Darren Ross

1-2年

How do the different account types provided by KIT compare to each other?

In reviewing KIT as an experienced trader, I am unable to compare different account types because, based on available information, KIT does not publicly detail separate account types for retail or institutional clients. This lack of clear segmentation is concerning to me, particularly from a risk and trust assessment perspective. In my experience, reputable brokers provide full transparency about their account offerings—outlining features such as minimum deposit, leverage, spreads, and whether demo accounts exist. Unfortunately, none of these specifics are disclosed by KIT, which is a significant red flag for me, especially for anyone trading with real capital.

Furthermore, KIT positions itself primarily towards institutional and experienced professional users with its Valdi Market Access platform, which is not suited for beginner or casual traders. This reinforces my impression that KIT may not cater to the diverse needs typical of retail forex brokers offering multiple account structures. As someone who values regulatory oversight and clarity, the absence of detailed account information—paired with KIT’s unregulated status—increases my concerns about transparency and client protection. For me, before considering any broker, understanding the account types and knowing what protections are in place is essential for prudent risk management. Therefore, when a broker does not provide such basic, critical information, I proceed with extreme caution.

Broker Issues

Platform

Leverage

Account

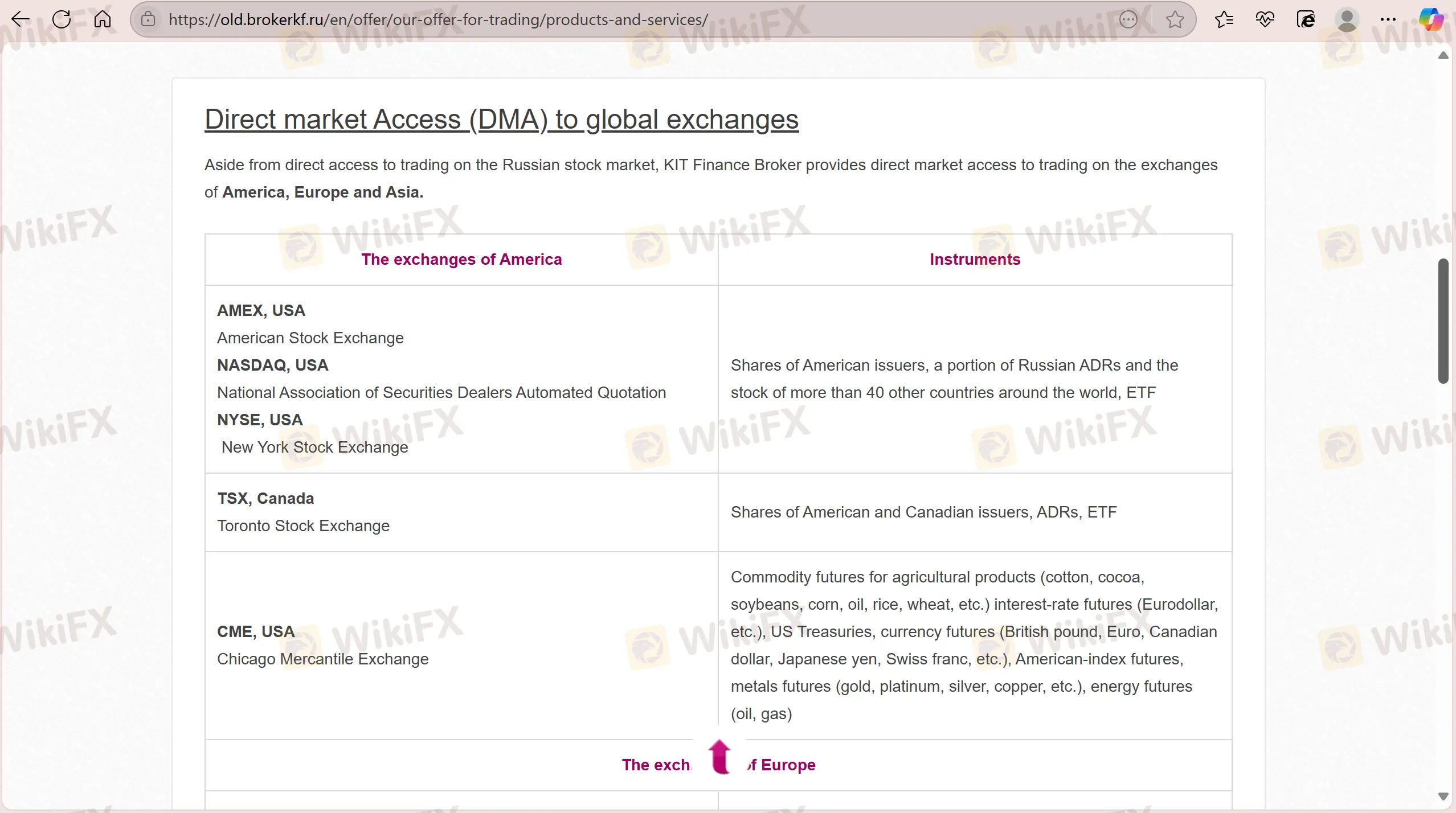

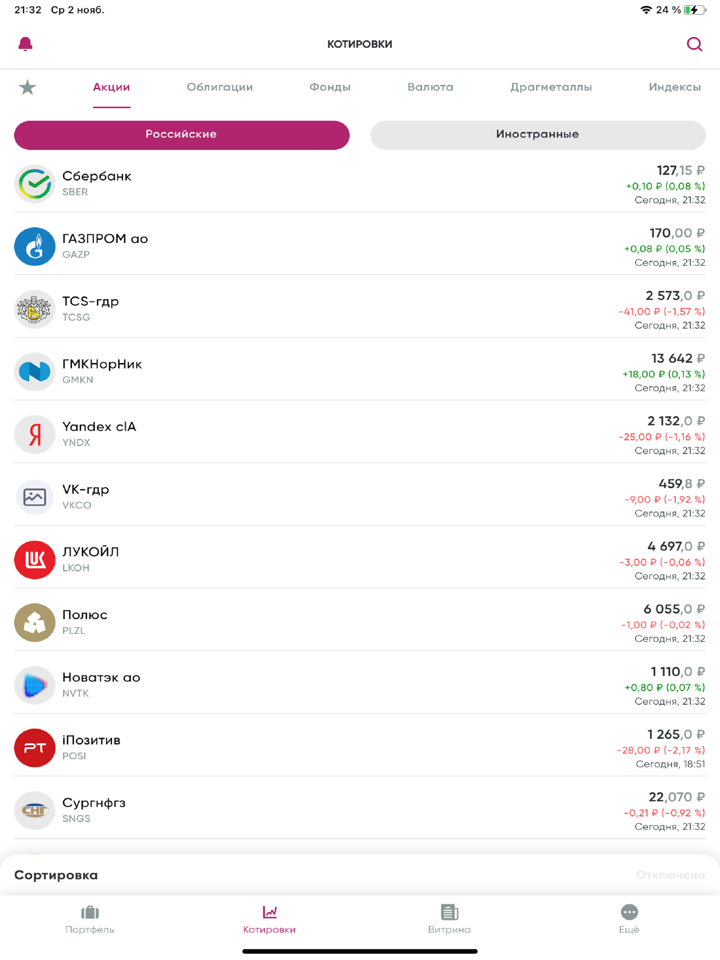

Instruments

joalund

1-2年

Does KIT offer fixed or variable spreads, and how are these affected during periods of high market volatility or major news releases?

