| Largo tiempo de operación | No hay cuentas demo disponibles |

| Se aplican varias tarifas |

Shikoku está regulado por la Agencia de Servicios Financieros (FSA), bajo Shikoku, con el número de licencia 四国財務局長(金商)第21号.

| Estado Regulatorio | Regulado Por | Institución Licenciada | Tipo de Licencia | Número de Licencia |

| Regulado | Agencia de Servicios Financieros (FSA) | Shikoku | Licencia de Forex Minorista | 四国財務局長(金商)第21号 |

El equipo de investigación de campo de WikiFX visitó la dirección de Shikoku en Japón y encontramos su oficina en el lugar, lo que significa que la empresa opera con una oficina física.

| Instrumentos de Negociación | Soportado |

| Fondos de Inversión | ✔ |

| Acciones | ✔ |

| Bonos | ✔ |

| Forex | ✔ |

| Materias Primas | ✔ |

| Índices | ❌ |

| Criptomonedas | ❌ |

| Opciones | ❌ |

| ETFs | ❌ |

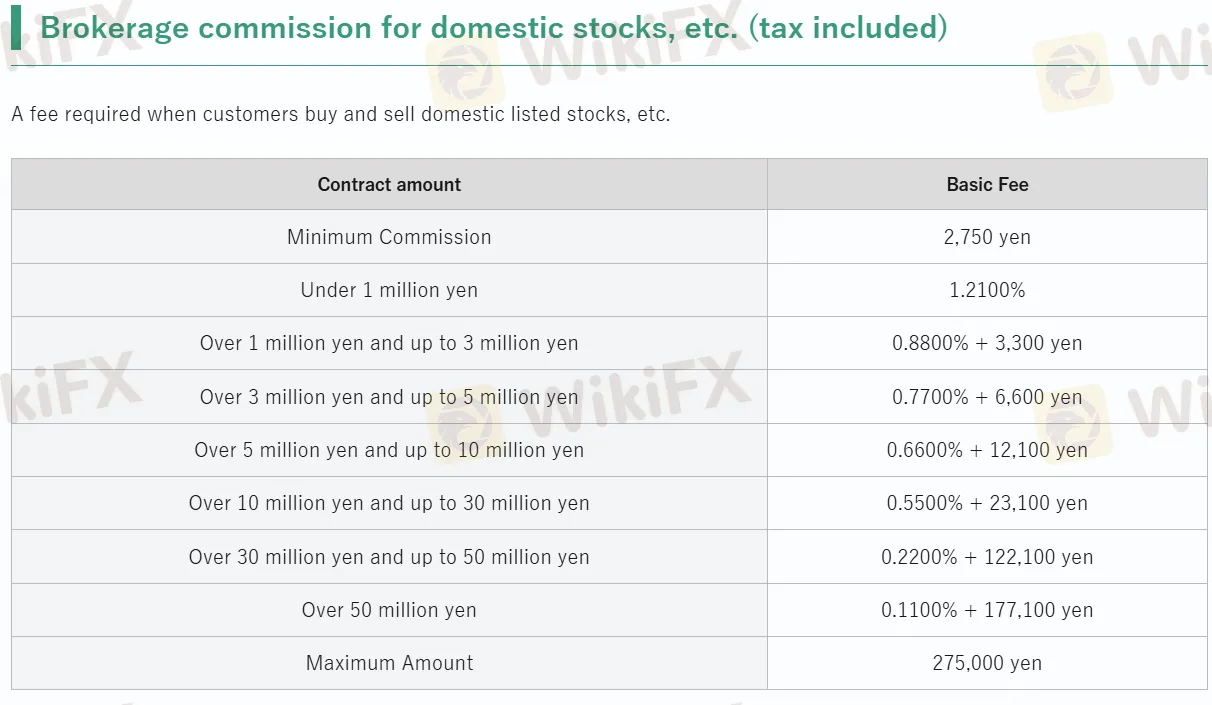

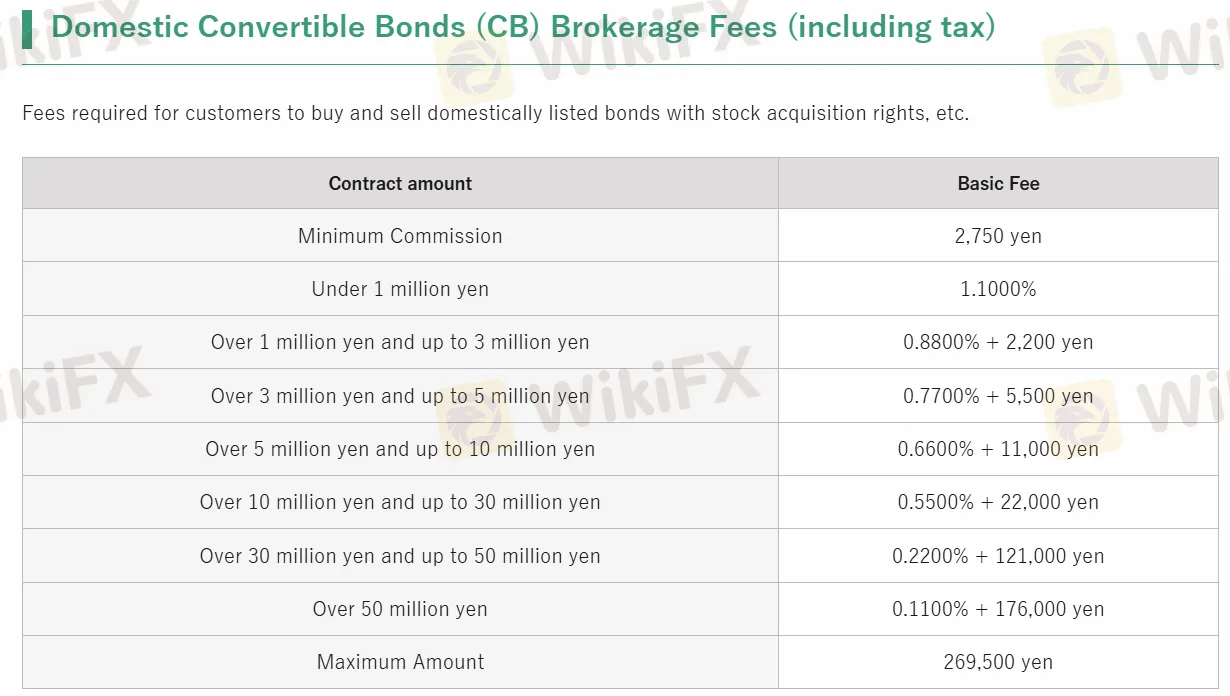

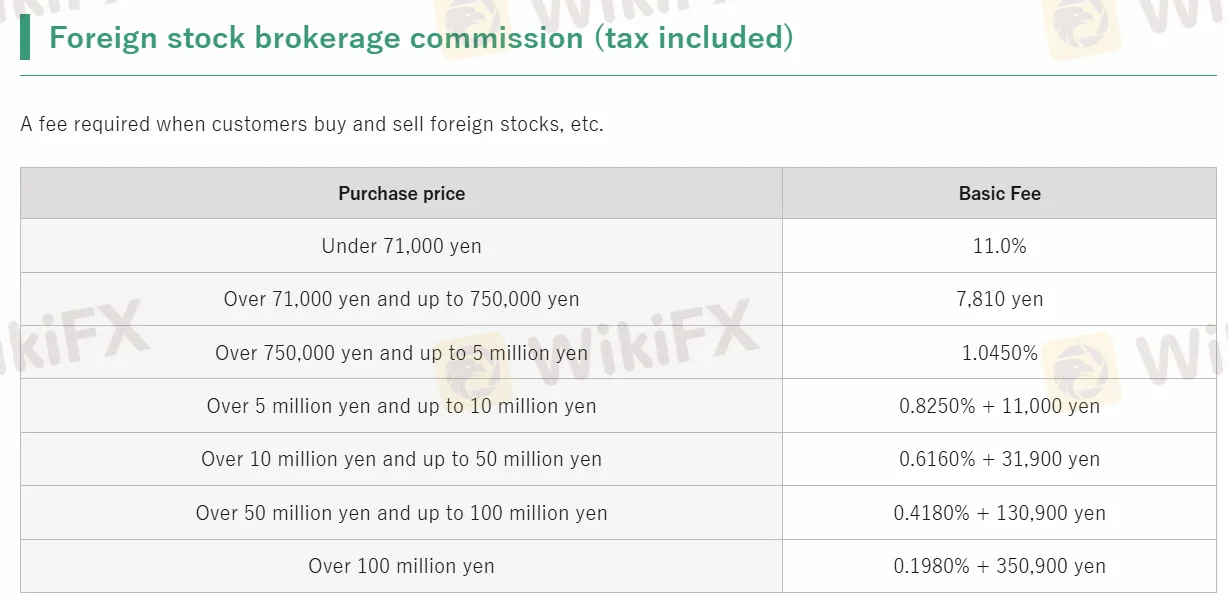

| Tipo de Servicio | Tarifa Básica |

| Corretaje de Acciones Nacionales | JPY 2,750 - 275,000 |

| Corretaje de Bonos Convertibles Nacionales | JPY 2,750 - 269,500 |

