x1250

1-2年

What are the key advantages and disadvantages of trading through Industrial Securities Futures?

After personally evaluating Industrial Securities Futures based on my experience as a forex trader, I approach this broker with a degree of caution despite its decade-long presence. The company is regulated by the China Financial Futures Exchange (CFFEX), which is an established authority, and this reassures me regarding its legitimacy in offering futures trading in China. I do value that the broker supports demo accounts, allowing new traders to familiarize themselves with their proprietary Xingzheng Futures APP on mobile before risking real funds. Their responsive customer support, accessible via several channels, also points to a certain level of operational maturity.

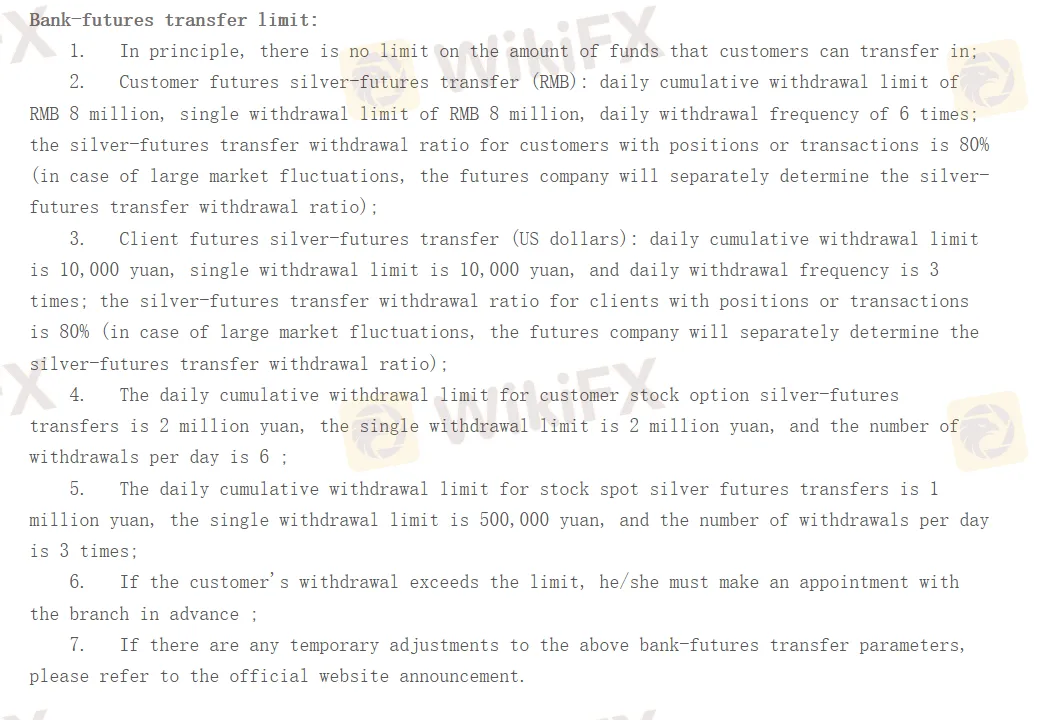

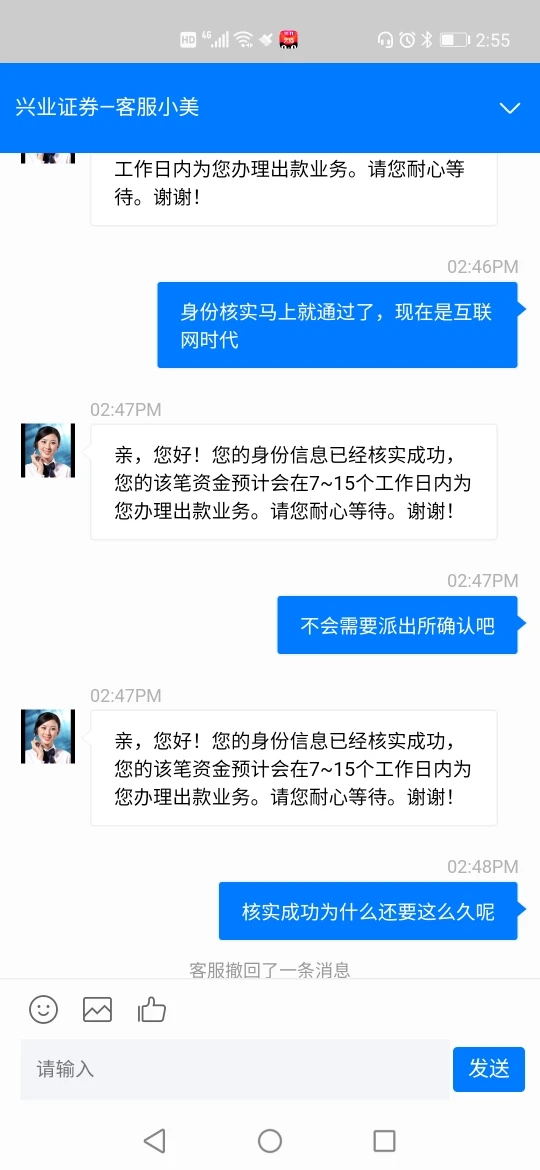

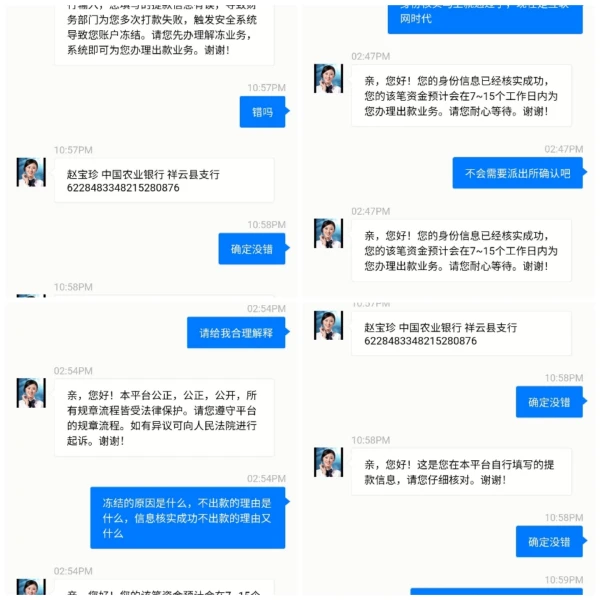

However, I find several areas that cause concern. The most critical drawback for me is the lack of transparency around fees, deposit and withdrawal processes, and account conditions. No clear information about trading costs or charges is provided, which makes it impossible for me to adequately assess my potential overhead or compare the broker’s competitiveness. Furthermore, I noticed a user report about withdrawal delays and account freezing, which raises questions about withdrawal reliability—a red flag I take seriously in my risk management.

In summary, while Industrial Securities Futures appears regulated and offers relevant tools for derivatives trading, the opacity around costs and some operational complaints mean I would approach them conservatively, never risking more than I could afford to lose until a longer, positive track record is established.

Broker Issues

INDUSTRIAL SECURITIES FUTURES 興證期貨 Regulation

Xxpro

1-2年

Is it possible to deposit funds into my Industrial Securities Futures account with cryptocurrencies such as Bitcoin or USDT?

Based on my careful review of Industrial Securities Futures, I could not find any indication that this broker allows deposits in cryptocurrencies such as Bitcoin or USDT. From my experience dealing with brokers regulated in China, and given that Industrial Securities Futures is licensed by the China Financial Futures Exchange (CFFEX), the range of accepted funding methods tends to be conventional and quite strict. Regulatory frameworks in China generally restrict or do not support the use of cryptocurrencies for funding trading accounts, primarily due to local financial compliance requirements and oversight.

For me, transparency around deposit and withdrawal methods is crucial when choosing a broker. However, Industrial Securities Futures does not provide specific details about its accepted deposit methods or fee structure on its available channels. This lack of clarity requires me to exercise extra caution, as I always want to know in advance how I can move my funds and what costs, if any, might be involved.

Given this, it is safest to assume that only standard fiat currency options—likely through bank transfer or linked institutions—are permitted. If you are considering funding your account, I strongly recommend contacting their customer service directly for the most reliable and up-to-date information. Always confirm deposit details with official sources to avoid misunderstandings or compliance issues—especially when it comes to sensitive means like cryptocurrency, which remains largely unsupported in this region and regulatory environment.