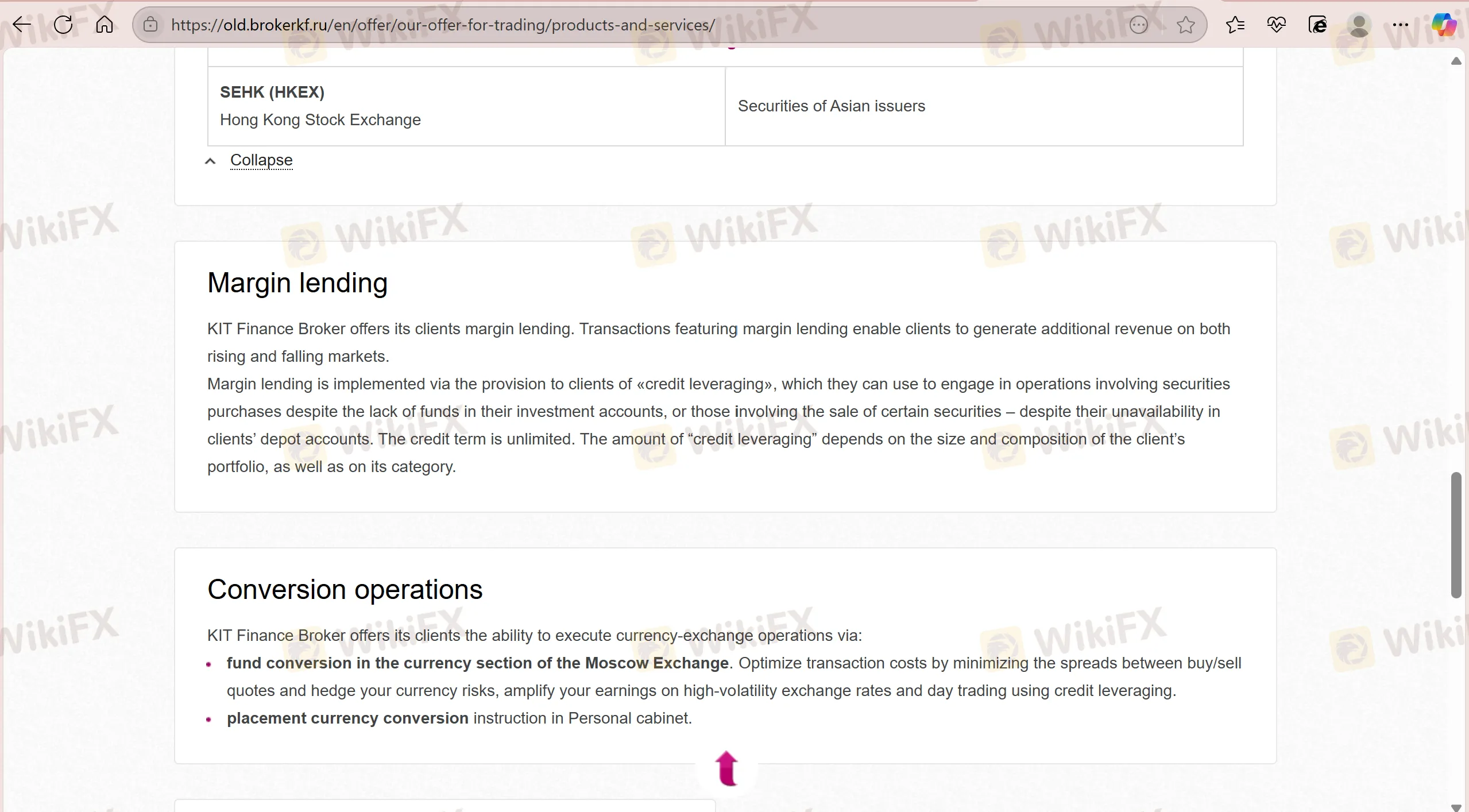

In my experience trying to evaluate KIT as a prospective trading venue, I’ve found it very challenging to find concrete details about their spread structure. Their WikiFX profile provides no official information about whether KIT offers fixed or variable spreads, and as someone who treats risk management with the utmost seriousness, this lack of transparency raises concerns for me. Typically, the spread type—fixed or variable—directly affects trading costs and strategy, especially during volatile market events or important news releases. Brokers that lack regulation or clear disclosures may not handle spreads in a way that's favorable or predictable for clients. In turbulent market conditions, variable spreads usually widen considerably. Without any stated policies or evidence of transparent practices, I would remain extremely cautious: a broker operating entirely without recognized regulatory oversight and clear trading conditions could potentially subject traders to erratic costs and execution risks at critical market moments. Personally, unless I can verify details like spread structures and execution protocols, I simply do not feel comfortable risking capital with such a provider. Safety, reliability, and transparency are non-negotiable aspects for me when choosing a forex broker.