| Corretaje de Acciones Extranjeras | 0.1980% - 11% |

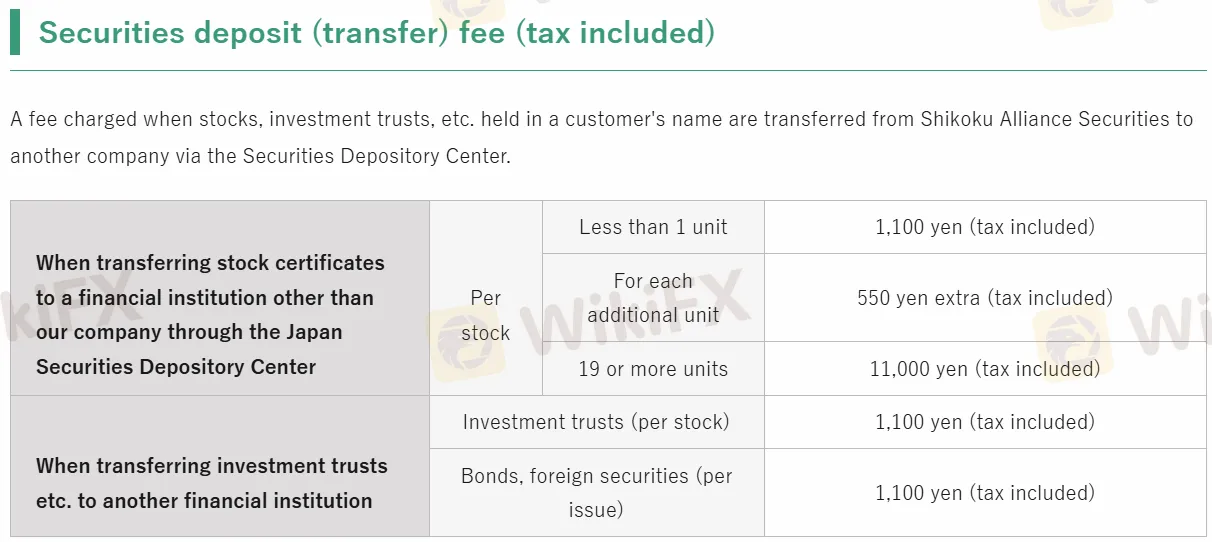

| Depósitos de Valores | JPY 550 - 11,000 |

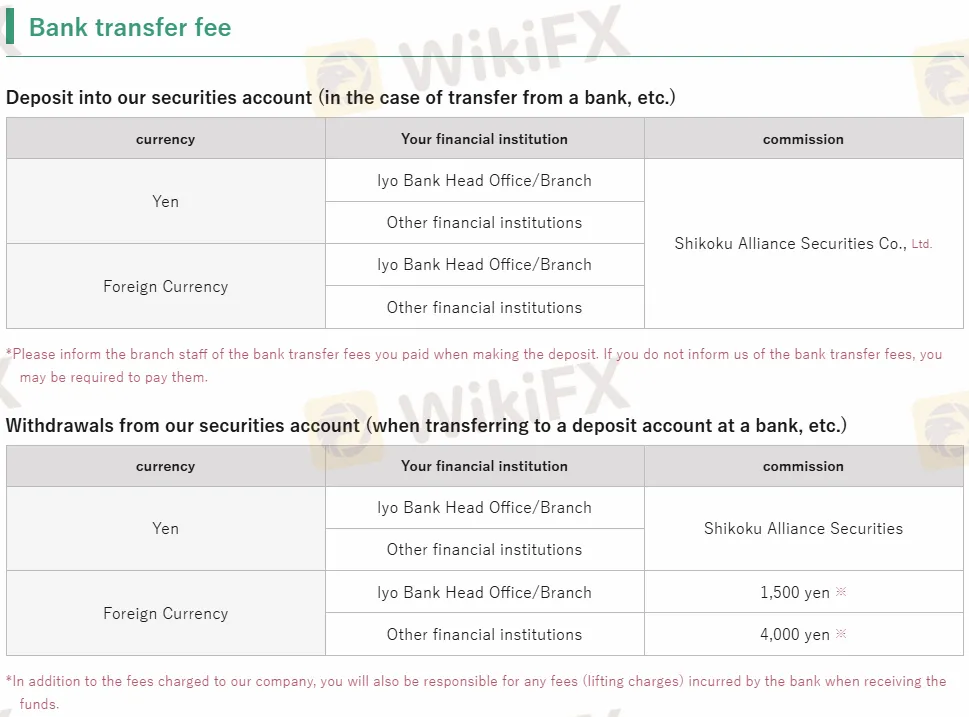

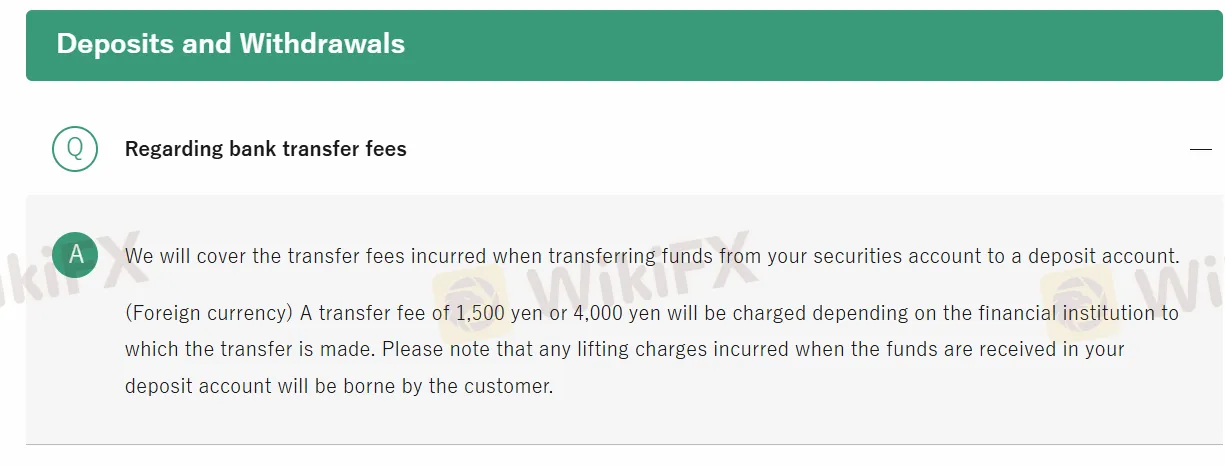

| Tarifa de Transferencia Bancaria | JPY 0 - 4,000 |

| Plataforma de Negociación | Soportado | Dispositivos Disponibles | Adecuado para |