Broker Issues

INDUSTRIAL SECURITIES FUTURES 興證期貨 Withdrawal

Deposit

MarceloD

1-2年

Does Industrial Securities Futures charge a commission per lot for their ECN or raw spread account types?

From my experience and based on the information currently available about Industrial Securities Futures, I have not found any clear disclosure regarding commission per lot charges, whether for ECN or raw spread account types. This lack of transparency is actually something I take quite seriously. As someone who trades actively and manages risk closely, knowing the cost structure upfront is vital for planning and position management. Trading with a broker without explicit information about commissions can make it difficult to estimate true trading costs or compare value between providers.

While Industrial Securities Futures is regulated by the China Financial Futures Exchange (CFFEX) and has a considerable operating history in China, the absence of clarity around fees and commissions means I would personally approach this broker with caution. I also noticed that their platform offering seems limited to their proprietary Xingzheng Futures APP, and there is no mention of ECN technology or raw spread accounts that are common with international forex brokers.

Given the regulatory framework, I do feel there is oversight, but the exact fee model—specifically commission per lot—remains undisclosed. For me, this is a red flag until full details are confirmed. In my view, no serious trading decisions should be made without independently verifying and understanding all associated costs directly from the broker.

Broker Issues

INDUSTRIAL SECURITIES FUTURES 興證期貨 Fees and Spreads

Rojas

1-2年

Does Industrial Securities Futures offer a swap-free (Islamic) account option for its traders?

Based on my review of Industrial Securities Futures, I have not found any clear indication that they offer a swap-free or Islamic account option to traders. In my own due diligence, I always look for explicit information on account types and fee structures, especially when considering brokers for clients who require Sharia-compliant solutions. With Industrial Securities Futures, I noticed that while they are licensed and regulated by the China Financial Futures Exchange (CFFEX) and provide specialized services such as private equity FOF and quantitative management strategies, there is a lack of transparency regarding several key aspects—including details on fees and account types.

This absence of detailed public information about their account offerings is a significant consideration for me, particularly as it relates to swap-free options which are vital for adhering to Islamic finance principles. From my experience, reputable brokers will typically outline their swap-free options and processes clearly if available. Here, the lack of such details makes it difficult for me to confidently recommend Industrial Securities Futures to those specifically seeking Islamic accounts. As always, I encourage any interested trader to directly contact the broker and request written confirmation regarding the availability of swap-free options before making any commitments. For my own trading decisions, openness and clarity on essential features like account types and fee policies are non-negotiable factors.

Broker Issues

INDUSTRIAL SECURITIES FUTURES 興證期貨 Instruments

Account

Leverage

Platform