Broker Issues

Fees and Spreads

Arnold Joseph

1-2年

What major risks or drawbacks should I watch out for when working with KIT?

As someone who has spent years navigating the forex world, I approach new brokers with careful skepticism, especially when regulatory concerns come into play. With KIT, several major risks stand out and warrant a cautious approach. The most significant issue for me is the complete absence of meaningful regulation—KIT is not supervised by any recognized authority, including the Central Bank of Russia. In my experience, a lack of oversight presents genuine risks regarding transparency, dispute resolution, and client fund protection.

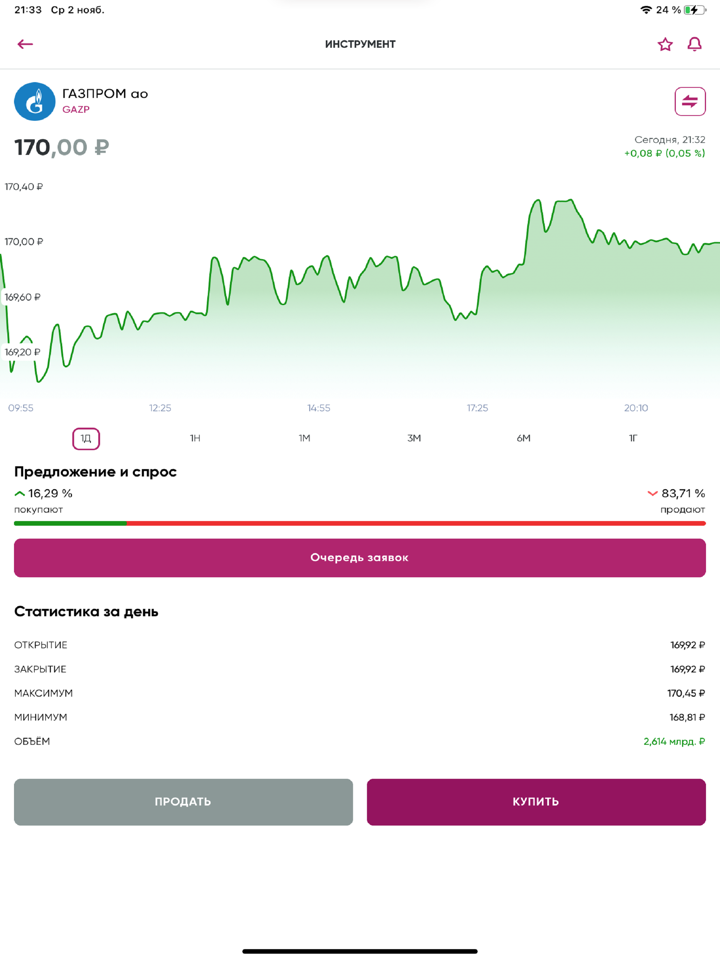

I also notice that KIT provides a “self-developed” trading platform tailored more for institutional players rather than the average retail trader. Relying on proprietary systems without the backing of recognized platforms like MT4 or MT5 means there’s limited transparency about execution quality, pricing, or technical reliability—all essential factors for responsible trading.