| Operador Web | ✔ | Web | / |

| MT4 | ❌ | / | Principiantes |

| MT5 | ❌ | / | Traders experimentados |

| Monto Mínimo | Tarifa de Transferencia Bancaria | Tiempo de Procesamiento | |

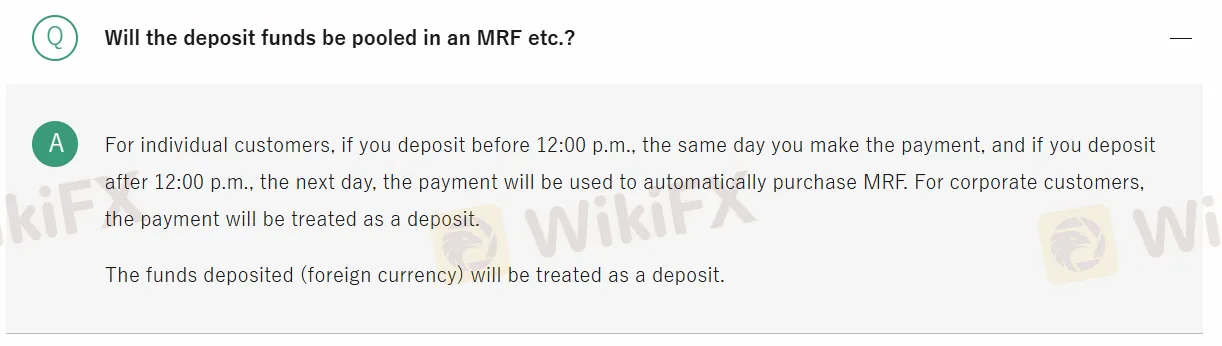

| Depósito | / | JPY 0 - 4,000 | Menos de 24 horas |

| Retiro | / | / |

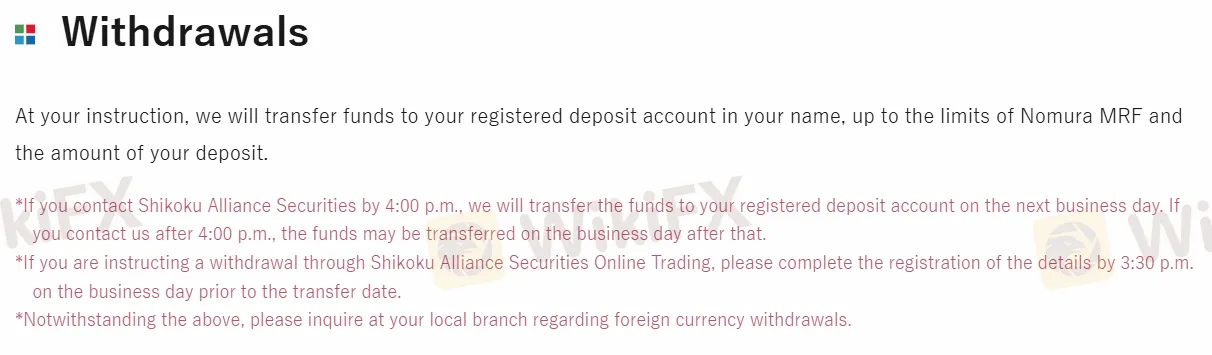

After carefully reviewing my own experience and the available information about Shikoku, I need to take a conservative approach regarding payment methods and withdrawal speeds. Based on what I found, Shikoku’s funding and withdrawal options are primarily bank transfers, and these come with a potential processing time of up to 24 hours. While same-day processing may occur, there is no evidence that Shikoku offers any instant withdrawal methods such as e-wallets or internal transfers that are popular with some international brokers. This is consistent with what I generally expect from a traditional Japanese broker, especially one regulated by the FSA and operating for over a decade. The focus seems to be on security and regulatory compliance, rather than rapid, technology-driven withdrawal solutions. In my trading, speed of withdrawal is important, but I weigh this against the trustworthiness and regulatory standards of the broker. With Shikoku, the process appears to prioritize procedural diligence over speed, which may be more reassuring for those worried about safety, but it does mean traders should not expect instant access to funds. For anyone considering trading with Shikoku, it is prudent to plan for at least some delay when withdrawing funds, and not to rely on instant liquidity.

