Şirket özeti

| Endüstriyel Menkul Değerler İnceleme Özeti | |

| Kuruluş | 2010 |

| Kayıtlı Ülke/Bölge | Çin |

| Düzenleme | CFFEX (düzenlenmiş) |

| Hizmetler | Özel öz sermaye FOF işi, nicel stratejilere dayalı aktif yönetim işi vb. |

| Demo Hesap | ✅ |

| İşlem Platformu | Xingzheng Futures UYG |

| Müşteri Desteği | Tel: 021-20370900, 0591-38117666 |

| E-posta: huangchen@xzfutures.com | |

| Adres: Fuzhou, Gulou Bölgesi, Hudong Yolu 268, Menkul Kıymetler Binası 6. Kat | |

| Weibo, WeChat | |

Endüstriyel Menkul Değerler Bilgileri

Endüstriyel Menkul Değerler, 2010 yılında Çin'de kurulmuş düzenlenmiş bir öncü aracı kurum ve finansal hizmetler sağlayıcısıdır. Özel öz sermaye FOF işi, nicel stratejilere dayalı aktif yönetim işi vb. için ürünler ve hizmetler sunmaktadır.

Artıları ve Eksileri

| Artıları | Eksileri |

| Demo hesaplar | Şeffaflık eksikliği |

| Uzun işlem süresi | |

| Çeşitli iletişim kanalları | |

| İyi düzenlenmiş |

Endüstriyel Menkul Değerler Güvenilir mi?

Evet. Industrial Securities, hizmetler sunmak için CFFEX tarafından lisanslanmıştır. Lisans numarası 0102'dir. Çin Finansal Vadeli İşlemler Borsası A.Ş. (CFFEX), Çin Halk Cumhuriyeti Devlet Konseyi ve Çin Menkul Kıymetler Düzenleme Komisyonu (CSRC) onayı ile kurulmuş olup, finansal vadeli işlemler, opsiyonlar ve diğer türevler için işlem ve takas hizmetleri sunan özel bir borsadır.

| Düzenlenen Ülke | Düzenleyici | Mevcut Durum | Düzenlenen Kuruluş | Lisans Türü | Lisans No. |

| Çin Finansal Vadeli İşlemler Borsası (CFFEX) | Düzenlenmiş | 兴证期货有限公司 | Vadeli İşlemler Lisansı | 0102 |

Industrial Securities Hizmetleri

| Hizmetler | Desteklenen |

| Özel öz sermaye FOF işi | ✔ |

| Nicel stratejilere dayalı aktif yönetim işi | ✔ |

Industrial Securities Ücretleri

Industrial Securities ücretleri hakkında herhangi bir bilgi sağlamamaktadır.

İşlem Platformu

| İşlem Platformu | Desteklenen | Kullanılabilir Cihazlar |

| Xingzheng Futures UYG | ✔ | Mobil |

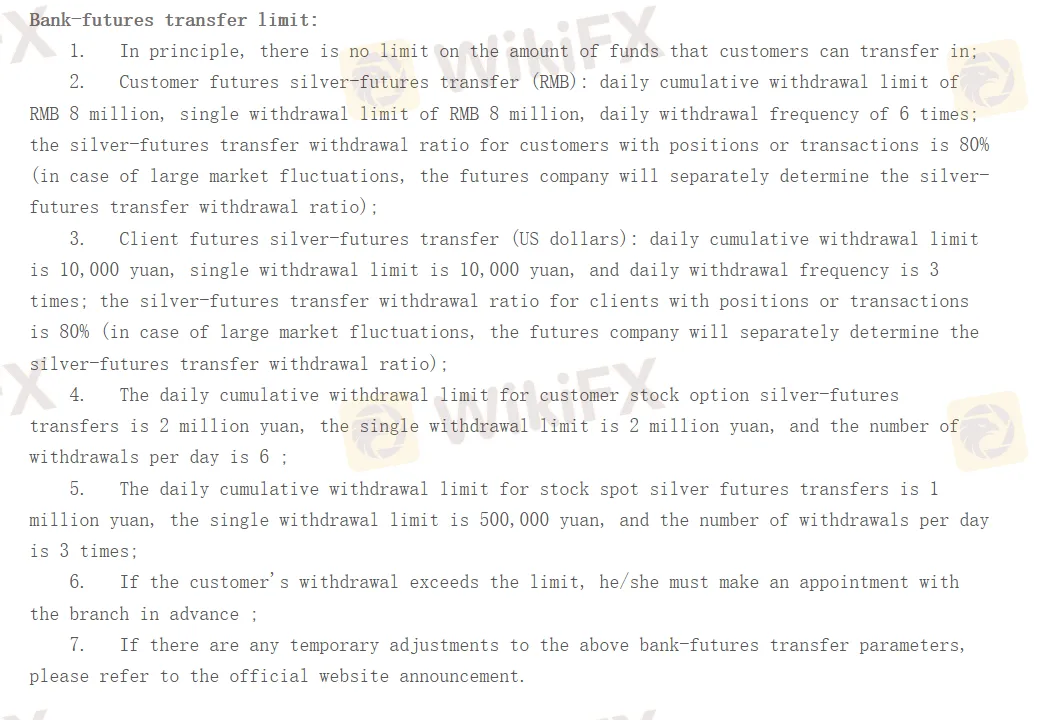

Para Yatırma ve Çekme

Maksimum çekim tutarı belirlenmiş ancak minimum çekim/yatırım tutarı belirlenmemiş ve herhangi bir ücret belirtilmemiştir.