The WikiFX information, which I treat very seriously, also highlights warnings about suspicious regulatory status and a physical address that could not be verified when visited. For me, these are important red flags, raising doubts about the operational integrity and overall trustworthiness of the broker. Even with their long operational history, the high-risk indicators and lack of proper transparency mean I wouldn’t risk substantial capital with KIT. For anyone considering KIT, I'd advise utmost caution and a stringent evaluation of what real safeguards are in place—my own rule is never to compromise on regulatory security.

Chris hagerman

1-2年

What are the primary advantages and disadvantages of trading using KIT?

In my experience as a forex trader, any broker’s credibility is central to my decision-making, and this is a major concern with KIT. KIT Finance, despite operating for over two decades and offering access to both Russian and global markets, is entirely unregulated. No oversight from the Central Bank of Russia or any other recognized authority is documented, meaning there’s little external verification or recourse if problems arise. For me, this kind of regulatory vacuum dramatically increases the potential risks—I can’t overlook that as an experienced trader.

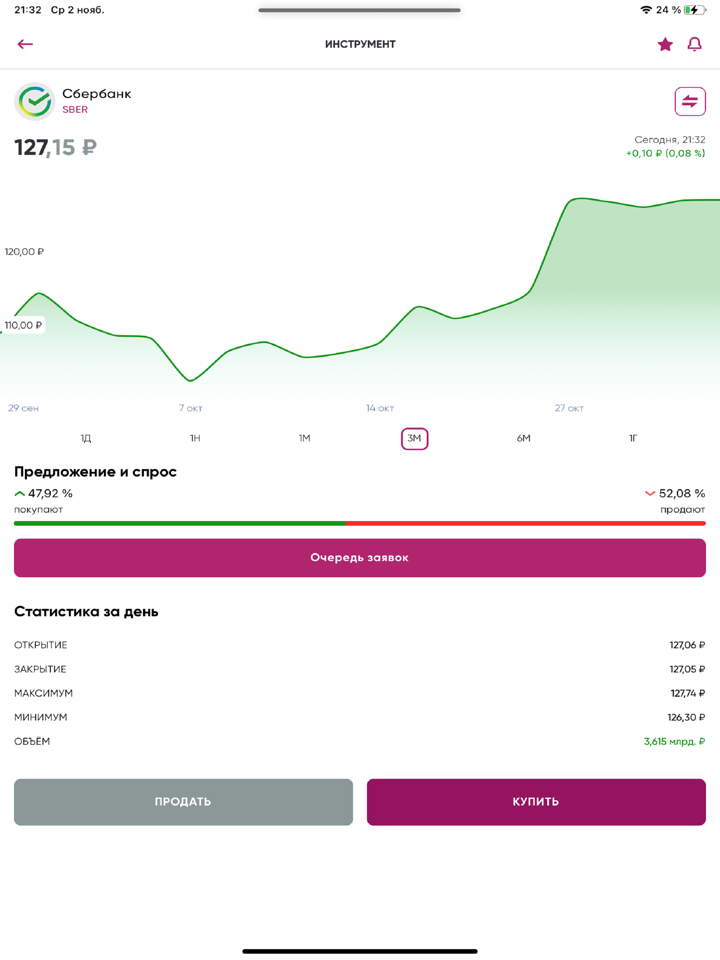

On the positive side, the brokerage claims to provide institutional-grade technology like the Valdi Market Access platform, aiming for speed, automation, and robust risk management. Such infrastructure can be appealing to advanced and professional users, particularly those who need nuanced tools for complex strategies and cross-asset exposure. The firm’s longevity and apparent focus on serving sophisticated clients could suggest some operational competence.

However, the disadvantages are serious. The warnings regarding suspicious licensing, absence of regulation, and lack of transparency are red flags. I couldn’t find clear details on account types, minimum deposits, or spreads. For me, opaque business practices are a deal breaker—especially when trades and funds are at stake. When trading my own capital, I far prefer brokers with clear regulatory supervision and full transparency on costs and procedures. While KIT might be tempting for those seeking access to certain Russian financial products, the overall risk profile is too high for my comfort.