In my evaluation as an independent trader, one factor I always prioritize is whether a broker operates under clear regulatory oversight. With Shikoku, I found that they are regulated by Japan’s Financial Services Agency (FSA), specifically under the entity 四国アライアンス証券株式会社, with a retail forex license. For me, Japanese FSA regulation signals a solid baseline of accountability and consumer protection, since the FSA is known for setting rigorous standards for financial institutions in Japan. Regulatory status alone, however, doesn't guarantee a flawless trading experience. I always look further, but the official oversight by the FSA consistently ranks high in my decision-making process, especially given the prevalence of unregulated brokers in the industry. Having a regulator like the FSA involved gives me greater confidence that the broker must comply with important rules regarding client fund segregation and operational transparency. Still, I remind myself that no regulatory framework is entirely foolproof, and it's essential to assess all aspects of a broker's offering before making substantial commitments. In summary, based on my own standards, Shikoku’s regulation by the Japanese FSA is a significant point in its favor.

In my time exploring and evaluating different brokers, I’ve learned that transparency around minimum deposit requirements is crucial for making informed decisions and managing risk. With Shikoku, what stands out to me is the absence of a clearly stated minimum deposit amount. Based on the information provided, there isn’t a specified figure for a minimum deposit—only that bank transfer fees range from JPY 0 to JPY 4,000, and that the processing time is typically under 24 hours. While this might suggest flexibility, I view it as a point to approach cautiously. A lack of explicit guidance on the minimum amount needed to fund an account can be inconvenient for planning, especially for traders like myself who prefer to start small or set strict allocation limits. Over the years, I’ve learned to be especially careful with any broker that isn’t fully straightforward on basic account conditions. Although Shikoku is regulated by Japan’s FSA and has been in operation for over a decade—factors that do add a level of security—the absence of clearly published minimum deposit details makes me hesitant to proceed without first contacting customer support directly for clarification. That, in my experience, is the safest and most responsible approach before committing any funds.

In my personal experience as a forex trader, I always prioritize broker safety and operational transparency. With Shikoku, while I appreciate its clear regulatory status in Japan and its decade-plus presence, certain drawbacks give me pause. The most significant concern is the lack of industry-standard trading platforms like MT4 or MT5—Shikoku relies solely on its Web Trader. For me, this means missing out on advanced charting tools, automated trading, and the familiarity that comes from widely used platforms. Additionally, Shikoku does not offer a demo account. This is a big issue because I find demo trading invaluable for assessing spreads, execution quality, and platform reliability before risking real money. Another risk factor I’d point out is the fee structure, which is both diverse and relatively high—domestic stock brokerage fees can range from JPY 2,750 up to JPY 275,000, and foreign stock fees reportedly reach up to 11%. Without transparent and easily accessible information on forex commission and spreads (beyond a stated EUR/USD spread “from 10–75 sen,” which is a broad and potentially costly range), estimating actual trading costs can be challenging. Lastly, the support for non-Japanese traders appears limited. Communication channels are narrow and, in my review process, inquiries were left unanswered. For those not based in Japan or unfamiliar with Japanese systems, this lack of proactive support, coupled with a website that several users found difficult to navigate, adds further complications. All these factors contribute to a medium risk profile that I cannot overlook.

Ingrese...

TOP

TOP

Chrome

Extensión de Chrome

Consulta regulatoria de bróker de Forex global

Navegue por los sitios web de los brokers de divisas e identifique con precisión los brokers legítimos y los fraudulentos.

Instalar ahora

within

Colombia

Hasta ahora, creo que shikoku es una empresa calificada, si la necesita, ¡creo que puede ser su elección! Varias condiciones comerciales son razonables, y lo más importante es que no es una empresa ilegal, no engañará a su dinero.

Positivo

文章

China

Estoy acostumbrado a invertir la confianza en Shikoku, ¡mi experiencia es excelente! Aunque aparecen tantos nuevos corredores, en cualquier caso, prefiero elegir el experimentado.

Positivo

FX1015868943

Hong Kong

Alguien dijo que Shikoku es una buena plataforma para invertir en varias operaciones bursátiles. ¿Hay alguien dispuesto a decirme cuáles son sus tarifas? Envié una consulta, pero nadie me responde...

Neutral

FX1022619685

Hong Kong

El diseño de su sitio web no es lo que prefiero, y es difícil encontrar en qué quieres enfocarte. ¿Alguien ha encontrado esto? Puede ser más adecuado para inversores japoneses. Para mí, encontraría algunos corredores que me hicieran sentir cómodo…

Neutral